CytomX Therapeutics, Inc. (Nasdaq: CTMX), a leader in the field of

masked, conditionally activated biologics, today reported third

quarter 2024 financial results and provided a business update.

“We are encouraged by the progress during Q3

across our clinical pipeline including the ongoing Phase 1a

evaluation of CX-904 and robust early enrollment for the CX-2051

Phase 1 study in colorectal cancer,” said Sean McCarthy, D.Phil.,

chief executive officer and chairman of CytomX. “We continue to

explore the optimal dose and schedule for CX-904 to enable

potential initiation of tumor-specific Phase 1b cohorts in 2025.

Regarding CX-2051, our successful continued escalation to higher

dose levels reflects the favorable tolerability profile observed to

date for this first in class antibody drug conjugate directed

against EpCAM, a very high potential but previously undruggable

target expressed in many cancer types. We are also thrilled to have

treated the first patient in the Phase 1 study of CX-801,

reinforcing the multi-modality breadth of the PROBODY® therapeutic

platform and our ongoing commitment to addressing as many areas of

unmet need as we can with our technology,” continued Dr.

McCarthy.

Third Quarter Business Highlights and

Recent Developments

Pipeline

CX-904, PROBODY® T-cell-engager (TCE)

targeted to EGFRxCD3; Phase 1a dose escalation and optimization

continue.

- Preliminary data

from 35 patients were presented on May 8, 2024, based on a data

cutoff of April 16, 2024, including non-step and step dosing

cohorts up to a target dose of 10 mg.

- CX-904 has now cleared the 15 mg

target dose level, utilizing a step-dose schedule. Dose escalation

and optimization continue in pancreatic ductal adenocarcinoma, head

and neck squamous cell carcinoma, and non-small cell lung cancer. A

maximum tolerated dose for step-dosing has not yet been

reached.

- Potential Phase 1b initiation in

one or more tumor types is anticipated in 2025 pending the

selection of an optimized dose and schedule and alignment with our

global development partner, Amgen.

CX-2051, a first in class EpCAM-directed

PROBODY® antibody drug conjugate; Phase 1a dose escalation

continues.

- The Phase 1 study

of CX-2051 was initiated in Q2 2024 and is currently focused in

metastatic colorectal cancer, one of many tumor types in which high

expression of EpCAM has been documented. EpCAM expression levels in

the Phase 1 study are being assessed retrospectively and are

anticipated to be high in the majority of CRC patients.

- The CX-2051

payload, a next generation topoisomerase-1 inhibitor licensed from

AbbVie (formerly Immunogen), is tailored to specific

EpCAM-expressing indications, including colorectal cancer, and

includes a payload-antibody linker designed to drive bystander

effect, contributing to anti-tumor activity.

- The study is

currently enrolling the fifth dose escalation cohort with favorable

safety and tolerability having been observed to date.

- Initial Phase 1a

data are expected in the first half 2025.

CX-801, PROBODY® interferon-alpha 2b;

Phase 1a dose escalation study initiated.

- In Q3 2024, the

first patient was dosed in the CX-801 Phase 1 study.

- Phase 1 dose

escalation is ongoing with a primary focus in melanoma. The study

will evaluate safety and initial clinical activity for CX-801

monotherapy and for CX-801 in combination with KEYTRUDA.

- Initial Phase 1a

data are expected in the second half of 2025.

Q3 2024 Financial Results

Cash, cash equivalents and investments totaled

$117.6 million as of September 30, 2024, compared to $137.2 million

as of June 30, 2024. Based our current operating plan, we expect

our existing capital resources will be sufficient to fund

operations to the end of 2025, not including the impact of

potential milestones that may be earned in our existing

collaborations.

Total revenue was $33.4 million for the three

months ended September 30, 2024 compared to $26.4 million for the

corresponding period in 2023. The increase in revenue was driven

primarily by a higher percentage of completion of research

activities related to the collaboration with Bristol Myers

Squibb.

Research and development expenses increased by

$4.9 million for the three months ended September 30, 2024 to $21.4

million, compared to $16.5 million for the corresponding period of

2023 primarily due to increased clinical and manufacturing

activities for CX-2051 and clinical-related expenses for

CX-904.

General and administrative expenses increased by $1.1 million

for the three months ended September 30, 2024 to 8.0 million,

compared to the corresponding period of 2023, primarily due to

higher professional services expenses supporting intellectual

property related activities and internal controls.

Conference Call &

WebcastCytomX management will host a conference call and

simultaneous webcast today at 5 p.m. EST (2 p.m. PST) to discuss

the financial results and provide a business update. Participants

may access the live webcast of the conference call from the Events

and Presentations page of CytomX’s website at

https://ir.cytomx.com/events-and-presentations. Participants may

register for the conference call here and are advised to do so at

least 10 minutes prior to joining the call. An archived replay of

the webcast will be available on the company’s website.

