EUROPE MARKETS: European Stocks Weighed By Trade Worries, Regional Politics

November 27 2018 - 9:09AM

Dow Jones News

By Barbara Kollmeyer, MarketWatch , Emily Horton

European stocks were in the red on Tuesday, with trade tensions

between the U.S. and China and regional politics steering investors

away from equities, moves that were in step with global

markets.

How are the markets performing?

The Stoxx Europe 600 fell 0.6% to 356.15, after closing up 1.2%

on Monday.

The German DAX (DAX) fell 0.4% to 11,302.25, the French CAC 40

index lost 0.5% to 4,969.35 and the FTSE 100 lost 0.6% to 6,994.21.

The FTSE Italy index dipped 0.5% to 19,138.32.

The pound fell to $1.2747 from $1.2811 late in New York on

Monday, The euro was mostly unchanged at $1.1325.

What is driving stocks?

A mixture of global political events overshadowed European

stocks. U.S. President Donald Trump reportedly suggested Monday

that

(https://edition.cnn.com/2018/11/27/politics/trump-brexit-deal-claims-gbr-intl/index.html)

British Prime Minister Theresa May's Brexit deal could threaten a

U.S.-U.K. trade agreement, which pressured the U.K. currency.

In a separate interview with The Wall Street Journal

(https://www.wsj.com/articles/trump-expects-to-move-ahead-with-boost-on-china-tariffs-1543266545?mod=searchresults&page=1&pos=1),

Trump said he was "unlikely" to hold off on higher tariffs for

Chinese goods. The comments came ahead of a meeting between U.S.

and Chinese leaders later in the week, which weighed on

Asia-Pacific stocks and set up Wall Street for losses.

In Italy, lawmakers said they were sticking to previously stated

2019 budget goals, but were leaving open the possibility of cutting

the country's budget deficit target.

What stocks are active?

Oil stocks fell after Monday's rebound. BP PLC (BP.LN) fell 0.5%

and Royal Dutch Shell PLC (RDSA.LN) slipped 1%. Resource stocks

also took a hit with miners, Rio Tinto PLC(RIO.LN) (RIO.LN) down 2%

and Glencore PLC (GLEN.LN) (GLEN.LN) off 1.6%. Sandvik AB (SAND.SK)

fell over 2%.

Drug stocks were leading the decliners, with Novartis AG

(NOVN.EB) (NOVN.EB) down 1% and Bayer AG (BAYN.XE) off 1.2%. Bayer

and Loxo Oncology Inc. (LOXO) said Tuesday that they received

accelerated approval from the U.S. Food and Drug Administration for

a joint oncology drug

(http://www.marketwatch.com/story/fda-approves-loxo-bayer-cancer-drug-2018-11-26).

Among banking names, BBVA SA (BBVA.MC) (BBVA.MC) fell over 4%

and Metro Bank PLC(MTRO) fell by 2.9%.

(END) Dow Jones Newswires

November 27, 2018 09:54 ET (14:54 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

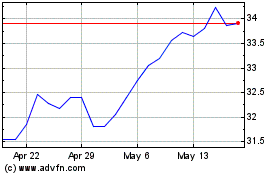

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Feb 2025 to Mar 2025

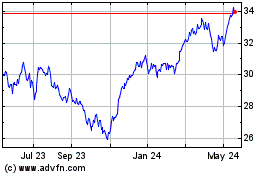

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Mar 2024 to Mar 2025