Form 8-K/A date of report 09-30-24

true

0001172358

0001172358

2024-09-30

2024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2024

DORCHESTER MINERALS, L.P.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

|

000-50175

|

|

81-0551518

|

|

(State or other jurisdiction of

|

|

Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization

|

|

File Number

|

|

Identification No.)

|

3838 Oak Lawn, Suite 300, Dallas, Texas 75219

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (214) 559-0300

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Units Representing Limited Partnership Interest

|

DMLP

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On September 30, 2024, Dorchester Minerals, L.P. (the “Partnership”) filed a Current Report on Form 8-K (the “Original Form 8-K”) to report the execution and consummation of a Contribution and Exchange Agreement with West Texas Minerals LLC, a Delaware limited liability company, Carrollton Mineral Partners, LP, a Texas limited partnership, Carrollton Mineral Partners Fund II, LP, a Texas limited partnership, Carrollton Mineral Partners III, LP, a Texas limited partnership, Carrollton Mineral Partners III-B, LP, a Texas limited partnership, Carrollton Mineral Partners IV, LP, a Texas limited partnership, CMP Permian, LP, a Texas limited partnership, CMP Glasscock, LP, a Texas limited partnership, and Carrollton Royalty, LP, a Texas limited partnership (collectively, the “Contributors”), the terms and conditions of which provided for the Contributors to contribute certain interests in oil and gas properties, rights and related assets (the “Properties”) to the Partnership in exchange for 6,721,144 common units representing limited partnership interests in the Partnership, subject to adjustment pursuant to a customary title defect process.

This Amendment No. 1 on Form 8-K/A amends Item 9.01 of the Original Form 8-K solely to provide the financial information required by Items 9.01(a) and 9.01(b) of Form 8-K that was omitted from the Original Form 8-K. Except as provided herein, this amendment does not amend, modify or update the disclosures contained in the Original Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(a) Financial statements of businesses acquired.

The audited combined statement of revenues and direct operating expenses of the Contributors for the year ended December 31, 2023, and the unaudited combined statement of revenues and direct operating expenses of the Contributors for the six months ended June 30, 2024 are attached hereto as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein.

(b) Pro forma financial information.

The unaudited pro forma financial statements of the Partnership as of and for the six months ended June 30, 2024 and for the year ended December 31, 2023, giving effect to the Acquisition, are attached hereto as Exhibit 99.3 and incorporated by reference herein.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

DORCHESTER MINERALS, L.P.

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Date: October 16, 2024

|

By:

|

/s/ Bradley J. Ehrman

|

| |

|

Bradley J. Ehrman

|

| |

|

Chief Executive Officer

|

Exhibit 23.1

CONSENT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

We have issued our report dated October 16, 2024, with respect to the Combined Statement of Revenues and Direct Operating Expenses related to certain interests in oil and natural gas properties, rights and related assets owned by the Contributors (as defined in Note 1 to the Combined Statement of Revenues and Direct Operating Expenses) included in this Current Report of Dorchester Minerals, L.P. on Form 8-K/A. We consent to the incorporation by reference of said report in the Registration Statements of Dorchester Minerals, L.P. on Forms S-4 (File No. 333-231841 and File No. 333-256021).

/s/ GRANT THORNTON LLP

Dallas, Texas

October 16, 2024

Exhibit 99.1

Contributors (as defined in Note 1)

Combined Statement 2023

REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

General Partner and Unitholders

Dorchester Minerals, L.P.

Opinion

We have audited the Combined Statement of Revenues and Direct Operating Expenses related to certain interests in oil and natural gas properties, rights, and related assets owned by the Contributors (as defined in Note 1 to the Combined Statement of Revenues and Direct Operating Expenses) (collectively, the “Properties”) for the year ended December 31, 2023, and the related notes to the statement.

In our opinion, the accompanying combined statement presents fairly, in all material respects, the revenues and direct operating expenses of the Properties for the year ended December 31, 2023, in accordance with accounting principles generally accepted in the United States of America.

Basis for opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Statement section of our report. We are required to be independent of the Properties and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Emphasis of matter - basis of accounting

We draw attention to Note 1 to the Combined Statement of Revenues and Direct Operating Expenses, which describes that the accompanying Combined Statement of Revenues and Direct Operating Expenses was prepared for the purpose of a filing requirement of United States Securities and Exchange Commission and is not intended to be a complete presentation of the Properties’ revenues and expenses. As a result, the combined statement may not be suitable for another purpose. Our opinion is not modified with respect to this matter.

Responsibilities of management for the statement

Management is responsible for the preparation and fair presentation of the Combined Statement of Revenues and Direct Operating Expenses in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of the combined statement that are free from material misstatement, whether due to fraud or error.

Auditor's responsibilities for the audit of the statement

Our objectives are to obtain reasonable assurance about whether the Combined Statement of Revenues and Direct Expenses as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the combined statement.

In performing an audit in accordance with US GAAS, we:

| |

●

|

Exercise professional judgment and maintain professional skepticism throughout the audit.

|

| |

●

|

Identify and assess the risks of material misstatement of the Combined Statement of Revenues and Direct Operating Expenses, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the Combined Statement of Revenues and Direct Operating Expenses.

|

| |

●

|

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Properties’ internal control. Accordingly, no such opinion is expressed.

|

| |

●

|

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the Combined Statement of Revenues and Direct Expenses.

|

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

/s/ GRANT THORNTON LLP

Dallas, Texas

October 16, 2024

Contributors (as defined in Note 1)

Combined Statement of Revenues and Direct Operating Expenses

(Dollars in thousands)

| |

|

Year Ended

December 31,

2023

|

|

| |

|

|

|

|

|

Operating revenues

|

|

|

|

|

|

Royalties

|

|

$ |

26,393 |

|

|

Total operating revenues

|

|

|

26,393 |

|

| |

|

|

|

|

|

Direct operating expenses

|

|

|

|

|

|

Operating expenses

|

|

|

1,286 |

|

|

Production taxes

|

|

|

1,273 |

|

|

Total direct operating expenses

|

|

|

2,559 |

|

| |

|

|

|

|

|

Revenues in excess of direct operating expenses

|

|

$ |

23,834 |

|

The accompanying notes are an integral part of the Combined Statement of Revenues and Direct Operating Expenses.

