Comcast Corporation (NASDAQ: CMCSA) today reported results for

the quarter ended September 30, 2024.

“Our convergence strategy continues to deliver a best-in-class

connectivity experience across our expanding network of 63 million

homes and businesses, which far exceeds the combined fiber

footprint of our three largest competitors," said Brian L. Roberts,

Chairman and Chief Executive Officer of Comcast Corporation. "Third

quarter results demonstrate the strength of this platform -

broadband ARPU increased 3.6%; revenue in our connectivity

businesses grew 5%; and Adjusted EBITDA margins across Connectivity

& Platforms grew to 40.9%. At the same time, we delivered an

incredibly successful Paris Summer Olympics that helped fuel

double-digit percentage growth in Peacock revenue and paid

subscribers and contributed to NBC's #1 ranking for the 2023-2024

season. We also released the universally acclaimed Despicable Me 4,

which grossed nearly $1.0 billion in worldwide box office, and

announced the grand opening of Universal Epic Universe in May 2025,

which will be the most ambitious and technologically sophisticated

theme park ever created. Overall, it was a very active and

successful quarter, and I couldn't be more pleased with how our

team is executing and positioning our company for long-term

growth."

($ in millions, except per share data)

3rd

Quarter

Consolidated Results

2024

2023

Change

Revenue

$32,070

$30,115

6.5%

Net Income Attributable to Comcast

$3,629

$4,046

(10.3%

)

Adjusted Net Income1

$4,337

$4,483

(3.3%

)

Adjusted EBITDA2

$9,735

$9,962

(2.3%

)

Earnings per Share3

$0.94

$0.98

(4.2%

)

Adjusted Earnings per Share1

$1.12

$1.08

3.3%

Net Cash Provided by Operating

Activities

$7,021

$8,154

(13.9%

)

Free Cash Flow4

$3,406

$4,032

(15.5%

)

For additional detail on segment revenue

and expenses, customer metrics, capital expenditures, and free cash

flow, please refer to the trending schedule on Comcast’s Investor

Relations website at www.cmcsa.com.

3rd Quarter 2024 Highlights:

- Adjusted EPS Increased 3.3% to $1.12; Generated Free Cash Flow

of $3.4 Billion

- Return of Capital to Shareholders Totaled $3.2 Billion Through

a Combination of $1.2 Billion in Dividend Payments and $2.0 Billion

in Share Repurchases. Repurchased $10.1 Billion of Shares Over the

Trailing Twelve Months, Reducing Shares Outstanding by 6%

- Connectivity & Platforms Adjusted EBITDA of $8.3 Billion

Was Consistent With the Prior Year Period and Adjusted EBITDA

Margin Increased 30 Basis Points to 40.9%. Excluding the Impact of

Foreign Currency, Connectivity & Platforms Adjusted EBITDA

Margin Increased 50 Basis Points

- Connectivity & Platforms Customer Relationships Decreased

by 29,000 to 51.7 Million and Domestic Broadband Customers

Decreased by 87,000 to 32.0 Million, Including the Impact From the

End of ACP. Excluding the Negative Impact From ACP, Estimated Total

Customer Relationship Net Additions Were 67,000 and Total Domestic

Broadband Net Additions Were 9,000

- Domestic Broadband Average Rate Per Customer Increased 3.6%,

Driving Domestic Broadband Revenue Growth of 2.7% to $6.5

Billion

- Domestic Wireless Customer Lines Increased 20% Compared to the

Prior Year Period to 7.5 Million, Including Net Additions of

319,000 in the Third Quarter

- Business Services Connectivity Adjusted EBITDA Increased 4.2%

to $1.4 Billion and Adjusted EBITDA Margin Was 57.4%

- Studios Adjusted EBITDA Increased 9.0% to $468 Million, Driven

by the Successful Theatrical Performance of Despicable Me 4 and

Twisters; DM4 Debuted in July and Grossed Nearly $1.0 Billion in

Worldwide Box Office Year-to-Date, Pushing the Minions Franchise's

Cumulative Total Past $5 Billion

- Peacock Paid Subscribers Increased 29% Compared to the Prior

Year Period to 36 Million, Including Net Additions of 3 Million in

the Third Quarter. Peacock Revenue Increased 82% to $1.5 Billion;

Adjusted EBITDA Improved Compared to the Prior Year Period

- Comcast's Exclusive Broadcast of the Paris Olympics in the U.S.

Showcased the Combined Capabilities Across Our Company and

Captivated the Nation's Attention for 17 Days. Average Daily

Viewers of the Games Across Our Linear Networks and Peacock of 31

Million Increased 82% Compared to the Prior Summer Olympics in

2021. Incremental Olympics Revenue in Media Was a Record High $1.9

Billion

3rd Quarter Consolidated Financial Results

Revenue increased 6.5% compared to the prior year period.

Net Income Attributable to Comcast decreased 10.3%.

