0001839341FALSECore Scientific, Inc./tx838 Walker RoadSuite 21-2105DoverDelaware00018393412024-06-032024-06-030001839341us-gaap:CommonStockMember2024-06-032024-06-030001839341core:WarrantExercisePriceOf6.81PerShareMember2024-06-032024-06-030001839341core:WarrantExercisePriceOf0.01PerShareMember2024-06-032024-06-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 3, 2024

Core Scientific, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40046 | | 86-1243837 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

838 Walker Road, Suite 21-2105 Dover, Delaware | | 19904 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (512) 402-5233

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock, par value $0.0001 per share | CORZ | The Nasdaq Global Select Market |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $6.81 per share | CORZW | The Nasdaq Global Select Market |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $0.01 per share | CORZZ | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On June 3, 2024, Core Scientific, Inc. (the “Company”) issued a press release announcing the expansion of the Company’s relationship with CoreWeave, Inc. (“CoreWeave”) through a series of agreements to provide additional hosting services to CoreWeave. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated into this Item 7.01 by reference.

Also on June 3, 2024, the Company released a supplementary investor presentation regarding the agreements with CoreWeave. A copy of the investor presentation is attached hereto as Exhibit 99.2 and is incorporated into this Item 7.01 by reference.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before, on or after the date hereof, regardless of any general incorporation language except as expressly set forth by specific reference in such filing.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “aim,” “estimate,” “plan,” “project,” “forecast,” “opportunity,” “goal,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “potential,” “hope” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements include, but are not limited, statements regarding potential benefits of or expectations regarding the strategic relationship, agreements and contemplated transactions with CoreWeave, impacts on the Company’s financial and operating results, completion and timing of certain events, impacts on the Company’s trading multiple and ability to deliver shareholder value, the Company’s intention and ability to capitalize on additional or related opportunities, and the Company’s plans, objectives, expectations and intentions. The Company’s actual results may differ materially from those anticipated in these forward-looking statements as a result of certain risks and other factors, which could include, but are not limited to, unanticipated difficulties or expenditures relating to the strategic relationship, agreements and contemplated transactions with CoreWeave; the possibility that the anticipated financial and operational benefits of the strategic relationship, agreements and contemplated transactions and additional opportunities are not realized when expected or at all; disruptions of current plans and operations caused by the announcement and execution of the strategic relationship, agreements and contemplated transactions; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business, regulatory or employee relationships, including those resulting from the announcement or execution of the strategic relationship, agreements and contemplated transactions; unexpected risks or the materialization of risks that are greater than anticipated; occurrence of any event, change or other circumstance that could give rise to the termination of the contracts with CoreWeave; delays in required approvals; the availability of government incentives; and legal proceedings, judgments or settlements in connection with the strategic relationship and contemplated transactions, as well as other risk factors set forth in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission.

These statements are provided for illustrative purposes only and are based on various assumptions, whether or not identified in this Current Report on Form 8-K, and on the current expectations of the Company’s management. These forward-looking statements are not intended to serve, and must not be relied on by any investor, as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including those identified in the Company’s reports filed with the Securities and Exchange Commission, and if any of these risks materialize or our assumptions prove incorrect, actual results could differ

materially from the results implied by these forward-looking statements. Accordingly, undue reliance should not be placed upon the forward-looking statements. The Company does not assume any duty or obligation (and does not undertake) to update or supplement any forward-looking statements.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits:

| | | | | | | | |

| | | |

Exhibit

No. | | Description |

| | |

| 99.1* | | |

| 99.2* | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* The information contained in this exhibit is furnished but not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Core Scientific, Inc. |

| | |

| Dated: June 4, 2024 | | |

| | |

| By: | /s/ Todd M. DuChene |

| Name: | Todd M. DuChene |

| Title: | Chief Legal Officer and Chief Administrative Officer |

Exhibit 99.1

press release corescientific.com

Core Scientific to Provide Approximately 200 MW of Infrastructure to Host CoreWeave’s High-Performance Computing Services, Capturing Significant AI Compute Opportunity

Transforms and Expands Core Scientific’s Hosting Business and Earnings Power While Maintaining Bitcoin Mining Capacity and Growth Potential

Long-Term Hosting Agreements Expected to Generate Total Cumulative Revenue for Core Scientific of More Than $3.5 Billion During Initial 12-Year Contract Terms

Positions Core Scientific as a Leading Player in the AI Data Center Space

AUSTIN, TX– June 4, 2024 – Core Scientific, Inc. (NASDAQ: CORZ) (“Core Scientific” or the “Company”), one of the largest owners and operators of high-powered digital infrastructure for bitcoin mining and hosting services in North America, today announced the signing of a series of 12-year contracts with CoreWeave, the AI Hyperscaler.

