false

--12-31

0001840563

0001840563

2025-02-21

2025-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

February 21, 2025

PMGC HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-41875 |

|

33-2382547 |

(State or other jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

|

c/o 120 Newport Center Drive, Ste. 249

Newport Beach, CA |

|

92660 |

| (Address of registrant’s principal executive office) |

|

(Zip code) |

(888) 445-4886

(Registrant’s telephone number, including

area code)

Elevai Labs Inc.

(Former name or former address, if changed since

last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ELAB |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.03 Material Modification to Rights of

Security Holders.

The information set forth

under Item 5.03 of this Current Report on Form 8-K is incorporated by referenced into this Item 3.03.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Changes in Fiscal Year.

| (a) | Amended and Restated Certificate of Designations, Rights, and Preferences of the Series B Preferred

Stock |

On February 21, 2025, PMGC

Holdings Inc. (the “Company”) filed the Amended and Restated Certificate of Designations, Rights, and Preferences of the Series

B Preferred Stock (the “Amended and Restated COD”) with the Secretary of State of the State of Nevada (the “Nevada Secretary

of State”). Pursuant to the Amended and Restated COD, holders of Series B Preferred Stock have no conversion rights. The Amended

and Restated COD also clarified that:

| (i) | Holders of Series B Preferred Stock are not entitled to dividends unless the Board of Directors of the

Company (the “Board”) determines in its sole discretion to issue dividends to such holders; |

| (ii) | With respect to the payment of dividends and distribution of assets upon Liquidation (as defined below)

of the Company, the Series B Preferred Stock will rank: (A) pari passu with the Company’s Series A Preferred Stock solely to the

extent that such parity does not result in the Series B Preferred Stock having priority over the Company’s Common Stock; and (B)

junior to all Indebtedness (as defined in the Amended and Restated COD) of the Company now existing or hereafter authorized (including

Indebtedness convertible into Common Stock); |

| (iii) | Upon any Liquidation, the holders of shares of Series B Preferred Stock then outstanding are entitled

to be paid out of the assets of the Company legally available for distribution to its stockholders, on parity with the holders of shares

of Common Stock or any other class or series of capital stock of the Company, and without any preference over any other class or series

of capital stock of the Company, an amount equal to the same per share liquidating distribution received by holders of Common Stock; |

| (iv) | The voting rights of the Series B Preferred Stock will not be adjusted or otherwise affected by any stock

split, stock dividend, recapitalization, or similar event affecting any other class of capital stock of the Company, and each share of

Series B Preferred Stock will have one (1) vote per share on all matters on which it is entitled to vote regardless of any corporate action

affecting the Common Stock or any other class of stock of the Company; |

| (v) | As long as any shares of Series B Preferred Stock are outstanding, the Company will not, either directly

or indirectly by amendment, merger, consolidation, domestication, transfer, continuance, recapitalization, reclassification, waiver, statutory

conversion, or otherwise, effect any of the following acts or transactions without (in addition to any other vote required by law or this

Articles of Incorporation) the written consent or affirmative vote of the holders of a majority of the then outstanding shares of the

Series B Preferred Stock, provided that such vote will be limited solely to matters directly and materially affecting the rights,

preferences, and privileges of the Series B Preferred Stock, and shall not provide the Series B Preferred Stock with any rights superior

to those held by Common stockholders, and any such act or transaction that has not been approved by such consent or vote prior to such

act or transaction being effected shall be null and void ab initio, and of no force or effect: (i) amend the Company’s

Articles of Incorporation or Bylaws so as to adversely alter the rights, preferences, privileges or powers of the Series B Preferred Stock;

(ii) create any new class or series of shares pari passu or senior to the Series B Preferred Stock without a proportionate

impact on all equity holders; (iii) pay or declare any dividend on Common Stock or junior securities of the Company, or incur Indebtedness

in any single transaction in excess of $1 million, provided that the actions apply on the same terms to all holders of capital

stock and do not provide a preference to Series B Preferred Stock over Common Stock; or (iv) redeem, purchase or otherwise acquire any

share or shares of Preferred Stock or Common Stock (other than (x) the repurchase of shares of Common Stock pursuant to a written benefit

plan or employment or consulting agreement, or (y) the repurchase of any equity securities in connection with the Company’s right

of first offer with respect to those securities contained in any written agreement with the Company), provided that the transactions

occur on terms that do not disproportionately benefit the Series B Preferred Stock over the Common Stock, and are conducted in accordance

with applicable law and existing agreements; and |

| | | |

| | (vi) | In determining whether a distribution (other than upon voluntary or involuntary liquidation), by dividend, redemption, or other acquisition

of shares of capital stock of the Company or otherwise, is permitted under the Nevada Revised Statutes, no portion of the Series B Preferred