About CytomX

TherapeuticsCytomX is a clinical-stage, oncology-focused

biopharmaceutical company focused on developing novel conditionally

activated, masked biologics designed to be localized to the tumor

microenvironment. By pioneering a novel pipeline of localized

biologics, powered by its PROBODY® therapeutic platform, CytomX’s

vision is to create safer, more effective therapies for the

treatment of cancer. CytomX’s robust and differentiated pipeline

comprises therapeutic candidates across multiple treatment

modalities including antibody-drug conjugates (“ADCs”), T-cell

engagers, and immune modulators such as cytokines. CytomX’s

clinical-stage pipeline includes CX-904, CX-2051 and CX-801. CX-904

is a masked, conditionally activated T-cell-engaging bispecific

antibody targeting the epidermal growth factor receptor (EGFR) on

tumor cells and the CD3 receptor on T cells. CX-904 is partnered

with Amgen in a global co-development alliance. CX-2051 is a

masked, conditionally activated ADC directed toward epithelial cell

adhesion molecule (EpCAM) and armed with a topoisomerase-1

inhibitor payload. CX-2051 has potential applicability across

multiple EpCAM-expressing epithelial cancers and was discovered in

collaboration with ImmunoGen, now part of AbbVie. CX-801 is a

masked interferon alpha-2b PROBODY® cytokine with broad potential

applicability in traditionally immuno-oncology sensitive as well as

insensitive (cold) tumors. CytomX has established strategic

collaborations with multiple leaders in oncology, including Amgen,

Astellas, Bristol Myers Squibb, Regeneron and Moderna. For more

information about CytomX and how it is working to make

conditionally activated treatments the new standard-of-care in the

fight against cancer,

visit www.cytomx.com and follow us

on LinkedIn and X

(formerly Twitter).

CytomX Therapeutics Forward-Looking

StatementsThis press release includes forward-looking

statements. Such forward-looking statements involve known and

unknown risks, uncertainties and other important factors that are

difficult to predict, may be beyond our control, and may cause the

actual results, performance, or achievements to be materially

different from any future results, performance or achievements

expressed or implied in such statements, including those related to

the future potential of partnerships or collaboration agreements.

Accordingly, you should not rely on any of these forward-looking

statements, including those relating to the potential benefits,

safety and efficacy or progress of CytomX’s or any of its

collaborative partners’ product candidates, including CX-904,

CX-2051, and CX-801, the potential benefits or applications of

CytomX’s PROBODY® therapeutic platform, CytomX’s or its

collaborative partners’ ability to develop and advance product

candidates into and successfully complete clinical trials,

including the ongoing and planned clinical trials of CX-904,

CX-2051 and CX-804 and the timing of initial and ongoing data

availability for our clinical trials, including CX-904, CX-2051 and

CX-801, and other development milestones. Risks and uncertainties

that contribute to the uncertain nature of the forward-looking

statements include: the unproven nature of CytomX’s novel PROBODY®

therapeutic technology; CytomX’s clinical trial product candidates

are in the initial stages of clinical development and its other

product candidates are currently in preclinical development, and

the process by which preclinical and clinical development could

potentially lead to an approved product is long and subject to

significant risks and uncertainties, including the possibility that

the results of preclinical research and early clinical trials,

including initial CX-904 results, may not be predictive of future

results; the possibility that CytomX’s clinical trials will not be

successful; the possibility that current preclinical research may

not result in additional product candidates; CytomX’s dependence on

the success of CX-904, CX-801, and CX-2051; CytomX’s reliance on

third parties for the manufacture of the Company’s product

candidates; possible regulatory developments in the United States

and foreign countries; and the risk that we may incur higher costs

than expected for research and development or unexpected costs and

expenses. Additional applicable risks and uncertainties include

those relating to our preclinical research and development,

clinical development, and other risks identified under the heading

"Risk Factors" included in CytomX’s Quarterly Report on Form 10-Q

filed with the SEC on November 7, 2024. The forward-looking

statements contained in this press release are based on information

currently available to CytomX and speak only as of the date on

which they are made. CytomX does not undertake and specifically

disclaims any obligation to update any forward-looking statements,

whether as a result of any new information, future events, changed

circumstances or otherwise.

PROBODY is a U.S. registered trademark of CytomX

Therapeutics, Inc.

Company Contact:Chris OgdenSVP,

Chief Financial Officercogden@cytomx.com

Investor Contact:Precision AQ

(formerly Stern Investor Relations)Stephanie

AscherStephanie.Ascher@precisionaq.com

Media Contact:Redhouse

CommunicationsTeri Dahlmanteri@redhousecomms.com

CYTOMX THERAPEUTICS,

INC.CONDENSED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)(in thousands, except

share and per share data)(Unaudited)