Contributors (as defined in Note 1)

Notes to the Combined Statement of Revenues and Direct Operating Expenses

|

1.

|

Description of Transaction and Basis of Presentation

|

Description of Transaction

On September 12, 2024, West Texas Minerals LLC, a Delaware limited liability company, Carrollton Mineral Partners, LP, a Texas limited partnership (“CMP”), Carrollton Mineral Partners Fund II, LP, a Texas limited partnership, Carrollton Mineral Partners III, LP, a Texas limited partnership, Carrollton Mineral Partners III-B, LP, a Texas limited partnership, Carrollton Mineral Partners IV, LP, a Texas limited partnership, CMP Permian, LP, a Texas limited partnership, CMP Glasscock, LP, a Texas limited partnership, and Carrollton Royalty, LP, a Texas limited partnership (collectively, the “Contributors”) entered into a Contribution and Exchange Agreement (the “Contribution and Exchange Agreement”) with Dorchester Minerals, L.P. (the “Partnership”), the terms and conditions of which provided for the Contributors to contribute certain interests in oil and natural gas properties, rights and related assets (the “Properties”) to the Partnership in exchange for 6,721,144 common units representing limited partnership interests in the Partnership (“Common Units”), subject to adjustment pursuant to a customary title defect process. The Properties consist of mineral, royalty and overriding royalty interests in producing and non-producing oil and natural gas properties representing approximately 14,225 net royalty acres located in 14 counties across New Mexico and Texas.

Basis of Presentation

The accompanying Combined Statement of Revenues and Direct Operating Expenses, were prepared for the purpose of providing historical information to comply with the rules and regulations of the Securities and Exchange Commission (“SEC”) under Rule 3-05 of Regulation S-X and are not intended to be a complete presentation of the financial statements of the Contributors and are not necessarily indicative of the financial position or results of operations of the Contributors on a stand-alone basis, nor are they intended to provide an indication of how the Properties will perform in the future.

Revenue that is directly related to the Properties is reflected in the accompanying Combined Statement of Revenues and Direct Operating Expenses. The direct operating expenses of the Properties presented in this Combined Statement of Revenues and Direct Operating Expenses are transportation, ad valorem taxes and production taxes that are directly attributed to the Properties.

Principles of Combination

All Contributors are commonly managed. All intercompany transactions have been eliminated in combination.

4

Contributors (as defined in Note 1)

Notes to the Combined Statement of Revenues and Direct Operating Expenses

|

2.

|

Summary of Significant Accounting Policies

|

Use of Estimates

The preparation of the Combined Statement of Revenues and Direct Operating Expenses in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the amounts reported therein.

Significant estimates include accruals of uncollected revenues and unpaid expenses attributable to the Properties. The Company analyzes estimates and judgments based on historical experience and various other assumptions and information that are believed to be reasonable. Estimates and assumptions about future events and their effects cannot be predicted with certainty and, accordingly, these estimates may change as additional information is obtained, as new events occur, and as the Contributors’ environment changes. Actual results may differ from the estimates and assumptions used in the preparation of the Contributors’ Combined Statement of Revenues and Direct Operating Expenses.

Revenue Recognition

The pricing of oil and natural gas sales is primarily determined by supply and demand in the marketplace and can fluctuate considerably. As a royalty owner, the Contributors have no operational control over the volumes and method of sale of oil and natural gas produced and sold.

Revenues are recorded under the cash receipts approach as directly received from the remitters’ statement accompanying the revenue check. Since the revenue checks are generally received two to four months after the production month, the Contributors accrue for revenue earned but not received by estimating production volumes and product prices. Identified differences between accrued revenue estimates and actual revenue received historically have not been significant.

The Contributors do not record revenue for unsatisfied or partially unsatisfied performance obligations. The Contributors’ right to revenues from the Properties occurs at the time of production, at which point, payment is unconditional, and no remaining performance obligation exists for the Contributor. Accordingly, the Contributors’ revenue contracts do not generate contract assets or liabilities.

Direct Operating Expenses

Direct operating expenses are recognized when incurred and consist of direct expenses third party operators charge the Contributors’ revenue interests. The direct operating expenses include transportation, ad valorem and production taxes.

Concentration of Credit Risk

The Contributors principal exposure to credit risk results from receivables generated by the production activities of the Contributors operators. As a royalty owner, the Contributors have no control over the volumes or method of sale of oil and natural gas produced and sold from the Properties. The Contributors combined historical production has three operators which accounted for 23%, 16%, and 15% of total operating revenues for the year ended December 31, 2023.

5

Contributors (as defined in Note 1)

Notes to the Combined Statement of Revenues and Direct Operating Expenses

|

3.

|

Commitments and Contingencies

|

Contingencies

The Contributors are subject to various possible contingencies that arise primarily from interpretation of federal and state laws and regulations affecting the oil and natural gas industry. Although management believes that it has complied with the various laws and regulations, administrative rulings and interpretations thereof, adjustments could be required as new interpretations and regulations are issued. In addition, environmental matters are subject to regulation by various federal and state agencies.

