Century Aluminum Company (NASDAQ: CENX) today announced its third

quarter 2024 results.

Business Highlights

- Net sales of $539.1 million

- Realized LME aluminum price of

$2,451/MT in third quarter is up $163/MT from prior quarter

- Reported net income attributable to

Century stockholders of $47.3 million and adjusted EBITDA

attributable to Century stockholders of $103.7 million1

- Cash and cash equivalents of $32.6

million and strong liquidity of $278.9 million as of

September 30, 2024

- Final Section 45X rules include direct

and indirect material costs as eligible for 10% production tax

credit, increasing Century benefit by $34.9 million

Third Quarter 2024 Financial

Results

|

$MM (except shipments and per share data) |

|

|

|

Q3 2024 |

Q2 2024 |

|

|

Aluminum shipments (tonnes) |

|

|

168,755 |

|

167,908 |

|

|

|

Net sales |

|

$ |

539.1 |

$ |

560.8 |

|

|

|

Net income (loss) attributable to Century stockholders |

|

$ |

47.3 |

$ |

(2.5 |

) |

|

|

Diluted earnings (loss) per share attributable to Century

stockholders |

|

$ |

0.46 |

$ |

(0.03 |

) |

|

|

Adjusted net income attributable to Century stockholders(1) |

|

$ |

60.0 |

$ |

0.7 |

|

|

|

Adjusted earnings per share attributable to Century

stockholders(1) |

|

$ |

0.63 |

$ |

0.01 |

|

|

|

Adjusted EBITDA attributable to Century stockholders(1) |

|

$ |

103.7 |

$ |

34.2 |

|

|

| |

|

|

|

|

|

Notes: |

|

|

|

|

|

(1) Non-GAAP measure; see reconciliation of GAAP to non-GAAP

financial measures. |

Net sales for the third quarter ended

September 30, 2024 decreased by $21.7 million sequentially

primarily due to lower third-party alumina sales offset by higher

LME aluminum price, regional and value-added product premiums.

Century reported net income attributable to

Century stockholders of $47.3 million for the third quarter of

2024, a $49.8 million increase sequentially. The increase in net

earnings during the third quarter of 2024 was primarily driven by

the recognition of full year 2023 and year to date 2024 Inflation

Reduction Act Advanced Manufacturing credits of $34.9 million,

higher LME aluminum price realization of $31.0 million,

partially offset by higher power prices of $2.9 million. Third

quarter results were also impacted by $12.0 million of net

exceptional items, in particular, $3.2 million of stock based

compensation costs and $6.9 million of costs incurred following the

impact of Hurricane Beryl in Jamaica. Therefore, Century reported

an adjusted net income of $60.0 million for the third quarter of

2024, a $59.3 million improvement sequentially.

Adjusted EBITDA attributable to Century

stockholders for the third quarter of 2024 was $103.7 million. This

was an increase of $69.5 million from the prior quarter, primarily

driven by favorable realized LME and regional price premiums of

$31.7 million, and $34.9 million related to the recognition of 2023

and 2024 additional section 45X tax credits.

Century's liquidity position at

September 30, 2024 was $278.9 million, comprised of cash and

cash equivalents of $32.6 million and $246.3 million in combined

borrowing availability.

“Strong global demand, continued supply-side

challenges and supportive macroeconomic policy in China and the

West led to rising aluminum and alumina prices in the third

quarter,” noted Century President and CEO Jesse Gary. “With bauxite

and alumina supply chains facing a number of challenges around the

world, we are thrilled to have our own strategic supply of bauxite

and alumina from our Jamalco operations following the acquisition

last year. “

“We were very pleased with the final Section 45X

rules issued earlier this month that increase the amount of

production tax credit we will receive and further bolsters the

competitiveness of our U.S. operations. When combined with benefits

of our Jamalco acquisition and growing demand for aluminum around

the world, we believe Century is well positioned to offer our

customers a unique value proposition and superior returns for our

shareholders.”