Under the terms of the agreements, Core Scientific will deliver approximately 200 megawatts (“MW”) of infrastructure to host CoreWeave’s high-performance compute (“HPC”) operations. Core Scientific will modify multiple existing, owned sites to host CoreWeave’s NVIDIA GPUs. The site modifications are expected to commence early in the second half of 2024 and achieve operational status in the first half of 2025.

“Our new contracts with CoreWeave position us to transform our hosting business and our earnings power by capturing exciting growth opportunities in AI compute, one of today’s most dynamic technology segments, while also maintaining our strong bitcoin mining franchise,” said Adam Sullivan, Core Scientific’s Chief Executive Officer. “As demand for ready, high-power sites continues to outpace supply, we believe Core Scientific is well positioned to meet customer needs with a much shorter time to power than greenfield data center projects. Our expanding relationship with CoreWeave creates a pathway for Core Scientific to diversify our business model and balance our portfolio between bitcoin mining and alternative compute hosting, positioning us to maximize cash flow and minimize risk while maintaining our significant exposure to bitcoin’s upside potential.”

“The agreements announced today also provide CoreWeave with options over the next 60 to 90 days to further expand its hosting footprint with Core Scientific at additional select sites, and we are continuing discussions with other potential clients regarding additional HPC hosting contracts to capitalize on our significant pipeline of powered real estate. We are capitalizing on one of the largest high-power digital infrastructure portfolios that we will continually seek to expand to deliver significant, resilient and sustainable value for our shareholders,” Mr. Sullivan added.

Core Scientific HPC Release - 2

Per the agreements, all capital investments required to modify Core Scientific’s existing infrastructure into cutting-edge, application-specific data centers customized for dense HPC will be funded by CoreWeave. An estimated $300 million of the capital investments associated with Core Scientific-owned infrastructure will be credited against hosting payments at no more than 50% of monthly fees until fully repaid. The agreements with CoreWeave provide opportunities for two renewal terms of five years each. The agreements also provide optionality for further expansion with meaningful additional megawatts at other Core Scientific sites, potentially ranking Core Scientific as one of the largest data center operators in the United States.

Core Scientific’s agreements with CoreWeave complement its current business model with the addition of an expected stable, recurring, long-term and high margin revenue stream. Moving forward, the new HPC hosting contracts will increase Core Scientific’s exposure to contracted, dollar-denominated revenue. Once the approximately 200 MW of HPC infrastructure is operational, the project is estimated to generate total cumulative revenue for Core Scientific of over $3.5 billion during the initial 12-year terms of the contracts.1 Estimated average annual revenue from the contracts is expected to be approximately $290 million. From revenue to gross margin, this is expected to enhance earnings power and drive shareholder value.

From 2019 to 2022, Core Scientific hosted thousands of CoreWeave’s GPUs in its data centers. In March of 2024, Core Scientific and CoreWeave entered a contract for HPC hosting at Core Scientific’s new Austin data center, with Core Scientific delivering 16 MW of capacity more than 30 days ahead of schedule.

With its total of 1.2 gigawatts of contracted power, Core Scientific is able to deliver nearly 500 MW of HPC power to be used for alternative compute workloads based on geographic proximity to major cities and fiber lines.2

In connection with this expansion of Core Scientific’s HPC hosting strategy, Core Scientific intends to redeploy certain of its bitcoin mining capacity from designated HPC sites to other of its dedicated bitcoin mining sites to support business continuity and growth.

Advisors

Moelis & Company LLC is acting as financial advisor to Core Scientific. Sidley Austin LLP is acting as legal advisor to Core Scientific.

1 Represents total cumulative revenue over all 12-year contract periods, before prepaid build out costs.

2 500 MW of HPC power represents 700 MW of gross contracted power.

