0001169561false00011695612024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 29, 2024

COMMVAULT SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-33026 | | 22-3447504 |

(State or other jurisdiction

of incorporation) | | (Commission

file number) | | (I.R.S. Employer

Identification No.) |

1 Commvault Way

Tinton Falls, New Jersey 07724

(Address of principal executive offices, including zip code)

(732) 870-4000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | CVLT | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 29, 2024, Commvault issued a press release announcing its results for its second fiscal quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

This information is being furnished pursuant to Item 2.02 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into filings under the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

| | | | | |

| Exhibit No. | Description |

| Press Release dated October 29, 2024 |

| 104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

COMMVAULT SYSTEMS, INC.

| | | | | | | | |

| Dated: | October 29, 2024 | /s/ Jennifer DiRico |

| | Jennifer DiRico

Chief Financial Officer

(Principal Financial Officer) |

Investor Relations Contact:

Michael J. Melnyk, CFA

732-870-4581

mmelnyk@commvault.com

Commvault Announces Fiscal 2025 Second Quarter Financial Results

Tinton Falls, N.J. – October 29, 2024 – Commvault [Nasdaq: CVLT] today announced its financial results for the fiscal second quarter ended September 30, 2024.

“Keeping customers resilient and their businesses continuous has never been more critical than it is today,” said Sanjay Mirchandani, President and CEO. “Our strong execution and increasing demand for our innovative Commvault Cloud platform has not only resulted in our fourth consecutive quarter of double-digit revenue growth, but it has given us the confidence to once again raise our outlook for the full fiscal year.”

Fiscal 2025 Second Quarter Highlights -

•Total revenues were $233.3 million, up 16% year over year

•Total annualized recurring revenue (ARR)1 grew to $853 million, up 20% year over year

•Subscription revenue was $134.0 million, up 37% year over year

•Subscription ARR1 grew to $687 million, up 30% year over year

•Income from operations (EBIT) was $15.0 million, an operating margin of 6.4%

•Non-GAAP EBIT2 was $47.7 million, an operating margin of 20.5%

•Operating cash flow was $55.6 million, with free cash flow2 of $53.7 million

•Second quarter share repurchases were $51.9 million, or approximately 363,000 shares of common stock

Notes are contained on the last page of this Press Release.

Financial Outlook for Third Quarter and Full Year Fiscal 20253 -

We are providing the following guidance for the third quarter of fiscal year 2025:

•Total revenues are expected to be between $243 million and $247 million

•Subscription revenue is expected to be between $143 million and $147 million

•Non-GAAP operating margin2 is expected to be between 20% and 21%

We are providing the following updated guidance for the full fiscal year 2025:

•Total revenues are expected to be between $952 million and $957 million

•Total ARR1 is expected to grow 18% year over year

•Subscription revenue is expected to be between $552 million and $557 million

•Subscription ARR1 is expected to grow between 26% and 28% year over year

•Non-GAAP operating margin2 is expected to be between 20% and 21%

•Free cash flow2 is expected to be at least $200 million

The above statements are based on the incorporation of actual second quarter results, current targets and the acquisition of Clumio, Inc. which closed on October 1, 2024. These statements are forward looking and made pursuant to the safe harbor provisions discussed in detail below. We do not undertake any obligation to update these forward-looking statements. Actual results may differ materially from anticipated results.

Conference Call Information

Commvault will host a conference call today, October 29, 2024 at 8:30 a.m. Eastern Time (5:30 a.m. Pacific Time) to discuss quarterly results. The live webcast and call dial-in numbers can be accessed by registering under the "News & Events" section of Commvault's website at ir.commvault.com under the "Investor Events" heading. An archived webcast of this conference call will also be available following the call.

About Commvault

Commvault (NASDAQ: CVLT) is the gold standard in cyber resilience, helping more than 100,000 organizations keep data safe and businesses resilient and moving forward. Today, Commvault offers the only cyber resilience platform that combines the best data security and rapid recovery at enterprise scale across any workload, anywhere—at the lowest TCO.