Fourth Quarter 2024

Outlook

The company expects fourth quarter Adjusted

EBITDA to range between $70 to $80 million driven by lower LME and

regional premium prices offset by lower power costs.

About Century Aluminum Company

With its corporate headquarters located in

Chicago, IL, Century Aluminum owns and operates primary aluminum

smelting facilities in the United States and Iceland and is the

majority owner and managing partner of the Jamalco alumina refinery

in Jamaica. Visit www.centuryaluminum.com for more

information.

Non-GAAP Financial Measures

Adjusted net income (loss), adjusted earnings

(loss) per share and adjusted EBITDA are non-GAAP financial

measures that management uses to evaluate Century's financial

performance. These non-GAAP financial measures facilitate

comparisons of this period’s results with prior periods on a

consistent basis by excluding items that management does not

believe are indicative of Century’s ongoing operating performance

and ability to generate cash. Management believes these

non-GAAP financial measures enhance an overall understanding of

Century’s performance and our investors’ ability to review

Century’s business from the same perspective as

management. The tables below, under the heading

"Reconciliation of Non-GAAP Financial Measures," provide a

reconciliation of each non-GAAP financial measure to the most

directly comparable GAAP financial measure. Non-GAAP financial

measures should be viewed in addition to, and not as an alternative

for, Century's reported results prepared in accordance with

GAAP. In addition, because not all companies use identical

calculations, adjusted net income (loss), adjusted earnings (loss)

per share and adjusted EBITDA included in this press release may

not be comparable to similarly titled measures of other

companies. Investors are encouraged to review the

reconciliations in conjunction with the presentation of these

non-GAAP financial measures. We do not provide a reconciliation of

forward-looking Adjusted EBITDA because the corresponding

forward-looking GAAP financial measures is not currently available

and management cannot reliably predict all the necessary components

of such forward-looking GAAP measures without unreasonable effort

or expense due to the inherent difficulty of forecasting and

quantifying certain amounts that are necessary for such a

reconciliation, including adjustments that could be made for

restructuring, the variability of our tax rate, the impact of

foreign currency fluctuation, and other charges reflected in our

historical results. The probable significance of each of these

items is high and, based on historical experience, could be

material.

Cautionary StatementThis press

release and statements made by Century Aluminum Company management

on the quarterly conference call contain "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995, which are subject to the "safe harbor" created

by section 27A of the Securities Act of 1933, as amended (the

"Securities Act"), and section 21E of the Securities Exchange Act

of 1934, as amended (the "Exchange Act"). Forward-looking

statements are statements about future events and are based on our

current expectations. These forward-looking statements may be

identified by the words "believe," "expect," "hope," "target,"

"anticipate," "intend," "plan," "seek," "estimate," "potential,"

"project," "scheduled," "forecast" or words of similar meaning, or

future or conditional verbs such as "will," "would," "should,"

"could," "might," or "may." Forward-looking statements, for

example, may include statements regarding: Our assessment of global

and local financial and economic conditions; Our assessment of the

aluminum market and aluminum prices (including premiums); Our

assessment of alumina pricing, energy prices, both in the United

States and Europe, costs associated with our other key raw

materials and supply and availability of those key raw materials,

including power (and related natural gas and coal), and the

likelihood and extent of any power curtailments; Our assessment of

power prices and availability for our U.S. and European operations;

