UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

Commission File Number 001-39171

BROOGE ENERGY LIMITED

(Translation of registrant’s name into English)

Opus Tower A, 1002, Business Bay

Dubai, United Arab Emirates

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Update on claim from Al Brooge International

Advisory – Sole Proprietorship LLC

As previously disclosed, on January 3, 2024, Brooge

Energy Limited (“BEL”) received a copy of a notice that was delivered to Brooge Petroleum and Gas Investment Company FZE,

a subsidiary of BEL (“BPGIC FZE”), on December 19, 2023 regarding a claim and demand for payment from Al Brooge International

Advisory – Sole Proprietorship LLC (“BIA”) for USD130 million plus interest accruing at a rate of 12% per annum beginning

on November 15, 2022.

On January 25, 2024, BEL became aware of a payment

order entered by the Court of First Instance in the United Arab Emirates against BPGIC FZE for the claim and amount described above. BPGIC

FZE, without the oversight or involvement of BEL, applied to the Court of Appeal in the United Arab Emirates to appeal the payment order.

For more information regarding the control of BPGIC FZE, please refer to the section entitled “Update on material information

following the events on December 27, 2023—Appointment of a Judicial Guardian over Brooge Petroleum and Gas Investment Company

FZE on December 27, 2023” in BEL’s report on Form 6-K furnished to the U.S. Securities and Exchange Commission on January

17, 2024. Representatives of BPGIC FZE, pursuant to authority conferred by BEL, sought to remand the case for pleading through the Court

of Appeal, but the Court of Appeal issued a ruling in favor of BIA on January 30, 2024. Representatives of BPGIC FZE, pursuant to authority

conferred by BEL, filed a request to stay the execution of the judgment and an appeal with the Court of Cassation on February 21, 2024.

The judgment against BPGIC FZE is currently executable, and BIA was awarded a precautionary attachment by the Court of First Instance

for up to $130 million over the assets of BPGIC FZE.

Class action lawsuit

On February 5, 2024, a class action complaint was filed in the United

States District Court for the Central District of California encaptioned Eric White v. Brooge Energy Limited F/K/A Brooge Holdings

Limited F/K/A Twelve Seas Investment Company, Nicolaas L. Paardenkooper, Saleh Yammout, Syed Masood Ali, Burgese Viraf Parekh, Lina Saheb,

Dimitri Elkin, Neil Richardson, Stephen N. Cannon, and Paul Ditchburn. The class action complaint contains allegations concerning

the recognition of revenue similar to those addressed in the Order Instituting Cease and Desist Proceedings, Pursuant to Section 8A of

the Securities Act of 1933 and Section 21C of the Securities Exchange Act of 1934, Making Findings, And Imposing Cease-And-Desist Orders

entered by the United States Securities and Exchange Commission on December 22, 2023 In The Matter of Brooge Energy Limited, Nicolaas

Lammert Paardenkooper and Lina Saheb.

Risk factor update

The following risk factor is intended to supplement

the risk factors set forth in BEL’s Annual Report on Form 20-F under the section entitled “Item 3. Key Information—D.

Risk Factors” and should be read together with such risk factors.

Litigation and other disputes and regulatory investigations could

have a material adverse effect on our business.

From time to time, BEL may be involved in litigation and other disputes

or regulatory investigations that arise in and outside the ordinary course of business. An adverse determination may result in liability

to BEL for the claim and may also result in the imposition of penalties and/or fines.

As a public company, BEL may also be subject to securities class action

and shareholder derivative lawsuits. From time to time, BEL may also be reviewed or investigated by U.S. federal, state, or local regulators

or regulators in the foreign jurisdictions in which BEL operates. Although BEL carries general liability insurance coverage, BEL’s

insurance may not cover all potential claims to which it is exposed, whether as a result of a dispute, litigation or governmental investigation,

and it may not adequately indemnify BEL for all liability that may be imposed.