Adjusted Net Income decreased 3.3%. Adjusted EBITDA

decreased 2.3%.

Earnings per Share (EPS) decreased 4.2% to $0.94.

Adjusted EPS increased 3.3% to $1.12.

Capital Expenditures decreased 11.6% to $2.9 billion.

Connectivity & Platforms’ capital expenditures decreased 6.5%

to $1.9 billion, reflecting lower spending on scalable

infrastructure and customer premise equipment, partially offset by

higher investment in line extensions and support capital. Content

& Experiences' capital expenditures were consistent and

continue to reflect significant spending due to the construction of

Epic Universe theme park in Orlando, which is scheduled to open on

May 22, 2025.

Net Cash Provided by Operating Activities was $7.0

billion. Free Cash Flow was $3.4 billion.

Dividends and Share Repurchases. Comcast paid dividends

totaling $1.2 billion and repurchased 49.9 million of its shares

for $2.0 billion, resulting in a total return of capital to

shareholders of $3.2 billion.

Connectivity & Platforms

($ in millions)

Constant Currency Change5

3rd

Quarter

2024

2023

Change

Connectivity & Platforms

Revenue

Residential Connectivity &

Platforms

$17,866

$17,951

(0.5

%)

(1.0

%)

Business Services Connectivity

2,425

2,320

4.5

%

4.5

%

Total Connectivity & Platforms

Revenue

$20,291

$20,271

0.1

%

(0.4

%)

Connectivity & Platforms Adjusted

EBITDA

Residential Connectivity &

Platforms

$6,904

$6,886

0.3

%

—

%

Business Services Connectivity

1,391

1,335

4.2

%

4.3

%

Total Connectivity & Platforms

Adjusted EBITDA

$8,295

$8,221

0.9

%

0.7

%

Connectivity & Platforms Adjusted

EBITDA Margin

Residential Connectivity &

Platforms

38.6

%

38.4

%

20 bps

40 bps

Business Services Connectivity

57.4

%

57.5

%

(10) bps

(10) bps

Total Connectivity & Platforms

Adjusted EBITDA Margin

40.9

%

40.6

%

30 bps

50 bps

Change percentages represent year/year

growth rates. The changes in Adjusted EBITDA margins are presented

as year/year basis point changes in the rounded Adjusted EBITDA

margins.

Revenue and Adjusted EBITDA for Connectivity &

Platforms were consistent with the prior year period. Adjusted

EBITDA margin increased to 40.9%.

(in thousands)

Net

Additions / (Losses)

3rd

Quarter

3Q24

3Q23

2024

2023

Customer Relationships

Domestic Residential Connectivity &

Platforms Customer Relationships

31,324

31,722

(103

)

(39

)

International Residential Connectivity

& Platforms Customer Relationships

17,716

17,958

78

74

Business Services Connectivity Customer

Relationships

2,627

2,640

(4

)

5

Total Connectivity & Platforms

Customer Relationships

51,667

52,320

(29

)

40

Domestic Broadband

Residential Customers

29,504

29,779

(79

)

(17

)

Business Customers

2,477

2,508

(8

)

(2

)

Total Domestic Broadband

Customers

31,981

32,287

(87

)

(18

)

Total Domestic Wireless Lines

7,519

6,278

319

294

Total Domestic Video Customers

12,834

14,495

(365

)

(490

)

Total Customer Relationships for Connectivity &

Platforms decreased by 29,000 to 51.7 million, primarily reflecting

a decrease in domestic customer relationships, partially offset by

an increase in international customer relationships. Domestic

Residential Connectivity & Platforms relationships include a

negative impact in the quarter from the end of the FCC's Affordable

Connectivity Program ("ACP") in the second quarter of 2024.

Excluding the negative impact from ACP, we estimate that total

customer relationships increased by 67,000. Total domestic

broadband customer net losses were 87,000. Excluding the negative

impact from ACP, we estimate that total broadband net additions

were 9,000. Total domestic wireless line net additions were 319,000

and total domestic video customer net losses were 365,000.

Residential Connectivity & Platforms

($ in millions)

Constant Currency Change5

3rd

Quarter

2024

2023

Change

Revenue

Domestic Broadband

$6,539

$6,366

2.7

%

2.7

%

Domestic Wireless

1,093

917

19.2

%

19.2

%

International Connectivity

1,236

1,109

11.4

%

8.3

%

Total Residential Connectivity

8,869

8,393

5.7

%

5.3

%

Video

6,713

7,154

(6.2

%)

(6.8

%)

Advertising

987

960

2.7

%

1.6

%

Other

1,298

1,444

(10.1

%)

(10.7

%)

Total Revenue

$17,866

$17,951

(0.5

%)

(1.0

%)

Operating Expenses

Programming

$4,102

$4,460

(8.0

%)

(8.6

%)

Non-Programming

6,860

6,605

3.9

%

3.0

%

Total Operating Expenses

$10,962

$11,065

(0.9

%)

(1.7

%)

Adjusted EBITDA

$6,904

$6,886

0.3

%

—

%

Adjusted EBITDA Margin

38.6

%

38.4

%

20 bps

40 bps

Change percentages represent year/year

growth rates. The changes in Adjusted EBITDA margins are presented

as year/year basis point changes in the rounded Adjusted EBITDA

margins.