The impact of the wars in Ukraine and in the Middle East, including

any related impacts on global energy markets and/or any sanctions

and export controls targeting Russia and businesses tied to Russia

and to sanctioned entities and individuals, including any possible

impact on our business, operations, financial condition, results of

operations, and global supply chains; The future financial and

operating performance of the Company and its subsidiaries; Our

ability to successfully manage market risk and to control or reduce

costs; Our plans and expectations with respect to future operations

of the Company and its subsidiaries, including any plans and

expectations to curtail or restart production, including the

expected impact of any such actions on our future financial and

operating performance; Our plans and expectations with regards to

future operations of our Mt. Holly smelter, including our

expectations as to the restart of curtailed production at Mt. Holly

including the timing, costs and benefits associated with restarting

curtailed production; Our plans with regards to future operations

of our Hawesville smelter; Our plans and expectations with regards

to the Grundartangi casthouse project, including our expectations

as to the costs and benefits associated with it; Our plans and

expectations with respect to the acquisition of a 55% interest in

Jamalco, including our expectations as to the costs and benefits

associated with Jamalco's operations; Our ability to successfully

obtain and/or retain competitive power arrangements for our

operations; The impact of Section 232 relief, including tariffs or

other trade remedies, the extent to which any such remedies may be

changed, including through exclusions or exemptions, and the

duration of any trade remedy; The impact of any new or changed law

or regulation, including, without limitation, sanctions or other

similar remedies or restrictions or any changes in interpretation

of existing laws or regulations; Our anticipated tax liabilities,

benefits or refunds including the realization of U.S. and certain

foreign deferred tax assets and liabilities; Our ability to qualify

for and realize potential tax benefits under the Inflation

Reduction Act of 2022 and the anticipated amounts of such benefits;

Our ability to realize the full amount of the DOE $500 million

grant, to negotiate favorable terms and conditions related to such

grant, to raise additional capital through additional grants,

incentives, subsidized loans and other debt and equity funding to

support construction of a new aluminum smelter; Our ability to

access existing or future financing arrangements and the terms of

any such future financing arrangements; Our ability to repay or

refinance debt in the future; Our ability to recover losses from

our insurance; Our assessment and estimates of our pension and

other postretirement liabilities, legal and environmental

liabilities and other contingent liabilities; Our assessment of any

future tax audits or insurance claims and their respective

outcomes; Negotiations with current labor unions or future

representation by a union of our employees; Our assessment of any

information technology-related risks, including the risk from

cyberattacks or other data security breaches, including the

cybersecurity incident that occurred on February 16, 2022; Our

plans and expectations regarding potential M&A and joint

venture activity including our ability to consummate such

transactions and our assessments of certain risks associated with

the same, including, for example, unforeseen costs and expenses

associated with unidentified liabilities, and difficulties

integrating an acquired asset into our existing operations; and Our

future business objectives, plans, strategies and initiatives,

including our competitive position and prospects.

Where we express an expectation or belief as to

future events or results, such expectation or belief is expressed

in good faith and believed to have a reasonable basis. However, our

forward-looking statements are based on current expectations and

assumptions that are subject to risks and uncertainties which may

cause actual results to differ materially from future results

expressed, projected or implied by those forward-looking

statements. Important factors that could cause actual results and

events to differ from those described in such forward-looking

statements can be found in the risk factors and forward-looking

statements cautionary language contained in our Annual Report on

Form 10-K, our Quarterly Reports on Form 10-Q and in other filings

made with the Securities and Exchange Commission. Although we have

attempted to identify those material factors that could cause

actual results or events to differ from those described in such

forward-looking statements, there may be other factors that could

cause actual results or events to differ from those anticipated,

estimated or intended. Many of these factors are beyond our ability

to control or predict. Given these uncertainties, the reader is

cautioned not to place undue reliance on our forward-looking

statements. We undertake no obligation to update or revise publicly

any forward-looking statements, whether as a result of new

information, future events, or otherwise.

|

CENTURY ALUMINUM COMPANY |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(in millions, except per share amounts) |