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues |

$ |

33,432 |

|

|

$ |

26,384 |

|

|

$ |

100,010 |

|

|

$ |

74,607 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

21,368 |

|

|

|

16,448 |

|

|

|

68,592 |

|

|

|

58,294 |

|

|

General and administrative |

|

7,953 |

|

|

|

6,813 |

|

|

|

24,102 |

|

|

|

22,191 |

|

|

Total operating expenses |

|

29,321 |

|

|

|

23,261 |

|

|

|

92,694 |

|

|

|

80,485 |

|

| Income (loss) from

operations |

|

4,111 |

|

|

|

3,123 |

|

|

|

7,316 |

|

|

|

(5,878 |

) |

|

Interest income |

|

1,693 |

|

|

|

2,699 |

|

|

|

5,858 |

|

|

|

7,334 |

|

|

Other (expense) income, net |

|

(7 |

) |

|

|

(7 |

) |

|

|

(19 |

) |

|

|

(39 |

) |

| Income before income taxes |

|

5,797 |

|

|

|

5,815 |

|

|

|

13,155 |

|

|

|

1,417 |

|

|

Provision for income taxes |

|

61 |

|

|

|

2,823 |

|

|

|

162 |

|

|

|

2,823 |

|

| Net income (loss) |

|

5,736 |

|

|

|

2,992 |

|

|

|

12,993 |

|

|

|

(1,406 |

) |

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on investments, net of tax |

|

44 |

|

|

|

(98 |

) |

|

|

(55 |

) |

|

|

(73 |

) |

| Total comprehensive income

(loss) |

$ |

5,780 |

|

|

$ |

2,894 |

|

|

$ |

12,938 |

|

|

$ |

(1,479 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.07 |

|

|

$ |

0.04 |

|

|

$ |

0.15 |

|

|

$ |

(0.02 |

) |

|

Diluted |

$ |

0.07 |

|

|

$ |

0.04 |

|

|

$ |

0.15 |

|

|

$ |

(0.02 |

) |

| Shares used to compute net income

(loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

85,093,227 |

|

|

|

80,731,951 |

|

|

|

84,005,093 |

|

|

|

71,225,433 |

|

|

Diluted |

|

85,204,709 |

|

|

|

80,991,722 |

|

|

|

84,428,843 |

|

|

|

71,225,433 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CYTOMX THERAPEUTICS,

INC.CONDENSED BALANCE SHEETS(in

thousands)

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(unaudited) |

|

|

(1) |

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

40,576 |

|

|

$ |

17,171 |

|

|

Short-term investments |

|

|

77,012 |

|

|

|

157,338 |

|

|

Accounts receivable |

|

|

3,352 |

|

|

|

3,432 |

|

|

Prepaid expenses and other current assets |

|

|

3,240 |

|

|

|

4,995 |

|

| Total current assets |

|

|

124,180 |

|

|

|

182,936 |

|

| Property and equipment, net |

|

|

2,942 |

|

|

|

3,958 |

|

| Intangible assets, net |

|

|

620 |

|

|

|

729 |

|

| Goodwill |

|

|

949 |

|

|

|

949 |

|

| Restricted cash |

|

|

1,027 |

|

|

|

917 |

|

| Operating lease right-of-use

asset |

|

|

9,193 |

|

|

|

12,220 |

|

| Other assets |

|

|

70 |

|

|

|

83 |

|

| Total assets |

|

$ |

138,981 |

|

|

$ |

201,792 |

|

| Liabilities and

Stockholders' Deficit |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,422 |

|

|

$ |

1,458 |

|

|

Accrued liabilities |

|

|

16,742 |

|

|

|

17,599 |

|

|

Operating lease liabilities - short term |

|

|

5,001 |

|

|

|

4,589 |

|

|

Deferred revenue, current portion |

|

|

96,063 |

|

|

|

132,267 |

|

| Total current liabilities |

|

|

119,228 |

|

|

|

155,913 |

|

| Deferred revenue, net of current

portion |

|

|

33,556 |

|

|

|

80,048 |

|

| Operating lease liabilities -

long term |

|

|

5,596 |

|

|

|

9,385 |

|

| Other long term liabilities |

|

|

4,053 |

|

|

|

3,893 |

|

| Total liabilities |

|

|

162,433 |

|

|

|

249,239 |

|

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders' deficit: |

|

|

|

|

|

|

Convertible preferred stock |

|

|

— |

|

|

|

— |

|

|

Common stock |

|

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

|

686,962 |

|

|

|

675,905 |

|

|

Accumulated other comprehensive income |

|

|

40 |

|

|

|

95 |

|

|

Accumulated deficit |

|

|

(710,455 |

) |

|

|

(723,448 |

|

| Total stockholders' deficit |

|

|

(23,452 |

) |

|

|

(47,447 |

|

| Total liabilities and

stockholders' deficit |

|

$ |

138,981 |

|

|

$ |

201,792 |

|

| |

|

|

|

|

|

__________________(1) The condensed balance sheet as

of December 31, 2023 was derived from the audited financial

statements included in the Company's Annual Report on Form 10-K for

the year ended December 31, 2023.

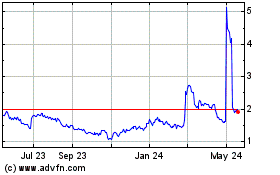

CytomX Therapeutics (NASDAQ:CTMX)

Historical Stock Chart

From Dec 2024 to Jan 2025

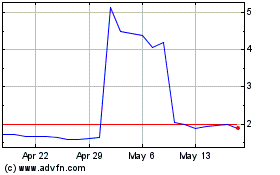

CytomX Therapeutics (NASDAQ:CTMX)

Historical Stock Chart

From Jan 2024 to Jan 2025