Safe Harbor Statement

This press release may contain forward-looking statements, including statements regarding financial projections, which are subject to risks and uncertainties, such as competitive factors, difficulties and delays inherent in the development, manufacturing, marketing and sale of software products and related services, general economic conditions, outcome of litigation and others. For a discussion of these and other risks and uncertainties affecting Commvault's business, see "Item 1A. Risk Factors" in our annual report on Form 10-K and "Item 1A. Risk Factors" in our most recent quarterly report on Form 10-Q. Statements regarding Commvault’s beliefs, plans, expectations or intentions regarding the future are forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from anticipated results. Commvault does not undertake to update its forward-looking statements.

Notes are contained on the last page of this Press Release.

Revenue Overview

($ in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2'24 | | Q3'24 | | Q4'24 | | Q1'25 | | Q2'25 |

| Revenue Summary: | | | | | | | | | |

| Subscription | $ | 97,757 | | | $ | 114,247 | | | $ | 119,873 | | | $ | 124,080 | | | $ | 134,038 | |

| Perpetual license | 14,388 | | | 14,874 | | | 15,196 | | | 13,736 | | | 10,522 | |

| Customer support | 77,019 | | | 76,812 | | | 77,025 | | | 76,288 | | | 77,688 | |

| Other services | 11,833 | | | 10,875 | | | 11,198 | | | 10,568 | | | 11,030 | |

| Total revenues | $ | 200,997 | | | $ | 216,808 | | | $ | 223,292 | | | $ | 224,672 | | | $ | 233,278 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2'24 | | Q3'24 | | Q4'24 | | Q1'25 | | Q2'25 |

| Y/Y Growth: | | | | | | | | | |

| Subscription | 25 | % | | 31 | % | | 27 | % | | 28 | % | | 37 | % |

| Perpetual license | (27) | % | | (25) | % | | (13) | % | | 4 | % | | (27) | % |

| Customer support | (1) | % | | (1) | % | | — | % | | (1) | % | | 1 | % |

| Other services | (1) | % | | 6 | % | | (20) | % | | (2) | % | | (7) | % |

| Total revenues | 7 | % | | 11 | % | | 10 | % | | 13 | % | | 16 | % |

Constant Currency

($ in thousands)

The constant currency impact is calculated using the average foreign exchange rates from the prior year period and applying these rates to foreign-denominated revenues in the current corresponding period. Commvault analyzes revenue growth on a constant currency basis in order to provide a comparable framework for assessing how the business performed excluding the effect of foreign currency fluctuations. The non-GAAP financial measures presented in this press release should not be considered as a substitute for, or superior to, the measures of financial performance prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Subscription | | Perpetual license | | Customer support | | Other services | | Total |

Q2'24 Revenue as Reported (GAAP) | $ | 97,757 | | $ | 14,388 | | $ | 77,019 | | $ | 11,833 | | $ | 200,997 |

Q2'25 Revenue as Reported (GAAP) | $ | 134,038 | | $ | 10,522 | | $ | 77,688 | | $ | 11,030 | | $ | 233,278 |

| % Change Y/Y (GAAP) | 37 | % | | (27) | % | | 1 | % | | (7) | % | | 16 | % |

| Constant Currency Impact | $ | (924) | | $ | (112) | | $ | (408) | | $ | (307) | | $ | (1,751) |

| % Change Y/Y Constant Currency | 36 | % | | (28) | % | | — | % | | (9) | % | | 15 | % |

Revenues by Geography

($ in thousands)

