As filed with the Securities and Exchange Commission on September 8, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________________

COMPASS PATHWAYS PLC

(Exact name of registrant as specified in its charter)

____________________________

| | | | | |

England and Wales

(State or other jurisdiction of

incorporation or organization) | Not Applicable

(I.R.S. Employer

Identification Number) |

33 Broadwick Street

London W1F 0DQ

United Kingdom

Tel: +1 (716) 676-6461

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Kabir Nath

Chief Executive Officer

130 Madison Avenue, 3rd Floor

New York, New York 10016

+1 (716) 676-6461

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| | | | | |

Benjamin K. Marsh

Goodwin Procter LLP

The New York Times Building

620 Eighth Avenue

New York, NY 10018

(212) 813-8800 | Sophie C. McGrath

Goodwin Procter (UK) LLP

100 Cheapside

London EC2V 6DY

United Kingdom

+44 20 7447 4200 |

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. The selling securityholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 8, 2023

PROSPECTUS

40,089,163 American Depositary Shares

Representing 40,089,163 Ordinary Shares

Offered by the Selling Securityholders

This prospectus relates to the proposed resale or other disposition by the selling securityholders identified herein of (i) 32,153,500 ADSs including (a) up to 16,076,750 American Depositary Shares, or ADSs, purchased by qualified institutional buyers or accredited investors, or the Purchasers, in a private placement, or the Private Placement, and (b) up to 16,076,750 ADSs issuable upon the exercise of outstanding warrants to purchase ADSs, or the Warrants, held by the Purchasers, and (ii) 7,935,663 ADSs held by ATAI Life Sciences AG, or ATAI, pursuant to a demand registration notice received by us on July 26, 2023, pursuant to our Investment and Shareholders' Agreement, dated April 17, 2020, as amended on August 7, 2020, by and between us and the shareholders named herein, or the Shareholders' Agreement. The closing of the Private Placement occurred on August 18, 2023. We refer to ATAI and the Purchasers together in this prospectus as the selling securityholders.

We are not selling any ADSs under this prospectus and will not receive any of the proceeds from the sale or other disposition of ADSs by the selling securityholders. We will, however, receive proceeds from the exercise of any Warrants. There is no assurance that the holders of Warrants will exercise the Warrants, and we believe the likelihood that these holders will exercise the Warrants, and therefore any cash proceeds that we may receive in relation to the exercise of such securities, will be dependent on the trading price of our ADSs. See "Use of Proceeds" beginning on page 9 of this prospectus.

The selling securityholders may sell the ADSs on Nasdaq or any other national securities exchange or quotation service on which the ADSs may be listed at the time of sale, in the over-the-counter market, through ordinary brokerage trades, pursuant to underwritten public offerings, negotiated transactions, block trades or a combination of these methods or through underwriters or broker-dealers, through agents and/or directly to one or more purchasers, or by any other legally available means. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, or at negotiated prices. See “Plan of Distribution” beginning on page 25 for more information about how the selling securityholders may sell or dispose of their ADSs.

The selling securityholders (which term as used herein includes their respective donees, pledgees, transferees or other successors in interest) may offer and sell or otherwise dispose of any or all of the ADSs described in this prospectus from time to time. The selling securityholders may sell any, all or none of the securities offered by this prospectus and we do not know when or in what amount the selling securityholders may sell their ADSs hereunder.

All expenses of registration incurred in connection with this offering are being borne by us. All selling and other expenses incurred by the selling securityholders will be borne by the selling securityholders.

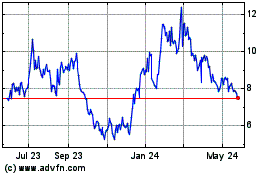

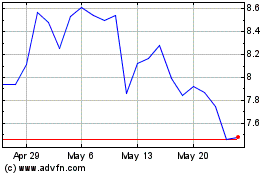

Our ADSs trade on the Nasdaq Global Select Market under the symbol “CMPS”. On September 7, 2023, the last reported sale price for our ADSs on Nasdaq was $9.62 per share.

INVESTING IN THESE SECURITIES INVOLVES A HIGH DEGREE OF RISK. PLEASE READ THE INFORMATION UNDER THE HEADING “RISK FACTORS” ON PAGE 8 OF THIS PROSPECTUS AND IN THE DOCUMENTS INCORPORATED BY REFERENCE IN THIS PROSPECTUS FOR A

DISCUSSION OF THE FACTORS YOU SHOULD CAREFULLY CONSIDER BEFORE DECIDING TO PURCHASE THESE SECURITIES.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. Under this shelf registration process, certain selling securityholders may from time to time sell any combination of the securities described in this prospectus in one or more offerings, as described under "Plan of Distribution."

Neither we nor the selling securityholders have authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus. Neither we nor the selling securityholders take responsibility for, and can provide no assurance as to the reliability of, any other information others may give you. The selling securityholders are offering to sell, and seeking offers to buy, our securities only in jurisdictions where it is lawful to do so. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy shares in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or shares are sold on a later date. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

This prospectus may be supplemented from time to time by one or more prospectus supplements or free writing prospectuses. Such prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or free writing prospectus, you must rely on the information in the prospectus supplement or free writing prospectus. You should carefully read both this prospectus and any applicable prospectus supplement together with additional information described under the heading “Where You Can Find Additional Information” before deciding to invest in any shares being offered.

Unless the context otherwise indicates, references in this prospectus to “COMPASS,” “we,” “our,” “us” and “the Company” refer, collectively, to COMPASS Pathways plc, a public limited company registered under the laws of England and Wales, and its consolidated subsidiaries.

We own various trademark registrations and applications, and unregistered trademarks, including COMPASS Pathways plc and our corporate logo. All other trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders. Solely for convenience, the trademarks and trade names in this prospectus may be referred to without the ® and ™ or RTM symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into it contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Forward-looking statements relate to future events or our future financial performance. Without limiting the foregoing, we generally identify forward-looking statements by terminology such as “may,” “would,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “assume,” “intend,” “potential,” “continue” or other similar words or the negative of these terms. These statements are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors, including those contained in or incorporated by reference into this prospectus and in the sections entitled “Risk Factors” in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. Accordingly, you should not place undue reliance upon these forward-looking statements. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur, and the timing of events and circumstances and actual results could differ materially from those projected in the forward looking statements. Forward-looking statements contained in or incorporated by reference into this prospectus include, but are not limited to, express or implied statements about:

•the potential for all Warrants issued in our Private Placement to be exercised in full, and any expected proceeds from the exercise of the Warrants;

•the timing, progress and results of our investigational COMP360 psilocybin treatment, including statements regarding the timing of initiation and completion of trials or studies and related preparatory work, including our expectations regarding the amendments we made to the protocols for our Phase 3 clinical program, results of discussions with the Food and Drug Administration, or FDA, regarding our trial design and the timing of the completion of our Phase 3 clinical program for treatment-resistant depression, or TRD, the period during which the results of the trials will become available and our research and development programs;

•our estimates regarding our expenses, capital requirements, the sufficiency of our cash resources, our expected cash runway and needs for and ability to raise additional financing;

