--12-31

0001874097

false

0001874097

2025-02-07

2025-02-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): February 7, 2025

CYNGN INC.

(Exact name of registrant

as specified in charter)

| Delaware |

|

001-40932 |

|

46-2007094 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

1015 O’Brien

Dr.

Menlo Park, CA 94025

(Address of principal

executive offices) (Zip Code)

(650) 924-5905

(Registrant’s telephone

number, including area code)

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

CYN |

|

The Nasdaq Stock Market LLC (The Nasdaq Capital Market) |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

☒

If an emerging growth

company, indicate by check mart if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.03 Material Modification of Rights to Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained

in Item 5.03 of this report is incorporated herein by reference.

Item 5.03 Amendment to Articles of Incorporation or Bylaws; Change

in Fiscal Year.

As previously disclosed on Form 8-K on January 30, 2025, Cyngn Inc.

(the “Company”) held a special stockholder meeting on January 30, 2025, at which stockholders voted to authorize the Company’s

Board of Directors to effect a reverse stock split of the outstanding shares of common stock within one (1) year of January 30, 2025,

at a specific ratio within a range of one-for-five (1-for-5) to a maximum of a one-for-one hundred fifty (1-for-150).

On January 30, 2025, the Company’s Board of Directors determined

to effect the reverse stock split of the common stock at a 1-for-150 ratio (the “Reverse Split”) and approved the filing of

a Certificate of Amendment (the “Certificate of Amendment”) to the Certificate of Incorporation, as amended, of the Company

to effect the Reverse Split.

On February 7, 2025, the Certificate of Amendment to effect the Reverse

Split was filed with the Secretary of State of Delaware.

As of February 12, 2025, the Company has 262,773,516 shares of common

stock issued and outstanding, which includes shares of common stock that have been issued upon exercise of those certain Series B Warrants

issued by the Company pursuant to that certain securities purchase agreement dated December 20, 2025. The implementation of the Reverse

Split of its outstanding shares of common stock will take effect in the public markets at the opening of trading on Tuesday, February

18, 2025. Upon effectuation of the Reverse Split, the Company anticipates that it will have 1,751,824 shares of common stock outstanding,

not accounting for fractional shares that result from the Reverse Split that are rounded up.

A copy of the Certificate of Amendment is filed as Exhibit 3.1 to this

Current Report on Form 8-K and incorporated herein by reference.

Item 8.01 Other Events.

On February 12, 2025, the Company issued a press release announcing

that all outstanding Series B cashless warrants have been fully exercised. A copy of the press release is attached as Exhibit 99.1 hereto.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Date: February 12, 2025

| |

CYNGN INC. |

| |

|

| |

By: |

/s/ Donald Alvarez |

| |

|

Donald Alvarez |

| |

|

Chief Financial Officer |

2

Exhibit 3.1

| |

Delaware |

Page 1 |

| |

The First State |

|

I, CHARUNI PATIBANDA-SANCHEZ,

SECRETARY OF STATE OF THE STATE OF DELAWARE, DO HEREBY CERTIFY THE ATTACHED IS A TRUE AND CORRECT COPY OF THE CERTIFICATE OF AMENDMENT

OF “CYNGN INC.”, FILED IN THIS OFFICE ON THE SEVENTH DAY OF FEBRUARY, A.D. 2025, AT 12:26 O’CLOCK P.M.

AND I DO HEREBY

FURTHER CERTIFY THAT THE EFFECTIVE DATE OF THE AFORESAID CERTIFICATE OF AMENDMENT IS THE TWELFTH DAY OF FEBRUARY, A.D. 2025 AT 5 O’CLOCK

P.M.

5278712 8100 |

|

Authentication: 202891408 |

| SR# 20250437507 |

|

Date: 02-08-25 |

| |

|

|

| You may verify this certificate online at corp.delaware.gov/authver.shtml |

|

CERTIFICATE OF AMENDMENT TO THE

FIFTH AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

CYNGNINC.,

a Delaware Corporation

Cyngn Inc.

(the “Corporation”), a corporation organized and existing under the General Corporation

Law of the State of Delaware, hereby certifies as follows:

FIRST: That the undersigned is the duly elected and

acting Chief Executive Officer of the Corporation.

SECOND:

That, pursuant to Section 242 of the Delaware General Corporation Law (the “DGCL”), the

first paragraph of Article Fourth of the Fifth Amended and Restated Certificate of Incorporation of the Corporation is hereby amended

to read in its entirety as follows:

“FOURTH:

The total number of shares of all classes of capital stock that the Corporation is authorized to issue is 410,000,000 shares, consisting

of (i) 400,000,000 shares of common stock, par value $0.00001 per share (the “Common Stock”),

and (ii) 10,000,000 shares of preferred stock, par value $0.00001 per share (the “Preferred

Stock”).”

Upon the

filing and effectiveness (the “Effective Time”) pursuant to the General Corporation

Law of the State of Delaware of this Certificate of Amendment to the Fifth Amended and Restated Certificate oflncorporation of the Corporation,

each One Hundred Fifty (150) shares of Common Stock either issued and outstanding or held by the Corporation in treasury stock immediately

prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be combined and

converted into one (1) share of Common Stock (the “Reverse Stock Split”).

No fractional

shares shall be issued in connection with the Reverse Stock Split. In lieu thereof, if, upon aggregating all of the shares of Common Stock

held by a record holder of Common Stock immediately following the Reverse Stock Split such holder would othenvise be entitled to a fractional

share of Common Stock, as a result of the Reverse Stock Split, the Corporation shall issue to such holder an additional fraction of a

share of Common Stock as is necessary to round the number of shares of Common Stock, held by such holder up to the nearest whole share,

such that no such holder will hold fractional shares following the Reverse Stock Split.