Our Americas region includes the United States, Canada, and Latin America. Our International region primarily includes Europe, Middle East, Africa, Australia, India, Southeast Asia, and China.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2'24 | | Q3'24 | | Q4'24 | | Q1'25 | | Q2'25 |

| Revenue | Y/Y Growth | | Revenue | Y/Y Growth | | Revenue | Y/Y Growth | | Revenue | Y/Y Growth | | Revenue | Y/Y Growth |

| Americas | $ | 120,300 | | 4 | % | | $ | 125,052 | | 16 | % | | $ | 131,069 | | 7 | % | | $ | 138,725 | | 14 | % | | $ | 144,408 | | 20 | % |

| International | 80,697 | | 12 | % | | 91,756 | | 6 | % | | 92,223 | | 14 | % | | 85,947 | | 13 | % | | 88,870 | | 10 | % |

| Total revenues | $ | 200,997 | | 7 | % | | $ | 216,808 | | 11 | % | | $ | 223,292 | | 10 | % | | $ | 224,672 | | 13 | % | | $ | 233,278 | | 16 | % |

Total ARR and Subscription ARR1

($ in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2'24 | | Q3'24 | | Q4'24 | | Q1'25 | | Q2'25 |

Total ARR1 | $ | 711,462 | | | $ | 752,480 | | | $ | 769,946 | | | $ | 802,709 | | | $ | 853,265 | |

Subscription ARR1 | $ | 529,590 | | | $ | 571,125 | | | $ | 596,667 | | | $ | 635,910 | | | $ | 687,050 | |

Income from Operations (EBIT)

•Income from operations (EBIT) was $15.0 million, an operating margin of 6.4%

•Non-GAAP EBIT2 was $47.7 million, an operating margin of 20.5%

GAAP and Non-GAAP Net Income2

•GAAP net income was $15.6 million, or $0.35 per diluted share

•Non-GAAP net income2 was $37.6 million, or $0.83 per diluted share

Cash Summary and Share Repurchases

•Cash flow from operations was $55.6 million in the second quarter

•As of September 30, 2024, ending cash and cash equivalents was approximately $303.1 million

•During the second quarter, Commvault repurchased $51.9 million, or approximately 363,000 shares, of common stock at an average share price of approximately $143.09 per share

Notes are contained on the last page of this Press Release.

Table I

Commvault Systems, Inc.

Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Six Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Subscription | $ | 134,038 | | | $ | 97,757 | | | $ | 258,118 | | | $ | 195,047 | |

| Perpetual license | 10,522 | | | 14,388 | | | 24,258 | | | 27,543 | |

| Customer support | 77,688 | | | 77,019 | | | 153,976 | | | 153,934 | |

| Other services | 11,030 | | | 11,833 | | | 21,598 | | | 22,623 | |

| Total revenues | 233,278 | | | 200,997 | | | 457,950 | | | 399,147 | |

| Cost of revenues: | | | | | | | |

| Subscription | 19,532 | | | 14,643 | | | 37,072 | | | 27,006 | |

| Perpetual license | 441 | | | 642 | | | 778 | | | 1,054 | |

| Customer support | 15,311 | | | 14,898 | | | 29,574 | | | 29,855 | |

| Other services | 7,578 | | | 7,670 | | | 15,226 | | | 15,488 | |

| Total cost of revenues | 42,862 | | | 37,853 | | | 82,650 | | | 73,403 | |

| Gross margin | 190,416 | | | 163,144 | | | 375,300 | | | 325,744 | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 101,947 | | | 84,712 | | | 197,897 | | | 168,839 | |

| Research and development | 33,839 | | | 31,261 | | | 66,943 | | | 62,692 | |

| General and administrative | 34,173 | | | 28,002 | | | 64,968 | | | 54,961 | |

| Restructuring | 566 | | | — | | | 5,245 | | | — | |

| Depreciation and amortization | 2,013 | | | 1,535 | | | 3,941 | | | 3,138 | |

| Impairment charges | 2,910 | | | — | | | 2,910 | | | — | |

| Total operating expenses | 175,448 | | | 145,510 | | | 341,904 | | | 289,630 | |

