Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 21 2025 - 7:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of January, 2025

Commission

File Number 001-41666

CASI PHARMACEUTICALS, INC.

(Translation of registrant’s name into English)

1701-1702, China Central Office Tower 1

No. 81 Jianguo Road, Chaoyang District

Beijing, 100025

People’s Republic of China

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F x Form 40-F ¨

CASI

Pharmaceuticals Receives Asset Freezing Order from Court of P.R. China

On

January 21, 2025, CASI Pharmaceuticals, Inc., a Cayman Islands incorporated company (“CASI” or the “Company”)

announced that the Company received on January 17, 2025 an asset freezing order (the “Asset Freezing Order”) from a court

of P.R.C. with respect to the Company’s previously announced dispute with Juventas Cell Therapy Ltd. (“Juventas”) and

the related arbitration proceedings initiated at the Hong Kong International Arbitration Centre in connection to Juventas’s purported

termination of the parties’ agreements with respect to the commercialization of CNCT19 (the “Arbitration Proceeding”).

In

the Asset Freezing Order, the Fourth Intermediate People’s Court of Beijing Municipality, granted Juventas’ application

to freeze the Company’s assets while the Arbitration Proceeding is ongoing and decided to freeze up to RMB 250 million of the Company’s

assets. To enforce the Asset Freezing Order, the court has decided to freeze the transfer of certain equity interest the Company owns

in its subsidiaries in the P.R.C. No other asset has been affected. The Company does not expect that such action will have material adverse

effects on its day-to-day operations.

The Company will continue to vigorously assert

and enforce its rights against Juventas through all available legal means. The Company cannot predict right now the final outcome of the

Arbitration Proceeding or how the parties’ dispute would ultimately be resolved.

Forward-Looking Statements

This 6-K contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “confident”

and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities

and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written materials and

in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including

statements about the Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent

risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking

statement. All information provided herein is as of the date of this 6-K, and the Company undertakes no obligation to update any forward-looking

statement, except as required under applicable law. We caution readers not to place undue reliance on any forward-looking statements contained

herein.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

CASI Pharmaceuticals, Inc. |

| |

|

| |

By: |

/s/ Wei-Wu He |

| |

Name: |

Wei-Wu He |

| |

Title: |

Chairman & CEO |

| |

|

| Date: January 21, 2025 |

|

|

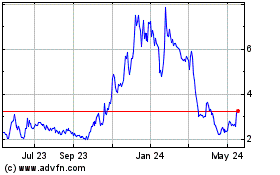

CASI Pharmaceuticals (NASDAQ:CASI)

Historical Stock Chart

From Feb 2025 to Mar 2025

CASI Pharmaceuticals (NASDAQ:CASI)

Historical Stock Chart

From Mar 2024 to Mar 2025