Revenue for Residential Connectivity & Platforms was

consistent with the prior year period, driven by increases in

domestic broadband, domestic wireless, international connectivity

and advertising revenue, offset by decreases in video and other

revenue. Domestic broadband revenue increased due to higher average

rates. Domestic wireless revenue increased due to an increase in

the number of customer lines and device sales. International

connectivity revenue increased primarily due to an increase in

broadband revenue from higher average rates and the positive impact

of foreign currency. Advertising revenue increased due to higher

domestic political advertising, partially offset by lower domestic

nonpolitical and international advertising. Video revenue decreased

due to a decline in the number of video customers, partially offset

by an overall increase in average rates. Other revenue decreased

primarily due to lower residential wireline voice revenue, driven

by a decline in the number of customers.

Adjusted EBITDA for Residential Connectivity &

Platforms was consistent with the prior year period reflecting

consistent revenue and operating expenses. Programming expenses

decreased primarily due to a decline in the number of domestic

video customers, partially offset by rate increases under our

domestic programming contracts. Non-programming expenses increased

primarily due to higher direct product costs, the impact of foreign

currency, increased technical and support costs and higher

marketing and promotion, including spending associated with the

Paris Olympics. Adjusted EBITDA margin increased to

38.6%.

Business Services Connectivity

($ in millions)

Constant Currency Change5

3rd

Quarter

2024

2023

Change

Revenue

$2,425

$2,320

4.5%

4.5%

Operating Expenses

1,034

985

4.9%

4.8%

Adjusted EBITDA

$1,391

$1,335

4.2%

4.3%

Adjusted EBITDA Margin

57.4

%

57.5

%

(10) bps

(10) bps

Change percentages represent year/year

growth rates. The changes in Adjusted EBITDA margins are presented

as year/year basis point changes in the rounded Adjusted EBITDA

margins.

Revenue for Business Services Connectivity increased due

to an increase in revenue from medium-sized and enterprise

customers, and an increase in revenue from small business customers

driven by higher average rates.

Adjusted EBITDA for Business Services Connectivity

increased due to higher revenue, partially offset by higher

operating expenses. The increase in operating expenses was

primarily due to increases in direct product costs and marketing

and promotion expenses. Adjusted EBITDA margin decreased to

57.4%.

Content & Experiences

($ in millions)

3rd

Quarter

2024

2023

Change

Content & Experiences

Revenue

Media

$8,231

$6,029

36.5

%

Excluding Olympics7

6,325

6,029

4.9

%

Studios

2,826

2,518

12.3

%

Theme Parks

2,289

2,418

(5.3

%)

Headquarters & Other

11

13

(16.8

%)

Eliminations

(758

)

(419

)

(80.7

%)

Total Content & Experiences

Revenue

$12,599

$10,559

19.3

%

Content & Experiences Adjusted

EBITDA

Media

$650

$723

(10.1

%)

Studios

468

429

9.0

%

Theme Parks

847

983

(13.8

%)

Headquarters & Other

(200

)

(178

)

(12.6

%)

Eliminations

38

17

125.6

%

Total Content & Experiences

Adjusted EBITDA

$1,802

$1,973

(8.7

%)

Revenue for Content & Experiences increased compared

to the prior year period, including $1.9 billion of incremental

revenue from the Paris Olympics included in the Media segment.

Adjusted EBITDA for Content & Experiences decreased due

to declines in Theme Parks and Media, partially offset by growth at

Studios.

Media

($ in millions)

3rd

Quarter

2024

2023

Change

Revenue

Domestic Advertising

$3,347

$1,913

74.9

%

Excluding Olympics7

1,915

1,913

0.1

%

Domestic Distribution

3,272

2,591

26.3

%

Excluding Olympics7

2,798

2,591

8.0

%

International Networks

1,070

1,019

5.0

%

Other

542

506

7.2

%

Total Revenue

$8,231

$6,029

36.5

%

Excluding Olympics7

6,325

6,029

4.9

%

Operating Expenses

7,581

5,306

42.9

%

Adjusted EBITDA

$650

$723

(10.1

%)

Revenue for Media increased primarily due to higher

domestic advertising and domestic distribution revenue. Excluding

$1.9 billion of incremental revenue from the Paris Olympics, Media

revenue increased 4.9%. Domestic advertising revenue increased

primarily reflecting the Paris Olympics and additional Peacock

sales, partially offset by lower revenue at our networks. Domestic

distribution revenue increased primarily reflecting the broadcast

of the Paris Olympics and higher revenue at Peacock, driven by an

increase in paid subscribers compared to the prior year period.