The Contributors are currently not involved in any litigation arising in the ordinary course of business. The Contributors have an obligation to indemnify the Partnership for breach of certain representations and warranties made by the Contributors as of September 12, 2024 and September 30, 2024 with respect to the contributed properties, including with respect to certain unknown contingencies.

Risks and Uncertainties

The Contributors’ revenue, profitability and future growth are substantially dependent upon the prevailing and future prices for oil and natural gas, each of which depends on numerous factors beyond the Contributors’ control such as overall oil and natural gas production and inventories in relevant markets, economic conditions, the global political environment, regulatory developments and competition from other energy sources. Oil and natural gas prices historically have been volatile and may be subject to significant fluctuations in the future.

Management has evaluated subsequent events through October 16, 2024, the date the Combined Statement of Revenues and Direct Operating Expenses were available to be issued. No additional subsequent events were identified requiring additional recognition or disclosure in the Combined Statement of Revenues and Direct Operating Expenses.

6

Contributors (as defined in Note 1)

Supplemental Reserve Information (Unaudited)

The following unaudited supplemental reserve information summarizes the net proved reserves of oil and natural gas and the standardized measure thereof for the year ended December 31, 2023 attributable to the Contributors’ interest. All of the reserves are located in the United States. The following table sets forth certain information with respect to the reserves attributable to the Contributors’ interest for 2023. The reserve disclosures are based on Contributors historical reserve studies generally prepared in accordance with the guidelines established by the SEC.

In accordance with U.S. GAAP and Securities and Exchange Commission rules and regulations, the following information is presented with regard to the oil and natural gas reserves, which are proved, developed and located in the United States. These rules require inclusion as a supplement to the basic financial statements a standardized measure of discounted future net cash flows relating to proved oil and natural gas reserves. The standardized measure, in management's opinion, should be examined with caution. The basis for these disclosures are reserve studies which contain imprecise estimates of quantities and rates of production of reserves. Revision of prior year estimates can have a significant impact on the results. Changes in production costs may result in significant revisions to previous estimates of proved reserves and their future value. Therefore, the standardized measure is not necessarily a best estimate of the fair value of oil and natural gas properties or of future net cash flows.

Estimated Quantities of Oil and Natural Gas Reserves

The following table sets forth certain data pertaining to the Contributors proved, developed reserves of the Properties for the year ended on December 31, 2023:

|

Year Ended December 31, 2023

|

|

Oil (MBbl)

|

|

|

Gas (MMcf)

|

|

|

Beginning of year proved reserves

|

|

|

2,216 |

|

|

|

4,916 |

|

|

Revisions in previous estimates

|

|

|

1,258 |

|

|

|

2,208 |

|

|

Sales of reserves in place

|

|

|

(421 |

) |

|

|

(716 |

) |

| |

|

|

|

|

|

|

|

|

|

Total proved reserves, end of year

|

|

|

3,053 |

|

|

|

6,408 |

|

7

Contributors (as defined in Note 1)

Supplemental Reserve Information (Unaudited)

Standardized Measure of Discounted Future Net Cash Flows

The Standard Measure of Discounted Future Net Cash Flows (excluding income tax expense) relating to proved, developed oil and natural gas reserves is presented below:

|

(Dollars in thousands)

|

|

|

|

|

|

Year Ended December 31, 2023

|

|

Pretax Amount

|

|

|

Future estimated gross revenues

|

|

$ |

168,022 |

|

|

Future estimated production costs

|

|

|

(14,255 |

) |

|

Future estimated net revenues

|

|

|

153,767 |

|

|

10% annual discount for estimated timing of cash flows

|

|

|

(74,236 |

) |

| |

|

|

|

|

|

Standardized measure of discounted future net cash flows

|

|

$ |

79,531 |

|

Changes in Standardized Measures

The following table sets forth the changes in standardized measure of discounted future net cash flows relating to proved, developed oil and natural gas reserves for the periods indicated:

|

(Dollars in thousands)

|

|

December 31, 2023

|

|

|

Standardized measure, beginning of year

|

|

$ |

85,735 |

|

|

Sales of oil and natural gas produced, net of production costs

|

|

|

(23,834 |

) |

|

Net change in prices and production costs

|

|

|

(28,981 |

) |

|

Revisions of previous quantity estimates

|

|

|

36,028 |

|

|

Accretion of discount

|

|

|

8,573 |

|

|

Changes in production rate and other

|

|

|

2,010 |

|

| |

|

|

|

|

|

Standardized measure, end of year

|

|

$ |

79,531 |

|

Exhibit 99.2

Contributors (as defined in Note 1)

Combined Statement for the Six Months Ended June 30, 2024

Contributors (as defined in Note 1)

Unaudited Combined Statement of Revenues and Direct Operating Expenses

(Dollars in thousands)

| |

|

Six Months Ended

|

|

| |

|

June 30, 2024

|

|

| |

|

|

|

|

|

Operating revenues

|

|

|

|

|

|

Royalties

|

|

$ |

13,914 |

|

|

Total operating revenues

|

|

|

13,914 |

|

| |

|

|

|

|

|

Direct operating expenses

|

|

|

|

|

|

Operating expenses

|

|

|

704 |

|

|

Production taxes

|

|

|

675 |

|

|

Total direct operating expenses

|

|

|

1,379 |

|

| |

|

|

|

|

|

Revenues in excess of direct operating expenses

|

|

$ |

12,535 |

|

The accompanying notes are an integral part of the Unaudited Combined Statement of Revenue and Direct Operating Expenses.

