UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. _)*

Dorchester

Minerals, L.P.

(Name of Issuer)

Common Units

Representing Limited Partnership Interest

(Title of Class of Securities)

25820R105

(CUSIP Number)

John R. Howard, Jr.

5949 Sherry Lane, Suite 1850

Dallas, Texas 75225

Tel: (212) 269-1056

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September

30, 2024

(Date of Event Which Requires

Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note.

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

Carrollton Mineral Partners, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

WC |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

681,113 |

| |

8 |

|

SHARED

VOTING POWER

-0- |

| |

9 |

|

SOLE

DISPOSITIVE POWER

681,113 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-0- |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

681,113 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.44% (1) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Based

on 47,339,756 common units representing limited partnership interests (“Common Units”)

of Dorchester Minerals, L.P. (the “Partnership”) outstanding as of October 31,

2024 as reported in the Partnership’s Quarterly Report on Form 10-Q for the quarterly

period ended September 30, 2024, filed with the Securities and Exchange Commission (the “SEC”)

on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

Carrollton Mineral Partners Fund II, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

WC |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

700,913 |

| |

8 |

|

SHARED

VOTING POWER

-0- |

| |

9 |

|

SOLE

DISPOSITIVE POWER

700,913 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-0- |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

700,913 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.48% (1) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

Carrollton Mineral Partners III, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

WC |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

356,996 |

| |

8 |

|

SHARED

VOTING POWER

-0- |

| |

9 |

|

SOLE

DISPOSITIVE POWER

356,996 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-0- |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

356,996 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.75% (1) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

Carrollton Mineral Partners III-B, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

WC |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

90,963 |

| |

8 |

|

SHARED

VOTING POWER

-0- |

| |

9 |

|

SOLE

DISPOSITIVE POWER

90,963 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-0- |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

90,963 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.19% (1) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

Carrollton Mineral Partners IV, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

WC |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

840,565 |

| |

8 |

|

SHARED

VOTING POWER

-0- |

| |

9 |

|

SOLE

DISPOSITIVE POWER

840,565 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-0- |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

840,565 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.78% (1) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

CMP Permian, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

WC |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

320,324 |

| |

8 |

|

SHARED

VOTING POWER

-0- |

| |

9 |

|

SOLE

DISPOSITIVE POWER

320,324 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-0- |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

320,324 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.68% (1) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

CMP Glasscock, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

WC |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

220,517 |

| |

8 |

|

SHARED

VOTING POWER

-0- |

| |

9 |

|

SOLE

DISPOSITIVE POWER

220,517 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-0- |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

220,517 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.47% (1) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

Carrollton Mineral Partners GP, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

-0- |

| |

8 |

|

SHARED

VOTING POWER

681,113 (1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED

DISPOSITIVE POWER

681,113 (1) |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

681,113 (1) |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.44% (2) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Carrollton Mineral Partners,

LP is a direct beneficial owner of 681,113 Common Units of the Partnership. As the sole general

partner of Carrollton Mineral Partners, LP, Carrollton Mineral Partners GP, LP may be deemed

to have shared and/or dispositive power with respect to such units. |

| (2) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

Carrollton Mineral Partners II GP, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

-0- |

| |

8 |

|

SHARED

VOTING POWER

700,913 (1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED

DISPOSITIVE POWER

700,913 (1) |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

700,913 (1) |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.48% (2) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Carrollton Mineral Partners

Fund II, LP is a direct beneficial owner of 700,913 Common Units of the Partnership. As the

sole general partner of Carrollton Mineral Partners Fund II, LP, Carrollton Mineral Partners

II GP, LP may be deemed to have shared and/or dispositive power with respect to such Common

Units. |

| (2) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

Carrollton Mineral Partners III GP, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

-0- |

| |

8 |

|

SHARED

VOTING POWER

356,996 (1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED

DISPOSITIVE POWER

356,996 (1) |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

356,996 (1) |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.75% (2) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Carrollton Mineral Partners

III, LP is a direct beneficial owner of 356,996 Common Units of the Partnership. As the sole

general partner of Carrollton Mineral Partners III, LP, Carrollton Mineral Partners III GP,

LP may be deemed to have shared and/or dispositive power with respect to such Common Units. |

| (2) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

Carrollton Mineral Partners III-B GP, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

-0- |

| |

8 |

|

SHARED

VOTING POWER

90,963 (1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED

DISPOSITIVE POWER

90,963 (1) |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

90,963 (1) |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.19% (2) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Carrollton Mineral Partners

III-B, LP is a direct beneficial owner of 90,963 Common Units of the Partnership. As the

sole general partner of Carrollton Mineral Partners III-B, LP, Carrollton Mineral Partners

III-B GP, LP may be deemed to have shared and/or dispositive power with respect to such Common

Units. |

| (2) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

Carrollton Mineral Partners IV GP, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