Stock will be treated as having any liquidation preference or seniority over Common Stock for purposes of any such determination. |

“Liquidation”

means any voluntary or involuntary liquidation, dissolution, or winding up of the Company.

| (b) | Certificate of Amendment to the Amended and Restated Certificate of Designations, Rights, and Preferences

of the Series B Preferred Stock |

On February 24, 2025, the

Company filed the Certificate of Amendment to the Amended and Restated COD with the Nevada Secretary of State (the “Certificate

of Amendment to the COD”). The Certificate of Amendment to the COD increased the authorized shares of Series B Preferred Stock from

50 million to 300 million shares.

The foregoing descriptions

are only a summary of the Amended and Restated COD and Certificate of Amendment to the COD, copies of which are filed as Exhibits 3.1

and 3.2 to this Current Report on Form 8-K, respectively, and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

PMGC HOLDINGS INC. |

| |

|

|

| Date: February 27, 2025 |

By: |

/s/ Graydon Bensler |

| |

|

Graydon Bensler |

| |

|

Chief Executive Officer |

Exhibit

3.1

Business Number E44920962024 - 7 Filed in the Office of Secretary of State State Of Nevada Filing Number 20254681176 Filed On 2/21/2025 9:54:00 AM Number of Pages 7

121240•ig 278 To: Pan•: 02 of 10 2025 - 02 - 21 12 - 53 - 54 EST Docusign Envelope ID. 8404FEC1 - A2B2 - 445F - AF6D - ABE97BD5822O 12124098278 AMENDED AND RESTATED CER@fi1CA’£E CH' LtESIGNA I’1ONS, RIGHT S, AND PREI kRENCES OI SMHiES B PREFERRED PMGC HOLDINGS INC. PM Ci C Holdings Inc . , a Nevatta corporation (the “C orporation ”), hereby certifies that the following rcs'ol rrtion was adopted by the Doard or oirectors of the Corporation (the “B oard of Directors ”) pursuant to the authority of the Doard of Directors as required by Section 75 . 1955 of the Nevada Revised Statutes . WHEREAS, the Articles of Incorporation of the Corporation (the “A rticles of Incorporation "), provides for a class of its authorized siock known as prefvrrA siock, comprised of 500 , 000 , 000 shares, $ 0 . 0001 par value per share (the “P referred Stock ”), issuable tiom time to time in one or more series : WHEREAS, the Bonrd of Directors is authorized by the provisions of the Articles of Incorporation to fix time powers, designations, preferences . and relative . participating, optional, or other rights, if any, and the qualifications, limitations . or restrictions thcrcof, if any, including any dividend rights, dividend rate, voting rights, conversion rights, rights, and terms of redemption and liquidation preferences, of any series of Preferred Stock and the number of shares constituting any such series ; NOW, THEREF - ORE, BE lT RESOLVED, that pursuant to this authority granted to and vested in the Board of Directors in accordance with the provisions of the Articles of Incorporation, the Board of Directors hereby adopts this Amended and Restated Certificate of Designations, Rights, and Prefcrcnces (the “C erii ticate of Designation ”) for the purpose of creating a series of Preferred Stock of the Corporation designated as Series B Preferred Stock, par value $ 0 . 0001 per share (the “S eries B Preferred Stock ”), and hereby states the designation and number of shares, and fixes the relative rights, powers and preferences, and qualifications, limitations, and restrictions of the Series D Preferred Stock as follows : 1. Designation and Amount. The shares of such series of Preferred Stock shall be designated as “Series B Preferred Stock” and the number of shares constituting such series shall be 50,000,000 shares. Each share of Series B Preferred Stock shall be identical in oll respects to every other sharr of Series R Preferred Stock. Such number of shares of Series B Prcfcrrcd Stock may from time to time be incrcascd (but not in excess of the total number of authorized shares of preferred stock) or decreased (but not below the number of shares of Series B Preferred Stock then outstanding) by further resolution duly adopted by the Board of Directors and by the fi I ing of a certificate pursuant to the provisions of the Nevada Revised Statutes stating that such increase or decrease, as the case may be, has been so authorized. Por the avoidance of' doubt, no stock split of any class of capital stock other than the Series B Preferred Stock (“C ltber Stock Split ”) shall etTectuate a change in the number ot issued and outstanding Series B t'relerred Stock at the time of the Other Stock Split. 2. No Redemption. The Series B Fretérred Stock shall not be redeemable. 3. Dividends. Holders of Series B Preferred Stock ate not entitled to dividends u alcss the Bonrd of Directors determines in its sold di sc ction to issue dividends to such holders. 4. Ranking . With respect to the payment of dividends and distribution of assets upon liquidation, dissolution, or winduig up of the Corporation, whether voluntary or involuntary, the Series B Preferred Stock will rank : (i) pai i passu with the C?orporation’s Series A Preferred Stock solcly to the extent that such panty does not result in the Series H Preferred Stock having priority over the Corporation’s Common Stock ; arid (ii) junior to all I ndebtedness of the Corporation now enisting or hereafter authorized (including Indebtedness convertible into Common Stock) . S . Liquidation . (a) Upon any voluntary or involuntary liquidation, dissolution, or winding up of the Corporation (each Of such evelJtS, “ Liquidation ”) . the holders of shares of Series B Preferred Steck then outstanding shall be entitled to be paid out of the assets of the Corporation legally available for distribution to its stockholders, on parity with the holders of shares of Coiuiiioo Stock or' any other class or series of capital stock of the Corporation, arid without any preference over any From: Barton N

