The Cheesecake Factory Incorporated (NASDAQ: CAKE) today

reported financial results for the fourth quarter of fiscal 2024,

which ended on December 31, 2024.

Total revenues were $921.0 million in the fourth quarter of

fiscal 2024 compared to $877.0 million in the fourth quarter of

fiscal 2023. Net income and diluted net income per share were $41.2

million and $0.83, respectively, in the fourth quarter of fiscal

2024.

The Company recorded pre-tax net expense of $14.4 million

related to impairment of assets and lease termination expense

partially offset by Fox Restaurant Concepts (“FRC”)

acquisition-related income. Excluding the after-tax impact of these

items, adjusted net income and adjusted diluted net income per

share for the fourth quarter of fiscal 2024 were $51.8 million and

$1.04, respectively. Please see the Company’s reconciliation of

non-GAAP financial measures at the end of this press release.

Comparable restaurant sales at The Cheesecake Factory

restaurants increased 1.7% year-over-year in the fourth quarter of

fiscal 2024.

“Our fourth quarter performance capped off an excellent year,

with solid revenue and earnings contributing to record annual

revenue and substantially improved profitability for 2024,” said

David Overton, Chairman and Chief Executive Officer. “While our

fourth quarter results were led by the strength of The Cheesecake

Factory restaurants, we delivered impressive performance across our

portfolio of concepts. Consumer demand for the distinct,

high-quality dining experiences we provide our guests across our

experiential concepts reinforces our confidence in the long-term

growth potential of our portfolio.”

“We continued to capture market share, as demonstrated by the

ongoing outperformance in comparable sales and traffic at The

Cheesecake Factory restaurants versus the broader casual dining

industry. During the fourth quarter, we opened nine new restaurants

to strong consumer demand, for a total of 23 new openings for the

year, surpassing our development expectations.”

“Our fourth quarter and full-year results marked the achievement

of our key financial and operational objectives, including

comparable sales growth, margin expansion and accelerating

accretive unit growth. With these accomplishments as a foundation,

we are confident in our ability to continue delivering on our goals

for 2025 and beyond. We remain focused on leveraging our scale,

operational strengths and the appeal of our differentiated concepts

to drive long-term value to our shareholders in the years to

come.”

Development

During the fourth quarter of fiscal 2024, the Company opened

nine new restaurants, including three North Italia locations, two

Flower Child locations, two FRC restaurants and the relocation of

two Cheesecake Factory restaurants. Subsequent to quarter-end, the

Company opened five new restaurants, including one North Italia

location, two Flower Child locations and two FRC restaurants.

The Company now expects to open as many as 25 new restaurants in

fiscal 2025, including as many as three to four The Cheesecake

Factory restaurants, six to seven North Italia locations, six to

seven Flower Child locations, and as many as eight to nine FRC

restaurants.

Liquidity and Capital Allocation

As of December 31, 2024, the Company had total available

liquidity of $340.7 million, including a cash balance of $84.2

million and availability on its revolving credit facility of $256.5

million. Total principal amount of debt outstanding was $455

million, including $345 million in principal amount of 0.375%

convertible senior notes due June 2026 and $110 million in

principal amount drawn on the Company’s revolving credit

facility.

The Company repurchased approximately 11,800 shares of its stock

at a cost of $0.5 million in the fourth quarter of fiscal 2024. In

addition, the Company’s Board of Directors has declared a quarterly

dividend of $0.27 per share to be paid on March 18, 2025, to

shareholders of record at the close of business on March 5,

2025.

Conference Call and Webcast

The Company will hold a conference call to review its results

for the fourth quarter of fiscal 2024 today at 2:00 p.m. Pacific

Time. The conference call will be webcast live on the Company’s

website at investors.thecheesecakefactory.com.

About The Cheesecake Factory Incorporated

The Cheesecake Factory Incorporated is a leader in experiential

dining. We are culinary forward and relentlessly focused on

hospitality. Delicious, memorable experiences created by passionate

people – this defines who we are and where we are going. We

currently own and operate 352 restaurants throughout the United

States and Canada under brands including The Cheesecake Factory®,

North Italia®, Flower Child® and a collection of other FRC brands.