Any claims against BEL or investigation into its business and activities,

whether meritorious or not, could be time consuming, result in significant legal and other expenses, require significant amounts of management

time and result in the diversion of significant operational resources. Class action lawsuits can often be particularly burdensome given

the breadth of claims, large potential damages and significant costs of defense. Legal or regulatory matters involving BEL’s directors,

officers or employees in their individual capacities can also create exposure for BEL because BEL may be obligated or may choose to indemnify

the affected individuals against liabilities and expenses they incur in connection with such matters. Regulatory investigations can also

lead to enforcement actions, fines and penalties, the loss of a license or permit or the assertion of private litigation claims. Risks

associated with these liabilities are often difficult to assess or quantify and their existence and magnitude can remain unknown for significant

periods of time, making the amount of any legal reserves related to these legal liabilities difficult to determine and, if a reserve is

established, subject to future revision. Future results of operations could be adversely affected if any reserve that BEL establishes

for a legal liability is increased or the underlying legal proceeding, investigation or other contingency is resolved for an amount in

excess of established reserves. Because litigation and other disputes and regulatory investigations are inherently unpredictable, the

results of any of these matters may have a material adverse effect on our business, financial condition and results of operations.

On December 22, 2023, without admitting or denying any violation or

wrongdoing, BEL reached a settlement with the U.S. Securities and Exchange Commission (the “SEC”) related to alleged fraudulent

accounting and offering conduct by BEL and two of its former officers. Pursuant to the SEC administrative order, and which centers on

financial statements that have since been restated by BEL, BEL paid a civil money penalty in the amount of $5,000,000. BEL also agreed

to cease and desist from committing or causing any violations and any future violations of certain provisions under the Securities Act

of 1933 and the Securities Exchange Act of 1934. Two of BEL’s former officers resolved related SEC charges without admitting or

denying the SEC’s findings.

Brooge Petroleum and Gas Investment Company FZE, our subsidiary, is

currently subject to a judgment in the amount of USD130 million plus interest at 12% from November 15, 2022 in respect of amounts purportedly

owed by Brooge Petroleum and Gas Investment Company FZE to Al Brooge International Advisory – Sole Proprietorship LLC. On February

21, 2024, representatives of BPGIC FZE, pursuant to authority conferred by BEL, filed a request to stay the execution of the judgment

and an appeal with the Court of Cassation; however, such request and appeal may be denied, and the execution of such judgment would likely

have a material adverse effect on BEL’s business, financial condition, results of operations and prospects.

On February 5, 2024, a class action complaint was filed in the United

States District Court for the Central District of California encaptioned Eric White v. Brooge Energy Limited F/K/A Brooge Holdings

Limited F/K/A Twelve Seas Investment Company, Nicolaas L. Paardenkooper, Saleh Yammout, Syed Masood Ali, Burgese Viraf Parekh, Lina Saheb,

Dimitri Elkin, Neil Richardson, Stephen N. Cannon, and Paul Ditchburn. The class action complaint contains allegations concerning

the recognition of revenue similar to those addressed in the Order Instituting Cease and Desist Proceedings, Pursuant to Section 8A of

the Securities Act of 1933 and Section 21C of the Securities Exchange Act of 1934, Making Findings, And Imposing Cease-And-Desist Orders

entered by the United States Securities and Exchange Commission on December 22, 2023 In The Matter of Brooge Energy Limited, Nicolaas

Lammert Paardenkooper and Lina Saheb. An adverse judgment or resolution in this matter may result in a material adverse effect on BEL’s

business, financial condition, results of operations and prospects.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

BROOGE ENERGY LIMITED |

| |

|

| Date: March 1, 2024 |

By: |

/s/ Alexander Lawson |

| |

|

Name: |

Alexander Lawson |

| |

|

Title: |

Director of the Board |

3

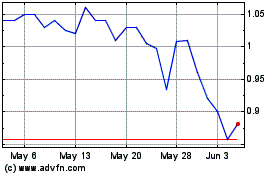

Brooge Energy (NASDAQ:BROG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Brooge Energy (NASDAQ:BROG)

Historical Stock Chart

From Jan 2024 to Jan 2025