-0- |

| |

8 |

|

SHARED

VOTING POWER

840,565 (1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED

DISPOSITIVE POWER

840,565 (1) |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

840,565 (1) |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.78% (2) |

| 14 |

|

TYPE

OF REPORTING PERSON

PN |

| (1) | Carrollton Mineral Partners

IV, LP is a direct beneficial owner of 840,565 Common Units of the Partnership. As the sole

general partner of Carrollton Mineral Partners IV, LP, Carrollton Mineral Partners IV GP,

LP may be deemed to have shared and/or dispositive power with respect to such Common Units. |

| (2) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

Carrollton Land Company, LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

-0- |

| |

8 |

|

SHARED

VOTING POWER

540,841 (1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED

DISPOSITIVE POWER

540,841 (1) |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

540,841 (1) |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.14% (2) |

| 14 |

|

TYPE

OF REPORTING PERSON

OO |

| (1) | CMP Permian, LP is a

direct beneficial owner of 320,324 Common Units of the Partnership and CMP Glasscock, LP

is a direct beneficial owner of 220,517 Common Units of the Partnership. As the sole general

partner of CMP Permian, LP and CMP Glasscock, LP, Carrollton Land Company, LLC may be deemed

to have shared and/or dispositive power with respect to such Common Units. |

| (2) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

CMP Energy, LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

-0- |

| |

8 |

|

SHARED

VOTING POWER

681,113 (1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED

DISPOSITIVE POWER

681,113 (1) |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

681,113 (1) |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.44% (2) |

| 14 |

|

TYPE

OF REPORTING PERSON

OO |

| (1) | Carrollton Mineral Partners,

LP is a direct beneficial owner of 681,113 Common Units of the Partnership. As the sole general

partner of Carrollton Mineral Partners GP, LP, the sole general partner of Carrollton Mineral

Partners, LP, CMP Energy, LLC may be deemed to have shared and/or dispositive power with

respect to such Common Units. |

| (2) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

CMP Energy II, LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

-0- |

| |

8 |

|

SHARED

VOTING POWER

700,913 (1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED

DISPOSITIVE POWER

700,913 (1) |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

700,913 (1) |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.48% (2) |

| 14 |

|

TYPE

OF REPORTING PERSON

OO |

| (1) | Carrollton Mineral Partners

Fund II, LP is a direct beneficial owner of 700,913 Common Units of the Partnership. As the

sole general partner of Carrollton Mineral Partners II GP, LP, the sole general partner of

Carrollton Mineral Partners Fund II, LP, CMP Energy II, LLC may be deemed to have shared

and/or dispositive power with respect to such Common Units. |

| | | |

| (2) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

CMP Energy III, LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

-0- |

| |

8 |

|

SHARED

VOTING POWER

447,959 (1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED

DISPOSITIVE POWER

447,959 (1) |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

447,959 (1) |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.95% (2) |

| 14 |

|

TYPE

OF REPORTING PERSON

OO |

| (1) | Carrollton Mineral Partners

III, LP is a direct beneficial owner of 356,996 Common Units of the Partnership and Carrollton

Mineral Partners III-B, LP is a direct beneficial owner of 90,963 Common Units of the Partnership.

As the sole general partner of Carrollton Mineral Partners III GP, LP, the sole general partner

of Carrollton Mineral Partners III, LP, and Carrollton Mineral Partners III-B GP, LP, the

sole general partner of Carrollton Mineral Partners III-B, LP, CMP Energy III, LLC may be

deemed to have shared and/or dispositive power with respect to such Common Units. |

| (2) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

CMP Energy IV, LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

-0- |

| |

8 |

|

SHARED

VOTING POWER

840,565 (1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED

DISPOSITIVE POWER

840,565 (1) |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

840,565 (1) |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.78% (2) |

| 14 |

|

TYPE

OF REPORTING PERSON

OO |

| (1) | Carrollton Mineral Partners

IV, LP is a direct beneficial owner of 840,565 Common Units of the Partnership. As the sole

general partner of Carrollton Mineral Partners IV GP, LP, the sole general partner of Carrollton

Mineral Partners IV, LP, CMP Energy IV, LLC may be deemed to have shared and/or dispositive

power with respect to such Common Units. |

| (2) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the SEC on October 31, 2024. |

CUSIP No. 25820R105

| 1

|

|

NAME

OF REPORTING PERSON

John R. Howard, Jr. |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨ (b)

x |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

TEXAS, UNITED STATES |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

0 |

| |

8 |

|

SHARED

VOTING POWER

3,211,391 (1) (2) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

3,211,391 (1) (2) |

| 11

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

3,211,391 (1) (2) |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.78% (3) |

| 14 |

|

TYPE

OF REPORTING PERSON

IN |

| (1) | Represents

(i) 681,113 Common Units of the Partnership held by Carrollton Mineral Partners, LP, (ii)

700,913 Common Units of the Partnership held by Carrollton Mineral Partners Fund II, LP,

(iii) 356,996 Common Units of the Partnership held by Carrollton Mineral Partners III, LP,