Core Scientific HPC Release - 3

About Core Scientific

Core Scientific is one of the largest owners and operators of high-powered digital infrastructure for bitcoin mining and hosting services in North America. Transforming energy into high value compute with superior efficiency at scale, we employ our own large fleet of computers (“miners”) to earn bitcoin for our own account and provide hosting services for large bitcoin mining and high-performance computing customers at our eight operational data centers in Georgia (2), Kentucky (1), North Carolina (1), North Dakota (1) and Texas (3). We derive the majority of our revenue from earning bitcoin for our own account (“self-mining”). To learn more, visit www.corescientific.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “aim,” “estimate,” “plan,” “project,” “forecast,” “opportunity,” “goal,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “potential,” “hope” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements include, but are not limited, statements regarding potential benefits of or expectations regarding the strategic relationship, agreements and contemplated transactions with CoreWeave, impacts on the Company’s financial and operating results, completion and timing of certain events, impacts on the Company’s trading multiple and ability to deliver shareholder value, the Company’s intention and ability to capitalize on additional or related opportunities, and the Company’s plans, objectives, expectations and intentions. The Company’s actual results may differ materially from those anticipated in these forward-looking statements as a result of certain risks and other factors, which could include, but are not limited to, unanticipated difficulties or expenditures relating to the strategic relationship, agreements and contemplated transactions with CoreWeave; the possibility that the anticipated financial and operational benefits of the strategic relationship, agreements and contemplated transactions and additional opportunities are not realized when expected or at all; disruptions of current plans and operations caused by the announcement and execution of the strategic relationship, agreements and contemplated transactions; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business, regulatory or employee relationships, including those resulting from the announcement or execution of the strategic relationship, agreements and contemplated transactions; unexpected risks or the materialization of risks that are greater than anticipated; occurrence of any event, change or other circumstance that could give rise to the termination of the contracts with CoreWeave; delays in required approvals; the availability of government incentives; and legal proceedings, judgments or settlements in connection with the strategic relationship, agreements and contemplated transactions, as well as other risk factors set forth in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission.

These statements are provided for illustrative purposes only and are based on various assumptions, whether or not identified in this press release, and on the current

Core Scientific HPC Release - 4

expectations of the Company’s management. These forward-looking statements are not intended to serve, and must not be relied on by any investor, as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including those identified in the Company’s reports filed with the Securities and Exchange Commission, and if any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Accordingly, undue reliance should not be placed upon the forward-looking statements. The Company does not assume any duty or obligation (and does not undertake) to update or supplement any forward-looking statements.

Non-GAAP Financial Measures

Adjusted EBITDA is a non-GAAP financial measure. For further information regarding the Company’s definition of, and additional information related to, non-GAAP financial measures, see “Key Business Metrics and Non-GAAP Financial Measures” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission.

Follow us on:

https://www.linkedin.com/company/corescientific/

https://twitter.com/core_scientific

Contacts

Core Scientific

Investors:

ir@corescientific.com

Media:

press@corescientific.com

Joseph Sala / Mahmoud Siddig

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

1 JUNE 3, 2024 Core Scientific Announces Strategic Expansion of HPC Business with Multi-Year CoreWeave Hosting Agreements JUNE 3, 2024

