false 0001819253 0001819253 2025-03-17 2025-03-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 17, 2025

biote Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-40128 |

|

85-1791125 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

| 1875 W. Walnut Hill Ln #100 |

| Irving, Texas 75038 |

| (Address of principal executive offices, including zip code) |

(844) 604-1246

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

BTMD |

|

The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencements communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure |

On March 17, 2025, biote Corp. (the “Company”) posted its Investor Presentation, dated March 2025, on its website. The updated presentation may be obtained at the Investor Relations section of biote’s website at https://ir.biote.com/news-events/presentations. A copy of the Investor Presentation is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

The information provided in Item 7.01 , including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information contained in this Item 7.01, including Exhibit 99.1.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Investor Presentation. |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| biote Corp. |

|

|

| By: |

|

/s/ Bret Christensen |

| Name: |

|

Bret Christensen |

| Title: |

|

Chief Executive Officer |

Date: March 17, 2025

Exhibit 99.1 Transforming Healthy Aging

2 Transforming Healthy Aging Forward-Looking Statements Forward-Looking

Statements Certain statements in this Presentation may be considered “forward-looking statements” within the meaning of the provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements

generally relate to future events of BioTE Holdings, LLC’s (“BioTE” or the “Company”) future financial or operating performance. For example, projections of future revenue and other metrics are forward-looking

statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “can,” “should,” “will,” “estimate,” “plan,” “project,”

“forecast,” “intend,” “expect,” “hope,” “anticipate,” “believe,” “seek,” “target,” “continue,” “could,” “might,”

“ongoing,” “potential,” “predict,” “would,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are based on current expectations, assumptions,

estimates and projections about our business and our industry, and are not guarantees of our future performance. These statements are subject to a number of known and unknown risks, uncertainties, and other factors, many of which are beyond ability

to control or predict, which may cause actual results to differ materially from those expressed or implied herein, including, but not limited to: the success of our dietary supplements to attain significant market acceptance among clinics,

practitioners and their patients; our customers’ reliance on certain third parties to support the manufacturing of bio-identical hormones for prescribers; our and our customers’ sensitivity to regulatory, economic, environmental and

competitive conditions in certain geographic regions; our ability to increase the use by practitioners and clinics of the Biote Method at the rate that we anticipate or at all; our ability to grow our business; the significant competition we face in

our industry; the impact of strategic acquisitions and the implementation of our growth strategies; our limited operating history; our ability to protect our intellectual property; the heavy regulatory oversight in our industry; changes in

applicable laws or regulations; changes to international tariffs; the inability to profitably expand in existing markets and into new markets; the possibility that we may be adversely impacted by other economic, business and/or competitive factors,

including the impact of hurricane and other natural disasters; future exchange and interest rates; and other risks and uncertainties indicated in the section captioned “Risk Factors” in our Annual Report on Form 10-K for the fiscal year

ended December 31, 2024 filed with the United States Securities Exchange Commission (“SEC”) on March 14, 2025 and any other materials subsequently filed or furnished with the SEC. These forward-looking statements are based upon estimates

and assumptions that are inherently uncertain. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such

forward- looking statements will be achieved. You are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statements contained in this release, whether as