(iv) 90,963 Common Units of the Partnership held by Carrollton Mineral Partners III-B, LP,

(v) 840,565 Common Units of the Partnership held by Carrollton Mineral Partners IV, LP, (vi)

320,324 Common Units of the Partnership held by CMP Permian, LP and (vii) 220,517 Common

Units of the Partnership held by CMP Glasscock, LP. |

| (2) | As

sole manager of CMP Energy, LLC, CMP Energy II, LLC, CMP Energy III, LLC, CMP Energy IV,

LLC and Carrollton Land Company, LLC, John R. Howard, Jr. may be deemed to have shared voting

and/or dispositive power with respect to such Common Units held by Carrollton Mineral Partners,

LP, Carrollton Mineral Partners Fund II, LP, Carrollton Mineral Partners III, LP, Carrollton

Mineral Partners III-B, LP, Carrollton Mineral Partners IV, LP, CMP Permian, LP and CMP Glasscock,

LP. |

| (3) | Based on 47,339,756 Common

Units of the Partnership outstanding as of October 31, 2024 as reported in the Partnership’s

Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2024, filed with

the SEC on October 31, 2024. |

| Item 1. |

Security and Issuer. |

This

Schedule 13D relates to common units representing limited partnership interests (“Common Units”), of Dorchester Minerals,

L.P., a Delaware limited partnership (the “Partnership”). The principal executive offices of the Partnership are located

at 3838 Oak Lawn Avenue, Suite 300, Dallas, Texas 75219.

| Item 2. |

Identity and Background. |

(a) This Schedule 13D is

filed jointly by:

| |

(i) |

Carrollton Mineral Partners, LP, a Texas limited partnership

(“CMP”); |

| |

(ii) |

Carrollton Mineral Partners Fund II, LP, a Texas limited

partnership (“CMPII”); |

| |

(iii) |

Carrollton Mineral Partners III, LP, a Texas limited

partnership (“CMPIII”); |

| |

(iv) |

Carrollton Mineral Partners III-B, LP, a Texas limited

partnership (“CMPIIIB”); |

| |

(v) |

Carrollton Mineral Partners IV, LP, a Texas limited

partnership (“CMPIV”); |

| |

(vi) |

CMP Permian, LP, a Texas limited partnership (“CMPP”); |

| |

(vii) |

CMP Glasscock, LP, a Texas limited partnership (“CMPG”); |

| |

(viii) |

Carrollton Mineral Partners GP, LP, a Texas limited partnership (“CMP GP”); |

| |

(ix) |

Carrollton Mineral Partners II GP, LP, a Texas limited partnership (“CMPII GP”); |

| |

(x) |

Carrollton Mineral Partners III GP, LP, a Texas limited partnership (“CMPIII GP”); |

| |

(xi) |

Carrollton Mineral Partners III-B GP, LP, a Texas limited partnership (“CMPIIIB GP”); |

| |

(xii) |

Carrollton Mineral Partners IV GP, LP, a Texas limited partnership (“CMPIV GP”); |

| |

(xiii) |

Carrollton Land Company, LLC, a Texas limited liability

company (“CLC”); |

| |

(xiv) |

CMP Energy, LLC, a Texas limited liability company

(“CMPE”); |

| |

(xv) |

CMP Energy II, LLC, a Texas limited liability company

(“CMPEII”); |

| |

(xvi) |

CMP Energy III, LLC, a Texas limited liability company

(“CMPEIII”); |

| |

(xvii) |

CMP Energy IV, LLC, a Texas limited liability company

(“CMPEIV”); and |

| |

(xviii) |

John R. Howard, Jr., a United States citizen (“Mr.

Howard”). |

CMP, CMPII, CMPIII, CMPIIIB,

CMPIV, CMPP, CMPG, CMP GP, CMPII GP, CMPIII GP, CMPIIIB GP, CMPIV GP, CLC, CMPE, CMPEII, CMPEII, CMPEIV and Mr. Howard are referred to

herein collectively as the "Reporting Persons" and individually as a "Reporting Person."

(b) The business address

of each Reporting Person is 3838 Oak Lawn Avenue, Suite 300, Dallas, Texas 75219.

(c)

| (i) | The

principal business of CMP is to invest in securities. |

| (ii) | The

principal business of CMPII is to invest in securities. |

| (iii) | The

principal business of CMPIII is to invest in securities. |

| (iv) | The

principal business of CMPIIIB is to invest in securities. |

| (v) | The

principal business of CMPIV is to invest in securities. |

| (vi) | The

principal business of CMPP is to invest in securities. |

| (vii) | The

principal business of CMPG is to invest in securities. |

| (viii) | The

principal business of CMP GP is to serve as the sole general partner of CMP. |

| (ix) | The

principal business of CMPII GP is to serve as the sole general partner of CMPII. |

| (x) | The

principal business of CMPIII GP is to serve as the sole general partner of CMPIII. |

| (xi) | The

principal business of CMPIIIB GP is to serve as the sole general partner of CMPIIIB. |

| (xii) | The

principal business of CMPIV GP is to serve as the sole general partner of CMPIV. |

| (xiii) | The

principal business of CLC is to serve as the sole general partner of CMPP and CMPG. |

| (xiv) | The

principal business of CMPE is to serve as the sole general partner of CMP GP. |

| (xv) | The

principal business of CMPEII is to serve as the sole general partner of CMPII GP. |

| (xvi) | The

principal business of CMPEIII is to serve as the sole general partner of CMPIII GP and CMPIIIB