Contributors (as defined in Note 1)

Notes to the Unaudited Combined Statement of Revenues and Direct Operating Expenses

|

1.

|

Description of Transaction and Basis of Presentation

|

Description of Transaction

On September 12, 2024, West Texas Minerals LLC, a Delaware limited liability company, Carrollton Mineral Partners, LP, a Texas limited partnership (“CMP”), Carrollton Mineral Partners Fund II, LP, a Texas limited partnership, Carrollton Mineral Partners III, LP, a Texas limited partnership, Carrollton Mineral Partners III-B, LP, a Texas limited partnership, Carrollton Mineral Partners IV, LP, a Texas limited partnership, CMP Permian, LP, a Texas limited partnership, CMP Glasscock, LP, a Texas limited partnership, and Carrollton Royalty, LP, a Texas limited partnership (collectively, the “Contributors”) entered into a Contribution and Exchange Agreement (the “Contribution and Exchange Agreement”) with Dorchester Minerals, L.P. (the “Partnership”), the terms and conditions of which provided for the Contributors to contribute certain interests in oil and natural gas properties, rights and related assets (the “Properties”) to the Partnership in exchange for 6,721,144 common units representing limited partnership interests in the Partnership (“Common Units”), subject to adjustment pursuant to a customary title defect process. The Properties consist of mineral, royalty and overriding royalty interests in producing and non-producing oil and natural gas properties representing approximately 14,225 net royalty acres located in 14 counties across New Mexico and Texas.

Basis of Presentation

The accompanying Unaudited Combined Statement of Revenues and Direct Operating Expenses, were prepared for the purpose of providing historical information to comply with the rules and regulations of the Securities and Exchange Commission (“SEC”) under Rule 3-05 of Regulation S-X and are not intended to be a complete presentation of the financial statements of the Contributors and are not necessarily indicative of the financial position or results of operations of the Contributors on a stand-alone basis, nor are they intended to provide an indication of how the Properties will perform in the future.

Revenue that is directly related to the Properties is reflected in the accompanying Unaudited Combined Statement of Revenues and Direct Operating Expenses. The direct operating expenses of the Properties presented in this Combined Statement of Revenues and Direct Operating Expenses are transportation, ad valorem taxes and production taxes that are directly attributed to the Properties.

Principles of Combination

All Contributors are commonly managed. Contributors have interests in various Properties that overlap with the interests of other Contributors All intercompany transactions have been eliminated in combination.

3

Contributors (as defined in Note 1)

Notes to the Unaudited Combined Statement of Revenues and Direct Operating Expenses

|

2.

|

Summary of Significant Accounting Policies

|

Use of Estimates

The preparation of the Unaudited Combined Statement of Revenues and Direct Operating Expenses in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the amounts reported therein.

Significant estimates include accruals of uncollected revenues and unpaid expenses attributable to the Properties. The Company analyzes estimates and judgments based on historical experience and various other assumptions and information that are believed to be reasonable. Estimates and assumptions about future events and their effects cannot be predicted with certainty and, accordingly, these estimates may change as additional information is obtained, as new events occur, and as the Contributors’ environment changes. Actual results may differ from the estimates and assumptions used in the preparation of the Contributors’ Unaudited Combined Statement of Revenues and Direct Operating Expenses.

Revenue Recognition

The pricing of oil and natural gas sales is primarily determined by supply and demand in the marketplace and can fluctuate considerably. As a royalty owner, the Contributors have no operational control over the volumes and method of sale of oil and natural gas produced and sold.

Revenues are recorded under the cash receipts approach as directly received from the remitters’ statement accompanying the revenue check. Since the revenue checks are generally received two to four months after the production month, the Contributors accrue for revenue earned but not received by estimating production volumes and product prices. Identified differences between accrued revenue estimates and actual revenue received historically have not been significant.

The Contributors do not record revenue for unsatisfied or partially unsatisfied performance obligations. The Contributors’ right to revenues from the Properties occurs at the time of production, at which point, payment is unconditional, and no remaining performance obligation exists for the Contributor. Accordingly, the Contributors’ revenue contracts do not generate contract assets or liabilities.

Direct Operating Expenses

Direct operating expenses are recognized when incurred and consist of direct expenses third party operators charge the Contributors’ revenue interests. The direct operating expenses include transportation, ad valorem and production taxes.

Concentration of Credit Risk

The Contributors principal exposure to credit risk results from receivables generated by the production activities of the Contributors operators. As a royalty owner, the Contributors have no control over the volumes or method of sale of oil and natural gas produced and sold from the Properties.

The Contributors’ historical production has two operators which accounted for 33% and 22% of the Contributors’ oil and natural gas properties total revenue for the six months ended June 30, 2024.

4

Contributors (as defined in Note 1)

Notes to the Unaudited Combined Statement of Revenues and Direct Operating Expenses

|

3.

|

Commitments and Contingencies

|

Contingencies

The Contributors are subject to various possible contingencies that arise primarily from interpretation of federal and state laws and regulations affecting the oil and natural gas industry. Although management believes that it has complied with the various laws and regulations, administrative rulings and interpretations thereof, adjustments could be required as new interpretations and regulations are issued. In addition, environmental matters are subject to regulation by various federal and state agencies.

The Contributors are currently not involved in any litigation arising in the ordinary course of business. The Contributors have an obligation to indemnify the Partnership for breach of certain representations and warranties made by the Contributors as of September 12, 2024 and September 30, 2024 with respect to the contributed properties, including with respect to certain unknown contingencies.