International networks revenue increased primarily due to the

positive impact of foreign currency and an increase in revenue

associated with the distribution of sports networks. Other revenue

increased primarily due to an increase in revenue from the

licensing of our owned content.

Adjusted EBITDA for Media decreased due to higher

operating expenses, which more than offset higher revenue. The

increase in operating expenses was primarily due to increased

sports programming costs associated with the Paris Olympics, higher

programming costs at Peacock and an increase in other sports

programming costs for our domestic television networks. Media

results include $1.5 billion of revenue and an Adjusted EBITDA6

loss of $436 million related to Peacock, including amounts

attributable to the Paris Olympics, compared to $830 million of

revenue and an Adjusted EBITDA6 loss of $565 million in the prior

year period.

Studios

($ in millions)

3rd

Quarter

2024

2023

Change

Revenue

Content Licensing

$1,865

$1,691

10.3

%

Theatrical

611

504

21.3

%

Other

350

324

8.2

%

Total Revenue

$2,826

$2,518

12.3

%

Operating Expenses

2,359

2,089

12.9

%

Adjusted EBITDA

$468

$429

9.0

%

Revenue for Studios increased primarily due to higher

content licensing revenue and theatrical revenue. Content licensing

revenue increased primarily due to the timing of when content was

made available by our television studios under licensing

agreements, including the impact of the work stoppages in the prior

year period. Theatrical revenue increased due to the successful

performance of recent releases, including Despicable Me 4 and

Twisters.

Adjusted EBITDA for Studios increased due to higher

revenue, which more than offset higher operating expenses. The

increase in operating expenses primarily reflected higher

programming and production expenses, mainly due to higher costs

associated with content licensing sales, including the impact of

the work stoppages in the prior year period.

Theme Parks

($ in millions)

3rd

Quarter

2024

2023

Change

Revenue

$2,289

$2,418

(5.3%)

Operating Expenses

1,442

1,435

0.5%

Adjusted EBITDA

$847

$983

(13.8%)

Revenue for Theme Parks decreased primarily due to lower

revenue at our domestic theme parks, driven by lower guest

attendance.

Adjusted EBITDA for Theme Parks decreased, reflecting

lower revenue and consistent operating expenses.

Headquarters & Other

Content & Experiences Headquarters & Other includes

overhead, personnel costs and costs associated with corporate

initiatives. Headquarters & Other Adjusted EBITDA loss in the

third quarter was $200 million, compared to a loss of $178 million

in the prior year period.

Eliminations

Amounts represent eliminations of transactions between our

Content & Experiences segments, the most significant being

content licensing between the Studios and Media segments, which are

affected by the timing of recognition of content licenses. Revenue

eliminations were $758 million, compared to $419 million in the

prior year period, and Adjusted EBITDA eliminations were a benefit

of $38 million, compared to a benefit of $17 million in the prior

year period.

Corporate, Other and Eliminations

($ in millions)

3rd

Quarter

2024

2023

Change

Corporate & Other

Revenue

$675

$643

5.0

%

Operating Expenses

978

893

9.6

%

Adjusted EBITDA

($302

)

($249

)

(21.3

%)

Eliminations

Revenue

($1,495

)

($1,358

)

10.1

%

Operating Expenses

(1,436

)

(1,375

)

4.5

%

Adjusted EBITDA

($59

)

$16

NM

NM=comparison not meaningful.

Corporate & Other

Corporate & Other primarily includes overhead and personnel

costs; our Sky-branded video services and television networks in

Germany; Comcast Spectacor, which owns the Philadelphia Flyers and

the Wells Fargo Center arena in Philadelphia, Pennsylvania; and

Xumo. Corporate & Other Adjusted EBITDA decreased primarily due

to increased marketing associated with the Paris Olympics.

Eliminations

Amounts represent eliminations of transactions between

Connectivity & Platforms, Content & Experiences and other

businesses, the most significant being distribution of television

network programming between the Media and Residential Connectivity

& Platforms segments. Revenue eliminations were $1.5 billion,

compared to $1.4 billion in the prior year period, and Adjusted

EBITDA eliminations were a loss of $59 million compared to a

benefit of $16 million in the prior year period. Current year

amounts reflect an increase in eliminations associated with the

Paris Olympics.

Notes:

1

We define Adjusted Net Income and Adjusted EPS as net income

attributable to Comcast Corporation and diluted earnings per common

share attributable to Comcast Corporation shareholders,

respectively, adjusted to exclude the effects of the amortization

of acquisition-related intangible assets, investments that

investors may want to evaluate separately (such as based on fair

value) and the impact of certain events, gains, losses or other

charges that affect period-over-period comparisons. See Table 5 for

reconciliations of non-GAAP financial measures.