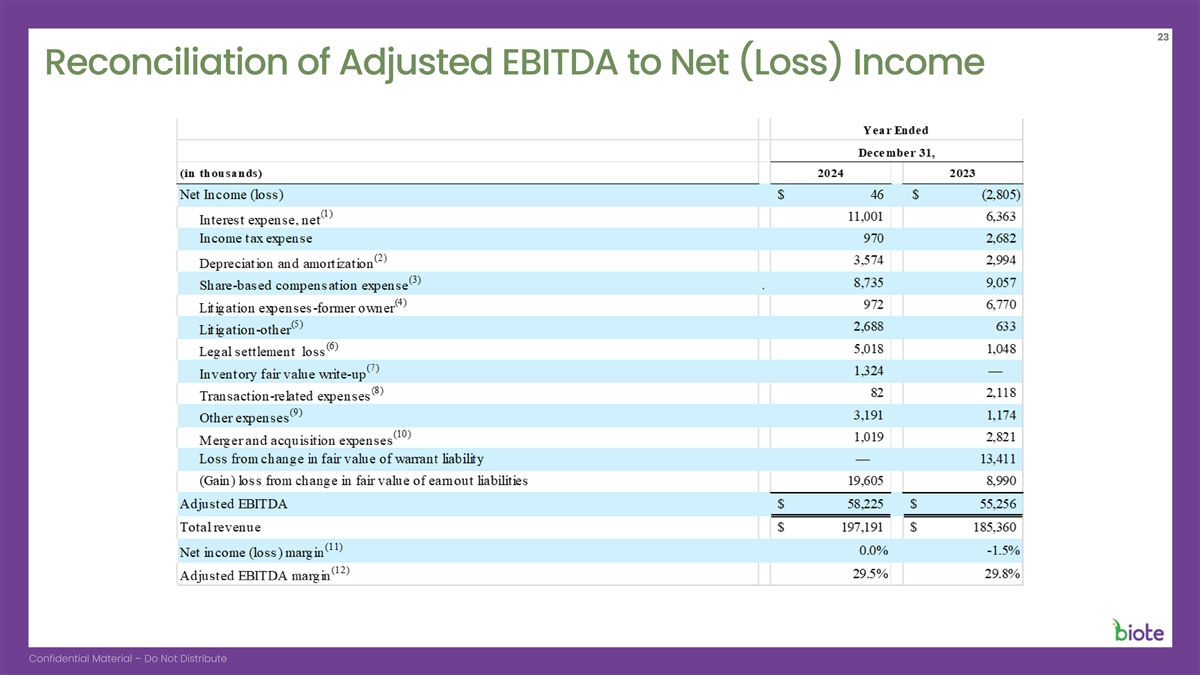

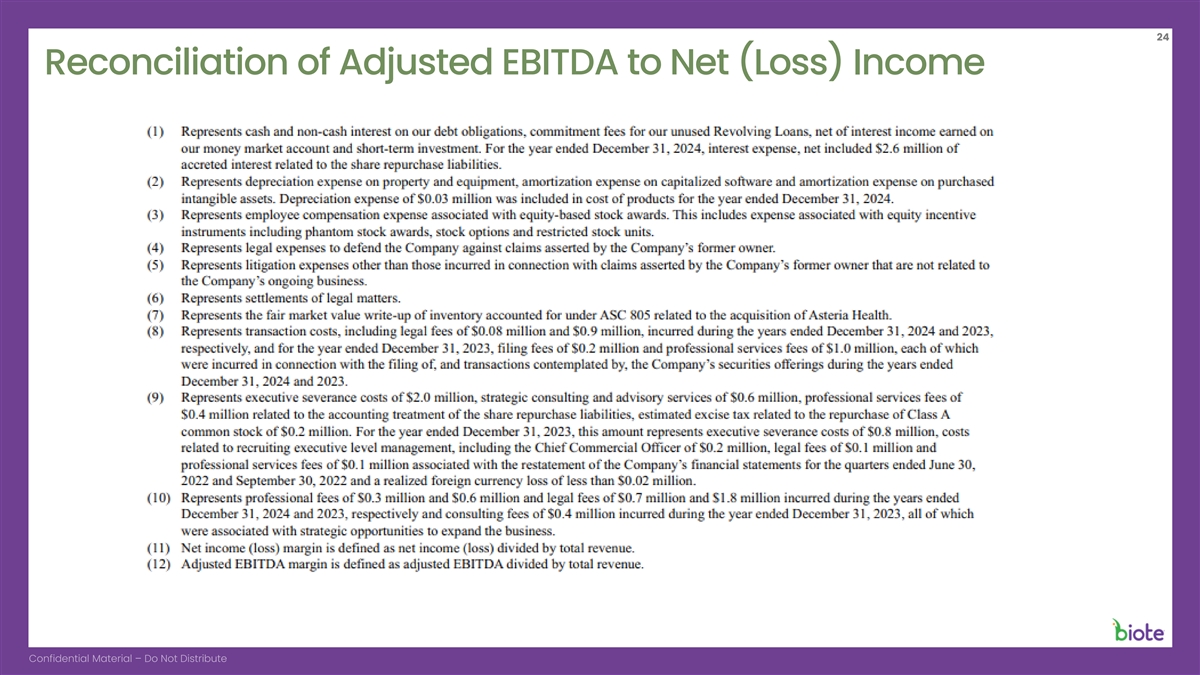

a result of new information, future events or otherwise, except as required by applicable law. Financial Information; Non-GAAP Financial Measures This Presentation includes certain financial measures not presented in accordance with generally

accepted accounting principles (“GAAP”) including, but not limited to, Adjusted EBITDA and Adjusted EBITDA Margin. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items

that are significant in understanding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of

profitability, liquidity or performance under GAAP. You should be aware that the presentation of these measures may not be comparable to similarly-titled measures used by other companies. A reconciliation of these measures to the most directly

comparable GAAP measure is included in the appendix to these slides on pages 23-24. The Company believes these non-GAAP measures provide useful information to management and investors regarding certain financial and business trends relating to the

Company’s financial condition and results of operations. The Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in and in

comparing its financial results with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by

management about which expense and income are excluded or included in determining these non-GAAP financial measures. This Presentation also includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in

making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that

would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward-looking non-GAAP

financial measures is included. Certain monetary amounts, percentages and other figures included in this Presentation have been subject to rounding adjustments. Certain other amounts that appear in this Presentation may not sum due to rounding. Use

of Projections This Presentation contains financial forecasts with respect to the Company’s projected financial results for the fiscal year ended December 31, 2024, including Revenue and, Adjusted EBITDA and Adjusted EBITDA Margin. The

Company’s independent auditor has not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, it did not express an opinion or provide

any other form of assurance with respect thereto for the purpose of this Presentation. These projections should not be relied upon as being necessarily indicative of future results. The assumptions and estimates underlying the prospective financial

information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial

information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of the Company or that actual results will not differ materially from those presented in the prospective financial information.

Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Industry and Market Data This

Presentation includes certain information and statistics obtained from third-party sources. The Company has not independently verified the accuracy or completeness of any such third-party information. No Offer This Presentation shall not constitute

an offer to sell or a solicitation of an offer to buy the securities of Biote, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of such state or jurisdiction.

3 Transforming Healthy Aging Looking Forward Biote offers an Our Vision

evidence-based, To be a part of individualized, and everyone’s routine comprehensive healthcare as approach to they age healthcare

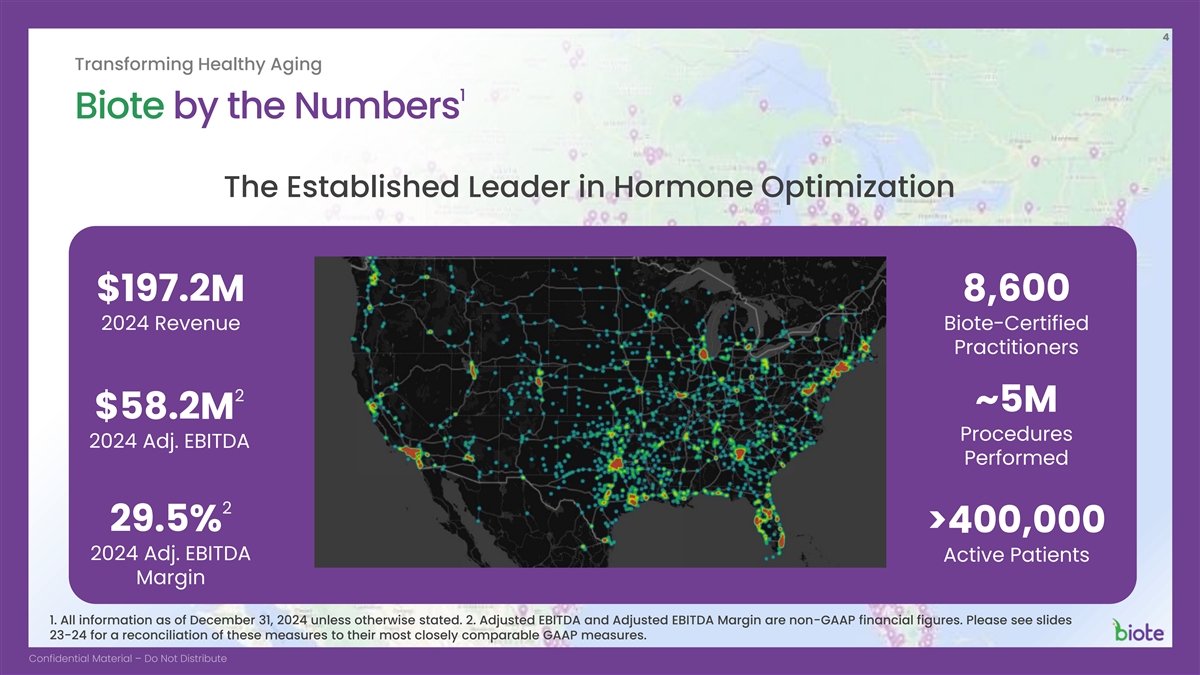

4 Transforming Healthy Aging 1 Biote by the Numbers The Established

Leader in Hormone Optimization $197.2M 8,600 2024 Revenue Biote-Certified Practitioners 2 ~5M $58.2M Procedures 2024 Adj. EBITDA Performed 2 29.5% >400,000 2024 Adj. EBITDA Active Patients Margin 1. All information as of December 31, 2024 unless

otherwise stated. 2. Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial figures. Please see slides 23-24 for a reconciliation of these measures to their most closely comparable GAAP measures.

5 Transforming Healthy Aging Investment Highlights Proprietary Trusted

Leader in Large & Growing Growing, Profitable Technology, Hormone Addressable & Capital-light Clinical, Education Optimization Markets Business Model & Training Platform Becoming the Leading Single-Source Provider of Evidence-Based