Internationally, 34 The Cheesecake Factory® restaurants operate

under licensing agreements. Our bakery division operates two

facilities that produce quality cheesecakes and other baked

products for our restaurants, international licensees and

third-party bakery customers. In 2024, we were named to the FORTUNE

Magazine “100 Best Companies to Work For®” list for the eleventh

consecutive year. To learn more, visit

www.thecheesecakefactory.com, www.northitalia.com,

www.iamaflowerchild.com and www.foxrc.com.

From Fortune. ©2024 Fortune Media IP Limited. All rights

reserved. Used under license. Fortune® and Fortune 100 Best

Companies to Work For® are registered trademarks of Fortune Media

IP Limited and are used under license. Fortune and Fortune Media IP

Limited are not affiliated with, and do not endorse products or

services of, The Cheesecake Factory Incorporated.

Safe Harbor Statement

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as codified in Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements include, without limitation, statements

regarding the Company’s operations, growth, digital strategies and

other objectives. Such forward-looking statements include all other

statements that are not historical facts, as well as statements

that are preceded by, followed by or that include words or phrases

such as “believe,” “plan,” “will likely result,” “expect,”

“intend,” “will continue,” “is anticipated,” “estimate,” “project,”

“may,” “could,” “would,” “should” and similar expressions. These

statements are based on current expectations and involve risks and

uncertainties which may cause results to differ materially from

those set forth in such statements. Investors are cautioned that

forward-looking statements are not guarantees of future performance

and that undue reliance should not be placed on such statements.

These forward-looking statements may be affected by various factors

including: economic, public health and political conditions that

impact consumer confidence and spending, including interest rate

fluctuations, periods of heightened inflation and market

instability, and armed conflicts; supply chain disruptions;

demonstrations, political unrest, potential damage to or closure of

the Company’s restaurants and potential reputational damage to the

Company or any of its brands; pandemics and related containment

measures, including the potential for quarantines or restriction on

in-person dining; acceptance and success of The Cheesecake Factory

in international markets; acceptance and success of North Italia,

Flower Child and Other Fox Restaurant Concepts restaurants; the

risks of doing business abroad through Company-owned restaurants

and/or licensees; foreign exchange rates, tariffs and cross border

taxation; changes in unemployment rates; increases in minimum wages

and benefit costs; the economic health of the Company’s landlords

and other tenants in retail centers in which its restaurants are

located, and the Company’s ability to successfully manage its lease

arrangements with landlords; the economic health of suppliers,

licensees, vendors and other third parties providing goods or

services to the Company; the timing of new unit development and

related permitting; compliance with debt covenants; strategic

capital allocation decisions including with respect to share

repurchases or dividends; the ability to achieve projected

financial results; the resolution of uncertain tax positions with

the Internal Revenue Service and the impact of tax reform

legislation; changes in laws impacting the Company’s business;

adverse weather conditions in regions in which the Company’s

restaurants are located; factors that are under the control of

government agencies, landlords and other third parties; the risks,

costs and uncertainties associated with opening new restaurants;

and other risks and uncertainties detailed from time to time in the

Company’s filings with the Securities and Exchange Commission

(“SEC”). Forward-looking statements speak only as of the dates on

which they are made, and the Company undertakes no obligation to

publicly update or revise any forward-looking statements or to make

any other forward-looking statements, whether as a result of new

information, future events or otherwise, unless required to do so

by law. Investors are referred to the full discussion of risks and

uncertainties associated with forward-looking statements and the

discussion of risk factors contained in the Company’s latest Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K as filed with the SEC, which are available at

www.sec.gov.