| Income from operations | 14,968 | | | 17,634 | | | 33,396 | | | 36,114 | |

| Interest income | 1,732 | | | 1,369 | | | 3,534 | | | 2,149 | |

| Interest expense | (105) | | | (112) | | | (209) | | | (208) | |

| Other income (expense), net | 65 | | | (154) | | | 593 | | | 187 | |

| Income before income taxes | 16,660 | | | 18,737 | | | 37,314 | | | 38,242 | |

| Income tax expense | 1,095 | | | 5,720 | | | 3,222 | | | 12,596 | |

| Net income | $ | 15,565 | | | $ | 13,017 | | | $ | 34,092 | | | $ | 25,646 | |

| Net income per common share: | | | | | | | |

| Basic | $ | 0.36 | | | $ | 0.30 | | | $ | 0.78 | | | $ | 0.58 | |

| Diluted | $ | 0.35 | | | $ | 0.29 | | | $ | 0.76 | | | $ | 0.57 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 43,770 | | | 43,949 | | | 43,724 | | | 44,003 | |

| Diluted | 45,114 | | | 44,903 | | | 45,095 | | | 45,010 | |

Table II

Commvault Systems, Inc.

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | | September 30, | | March 31, |

| | | 2024 | | 2024 |

| ASSETS |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 303,071 | | | $ | 312,754 | |

| | | | |

| Trade accounts receivable, net | | 194,879 | | | 222,683 | |

| Assets held for sale | | 34,770 | | | 38,680 | |

| Other current assets | | 30,235 | | | 21,009 | |

| Total current assets | | 562,955 | | | 595,126 | |

| | | | |

| Deferred tax assets, net | | 119,969 | | | 111,181 | |

| Property and equipment, net | | 8,282 | | | 7,961 | |

| Operating lease assets | | 11,939 | | | 10,545 | |

| Deferred commissions cost | | 65,927 | | | 62,837 | |

| Intangible assets, net | | 5,196 | | | 1,042 | |

| Goodwill | | 150,072 | | | 127,780 | |

| Other assets | | 34,136 | | | 27,441 | |

| Total assets | | $ | 958,476 | | | $ | 943,913 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | | |

| Accounts payable | | $ | 92 | | | $ | 299 | |

| Accrued liabilities | | 107,645 | | | 117,244 | |

| Current portion of operating lease liabilities | | 5,313 | | | 4,935 | |

| Deferred revenue | | 355,267 | | | 362,450 | |

| Total current liabilities | | 468,317 | | | 484,928 | |

| | | | |

| Deferred revenue, less current portion | | 198,090 | | | 168,472 | |

| Deferred tax liabilities | | 3,396 | | | 1,717 | |

| Long-term operating lease liabilities | | 7,192 | | | 7,155 | |

| Other liabilities | | 3,693 | | | 3,556 | |

| | | | |

| Total stockholders’ equity | | 277,788 | | | 278,085 | |

| Total liabilities and stockholders’ equity | | $ | 958,476 | | | $ | 943,913 | |

Table III

Commvault Systems, Inc.

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Six Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities | | | | | | | |

| Net income | $ | 15,565 | | | $ | 13,017 | | | $ | 34,092 | | | $ | 25,646 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 2,042 | | | 1,564 | | | 3,999 | | | 3,196 | |

| Noncash stock-based compensation | 26,403 | | | 23,615 | | | 52,807 | | | 47,339 | |

| Noncash change in fair value of equity securities | (65) | | | 154 | | | (135) | | | (187) | |

| Noncash impairment charges | 2,910 | | | — | | | 2,910 | | | — | |

| Noncash operating lease expense | 1,369 | | | 1,356 | | | 2,948 | | | 2,591 | |

| Deferred income taxes | (3,689) | | | — | | | (8,483) | | | — | |

| Amortization of deferred commissions cost | 8,019 | | | 6,430 | | | 15,477 | | | 12,749 | |

| | | | | | | |

| | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | |

| Trade accounts receivable, net | 3,432 | | | (19,812) | | | 23,113 | | | 8,245 | |