•our reliance on the success of our investigational COMP360 psilocybin treatment;

•the timing, scope or likelihood of regulatory filings and approvals;

•our expectations regarding the size of the eligible patient populations for COMP360 psilocybin treatment, if approved for commercial use;

•our ability to identify third-party clinical sites to conduct our trials and our ability to identify and train appropriately qualified therapists to administer COMP360 psilocybin treatment in our clinical trials;

•our ability to implement our business model and our strategic plans for our business and our investigational COMP360 psilocybin treatment;

•our ability to identify new indications for COMP360 beyond our current primary focus on TRD, anorexia nervosa, and post-traumatic stress disorder, or PTSD;

•our ability to identify, develop or acquire digital technologies to enhance our administration of our investigational COMP360 psilocybin treatment;

•our ability to leverage our technology and drug development candidates to advance new psychedelic compounds in other areas of unmet mental health need;

•our ability to successfully establish and maintain Centers of Excellence and our ability to achieve our goals with respect to the Center for Mental Health Research and Innovation;

•our commercialization, marketing and manufacturing capabilities and strategy;

•the pricing, coverage and reimbursement of our investigational COMP360 psilocybin treatment, if approved;

•the scalability and commercial viability of our manufacturing methods and processes;

•the rate and degree of market acceptance and clinical utility of our investigational COMP360 psilocybin treatment, in particular, and psilocybin-based treatments, in general;

•our ability to establish or maintain collaborations or strategic relationships or obtain additional funding;

•our expectations regarding potential benefits of our investigational COMP360 psilocybin treatment and our therapeutic approach generally;

•our expectations around feedback from and discussions with regulators, regulatory development paths and with respect to Controlled Substances Act designation;

•the scope of protection we and any current or future licensors or collaboration partners are able to establish and maintain for intellectual property rights covering COMP360;

•our ability to operate our business without infringing, misappropriating, or otherwise violating the intellectual property rights and proprietary technology of third parties;

•regulatory developments in the United States, under the laws and regulations of England and Wales, and other jurisdictions;

•developments and projections relating to our competitors and our industry;

•the effectiveness of our internal control over financial reporting;

•our ability to attract and retain qualified employees and key personnel;

•our Loan and Security Agreement, or the Loan Agreement, with Hercules Capital, Inc., or Hercules, contains milestones that must be achieved in order to draw down additional amounts under our Loan Agreement on our term loan facility and operating and financial covenants that restrict our operating activities;

•the effect of global financial and economic conditions and geopolitical events, including instability in the banking system, fluctuating interest rates and inflation, and foreign exchange fluctuations, particularly the Pound Sterling to U.S. Dollar, the risk of economic slowdown or recession in the United States, overall market volatility in the United States or the United Kingdom, including as a result of, among other factors, the ongoing war between Russia and Ukraine or similar events, on our business;

•the effect of public health crises, pandemics or epidemics such as the COVID-19 pandemic, and any future mitigation efforts, and current or future economic effects, on any of the foregoing or other aspects of our business or operations;

•whether we are classified as a controlled foreign corporation, or CFC, or a passive foreign investment company, or PFIC, under the Internal Revenue Code of 1986, as amended, for current and future periods; and

•the future trading price of the ADSs and impact of securities analysts’ reports on these prices.

The forward-looking statements made or incorporated by reference in this prospectus relate only to events as of the date on which the statements are made. We have included important factors in the cautionary statements included in this prospectus and incorporated herein by reference, including under the caption entitled “Risk Factors” that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make. Except as required by law, we do not assume any intent to update any forward-looking statements after the date on which the statement is made, whether as a result of new information, future events or circumstances or otherwise.

PROSPECTUS SUMMARY

Company Overview

We are a biotechnology company dedicated to accelerating patient access to evidence-based innovation in mental health. We are motivated by the need to find better ways to help and empower people suffering with mental health challenges who are not helped by existing treatments, and are pioneering the development of a new model of psilocybin treatment, in which our proprietary, investigational COMP360 psilocybin is administered in conjunction with psychological support, which we refer to as COMP360 psilocybin treatment.

Private Placement

In connection with the Private Placement, on August 16, 2023, we entered into a Securities Purchase Agreement, or the Purchase Agreement, with the purchasers named therein, or the Purchasers, pursuant to which we agreed to sell to the Purchasers, up to an aggregate of (i) 16,076,750 ADSs, representing 16,076,750 ordinary shares, and (ii) accompanying Warrants to purchase up to 16,076,750 ADSs, representing 16,076,750 ordinary shares, at a purchase price of approximately $7.78 per ADS and accompanying Warrant to purchase one ADS. Each Warrant has an exercise price of $9.93 per ADS. The Warrants are exercisable at the election of the investors for a three-year period beginning any time on or after the later of (i) February 18, 2024 and (ii) the date this registration statement is declared effective.

The Warrants provide that a holder of Warrants will not have the right to exercise any portion of its Warrants for ADSs if such holder, together with its affiliates, would beneficially own in excess of 4.99% or 9.99% (at the election of such holder) of the number of ADSs outstanding immediately after giving effect to such exercise; provided, however, that each holder may increase or decrease such percentage by giving us sixty-one (61) days’ notice, but not to any percentage in excess of 19.99%. If there is no effective registration statement at the time of exercise, the Warrants may be exercised on a cashless basis.

The ADSs issued to the Purchasers, the Warrants issued to the Purchasers and the ADSs issuable upon exercise of the Warrants, as applicable, were not initially registered under the Securities Act or any state securities laws. We have relied on the exemption from the registration requirements pursuant to Section 4(a)(2) of the Securities Act, as a transaction by an issuer not involving a public offering. In connection with their execution of the Purchase Agreement, each of the Purchasers represented that securities purchased by such Purchaser were being acquired for investment purposes only and not with a view to, or for, resale or distribution thereof in whole or in part.

Pursuant to the Purchase Agreement, we agreed to file a resale registration statement with the SEC within thirty (30) days following the closing of the Private Placement to register (i) the ADSs issued and sold in the Private Placement and (ii) the ADSs issuable upon exercise of the Warrants issued and sold in the Private Placement. We also agreed, among other things, to indemnify the Purchasers, their partners, members, officers and directors, and each person who controls such Purchasers, from certain liabilities and to pay certain expenses incurred by us in connection with such registration.

The registration statement of which this prospectus is a part relates to the offer and resale of the ADSs issued to the Purchasers pursuant to the Purchase Agreement, including the ADSs issuable upon exercise of the Warrants.

Shareholders' Agreement

Pursuant to the terms of our Shareholders’ Agreement, ATAI is entitled to registration rights with respect to certain of its securities under the Securities Act of 1933, as amended, or the Securities Act, including demand registration rights. On July 26, 2023, ATAI exercised its demand registration rights and, in accordance with the terms of the Shareholders' Agreement, we are required to file a resale registration statement on Form S-3 covering 7,935,663 shares held by ATAI within forty-five (45) days after the date ATAI gave notice of such registration request.