THIRD:

That the foregoing Certificate of Amendment of the Fifth Amended and Restated Certificate of Incorporation of the Corporation has been

duly adopted and approved by the Board of Directors and stockholders of the Corporation in accordance with the applicable provisions of

Sections 228 and 242 of the DGCL.

FOURTH: That this amendment will become effective

at 5:00 pm Eastern Standard Time on Febmary 12, 2025.

IN WITNESS

WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its Chief Executive Officer on this 7th day

of February, 2025.

| By: |

/s/ Lior Tal |

|

| |

Lior Tal |

|

| |

Chief Executive Officer |

|

| |

State of Delaware |

| |

Secretary of State |

| |

Division of Corporations |

| |

Delivered 12:26 PM 02/0712025 |

| |

FILED 12:26 PM 02/07/2025 |

| |

SR 20250437507 - File Number 5278712 |

| |

|

Exhibit 99.1

Cyngn Clears All Outstanding Cashless Warrants from December Capital

Raise

MENLO PARK, Calif., February 12, 2025 – Today, Cyngn Inc.

(NASDAQ: CYN) announced that all outstanding Series B cashless warrants have been fully exercised. These warrants were originally issued

in connection with a public offering that closed on December 23, 2024. As part of that transaction, the Company entered into a securities

purchase agreement (the “Purchase Agreement”) for the sale of 3,076,006 shares of its common stock, par value $0.00001 per

share (“Common Stock”), and 9,346,354 Pre-Funded Warrants to purchase shares of Common Stock (the “Pre-Funded Warrants”)

in lieu of shares of Common Stock. Under the Purchase Agreement, Cyngn also issued Series A Warrants (the “Series A Warrants”)

and Series B Warrants (the “Series B Warrants”).

On January 30, 2025 at a special meeting of stockholders, Cyngn’s

stockholders approved a proposal to authorize, in compliance with Nasdaq listing rule 5635(d), the issuance of both the Series A and Series

B Warrants, the shares of Common Stock underlying those Warrants, and certain provisions of the Warrants. After the stockholders’

approval, the Series A Warrants and Series B Warrants exercise price was adjusted to $0.322 and the number of shares underlying the Warrants

increased to up to 77,639,749 shares of Common Stock. The Series B Warrants also included an alternative cashless exercise provision which

resulted in an increase in the number of shares issuable under the Series B Warrants to an aggregate of up to approximately 232,919,249

shares. Ten institutional investors previously held all of the Series B Warrants. As of February 11, 2025, the last of these Series B

Warrants were exercised and eliminated from Cyngn’s capital structure. Upon completion of the exercises of the Series B Warrants,

the company had 262,773,516 shares of common stock outstanding.

About Cyngn

Cyngn develops and deploys scalable, differentiated autonomous vehicle

technology for industrial organizations. Cyngn's self-driving solutions allow existing workforces to increase productivity and efficiency.

The Company addresses significant challenges facing industrial organizations today, such as labor shortages, costly safety incidents,

and increased consumer demand for eCommerce.

Cyngn's DriveMod Kit can be installed on new industrial vehicles at

end of line or via retrofit, empowering customers to seamlessly adopt self-driving technology into their operations without high upfront

costs or the need to completely replace existing vehicle investments.

Cyngn's flagship product, its Enterprise Autonomy Suite, includes DriveMod

(autonomous vehicle system), Cyngn Insight (customer-facing suite of AV fleet management, teleoperation, and analytics tools), and Cyngn

Evolve (internal toolkit that enables Cyngn to leverage data from the field for artificial intelligence, simulation, and modeling). For

all terms referenced within, please refer to the Company's annual report on Form 10-K with the SEC filed on March 7, 2024.

Where to find Cyngn:

| ● | Website: https://cyngn.com |

| | | |

| ● | LinkedIn: https://www.linkedin.com/company/cyngn |

| | | |

| ● | YouTube:

https://www.youtube.com/@cyngnhq |

Forward-Looking Statements

This press release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Any statement that is not historical in nature is a forward-looking statement and may be

identified by the use of words and phrases such as "expects," "anticipates," "believes," "will,"

"will likely result," "will continue," "plans to," "potential," "promising," and similar

expressions. These statements are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties

and assumptions that could cause actual results to differ materially from those described in the forward-looking statements, including

the risk factors described from time to time in the Company's reports to the Securities and Exchange Commission (SEC), including, without

limitation the risk factors discussed in the Company's annual report on Form 10-K filed with the SEC on March 7, 2024. Readers are cautioned

that it is not possible to predict or identify all the risks, uncertainties and other factors that may affect future results. No forward-looking

statement can be guaranteed, and actual results may differ materially from those projected. Cyngn undertakes no obligation to publicly

update any forward-looking statement, whether as a result of new information, future events, or otherwise.

Investor Contact:

Donald Alvarez, CFO

investors@cyngn.com

Media Contact:

Luke Renner, Head of Marketing

media@cyngn.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

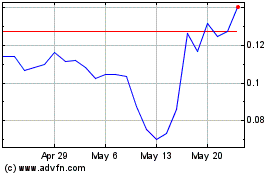

CYNGN (NASDAQ:CYN)

Historical Stock Chart

From Jan 2025 to Feb 2025

CYNGN (NASDAQ:CYN)

Historical Stock Chart

From Feb 2024 to Feb 2025