false

0001455365

0001455365

2024-11-13

2024-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2024

Cognition

Therapeutics, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40886 |

|

13-4365359 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S.

Employer

Identification No.) |

2500

Westchester Avenue

Purchase,

NY |

|

10577 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (412)

481-2210

Not

Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Exchange on Which

Registered |

| Common

Stock, par value $0.001 per share |

|

CGTX |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02 |

Results of Operations and Financial Condition. |

On November 13, 2024, Cognition Therapeutics, Inc. (the “Company”)

issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the Company’s press

release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information disclosed under Item 2.02, including Exhibit 99.1,

is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific

reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are being furnished herewith:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| COGNITION THERAPEUTICS, INC. |

|

| |

|

| By: |

/s/ Lisa Ricciardi |

|

| Name: |

Lisa Ricciardi |

|

| Title: |

President and Chief Executive Officer |

|

Date: November 13, 2024

Exhibit 99.1

Cognition Therapeutics Reports Financial Results

for the Third Quarter 2024

and Provides Business and Clinical Update

- CT1812 slowed cognitive decline by 95% in

Alzheimer’s disease patients with lower levels of plasma p-tau217 in a pre-specified analysis from Phase 2 SHINE study presented

at CTAD -

- On track to report topline results from Phase

2 SHIMMER study investigating CT1812 in patients with mild-to-moderate dementia with Lewy bodies (DLB) by end of 2024 -

Purchase,

NY – November 13, 2024 – Cognition Therapeutics, Inc. (Nasdaq: CGTX), a clinical-stage

company developing product candidates that

treat neurodegenerative disorders, (the “Company” or “Cognition”) today reported financial results for

the third quarter ended September 30, 2024, and provided a business update.

“In the third quarter and recent weeks Cognition Therapeutics

achieved one of the most important milestones in its history as the Phase 2 SHINE study results became available. Among the many findings

in the SHINE study, new and compelling data presented at CTAD showed a near-total preservation of cognition (as measured by the ADAS-Cog11

and MMSE scales) in a sub-group of Alzheimer’s patients treated with CT1812 who had p-tau217 levels below median,” said Lisa

Ricciardi, Cognition’s president and CEO. “We are moving rapidly to advance CT1812 in Alzheimer’s disease and plan

to request an end-of-Phase 2 meeting with the FDA where we will review CT1812’s safety and tolerability profile as well as the

totality of results from SHINE. We will seek alignment with the FDA on a pivotal Phase 3 program design in light of recent findings relating

to lower levels of plasma p-tau217, an important biomarker of Alzheimer’s disease pathology easily measured with a blood test.”

Ms. Ricciardi concluded: “In addition to the substantial progress

we have made with CT1812 in Alzheimer’s disease, we expect to report top-line results from our Phase 2 SHIMMER study in mild-to-moderate

dementia with Lewy bodies (DLB) by the end of this year. DLB is the second most common neurodegenerative disease, yet few therapies have

been studied in this indication and no disease-modifying treatments exist. SHIMMER will deliver safety and tolerability data in a second

indication and potentially provide insights to be integrated into a larger clinical study in this under-studied and under-represented

population.”

Business and Corporate Highlights

| · | Results of a pre-specified analysis from the Phase 2 SHINE study of CT1812

in participants with mild-to-moderate Alzheimer’s disease were presented in an oral session at the Clinical Trials on Alzheimer’s

Disease (CTAD) conference |

| o | Patients with baseline levels of p-tau217 below the median showed a 95% slowing of cognitive decline on the ADAS-Cog11 scale and 108%

slowing of cognitive decline on the MMSE scale* |

| o | Lower levels of plasma p-tau217 are indicative of less advanced Alzheimer’s pathology, and we believe may identify patients

likely to have a greater response to therapy |

| o | The CTAD presentation by Dr. Michael Woodward and an archive of investor webinar are available on the Cognition website |

Cognition Therapeutics, Inc.

www.cogrx.com

| · | Baseline characteristics of participants enrolled in the Phase 2 SHIMMER

study were also presented at CTAD, confirming enrollment of individuals with mild-to-moderate DLB |

| o | This poster is available on the Company’s website |

| · | Continued enrollment in Phase 2 START study (NCT05531656) in early Alzheimer’s

disease and Phase 2 MAGNIFY study (NCT05893537) in geographic atrophy secondary to dry age-related macular degeneration |

Third Quarter 2024 Financial Results

Cash and cash equivalents as of September 30, 2024 were approximately

$22.0 million and total grant funds remaining from the NIA were $53.6 million. The Company estimates that it has sufficient cash to fund

operations and capital expenditures into the second quarter of 2025.