Company Information

We were originally incorporated as a private limited company under the laws of England and Wales in June 2020 under the name COMPASS Rx Limited to become a holding company for COMPASS Pathfinder Holdings Limited. COMPASS Rx Limited was subsequently re-registered as a public limited company in August 2020 and renamed COMPASS Pathways plc. COMPASS Pathfinder Holdings Limited was originally incorporated under the laws of England and Wales in June 2017. Our registered office is located at 33 Broadwick Street, London W1F 0DQ, United Kingdom, and our telephone number is +1 (716) 676-6461. Our website address is www.compasspathways.com. We do not incorporate the information on or accessible through our website into this prospectus supplement, and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

THE OFFERING

The following summary of the offering contains basic information about the offering and is not intended to be complete. It does not contain all the information that may be important to you. For a more complete understanding of our ADSs, please refer to the description of our share capital and our ADSs included in Exhibit 4.3 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and incorporated by reference herein. | | | | | |

| ADSs Offered by the Selling Securityholders | Up to 40,089,163 ADSs, each representing one ordinary share, nominal value £0.008 per share. |

| Use of Proceeds | We will not receive any proceeds from the sale of the ADSs covered by this prospectus, except with respect to amounts received by us due to the exercise of Warrants. |

| Nasdaq Global Select Market Symbol | “CMPS” |

| Offering Price | The selling securityholders may offer the ADSs offered by this prospectus at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, or at negotiated prices. |

| Risk Factors | You should read the “Risk Factors” section of this prospectus, and the risk factors incorporated by reference in this prospectus, for a discussion of factors to consider carefully before deciding to invest in our ADSs. |

RISK FACTORS

Investment in any securities offered pursuant to this prospectus involves risks. You should carefully consider the risk factors described below and incorporated by reference to our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, before acquiring any of such securities. Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations.

Risks Related to this Offering

The number of shares being registered for sale is significant in relation to the number of our outstanding Ordinary Shares.

We have filed a registration statement of which this prospectus is a part to register the shares offered hereunder for sale into the public market by the selling securityholders. Pursuant to this prospectus, we are registering 40,089,163 ADSs, representing 40,089,163 ordinary shares, which includes (i) 16,076,750 ADSs, representing 16,076,750 Ordinary Shares, pursuant to the Private Placement, which may be resold in the public market immediately without restriction and (ii) 7,935,663 ADSs, representing 7,935,663 Ordinary Shares, pursuant to ATAI’s demand notice, plus up to an additional 16,076,750 ADSs, representing 16,076,750 Ordinary Shares, registered hereunder may be resold in the public market without restriction following exercise of the Warrants. These shares represent a large number of our Ordinary Shares, and if a large part or all of such shares are sold in the market all at once or at about the same time, that could depress the market price of our ADSs during the period the registration statement remains effective and could also affect our ability to raise equity capital.

The Warrants issued pursuant to the Purchase Agreement may not be exercised.

The Warrant holders are not obligated to exercise the Warrants, so we may not receive any additional proceeds under the Purchase Agreement. We believe the likelihood that these holders will exercise the Warrants, and therefore any cash proceeds that we may receive in relation to the exercise of such Warrants, will be dependent on the trading price of our ADSs. If the Warrants are not exercised, or only a portion of the Warrants are exercised, we may need to obtain additional funding sooner than expected to continue operations. Further, changing circumstances, some of which may be beyond our control, such as fluctuating inflation and interest rates, could cause us to consume capital significantly faster than we currently anticipate, and we may need to seek additional funds sooner than planned. Adequate additional financing may not be available to us on acceptable terms or at all.

USE OF PROCEEDS

We are registering these securities pursuant to registration rights granted to the selling securityholders. We are not selling any securities under this prospectus. The selling securityholders will receive all of the proceeds from this offering, except with respect to amounts received by us due to the exercise of the Warrants.

We expect to use the proceeds from the exercise of Warrants, if any, for general corporate purposes. We will have broad discretion over the use of any proceeds from the exercise of Warrants. There is no assurance that the holders of our Warrants will elect to exercise for cash any or all of such Warrants. We believe the likelihood that the holders will exercise such Warrants, and therefore any cash proceeds that we may receive in relation to the exercise of such Warrants being offered for sale in this prospectus, will be dependent on the trading price of our ADSs. If the market price for our ADSs is less than the exercise price of the Warrants, we believe the holders of such Warrants will be unlikely to exercise such Warrants.

The selling securityholders will pay any underwriting discounts and commissions and its own costs and expenses, including, but not limited to, all fees and disbursements to counsel or other advisors to the selling securityholders and any stock transfer taxes. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares covered by this prospectus, including, without limitation, all registration and filing fees and fees and expenses of our counsel.

SELLING SECURITYHOLDERS

This prospectus covers the sale or other disposition from time to time by the selling securityholders of up to the total number ADSs (i) that were covered by the demand notice provided to us by ATAI under our Shareholders' Agreement and (ii) that were issued to the selling securityholders pursuant to the Purchase Agreement, plus the total number of ADSs issuable upon exercise of the Warrants issued to the selling securityholders pursuant to the Purchase Agreement, without giving effect to the beneficial ownership limitations described under “Company Overview—Private Placement.”

We are registering the above-referenced ADSs to permit each of the selling securityholders and their pledgees, donees, transferees or other successors-in interest that receive their ADSs after the date of this prospectus to resell or otherwise dispose of the ADSs in the manner contemplated under “Plan of Distribution” below.

The following table sets forth the name of each selling securityholder, the number of ADSs owned by each of the respective selling securityholders, and the number of ADSs that may be offered under this prospectus assuming all of the ADSs covered hereby are sold. The percentages of shares owned before and after the offering are based on 61,880,764 ADSs outstanding as of September 6, 2023.

The information set forth below is based upon information obtained from the selling securityholders and upon information in our possession regarding the demand notice and the issuance of ADSs and Warrants to purchase ADSs to the selling securityholders in connection with the Private Placement. The number of ADSs in the column “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” represents all of the ADSs that a selling securityholder may offer under this prospectus, assuming the exercise of all Warrants. The selling securityholders may sell some, all or none of their ADSs. We do not know how long the selling securityholders will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling securityholders regarding the sale or other disposition of any of the shares. The ADSs covered hereby may be offered from time to time by the selling securityholders.