To: Page: 03 of 10 202542 - 21 12:53:54 EST Docus)gtJ Envelope 10. 8404FEC1 - A282 - 445F - AF6D - ABE97BO5822O 12t24O98278 other class or series of capital stock of the Corporation, an amount equal to the same per share liquidating distr i button received by holders of Common Stock . ma the event that, upon such voluntary or involuntary liquidation, dissolution, or winding up, the available assets of the Corporation arc insufficicni to pay the full amount of the liquidating distributions on all outstanding shares of Common Stock, Series B Preferred Stock, or other class of capital stock entitled to distributions upun Liquidation . then such stockholders shall share ratably in any such distribution of asseis in proportion to the full liquidating distributions to which they would otherwise be respectively entitled . Written notice of any such voluntary or involuntary liquidation, dissolution, or winding up of the Corpotation, stating the py yfnent date or dates when, and the place or places where, the amounts distributable ie such circumstances shall be payable, shall be given within ten ( 10 ) days of the date the Board of Directors approves such aciion, or no later than twenty ( 20 ) days of any stockholders’ meeting catled to approve such action, or within twenty ( 20 ) days of the commencement of any involuntary proceedint„ whichever is earlier, to each record holder of shares of the capital stock of the Corporation cntitlcd to distributions upt›n Liquidation at the respective addresses tit such holder as the same shall appear on the stock transt'er records of' the Corporation . Atier payment of‘ the fiill amount ot‘ the liquidating distributions to which they arc entitled, the holders of Series B Preferred Stock will have no right or claim to any of the remaining assets of the Corporation . (b) If . at any time while the Series B Preferred Stock is outst‹anding, (i) the Corporation, directly or indirectly . in one or more related transactions effects any merger or consolidation ot the Corporation with or into another entity, (ii) the Corporation, directly or indirectly, effects any sale, assignment, transfci, conveyance, or otlicr disposition of all or substantially all of its assets in one or a señes of related transactions, (iii) any, direct or indirect, purchase offer, tender offet, or exchange offer (whcthcr hy the Corporation or another person or entity) is completed pursuant to which holders of Common Stock are permitted to sell, tender, or exchant,e their shares for other securities, cash, or property and has been accepted by the holders of more than SOA» of the outstanding Common Stock or more than 50 iâ of the voting power or be common equity of the Corporation, or (iv) the Corporation, directly or indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business combination (incl uding, without limitation, a reorganization, rccapitalization, spin - off, merger, or scheme of arrangement) with anothcr Person ι ^ 6 r u p o f Persons whereby such othcr Person or group acquires more than 50 % of the voting power of the Common Stock of the Corporation (each a “D eemed Liquidation ”) ; provided, however, that the issuance of Common Stork in y financing tmosaction engaged in by thc Corporation shall not be a Deemed Liquidation unless it results in more than 50 % of the voting power of Coiiiiiiun Stock being issued to one stockholder or a number of stockholders wlie report on a Schedule 13 G or Schedule 13 D pursuant to Section l 3 (d) of' the Exchange Act that they are acting as a single group in holding ihe Common Stock, then the Corporation shell provide at least 10 days' notice to Ihc hnlders of its capital stock entitled to o distribution on Liquidation prior to the consummation of thc Deemed Liquidation, which shall be deemed givcn by the Corporatism upon the disclosure of the potential Deemcd Liquidation in any of the Corporation's public filings with tlie SEC . If a Deemed Liquidation occurs . the holders of the Corporation’s capital stock entitled to a distribution on Liquidation will have the option of receiving distributions pursuant to Section 5 (a) . All payments in respect of a Deemed Liquidation will be paid in shares of Common Stock . (c) In determining whether a distribution (other I han upon voluntary or involuntary liquidation), by dividend, redemption, or other acquisition of shares of capital steck of the Corporation or otherwise, is permitted under the Nevada Revised Statutes, no ponion of the Series B Preferred Stock shall he treated as having any liquidation preference or seniority over Common Stock for purposes of any such determinalion . (d) Holders of the Series B Preferred Stock small send notices pursuant to Section 5 (b) to the ClJief Financial Officer of the Company at 120 Newport Center Drive, Suite 250 , Newport Beach, CA, 92660 . 6. Conversion . The folders of the shares of Series B Preferred Stock shall not have any rights hereunder to convert such shnres into, or exchange such fihores for, shores of nny other fieries or closs of cnpitnl stock of the Corporation or of any other person . 7. Voting Rights . (at For so long as any shares of the Series B Preferrcd Stock remain isseed and outstanding, each share of Scries B Preferred Stock shall entitle the holdcr thereof to the right to vote in respect of all ITiattCtS CODCe i ι 8 the Common Slock in an amount equal to the rim ther of shares of Common Stock underlying a share of Series B Prefers ed Stock From: Barton N!