| Operating lease liabilities | (1,671) | | | (1,363) | | | (3,973) | | | (2,526) | |

| Other current assets and Other assets | (2,139) | | | (2,439) | | | (4,342) | | | (3,832) | |

| Deferred commissions cost | (9,151) | | | (6,961) | | | (17,420) | | | (12,561) | |

| Accounts payable | (334) | | | (146) | | | (205) | | | 32 | |

| Accrued liabilities | 11,179 | | | 15,567 | | | (11,832) | | | (3,963) | |

| Deferred revenue | 2,392 | | | 8,959 | | | 11,830 | | | 1,746 | |

| Other liabilities | (673) | | | 396 | | | (505) | | | 899 | |

| Net cash provided by operating activities | 55,589 | | | 40,337 | | | 100,281 | | | 79,374 | |

| Cash flows from investing activities | | | | | | | |

| | | | | | | |

| | | | | | | |

| Purchase of property and equipment | (1,848) | | | (266) | | | (2,711) | | | (1,413) | |

| Purchase of equity securities | (108) | | | (260) | | | (581) | | | (572) | |

| Business combination, net of cash acquired | — | | | — | | | (21,000) | | | — | |

| Net cash used in investing activities | (1,956) | | | (526) | | | (24,292) | | | (1,985) | |

| Cash flows from financing activities | | | | | | | |

| Repurchase of common stock | (51,903) | | | (31,327) | | | (103,295) | | | (82,357) | |

| Proceeds from stock-based compensation plans | 5,760 | | | 5,167 | | | 11,100 | | | 6,368 | |

| | | | | | | |

| Net cash used in financing activities | (46,143) | | | (26,160) | | | (92,195) | | | (75,989) | |

| Effects of exchange rate — changes in cash | 7,710 | | | (4,953) | | | 6,523 | | | (5,891) | |

| Net increase (decrease) in cash and cash equivalents | 15,200 | | | 8,698 | | | (9,683) | | | (4,491) | |

| Cash and cash equivalents at beginning of period | 287,871 | | | 274,589 | | | 312,754 | | | 287,778 | |

| Cash and cash equivalents at end of period | $ | 303,071 | | | $ | 283,287 | | | $ | 303,071 | | | $ | 283,287 | |

| | | | | | | |

| Supplemental disclosures of noncash activities | | | | | | | |

| Issuance of common stock for business combination | $ | — | | | $ | — | | | $ | 4,900 | | | $ | — | |

| Operating lease liabilities arising from obtaining right-of-use assets | $ | 2,499 | | | $ | 3,666 | | | $ | 4,467 | | | $ | 4,695 | |

Table IV

Commvault Systems, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP financial measures and reconciliation: | | | | | | | |

| GAAP income from operations | $ | 14,968 | | | $ | 17,634 | | | $ | 33,396 | | | $ | 36,114 | |

Noncash stock-based compensation4 | 26,223 | | | 23,615 | | | 48,619 | | | 47,339 | |

FICA and payroll tax expense related to stock-based compensation5 | 772 | | | 471 | | | 2,135 | | | 1,485 | |

Restructuring6 | 566 | | | — | | | 5,245 | | | — | |

Amortization of intangible assets7 | 573 | | | 312 | | | 1,146 | | | 626 | |

Litigation settlement8 | — | | | — | | | 675 | | | — | |

Business combination costs9 | 1,736 | | | — | | | 1,925 | | | — | |

Noncash impairment charges10 | 2,910 | | | — | | | 2,910 | | | — | |

| Non-GAAP income from operations | $ | 47,748 | | | $ | 42,032 | | | $ | 96,051 | | | $ | 85,564 | |

| | | | | | | |

| GAAP net income | $ | 15,565 | | | $ | 13,017 | | | $ | 34,092 | | | $ | 25,646 | |

Noncash stock-based compensation4 | 26,223 | | | 23,615 | | | 48,619 | | | 47,339 | |