None of the selling securityholders, other than ATAI, has, or within the past three years has had, any position, office or other material relationship with us. Florian Brand, the Chief Executive Officer of ATAI, previously served as a member of our board of directors. In addition, our former director, Jason Camm, sits on the supervisory board of ATAI.

| | | | | | | | | | | | | | | | | |

| Name of Selling Securityholders | ADSs Beneficially Owned Prior to Offering(1) | Maximum Number of ADSs that may be Offered Pursuant to this Prospectus | ADSs Beneficially Owned After Offering(1) |

| Number | Percent | Number | Percent |

| | | | | |

ATAI Life Sciences AG(2) | 9,565,774 | 15.46% | 7,935,663 | 1,630,111 | 2.63% |

TCG Crossover Fund I, L.P.(3) | 964,500 | 1.56% | 1,929,000 | — | — |

TCG Crossover Fund II, L.P.(3) | 2,893,500 | 4.68% | 5,787,000 | — | — |

Vivo Opportunity Fund Holdings, L.P.(4) | 1,608,000 | 2.60% | 3,216,000 | — | — |

Citadel CEMF Investments Ltd.(5) | 1,565,000 | 2.53% | 3,130,000 | — | — |

RA Capital Healthcare Fund, L.P.(6) | 1,286,000 | 2.08% | 2,572,000 | — | — |

Paradigm BioCapital International Fund Ltd.(7) | 1,160,000 | 1.87% | 2,320,000 | — | — |

Armistice Capital Master Fund Ltd.(8) | 964,550 | 1.56% | 1,929,100 | — | — |

Soleus Capital Master Fund(9) | 964,550 | 1.56% | 1,929,100 | — | — |

Aisling Capital V, LP(10) | 964,500 | 1.56% | 1,929,000 | — | — |

Logos Global Master Fund LP(11) | 1,038,070 | 1.68% | 1,286,140 | 395,000 | * |

Logos Opportunities Fund III LP(12) | 257,980 | * | 515,960 | — | — |

Woodline Master Fund LP(13) | 617,400 | 1.00% | 1,234,800 | — | — |

Investor Company ITF Rosalind Master Fund L.P.(14) | 639,500 | 1.03% | 1,029,000 | 125,000 | * |

Alyeska Master Fund, LP(15) | 386,000 | * | 772,000 | — | — |

Marshall Wace Investment Strategies – Eureka Fund(16) | 193,000 | * | 386,000 | — | — |

MW XO Health Innovations Fund, LP(17) | 193,000 | * | 386,000 | — | — |

Laurion Capital Master Fund Ltd.(18) | 510,907 | * | 643,000 | 189,407 | * |

PFM Biotech Opportunities LP(19) | 283,100 | * | 516,000 | 25,100 | * |

DAFNA Lifescience LP(20) | 145,900 | * | 291,800 | — | — |

DAFNA Lifescience Select LP(21) | 47,100 | * | 94,200 | — | — |

KVP Capital, LP(22) | 128,700 | * | 257,400 | — | — |

* Less than one percent

(1) “Beneficial ownership” is a term broadly defined by the SEC in Rule 13d-3 under the Exchange Act, and includes more than the typical form of share ownership, that is, shares held in the person’s name. The term also includes what is referred to as “indirect ownership,” meaning ownership of shares as to which a person has or shares investment power. For purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares underlying options, warrants and other purchase rights that are currently exercisable or exercisable within 60 days of September 6, 2023.

(2) ATAI Life Sciences AG is a wholly-owned subsidiary of ATAI Life Sciences N.V. As a result, ATAI Life Sciences AG and ATAI Life Sciences N.V. both hold shared voting and dispositive power over the securities. ATAI Life Sciences AG is a German public limited company.

(3) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 964,500 ADSs held by TCG Crossover Fund I, L.P., or TCG Crossover I, and 2,893,500 ADSs held by TCG Crossover Fund II, L.P., or TCG Crossover II. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 964,500 ADSs issuable upon the exercise of Warrants held by TCG Crossover I and 2,893,500 ADSs issuable upon the exercise of Warrants held by TCG Crossover II, but are not exercisable within 60 days of September 6, 2023. TCG Crossover GP I, LLC, or TCG Crossover GP I, is the general partner of TCG Crossover I, and TCG Crossover GP II, LLC, or TCG Crossover GP II, is the general partner of TCG Crossover II. Chen Yu is the sole managing member of each of TCG Crossover GP I and TCG Crossover GP II and holds voting and dispositive power with respect to these securities.

(4) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 1,608,000 ADSs held by Vivo Opportunity Fund Holdings, L.P., or Vivo Opportunity Fund. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 1,608,000 ADSs issuable upon the exercise of Warrants held by Vivo Opportunity Fund, but are not exercisable within 60 days of September 6, 2023. Vivo Opportunity, LLC is the general partner of Vivo Opportunity Fund and may be deemed to have beneficial ownership of these securities. The Warrants are subject to a beneficial ownership limitation of 9.99%, which such limitation restricts Vivo Opportunity Fund from exercising that portion of the Warrants that would result in Vivo Opportunity Fund and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation.

(5) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 1,565,000 ADSs held by Citadel CEMF Investments Ltd. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 1,565,000 ADSs issuable upon the exercise of Warrants held by Citadel CEMF Investments Ltd., but are not exercisable within 60 days of September 6, 2023. Citadel Advisors LLC is the portfolio manager of Citadel CEMF Investments Ltd. Citadel Advisors Holdings LP is the sole member of Citadel Advisors LLC.

Citadel GP LLC is the General Partner of Citadel Advisors Holdings LP. Kenneth Griffin owns a controlling interest in Citadel GP LLC. Mr. Griffin, as the owner of a controlling interest in Citadel GP LLC, may be deemed to have shared power to vote and/or shared power to dispose of the securities held by Citadel CEMF Investments Ltd. This disclosure shall not be construed as an admission that Mr. Griffin or any of the Citadel related entities listed above is the beneficial owner of any securities of the Company other than the securities actually owned by such person (if any).

(6) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 1,286,000 ADSs held by RA Capital Healthcare Fund, L.P. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 1,286,000 ADSs issuable upon the exercise of Warrants held by RA Capital Healthcare Fund, L.P., but are not exercisable within 60 days of September 6, 2023. RA Capital Management, L.P. is the investment manager for the RA Capital Healthcare Fund, L.P., or RACHF. The general partner of RA Capital Management, L.P. is RA Capital Management GP, LLC, of which Peter Kolchinsky and Rajeev Shah are the managing members. Each of Mr. Kolchinsky and Mr. Shah may be deemed to have voting and investment power over the securities held by RACHF. Mr. Kolchinsky and Mr. Shah disclaim beneficial ownership of such securities, except to the extent of any pecuniary interest therein.

(7) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 1,160,000 ADSs held by Paradigm BioCapital International Fund Ltd. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 1,160,000 ADSs issuable upon the exercise of Warrants held by Paradigm BioCapital International Fund Ltd., but are not exercisable within 60 days of September 6, 2023. Paradigm BioCapital Advisors LP is the investment manager of Paradigm BioCapital International Fund Ltd. Paradigm BioCapital Advisors GP LLC is the general partner of Paradigm BioCapital Advisors LP. Dr. Senai Asefaw is the managing member of Paradigm BioCapital Advisors GP LLC. As a result, Dr. Senai Asefaw may be deemed to have voting and investment power over the securities held by Paradigm BioCapital International Fund Ltd. Dr. Senai Asefaw disclaims beneficial ownership of such securities, except to the extent of any pecuniary interest therein.

(8) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 964,550 ADSs held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company, or the Master Fund. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 964,550 ADSs issuable upon the exercise of Warrants held by the Master Fund, but are not exercisable within 60 days of September 6, 2023. The ADSs and ADSs issuable upon the exercise of Warrants held by the Master Fund may be deemed to be beneficially owned by: (i) Armistice Capital, LLC, or Armistice Capital, as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The Warrants are subject to a beneficial ownership limitation of 4.99%, which such limitation restricts the selling securityholder from exercising that portion of the Warrants that would result in the selling securityholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation.

