EUROPE MARKETS: Italian Stocks Send Europe Screeching Into Reverse

May 28 2019 - 5:32AM

Dow Jones News

By Dave Morris

Italian banks were hit as continuing anxiety over the country's

euroskeptic party's success in European elections sent sovereign

bond yields surging.

How did markets perform?

The Stoxx 600 fell 0.3% to 376.1 giving back Monday's gains of

0.2%.

The U.K.'s FTSE 100 was nearly flat at 7,280.7, after being

closed Monday.

The pound dipped 0.1% to $1.2658, in addition to edging down

0.1% Monday.

In Germany, the DAX (DAX) was down 0.3%, sinking to 12,038.7. On

Monday it rose 0.5%.

France's CAC 40 retreated 0.4% to 5,315.8, handing over all of

Monday's 0.4% rise.

Italy's FTSE MIB slipped to 20,210.4, down 0.8% in addition to

the 0.1% fall Monday.

What's moving the markets?

Italian banks were stung by the latest from Brussels following

the European election results Sunday, where right-wing anti-Euro

party Lega Nord topped the polls with 34.3% of the vote. With a

clash looming among Italian deputy Prime Minister Matteo Salvini

and the European Council over budgetary restraint, the spread among

Italian and benchmark German 10-year government bonds shot to

2.88.

Bloomberg reported that

(https://www.bloomberg.com/news/articles/2019-05-27/u-s-not-ready-to-make-a-trade-deal-with-china-trump-says),

in a press conference during a state visit to Japan, U.S. President

Donald Trump described the current state of trade negotiations with

China saying: "They would like to make a deal. We're not ready to

make a deal." He added that U.S. tariffs on Chinese products could

go up "very substantially".

German and French economic data was a tale of two European

consumers. It was the best of times in France, where May's consumer

confidence data leapt ahead to 99 on the strength of President

Emmanuel Macron's tax cuts. In Germany, however, June consumer

sentiment came in at 10.1 points, lower than the 10.5 expected.

Which stocks are active?

The spike in Italian 10-year government bond yields, which

raises the cost for Italian banks, sent some of their shares

tumbling. UniCredit SpA (UCG.MI) declined 2.6%, Unione di Banche

Italiane SpA (UBI.MI) fell 2.6% and FinecoBank SpA (FBK.MI) dipped

3.6%.

A Goldman Sachs report on Rio Tinto PLC (RIO.LN) sent shares up

3.1%. Analysts upgraded the miner to a buy on expectations of

increased demand for iron ore, particularly after the Vale dam

disaster which hurt global production of the commodity.

NMC Health PLC (NMC.LN) shares shot up 3.9% as the company

upgraded its earnings forecast for 2019. The health-care provider

said it sees changes to accounting standards leading to higher

earnings before interest, taxes, amortization and depreciation of

between $665 million and $675 million.

AstraZeneca PLC (AZN.LN) shares were down 1.3%, after a report

in The Wall Street Journal

(https://www.wsj.com/articles/drug-giant-tries-new-tactic-to-fight-cancer-11558958400?mod=searchresults&page=1&pos=1)

indicated that the company's new cancer research chief wanted to

take the bold yet unorthodox approach of pursuing drugs targeting

early stages of the disease rather than later ones. The stock price

has been noticeably volatile in the past 12 months, but has been

broadly increasing.

(END) Dow Jones Newswires

May 28, 2019 06:17 ET (10:17 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

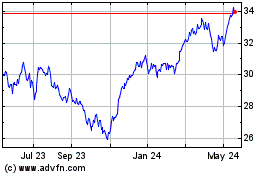

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

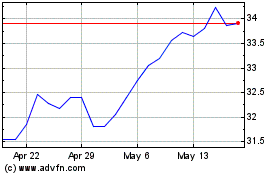

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024