2

We define Adjusted EBITDA as net income attributable to Comcast

Corporation before net income (loss) attributable to noncontrolling

interests, income tax expense, investment and other income (loss),

net, interest expense, depreciation and amortization expense, and

other operating gains and losses (such as impairment charges

related to fixed and intangible assets and gains or losses on the

sale of long-lived assets), if any. From time to time, we may

exclude from Adjusted EBITDA the impact of certain events, gains,

losses or other charges (such as significant legal settlements)

that affect the period-to-period comparability of our operating

performance. See Table 4 for reconciliation of non-GAAP financial

measure.

3

All earnings per share amounts are presented on a diluted basis.

4

We define Free Cash Flow as net cash provided by operating

activities (as stated in our Consolidated Statement of Cash Flows)

reduced by capital expenditures and cash paid for intangible

assets. From time to time, we may exclude from Free Cash Flow the

impact of certain cash receipts or payments (such as significant

legal settlements) that affect period-to-period comparability. Cash

payments related to certain capital or intangible assets, such as

the construction of Universal Beijing Resort, are presented

separately in our Consolidated Statement of Cash Flows and are

therefore excluded from capital expenditures and cash paid for

intangible assets for Free Cash Flow. See Table 4 for

reconciliation of non-GAAP financial measure.

5

Constant currency growth rates are calculated by comparing the

results for each comparable prior year period adjusted to reflect

the average exchange rates from each current year period presented

rather than the actual exchange rates that were in effect during

the respective periods. See Table 6 for reconciliations of non-GAAP

financial measures.

6

Adjusted EBITDA is the measure of profit or loss for our segments.

From time to time, we may present Adjusted EBITDA for components of

our reportable segments, such as Peacock. We believe these measures

are useful to evaluate our financial results and provide a basis of

comparison to others, although our definition of Adjusted EBITDA

may not be directly comparable to similar measures used by other

companies. Adjusted EBITDA for components are presented on a

consistent basis with the respective segments and disaggregated in

accordance with GAAP.

7

From time to time, we may present adjusted information (e.g.,

Adjusted Revenues) to exclude the impact of certain events, gains,

losses or other charges affecting period-to-period comparability of

our operating performance. See Table 7 for reconciliations of

non-GAAP financial measures.

Numerical information is presented on a rounded basis using

actual amounts, unless otherwise noted. The change in Peacock paid

subscribers is calculated using rounded paid subscriber amounts.

Minor differences in totals and percentage calculations may exist

due to rounding.

Conference Call and Other Information

Comcast Corporation will host a conference call with the

financial community today, October 31, 2024, at 8:30 a.m. Eastern

Time (ET). The conference call and related materials will be

broadcast live and posted on our Investor Relations website at

www.cmcsa.com. A replay of the call

will be available today, October 31, 2024, starting at 11:30 a.m.

ET on the Investor Relations website.

From time to time, we post information that may be of interest

to investors on our website at www.cmcsa.com and on our corporate website,

www.comcastcorporation.com. To

automatically receive Comcast financial news by email, please visit

www.cmcsa.com and subscribe to email

alerts.

Caution Concerning Forward-Looking Statements

This press release includes statements that may constitute

forward-looking statements. In evaluating these statements, readers

should consider various factors, including the risks and

uncertainties we describe in the “Risk Factors” sections of our

most recent Annual Report on Form 10-K, our most recent Quarterly

Report on Form 10-Q and other reports filed with the Securities and

Exchange Commission (SEC). Factors that could cause our actual

results to differ materially from these forward-looking statements

include changes in and/or risks associated with: the competitive

environment; consumer behavior; the advertising market; consumer

acceptance of our content; programming costs; key distribution

and/or licensing agreements; use and protection of our intellectual

property; our reliance on third-party hardware, software and

operational support; keeping pace with technological developments;

cyber attacks, security breaches or technology disruptions; weak

economic conditions; acquisitions and strategic initiatives;

operating businesses internationally; natural disasters, severe

weather-related and other uncontrollable events; loss of key

personnel; labor disputes; laws and regulations; adverse decisions

in litigation or governmental investigations; and other risks

described from time to time in reports and other documents we file

with the SEC. Readers are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date they

are made, and involve risks and uncertainties that could cause

actual events or our actual results to differ materially from those

expressed in any such forward-looking statements. We undertake no

obligation to update or revise publicly any forward-looking

statements, whether because of new information, future events or

otherwise. The amount and timing of any dividends and share

repurchases are subject to business, economic and other relevant

factors.

Non-GAAP Financial Measures

In this discussion, we sometimes refer to financial measures

that are not presented according to generally accepted accounting

principles in the U.S. (GAAP). Certain of these measures are

considered “non-GAAP financial measures” under the SEC regulations;

those rules require the supplemental explanations and

reconciliations that are in Comcast’s Form 8-K (Quarterly Earnings

Release) furnished to the SEC.