Risks and Uncertainties

The Contributors’ revenue, profitability and future growth are substantially dependent upon the prevailing and future prices for oil and natural gas, each of which depends on numerous factors beyond the Contributors’ control such as overall oil and natural gas production and inventories in relevant markets, economic conditions, the global political environment, regulatory developments and competition from other energy sources. Oil and natural gas prices historically have been volatile and may be subject to significant fluctuations in the future.

Management has evaluated subsequent events through October 16, 2024, the date the Combined Statement of Revenues and Direct Operating Expenses were available to be issued. No additional subsequent events were identified requiring additional recognition or disclosure in the Combined Statement of Revenues and Direct Operating Expenses.

Exhibit 99.3

DORCHESTER MINERALS, L.P.

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

On September 30, 2024, (the “Closing Date”), Dorchester Minerals, L.P., a Delaware limited partnership (the “Partnership”), completed the previously announced acquisition of mineral, royalty and overriding royalty interests in producing and non-producing oil and natural gas properties (the “Acquisition”), pursuant to the Contribution and Exchange Agreement (the “Contribution and Exchange Agreement”) entered into on September 12, 2024, with West Texas Minerals LLC, a Delaware limited liability company, Carrollton Mineral Partners, LP, a Texas limited partnership (“CMP”), Carrollton Mineral Partners Fund II, LP, a Texas limited partnership, Carrollton Mineral Partners III, LP, a Texas limited partnership, Carrollton Mineral Partners III-B, LP, a Texas limited partnership, Carrollton Mineral Partners IV, LP, a Texas limited partnership, CMP Permian, LP, a Texas limited partnership, CMP Glasscock, LP, a Texas limited partnership, and Carrollton Royalty, LP, a Texas limited partnership (collectively, the “Contributors”), the terms and conditions of which provided for the Contributors to contribute certain interests in oil and natural gas properties, rights and related assets (the “Properties”) to the Partnership in exchange for 6,721,144 common units representing limited partnership interests in the Partnership (“Common Units”), subject to adjustment pursuant to a customary title defect process. The Properties consist of mineral, royalty and overriding royalty interests in producing and non-producing oil and natural gas properties representing approximately 14,225 net mineral acres located in 14 counties across New Mexico and Texas. The Contribution and Exchange Agreement includes customary representations, warranties, covenants and indemnities of the Partnership and the Contributors and also provided for the Contributors to pay the Partnership at closing an amount of cash equal to the aggregate amount of cash receipts from or attributed to the Properties that were received by the Contributors during the period beginning July 1, 2024 and ending September 30, 2024 (“Contributed Cash”).

The following unaudited pro forma condensed combined financial statements present the Partnership’s unaudited proforma balance sheet as of June 30, 2024, unaudited pro forma statement of operations for the year ended December 31, 2023, and the unaudited pro forma statement of operations for the six months ended June 30, 2024. The unaudited pro forma condensed combined statements of operations for the year ended December 31, 2023 and for the six months ended June 30, 2024 are presented as if the Acquisition was completed as of January 1, 2023. The unaudited pro forma Condensed Combined Balance Sheet as of June 30, 2024 gives effect to the Acquisition as if it was completed on June 30, 2024.

The assumptions and estimates underlying the unaudited adjustments to the pro forma condensed combined financial statements are described in the accompanying notes, which should be read together with the pro forma condensed combined financial statements. The pro forma adjustments related to the Acquisition are based on preliminary estimates, accounting judgments and currently available information and assumptions that management believes are reasonable and are subject to change. Accordingly, these pro forma adjustments are preliminary and have been made solely for the purpose of providing these pro forma condensed combined financial statements. Differences between these preliminary estimates and the final fair value of assets acquired may occur and these differences could be material. The differences, if any, could have a material impact on the accompanying pro forma condensed combined financial statements and the Partnership’s future results of operations. The unaudited pro forma condensed combined financial statements should be read together with the Partnership’s historical consolidated financial statements, which are included in the Partnership’s latest annual report on Form 10-K, the Partnership’s latest quarterly report on 10-Q and the Combined Statement of Revenues and Direct Operating Expenses of the Contributors presented in exhibit 99.1 to this Form 8-K/A.

The unaudited pro forma condensed combined financial statements are presented for illustrative purposes only, in accordance with Article 11 of Regulation S-X. The pro forma financial information is not necessarily indicative of the results of operations that would have been realized had the Acquisition actually been completed on the dates indicated, nor are they indicative of the Partnership’s future financial position or operating results.

Dorchester Minerals, L.P.

Unaudited Pro Forma Condensed Combined Balance Sheet

As of June 30, 2024

(In thousands)

| |

|

Partnership

Historical

|

|

|

Pro Forma

Adjustments

|

|

|

Pro Forma

Combined

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

35,161 |

|

|

$ |

6,682 |

(a)

|

|

$ |

41,843 |

|

|

Trade and other receivables

|

|

|

16,325 |

|

|

|

2,301 |

(a)

|

|

|

18,626 |

|

|

Net profits interest receivable - related party

|

|

|

5,911 |

|

|

|

- |

|

|

|

5,911 |

|

|

Total current assets

|

|

|

57,397 |

|

|

|

8,983 |

|

|

|

66,380 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil and natural gas properties (full cost method)

|

|

|

519,010 |

|

|

|

193,659 |

(a)

|

|

|

712,669 |

|

|

Accumulated full cost depletion

|

|

|

(401,479 |

) |

|

|

- |

|

|

|

(401,479 |

) |

|

Total

|

|

|

117,531 |

|

|

|

193,659 |

|

|

|

311,190 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold improvements

|

|

|

989 |

|

|

|

- |

|

|

|

989 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated amortization

|

|

|

(560 |

) |

|

|

- |

|

|

|

(560 |

) |

|

Total

|

|

|

429 |

|

|

|

|

|

|

|

429 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating lease right-of-use asset

|

|

|

674 |

|

|

|

- |

|

|

|

674 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

176,031 |

|

|

$ |

202,642 |

|

|

$ |

378,673 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND PARTNERSHIP CAPITAL