Therapeutic Wellness Solutions

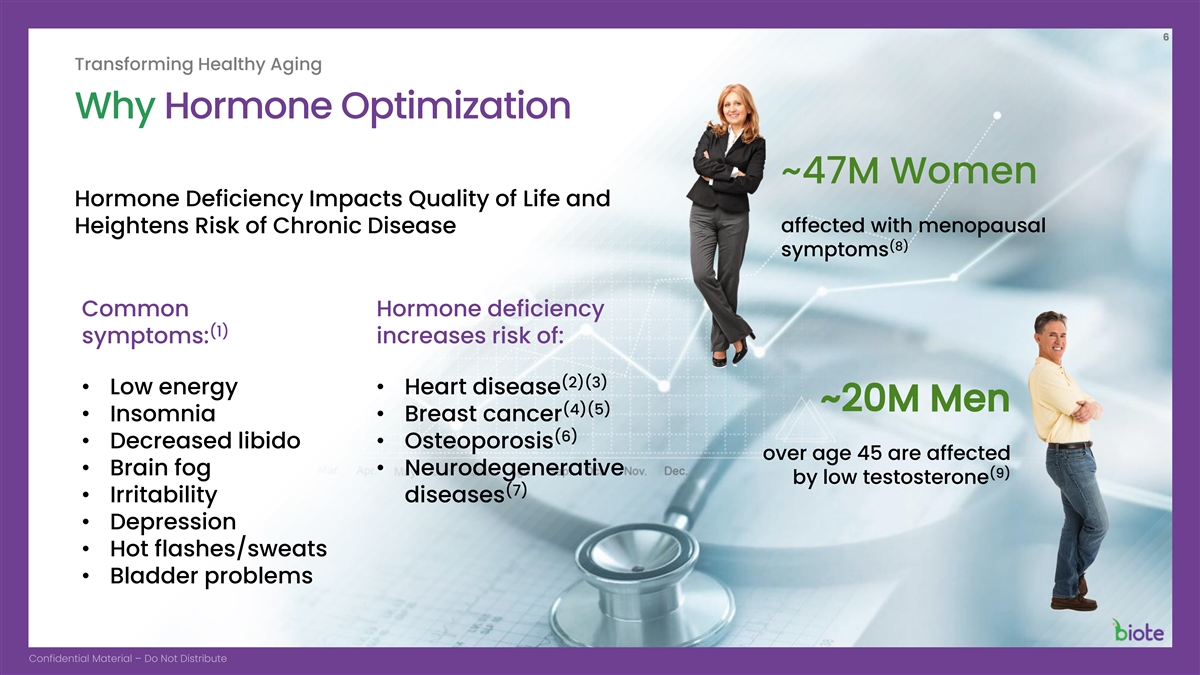

6 Transforming Healthy Aging Why Hormone Optimization ~47M Women Hormone

Deficiency Impacts Quality of Life and affected with menopausal Heightens Risk of Chronic Disease (8) symptoms Common Hormone deficiency (1) symptoms: increases risk of: (2)(3) • Low energy• Heart disease ~20M Men (4)(5) •

Insomnia• Breast cancer (6) • Decreased libido• Osteoporosis over age 45 are affected • Brain fog• Neurodegenerative (9) by low testosterone (7) • Irritability diseases • Depression • Hot

flashes/sweats • Bladder problems

7 Transforming Healthy Aging Biote: A Better Solution for Practitioners

& Patients 1 Network of 8,600 certified practitioners • OB/GYN Biote-certified practitioners customize • Family Practice/Internal Medicine treatment therapies based on our • Urology proprietary algorithms to meet each •

Functional Medicine patient’s unique needs and preferences • Nurse Practitioners Our Practitioner Certification Process is Our proprietary technology empowers rigorous, involving pre-screening, an practitioners with a single-source

intensive two-day training program, and platform, exclusive software solutions continuous education and evaluation in and strategic marketing support practice 1. As of December 31, 2024.

8 Transforming Healthy Aging A More Proactive and Holistic Approach to

Healthcare Practitioners Seek: ▪ Single-source technology platform ▪ Therapies to address common health conditions ▪ Revenue opportunities that enhance clinic economics Patients Seek: ▪ Ease and convenience from a single

provider ▪ Evidence-based results ▪ Broad range of complementary wellness therapies