About Comcast Corporation

Comcast Corporation (Nasdaq: CMCSA) is a global media and

technology company. From the connectivity and platforms we provide,

to the content and experiences we create, our businesses reach

hundreds of millions of customers, viewers, and guests worldwide.

We deliver world-class broadband, wireless, and video through

Xfinity, Comcast Business, and Sky; produce, distribute, and stream

leading entertainment, sports, and news through brands including

NBC, Telemundo, Universal, Peacock, and Sky; and bring incredible

theme parks and attractions to life through Universal Destinations

& Experiences. Visit www.comcastcorporation.com for more

information.

TABLE 1

Condensed Consolidated Statements of

Income (Unaudited)

Three Months Ended

Nine Months Ended

(in millions, except per share data)

September 30,

September 30,

2024

2023

2024

2023

Revenue

$32,070

$30,115

$91,817

$90,319

Costs and expenses

Programming and production

10,216

8,652

27,000

26,506

Marketing and promotion

1,989

1,866

5,929

5,929

Other operating and administrative

10,128

9,629

29,615

28,247

Depreciation

2,219

2,203

6,548

6,662

Amortization

1,659

1,290

4,421

4,146

26,211

23,640

73,512

71,489

Operating income

5,859

6,475

18,304

18,830

Interest expense

(1,037)

(1,060)

(3,065)

(3,068)

Investment and other income (loss),

net

Equity in net income (losses) of

investees, net

(152)

49

(438)

454

Realized and unrealized gains (losses) on

equity securities, net

(22)

(87)

(163)

(130)

Other income (loss), net

171

88

461

349

(3)

50

(140)

672

Income before income taxes

4,819

5,465

15,099

16,434

Income tax expense

(1,243)

(1,468)

(3,906)

(4,481)

Net income

3,576

3,997

11,192

11,954

Less: Net income (loss) attributable to

noncontrolling interests

(53)

(49)

(222)

(175)

Net income attributable to Comcast

Corporation

$3,629

$4,046

$11,415

$12,128

Diluted earnings per common share

attributable to Comcast Corporation shareholders

$0.94

$0.98

$2.90

$2.90

Diluted weighted-average number of common

shares

3,880

4,141

3,930

4,184

TABLE 2

Consolidated Statements of Cash Flows

(Unaudited)

Nine Months Ended

(in millions)

September 30,

2024

2023

OPERATING ACTIVITIES

Net income

$11,192

$11,954

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

10,969

10,807

Share-based compensation

983

955

Noncash interest expense (income), net

331

235

Net (gain) loss on investment activity and

other

620

(266)

Deferred income taxes

123

394

Changes in operating assets and

liabilities, net of effects of acquisitions and divestitures:

Current and noncurrent receivables,

net

74

(26)

Film and television costs, net

(287)

(531)

Accounts payable and accrued expenses

related to trade creditors

(906)

(518)

Other operating assets and liabilities

(3,505)

(425)

Net cash provided by operating

activities

19,593

22,579

INVESTING ACTIVITIES

Capital expenditures

(8,267)

(8,922)

Cash paid for intangible assets

(2,043)

(2,405)

Construction of Universal Beijing

Resort

(111)

(119)

Proceeds from sales of businesses and

investments

689

410

Purchases of investments

(934)

(949)

Other

108

267

Net cash (used in) investing

activities

(10,559)

(11,718)

FINANCING ACTIVITIES

Proceeds from (repayments of) short-term

borrowings, net

—

(660)

Proceeds from borrowings

6,268

6,046

Repurchases and repayments of debt

(2,433)

(3,041)

Repurchases of common stock under

repurchase program and employee plans

(6,920)

(7,770)

Dividends paid

(3,624)

(3,586)

Other

250

(126)

Net cash (used in) financing

activities

(6,459)

(9,136)

Impact of foreign currency on cash, cash

equivalents and restricted cash

21

(18)

Increase (decrease) in cash, cash

equivalents and restricted cash

2,596

1,707

Cash, cash equivalents and restricted

cash, beginning of period

6,282

4,782

Cash, cash equivalents and restricted

cash, end of period

$8,878

$6,489

TABLE 3

Condensed Consolidated Balance Sheets

(Unaudited)

(in millions)

