Dave and Coastal Community Bank Announce Strategic Partnership

March 03 2025 - 7:00AM

Dave Inc. (“Dave” or the “Company”) (Nasdaq: DAVE), one of the

nation’s leading neobanks and Coastal Financial Corporation

(Nasdaq: CCB), the holding company for Coastal Community Bank,

today announced a definitive strategic partnership.

Coastal Community Bank will become a sponsor

bank of Dave, including for Dave’s banking products and Dave’s new,

simplified ExtraCash product. Customers will begin onboarding to

Coastal Community Bank as soon as Q2 2025.

“We are thrilled to work with Dave as a sponsor

bank. From our first discussions with their team, it was clear that

we are aligned in bringing accessible, transparent financial

services to traditionally underbanked populations,” said Brian

Hamilton, President of CCBX.

The strategic partnership with Coastal Community

Bank and CCBX, the bank’s banking-as-a-service division, will

accelerate Dave’s business growth and expansion, and support Dave’s

mission to provide products that level the financial playing field

for Americans.

“This partnership marks a milestone moment for

Dave. Coastal Community Bank is the right partner for our company

because of their customer-first mission, deep knowledge across

credit and banking products, strong risk management, and our shared

ambition to make a difference in the communities that need it

most,” said Jason Wilk, CEO and Founder of Dave.

About Dave:

Dave (Nasdaq: DAVE) is a leading U.S. neobank

and fintech pioneer serving millions of everyday Americans. Dave

uses disruptive technologies to provide best-in-class banking

services at a fraction of the price of incumbents. For more

information about the company, visit: www.dave.com. For investor

information and updates, visit: investors.dave.com and follow

@davebanking on X.

About Coastal Financial

Corporation:

Coastal Financial Corporation (Nasdaq: CCB), is

an Everett, Washington based bank holding company whose wholly

owned subsidiaries are Coastal Community Bank (“Bank”) and

Arlington Olympic LLC. The $4.12 billion Bank provides service

through 14 branches in Snohomish, Island, and King Counties, the

Internet and its mobile banking application. The Bank provides

banking as a service to broker-dealers, digital financial service

providers, companies and brands that want to provide financial

services to their customers through the Bank's CCBX segment. To

learn more about Coastal Financial Corporation visit

www.coastalbank.com.

Forward-Looking Statements

This press release includes forward-looking

statements, which are subject to the “safe harbor” provisions of

the U.S. Private Securities Litigation Reform Act of 1995. These

statements may be identified by words such as “feels,” “believes,”

“expects,” “estimates,” “projects,” “intends,” “remains,” “should,”

“is to be,” or the negative of such terms, or other comparable

terminology and include, among other things, statements relating to

the strategic partnership with Coastal Community Bank, financial

inclusion, and Dave’s business growth and expansion. Such

forward-looking statements are not guarantees of future performance

and are subject to risks and uncertainties, which could cause

actual results to differ materially from the forward-looking

statements contained herein due to many factors, including, but not

limited to: the ability of Dave to compete in its highly

competitive industry; the ability of Dave to keep pace with the

rapid technological developments in its industry and the larger

financial services industry; the ability of Dave to manage risks

associated with providing ExtraCash advances; the ability of Dave

to retain its current Members, acquire new Members and sell

additional functionality and services to its Members; the ability

of Dave to protect intellectual property and trade secrets; the

ability of Dave to maintain the integrity of its confidential

information and information systems or comply with applicable

privacy and data security requirements and regulations; the

reliance by Dave on a single bank partner; the ability of Dave to

maintain or secure current and future key banking relationships and

other third-party service providers; failures by third-party

service providers; changes in applicable laws or regulations and

extensive and evolving government regulations that impact

operations and business; the ability to attract or maintain a

qualified workforce; level of product service failures that could

lead Dave Members to use competitors’ services; investigations,

claims, disputes, enforcement actions, litigation and/or other

regulatory or legal proceedings, including the Department of

Justice’s lawsuit against Dave; the ability to maintain the listing

of Dave Class A Common Stock on The Nasdaq Stock Market; the

possibility that Dave may be adversely affected by other economic

factors, including fluctuating interest rates, and business, and/or

competitive factors; and other risks and uncertainties discussed in

Dave’s Annual Report on Form 10-K filed with the Securities and

Exchange Commission (the “SEC”) on March 5, 2024 and subsequent

Quarterly Reports on Form 10-Q under the heading “Risk Factors,”

filed with the SEC and other reports and documents Dave files from

time to time with the SEC. Any forward-looking statements speak

only as of the date on which they are made, and Dave undertakes no

obligation to update any forward-looking statement to reflect

events or circumstances after the date of this press release.

Contacts for Dave

Investor Relations Contact

Sean Mansouri, CFA

Elevate IR

DAVE@elevate-ir.com

Media Contact

Dan Ury

press@dave.com

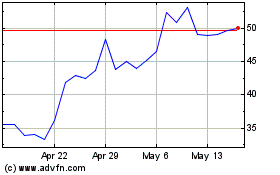

Dave (NASDAQ:DAVE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dave (NASDAQ:DAVE)

Historical Stock Chart

From Mar 2024 to Mar 2025