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and other current liabilities

|

|

$ |

4,310 |

|

|

$ |

- |

|

|

$ |

4,310 |

|

|

Operating lease liability

|

|

|

268 |

|

|

|

- |

|

|

|

268 |

|

|

Total current liabilities

|

|

|

4,578 |

|

|

|

|

|

|

|

4,578 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating lease liability

|

|

|

907 |

|

|

|

- |

|

|

|

907 |

|

|

Total liabilities

|

|

|

5,485 |

|

|

|

|

|

|

|

5,485 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Partnership capital:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Partner

|

|

|

(1,065 |

) |

|

|

- |

|

|

|

(1,065 |

) |

|

Unitholders

|

|

|

171,611 |

|

|

|

202,642 |

(a)

|

|

|

374,253 |

|

|

Total partnership capital

|

|

|

170,546 |

|

|

|

202,642 |

|

|

|

373,188 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and partnership capital

|

|

$ |

176,031 |

|

|

$ |

202,642 |

|

|

$ |

378,673 |

|

See accompanying notes to the unaudited pro forma condensed combined financial statements.

Dorchester Minerals, L.P.

Unaudited Pro Forma Condensed Combined Statement of Operations

For the Six Months Ended June 30, 2024

(In thousands, except per unit amounts)

| |

|

Partnership

Historical

|

|

|

Contributors

Historical

|

|

|

Pro Forma

Adjustments

|

|

|

Pro Forma

Combined

|

|

|

Operating revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalties

|

|

$ |

56,513 |

|

|

$ |

13,914 |

|

|

$ |

- |

|

|

$ |

70,427 |

|

|

Net profits interest

|

|

|

10,842 |

|

|

|

- |

|

|

|

- |

|

|

|

10,842 |

|

|

Lease bonus and other

|

|

|

984 |

|

|

|

- |

|

|

|

- |

|

|

|

984 |

|

|

Total operating revenues

|

|

|

68,339 |

|

|

|

13,914 |

|

|

|

- |

|

|

|

82,253 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating, including production taxes

|

|

|

6,138 |

|

|

|

1,379 |

|

|

|

- |

|

|

|

7,517 |

|

|

Depreciation, depletion and amortization

|

|

|

14,586 |

|

|

|

- |

|

|

|

16,290 |

(b)

|

|

|

30,876 |

|

|

General and administrative

|

|

|

5,820 |

|

|

|

- |

|

|

|

- |

|

|

|

5,820 |

|

|

Total costs and expenses

|

|

|

26,544 |

|

|

|

1,379 |

|

|

|

16,290 |

|

|

|

44,213 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

41,795 |

|

|

$ |

12,535 |

|

|

$ |

(16,290 |

) |

|

$ |

38,040 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allocation of net income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Partner

|

|

$ |

1,431 |

|

|

|

|

|

|

$ |

(150 |

) (c)

|

|

$ |

1,281 |

|

|

Unitholders

|

|

$ |

40,364 |

|

|

|

|

|

|

$ |

(3,605 |

) (c)

|

|

$ |

36,759 |

|

|

Net income per common unit (basic and diluted)

|

|

$ |

1.01 |

|

|

|

|

|

|

|

|

|

|

$ |

0.79 |

|

|

Weighted average basic and diluted common units outstanding

|

|

|

39,847 |

|

|

|

|

|

|

|

6,721 |

(a)

|

|

|

46,568 |

|

See accompanying notes to the unaudited pro forma condensed combined financial statements.

Dorchester Minerals, L.P.

Unaudited Pro Forma Condensed Combined Statement of Operations

For the Year Ended December 31, 2023

(In thousands, except per unit amounts)

| |

|

Partnership

Historical

|

|

|

Contributors

Historical

|

|

|

Pro Forma

Adjustments

|

|

|

Pro Forma Combined

|

|

|

Operating revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalties

|

|

$ |

114,531 |

|

|

$ |

26,393 |

|

|

$ |

- |

|

|

$ |

140,924 |

|

|

Net profits interest

|

|

|

34,338 |

|

|

|

- |

|

|

|

- |

|

|

|

34,338 |

|

|

Lease bonus

|

|

|

12,668 |

|

|

|

- |

|

|

|

- |

|

|

|

12,668 |

|

|

Other

|

|

|

2,262 |

|

|

|

- |

|

|

|

- |

|

|

|

2,262 |

|

|

Total operating revenues

|

|

|

163,799 |

|

|

|

26,393 |

|

|

|

- |

|

|

|

190,192 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production taxes

|

|

|

5,776 |

|

|

|

1,286 |

|

|

|

- |

|

|

|

7,062 |

|

|

Operating expenses

|

|

|

6,435 |

|

|

|

1,273 |

|

|

|

- |

|

|

|

7,708 |

|

|

Depreciation, depletion and amortization

|

|

|

26,307 |

|

|

|

- |

|

|

|

35,421 |

(b)

|

|

|

61,728 |

|

|

General and administrative

|

|

|

11,164 |

|

|

|

- |

|

|

|

- |

|

|

|

11,164 |

|

|

Total costs and expenses

|

|

|

49,682 |

|

|

|

2,559 |

|

|

|

35,421 |

|

|

|

87,662 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

114,117 |

|

|

$ |

23,834 |

|

|

$ |

(35,421 |

) |

|

$ |

102,530 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allocation of net income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Partner