GP. |

| (xvii) | The

principal business of CMPEIV is to serve as the sole general partner of CMPIV GP. |

| (xviii) | The

principal occupation of Mr. Howard is to serve as manager of each of CLC, CMPE, CMPEII, CMPEIII

and CMPEIV. |

(d) None of the Reporting

Persons have, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

To the best of the Reporting Persons' knowledge, none of their respective executive officers or directors, as applicable, have, during

the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) None of the Reporting

Persons have, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction

and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. To the best

of the Reporting Persons' knowledge, none of their respective executive officers or directors, as applicable, have, during the last five

years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to such laws.

(f) The information set

forth in item 2(a) of this Schedule 13D is incorporated herein by reference.

| Item 3. |

Source and Amount of Funds or Other Consideration. |

On September 12, 2024, the

Partnership, entered into a Contribution and Exchange Agreement (the “Contribution and Exchange Agreement”), with West Texas

Minerals LLC, a Delaware limited liability company, CMP, CMPII, CMPIII, CMPIIIB, CMPIV, CMPP, CMPG and Carrollton Royalty, LP, a Texas

limited partnership (collectively, the “Contributors”) , the terms and conditions of which provided for the Contributors

to contribute certain interests in oil and gas properties, rights and related assets (the “Properties”) to the Partnership

in exchange for 6,721,144 Common Units, subject to adjustment pursuant to a customary title defect process. The Properties consist of

mineral, royalty and overriding royalty interests in producing and non-producing oil and natural gas properties representing approximately

14,225 net mineral acres located in 14 counties across New Mexico and Texas. The Contribution and Exchange Agreement includes customary

representations, warranties, covenants and indemnities of the Partnership and the Contributors and also provided for the Contributors

to pay the Partnership at closing an amount of cash equal to the aggregate amount of cash receipts from or attributed to the Properties

that were received by the Contributors during the period beginning July 1, 2024 and ending on September 30, 2024.

No material relationships

exist between the Partnership and the Contributors, except that in connection with completion of the acquisition of the Properties, the

members of Dorchester Minerals Management GP, LLC, the general partner of the general partner of the Partnership (“DMMGP”),

agreed to vote their membership interests in DMMGP in favor of one representative designated by CMP (with the consent of the members

of DMMGP, such consent not to be unreasonably withheld, conditioned or delayed) to the Board of Managers of DMMGP to serve on committees

established to govern the Partnership (the “Contributor-Appointed Manager); provided that such agreement terminates upon such time

that CMP is unable to certify to the Partnership that the Contributors, collectively, hold an aggregate of at least 1,000,000 Common

Units. On October 15, 2024, F. Damon Box was appointed to the Board of Managers of DMMGP.

The Partnership completed

its acquisition of the Properties of the Contributors pursuant to the Contribution and Exchange Agreement on September 30, 2024. In exchange,

the Partnership issued to the Contributors an aggregate of 6,721,144 Common Units, the offer and sale of which are registered by the

Partnership’s registration statements on Form S-4.

The foregoing description

of the Contribution and Exchange Agreement contained in this Schedule 13D does not purport to be complete and is qualified in its entirety

by the text of the Contribution and Exchange Agreement, which is filed as Exhibit 1 to this Schedule 13D and is incorporated by reference

herein.

| Item 4. |

Purpose of Transaction. |

The securities covered by

this Schedule 13D were acquired for investment purposes.

Except

as set forth above, the Reporting Persons have no present plans or proposals that relate to, or that would result in, any of the actions

described in subparagraphs (a) through (j) of Item 4 of Schedule 13D; however, as part of their ongoing evaluation of the investment

described in this Schedule 13D and investment alternatives, the Reporting Persons may consider such matters in the future, and subject

to applicable law, may formulate a plan with respect to such matters, and, from time to time, the Reporting Persons may hold discussions

with management or the Board of Managers of the Partnership, other holders of securities of the Partnership or other third parties regarding

such matters. The Reporting Persons retain the right to change their investment intent, and may, from time to time, acquire additional

Common Units or other securities of the Partnership, or sell or otherwise dispose of (or enter into plans or arrangements to sell or

otherwise dispose of), all or part of the Common Units or other securities of the Partnership, if any, beneficially owned by them, in

any manner permitted by law.

| Item 5. |

Interest in Securities of the Issuer. |

(a) – (b) The aggregate

number and percentage of Common Units beneficially owned by the Reporting Persons are as follows:

Carrollton Mineral Partners, LP

| Aggregate

amount beneficially owned: | |

| 681,113 | |

| Percent of class: | |

| 1.44% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 681,113 | |

| Shared power to vote

or direct the vote: | |

| 0 | |

| Sole power to dispose

or direct the disposition of: | |

| 681,113 | |

| Shared power to dispose

or direct the disposition of: | |

| 0 | |

Carrollton Mineral Partners Fund II, LP

| Aggregate

amount beneficially owned: | |

| 700,913 | |

| Percent of class: | |

| 1.48% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 700,913 | |

| Shared power to vote

or direct the vote: | |

| 0 | |

| Sole power to dispose

or direct the disposition of: | |

| 700,913 | |

| Shared power to dispose

or direct the disposition of: | |

| 0 | |

Carrollton Mineral Partners III, LP

| Aggregate

amount beneficially owned: | |

| 356,996 | |

| Percent of class: | |

| 0.75% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 356,996 | |

| Shared power to vote

or direct the vote: | |

| 0 | |

| Sole power to dispose

or direct the disposition of: | |

| 356,996 | |

| Shared power to dispose

or direct the disposition of: | |

| 0 | |

Carrollton Mineral Partners III-B, LP

| Aggregate

amount beneficially owned: | |

| 90,963 | |

| Percent of class: | |

| 0.19% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 90,963 | |

| Shared power to vote

or direct the vote: | |

| 0 | |

| Sole power to dispose

or direct the disposition of: | |

| 90,963 | |

| Shared power to dispose

or direct the disposition of: | |

| 0 | |

Carrollton Mineral Partners IV, LP

| Aggregate

amount beneficially owned: | |

| 840,565 | |

| Percent of class: | |

| 1.78% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 840,565 | |

| Shared power to vote

or direct the vote: | |

| 0 | |

| Sole power to dispose

or direct the disposition of: | |

| 840,565 | |

| Shared power to dispose

or direct the disposition of: | |

| 0 | |

CMP Permian, LP

| Aggregate

amount beneficially owned: | |

| 320,324 | |

| Percent of class: | |

| 0.68% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 320,324 | |

| Shared power to vote

or direct the vote: | |

| 0 | |

| Sole power to dispose

or direct the disposition of: | |

| 320,324 | |

| Shared power to dispose

or direct the disposition of: | |

| 0 | |

CMP Glasscock, LP

| Aggregate

amount beneficially owned: | |

| 220,517 | |

| Percent of class: | |

| 0.47% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 220,517 | |

| Shared power to vote

or direct the vote: | |

| 0 | |

| Sole power to dispose

or direct the disposition of: | |

| 220,517 | |

| Shared power to dispose

or direct the disposition of: | |

| 0 | |

Carrollton Mineral Partners GP, LP

| Aggregate

amount beneficially owned: | |

| 681,113 | |

| Percent of class: | |

| 1.44% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 0 | |

| Shared power to vote

or direct the vote: | |

| 681,113 | (2) |

| Sole power to dispose

or direct the disposition of: | |

| | |

| Shared power to dispose

or direct the disposition of: | |

| 681,113 | (2) |

Carrollton Mineral Partners II GP, LP

| Aggregate

amount beneficially owned: | |

| 700,913 | |

| Percent of class: | |

| 1.48% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 0 | |

| Shared power to vote

or direct the vote: | |

| 700,913 | (3) |

| Sole power to dispose

or direct the disposition of: | |

| 0 | |

| Shared power to dispose

or direct the disposition of: | |

| 700,913 | (3) |

Carrollton Mineral Partners III GP, LP

| Aggregate

amount beneficially owned: | |

| 356,996 | |

| Percent of class: | |

| 0.75% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 0 | |

| Shared power to vote

or direct the vote: | |

| 356,996 | (4) |

| Sole power to dispose

or direct the disposition of: | |

| 0 | |

| Shared power to dispose

or direct the disposition of: | |

| 356,996 | (4) |

Carrollton Mineral Partners III-B GP, LP

| Aggregate

amount beneficially owned: | |

| 90,963 | |

| Percent of class: | |

| 0.19% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 0 | |

| Shared power to vote

or direct the vote: | |

| 90,963 | (5) |

| Sole power to dispose

or direct the disposition of: | |

| 0 | |

| Shared power to dispose

or direct the disposition of: | |

| 90,963 | (5) |

Carrollton Mineral Partners IV GP, LP

| Aggregate

amount beneficially owned: | |

| 840,565 | |

| Percent of class: | |

| 1.78% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 0 | |

| Shared power to vote

or direct the vote: | |

| 840,565 | (6) |

| Sole power to dispose

or direct the disposition of: | |

| 0 | |

| Shared power to dispose

or direct the disposition of: | |