2 JUNE 3, 2024 Forward-looking statements This presentation of Core Scientific, Inc. (the “Company”) includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward- looking statements may be identified by the use of words such as “aim,” “estimate,” “plan,” “project,” “forecast,” “opportunity,” “goal,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “potential,” “hope” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements include, but are not limited, statements regarding potential benefits of or expectations regarding the strategic relationship, agreements and contemplated transactions with CoreWeave, Inc. (“CoreWeave”), impacts on the Company’s financial and operating results, completion and timing of certain events, impacts on the Company’s trading multiple and ability to deliver shareholder value, the Company’s intention and ability to capitalize on additional or related opportunities, and the Company’s plans, objectives, expectations and intentions. The Company’s actual results may differ materially from those anticipated in these forward-looking statements as a result of certain risks and other factors, which could include, but are not limited to, unanticipated difficulties or expenditures relating to the strategic relationship, agreements and contemplated transactions with CoreWeave; the possibility that the anticipated financial and operational benefits of the strategic relationship, agreements and contemplated transactions and additional opportunities are not realized when expected or at all; disruptions of current plans and operations caused by the announcement and execution of the strategic relationship, agreements and contemplated transactions; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business, regulatory or employee relationships, including those resulting from the announcement or execution of the strategic relationship, agreements and contemplated transactions; unexpected risks or the materialization of risks that are greater than anticipated; occurrence of any event, change or other circumstance that could give rise to the termination of the contracts with CoreWeave; delays in required approvals; the availability of government incentives; and legal proceedings, judgments or settlements in connection with the strategic relationship, agreements and contemplated transactions, as well as other risk factors set forth in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. These statements are provided for illustrative purposes only and are based on various assumptions, whether or not identified in this presentation, and on the current expectations of the Company’s management. These forward-looking statements are not intended to serve, and must not be relied on by any investor, as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including those identified in the Company’s reports filed with the Securities and Exchange Commission, and if any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Accordingly, undue reliance should not be placed upon the forward-looking statements. The Company does not assume any duty or obligation (and does not undertake) to update or supplement any forward-looking statements. Non-GAAP Financial Measures Adjusted EBITDA, which is referred to in this presentation, is a non-GAAP financial measure. For further information regarding the Company’s definition of, and additional information related to, non-GAAP financial measures, see “Key Business Metrics and Non-GAAP Financial Measures” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission.