|

(Unaudited) |

| |

|

Three months ended |

| |

|

September 30, |

|

June 30, |

| |

|

2024 |

|

2024 |

|

NET SALES: |

|

|

|

|

|

Related parties |

|

$ |

332.1 |

|

|

$ |

324.2 |

|

|

Other customers |

|

|

207.0 |

|

|

|

236.6 |

|

|

Total net sales |

|

|

539.1 |

|

|

|

560.8 |

|

|

Cost of goods sold |

|

|

457.3 |

|

|

|

540.4 |

|

|

Gross profit |

|

|

81.8 |

|

|

|

20.4 |

|

|

Selling, general and administrative expenses |

|

|

15.6 |

|

|

|

12.3 |

|

|

Other operating expense - net |

|

|

2.4 |

|

|

|

1.7 |

|

|

Operating income |

|

|

63.8 |

|

|

|

6.4 |

|

|

Interest expense |

|

|

(11.9 |

) |

|

|

(10.3 |

) |

|

Interest income |

|

|

0.4 |

|

|

|

0.6 |

|

|

Net loss on forward and derivative contracts |

|

|

(4.0 |

) |

|

|

(4.0 |

) |

|

Bargain purchase gain |

|

|

— |

|

|

|

— |

|

|

Other income (loss) - net |

|

|

(4.0 |

) |

|

|

1.1 |

|

|

Income (loss) before income taxes |

|

|

44.3 |

|

|

|

(6.2 |

) |

|

Income tax expense |

|

|

(2.0 |

) |

|

|

(0.5 |

) |

|

Net income (loss) |

|

|

42.3 |

|

|

|

(6.7 |

) |

|

Net loss attributable to noncontrolling interests |

|

|

(5.0 |

) |

|

|

(4.2 |

) |

|

Net income (loss) attributable to Century stockholders |

|

|

47.3 |

|

|

|

(2.5 |

) |

|

Less: net income allocated to participating securities |

|

|

2.5 |

|

|

|

— |

|

|

Net income (loss) allocated to common stockholders |

|

$ |

44.8 |

|

|

$ |

(2.5 |

) |

| |

|

|

|

|

|

INCOME (LOSS) ATTRIBUTABLE TO CENTURY STOCKHOLDERS PER COMMON

SHARE: |

|

Basic |

|

$ |

0.48 |

|

|

$ |

(0.03 |

) |

|

Diluted |

|

|

0.46 |

|

|

|

(0.03 |

) |

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: |

|

|

|

|

|

Basic |

|

|

92.8 |

|

|

|

92.7 |

|

|

Diluted |

|

|

98.4 |

|

|

|

92.7 |

|

|

|

|

|

|

|

|

|

|

|

|

CENTURY ALUMINUM COMPANY |

|

CONSOLIDATED BALANCE SHEETS |

|

(in millions, except per share amounts) |

|

(Unaudited) |

| |

September 30, 2024 |

|

December 31, 2023 |

|

ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

32.6 |

|

|

$ |

88.8 |

|

|

Restricted cash |

|

2.8 |

|

|

|

1.5 |

|

|

Accounts receivable - net |

|

62.2 |

|

|

|

53.7 |

|

|

Non-trade receivables |

|

52.7 |

|

|

|

36.2 |

|

|

Due from affiliates |

|

12.0 |

|

|

|

20.2 |

|

|

Manufacturing credit receivable |

|

78.8 |

|

|

|

59.3 |

|

|

Inventories |

|

544.5 |

|

|

|

477.0 |

|

|

Derivative assets |

|

2.1 |

|

|

|

2.9 |

|

|

Prepaid and other current assets |

|

19.2 |

|

|

|

27.5 |

|

|

Total current assets |

|

806.9 |

|

|

|

767.1 |

|

|

Property, plant and equipment - net |

|

965.3 |

|

|

|

1,004.2 |

|

|

Other assets |

|

124.7 |

|

|

|

75.2 |

|

|

TOTAL ASSETS |

$ |

1,896.9 |

|

|

$ |

1,846.5 |

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

LIABILITIES: |

|

|

|

|

Accounts payable, trade |

$ |

240.9 |

|

|

$ |

249.5 |

|

|

Accrued compensation and benefits |

|

41.5 |

|

|

|

38.1 |

|

|

Due to affiliates |

|

104.5 |

|

|

|

101.4 |

|

|

Accrued and other current liabilities |

|

43.7 |

|

|

|

50.9 |

|

|

Derivative liabilities |

|

5.1 |

|

|

|

1.4 |

|

|

Deferred credit - preliminary bargain purchase gain |

|

— |

|

|

|

273.4 |

|

|

Current debt due to affiliates |

|

10.1 |

|

|

|

10.0 |

|

|

Current maturities of long-term debt |

|

26.5 |

|

|

|

38.3 |

|

|

Total current liabilities |

|

472.3 |

|

|

|

763.0 |

|

|

Long-term debt - net |

|

449.3 |

|

|

|

430.9 |

|

|

Accrued benefits costs - less current portion |

|

119.2 |

|

|

|

120.3 |

|

|

Deferred taxes |

|

75.1 |

|

|

|

72.4 |

|

|

Asset retirement obligations - less current portion |

|

54.1 |

|

|

|

49.5 |

|

|

Other liabilities |

|

98.4 |

|

|

|

66.3 |

|

|

Total noncurrent liabilities |

|

796.1 |

|

|

|

739.4 |

|

|

TOTAL LIABILITIES |

$ |

1,268.4 |

|

|

$ |

1,502.4 |

|

| |

|

|

|

|

SHAREHOLDERS’ EQUITY: |

|

|

|

|

Series A Preferred stock (one cent par value, 5,000,000 shares

authorized; 160,000 issued and 51,817 outstanding at September 30,

2024; 160,000 issued and 52,284 outstanding at December 31,

2023) |

|

— |

|

|

|

— |

|

|

Common stock (one cent par value, 195,000,000 authorized;

99,985,365 issued and 92,798,844 outstanding at September 30, 2024;