(9) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 964,550 ADSs held by Soleus Capital Master Fund, L.P., or Soleus Capital Master Fund. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 964,550 ADSs issuable upon the exercise of Warrants held by Soleus Capital Master Fund, but are not exercisable within 60 days of September 6, 2023. Soleus Capital, LLC is the sole general partner of Soleus Capital Master Fund and thus holds voting and dispositive power over the shares held by Soleus Capital Master Fund. Soleus Capital Group, LLC is the sole managing member of Soleus Capital, LLC. Mr. Guy Levy is the sole managing member of Soleus Capital Group, LLC. Each of Soleus Capital Group, LLC, Soleus Capital, LLC and Mr. Guy Levy disclaims beneficial ownership of the securities held by Soleus Capital Master Fund, except to the extent of their respective pecuniary interests therein.

(10) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 964,500 ADSs held by Aisling Capital V, LP, or Aisling. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 964,500 ADSs issuable upon the exercise of Warrants held by Aisling, but are not exercisable within 60 days of September 6, 2023. Aisling is controlled by Aisling Capital Partners V, LP, or Aisling GP, as general partner of Aisling, which is controlled by Aisling Capital Partners V LLC, or Aisling Partners, as general partner of Aisling GP, and each of the individual managing members of Aisling Partners. The individual managing members, or collectively, the Managers, of Aisling Partners are Dr. Andrew Schiff and Steve Elms. Aisling GP, Aisling Partners and the Managers share voting and dispositive power over the ADSs directly held by Aisling. Each of Aisling GP, Aisling Partners and the Managers may be deemed to be the beneficial owner of the ADSs to the extent of its pecuniary interest therein. The above information shall not be deemed an admission that any of Aisling GP, Aisling Partners or any of the Managers is the beneficial owner of any of the ADSs.

(11) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of (i) 395,000 ordinary shares equivalent to 395,000 ADSs held prior to the Private Placement and (ii) 643,070 ADSs held by Logos Global Master Fund LP. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 643,070 ADSs issuable upon the exercise of Warrants held by Logos Global Master Fund LP, but are not exercisable within 60 days of September 6, 2023. Arsani William and Graham Walmsley are General Partners of Logos Global Master Fund LP and as a result share power to direct the voting and disposition of these securities and may be deemed to beneficially own these securities.

(12) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 257,980 ADSs held by Logos Opportunities Fund III LP. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 257,980 ADSs issuable upon the exercise of Warrants held by Logos Opportunities Fund III LP, but are not exercisable within 60 days of September 6, 2023. Arsani William and Graham Walmsley are General Partners of Logos Opportunities Fund III LP and as a result share power to direct the voting and disposition of these securities and may be deemed to beneficially own these securities.

(13) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 617,400 ADSs held by Woodline Master Fund LP. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 617,400 ADSs issuable upon the exercise of Warrants held by Woodline Master

Fund LP, but are not exercisable within 60 days of September 6, 2023. Woodline Partners LP serves as the investment manager of Woodline Master Fund LP and may be deemed to be the beneficial owner of the shares. Woodline Partners LP disclaims any beneficial ownership of these shares.

(14) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of (i) 125,000 ordinary shares equivalent to 125,000 ADSs held prior to the Private Placement and (ii) 514,500 ADSs held by Investor Company ITF Rosalind Master Fund L.P. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 514,500 ADSs issuable upon the exercise of Warrants held by Investor Company ITF Rosalind Master Fund L.P., but are not exercisable within 60 days of September 6, 2023. Rosalind Advisors, Inc. is the investment advisor to Rosalind Master Fund L.P. and may be deemed the beneficial owner of shares held by Rosalind Master Fund L.P. Steven Salamon is the portfolio manager of Rosalind Advisors, Inc. and may be deemed to beneficially own the securities held by Rosalind Master Fund L.P.

(15) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 386,000 ADSs held by Alyseka Master Fund, L.P., or Alyseka. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 386,000 ADSs issuable upon the exercise of Warrants held by Alyseka, but are not exercisable within 60 days of September 6, 2023. Alyeska Investment Group, L.P., the investment manager of Alyeska, has voting and investment control of the shares held by Alyeska. The general partner of Alyeska is Alyeska Fund GP, LLC. Anand Parekh is the Chief Executive Officer of Alyeska Investment Group, L.P. and may be deemed to be the beneficial owner of such shares. Mr. Parekh, however, disclaims any beneficial ownership of the securities held by Alyeska.

(16) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 193,000 ADSs held by Marshall Wace Investment Strategies – Eureka Fund. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 193,000 ADSs issuable upon the exercise of Warrants held by Marshall Wace Investment Strategies – Eureka Fund, but are not exercisable within 60 days of September 6, 2023. Marshall Wace, LLP, is the investment manager of Marshall Wace Investment Strategies – Eureka Fund, which is a sub-trust of Marshall Wace Investment Strategies, an umbrella unit trust established in Ireland with limited liability between sub-trusts, the manager of which is Marshall Wace Ireland Limited. No individual has ultimate beneficial ownership of the securities.

(17) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 193,000 ADSs held by MW XO Health Innovations Fund, LP. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 193,000 ADSs issuable upon the exercise of Warrants held by MW XO Health Innovations Fund, LP, but are not exercisable within 60 days of September 6, 2023. Marshall Wace, LLC, as general partner of Marshall Wace North America, LP, is the investment manager of MW XO Health Innovations Fund, LP. No individual has ultimate beneficial ownership of the securities.

(18) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of (i) 189,407 ordinary shares equivalent to 189,407 ADSs held prior to the Private Placement and (ii) 321,500 ADSs held by Laurion Capital Master Fund Ltd. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 321,500 ADSs issuable upon the exercise of Warrants held by Laurion Capital Master Fund Ltd., but are not exercisable within 60 days of September 6, 2023. Laurion Capital Management LP, the investment manager of Laurion Capital Master Fund Ltd., has voting and investment power over the securities held by Laurion Capital Master Fund Ltd. Messrs. Benjamin A. Smith and Sheehan Maduraperuma are the managing members of Laurion Capital GP LLC, which is the general partner of Laurion Capital Management LP. Each of Laurion Capital Master Fund Ltd., Laurion Capital GP LLC, Benjamin A. Smith and Sheehan Maduraperuma disclaims beneficial ownership over these securities.

(19) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of (i) 25,100 ordinary shares equivalent to 25,100 ADSs held prior to the Private Placement and (ii) 258,000 ADSs held by PFM Biotech Opportunities LP. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 258,000 ADSs issuable upon the exercise of Warrants held by PFM Biotech Opportunities LP, but are not exercisable within 60 days of September 6, 2023. Brian Grossman is the Portfolio Manager of PFM Biotech Opportunities LP and as a result has power to direct the voting and disposition of these securities and may be deemed to beneficially own these securities.