To: Page: 04 of 10 2025 - 02 - 21 12:53 - .54 ESD Docusigia Envelope ID: &4O4FEC1 - A2B2 - 445F - AF6D - ABE97BD5822D 1212409B278 on an as - converted basis on the record date for such vote . The Coiiunon Stock (and any other class or series of capital stock of the Corporation entitled to vote generally with the Common Stock) and the Series B Preferred Stock shall vote as a single class and such voting rights shall be identical in all respects . For purposes of clarification, the voting rights of the Series B Preferred Stock shall not be adjusted or olherwise effected by any stock split, stock dividend, recapitalization, or similar evcmt affecting any other class of cupital stock of the Corporation, and each share of Series B Preferred Stock shall have one (I ) vote per share on all matters on which it is entitled to vote regardless of any corporate action affecting the Common Stock or any other class of stock of the Corporation . (b) As long as any shares of Series B Preferred Stock are outstanding, the Corporation shall not, either directly or indirectly by amendment, merger, consolidation, domestication, transfer, continuance, recapitalization, reclassification, waiver, statutory conversion, or otherwise, effect any of the following acts or transactions without (in addition to any other vote required by law or this Articles of Incorpoiution) the written consent or affirmativc vote of th e holders of a majority of ihe then outstanding shares of the Series B i • referred Stock, provided that such vote shall be limited solely to matters directly and materially affecting the rights . preferences, and privileges of the . Series H Preferred Stock, end sholl not provide the Series B Preferred Stock with ony rights superior to those held by Common Stockholders, and any such act or transaction that has not been approved by such consent or vote prior to such act or transaction being effected shall be null and void at ioifio . and of no force or effect : (i) amend the Corporation's Articles of Incorporation or Bylaws so as to adversely alter the rights, preferences, privileges or powers of the Series B Preferred Stock ; (ii) create any new class or serics of shares part pu . men or senior to the Series B Preferred Stock without a proportionate impact on alt equity holders ; (iii) pay or declare any dividend on Common Stock or junior securities of the Corporation, or incur‘ Indebtedness in any single transaction in excess of $ 1 million, resided that the actions apply on the same terms to all holders of capital stock and do not provide a preference to Series B Preferred Stock over Common Stock ; or (iv) redeem, purchase or otherwise acquire any share or shares of Preferred Stock or Common Stock (other than (x) the repurchase of shares of Common Stock pursuant to a written benefit plan or employment or consulting agreement, or (y) the repurchase of any equity securities in connection with the Corporation’s right of first offer with respect to those securitics contained in any writtcn agreement with the Corporation), provided that the transactions occur on terns that do not disproportionately benefit the Series B Preferred Stock over the Common Stock, and nre conducted in accordance with applicable law and existing agreements . S . [Reserved . ] 9 . Certain AdjustmmLe . (a) Pro Rata Distributions . During sucb time as the Series B Preferred Stock is outstanding . if the Corporation shall declare or make any dividend or other distribution of its assets (or rights to acquire its assets) to holders of shares of Conmion Stock, by way of return of capital or otherwise (including, without limitation, any distribution of cash, stock or other securities, property . or options by way of a dividend, spin off . reclassification, corporate rearrangement, scheme of arrangement, or other similar transaction) (a “D istribution "), at any time after the issuance of the Series B Preferred Stock, then, in each such cnse, the holder of Series B Preferred Stock shall be entitled to participate in such Distribution to the same extent that the holder of Series B Preferred Stock would have participated therein if the holder of Series B Preferred Stock had held the number of shares of Common Stock acquirable upon complete conversion of the Series B Preferred Stock) immediately before the date of which a rerord is tnken for such Distribution, or, if no such record is taken, the date as of which the record holders of shares of Common Stock arc to be determined for the panicipation in such Distribution . (c) Notice to Holder. i Notice tg Allow Exercise by Holder . If(A) the Corporation shall declare a dividend (or any other distribution in whatever form) on the Common Stock, (B) the Corporation shall declare a special nonrecurring cash dividend on or a redemption of the Common Stock . (C) the Corporation shall authorize the grantmg to all holders of the Common Stock rights or warrant to subscribe for or purchase any shares of capital stock of any class or of any rights, (D) the approval of any stockholders of the Corporation shall be required in connection with From: Burton Ni