The Cheesecake Factory Incorporated Condensed

Consolidated Statements of Income (unaudited; in thousands,

except per share data) Consolidated Statements of

Income

13 Weeks Ended December 31,

2024

13 Weeks Ended January 2,

2024

52 Weeks Ended December 31,

2024

52 Weeks Ended January 2,

2024

Amount

Percent of Revenues

Amount

Percent of Revenues

Amount

Percent of Revenues

Amount

Percent of Revenues

Revenues

$

920,963

100.0

%

$

877,009

100.0

%

$

3,581,699

100.0

%

$

3,439,503

100.0

%

Costs and expenses: Food and beverage costs

205,768

22.3

%

201,449

23.0

%

806,021

22.5

%

803,500

23.4

%

Labor expenses

315,231

34.2

%

308,555

35.2

%

1,264,382

35.3

%

1,227,895

35.7

%

Other operating costs and expenses

247,113

26.8

%

234,969

26.8

%

959,221

26.7

%

922,428

26.8

%

General and administrative expenses

57,783

6.3

%

54,683

6.2

%

228,737

6.4

%

217,449

6.3

%

Depreciation and amortization expenses

26,435

2.9

%

24,012

2.7

%

101,450

2.8

%

93,136

2.7

%

Impairment of assets and lease terminations expense

15,224

1.7

%

27,827

3.2

%

13,647

0.4

%

29,464

0.9

%

Acquisition-related contingent consideration, compensation and

amortization (income)/expenses

(858

)

(0.1

)%

7,796

0.9

%

2,429

0.1

%

11,686

0.3

%

Preopening costs

7,635

0.8

%

9,579

1.1

%

27,495

0.8

%

25,379

0.7

%

Total costs and expenses

874,331

94.9

%

868,870

99.1

%

3,403,382

95.0

%

3,330,937

96.8

%

Income from operations

46,632

5.1

%

8,139

0.9

%

178,317

5.0

%

108,566

3.2

%

Interest expense, net

(2,137

)

(0.2

)%

(2,937

)

(0.3

)%

(10,107

)

(0.3

)%

(10,160

)

(0.3

)%

Other income, net

841

0.0

%

454

0.0

%

2,837

0.1

%

1,608

0.0

%

Income before income taxes

45,336

4.9

%

5,656

0.6

%

171,047

4.8

%

100,014

2.9

%

Income tax provision/(benefit)

4,182

0.4

%

(7,025

)

(0.8

)%

14,264

0.4

%

(1,337

)

0.0

%

Net income

$

41,154

4.5

%

$

12,681

1.4

%

$

156,783

4.4

%

$

101,351

2.9

%

Basic net income per share

$

0.86

$

0.27

$

3.28

$

2.10

Basic weighted average shares outstanding

47,953

47,828

47,789

48,324

Diluted net income per share

$

0.83

$

0.26

$

3.20

$

2.07

Diluted weighted average shares outstanding

49,645

48,609

48,974

49,050

The Cheesecake Factory Incorporated Selected

Segment Information (unaudited; in thousands)

For the 13 Weeks Ended December 31, 2024 The

Cheesecake Factory North Other

restaurants Italia FRC Other

Total Revenues

$

669,382

$

81,309

$

85,119

$

85,153

$

920,963

Costs and expenses: Food and beverage costs

149,130

18,371

18,346

19,921

205,768

Labor expenses

221,494

29,559

29,941

34,237

315,231

Other operating costs and expenses

175,382

21,598

25,090

25,043

247,113

General and administrative expenses

-

-

-

57,783

57,783

Depreciation and amortization expenses

16,768

2,591

3,143

3,933

26,435

Impairment of assets and lease terminations expense

330

-

14,893

1

15,224

Acquisition-related contingent consideration, compensation and

amortization (income)/expenses

-

-

315

(1,173

)

(858

)

Preopening costs

1,884

2,230

2,396

1,125

7,635

Total costs and expenses

564,988

74,349

94,124

140,870

874,331

Income/(loss) from operations

$

104,394

$

6,960

$

(9,005

)

$

(55,717

)

