Trump Media and Technology Group Corp. (Nasdaq: DJT) ("TMTG" or the

"Company"), operator of the social media platform Truth Social, the

video streaming service Truth+, and the financial services and

FinTech brand Truth.Fi, announced its financial results for the

full year ending on December 31, 2024. These results are included

in TMTG’s Annual Report on Form 10-K that will be filed with the

Securities and Exchange Commission (the "SEC") today.

TMTG closed 2024 with a strong balance sheet comprised of $776.8

million in cash and short-term investments, strongly positioning

the Company to advance its immediate goal of enhancing and

expanding all its platforms—Truth Social, Truth+, and Truth.Fi.

TMTG has achieved this result after launching its first product

less than three years ago, amid severe repression of free speech

across social media platforms, with the mission of opening up the

Internet and giving people their voices back. Now, the Company has

established a strong cash position to pursue further expansions and

acquisitions, has opened up new frontiers for an iconic brand and

has attracted approximately 650,000, largely retail, shareholders,

as of October 15, 2024.

TMTG began with the launch of the free speech social media

platform Truth Social, designed to provide an outlet for users,

including President Trump, who were being subject to onerous

political censorship on other platforms. In 2024, the Company

continued its consistent efforts to enhance and refine the

platform, including by introducing:

- live TV

- a personalized “For you” feed

- video ads on Truth Social apps

- an increased character count of

3,000 characters

- bookmarks

In 2024, the Company successfully rolled out the Truth+ video

streaming service. Featuring news, entertainment, faith-based

programming, and other family-friendly content, Truth+ is now

nearing completion of beta testing and transitioning to a full

launch. The introduction of Truth+ in 2024 entailed:

- creating a proprietary, multi-site

content delivery network that is designed to be uncancellable

- launching streaming on the Web and

through native apps for iOS, Android, and connected TVs

- offering an expanding streaming

catalogue of live TV and video on demand

- providing ultra-fast TV streaming

and cutting-edge features including live TV rewind with visual

thumbnails, catch-up TV for up to seven days, network DVR, and a

Spanish language interface option

Subsequent to 2024, TMTG announced the rollout of its financial

services and financial technology strategy, including the launch of

the Truth.Fi brand encompassing financial services and FinTech. To

introduce the new brand, the Company has:

- reached an agreement to obtain

secure payment processing capabilities to help monetize TMTG’s

platforms through subscription services on Truth+ and various forms

of e-commerce on Truth Social

- licensed the Truth.Fi brand to an

investment adviser who has commenced preparations to launch a set

of separately managed accounts (“SMAs”) in cooperation with Charles

Schwab, as well as a slate of exchange traded funds (“ETFs”) that

will reflect America First principles; in connection with these

efforts, TMTG has applied to trademark Truth.Fi Made in America

ETF, Truth.Fi Made in America SMA, Truth.Fi U.S. Energy

Independence ETF, Truth.Fi U.S. Energy Independence SMA, Truth.Fi

Bitcoin Plus ETF, and Truth.Fi Bitcoin Plus SMA.

“After going public and listing on NASDAQ less than a year ago,

TMTG developed quickly in 2024, and this year we aim to continue

growing all our platforms,” said TMTG CEO and Chairman Devin Nunes.

“We will continue to explore opportunities to partner, merge with,

and acquire other entities that are able to function effectively if

TMTG evolves into a holding company with subsidiaries

spanning several industries. Americans proved in 2024 that they’re

looking for an alternative to cancel culture—they want to conduct

their business and commerce free from debanking, political

retaliation, and obnoxious corporate messaging that violates their

values. TMTG aims to fill this demand and to expand throughout the

Patriot Economy, combining with companies that complement our

technology, brand and America First principles.”

For the full year of 2024, TMTG had cash used in operating

activities of $61.0 million, approximately half of which comprised

legal expenses including costs related to the Company’s March 2024

merger with a special purpose acquisition company. Partly as a

result of obstruction by the Biden-era Securities and Exchange

Commission, which turned the process into one of the longest SPAC

mergers in history, TMTG incurred significant legal expenses

related to its merger and has brought litigation seeking to recoup

its damages. Additionally, the company had non-cash losses, mostly

in the first quarter—including $107.4 million in stock-based

compensation expense and a further $225.9 million recorded as an

accounting loss due to changes in the fair value of derivative

liabilities.

The Company believes its balance sheet, having risen from $2.6

million in cash and short-term investments at the end of 2023 to

$776.8 million at the end of 2024, strongly positions TMTG for the

future relative to its current operating costs.

TMTG had $3.6 million in net sales for the year, in addition to

$11.6 million in net interest income, such revenue largely

resulting from incipient advertising initiatives and tests of other

monetization projects with various partners. In 2024 the Company

focused on building out its ecosystem, improving the Truth Social

platform, and expanding its range of services, such as constructing

its own content delivery network to create the Truth+ video

streaming platform. TMTG believes its robust and uncancellable

infrastructure, expanding range of services and recent agreement to

secure payment processing services will advance its monetization

initiatives and open new avenues for generating revenue in 2025 and

beyond.

Cautionary Statement About Forward-Looking

Statements

This press release includes forward-looking statements

regarding, among other things, the plans, strategies, and

prospects, both business and financial, of TMTG. We have based

these forward-looking statements on our current expectations and

projections about future events, including potential merger &

acquisition activity, the rollout of products and features, the

future plans, timing and potential success of the streaming

services and the launch and success of our financial services and

FinTech platform. Although we believe that our plans, intentions,

and expectations reflected in or suggested by these forward-looking

statements are reasonable, we cannot assure you that we will

achieve or realize these plans, intentions, or expectations.

Forward-looking statements are inherently subject to risks,

uncertainties, and assumptions. Generally, statements that are not

historical facts, including statements concerning possible or

assumed future actions, business strategies, events, or results of

operations, are forward-looking statements. These statements may be

preceded by, followed by, or include the words “believes,”

“estimates,” “expects,” “projects,” “forecasts,” “may,” “will,”

“should,” “seeks,” “plans,” “scheduled,” “anticipates,” “soon,”

“goal,” “intends,” or similar expressions. Forward-looking

statements are not guarantees of future performance, and involve

risks, uncertainties and assumptions that may cause our actual

results to differ materially from the expectations that we describe

in our forward-looking statements. There may be events in the

future that we are not accurately able to predict, or over which we

have no control.

About TMTG

The mission of TMTG is to end Big Tech’s assault on free speech

by opening up the Internet and giving people their voices back.

TMTG operates Truth Social, a social media platform established as

a safe harbor for free expression amid increasingly harsh

censorship by Big Tech corporations, as well as Truth+, a TV

streaming platform focusing on family-friendly live TV channels and

on-demand content. TMTG is also launching Truth.Fi, a financial

services and FinTech brand incorporating America First investment

vehicles.

Investor Relations Contact

Shannon Devine (MZ Group | Managing Director - MZ North

America)

Email: shannon.devine@mzgroup.us

Media Contact

press@tmtgcorp.com

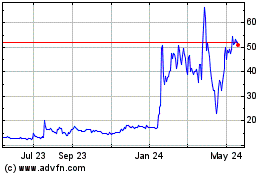

Trump Media and Technology (NASDAQ:DJT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Trump Media and Technology (NASDAQ:DJT)

Historical Stock Chart

From Feb 2024 to Feb 2025