FICA and payroll tax expense related to stock-based compensation5 | 772 | | | 471 | | | 2,135 | | | 1,485 | |

Restructuring6 | 566 | | | — | | | 5,245 | | | — | |

Amortization of intangible assets7 | 573 | | | 312 | | | 1,146 | | | 626 | |

Litigation settlement8 | — | | | — | | | 675 | | | — | |

Business combination costs9 | 1,736 | | | — | | | 1,925 | | | — | |

Noncash impairment charges10 | 2,910 | | | — | | | 2,910 | | | — | |

Non-GAAP provision for income taxes adjustment11 | (10,770) | | | (5,927) | | (20,770) | | | (11,081) |

| Non-GAAP net income | $ | 37,575 | | | $ | 31,488 | | | $ | 75,977 | | | $ | 64,015 | |

| | | | | | | |

| GAAP diluted earnings per share | $ | 0.35 | | | $ | 0.29 | | | $ | 0.76 | | | $ | 0.57 | |

Noncash stock-based compensation4 | 0.58 | | | 0.53 | | | 1.08 | | | 1.05 | |

FICA and payroll tax expense related to stock-based compensation5 | 0.02 | | | 0.01 | | | 0.05 | | | 0.03 | |

Restructuring6 | 0.01 | | | — | | | 0.12 | | | — | |

Amortization of intangible assets7 | 0.01 | | | 0.01 | | | 0.03 | | | 0.01 | |

Litigation settlement8 | — | | | — | | | 0.01 | | | — | |

Business combination costs9 | 0.04 | | | — | | | 0.04 | | | — | |

Noncash impairment charges10 | 0.06 | | | — | | | 0.06 | | | — | |

Non-GAAP provision for income taxes adjustment11 | (0.24) | | (0.14) | | (0.47) | | (0.24) |

| Non-GAAP diluted earnings per share | $ | 0.83 | | | $ | 0.70 | | | $ | 1.68 | | | $ | 1.42 | |

| | | | | | | |

| GAAP diluted weighted average shares outstanding | 45,114 | | 44,903 | | 45,095 | | 45,010 |

Notes are contained on the last page of this Press Release.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP free cash flow reconciliation: | | | | | | | |

| GAAP cash provided by operating activities | $ | 55,589 | | | $ | 40,337 | | | $ | 100,281 | | | $ | 79,374 | |

| Purchase of property and equipment | (1,848) | | | (266) | | | (2,711) | | | (1,413) | |

| Non-GAAP free cash flow | $ | 53,741 | | | $ | 40,071 | | | $ | 97,570 | | | $ | 77,961 | |

Use of Non-GAAP Financial Measures

Commvault has provided in this press release the following non-GAAP financial measures: non-GAAP income from operations (EBIT), non-GAAP income from operations margin, non-GAAP net income, non-GAAP diluted earnings per share, non-GAAP free cash flow, annualized recurring revenue (ARR) and subscription ARR. This financial information has not been prepared in accordance with GAAP. Commvault uses these non-GAAP financial measures internally to understand, manage and evaluate its business and make operating decisions. In addition, Commvault believes these non-GAAP operating measures are useful to investors, when used as a supplement to GAAP financial measures, in evaluating Commvault’s ongoing operational performance. Commvault believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends, and in comparing its financial results with other companies in Commvault’s industry, many of which present similar non-GAAP financial measures to the investment community. Commvault has also provided its revenues on a constant currency basis. Commvault analyzes revenue growth on a constant currency basis in order to provide a comparable framework for assessing how the business performed excluding the effect of foreign currency fluctuations.

All of these non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures, which are included in this press release.