| 840,565 | (6) |

Carrollton Land Company, LLC

| Aggregate

amount beneficially owned: | |

| 540,841 | |

| Percent of class: | |

| 1.14% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 0 | |

| Shared power to vote

or direct the vote: | |

| 540,841 | (7) |

| Sole power to dispose

or direct the disposition of: | |

| 0 | |

| Shared power to dispose

or direct the disposition of: | |

| 540,841 | (7) |

CMP Energy, LLC

| Aggregate

amount beneficially owned: | |

| 681,113 | |

| Percent of class: | |

| 1.44% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 0 | |

| Shared power to vote

or direct the vote: | |

| 681,113 | (8) |

| Sole power to dispose

or direct the disposition of: | |

| 0 | |

| Shared power to dispose

or direct the disposition of: | |

| 681,113 | (8) |

CMP Energy II, LLC

| Aggregate

amount beneficially owned: | |

| 700,913 | |

| Percent of class: | |

| 1.48% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 0 | |

| Shared power to vote

or direct the vote: | |

| 700,913 | (9) |

| Sole power to dispose

or direct the disposition of: | |

| 0 | |

| Shared power to dispose

or direct the disposition of: | |

| 700,913 | (9) |

CMP Energy III, LLC

| Aggregate

amount beneficially owned: | |

| 447,959 | |

| Percent of class: | |

| 0.95% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 0 | |

| Shared power to vote

or direct the vote: | |

| 447,959 | (10) |

| Sole power to dispose

or direct the disposition of: | |

| 0 | |

| Shared power to dispose

or direct the disposition of: | |

| 447,959 | (10) |

CMP Energy IV, LLC

| Aggregate

amount beneficially owned: | |

| 840,565 | |

| Percent of class: | |

| 1.78% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | |

| Sole power to vote

or direct the vote: | |

| 0 | |

| Shared power to vote

or direct the vote: | |

| 840,565 | (11) |

| Sole power to dispose

or direct the disposition of: | |

| 0 | |

| Shared power to dispose

or direct the disposition of: | |

| 840,565 | (11) |

John R. Howard, Jr.

| Aggregate

amount beneficially owned: | |

| | | |

| 3,211,391 | |

| Percent of class: | |

| | | |

| 6.78% | (1) |

| Number of shares as

to which the Reporting Person has: | |

| | | |

| | |

| Sole power to vote

or direct the vote: | |

| | | |

| 0 | |

| Shared power to vote

or direct the vote: | |

| | | |

| 3,211,391 | (12)(13) |

| Sole power to dispose

or direct the disposition of: | |

| | | |

| 0 | |

| Shared power to dispose

or direct the disposition of: | |

| | | |

| 3,211,391 | (12)(13) |

| (1) | Based

on 47,339,756 Common Units of the Partnership outstanding as of October 31, 2024 as reported

in the Partnership’s Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2024, filed with the Securities and Exchange Commission (the “SEC”) on October

31, 2024. |

| (2) | Carrollton

Mineral Partners, LP is a direct beneficial owner of 681,113 Common Units of the Partnership.

As the sole general partner of Carrollton Mineral Partners, LP, CMP GP may be deemed to have

shared and/or dispositive power with respect to such units. |

| (3) | Carrollton

Mineral Partners Fund II, LP is a direct beneficial owner of 700,913 Common Units of the

Partnership. As the sole general partner of Carrollton Mineral Partners Fund II, LP, CMPII

GP may be deemed to have shared and/or dispositive power with respect to such Common Units. |

| (4) | Carrollton

Mineral Partners III, LP is a direct beneficial owner of 356,996 Common Units of the Partnership.

As the sole general partner of Carrollton Mineral Partners III, LP, CMPIII GP may be deemed

to have shared and/or dispositive power with respect to such Common Units. |

| (5) | Carrollton

Mineral Partners III-B, LP is a direct beneficial owner of 90,963 Common Units of the Partnership.

As the sole general partner of Carrollton Mineral Partners III-B, LP, CMPIIIB GP may be deemed

to have shared and/or dispositive power with respect to such Common Units. |

| (6) | Carrollton

Mineral Partners IV, LP is a direct beneficial owner of 840,565 Common Units of the Partnership.

As the sole general partner of Carrollton Mineral Partners IV, LP, CMPIV GP may be deemed

to have shared and/or dispositive power with respect to such Common Units. |

| (7) | CMP

Permian, LP is a direct beneficial owner of 320,324 Common Units of the Partnership and CMP

Glasscock, LP is a direct beneficial owner of 220,517 Common Units of the Partnership. As

the sole general partner of CMP Permian, LP and CMP Glasscock, LP, Carrollton Land Company,

LLC may be deemed to have shared and/or dispositive power with respect to such Common Units. |

| (8) | Carrollton

Mineral Partners, LP is a direct beneficial owner of 681,113 Common Units of the Partnership.