|

|

$ |

3,728 |

|

|

|

|

|

|

$ |

(463 |

) (c)

|

|

$ |

3,265 |

|

|

Unitholders

|

|

$ |

110,389 |

|

|

|

|

|

|

$ |

(11,124 |

) (c)

|

|

$ |

99,265 |

|

|

Net income per common unit (basic and diluted)

|

|

$ |

2.85 |

|

|

|

|

|

|

|

|

|

|

$ |

2.18 |

|

|

Weighted average basic and diluted common units outstanding

|

|

|

38,783 |

|

|

|

|

|

|

|

6,721 |

(a)

|

|

|

45,504 |

|

See accompanying notes to the unaudited pro forma condensed combined financial statements.

Dorchester Minerals, L.P.

Notes to the Unaudited Pro Forma Condensed Combined Financial Statements

1. Basis of Presentation

The unaudited pro forma condensed combined financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and pursuant to the rules and regulations of SEC Regulation S-X, and present the pro forma financial position and results of operations of the Partnership after giving effect to the Acquisition.

The pro forma condensed combined balance sheet as of June 30, 2024 assumes that the Acquisition occurred on June 30, 2024. The pro forma condensed combined statement of operations for the six months ended June 30, 2024 and the year ended December 31, 2023 give pro forma effect to the Acquisition as if the Acquisition had occurred on January 1, 2023, the beginning of the earliest period presented.

The pro forma condensed combined financial statements are not necessarily indicative of what the actual results of operations and financial position would have been had the transaction taken place on the dates indicated, nor are they indicative of the future consolidated results of operations or financial position of the Partnership following the transaction.

The pro forma basic and diluted earnings per share amounts presented in the unaudited pro forma Condensed Combined Statement of Operations are based on the weighted average number of the Common Units outstanding, assuming the Acquisition occurred at the beginning of the earliest period presented.

The pro forma adjustments related to the purchase price allocation of the Acquisition are preliminary and are subject to revisions as additional information becomes available. Revisions to the preliminary purchase price allocation of the assets acquired may have a significant impact on the pro forma amounts. The pro forma adjustments related to the Acquisition reflect the fair values of the assets acquired as of the Closing Date. The pro forma adjustments do not necessarily reflect the fair values that would have been recorded if the acquisition had occurred on June 30, 2024.

2. Consideration and Cost of Acquisition Allocation

The Partnership has performed a preliminary valuation analysis of the fair value of the oil and natural gas properties acquired. Using the total consideration for the Acquisition, the Partnership has estimated the allocation of the cost of the Acquisition to such assets. The Partnership is accounting for the Acquisition as an asset acquisition, and thus, all transaction costs associated with the Acquisition were capitalized in accordance with U.S. GAAP. The following table summarizes the allocation of the preliminary cost of the Acquisition as of the Closing Date:

|

(Dollars in thousands)

|

|

Estimated

Consideration

|

|

| |

|

|

|

|

|

Fair value of Common Units issued

|

|

$ |

202,642 |

|

|

Purchase price adjustments

|

|

|

(10,005 |

) |

|

Transaction costs

|

|

|

1,022 |

|

| |

|

|

|

|

|

Total purchase price

|

|

$ |

193,659 |

|

|

(Dollars in thousands)

|

|

Cost of

Acquisition

Allocation

|

|

| |

|

|

|

|

|

Oil and natural gas properties

|

|

$ |

193,659 |

|

Dorchester Minerals, L.P.

Notes to the Unaudited Pro Forma Condensed Combined Financial Statements

3. Pro Forma Adjustments

The pro forma adjustments are based on our preliminary estimates and assumptions that are subject to change. The following adjustments have been reflected in the unaudited pro forma condensed combined financial statements:

| |

(a)

|

Represents the consideration transferred and the preliminary allocation of the cost of the Acquisition. The cost of the Acquisition consisted of the 6,721,144 Common Units issued to the Contributors valued at $202.6 million; less estimated net final settlement cash receipts of $10.0 million, including Contributed Cash of $7.7 million; plus estimated transaction costs of $1.0 million.

|

| |

(b)

|

Represents the increase in depletion expense computed on a unit of production basis following the preliminary allocation of the cost of the Acquisition to oil and natural gas properties, as if the Acquisition was consummated on January 1, 2023.

|

| |

(c)

|

Reflects the impact on the allocation of net income attributable to the General Partner and Common Unitholders as a result of the Condensed Combined Statement of Operations of the Acquisition.

|

4. Supplemental Pro Forma Combined Oil and Natural Gas Reserves Information

The following unaudited supplemental pro forma oil and natural gas reserve tables present how the combined oil and natural gas reserves and standardized measure information of the Partnership and the Acquisition may have appeared had the Acquisition occurred on January 1, 2023. The supplemental pro forma combined oil and natural gas reserves and standardized measure information are for illustrative purposes only. Numerous uncertainties are inherent in estimating quantities and values of proved reserves including future rates of production, exploration and development expenditures, commodity prices, and service costs which may affect the reserve volumes attributable to the Properties and the standardized measure of discounted future net cash flows.

The following tables provide a summary of the changes in estimated proved, developed reserves for the year ended December 31, 2023, as well as pro forma proved, developed reserves as of the beginning and end of the year, giving effect to the acquisitions as if it had occurred on January 1, 2023. The pro forma standardized measure does not include future income taxes attributable to the Acquisition as both entities are considered pass-through entities for tax purposes.

6

Dorchester Minerals, L.P.

