EUROPE MARKETS: European Stocks Close Little Changed, With Central Bankers In Focus After The Bell

November 28 2018 - 1:49PM

Dow Jones News

By Anneken Tappe, MarketWatch , Emily Horton

Major oil companies, banks under pressure

European stocks ended the session little changed on Wednesday,

as investors were focused on Federal Reserve Chairman Jerome Powell

and Bank of England Gov. Mark Carney, who spoke after the

close.

How are the markets performing?

The Stoxx Europe 600 ended little changed at 357.39, after

closing up 0.2% on Tuesday.

The German DAX (DAX) slipped 0.1% to close at 11,298.88, while

the French CAC finished unchanged at 4,983.24. The FTSE 100 ended

Wednesday 0.2% lower at 7,004.52.

The British pound soared to $1.2839, from $1.2745 late in New

York on Tuesday and the euro climbed 0.8% to $1.1383, as both

currencies benefited from weakness in the U.S. dollar

(http://www.marketwatch.com/story/dollar-set-to-take-cues-from-speech-by-feds-powell-2018-11-28).

What is driving stocks?

European investors were keeping a close eye on geopolitical

events, notably a meeting planned for U.S. President Donald Trump

and President Xi Jinping of China at the G-20 summit in Buenos

Aires this weekend. Trump economic adviser Larry Kudlow said

Tuesday that there was a good possibility for a deal but also that

the White House was disappointed in the Chinese response so

far.

Besides trade, central banks were in focus with remarks from

both the Federal Reserve and the Bank of England scheduled for

after the European close.

In the U.K., the BOE's stress test results showed a resilience

of the financial sector. However, the central bank's worst case

scenario of a no-deal Brexit without a transition period

(http://www.marketwatch.com/story/bank-of-england-shows-bleak-outlook-for-uk-economy-under-no-deal-brexit-scenario-2018-11-28)

saw British gross domestic product 7.75%-10.5% lower by the end of

2023 versus the May 2016 trend.

In the U.S., the Fed warned of corporate debt burdens

(http://www.marketwatch.com/story/fed-flags-concerns-over-corporate-debt-in-first-ever-financial-stability-report-2018-11-28)

in its first-ever financial stability report, and Chairman Jerome

Powell's comments sparked a stock market rally

(http://www.marketwatch.com/story/stock-index-futures-point-to-gains-ahead-of-speech-by-fed-chief-powell-2018-11-28)

when saying that interest rates were "just below" the neutral

rate.

What stocks are active?

In the energy sector, BP PLC (BP.LN) (BP.LN) ended just 0.1%

lower after being down more than 1% during the session. Similarly,

Royal Dutch Shell Group PLC (RDSA.LN) (RDSA.LN) dropped as much as

1.2% during active trading, but closed just 0.2% lower.

Among banks, another weak sector, Holdings PLC (HSBA.LN)

(HSBA.LN) finished 0.5% down.

Meanwhile in the consumer goods sector, Reckitt Benckiser Group

PLC (RB.LN) dropped 1.9% into the close.

(END) Dow Jones Newswires

November 28, 2018 14:34 ET (19:34 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

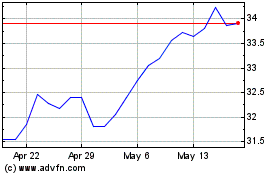

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Feb 2025 to Mar 2025

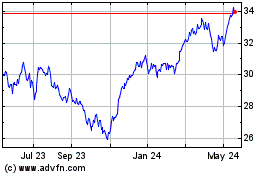

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Mar 2024 to Mar 2025