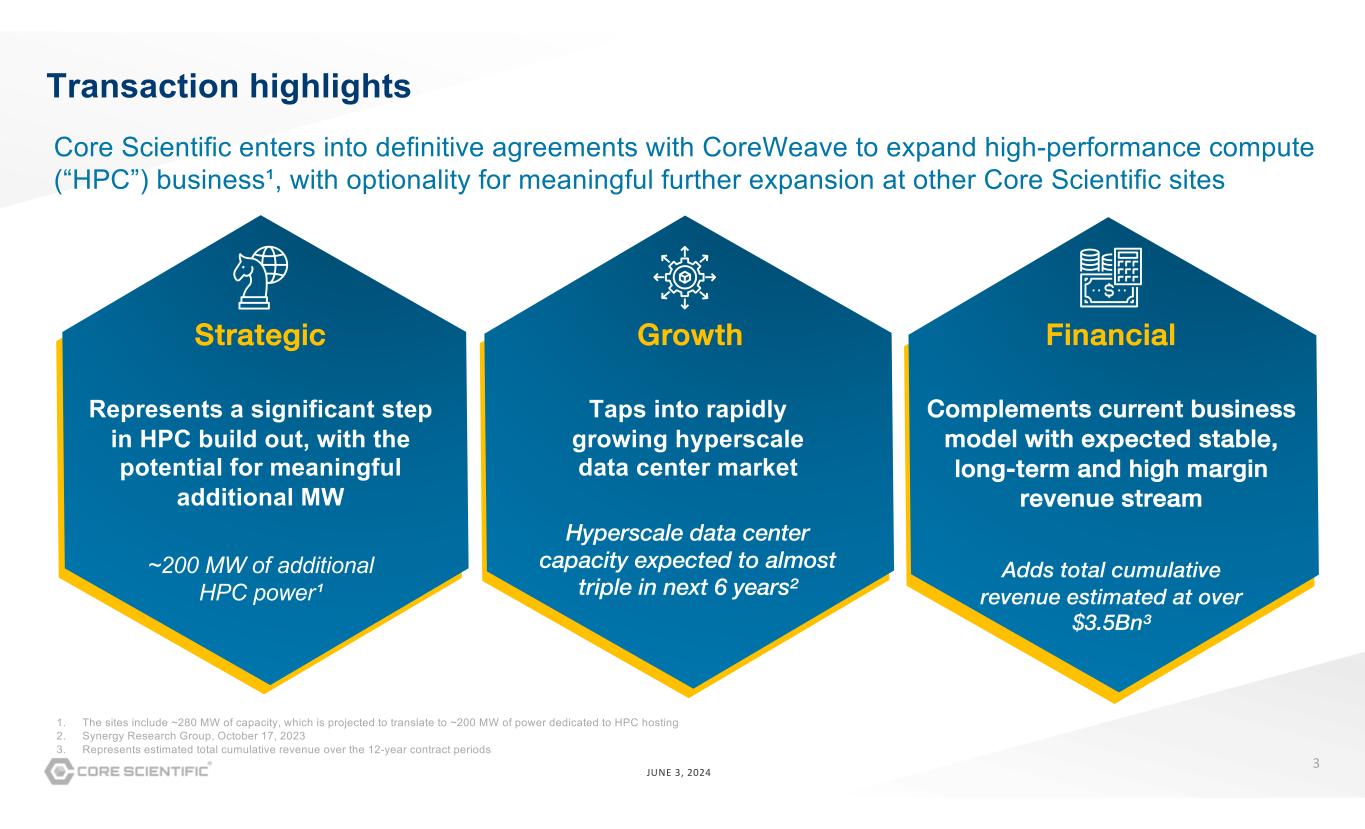

3 JUNE 3, 2024 Strategic Represents a significant step in HPC build out, with the potential for meaningful additional MW ~200 MW of additional HPC power¹ Growth Taps into rapidly growing hyperscale data center market Hyperscale data center capacity expected to almost triple in next 6 years² Financial Complements current business model with expected stable, long-term and high margin revenue stream Adds total cumulative revenue estimated at over $3.5Bn³ Transaction highlights 1. The sites include ~280 MW of capacity, which is projected to translate to ~200 MW of power dedicated to HPC hosting 2. Synergy Research Group, October 17, 2023 3. Represents estimated total cumulative revenue over the 12-year contract periods Core Scientific enters into definitive agreements with CoreWeave to expand high-performance compute (“HPC”) business¹, with optionality for meaningful further expansion at other Core Scientific sites