$

46,632

For the 13 Weeks Ended January 2, 2024 The

Cheesecake Factory North Other

restaurants Italia FRC Other

Total Revenues

$

658,445

$

67,224

$

70,913

$

80,427

$

877,009

Costs and expenses: Food and beverage costs

152,401

16,206

15,769

17,073

201,449

Labor expenses

225,951

23,897

25,083

33,624

308,555

Other operating costs and expenses

173,781

18,285

19,335

23,568

234,969

General and administrative expenses

-

-

-

54,683

54,683

Depreciation and amortization expenses

16,251

1,694

2,289

3,778

24,012

Impairment of assets and lease terminations expense

20,241

1,015

2,527

4,044

27,827

Acquisition-related contingent consideration, compensation and

amortization expenses

-

-

316

7,480

7,796

Preopening costs

4,457

2,926

1,998

198

9,579

Total costs and expenses

593,082

64,023

67,317

144,448

868,870

Income/(loss) from operations

$

65,363

$

3,201

$

3,596

$

(64,021

)

$

8,139

For the 52 Weeks Ended December 31, 2024

The Cheesecake Factory North Other

restaurants Italia FRC Other

Total Revenues

$

2,661,627

$

299,575

$

299,969

$

320,528

$

3,581,699

Costs and expenses: Food and beverage costs

599,899

69,505

66,665

69,952

806,021

Labor expenses

913,560

111,082

108,377

131,363

1,264,382

Other operating costs and expenses

696,739

82,290

88,672

91,520

959,221

General and administrative expenses

-

-

-

228,737

228,737

Depreciation and amortization expenses

66,010

9,244

11,389

14,807

101,450

Impairment of assets and lease termination (income)/expenses

(1,402

)

-

14,893

156

13,647

Acquisition-related contingent consideration, compensation and

amortization expenses

-

-

1,262

1,167

2,429

Preopening costs

7,499

7,409

9,206

3,381

27,495

Total costs and expenses

2,282,305

279,530

300,464

541,083

3,403,382

Income/(loss) from operations

$

379,322

$

20,045

$

(495

)

$

(220,555

)

$

178,317

For the 52 Weeks Ended January 2, 2024 The

Cheesecake Factory North Other

restaurants Italia FRC Other

Total Revenues

$

2,595,066

$

258,878

$

263,923

$

321,636

$

3,439,503

Costs and expenses: Food and beverage costs

607,439

64,425

59,865

71,771

803,500

Labor expenses

907,579

93,540

93,840

132,936

1,227,895

Other operating costs and expenses

685,521

69,918

72,554

94,435

922,428

General and administrative expenses

-

-

-

217,449

217,449

Depreciation and amortization expenses

64,206

6,407

7,916

14,607

93,136

Impairment of assets and lease terminations expense

20,401

1,015

2,582

5,466

29,464

Acquisition-related contingent consideration, compensation and

amortization expenses

-

-

1,262

10,424

11,686

Preopening costs

12,857

5,058

6,482

982

25,379

Total costs and expenses

2,298,003

240,363

244,501

548,070

3,330,937

Income/(loss) from operations

$

297,063

$

18,515

$

19,422

$

(226,434

)

$

108,566

The Cheesecake Factory Incorporated Selected

Operating, Restaurant and Balance Sheet Information

(unaudited; in thousands, except statistical data)

The Cheesecake Factory restaurants operating

information: 13 Weeks EndedDecember 31, 2024

13 Weeks EndedJanuary 2, 2024 52 Weeks EndedDecember 31,

2024 52 Weeks EndedJanuary 2, 2024 Comparable restaurant

sales vs. prior year

1.7

%

2.5

%

1.0

%

3.0

%

Restaurants opened during period

2

3

3

6

Restaurants open at period-end

215

216

215

216

Restaurant operating weeks

2,795

2,783

11,214

11,010

North Italia operating information: Comparable

restaurant sales vs. prior year

1

%

7

%

2

%

8

%

Restaurants opened during period

3

3

6

3

Restaurants open at period-end

42

36

42

36

Restaurant operating weeks

535

442

2,021

1,729

Other Fox Restaurant Concepts (FRC) operating

information:(1) Restaurants opened during period

2

3

8

6

Restaurants open at period-end

48

40

48

40

Restaurant operating weeks

611

512

2,264

1,906

Other operating information:(2) Restaurants opened

during period

2

-

6

1

Restaurants open at period-end

43

39

43

39

Restaurant operating weeks

551

519

2,114

2,074

Number of company-owned restaurants: The

Cheesecake Factory

215

North Italia

42

Other FRC

48

Other

43

Total

348

Number of international-licensed restaurants:

The Cheesecake Factory

34

(1) The Other FRC segment includes all FRC brands except

Flower Child. (2) The Other segment includes the Flower Child,

Grand Lux Cafe and Social Monk Asian Kitchen concepts, as well as

the Company's third-party bakery, international and consumer

packaged goods businesses, unallocated corporate expenses and gift

card costs.