September 30,

December 31,

2024

2023

ASSETS

Current Assets

Cash and cash equivalents

$8,814

$6,215

Receivables, net

14,036

13,813

Other current assets

4,336

3,959

Total current assets

27,186

23,987

Film and television costs

13,340

12,920

Investments

9,021

9,385

Property and equipment, net

61,775

59,686

Goodwill

60,076

59,268

Franchise rights

59,365

59,365

Other intangible assets, net

26,423

27,867

Other noncurrent assets, net

12,686

12,333

$269,871

$264,811

LIABILITIES AND EQUITY

Current Liabilities

Accounts payable and accrued expenses

related to trade creditors

$11,779

$12,437

Accrued participations and residuals

1,476

1,671

Deferred revenue

3,778

3,242

Accrued expenses and other current

liabilities

8,977

11,613

Current portion of debt

2,610

2,069

Advance on sale of investment

9,167

9,167

Total current liabilities

37,786

40,198

Noncurrent portion of debt

98,754

95,021

Deferred income taxes

26,263

26,003

Other noncurrent liabilities

20,526

20,122

Redeemable noncontrolling interests

224

241

Equity

Comcast Corporation shareholders'

equity

85,774

82,703

Noncontrolling interests

544

523

Total equity

86,318

83,226

$269,871

$264,811

TABLE 4

Reconciliation from Net Income

Attributable to Comcast Corporation to Adjusted EBITDA

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in millions)

2024

2023

2024

2023

Net income attributable to Comcast

Corporation

$3,629

$4,046

$11,415

$12,128

Net income (loss) attributable to

noncontrolling interests

(53)

(49)

(222)

(175)

Income tax expense

1,243

1,468

3,906

4,481

Interest expense

1,037

1,060

3,065

3,068

Investment and other (income) loss,

net

3

(50)

140

(672)

Depreciation

2,219

2,203

6,548

6,662

Amortization

1,659

1,290

4,421

4,146

Adjustments (1)

(2)

(6)

(11)

(16)

Adjusted EBITDA

$9,735

$9,962

$29,261

$29,621

Reconciliation from Net Cash Provided

by Operating Activities to Free Cash Flow (Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in millions)

2024

2023

2024

2023

Net cash provided by operating

activities

$7,021

$8,154

$19,593

$22,579

Capital expenditures

(2,913)

(3,294)

(8,267)

(8,922)

Cash paid for capitalized software and

other intangible assets

(702)

(827)

(2,043)

(2,405)

Free Cash Flow

$3,406

$4,032

$9,283

$11,253

Alternate Presentation of Free Cash

Flow (Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in millions)

2024

2023

2024

2023

Adjusted EBITDA

$9,735

$9,962

$29,261

$29,621

Capital expenditures

(2,913)

(3,294)

(8,267)

(8,922)

Cash paid for capitalized software and

other intangible assets

(702)

(827)

(2,043)

(2,405)

Cash interest expense

(690)

(744)

(2,503)

(2,566)

Cash taxes

(1,420)

(1,439)

(5,988)

(3,823)

Changes in operating assets and

liabilities

(1,126)

(55)

(2,652)

(2,030)

Noncash share-based compensation

294

287

983

955

Other (2)

228

143

492

423

Free Cash Flow

$3,406

$4,032

$9,283

$11,253

(1)

3rd quarter and year to date 2024 Adjusted

EBITDA exclude $(2) and $(11) million of other operating and

administrative expenses, respectively, related to our investment

portfolio. 3rd quarter and year to date 2023 Adjusted EBITDA

exclude $(6) and $(16) million of other operating and

administrative expenses, respectively, related to our investment

portfolio.

(2)

3rd quarter and year to date 2024 include

adjustments of $(2) and $(11) million, respectively, related to our

investment portfolio and 3rd quarter and year to date 2023 include

adjustments of $(6) and $(16) million, respectively, related to our

investment portfolio, as these amounts are excluded from Adjusted

EBITDA.

TABLE 5

Reconciliations of Adjusted Net Income

and Adjusted EPS (Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

(in millions, except per share data)

$

EPS

$

EPS

$

EPS

$

EPS

Net income attributable to Comcast

Corporation and diluted earnings per share attributable to Comcast

Corporation shareholders

$3,629

$0.94

$4,046

$0.98

$11,415

$2.90

$12,128

$2.90

Change

(10.3%)

(4.2%)

(5.9%)

0.2%

Amortization of acquisition-related

intangible assets (1)

624

0.16

443

0.11

1,494

0.38

1,318

0.32

Investments (2)

83

0.02

(6)

—

333

0.08

(364)

(0.09)

Adjusted Net income and Adjusted

EPS

$4,337

$1.12

$4,483

$1.08

$13,243

$3.37

$13,083

$3.13

Change

(3.3%)

3.3%

1.2%

7.7%

(1)

Acquisition-related intangible assets are

recognized as a result of the application of Accounting Standards

Codification Topic 805, Business Combinations (such as customer

relationships), and their amortization is significantly affected by

the size and timing of our acquisitions. Amortization of intangible

assets not resulting from business combinations (such as software

and acquired intellectual property rights used in our theme parks)

is included in Adjusted Net Income and Adjusted EPS.

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Amortization of acquisition-related

intangible assets before income taxes

$817

$571

$1,949

$1,699

Amortization of acquisition-related

intangible assets, net of tax

$624

$443

$1,494

$1,318

(2)

Adjustments for investments include

realized and unrealized (gains) losses on equity securities, net

(as stated in Table 1), as well as the equity in net (income)

losses of investees, net, for certain equity method investments,

including Atairos and Hulu and costs related to our investment

portfolio.