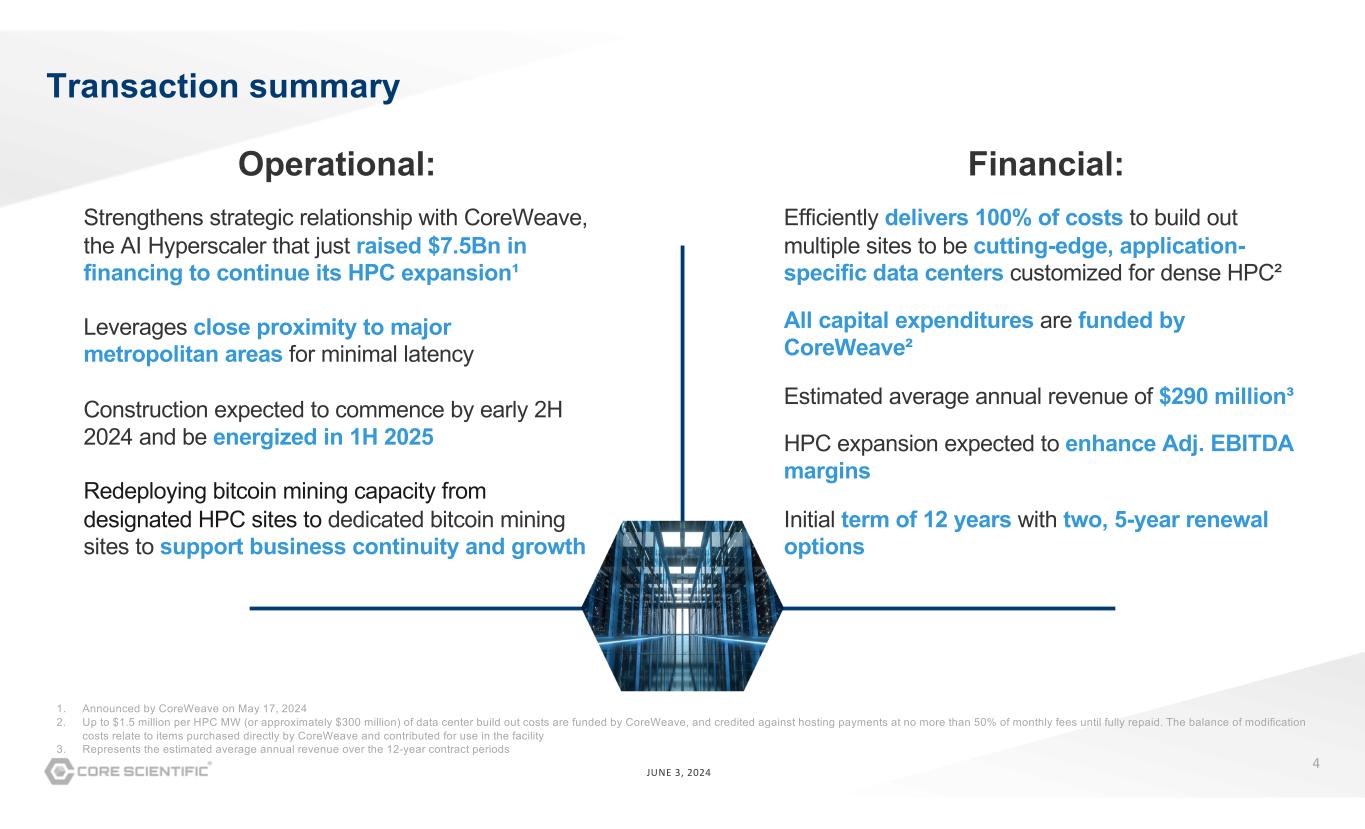

4 JUNE 3, 2024 Strengthens strategic relationship with CoreWeave, the AI Hyperscaler that just raised $7.5Bn in financing to continue its HPC expansion¹ Leverages close proximity to major metropolitan areas for minimal latency Construction expected to commence by early 2H 2024 and be energized in 1H 2025 Redeploying bitcoin mining capacity from designated HPC sites to dedicated bitcoin mining sites to support business continuity and growth Financial:Operational: Transaction summary Efficiently delivers 100% of costs to build out multiple sites to be cutting-edge, application- specific data centers customized for dense HPC² All capital expenditures are funded by CoreWeave² Estimated average annual revenue of $290 million³ HPC expansion expected to enhance Adj. EBITDA margins Initial term of 12 years with two, 5-year renewal options 1. Announced by CoreWeave on May 17, 2024 2. Up to $1.5 million per HPC MW (or approximately $300 million) of data center build out costs are funded by CoreWeave, and credited against hosting payments at no more than 50% of monthly fees until fully repaid. The balance of modification costs relate to items purchased directly by CoreWeave and contributed for use in the facility 3. Represents the estimated average annual revenue over the 12-year contract periods

