Biora Therapeutics Undertakes Chapter 11 Sale Process to Position Business for Future Growth

December 30 2024 - 7:00AM

Biora Therapeutics, Inc. (“Biora” or the “Company”), a biotech

company developing smart pill-based therapeutic platforms, today

announced it has reached an agreement with certain of its

prepetition creditors (the “Lenders”) to provide financing to

support a chapter 11 sale process, which will ultimately lead to a

strengthened balance sheet and help enable it to launch its next

stage of product development. To effectuate the transaction, the

Company has filed a voluntary petition under chapter 11 of the U.S.

Bankruptcy Code in the District of Delaware.

Throughout this process, Biora expects to operate its business

as usual and in the ordinary course as the Lenders have agreed to

provide the Company with a debtor in possession financing facility

of up to $10.25 million, subject to Court approval. This funding is

expected to allow Biora to meet its obligations arising during the

chapter 11 case to vendors, suppliers, employees and other

stakeholders as it pursues a court-supervised sale process.

Biora intends to file a motion requesting approval of a

marketing and sale process (the “Bid Procedures Motion”). The sales

process is expected to occur on an expedited timeline which will

help minimize any potential adverse impact on the Company’s

operations, vendors, and employees and allow it to quickly emerge

from the sale in a position to continue the clinical development of

its products. The Bid Procedures Motion will facilitate a

competitive bidding process under section 363 of the Bankruptcy

Code, designed to achieve the highest or otherwise best value for

Biora and its stakeholders. The Lenders have agreed to serve as a

stalking horse bidder for the Company’s assets.

“This path will help allow us to focus on the BioJet and NaviCap

platforms which we believe continue to make tremendous progress. We

are happy that the Lenders recognize this progress and have showed

their confidence by financing the process as we continue the

development of our programs,” said Adi Mohanty, Chief Executive

Officer of Biora Therapeutics.

The Company has filed customary motions with the court to

authorize ongoing operations, including the timely, uninterrupted

payment of employee wages, salaries, and benefits. Biora intends to

pay vendors and suppliers in full under normal terms for goods and

services provided during the chapter 11 case. The Company expects

these motions to be approved in the coming days.

Court filings and other information regarding Biora’s

court-supervised process is available at cases.ra.kroll.com/biora.

The Company has set up an information line to answer questions

about this announcement, which can be reached by calling

1-877-329-1873 (toll-free U.S. calls) or 1-646-817-8535

(international).

McDermott Will & Emery is Biora’s legal counsel, MTS Health

Partners is its investment banker, and Evora Partners, LLC is its

restructuring advisor.

About Biora TherapeuticsBiora Therapeutics is a

clinical-stage biotech company developing two smart pill-based

therapeutics platforms: the NaviCap™ platform for colon-targeted

treatment of IBD, designed to improve patient outcomes through

treatment at the site of disease in the gastrointestinal tract, and

the BioJet™ platform for oral delivery of large molecules, designed

to replace injection with needle-free delivery. For more

information, visit bioratherapeutics.com.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. All statements

contained in this press release that do not relate to matters of

historical fact should be considered forward-looking statements,

including statements regarding the Company’s business and balance

sheet strength, profitability, continued product development,

advancement of its strategy, ability to continue operating its

business, make timely payments and meet its obligations to vendors,

suppliers, employees and other stakeholders, ability to maintain

its workforce, and ability to implement the restructuring pursuant

to the Chapter 11 cases and plan of reorganization, including the

timetable of completing such transactions, if at all. These

forward-looking statements are based on management’s current

expectations. These statements are neither promises nor guarantees,

but involve known and unknown risks, uncertainties and other

important factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to: the

Company’s ability to obtain Court approval with respect to motions

in the Chapter 11 cases; the effects of the Chapter 11 cases on the

Company and on the interests of its constituents; the length of

time the Company will operate under the Chapter 11 cases; the

potential adverse effects of the Chapter 11 cases on the Company’s

liquidity and results of operations and increased legal and other

professional costs necessary to effect the Chapter 11 sale process;

the potential risks associated with trading on the OTC Market,

including liquidity constraints and limited regulatory oversight;

risks related to the Company’s indebtedness that may restrict its

current and future operations; and the Company’s ability to

continue as a going concern. These factors could cause actual

results to differ materially from those indicated by the

forward-looking statements made in this press release. Any such

forward-looking statements represent management’s estimates as of

the date of this press release. All forward-looking statements

speak only as of the date made, and the Company disclaims any

obligation to update any of these statements, even if subsequent

events cause our views to change. The Company therefore cautions

readers against relying on these forward-looking statements and

they should not be relied upon as representing our views as of any

date subsequent to the date of this press release.

Media Contactmedia@bioratherapeutics.com

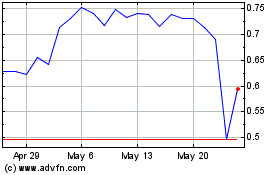

Biora Therapeutics (NASDAQ:BIOR)

Historical Stock Chart

From Dec 2024 to Jan 2025

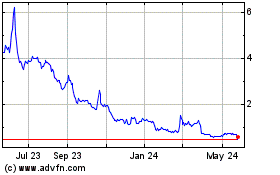

Biora Therapeutics (NASDAQ:BIOR)

Historical Stock Chart

From Jan 2024 to Jan 2025