(20) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 145,900 ADSs held by DAFNA Lifescience LP. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 145,900 ADSs issuable upon the exercise of Warrants held by DAFNA Lifescience LP, but are not exercisable within 60 days of September 6, 2023. DAFNA Capital Management LLC is the sole general partner of DAFNA LifeScience LP. The Chief Executive Officer and Chief Investment Officer of DAFNA Capital Management LLC are Dr. Nathan Fischel and Dr. Fariba Ghodsian, respectively. These individuals may be deemed to have shared voting and investment power of the shares held by DAFNA LifeScience LP. Each of Dr. Fischel and Dr. Ghodsian disclaim beneficial ownership of such shares, except to the extent of his or her pecuniary interest therein.

(21) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 47,100 ADSs held by DAFNA Lifescience Select LP. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 47,100 ADSs issuable upon the exercise of Warrants held by DAFNA Lifescience Select LP, but are not exercisable within 60 days of September 6, 2023. DAFNA Capital Management LLC is the sole general partner of DAFNA LifeScience Select LP. The Chief Executive Officer and Chief Investment Officer of DAFNA Capital Management LLC are Dr. Nathan Fischel and Dr. Fariba Ghodsian, respectively. These individuals may be deemed to have shared voting and investment power of the shares held by DAFNA LifeScience Select LP. Each of Dr. Fischel and Dr. Ghodsian disclaim beneficial ownership of such shares, except to the extent of his or her pecuniary interest therein.

(22) The ADSs reported under “ADSs Beneficially Owned Prior to Offering” consist of 128,700 ADSs held by KVP Capital, LP. In addition to the foregoing ADSs, the ADSs reported under “Maximum Number of ADSs that may be Offered Pursuant to this Prospectus” also consists of 128,700 ADSs issuable upon the exercise of Warrants held by KVP Capital, LP, but are not

exercisable within 60 days of September 6, 2023. Caley Castelein controls KVP Capital GP, LLC, which is the general partner of KVP Capital, LP, and as a result may be deemed to beneficially own these securities.

MATERIAL INCOME TAX CONSIDERATIONS

The following summary contains a description of certain material U.K. and U.S. federal income tax consequences of the acquisition, ownership and disposition of our Ordinary Shares or ADSs. This summary should not be considered a comprehensive description of all the tax considerations that may be relevant to the decision to acquire Ordinary Shares or ADSs in this offering.

Material U.S. federal income tax considerations for U.S. holders

The following is a description of the material U.S. federal income tax consequences to the U.S. Holders described below of owning and disposing of our Ordinary Shares or ADSs. It is not a comprehensive description of all tax considerations that may be relevant to a particular person’s decision to acquire securities. This discussion applies only to a U.S. Holder that holds our Ordinary Shares or ADSs as a capital asset for tax purposes (generally, property held for investment). In addition, it does not describe all of the tax consequences that may be relevant in light of a U.S. Holder’s particular circumstances, including state and local tax consequences, estate tax consequences, alternative minimum tax consequences, the special tax accounting rules under Section 451(b) of the Code, the potential application of the Medicare contribution tax, and tax consequences applicable to U.S. Holders subject to special rules, such as:

•banks, insurance companies, and certain other financial institutions;

•U.S. expatriates and certain former citizens or long-term residents of the United States;

•dealers or traders in securities who use a mark-to-market method of tax accounting;

•persons holding Ordinary Shares or ADSs as part of a hedging transaction, “straddle,” wash sale, conversion transaction or integrated transaction or persons entering into a constructive sale with respect to Ordinary Shares or ADSs;

•persons whose “functional currency” for U.S. federal income tax purposes is not the U.S. dollar;

•brokers, dealers or traders in securities, commodities or currencies;

•tax-exempt entities or government organizations;

•S corporations, partnerships, or other entities or arrangements classified as partnerships for U.S. federal income tax purposes;

•regulated investment companies or real estate investment trusts;

•persons who acquired our Ordinary Shares or ADSs pursuant to the exercise of any employee stock option or otherwise as compensation; and

•persons holding our Ordinary Shares or ADSs in connection with a trade or business, permanent establishment, or fixed base outside the United States.

If an entity that is classified as a partnership for U.S. federal income tax purposes holds Ordinary Shares or ADSs, the U.S. federal income tax treatment of a partner will generally depend on the status of the partner and the activities of the partnership. Partnerships holding Ordinary Shares or ADSs and partners in such partnerships are encouraged to consult their tax advisers as to the particular U.S. federal income tax consequences of holding and disposing of Ordinary Shares or ADSs.

The discussion is based on Internal Revenue Code of 1986, as amended, or the Code, administrative pronouncements, judicial decisions, final, temporary and proposed Treasury Regulations, and the income tax treaty between the United Kingdom and the United States, or the Treaty, all as of the date hereof, changes to any of which may affect the tax consequences described herein—possibly with retroactive effect.

A “U.S. Holder” is a holder who, for U.S. federal income tax purposes, is a beneficial owner of Ordinary Shares or ADSs and is:

(i) An individual who is a citizen or individual resident of the United States;

(ii) a corporation, or other entity taxable as a corporation, created or organized in or under the laws of the United States, any state therein or the District of Columbia;

(iii) an estate the income of which is subject to U.S. federal income taxation regardless of its source; or

(iv) a trust if (1) a U.S. court is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have authority to control all substantial decisions of the trust or (2) the trust has a valid election to be treated as a U.S. person under applicable U.S. Treasury Regulations.

The discussion below assumes that the representations contained in the deposit agreement are true and that the obligations in the deposit agreement and any related agreement will be complied with in accordance with their terms. Generally, a holder of an ADS should be treated for U.S. federal income tax purposes as holding the Ordinary Shares represented by the ADS. Accordingly, no gain or loss will be recognized upon an exchange of ADSs for Ordinary Shares. The U.S. Treasury has expressed concerns that intermediaries in the chain of ownership between the holder of an ADS and the issuer of the security underlying the ADS may be taking actions that are inconsistent with the beneficial ownership of the underlying security. Accordingly the creditability of foreign taxes, if any, as described below, could be affected by actions taken by intermediaries in the chain of ownership between the holders of ADSs and our company if as a result of such actions the holders of ADSs are not properly treated as beneficial owners of the underlying Ordinary Shares. These actions would also be inconsistent with the claiming of the reduced tax rate, described below, applicable to dividends received by certain non-corporate holders.

PERSONS CONSIDERING AN INVESTMENT IN ORDINARY SHARES OR ADSs SHOULD CONSULT THEIR TAX ADVISORS AS TO THE PARTICULAR TAX CONSEQUENCES APPLICABLE TO THEM RELATING TO THE ACQUISITION, OWNERSHIP AND DISPOSITION OF THE ORDINARY SHARES OR ADSs, INCLUDING THE APPLICABILITY OF U.S. FEDERAL, STATE AND LOCAL TAX LAWS.

Passive Foreign Investment Company Rules

If we are classified as a passive foreign investment company, or PFIC, in any taxable year, a U.S. Holder will be subject to special rules generally intended to reduce or eliminate any benefits from the deferral of U.S. federal income tax that a U.S. Holder could derive from investing in a non-U.S. company that does not distribute all of its earnings on a current basis.