99,876,385 issued and 92,689,864 outstanding at December 31,

2023) |

|

1.0 |

|

|

|

1.0 |

|

|

Additional paid-in capital |

|

2,546.3 |

|

|

|

2,542.9 |

|

|

Treasury stock, at cost |

|

(86.3 |

) |

|

|

(86.3 |

) |

|

Accumulated other comprehensive loss |

|

(96.4 |

) |

|

|

(97.9 |

) |

|

Accumulated deficit |

|

(1,712.5 |

) |

|

|

(2,004.1 |

) |

|

Total Century shareholders’ equity |

|

652.1 |

|

|

|

355.6 |

|

|

Noncontrolling interests |

|

(23.6 |

) |

|

|

(11.5 |

) |

|

Total equity |

|

628.5 |

|

|

|

344.1 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

1,896.9 |

|

|

$ |

1,846.5 |

|

|

|

|

CENTURY ALUMINUM COMPANY |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

(in millions) |

|

(Unaudited) |

| |

Nine months ended September 30, |

| |

2024 |

|

2023 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

Net income (loss) |

$ |

280.3 |

|

|

$ |

(77.9 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: |

|

|

|

|

Unrealized loss on derivative instruments |

|

0.8 |

|

|

|

84.2 |

|

|

Depreciation, depletion and amortization |

|

64.8 |

|

|

|

55.3 |

|

|

Change in deferred tax benefit (expense) |

|

1.7 |

|

|

|

(23.5 |

) |

|

Gain on sale of assets |

|

(2.3 |

) |

|

|

— |

|

|

Bargain purchase gain |

|

(245.9 |

) |

|

|

— |

|

|

Other non-cash items - net |

|

4.7 |

|

|

|

(1.2 |

) |

|

Change in operating assets and liabilities, net of

acquisition: |

|

|

|

|

Accounts receivable - net |

|

(15.9 |

) |

|

|

21.4 |

|

|

Non-trade receivables |

|

7.1 |

|

|

|

— |

|

|

Manufacturing credit receivable |

|

(71.9 |

) |

|

|

— |

|

|

Due from affiliates |

|

8.3 |

|

|

|

(13.0 |

) |

|

Inventories |

|

(67.5 |

) |

|

|

26.3 |

|

|

Prepaid and other current assets |

|

9.6 |

|

|

|

4.8 |

|

|

Accounts payable, trade |

|

40.1 |

|

|

|

(45.1 |

) |

|

Due to affiliates |

|

6.6 |

|

|

|

15.8 |

|

|

Accrued and other current liabilities |

|

(3.9 |

) |

|

|

(2.0 |

) |

|

Ravenswood retiree medical settlement |

|

(2.0 |

) |

|

|

(2.0 |

) |

|

Other - net |

|

2.2 |

|

|

|

(3.5 |

) |

|

Net cash provided by operating activities |

|

16.8 |

|

|

|

39.6 |

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

Purchase of property, plant and equipment |

|

(69.1 |

) |

|

|

(62.7 |

) |

|

Proceeds from sales of property, plant and equipment |