As the sole general partner of CMP GP, the sole general partner of Carrollton Mineral Partners,

LP, CMP Energy, LLC may be deemed to have shared and/or dispositive power with respect to

such Common Units. |

| (9) | Carrollton

Mineral Partners Fund II, LP is a direct beneficial owner of 700,913 Common Units of the

Partnership. As the sole general partner of CMPII GP, the sole general partner of Carrollton

Mineral Partners Fund II, LP, CMP Energy II, LLC may be deemed to have shared and/or dispositive

power with respect to such Common Units. |

| (10) | Carrollton

Mineral Partners III, LP is a direct beneficial owner of 356,996 Common Units of the Partnership

and Carrollton Mineral Partners III-B, LP is a direct beneficial owner of 90,963 Common Units

of the Partnership. As the sole general partner of CMPIII GP, the sole general partner of

Carrollton Mineral Partners III, LP, and CMPIIIB GP, the sole general partner of Carrollton

Mineral Partners III-B, LP, CMP Energy III, LLC may be deemed to have shared and/or dispositive

power with respect to such Common Units. |

| (11) | Carrollton

Mineral Partners IV, LP is a direct beneficial owner of 840,565 Common Units of the Partnership.

As the sole general partner of CMPIV GP, the sole general partner of Carrollton Mineral Partners

IV, LP, CMP Energy IV, LLC may be deemed to have shared and/or dispositive power with respect

to such Common Units. |

| (12) | Represents

(i) 681,113 Common Units of the Partnership held by Carrollton Mineral Partners, LP, (ii)

700,913 Common Units of the Partnership held by Carrollton Mineral Partners Fund II, LP,

(iii) 356,996 Common Units of the Partnership held by Carrollton Mineral Partners III, LP,

(iv) 90,963 Common Units of the Partnership held by Carrollton Mineral Partners III-B, LP,

(v) 840,565 Common Units of the Partnership held by Carrollton Mineral Partners IV, LP, (vi)

320,324 Common Units of the Partnership held by CMP Permian, LP and (vii) 220,517 Common

Units of the Partnership held by CMP Glasscock, LP. |

| (13) | As

manager of CMP Energy, LLC, CMP Energy II, LLC, CMP Energy III, LLC, CMP Energy IV, LLC and

Carrollton Land Company, LLC, John R. Howard, Jr. may be deemed to have shared voting and/or

dispositive power with respect to such Common Units held by Carrollton Mineral Partners,

LP, Carrollton Mineral Partners Fund II, LP, Carrollton Mineral Partners III, LP, Carrollton

Mineral Partners III-B, LP, Carrollton Mineral Partners IV, LP, CMP Permian, LP and CMP Glasscock,

LP. |

(c) None of the Reporting Persons, nor, to the

best of the Reporting Persons' knowledge, any of their respective executive officers or directors, as applicable, has acquired or disposed

of, any securities of the Partnership from the 60 days prior to the date of the event which requires the filing of this statement up

through the date hereof.

(d) Except as set forth herein, no other person

is known by the Reporting Persons to have the right to receive or the power to direct the receipt of dividends from, or the proceeds

from the sale of, Common Units beneficially owned by the Reporting Persons.

(e)

Not applicable.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Pursuant to Rule 13d-1(k)

promulgated under the Act, the Reporting Persons entered into a Joint Filing Agreement (the “Joint Filing Agreement”) with

respect to the joint filing of this Schedule 13D and any amendment or amendments hereto. The description of the Joint Filing Agreement

contained in this Schedule 13D does not purport to be complete and is qualified in its entirety by the text of the Joint Filing Agreement,

which is filed as Exhibit 2 to this Schedule 13D and is incorporated by reference herein.

In connection with completion

of the acquisition of the Properties, the members of DMMGP have agreed to vote their membership interests in DMMGP in favor of one representative

designated by CMP (with the consent of the members of DMMGP, such consent not to be unreasonably withheld, conditioned or delayed) to

the Board of Managers of DMMGP to serve on committees established to govern the Partnership; provided that such agreement terminates

upon such time that CMP is unable to certify to the Partnership that the Contributors, collectively, hold an aggregate of at least 1,000,000

Common Units.

Except as described in this

Item 6, there are no contracts, arrangements, understandings or relationships (legal or otherwise) between the persons named in Item

2 or, to the best of the Reporting Persons' knowledge, between such persons and any other person with respect to any securities of the

Partnership, including, but not limited to, transfer or voting of any of the securities, finder's fees, joint ventures, loan or option

arrangements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies, including any

securities pledged or otherwise subject to a contingency the occurrence of which would give another person voting power or investment

power over such securities other than standard default and similar provisions contained in loan agreements.

| Item 7. |

Material to be Filed as Exhibits. |

| Exhibit |

|

Description |

| 1 |

|

Contribution

and Exchange Agreement dated September 12, 2024, by and among Dorchester Minerals, L.P., West Texas Minerals LLC, Carrollton Mineral

Partners, LP, Carrollton Mineral Partners Fund II, LP, Carrollton Mineral Partners III, LP, Carrollton Mineral Partners III-B, LP, Carrollton

Mineral Partners IV, LP, CMP Permian, LP, CMP Glasscock, LP, and Carrollton Royalty, LP (incorporated by reference to Exhibit 2.1 to

