PMGC Holdings Inc. Announces Reverse Stock Split to Maintain Nasdaq Listing Compliance

March 06 2025 - 8:00AM

PMGC Holdings Inc. (NASDAQ: ELAB) (“PMGC” or the “Company”) today

announced that it will effect a 1-for-7 reverse stock split (the

“Split”) of its issued and outstanding common stock, par value

$0.0001 per share (“Common Stock”), effective at midnight, Eastern

time, on March 10, 2025.

Key Details of the Reverse Stock Split:

- Conversion Ratio: Every 7 shares of issued and outstanding

Common Stock will be automatically consolidated into one share,

with no further action required from shareholders.

- Fractional Shares: Shareholders entitled to fractional shares

will receive one full share for each fractional portion.

- Updated Stock Identifier: While the trading symbol for the

Common Stock will remain “ELAB,” the Common Stock will be

designated a new CUSIP number (73017P201).

- Equity Adjustments: Outstanding stock awards, options, and the

shares reserved for the equity incentive plan will be adjusted

proportionally to reflect the Split.

- Warrant Share and Exercise Price Adjustments: Shares of Common

Stock underlying outstanding warrants and the exercise price of the

outstanding warrants will be adjusted proportionally to reflect

this stock split.

Purpose of the Reverse Stock Split:

The reverse stock split is a critical step in ensuring

compliance with Nasdaq’s listing requirements, allowing PMGC to

maintain its presence on The Nasdaq Capital Market. A continued

listing enhances the Company’s visibility, strengthens investor

confidence, and positions PMGC for future growth. There is no

guarantee the Company will meet the minimum bid price

requirement.

Nasdaq Rule Changes and Compliance

Considerations:

In line with recent Nasdaq rule changes approved by the U.S.

Securities and Exchange Commission (“SEC”) on January 17, 2025,

PMGC is implementing the reverse stock split to ensure continued

compliance with listing requirements, notably:

- Removal of Stay Period After the

Second 180-Day Compliance Period:Under amended Nasdaq Listing Rule

5815, if an issuer fails to meet the $1.00 minimum bid price after

a second 180-day compliance period, a hearing request will no

longer delay delisting. The stock will be automatically suspended

and moved to the OTC market while any appeal is pending.

- Limited Reverse Split Allowances:Under amended Nasdaq Listing

Rule 5810(c)(3)(A)(iv), issuers that have conducted a reverse stock

split within the past year are ineligible for another compliance

period to regain the minimum bid price. Additionally, if a company

has performed reverse splits totaling 1-to-250 within two years, it

cannot use another compliance period.

- Accelerated Delisting for Stocks

Below $0.10:Under Nasdaq Listing Rule 5810(c)(3)(A)(iii), stocks

trading at or below $0.10 for 10 consecutive business days will be

automatically subject to a Nasdaq delisting determination, with no

compliance period granted.

These amendments emphasize the importance of maintaining a

stable share price above the minimum threshold and reinforce PMGC’s

commitment to staying ahead of potential noncompliance issues.

Impact on Shareholders:

- No Immediate Action Required:

Shareholders holding shares through a broker or in street name will

see their holdings updated automatically.

- Certificate Holders: Shareholders with physical certificates

can exchange them, if desired, through VStock Transfer, LLC, the

transfer agent of the Company, which will provide detailed

instructions.

- Share Value: The reverse split does

not impact the overall value of shareholder equity; it only reduces

the number of shares outstanding while proportionally adjusting the

share price.

Impact on our Common Stock:

Post Split it is anticipated that there will be approximately

577,000 shares of common stock issued and outstanding as of March

10, 2025. The Company is a Nevada corporation, and pursuant to the

Nevada Revised Statutes, shareholder approval is not required to

effect the Split since in connection with the Split, the Company’s

total number of authorized shares of common stock will also be

decreased at the same ratio (1-for-7) as the issued and outstanding

shares of Common Stock.

For additional information, please refer to PMGC’s full Form 8-K

filing available on the SEC’s website or contact PMGC directly

at IR@pmgcholdings.com

Forward-Looking Statements

Statements contained in this press release regarding matters

that are not historical facts are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, as amended. Words such as “believes,” “expects,” “plans,”

“potential,” “would” and “future” or similar expressions such as

“look forward” are intended to identify forward-looking statements.

Forward-looking statements are made as of the date of this press

release and are neither historical facts nor assurances of future

performance. Instead, they are based only on our current beliefs,

expectations and assumptions regarding the future of our business,

future plans and strategies, projections, anticipated events and

trends, the economy, activities of regulators and future

regulations and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict and many of which are outside of our control.

Although the Company believes that the expectations expressed in

these forward-looking statements are reasonable, it cannot assure

you that such expectations will turn out to be correct, and the

Company cautions investors that actual results may differ

materially from the anticipated results. Therefore, you should not

rely on any of these forward-looking statements. These and other

risks are described more fully in PMGC Holdings’ filings with the

United States Securities and Exchange Commission (“SEC”), including

the “Risk Factors” section of the Company’s Annual Report on Form

10-K for the year ended December 31, 2023, filed with the SEC on

March 29, 2024, and its other documents subsequently filed with or

furnished to the SEC. Investors and security holders are urged to

read these documents free of charge on the SEC’s web site

at www.sec.gov. All forward-looking statements contained in

this press release speak only as of the date on which they were

made. Except to the extent required by law, the Company undertakes

no obligation to update such statements to reflect events that

occur or circumstances that exist after the date on which they were

made.

IR Contact:IR@pmgcholdings.com

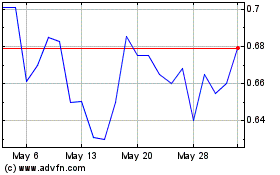

PMGC (NASDAQ:ELAB)

Historical Stock Chart

From Feb 2025 to Mar 2025

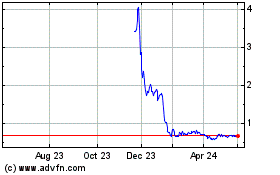

PMGC (NASDAQ:ELAB)

Historical Stock Chart

From Mar 2024 to Mar 2025