Selected Consolidated Balance

Sheet Information December 31, 2024 January 2,

2024 Cash and cash equivalents

$

84,176

$

56,290

Long-term debt, net of issuance costs (1)

452,062

470,047

(1) Includes $342.1 million net balance of 0.375%

convertible senior notes due 2026 (principal amount of $345 million

less $2.9 million in unamortized issuance costs) and $110 million

drawn on the Company's revolving credit facility. The unamortized

issuance costs were recorded as a contra-liability and netted with

long-term debt on the Condensed Consolidated Balance Sheet and are

being amortized as interest expense.

Reconciliation of Non-GAAP Results to GAAP Results

In addition to the results provided in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”) in this press release, the Company is providing

non-GAAP measurements which present net income and net income per

share excluding the impact of certain items. The non-GAAP

measurements are intended to supplement the presentation of the

Company’s financial results in accordance with GAAP. These non-GAAP

measures are calculated by eliminating from net income and diluted

net income per share the impact of items the Company does not

consider indicative of its ongoing operations. The Company uses

these non-GAAP financial measures for financial and operational

decision-making and as a means to evaluate period-to-period

comparisons.

The Cheesecake Factory Incorporated Reconciliation of

Non-GAAP Financial Measures (unaudited; in thousands, except

per share data) 13 Weeks Ended 13 Weeks

Ended 52 Weeks Ended 52 Weeks Ended December

31, 2024 January 2, 2024 December 31, 2024

January 2, 2024 Net income (GAAP)

$

41,154

$

12,681

$

156,783

$

101,351

Impairment of assets and lease termination expenses(1)

15,224

27,827

13,647

29,464

Acquisition-related contingent consideration, compensation and

amortization (income)/expenses(2)

(858

)

7,796

2,429

11,686

Tax effect of adjustments(3)

(3,735

)

(9,262

)

(4,180

)

(10,699

)

Adjusted net income (non-GAAP)

$

51,785

$

39,042

$

168,679

$

131,802

Diluted net income/(loss) per share (GAAP)

$

0.83

$

0.26

$

3.20

$

2.07

Impairment of assets and lease termination expenses(1)

0.31

0.57

0.28

0.61

Acquisition-related contingent consideration, compensation and

amortization (income)/expenses(2)

(0.02

)

0.16

0.05

0.24

Tax effect of adjustments(3)

(0.08

)

(0.19

)

(0.09

)

(0.22

)

Adjusted diluted net income per share (non-GAAP)(4)

$

1.04

$

0.80

$

3.44

$

2.69

(1) A detailed breakdown of impairment of assets and lease

termination expenses recorded in the thirteen and fifty-two weeks

ended December 31, 2024 and January 2, 2024 can be found in the

Selected Segment Information table. (2) Represents changes in the

fair value of the deferred consideration and contingent

consideration and compensation liabilities related to the North

Italia and FRC acquisition, as well as amortization of acquired

definite-lived licensing agreements. (3) Based on the federal

statutory rate and an estimated blended state tax rate, the tax

effect on all adjustments assumes a 26% tax rate for the fiscal

2024 and 2023 periods. (4) Adjusted net income per share may not

add due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219585576/en/

Etienne Marcus (818) 871-3000

investorrelations@thecheesecakefactory.com

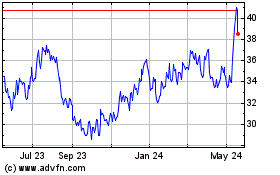

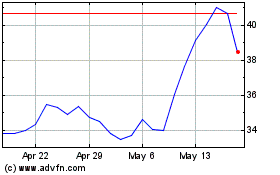

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Feb 2024 to Feb 2025