Notes to the Unaudited Pro Forma Condensed Combined Financial Statements

Estimated Pro Forma Combined Quantities of Proved, Developed Reserves

| |

|

Partnership Historical

|

|

| |

|

Oil

(mbbls)

|

|

|

Natural Gas

(mmcf)

|

|

|

Estimated quantity at December 31, 2022

|

|

|

8,920 |

|

|

|

39,153 |

|

|

Revisions in previous estimates

|

|

|

1,283 |

|

|

|

839 |

|

|

Purchase of reserves in place

|

|

|

374 |

|

|

|

743 |

|

|

Production

|

|

|

(2,259 |

) |

|

|

(7,384 |

) |

|

Estimated quantity at December 31, 2023

|

|

|

8,318 |

|

|

|

33,351 |

|

| |

|

Contributors Historical

|

|

| |

|

Oil

(mbbls)

|

|

|

Natural Gas

(mmcf)

|

|

|

Estimated quantity at December 31, 2022

|

|

|

2,216 |

|

|

|

4,916 |

|

|

Revisions in previous estimates

|

|

|

1,258 |

|

|

|

2,208 |

|

|

Production

|

|

|

(421 |

) |

|

|

(716 |

) |

|

Estimated quantity at December 31, 2023

|

|

|

3,053 |

|

|

|

6,408 |

|

| |

|

Pro Forma Combined

|

|

| |

|

Oil

(mbbls)

|

|

|

Natural Gas

(mmcf)

|

|

|

Estimated quantity at December 31, 2022

|

|

|

11,136 |

|

|

|

44,069 |

|

|

Revisions in previous estimates

|

|

|

2,541 |

|

|

|

3,047 |

|

|

Purchase of reserves in place

|

|

|

374 |

|

|

|

743 |

|

|

Production

|

|

|

(2,680 |

) |

|

|

(8,100 |

) |

|

Estimated quantity at December 31, 2023

|

|

|

11,371 |

|

|

|

39,759 |

|

7

Dorchester Minerals, L.P.

Notes to the Unaudited Pro Forma Condensed Combined Financial Statements

Pro Forma Combined Standardized Measure of Discounted Future Net Cash Flows of Proved, Developed Reserves

(In thousands)

| |

|

As of December 31, 2023

|

|

| |

|

Partnership

Historical

|

|

|

Contributors

Historical

|

|

|

Combined

Pro forma

|

|

|

Future estimated gross revenues

|

|

$ |

559,865 |

|

|

$ |

168,022 |

|

|

$ |

727,887 |

|

|

Future estimated production costs

|

|

|

(35,026 |

) |

|

|

(14,255 |

) |

|

|

(49,281 |

) |

|

Future estimated net revenues

|

|

|

524,839 |

|

|

|

153,767 |

|

|

|

678,606 |

|

|

10% annual discount for estimated timing of cash flows

|

|

|

(252,761 |

) |

|

|

(74,236 |

) |

|

|

(326,997 |

) |

|

Standardized measure of discounted future estimated net cash flows

|

|

$ |

272,078 |

|

|

$ |

79,531 |

|

|

$ |

351,609 |

|

Pro Forma Combined Changes in the Standardized Measure of Discounted Future Net Cash Flows of Proved, Developed Reserves

(In thousands)

| |

|

Year Ended December 31, 2023

|

|

| |

|

Partnership

Historical

|

|

|

Contributors

Historical

|

|

|

Combined

Pro forma

|

|

|

Standardized measure, beginning of year

|

|

$ |

419,153 |

|

|

$ |

85,735 |

|

|

$ |

504,888 |

|

|

Sales of oil and natural gas produced, net of production costs

|

|

|

(137,015 |

) |

|

|

(23,834 |

) |

|

|

(160,849 |

) |

|

Net change in prices and production costs

|

|

|

(122,884 |

) |

|

|

(28,981 |

) |

|

|

(151,865 |

) |

|

Net change due to purchases of minerals in place

|

|

|

9,813 |

|

|

|

- |

|

|

|

9,813 |

|

|

Revisions of previous quantity estimates

|

|

|

54,220 |

|

|

|

36,028 |

|

|

|

90,248 |

|

|

Accretion of discount

|

|

|

41,915 |

|

|

|

8,573 |

|

|

|

50,488 |

|

|

Change in production rate and other

|

|

|

6,876 |

|

|

|

2,010 |

|

|

|

8,886 |

|

|

Standardized measure, end of year

|

|

$ |

272,078 |

|

|

$ |

79,531 |

|

|

$ |

351,609 |

|

v3.24.3

Document And Entity Information

|

Sep. 30, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

DORCHESTER MINERALS, L.P.

|

| Document, Type |

8-K/A

|

| Document, Period End Date |

Sep. 30, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-50175

|

| Entity, Tax Identification Number |

81-0551518

|

| Entity, Address, Address Line One |

3838 Oak Lawn

|

| Entity, Address, Address Line Two |

Suite 300

|

| Entity, Address, City or Town |

Dallas

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

75219

|

| City Area Code |

214

|

| Local Phone Number |

559-0300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Units Representing Limited Partnership Interest

|

| Trading Symbol |

DMLP

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Description |

Form 8-K/A date of report 09-30-24

|

| Amendment Flag |

true

|

| Entity, Central Index Key |

0001172358

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

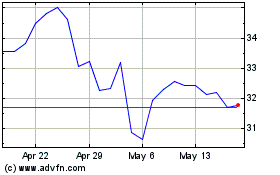

Dorchester Minerals (NASDAQ:DMLP)

Historical Stock Chart

From Nov 2024 to Dec 2024