To.’ Page: 05 of 10 2025 - 0t - 21 12:53:54 EST Docusign Env&ope ID: 8404FEC1 - A2g2 - 445F - AF6D - ABE97BD5g22D any reclzssification of the Coinnion Stock, any consolidation, inerger, statutory conversion, transfcr, doiuesticatiou, or continuance to which the Corporation or any Sobsidiary is a party, any sale or transfer of all or substantîally all of the assets of the Corporation, or any compulsory shate exchange whereby the Coinmon Sxock is converted into other securities, cash or property, or (E) the Corporation shall authorize a Deemed Liquidation or the voluntary or involuntary dissolution, liquidation or winding up of the afPairs of the Corporation . then, in cach vase, the Corporation shall cause to be delivt : red to each holder of Series B Preferred Stock, in whiting or by electronic tmnsmission, at least 20 calendar days prior to the applicable record or effective date hereinafter specified . a notice stating (x) the date on which a record is to be taken for the purpose of such dividcnd, distribution, rcdemption, rights, or warrants, or if a record is not to be taken, the date as of which the holders of the Common Stock of record to be entitled to such dividend, distributions, redemption . rights, or warrants are to be determined or (y) the date on which such reclassification, consolidation, merger, sale, transfer, or share exchange (or other applicable transaction) is expected to bccumc effective or close, and the date as of which it is cnpcvted that holden of the Common Stock of rcccrd shall be entitled to exchange their shares of‘the Common Stock tör securities, cash, or other property deliverable upon sucli transaction ; JirovideN that the failure to deliver stich notice or any defecl therein or in the mailing thereof shall not affcct the validity of the corporate action rcquirod to bc spccificd in such notice . (d) [Reserved . ] 10. Record Holders . Tire Cortxn - ation and its transfer agent may deem and treat the record holder of any Series B Preferred Stoct ; as the true and lawtiil owner thereot for all purposes . and neither the Corporation nor its transfer agent shall be affected by any notice to thc contrary . 11. No Preemptive Rights . No holders of the Series B Preferred Stork will, as holders of Series B Preferred Stock, have any preemptive rights to purchase or subscribe for Common Stock or any other security of the Corporation . 12. E xclusion of Other Riehts . The Series D Preferred Stock shall not have any preferences or other rightg, voting powers, restrictions, limitations as to dividends or other distributions, qualifications, or rerms or conditions of redemption other than expressly set forth in the Articles of’ Incorporation and this Certificate of Dcsignation, as each may be amended from time to time . 13. H eadings of Subdivisions . The headings of the various subdivisions hereof are for convenience of reference only and shall not affect the interpretation of any of the provisions hereof . 14. S everability of Provisions . If any preferences or other rights, voting powers, restrictions, limitations as to dividends or other distributions . qualifications, or terms or conditions of redemption of the Series B Preferred Stock set forth in this Certificate of Oesignation are invalid, unlawful, or incapable of being enforced by reason of any rule of law or public policy, all other preferences or otlicr rights, voting growers, restrictions, limitations as to dividends or other distributions, qualifications, or terms ot conditions of redemption of Series B Preferred Stock set forth in this Certificate of Designation which can be given effect without the invalid, unlawful . or unenforceable provision thereof shall, nevertheless, remnin in full force end effect and no preferences or other rights, voting powers, restrictions, limitations as to dividends or other distributions, qualifications, or terms or conditions of redemption of the Series B Preferred Stock herein set forth shall be deemed dependent upon any other provision thereof unless so expressed therein . 15. Definitions. As used herein the following terms shall have the following meanings: “ Commun Stock ” rneans the Corporntion's conuiion stock, par value $0.0001 per sliarc. “I ndebtedness ” means (i) all obligations of the Corporal . ion or any Subsidiary for borrowe‹l money or with respect to deposits or advances of any kind, (ii) all obligations of the Corporation or any of its Subsidiaries cvidonccd by bonds, debentures, notes, or similar instniments, (iii) all letters of credit and letters of guaranty in respect of which the Corporation or any of its Subsidiaries is an account party, (iv) all securitization or similar facilities of the Corporation or any of its Subsidiaries, and (iv) all guarantees by the Corporation or any of its Subsidiaries of any of the foregoing . “Person” means any individual, corporation, estate, partnership, joint venture, association, joint - stock company, limited liability company, trust, unincorporated organization, or any other entity . Fmm:BononN+