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Realized and unrealized (gains) losses on

equity securities, net

$22

$87

$163

$130

Equity in net (income) losses of

investees, net and other

87

(96)

275

(614)

Investments before income taxes

109

(9)

438

(484)

Investments, net of tax

$83

($6)

$333

($364)

TABLE 6

Reconciliation of Constant Currency

(Unaudited)

Three Months Ended

September 30, 2023

Nine Months Ended

September 30, 2023

Effects of

Constant

Effects of

Constant

As

Foreign

Currency

As

Foreign

Currency

(in millions)

Reported

Currency

Amounts

Reported

Currency

Amounts

Reconciliation of Connectivity &

Platforms Constant Currency

Connectivity & Platforms

Revenue

Residential Connectivity &

Platforms

$17,951

$99

$18,050

$53,888

$253

$54,141

Business Services Connectivity

2,320

—

2,320

6,894

1

6,895

Total Connectivity & Platforms

Revenue

$20,271

$99

$20,370

$60,783

$254

$61,037

Connectivity and Platforms Adjusted

EBITDA

Residential Connectivity &

Platforms

$6,886

$16

$6,902

$20,672

$39

$20,711

Business Services Connectivity

1,335

(1)

1,334

3,988

(1)

3,988

Total Connectivity & Platforms

Adjusted EBITDA

$8,221

$15

$8,237

$24,660

$39

$24,699

Connectivity & Platforms Adjusted

EBITDA Margin

Residential Connectivity &

Platforms

38.4%

(20) bps

38.2%

38.4%

(10) bps

38.3%

Business Services Connectivity

57.5%

- bps

57.5%

57.8%

- bps

57.8%

Total Connectivity & Platforms

Adjusted EBITDA Margin

40.6%

(20) bps

40.4%

40.6%

(10) bps

40.5%

Three Months Ended

September 30, 2023

Nine Months Ended

September 30, 2023

Effects of

Constant

Effects of

Constant

As

Foreign

Currency

As

Foreign

Currency

(in millions)

Reported

Currency

Amounts

Reported

Currency

Amounts

Reconciliation of Residential

Connectivity & Platforms Constant Currency

Revenue

Domestic broadband

$6,366

$—

$6,366

$19,086

$—

$19,086

Domestic wireless

917

—

917

2,644

—

2,644

International connectivity

1,109

31

1,141

3,009

77

3,086

Total residential connectivity

$8,393

$31

$8,424

$24,739

$77

$24,816

Video

7,154

47

7,201

21,895

124

22,018

Advertising

960

11

971

2,860

25

2,885

Other

1,444

10

1,454

4,394

28

4,422

Total Revenue

$17,951

$99

$18,050

$53,888

$253

$54,141

Operating Expenses

Programming

$4,460

$28

$4,488

$13,638

$74

$13,712

Non-Programming

6,605

55

6,659

19,578

140

19,718

Total Operating Expenses

$11,065

$83

$11,148

$33,216

$214

$33,430

Adjusted EBITDA

$6,886

$16

$6,902

$20,672

$39

$20,711

Adjusted EBITDA Margin

38.4%

(20) bps

38.2%

38.4%

(10) bps

38.3%

TABLE 7

Reconciliation of Media Revenue

Excluding Olympics (Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in millions)

2024

2023

Change

2024

2023

Change

Revenue

$8,231

$6,029

36.5%

$20,926

$18,376

13.9%

Paris Olympics

1,906

—

1,906

—

Revenue excluding Olympics

$6,325

$6,029

4.9%

$19,020

$18,376

3.5%

Reconciliation of Media Domestic

Advertising Revenue Excluding Olympics (Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in millions)

2024

2023

Change

2024

2023

Change

Revenue

$3,347

$1,913

74.9%

$7,363

$5,965

23.4%

Paris Olympics

1,432

—

1,432

—

Revenue excluding Olympics

$1,915

$1,913

0.1%

$5,931

$5,965

(0.6) %

Reconciliation of Media Domestic

Distribution Revenue Excluding Olympics (Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in millions)

2024

2023

Change

2024

2023

Change

Revenue

$3,272

$2,591

26.3%

$8,942

$7,916

13.0%

Paris Olympics

473

—

473

—

Revenue excluding Olympics

$2,798

$2,591

8.0%

$8,468

$7,916

7.0%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031386583/en/

Investor Contacts: Marci Ryvicker (215) 286-4781 Jane

Kearns (215) 286-4794 Marc Kaplan (215) 286-6527

Press Contacts: Jennifer Khoury (215) 286-7408 John

Demming (215) 286-8011

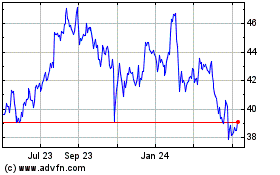

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Nov 2023 to Nov 2024