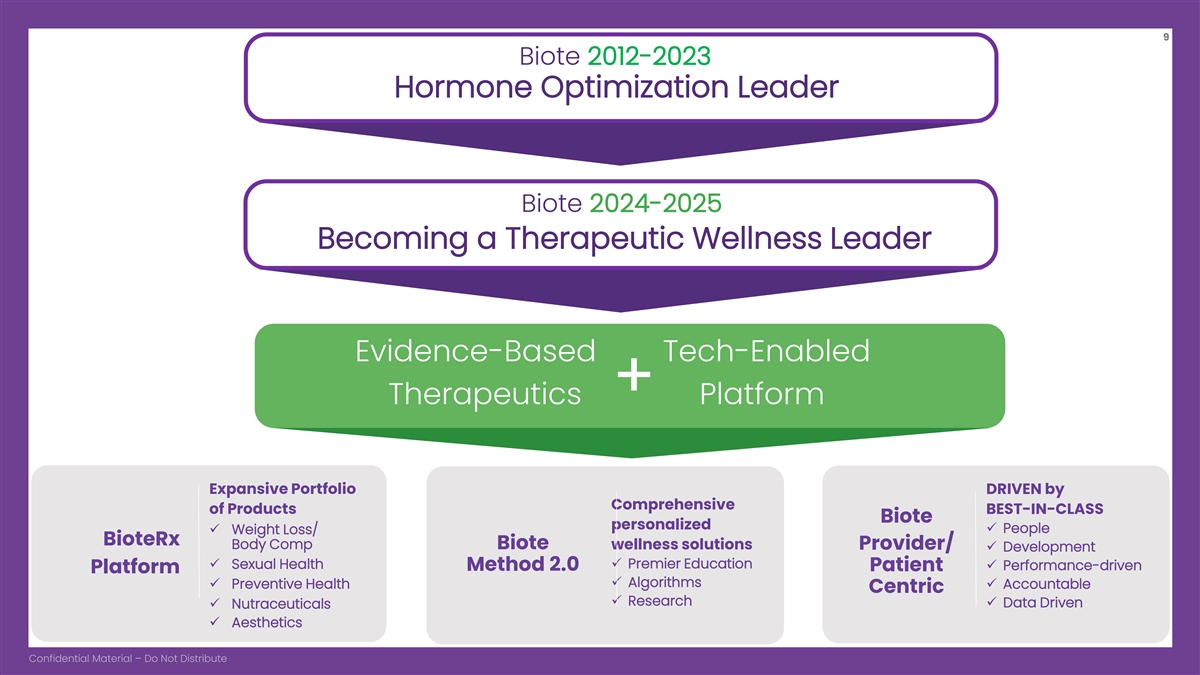

9 Biote 2012-2023 Hormone Optimization Leader Biote 2024-2025 Becoming a

Therapeutic Wellness Leader Evidence-Based Tech-Enabled + Therapeutics Platform Expansive Portfolio DRIVEN by Comprehensive of Products BEST-IN-CLASS Biote personalized ✓ People ✓ Weight Loss/ BioteRx Body Comp Biote wellness solutions

Provider/ ✓ Development ✓ Sexual Health✓ Premier Education ✓ Performance-driven Method 2.0 Patient Platform ✓ Algorithms ✓ Preventive Health✓ Accountable Centric ✓ Research ✓ Data Driven

✓ Nutraceuticals ✓ Aesthetics

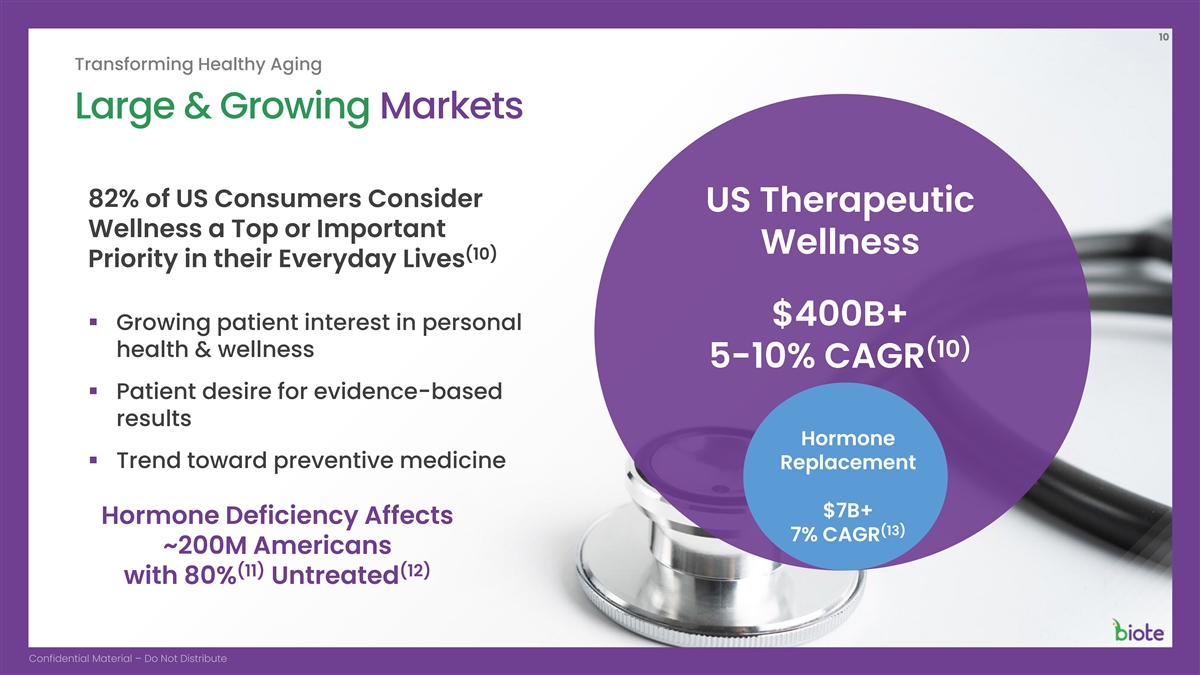

10 Transforming Healthy Aging Large & Growing Markets 82% of US

Consumers Consider US Therapeutic Wellness a Top or Important Wellness (10) Priority in their Everyday Lives $400B+ ▪ Growing patient interest in personal health & wellness (10) 5-10% CAGR ▪ Patient desire for evidence-based results

Hormone ▪ Trend toward preventive medicine Replacement $7B+ Hormone Deficiency Affects (13) 7% CAGR ~200M Americans (11) (12) with 80% Untreated