|

— |

|

|

|

25.7 |

|

|

Proceeds from sale of assets |

|

2.3 |

|

|

|

— |

|

|

Acquisition of subsidiary, net of cash acquired |

|

— |

|

|

|

19.4 |

|

|

Net cash used in investing activities |

|

(66.8 |

) |

|

|

(17.6 |

) |

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

Borrowings under revolving credit facilities |

|

409.4 |

|

|

|

575.2 |

|

|

Repayments under revolving credit facilities |

|

(423.6 |

) |

|

|

(632.0 |

) |

|

Repayments under Iceland term facility |

|

(1.2 |

) |

|

|

(9.8 |

) |

|

Borrowings under Grundartangi casthouse debt facility |

|

25.0 |

|

|

|

40.0 |

|

|

Repayments under Grundartangi casthouse debt facility |

|

(4.5 |

) |

|

|

— |

|

|

Borrowings under Vlissingen credit facility |

|

— |

|

|

|

10.0 |

|

|

Carbon credit proceeds |

|

— |

|

|

|

33.8 |

|

|

Carbon credit repayments |

|

(10.0 |

) |

|

|

— |

|

|

Net cash (used) provided by financing activities |

|

(4.9 |

) |

|

|

17.2 |

|

|

CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH |

|

(54.9 |

) |

|

|

39.2 |

|

|

Cash, cash equivalents and restricted cash, beginning of

period |

|

90.3 |

|

|

|

55.5 |

|

|

Cash, cash equivalents and restricted cash, end of period |

$ |

35.4 |

|

|

$ |

94.7 |

|

|

|

CENTURY ALUMINUM

COMPANYSELECTED OPERATING DATA(in

millions, except shipments)(Unaudited)

|

SHIPMENTS - PRIMARY

ALUMINUM(1) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

United States |

|

Iceland |

|

Total |

|

|

|

Tonnes |

|

Sales $ |

|

Tonnes |

|

Sales $ |

|

Tonnes |

|

Sales $ |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3rd Quarter |

|

97,173 |

|

$ |

282.6 |

|

71,582 |

|

$ |

202.8 |

|

168,755 |

|

$ |

485.4 |

|

2nd Quarter |

|

93,805 |

|

$ |

266.5 |

|

74,103 |

|

$ |

185.8 |

|

167,908 |

|

$ |

452.3 |

|

1st Quarter |

|

97,602 |

|

$ |

258.1 |

|

77,025 |

|

$ |

189.5 |

|

174,627 |

|

$ |

447.6 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3rd Quarter |

|

93,675 |

|

$ |

265.8 |

|

78,320 |

|

$ |

207.9 |

|

171,995 |

|

$ |

473.7 |

|

2nd Quarter |

|

97,224 |

|

$ |

296.4 |

|

76,425 |

|

$ |

212.3 |

|

173,649 |

|

$ |

508.7 |

|

1st Quarter |

|

102,430 |

|

$ |

317.6 |

|

78,735 |

|

$ |

210.1 |

|

181,165 |

|

$ |

527.7 |

(1) Excludes scrap aluminum sales, purchased

aluminum and alumina sales.