A non-U.S. corporation will be classified as a PFIC for any taxable year in which, after applying certain look-through rules, either:

•at least 75% of its gross income is passive income (such as interest income); or

•at least 50% of its gross assets (determined on the basis of a quarterly average) is attributable to assets that produce passive income or are held for the production of passive income.

We will be treated as owning our proportionate share of the assets and earning our proportionate share of the income of any other corporation, the equity of which we own, directly or indirectly, 25% or more (by value).

Based on the current and expected composition of our income and assets and the value of our assets, we believe that we were a PFIC for U.S. federal income tax purposes for our taxable year ended December 31, 2022. However, a separate determination must be made after the close of each taxable year as to whether we are a PFIC for that year. As a result, our PFIC status may change from year to year, and we may be classified as a PFIC currently or in the future. The total value of our assets for purposes of the asset test generally will be calculated using the market price of the Ordinary Shares or ADSs, which may fluctuate considerably. Fluctuations in the market price of the Ordinary Shares or ADSs may result in our being a PFIC for any taxable year. However, if we are a “controlled foreign corporation” for any taxable year (see discussion below in “Controlled foreign corporation considerations”), the

value of our assets for purposes of the asset test will be determined based on the tax basis of such assets which could increase the likelihood that we are treated as a PFIC. Under the income test, our status as a PFIC depends on the composition of our income which will depend on the transactions we enter into in the future and our corporate structure. The composition of our income and assets is also affected by the spending of the cash we raise in any offering. Because of the uncertainties involved in establishing our PFIC status, there can be no assurance regarding if we currently are treated as a PFIC or may be treated as a PFIC in the future.

If we are classified as a PFIC in any year with respect to which a U.S. Holder owns the Ordinary Shares or ADSs, we will continue to be treated as a PFIC with respect to such U.S. Holder in all succeeding years during which the U.S. Holder owns the Ordinary Shares or ADSs, regardless of whether we continue to meet the tests described above unless (i) we cease to be a PFIC and the U.S. Holder has made a “deemed sale” election under the PFIC rules, or (ii) the U.S. Holder makes a Qualified Electing Fund Election, or QEF Election, with respect to all taxable years during such U.S. Holders holding period in which we are a PFIC. If the “deemed sale” election is made, a U.S. Holder will be deemed to have sold the Ordinary Shares or ADSs the U.S. Holder holds at their fair market value and any gain from such deemed sale would be subject to the rules described below. After the deemed sale election, so long as we do not become a PFIC in a subsequent taxable year, the U.S. Holder’s Ordinary Shares or ADSs with respect to which such election was made will not be treated as shares in a PFIC and the U.S. Holder will not be subject to the rules described below with respect to any “excess distribution” the U.S. Holder receives from us or any gain from an actual sale or other disposition of the Ordinary Shares or ADSs. U.S. Holders should consult their tax advisors as to the possibility and consequences of making a deemed sale election if we cease to be a PFIC and such election becomes available.

For each taxable year we are treated as a PFIC with respect to U.S. Holders, U.S. Holders will be subject to special tax rules with respect to any “excess distribution” such U.S. Holder receives and any gain such U.S. Holder recognizes from a sale or other disposition (including, under certain circumstances, a pledge) of Ordinary Shares or ADSs, unless (i) such U.S. Holder makes a QEF Election or (ii) our Ordinary Shares or ADSs constitute “marketable” securities, and such U.S. Holder makes a mark-to-market election as discussed below. Distributions a U.S. Holder receives in a taxable year that are greater than 125% of the average annual distributions a U.S. Holder received during the shorter of the three preceding taxable years or the U.S. Holder’s holding period for the Ordinary Shares or ADSs will be treated as an excess distribution. Under these special tax rules:

•the excess distribution or gain will be allocated ratably over a U.S. Holder’s holding period for the Ordinary Shares or ADSs;

•the amount allocated to the current taxable year, and any taxable year prior to the first taxable year in which we became a PFIC, will be treated as ordinary income; and

•the amount allocated to each other year will be subject to the highest tax rate in effect for that year and the interest charge generally applicable to underpayments of tax will be imposed on the resulting tax attributable to each such year.

The tax liability for amounts allocated to years prior to the year of disposition (or “excess distribution”) cannot be offset by any net operating losses for such years, and gains (but not losses) realized on the sale of the Ordinary Shares or ADSs cannot be treated as capital, even if a U.S. Holder holds the Ordinary Shares or ADSs as capital assets.

In addition, if we are a PFIC, a U.S. Holder will generally be subject to similar rules with respect to distributions we receive from, and our dispositions of the stock of, any of our direct or indirect subsidiaries that also are PFICs, as if such distributions were indirectly received by, and/or dispositions were indirectly carried out by, such U.S. Holder. U.S. Holders should consult their tax advisors regarding the application of the PFIC rules to our subsidiaries.

U.S. Holders can avoid the interest charge on excess distributions or gain relating to the Ordinary Shares or ADSs by making a mark-to-market election with respect to the Ordinary Shares or ADSs, provided that the Ordinary Shares or ADSs are “marketable.” Ordinary shares or ADSs will be marketable if they are “regularly traded” on certain U.S. stock exchanges or on a foreign stock exchange that meets certain conditions. For these purposes, the

Ordinary Shares or ADSs will be considered regularly traded during any calendar year during which they are traded, other than in de minimis quantities, on at least 15 days during each calendar quarter. Any trades that have as their principal purpose meeting this requirement will be disregarded. Our ADSs will be listed on Nasdaq, which is a qualified exchange for these purposes. Consequently, if our ADSs remain listed on Nasdaq and are regularly traded, we expect the mark-to-market election would be available to U.S. Holders if we are a PFIC. Each U.S. Holder should consult its tax advisor as to the whether a mark-to-market election is available or advisable with respect to the Ordinary Shares or ADSs.

A U.S. Holder that makes a mark-to-market election must include in ordinary income for each year an amount equal to the excess, if any, of the fair market value of the Ordinary Shares or ADSs at the close of the taxable year over the U.S. Holder’s adjusted tax basis in the Ordinary Shares or ADSs. An electing holder may also claim an ordinary loss deduction for the excess, if any, of the U.S. Holder’s adjusted basis in the Ordinary Shares or ADSs over the fair market value of the Ordinary Shares or ADSs at the close of the taxable year, but this deduction is allowable only to the extent of any net mark-to-market gains for prior years. Gains from an actual sale or other disposition of the Ordinary Shares or ADSs will be treated as ordinary income, and any losses incurred on a sale or other disposition of the shares will be treated as an ordinary loss to the extent of any net mark-to-market gains for prior years. Once made, the election cannot be revoked without the consent of the Internal Revenue Service, or the IRS, unless the Ordinary Shares or ADSs cease to be marketable.

However, a mark-to-market election generally cannot be made for equity interests in any lower-tier PFICs that we own, unless shares of such lower-tier PFIC are themselves “marketable.” As a result, even if a U.S. Holder validly makes a mark-to-market election with respect to our Ordinary Shares or ADSs, the U.S. Holder may continue to be subject to the PFIC rules (described above) with respect to its indirect interest in any of our investments that are treated as an equity interest in a PFIC for U.S. federal income tax purposes. U.S. Holders should consult their tax advisors to determine whether any of these elections would be available and if so, what the consequences of the alternative treatments would be in their particular circumstances.