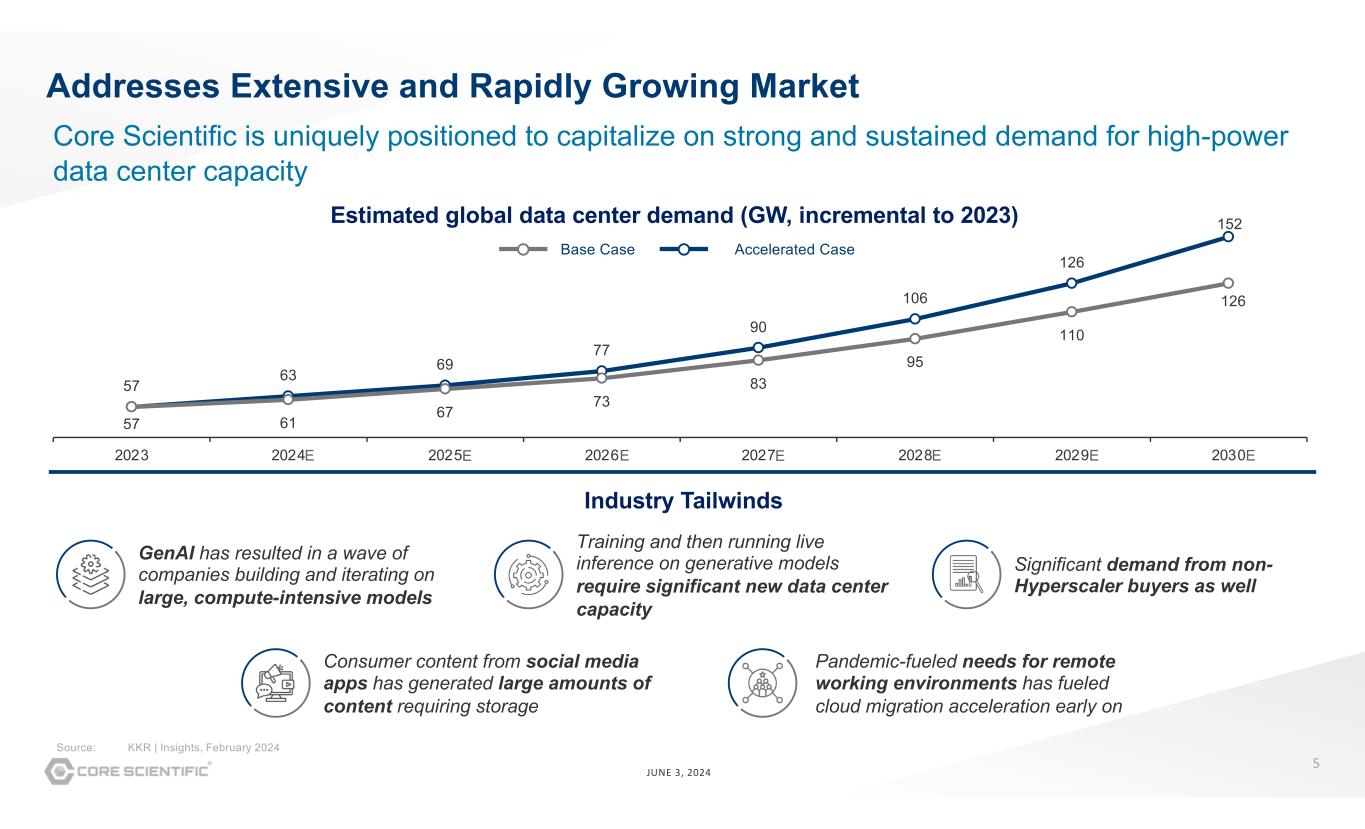

5 JUNE 3, 2024 Addresses Extensive and Rapidly Growing Market Source: KKR | Insights, February 2024 Pandemic-fueled needs for remote working environments has fueled cloud migration acceleration early on Training and then running live inference on generative models require significant new data center capacity GenAI has resulted in a wave of companies building and iterating on large, compute-intensive models Significant demand from non- Hyperscaler buyers as well Consumer content from social media apps has generated large amounts of content requiring storage Industry Tailwinds Core Scientific is uniquely positioned to capitalize on strong and sustained demand for high-power data center capacity Estimated global data center demand (GW, incremental to 2023) Base Case Accelerated Case 57 63 69 77 90 106 126 152 57 61 67 73 83 95 110 126 40 60 80 100 120 140 160 2023 2024 2025 2026 2027 2028 2029 2030E E E E E E E