12 t 24098278 To: Pene: 06 of 10 2025 - 02 - 21 12:53:54 EST DouuGigla Enyelope IO. 8404 FEC1 - A282W5F - AF6D - ABE97BD5e22 D 12124098278 “ñ tockl oIJer Appruval ” means the approval from the stocMulders où the Company où tke terms of this Certificate of Designation. “S ubsidiary ” of any Person means any corporation, limited liability company, partnership, association, trust, or other entity of which securities or other ownership interests representing more than 50 % of the ordinary voting power (or, in the case of a partnership, more than 50 % of the general partnership interests) are owned by such Person or one or more Subsidiarim of such Person or by such Person and one or more Subsidiaries of such Person . “T rading Dav ” ineans a day on which the Cominon Stock is tradcd on a Trading Market . “T rading Market ” incans any of the following markcts or exchangcs on which the Common Stock is tistcd or quotcd för trading on the date in question : the NY SE American, The Nasdaq Capital MarkeL The Nasdaq Global Market, The Nasdaq Global Select Market, or the New York Stock Exchange (or any succcssors to any of the foregoing) . From: Barton N

To: Page: 07 of 10 2025 - 02 - 21 12:53 54 EST DocusigtJ Envelope IO. &404 FCC1 - A28Z - 445F - AF6O - ABE97BO5822O 12124098278 1 N Wl' I NLSS W t 4 kttiiok, the Corporation has caused this Amended and Ftestated Certificate of Desit,nations . Rights, and Preferences rif Series B Preferred Stock to be . signed in its name and on its behalf on this 21 “ day of February, 2025 . PMGC HOLDINGS INC . Name: Title: firaydon Bcnsler Chief E'xeciiti e Ol‘ficet From: Borton N

Exhibit

3.2

Business Number E44920962024 - 7 Filed in the Office of Secretary of State State Of Nevada Filing Number 20254686708 Filed On 2/24/2025 9:21:00 AM Number of Pages 2