Unless otherwise provided by the U.S. Treasury, each U.S. shareholder of a PFIC is required to file an annual report containing such information as the U.S. Treasury may require. A U.S. Holder’s failure to file the annual report will cause the statute of limitations for such U.S. Holder’s U.S. federal income tax return to remain open with regard to the items required to be included in such report until three years after the U.S. Holder files the annual report, and, unless such failure is due to reasonable cause and not willful neglect, the statute of limitations for the U.S. Holder’s entire U.S. federal income tax return will remain open during such period. U.S. Holders should consult their tax advisors regarding the requirements of filing such information returns under these rules.

WE STRONGLY URGE YOU TO CONSULT YOUR TAX ADVISOR REGARDING THE IMPACT OF OUR PFIC STATUS ON YOUR INVESTMENT IN THE ORDINARY SHARES OR ADSs AS WELL AS THE APPLICATION OF THE PFIC RULES TO YOUR INVESTMENT IN THE ORDINARY SHARES OR ADSs.

Controlled foreign corporation considerations

Each “Ten Percent Shareholder” (as defined below) in a non-U.S. corporation that is classified as a “controlled foreign corporation,” or a CFC, for U.S. federal income tax purposes generally is required to include in income each year for U.S. federal tax purposes such Ten Percent Shareholder’s pro rata share of certain types of income earned by the CFC, including “Subpart F income,” “global intangible low-taxed income” and certain other income generated by the CFC, even if the CFC has made no distributions to its shareholders. In addition, a Ten Percent Shareholder that realizes gain from the sale or exchange of shares in the CFC may be required to classify a portion of such gain as dividend income rather than capital gain (see discussion below in “Taxation of distributions” regarding the tax treatment of dividend income). A non-U.S. corporation generally will be classified as a CFC for U.S. federal income tax purposes if Ten Percent Shareholders own, directly or indirectly, more than 50% of either the total combined voting power of all classes of stock of such corporation entitled to vote or of the total value of the stock of such corporation. A “Ten Percent Shareholder” is a United States person (as defined by the Code) who owns or is considered to own 10% or more of either the total combined voting power of all classes of stock of such corporation entitled to vote or of the total value of the stock of such corporation.

We believe that we were not a CFC in the 2022 taxable year, though we have not made a determination regarding our CFC status in the current taxable year, and we may become a CFC in a subsequent taxable year. The determination of CFC status is complex and includes attribution rules, the application of which is not entirely certain. In addition, recent changes to the attribution rules relating to the determination of CFC status may make it difficult to determine our CFC status for any taxable year. It is possible that, following this offering, a shareholder treated as a U.S. person for U.S. federal income tax purposes will acquire, directly or indirectly, enough shares to be treated as a Ten Percent Shareholder. We also believe that immediately following this offering we may have certain shareholders that are Ten Percent Shareholders for U.S. federal income tax purposes. U.S. Holders should consult their own tax advisors with respect to the potential adverse U.S. tax consequences of becoming a Ten Percent Shareholder in a CFC. If we are classified as both a CFC and a PFIC, we generally will not be treated as a PFIC with respect to those U.S. Holders that meet the definition of a Ten Percent Shareholder during the period in which we are a CFC.

Taxation of distributions

Subject to the discussion above under “Passive Foreign Investment Company Rules,” distributions paid on Ordinary Shares or ADSs, other than certain pro rata distributions of Ordinary Shares or ADSs, will generally be treated as dividends to the extent paid out of our current or accumulated earnings and profits (as determined under U.S. federal income tax principles). Because we may not calculate our earnings and profits under U.S. federal income tax principles, we expect that distributions generally will be reported to U.S. Holders as dividends. Subject to applicable limitations and the discussions above regarding concerns expressed by the U.S. Treasury, dividends paid to certain non-corporate U.S. Holders may be taxable at preferential rates applicable to “qualified dividend income” if we are a “qualified foreign corporation” and certain other requirements are met. However, the qualified dividend income treatment may not apply if we are treated as a PFIC with respect to the U.S. Holder. The amount of the dividend will be treated as foreign-source dividend income to U.S. Holders and will not be eligible for the dividends-received deduction generally available to U.S. corporations under the Code. Dividends will generally be included in a U.S. Holder’s income on the date of the U.S. Holder’s receipt of the dividend. The amount of any dividend income paid in foreign currency will be the U.S. dollar amount calculated by reference to the exchange rate in effect on the date of actual or constructive receipt, regardless of whether the payment is in fact converted into U.S. dollars. If the dividend is converted into U.S. dollars on the date of receipt, a U.S. Holder should not be required to recognize foreign currency gain or loss in respect of the dividend income. A U.S. Holder may have foreign currency gain or loss if the dividend is converted into U.S. dollars after the date of receipt. Such gain or loss would generally be treated as U.S.-source ordinary income or loss. The amount of any distribution of property other than cash (and other than certain pro rata distributions of Ordinary Shares or ADSs or rights to acquire Ordinary Shares or ADSs) will be the fair market value of such property on the date of distribution.

For foreign tax credit limitation purposes, our dividends will generally be treated as passive category income. Because no U.K. income taxes will be withheld from dividends on Ordinary Shares or ADSs, there will be no creditable foreign taxes associated with any dividends that a U.S. Holder will receive. The rules governing foreign tax credits are complex and U.S. Holders should therefore consult their tax advisers regarding the effect of the receipt of dividends for foreign tax credit limitation purposes.

Sale or other taxable disposition of Ordinary Shares and ADSs

Subject to the discussion above under “Passive Foreign Investment Company Rules,” gain or loss realized on the sale or other taxable disposition of Ordinary Shares or ADSs will be capital gain or loss, and will be long-term capital gain or loss if the U.S. Holder held the Ordinary Shares or ADSs for more than one year. The amount of the gain or loss will equal the difference between the U.S. Holder’s tax basis in the Ordinary Shares or ADSs disposed of and the amount realized on the disposition, in each case as determined in U.S. dollars. This gain or loss will generally be U.S.-source gain or loss for foreign tax credit purposes. The deductibility of capital losses is subject to limitations.

If the consideration received by a U.S. Holder is not paid in U.S. dollars, the amount realized will be the U.S. dollar value of the payment received determined by reference to the spot rate of exchange on the date of the sale or other disposition. However, if the Ordinary Shares or ADSs are treated as traded on an “established securities

market” and you are either a cash basis taxpayer or an accrual basis taxpayer that has made a special election (which must be applied consistently from year to year and cannot be changed without the consent of the IRS), you will determine the U.S. dollar value of the amount realized in a non-U.S. dollar currency by translating the amount received at the spot rate of exchange on the settlement date of the sale. If you are an accrual basis taxpayer that is not eligible to or does not elect to determine the amount realized using the spot rate on the settlement date, you will recognize foreign currency gain or loss to the extent of any difference between the U.S. dollar amount realized on the date of sale or disposition and the U.S. dollar value of the currency received at the spot rate on the settlement date.

Information reporting and backup withholding