Non-GAAP income from operations and non-GAAP income from operations margin. These non-GAAP financial measures exclude noncash stock-based compensation charges and additional Federal Insurance Contribution Act (FICA) and related payroll tax expense incurred by Commvault when employees exercise in-the-money stock options or vest in restricted stock awards. Commvault has also excluded restructuring costs, noncash amortization of intangible assets, litigation settlement, business combination costs, and noncash impairment charges from its non-GAAP results. These expenses are further discussed in Table IV. Commvault believes that these non-GAAP financial measures are useful metrics for management and investors because they compare Commvault’s core operating results over multiple periods. When evaluating the performance of Commvault’s operating results and developing short- and long-term plans, Commvault does not consider such expenses.

Although noncash stock-based compensation and the additional FICA and related payroll tax expenses are necessary to attract and retain employees, Commvault places its primary emphasis on stockholder dilution as compared to the accounting charges related to such equity compensation plans. Commvault believes that providing non-GAAP financial measures that exclude noncash stock-based compensation expense and the additional FICA and related payroll tax expenses incurred on stock option exercises and vesting of restricted stock awards allow investors to make meaningful comparisons between Commvault’s operating results and those of other companies.

There are a number of limitations related to the use of non-GAAP income from operations and non-GAAP income from operations margin. The most significant limitation is that these non-GAAP financial measures exclude certain operating costs, primarily related to noncash stock-based compensation, which is of a recurring nature. Noncash

stock-based compensation has been, and will continue to be for the foreseeable future, a significant recurring expense in Commvault’s operating results. In addition, noncash stock-based compensation is an important part of Commvault’s employees’ compensation and can have a significant impact on their performance. The following table presents the stock-based compensation expense included in cost of revenues, sales and marketing, research and development and general and administrative ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenues | $ | 1,374 | | | $ | 1,599 | | | $ | 2,955 | | | $ | 3,289 | |

| Sales and marketing | 11,631 | | | 9,941 | | | 21,117 | | | 19,645 | |

| Research and development | 5,555 | | | 5,385 | | | 10,719 | | | 10,732 | |

| General and administrative | 7,663 | | | 6,690 | | | 13,828 | | | 13,673 | |

Stock-based compensation expense | $ | 26,223 | | | $ | 23,615 | | | $ | 48,619 | | | $ | 47,339 | |

The table above excludes stock-based compensation expense related to the Company's restructuring activities described below in Note 6.

The components that Commvault excludes in its non-GAAP financial measures may differ from the components that its peer companies exclude when they report their non-GAAP financial measures. Due to the limitations related to the use of non-GAAP measures, Commvault’s management assists investors by providing a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure. Commvault's management uses non-GAAP financial measures only in addition to, and in conjunction with, results presented in accordance with GAAP.

Non-GAAP net income and non-GAAP diluted earnings per share (EPS). In addition to the adjustments discussed in non-GAAP income from operations, non-GAAP net income and non-GAAP diluted EPS incorporates a non-GAAP effective tax rate of 24%. Beginning in fiscal 2025, Commvault lowered its estimated non-GAAP effective tax rate from 27% to 24%.

Commvault anticipates that in any given period its non-GAAP tax rate may be either higher or lower than the GAAP tax rate as evidenced by historical fluctuations. The GAAP tax rates in recent fiscal years were not meaningful percentages due to the dollar amount of GAAP pre-tax income. For the same reason as the GAAP tax rates, the estimated cash tax rates in recent fiscal years are not meaningful percentages. Commvault defines its cash tax rate as the total amount of cash income taxes payable for the fiscal year divided by consolidated GAAP pre-tax income. Over time, Commvault believes its GAAP and cash tax rates will align.

Commvault considers non-GAAP net income and non-GAAP diluted EPS useful metrics for Commvault management and its investors for the same basic reasons that Commvault uses non-GAAP income from operations and non-GAAP income from operations margin. In addition, the same limitations as well as management actions to compensate for such limitations described above also apply to Commvault’s use of non-GAAP net income and non-GAAP diluted EPS.

Non-GAAP free cash flow. Commvault defines this non-GAAP financial measure as net cash provided by operating activities less purchases of property and equipment. Commvault considers non-GAAP free cash flow a useful metric for Commvault management and its investors in evaluating Commvault's ability to generate cash from its business operations. In addition, the same limitations as well as management actions to compensate for such limitations described above also apply to Commvault’s use of non-GAAP free cash flow.