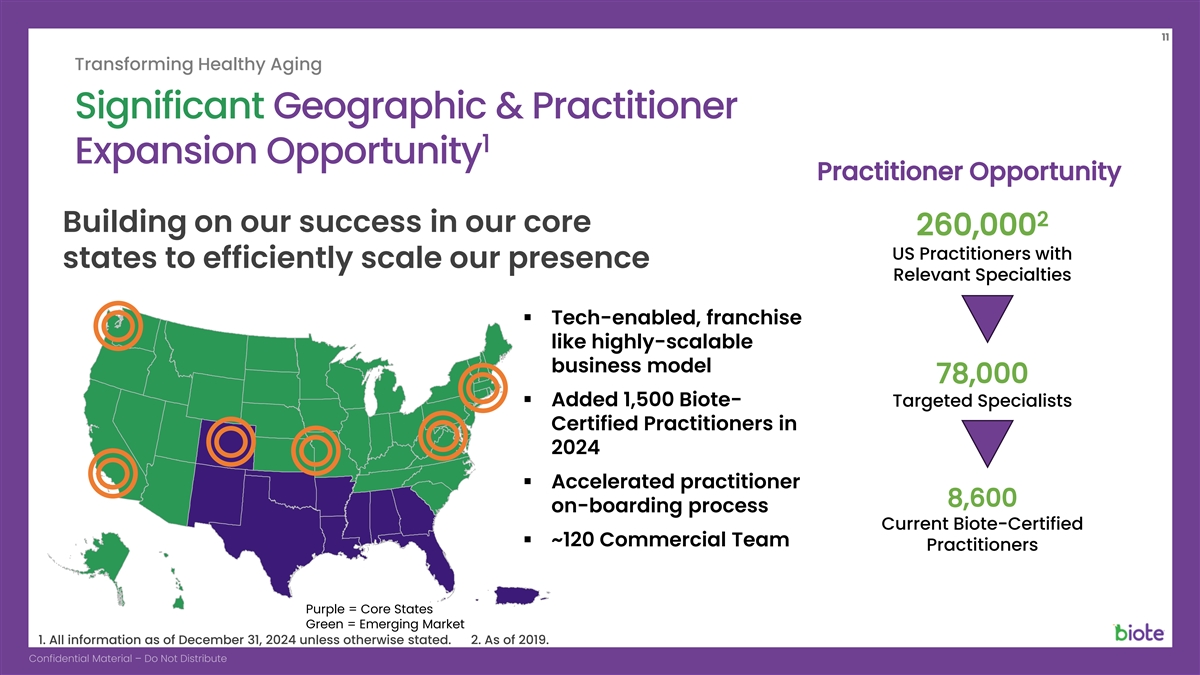

11 Transforming Healthy Aging Significant Geographic & Practitioner

1 Expansion Opportunity Practitioner Opportunity 2 Building on our success in our core 260,000 US Practitioners with states to efficiently scale our presence Relevant Specialties ▪ Tech-enabled, franchise- like highly-scalable business model

78,000 ▪ Added 1,500 Biote- Targeted Specialists Certified Practitioners in 2024 ▪ Accelerated practitioner 8,600 on-boarding process Current Biote-Certified ▪ ~120 Commercial Team Practitioners Purple = Core States Green =

Emerging Market 1. All information as of December 31, 2024 unless otherwise stated. 2. As of 2019.

12 Transforming Healthy Aging Nutraceuticals Complement Our Hormone

Therapy Offerings ▪ Biote-branded dietary supplements and cosmeceuticals ▪ Complementary to procedures performed by Biote-certified practitioners ▪ Nutraceuticals strengthen the patient connection to Biote and enhance practitioner

economics

13 Transforming Healthy Aging BioteRx: New Therapeutic Wellness

Offerings from a Trusted Network of Providers Wellness Categories Hormone Optimization Weight Loss/ Thyroid Body Composition Health Sexual Preventive Health Wellness Hair Loss/ Aesthetic Dermatology

14 Transforming Healthy Aging Our Scalable & Proprietary Platform

Drives Clinic Success + + + + = The Biote Method Clinical Didactic & Access to Practice Practice Proprietary Decision High Quality Training Clinical Retention Practice Support Certification Products and Support Management Software Training

Software 1 Our advantages : ▪ Over 95% practice retention ▪ Biote-trained clinic network is the largest in the country ▪ Proprietary algorithms and best-in-class technology platform 2 ▪ Average Biote clinic generates $100,000

in incremental annual revenue ▪ Over 120 commercial team members across the U.S. 1. All information as of December 31, 2024 unless otherwise stated. 2. Average clinic performance three years after onboarding.

15 Commitment to Research Transforming Healthy Aging ▪ The Aging

Male Leadership in Education, ▪ European Journal of Breast Health ▪ Therapeutic Advances in Endocrinology and Metabolism Training & Research (14) Breast Cancer Study ▪ Testosterone and/or Testosterone/Estradiol delivered

subcutaneously significantly reduced the incidence of breast cancer (15) Safety Study ▪ Overall complication rate was <1% Leading Voice in Training & Education ▪ National training center in Irving, TX ▪ 5 regional training

centers across U.S. ▪ 15 medical advisors and 6 medical/clinical faculty Evolution of Hormone Optimization and Wellness ▪ The New York Times Magazine ▪ Men’s Health ▪ USA Today ▪ Healthline