To: Page: 2 of 5 2025 - 02 - 24 12:21:32 EST Douusigi4 Envelope ID. FBF625F04D2E - 401F - A5DE - 974B229EC905 12124098278 CERTIFICATE OF AMENDNlENT TO TH E AM ENDED AND RESTATED C ERTI FICAT E OF DESIGNATIONS, RIGHTS, AND PREFERENCES' O F TlIK SERIES D PREFERRED STOCK OI ι PM GC HOLDINGS INC. The undersit,ned, for the purposes of amending the Amended and Restated Certi ficaae of Designs tions, Rights, and Prefer ciices of the Sci ice B Pi ufct red Stock ‹›f PMGC Huldi rigs I nc . (the "C or poratiuii ”), a cm poi ation organized arid existing under and by vin u e ot the Ncvada Revised Statutes (the “N RS" ), docs hereby certify that : £ IRST : That the Boord of Directors of the Corporation ( the “B oard ”) adopted a resolution proposing and declaring advisable the following amendment to the Aincndcd and Restated Ccrii ficaie of Designations, Rights, and Preferences of the Series B Preferred Stock of the Corporation (the “Certificate of Designation”) to increase the authorized shares r s«i n P«r«a stock of the Corporation troin 5 0 million to 300 million and the fi ling of this Ccrti ficate of Amendment to the € ertificate o f Designation (this “A naendcd Certificate of Dcsignatioii”) with the Sccretary of State of thc Statc of Ncyada . SLCOND : That upnn the filing efl this A mended Ccrti ficate of Designation with the Secretary of State of the State of Nc'vada . Section I ot the Certj ficate of Designation wiTT be amended and restated in its entirety as £ uilows : “ 1 . Desi ination and Amount . Th e shares of such series of P referred Stock shall be designated as Series B Preferred Stock” and the number of shares constituting such scrics shall bc 300 , 000 , 000 shares . Each share of Series B Prc fcrrcd Stock shall be identical in all i aspects to ever y othet share of Series B P i eferred Stock . Such number of shares of Series B Prefcrred Stock may from time to time be increased (but not in excess ot the tota! number of authorized shares of preferrcd stock) or decreased (but not below the numbet of shares of Series B Preferred Stock then outstanding) by further i esolution duly adopted by the Boar d of Directors and by thc fi ling of a certificate pui suaiit to t)ie provi . sions o I' the Nevada Revi sed S tattites stating that such increase or decrease, as thc case may be . has been so authorized . For the avoidance of doubt . no stock spi it of any c less of capital stock other than the Series R Preferred Stuck (“Other Stock Spl it”) shrill cffectuute n chani ; c in the nuinbcr tif issued and outstanding Series B Preferred Stock at the Time of the Other Stock Split . ” THIRD : That the aforesaid amendments were duly adopted in accordance with the applicable proc is ions of the NRS . FOURTH : Other than as set forth in this Aincnded C'ertificate of Designation . the Certificate of Dcsignalion shall rema in in full force and effeci . lN WITNESS WH EItEOF, Ihe Corporation has can . sed this Certificate of Amendment to the Amended and Restated Certificate of Designations, Rights . and Preferences oI the Series B Preferred Stock of the Corporation to be signed in its name and on its behalf on this 24 " day of February, 202 S . PMGC HOLD lNGS INC. • •• ι . By. Graydon Bensler From: Borton Nl

v3.25.0.1

Cover

|

Feb. 21, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 21, 2025

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-41875

|

| Entity Registrant Name |

PMGC HOLDINGS INC.

|

| Entity Central Index Key |

0001840563

|

| Entity Tax Identification Number |

33-2382547

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

c/o 120 Newport Center Drive

|

| Entity Address, Address Line Two |

Ste. 249

|

| Entity Address, City or Town |

Newport Beach

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92660

|

| City Area Code |

888

|

| Local Phone Number |

445-4886

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ELAB

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Information, Former Legal or Registered Name |

Elevai Labs Inc.

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

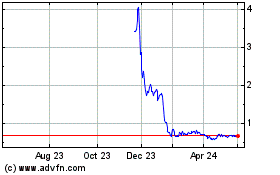

PMGC (NASDAQ:ELAB)

Historical Stock Chart

From Feb 2025 to Mar 2025

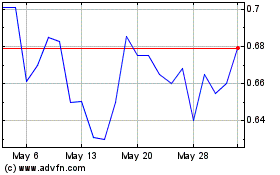

PMGC (NASDAQ:ELAB)

Historical Stock Chart

From Mar 2024 to Mar 2025