Forward-looking non-GAAP measures. In this press release, Commvault presents certain forward-looking non-GAAP metrics. Commvault cannot provide a reconciliation to the comparable GAAP metric without unreasonable efforts, as certain financial information, the probable significance of which may be material, is not available and cannot be reasonably estimated.

Notes

1.Annualized recurring revenue (ARR) is defined as the annualized recurring value of all active contracts at the end of a reporting period. It includes the following contract types: subscription (including term license contracts, SaaS and utility software), maintenance contracts related to perpetual licenses, other extended maintenance contracts (enterprise support), and managed services. It excludes any element of the arrangement that is not expected to recur, primarily perpetual licenses and most professional services. Subscription ARR includes only term license contracts, SaaS and utility software arrangements. Contracts are annualized by dividing the total contract value by the number of days in the contract term, then multiplying by 365.

ARR should be viewed independently of GAAP revenue, deferred revenue and unbilled revenue and is not intended to be combined with or to replace those items. ARR is not a forecast of future revenue. Management believes that reviewing this metric, in addition to GAAP results, helps investors and financial analysts understand the value of Commvault's recurring revenue streams presented on an annualized basis.

2.A reconciliation of GAAP to non-GAAP results has been provided in Financial Statement Table IV included in this press release. An explanation of these measures is also included under the heading “Use of Non-GAAP Financial Measures.”

3.Commvault does not provide forward-looking guidance on a GAAP basis as certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated. See “Use of Non-GAAP Financial Measures” for additional explanation.

4.Represents noncash stock-based compensation charges associated with restricted stock units granted and our Employee Stock Purchase Plan, exclusive of stock-based compensation expense related to Commvault's restructuring activities described below in Note 6.

5.Represents additional FICA and related payroll tax expenses incurred by Commvault when employees exercise in-the-money stock options or vest in restricted stock awards.

6.These restructuring charges relate primarily to severance and related costs associated with headcount reductions and stock-based compensation related to modifications of existing unvested awards granted to certain employees impacted by the restructuring plan.

7.Represents noncash amortization of intangible assets.

8.During the first quarter of fiscal 2025, we entered into a settlement agreement resulting in a payment of approximately $1.5 million which resolved certain legal matters. Approximately $0.7 million was recorded in general and administrative expenses for the six months ended September 30, 2024, and the remaining

$0.8 million was incurred in a prior period that is not presented in the consolidated statements of operations.

9.During the first half of fiscal 2025, Commvault incurred costs related to the acquisitions of Appranix, Inc. and Clumio, Inc., including legal, accounting and advisory services. Management believes, when used as a supplement to GAAP results, that the exclusion of these costs will help investors and financial analysts understand Commvault's operating results and underlying operational trends as compared to other periods.

10.Represents noncash impairment charges of assets held for sale.

11.The provision for income taxes is adjusted to reflect Commvault’s estimated non-GAAP effective tax rate of 24% for fiscal 2025, and 27% for fiscal 2024. Beginning in fiscal 2025, Commvault lowered its estimated non-GAAP effective tax rate from 27% to 24%. Commvault believes that a 24% rate more closely aligns with its effective tax rate expectations over the next few years.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

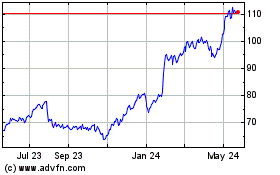

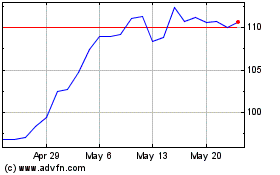

CommVault Systems (NASDAQ:CVLT)

Historical Stock Chart

From Oct 2024 to Nov 2024

CommVault Systems (NASDAQ:CVLT)

Historical Stock Chart

From Nov 2023 to Nov 2024