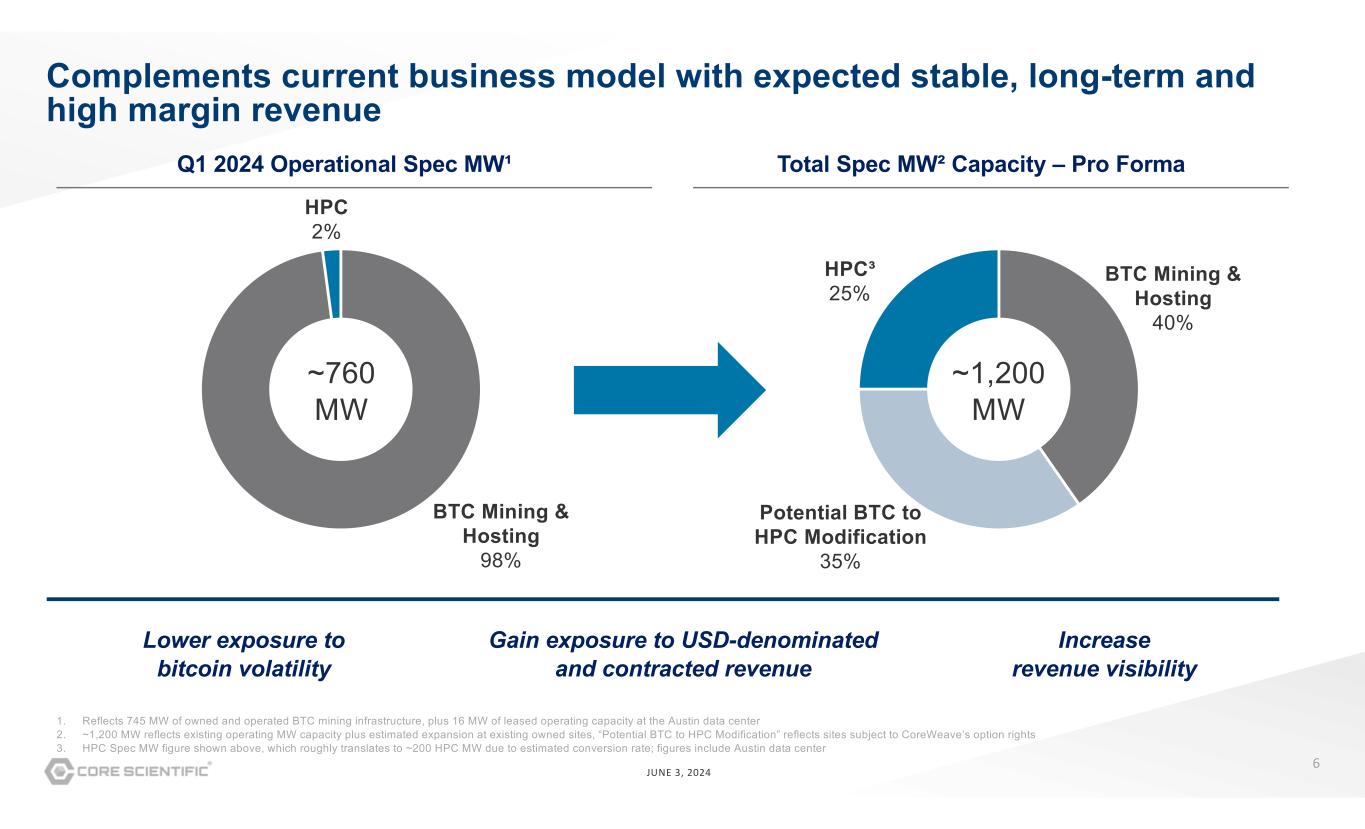

6 JUNE 3, 2024 Complements current business model with expected stable, long-term and high margin revenue 1. Reflects 745 MW of owned and operated BTC mining infrastructure, plus 16 MW of leased operating capacity at the Austin data center 2. ~1,200 MW reflects existing operating MW capacity plus estimated expansion at existing owned sites, “Potential BTC to HPC Modification” reflects sites subject to CoreWeave’s option rights 3. HPC Spec MW figure shown above, which roughly translates to ~200 HPC MW due to estimated conversion rate; figures include Austin data center Lower exposure to bitcoin volatility Gain exposure to USD-denominated and contracted revenue Increase revenue visibility Q1 2024 Operational Spec MW¹ Total Spec MW² Capacity – Pro Forma ~760 MW BTC Mining & Hosting 40% Potential BTC to HPC Modification 35% HPC³ 25% ~1,200 MW BTC Mining & Hosting 98% HPC 2%

7 JUNE 3, 2024 Key Expected Benefits Continues build- out of HPC capabilities Moderates revenue volatility linked to bitcoin price Amplifies access to fast-growing, extensive hyperscale data center market Upgrades business model with stable, long- term and high margin revenue stream Raises revenue visibility Improves asset quality and balance sheet flexibility Expands exposure to dollar- denominated and contracted revenue

Thank you! Investor Relations (737) 931-1351 ir@corescientific.com Corescientific.com

v3.24.1.1.u2

Cover

|

Jun. 03, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 03, 2024

|

| Entity Registrant Name |

Core Scientific, Inc./tx

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40046

|

| Entity Tax Identification Number |

86-1243837

|

| Entity Address, Postal Zip Code |

19904

|

| City Area Code |

512

|

| Local Phone Number |

402-5233

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001839341

|

| Amendment Flag |

false

|

| Entity Address, Address Line One |

838 Walker Road

|

| Entity Address, Address Line Two |

Suite 21-2105

|

| Entity Address, City or Town |

Dover

|

| Entity Address, State or Province |

DE

|

| Common stock, par value $0.0001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

CORZ

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $6.81 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $6.81 per share

|

| Trading Symbol |

CORZW

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $0.01 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $0.01 per share

|

| Trading Symbol |

CORZZ

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=core_WarrantExercisePriceOf6.81PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=core_WarrantExercisePriceOf0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

Core Scientific (NASDAQ:CORZZ)

Historical Stock Chart

From May 2024 to Jun 2024

Core Scientific (NASDAQ:CORZZ)

Historical Stock Chart

From Jun 2023 to Jun 2024