Research and development expenses were $11.4 million for the third

quarter ended September 30, 2024, compared to $11.7 million for the comparable period in 2023. The decrease was primarily related to lower

costs with contract manufacturing organizations for the production of pre-clinical and future clinical trial supply.

General and administrative expenses were $3.1 million for the third

quarter ended September 30, 2024, compared to $3.1 million for the comparable period in 2023. The change in general & administrative

expenses was not significant in either period.

The Company reported a net loss of $9.9 million, or $(0.25) per basic

and diluted share for the third quarter ended September 30, 2024, compared to a net loss of $6.7 million, or $(0.22) per basic and diluted

share for the same period in 2023.

| * | ADAS-Cog11: Alzheimer’s Disease Assessment Scale – Cognitive

Subscale (11-task version) |

MMSE: Mini Mental State Examination

About Cognition Therapeutics, Inc.

Cognition Therapeutics, Inc., is a clinical-stage biopharmaceutical

company discovering and developing innovative, small molecule therapeutics targeting age-related degenerative disorders of the central

nervous system and retina. We currently are investigating our lead candidate CT1812 in clinical programs in Alzheimer’s disease,

dementia with Lewy bodies (DLB) and dry age-related macular degeneration (dry AMD). We believe CT1812 and our pipeline of σ-2 receptor

modulators can regulate pathways that are impaired in these diseases that are functionally distinct from other approaches for the treatment

of degenerative diseases. More about Cognition Therapeutics and our pipeline can be found at https://cogrx.com.

Cognition Therapeutics, Inc.

www.cogrx.com

Forward-Looking Statements

This press release contains forward-looking statements within the

meaning of The Private Securities Litigation Reform Act of 1995. All statements contained in this press release, other than statements

of historical facts or statements that relate to present facts or current conditions, including but not limited to, statements regarding

our product candidates, including CT1812, and any expected or implied benefits or results, including that initial clinical results observed

with respect to CT1812 will be replicated in later trials and our clinical development plans, are forward-looking statements. These statements,

including statements relating to the timing and expected results of our clinical trials and our regulatory plans involve known and unknown

risks, uncertainties and other important factors that may cause our actual results, performance, or achievements to be materially different

from any future results, performance, or achievements expressed or implied by the forward-looking statements. In some cases, you can

identify forward-looking statements by terms such as “may,” “might,” “will,” “should,”

“expect,” “plan,” “aim,” “seek,” “anticipate,” “could,” “intend,”

“target,” “project,” “contemplate,” “believe,” “estimate,” “predict,”

“forecast,” “potential” or “continue” or the negative of these terms or other similar expressions.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our business, financial condition, and results of operations. These forward-looking statements speak

only as of the date of this press release and are subject to a number of risks, uncertainties and assumptions, some of which cannot be

predicted or quantified and some of which are beyond our control. Factors that may cause actual results to differ materially from current

expectations include, but are not limited to: competition; our ability to secure new (and retain existing) grant funding; our ability

to grow and manage growth, maintain relationships with suppliers and retain our management and key employees; our ability to successfully

advance our current and future product candidates through development activities, preclinical studies and clinical trials and costs related

thereto; uncertainties inherent in the results of preliminary data, pre-clinical studies and earlier-stage clinical trials being predictive

of the results of early or later-stage clinical trials; the timing, scope and likelihood of regulatory filings and approvals, including

regulatory approval of our product candidates; changes in applicable laws or regulations; the possibility that the we may be adversely

affected by other economic, business or competitive factors, including ongoing economic uncertainty; our estimates of expenses and profitability;

the evolution of the markets in which we compete; our ability to implement our strategic initiatives and continue to innovate our existing

products; our ability to defend our intellectual property; impacts of ongoing global and regional conflicts on our business, supply chain

and labor force; our ability to maintain the listing of our common stock on the Nasdaq Global Market and the risks and uncertainties

described more fully in the “Risk Factors” section of our annual and quarterly reports filed with the Securities &

Exchange Commission and are available at www.sec.gov. These risks are

not exhaustive and we face both known and unknown risks. You should not rely on these forward-looking statements as predictions of future

events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur, and actual results could

differ materially from those projected in the forward-looking statements. Moreover, we operate in a dynamic industry and economy. New

risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties

that we may face. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained

herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Cognition Therapeutics, Inc.

www.cogrx.com

Cognition Therapeutics, Inc.