Dorchester Minerals, L.P. Current Report on Form 8-K filed with the SEC on September 16, 2024). |

| |

|

|

| 2 |

|

Joint Filing Agreement, dated

as of November 7, 2024 by and between the Reporting Persons. |

SIGNATURES

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: November 7, 2024

| |

CARROLLTON MINERAL PARTNERS,

LP |

| |

|

| |

By: CMP Energy, LLC, the general partner of Carrollton

Mineral Partners GP, LP, its general partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS FUND II, LP |

| |

|

| |

By: CMP Energy II, LLC, the general partner of

Carrollton Mineral Partners II GP, LP, its general partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS III, LP |

| |

|

| |

By: CMP Energy III, LLC, the general partner of

Carrollton Mineral Partners III GP, LP, its general partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS III-B, LP |

| |

|

| |

By: CMP Energy III, LLC, the general partner of

Carrollton Mineral Partners III-B GP, LP, its general partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS IV, LP |

| |

|

| |

By: CMP Energy IV, LLC, the general partner of

Carrollton Mineral Partners IV GP, LP, its general partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

CMP PERMIAN, LP |

| |

|

| |

By: Carrollton Land Company, LLC, its general

partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CMP GLASSCOCK, LP |

| |

|

| |

By: Carrollton Land Company, LLC, its general

partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS GP, LP |

| |

|

| |

By: CMP Energy, LLC, its general partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS II GP, LP |

| |

|

| |

By: CMP Energy II, LLC, its general partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS III GP, LP |

| |

|

| |

By: CMP Energy III, LLC, its general partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS III-B GP, LP |

| |

|

| |

By: CMP Energy III, LLC, its general partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS IV GP, LP |

| |

|

| |

By: CMP Energy IV, LLC, its general partner |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

President |

| |

CARROLLTON LAND COMPANY, LLC |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CMP ENERGY, LLC |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CMP ENERGY II, LLC |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CMP ENERGY III, LLC |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CMP ENERGY IV, LLC |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

/s/ John R. Howard,

Jr. |

| |

John R. Howard, Jr., in his individual

capacity |

EXHIBIT 2

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k)(1)

under the Securities Exchange Act of 1934, as amended, the persons named below agree to the joint filing on behalf of each of them of

a statement on Schedule 13D (including amendments thereto) with respect to 3,211,391 common units representing limited partnership interests

of Dorchester Minerals, L.P., a Delaware limited partnership, and further agree that this Joint Filing Agreement be included as an Exhibit to

such joint filings.

In evidence thereof, the

undersigned, being duly authorized, have executed this Joint Filing Agreement as of November 7, 2024.

| |

CARROLLTON MINERAL PARTNERS,

LP |

| |

|

| |

By: CMP Energy, LLC, the general partner

of Carrollton Mineral Partners GP, LP, its general partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS FUND

II, LP |

| |

|

| |

By: CMP Energy II, LLC, the general

partner of Carrollton Mineral Partners II GP, LP, its general partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS III,

LP |

| |

|

| |

By: CMP Energy III, LLC, the general

partner of Carrollton Mineral Partners III GP, LP, its general partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS III-B,

LP |

| |

|

| |

By: CMP Energy III, LLC, the general

partner of Carrollton Mineral Partners III-B GP, LP, its general partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS IV,

LP |

| |

|

| |

By: CMP Energy IV, LLC, the general

partner of Carrollton Mineral Partners IV GP, LP, its general partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

CMP PERMIAN, LP |

| |

|

| |

By: Carrollton Land Company, LLC,

its general partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CMP GLASSCOCK, LP |

| |

|

| |

By: Carrollton Land Company, LLC,

its general partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS GP, LP |

| |

|

| |

By: CMP Energy, LLC, its general partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS II GP, LP |

| |

|

| |

By: CMP Energy II, LLC, its general

partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS III GP, LP |

| |

|

| |

By: CMP Energy III, LLC, its general

partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS III-B GP, LP |

| |

|

| |

By: CMP Energy III, LLC, its general

partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CARROLLTON MINERAL PARTNERS IV GP, LP |

| |

|

| |

By: CMP Energy IV, LLC, its general

partner |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

President |

| |

CARROLLTON LAND COMPANY, LLC |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CMP ENERGY, LLC |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CMP ENERGY II, LLC |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CMP ENERGY III, LLC |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

CMP ENERGY IV, LLC |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr. |

| |

Manager |

| |

|

| |

/s/ John R. Howard, Jr. |

| |

John R. Howard, Jr., in his individual

capacity |

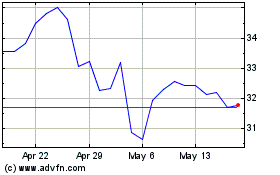

Dorchester Minerals (NASDAQ:DMLP)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dorchester Minerals (NASDAQ:DMLP)

Historical Stock Chart

From Mar 2024 to Mar 2025