CENTURY ALUMINUM

COMPANYRECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(in millions, except per share

amounts)(Unaudited)

| |

|

Three months ended |

| |

|

September 30, 2024 |

|

June 30, 2024 |

| |

|

$MM |

|

EPS |

|

$MM |

|

EPS |

|

Net income (loss) attributable to Century

stockholders |

|

$ |

47.3 |

|

$ |

0.51 |

|

$ |

(2.5 |

) |

|

$ |

(0.03 |

) |

|

Less: net income (loss) allocated to participating securities |

|

|

2.5 |

|

|

0.03 |

|

|

— |

|

|

|

— |

|

|

Net income (loss) allocated to common stockholders |

|

|

44.8 |

|

|

0.48 |

|

|

(2.5 |

) |

|

|

(0.03 |

) |

|

Lower of cost or NRV inventory adjustment, net of tax |

|

|

— |

|

|

— |

|

|

(2.0 |

) |

|

|

(0.02 |

) |

|

Unrealized loss (gain) on derivative contracts, net of tax |

|

|

1.9 |

|

|

0.02 |

|

|

1.7 |

|

|

|

0.02 |

|

|

Share-based compensation |

|

|

3.2 |

|

|

0.03 |

|

|

3.5 |

|

|

|

0.04 |

|

|

Jamalco hurricane impact(1) |

|

|

6.9 |

|

|

0.07 |

|

|

— |

|

|

|

— |

|

|

Impact of preferred and convertible shares |

|

|

3.2 |

|

|

0.03 |

|

|

— |

|

|

|

— |

|

|

Adjusted net income attributable to Century

stockholders |

|

$ |

60.0 |

|

$ |

0.63 |

|

$ |

0.7 |

|

|

$ |

0.01 |

|

| |

|

|

|

|

|

|

|

|

(1) This amount includes Century's 55%

share of incremental costs incurred due to the impact of Hurricane

Beryl at Jamalco. These costs include repair costs of the damaged

port, costs of alternative shipping arrangements and fixed costs

incurred while alumina production was impeded.

| |

|

Three months ended |

| |

|

September 30, 2024 |

|

June 30, 2024 |

|

Net income (loss) attributable to Century

stockholders |

|

$ |

47.3 |

|

|

$ |

(2.5 |

) |

|

Add: Net loss attributable to noncontrolling interests |

|

|

(5.0 |

) |

|

|

(4.2 |

) |

|

Net income (loss) |

|

|

42.3 |

|

|

|

(6.7 |

) |

|

Interest expense |

|

|

11.9 |

|

|

|

10.3 |

|

|

Interest income |

|

|

(0.4 |

) |

|

|

(0.6 |

) |

|

Net loss (gain) on forward and derivative contracts |

|

|

4.0 |

|

|

|

4.0 |

|

|

Other (income) expense - net |

|

|

4.0 |

|

|

|

(1.1 |

) |

|

Income tax expense |

|

|

2.0 |

|

|

|

0.5 |

|

|

Operating income |

|

|

63.8 |

|

|

|

6.4 |

|

|

Lower of cost or NRV inventory adjustment |

|

|

— |

|

|

|

(1.8 |

) |

|

Share-based compensation |

|

|

3.2 |

|

|

|

3.5 |

|

|

Jamalco hurricane impact (2) |

|

|

12.6 |

|

|

|

— |

|

|

Depreciation, depletion and amortization |

|

|

24.8 |

|

|

|

21.9 |

|

|

Adjusted EBITDA |

|

|

104.4 |

|

|

|

30.0 |

|

|

Less: Adjusted EBITDA attributable to noncontrolling interests |

|

|

0.7 |

|

|

|

(4.2 |

) |

|

Adjusted EBITDA attributable to Century

stockholders |

|

|

103.7 |

|

|

|

34.2 |

|

| |

|

|

|

|

(2) This amount includes Century's 100%

share of incremental costs incurred due to the impact of Hurricane

Beryl at Jamalco. These costs include repair costs of the damaged

port, costs of alternative shipping arrangements and fixed costs

incurred while alumina production was impeded.

ContactRyan Crawford(Investors and

media)312-696-3132

Source: Century Aluminum Company

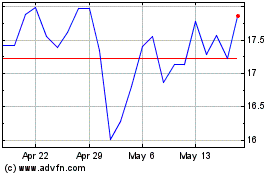

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From Mar 2025 to Apr 2025

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From Apr 2024 to Apr 2025