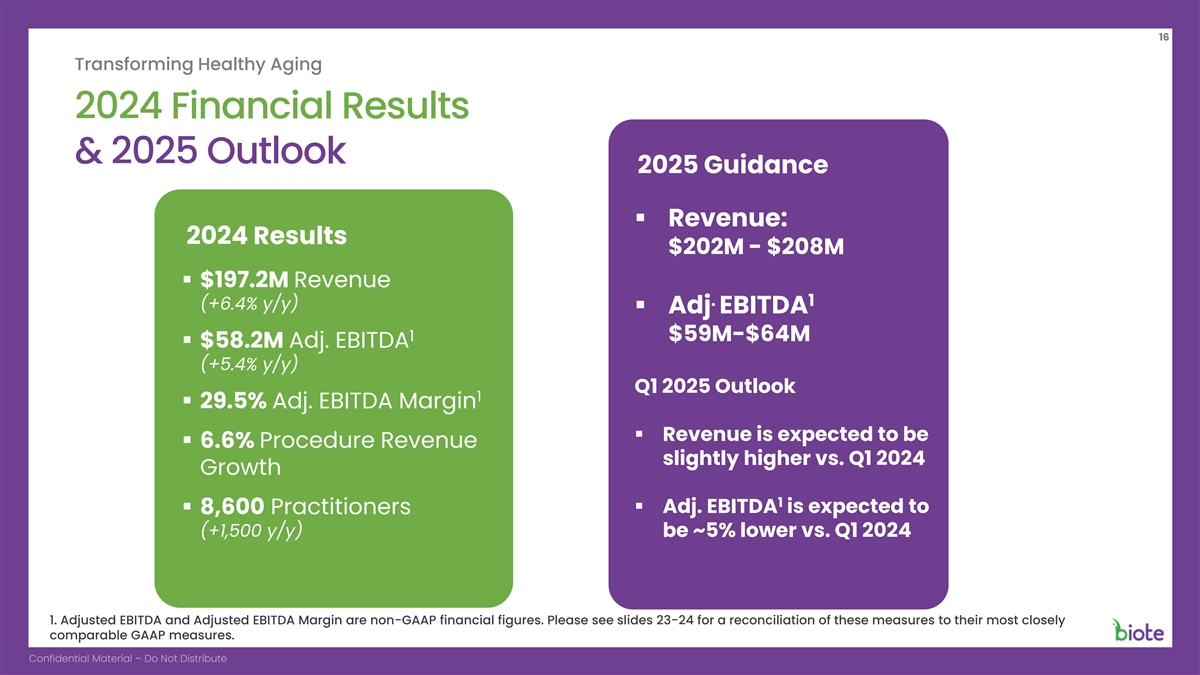

16 Transforming Healthy Aging 2024 Financial Results & 2025 Outlook

2025 Guidance ▪ Revenue: 2024 Results $202M - $208M ▪ $197.2M Revenue . 1 (+6.4% y/y) ▪ Adj EBITDA 1 $59M-$64M ▪ $58.2M Adj. EBITDA (+5.4% y/y) Q1 2025 Outlook 1 ▪ 29.5% Adj. EBITDA Margin ▪ Revenue is expected to

be ▪ 6.6% Procedure Revenue slightly higher vs. Q1 2024 Growth 1 ▪ Adj. EBITDA is expected to ▪ 8,600 Practitioners (+1,500 y/y) be ~5% lower vs. Q1 2024 1. Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial figures.

Please see slides 23-24 for a reconciliation of these measures to their most closely comparable GAAP measures.

17 Transforming Healthy Aging Capital Allocation Priorities Organic

Drive growth, gain efficiency and expand capabilities Investments Company agreed to repurchase ~18.4 million shares from founder on fixed terms (binding settlement term sheet) and cancelled 3.9 million earnout shares Share Company agreed to

repurchase ~8.3 million shares from legacy Repurchases shareholder on fixed terms (binding settlement term sheet) and cancelled ~4.0 million earnout shares Company authorized a $20 million share repurchase program Company purchased $5.6M in 2024;

remaining balance is $14.4M

18 Transforming Healthy Aging Strengthened Capabilities ▪

Strategic acquisition strengthens control over our supply chain and enhances our efficiency ▪ Deep expertise in 503B manufacturing ▪ Enables longer-term development of innovative wellness therapeutics ▪ Vertical integration of

manufacturing provides direct control over our new product research efforts ▪ Manufacturing insourcing expected to drive margin improvement

19 Transforming Healthy Aging Our 2025 Priorities ▪ Strengthen

our efforts to maximize the value from our top-tier providers ▪ Fully leverage the capabilities of our enhanced clinical decision support software ▪ Continue to develop more high-value and differentiated offerings for our practitioners

and patients ▪ Intensify our focus on adding new practitioners ▪ Ample capacity to accelerate growth in newly trained practitioners and optimize their clinic success through our quickstart program ▪ Positioning Biote to serve a

broader range of physicians beyond early adopters of the Biote Method ▪ Drive revenue growth by strengthening accountability and improving consistency and discipline ▪ Implementing these changes quickly, with an expectation they will

take time to show results ▪ Confident in our ability to create a stronger commercial organization with increased productivity later this year

20 Transforming Healthy Aging Key Takeaways ▪ Leveraging our

leadership in hormone optimization to capture the significant growth opportunity in therapeutic wellness ▪ Our addressable market is substantial, and that we have only just begun to tap into the geographic expansion opportunity in front of us