Unaudited Selected Financial Data

| (in thousands, except share and per share data amounts) |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

| Consolidated Statements of Operations Data: |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

$ |

11,392 |

|

|

$ |

11,669 |

|

|

$ |

33,522 |

|

|

$ |

25,596 |

|

| General and administrative |

|

|

3,071 |

|

|

|

3,076 |

|

|

|

9,721 |

|

|

|

9,939 |

|

| Total operating expenses |

|

|

14,463 |

|

|

|

14,745 |

|

|

|

43,243 |

|

|

|

35,535 |

|

| Loss from operations |

|

|

(14,463 |

) |

|

|

(14,745 |

) |

|

|

(43,243 |

) |

|

|

(35,535 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Grant income |

|

|

4,293 |

|

|

|

7,684 |

|

|

|

16,516 |

|

|

|

18,035 |

|

| Other income (expense), net |

|

|

236 |

|

|

|

314 |

|

|

|

813 |

|

|

|

(129 |

) |

| Interest expense |

|

|

(3 |

) |

|

|

(2 |

) |

|

|

(20 |

) |

|

|

(18 |

) |

| Loss on currency translation from liquidation of subsidiary |

|

|

— |

|

|

|

— |

|

|

|

(195 |

) |

|

|

— |

|

| Total other income, net |

|

|

4,526 |

|

|

|

7,996 |

|

|

|

17,114 |

|

|

|

17,888 |

|

| Net loss |

|

$ |

(9,937 |

) |

|

$ |

(6,749 |

) |

|

$ |

(26,129 |

) |

|

$ |

(17,647 |

) |

| Foreign currency translation adjustment, including reclassifications |

|

|

— |

|

|

|

— |

|

|

|

195 |

|

|

|

3 |

|

| Total comprehensive loss |

|

$ |

(9,937 |

) |

|

$ |

(6,749 |

) |

|

$ |

(25,934 |

) |

|

$ |

(17,644 |

) |

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.25 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.69 |

) |

|

$ |

(0.59 |

) |

| Diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.69 |

) |

|

$ |

(0.59 |

) |

| Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

40,418,065 |

|

|

|

30,265,506 |

|

|

|

38,080,658 |

|

|

|

29,696,296 |

|

| Diluted |

|

|

40,418,065 |

|

|

|

30,265,506 |

|

|

|

38,080,658 |

|

|

|

29,696,296 |

|

| | |

As of | |

| (in thousands) | |

September 30, 2024 | | |

December 31, 2023 | |

| Consolidated Balance Sheet Data: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 22,011 | | |

$ | 29,922 | |

| Total assets | |

| 27,579 | | |

| 35,163 | |

| Total liabilities | |

| 13,097 | | |

| 10,689 | |

| Accumulated deficit | |

| (167,318 | ) | |

| (141,189 | ) |

| Total stockholders’ equity | |

| 14,482 | | |

| 24,474 | |

Contact Information:

Cognition Therapeutics, Inc.

info@cogrx.com |

Casey McDonald (media)

Tiberend Strategic

Advisors, Inc.

cmcdonald@tiberend.com |

Mike Moyer (investors)

LifeSci Advisors

mmoyer@lifesciadvisors.com |

Cognition Therapeutics, Inc.

www.cogrx.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

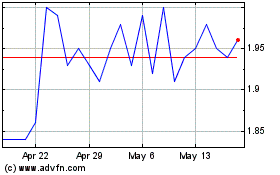

Cognition Therapeutics (NASDAQ:CGTX)

Historical Stock Chart

From Feb 2025 to Mar 2025

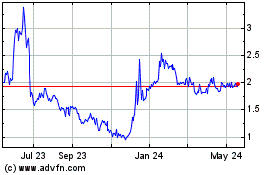

Cognition Therapeutics (NASDAQ:CGTX)

Historical Stock Chart

From Mar 2024 to Mar 2025