▪ Best-in-class technology, training and education platform distinguishes the Biote brand ▪ Efficient and scalable business model generates strong profitability and solid cash flow We are well-Positioned to Become the Leading

Single-Source Provider of Evidence-Based Therapeutic Wellness Solutions

21 Thank You

22 Appendix A

23 Reconciliation of Adjusted EBITDA to Net (Loss) Income

24 Reconciliation of Adjusted EBITDA to Net (Loss) Income

25 Appendix B

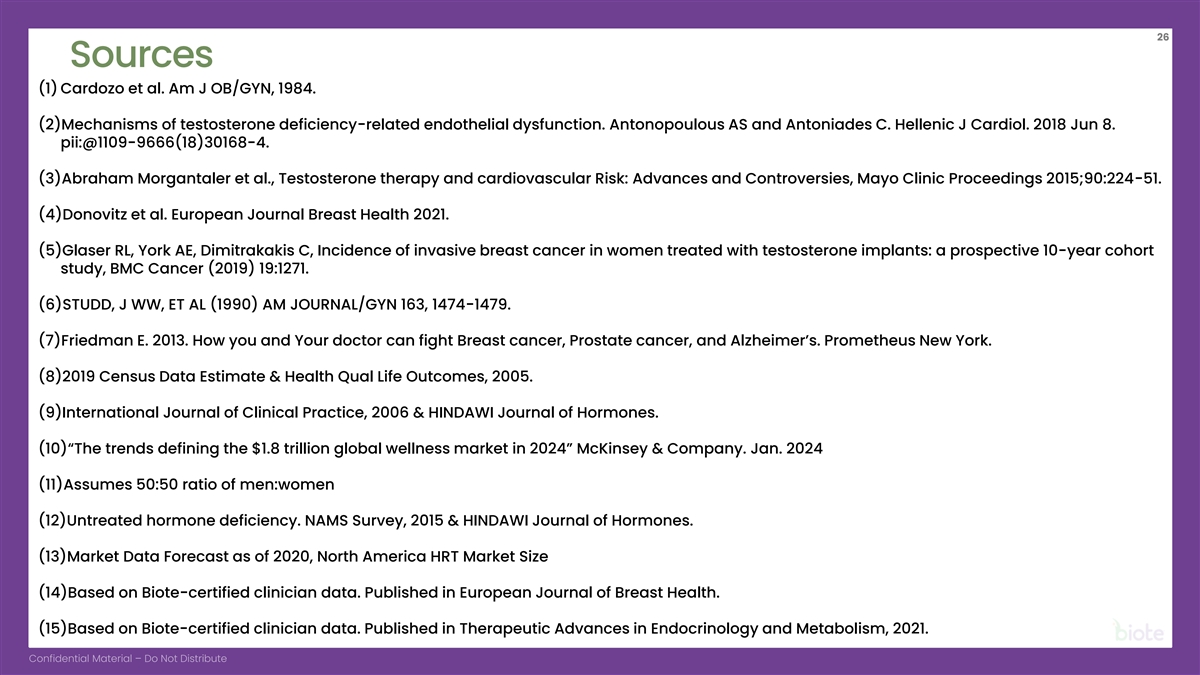

26 Sources (1) Cardozo et al. Am J OB/GYN, 1984. (2)Mechanisms of

testosterone deficiency-related endothelial dysfunction. Antonopoulous AS and Antoniades C. Hellenic J Cardiol. 2018 Jun 8. pii:@1109-9666(18)30168-4. (3)Abraham Morgantaler et al., Testosterone therapy and cardiovascular Risk: Advances and

Controversies, Mayo Clinic Proceedings 2015;90:224-51. (4)Donovitz et al. European Journal Breast Health 2021. (5)Glaser RL, York AE, Dimitrakakis C, Incidence of invasive breast cancer in women treated with testosterone implants: a prospective

10-year cohort study, BMC Cancer (2019) 19:1271. (6)STUDD, J WW, ET AL (1990) AM JOURNAL/GYN 163, 1474-1479. (7)Friedman E. 2013. How you and Your doctor can fight Breast cancer, Prostate cancer, and Alzheimer’s. Prometheus New York. (8)2019

Census Data Estimate & Health Qual Life Outcomes, 2005. (9)International Journal of Clinical Practice, 2006 & HINDAWI Journal of Hormones. (10)“The trends defining the $1.8 trillion global wellness market in 2024” McKinsey &

Company. Jan. 2024 (11)Assumes 50:50 ratio of men:women (12)Untreated hormone deficiency. NAMS Survey, 2015 & HINDAWI Journal of Hormones. (13)Market Data Forecast as of 2020, North America HRT Market Size (14)Based on Biote-certified clinician

data. Published in European Journal of Breast Health. (15)Based on Biote-certified clinician data. Published in Therapeutic Advances in Endocrinology and Metabolism, 2021.

v3.25.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Biote (NASDAQ:BTMD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Biote (NASDAQ:BTMD)

Historical Stock Chart

From Mar 2024 to Mar 2025