false

0001805077

0001805077

2024-02-13

2024-02-13

0001805077

us-gaap:CommonStockMember

2024-02-13

2024-02-13

0001805077

us-gaap:WarrantMember

2024-02-13

2024-02-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 13, 2024

EOS ENERGY ENTERPRISES,

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39291 |

|

84-4290188 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

3920 Park Avenue

Edison, New Jersey 08820

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (732) 225-8400

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

EOSE |

|

The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one share of common stock |

|

EOSEW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

On February 13, 2024, the Company issued a press

release providing its preliminary results for the fourth quarter and year ended December 31, 2023 and certain other business updates.

A copy of the press release is furnished herewith as Exhibit 99.1.

The information furnished under this Item 2.02

and in the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as

amended, or the Exchange Act regardless of any general incorporation language in such filing, unless expressly incorporated by specific

reference in such filing.

Item 7.01 Regulation FD Disclosure.

Item 2.02 above is incorporated herein by reference.

The information furnished under this Item 7.01

and in the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language

in such filing, unless expressly incorporated by specific reference in such filing.

Item 8.01 Other Events.

The Company expects to record revenue of $6.6

million for the quarter ended December 31, 2023, a 148% increase compared to the quarter ended December 31, 2022, and revenue of $16.4

million for the full year ended December 31, 2023, as the Company transitioned manufacturing to the Eos Z3TM Cube and ramped up its semi-automated

manufacturing facility. As a result of this transition, gross margin for the year ended December 31, 2023 is expected to improve by 30%

to 50% over the prior year. The Company had an ending cash balance (excluding restricted cash) of $69.5 million and an orders backlog

of $534.8 million as of December 31, 2023. These preliminary results for the quarter and year ended December 31, 2023 are preliminary

and estimated based on the information available to us at this time, and should not be viewed as a substitute for our interim unaudited

condensed consolidated financial statements prepared in accordance with GAAP. Actual financial results for the quarter and year ended

December 31, 2023, may differ materially from the preliminary financial results. Accordingly, you should not place undue reliance on these

preliminary results.

The preliminary results for the quarter and year

ended December 31, 2023 have been prepared by and are the responsibility of management. Neither our independent registered public accounting

firm, nor any other independent accountants, have audited, reviewed, compiled or performed any procedures with respect to the preliminary

results, nor have they expressed any opinion or any other form of assurance with respect thereto.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EOS ENERGY ENTERPRISES, INC. |

| |

|

|

| |

|

|

| Dated: February 13, 2024 |

By: |

/s/ Nathan Kroeker |

| |

|

Name: |

Nathan Kroeker |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

Eos Energy Enterprises Achieves “Power On” Status of

all Motion Systems on its First State-of-the-Art Manufacturing Line and Provides Preliminary Results

February 13, 2024 —

EDISON, N.J. — Eos Energy Enterprises, Inc. (NASDAQ: EOSE) (“Eos” or the “Company”), a leading provider

of safe, scalable, efficient, and sustainable zinc-based energy storage systems, today announced that it achieved “Power On”

status of all motion systems on its first state-of-the-art manufacturing line and expects to record revenue of $6.6 million for the fourth

quarter, a 148% increase versus fourth quarter 2022. Full year 2023 revenue is expected to be $16.4 million as the Company transitioned

manufacturing to the Eos Z3TM Cube and ramped up its semi-automated manufacturing facility. As a result of this transition,

full year 2023 gross margin is expected to improve by 30% to 50% over the prior year. The Company had an ending cash balance (excluding

restricted cash) of $69.5 million and an orders backlog of $534.8 million as of December 31, 2023.

The Company also provided

further details on its first state-of-the-art manufacturing line and its preliminary fourth quarter and full year 2023 revenue.

State-of-the-Art Manufacturing

Line Update

At the end of January,

the Company, and its automation partner, ACRO Automation, achieved a significant milestone towards Factory Acceptance Testing in ACRO’s

Wisconsin facility. ACRO recently fully powered on the core Eos Z3 battery assembly section of the state-of-the-art manufacturing

line. This begins equipment commissioning, along with controls configuration and uploading software into programmable logic controllers

(PLCs) to operate conveyors, indexers, robots, and pneumatic devices. During the week of February 5, the Company successfully powered

on the second half of the line that performs final Eos Z3 battery module assembly and testing, achieving “Power On” of all

motion systems on the line. The Company is on track for the first state-of-the-art manufacturing line to be installed and commissioned

in Eos’s Turtle Creek facility in Q2 2024.

Fourth Quarter 2023

Revenue

Q4 2023 Revenue is expected

to be $6.6 million, up 148% compared to Q4 2022 revenue of $2.7 million and up 866% compared to Q3 2023 revenue of $0.7

million. The year-over-year growth in revenue was a result of the Company’s transition from Gen 2.3 to the Eos Z3 Cube while the

sequential growth was driven by higher production volumes off its semi-automated production line. The Eos Z3 Cube has higher power density

than Gen 2.3 with a streamlined manufacturing process driven by the Eos Z3 battery module design that incorporates 50% fewer cells, weighs

79% less and has 98% less welds that takes current manufacturing cycle time to below 4 minutes versus the Gen 2.3 which took 90 minutes

to fully manufacture. The Company shipped its first Eos Z3 Cubes at the end of September to two different customers and is currently in

the process of delivering a project owned by a large North American Infrastructure Fund in Orchard, Texas.

Full Year 2023 Revenue

Full year 2023 Revenue is expected to be $16.4

million, a decrease compared to full year 2022 revenue of $17.9 million as the Company reduced and concluded Gen 2.3 production in the

first half of 2023, while simultaneously standing up the Eos Z3 iterative manufacturing processes. The Company’s strategy to scale

|

|

is centered on expanding capacity with

a disciplined and iterative approach to ensure capital efficiency designed around a three phased approach: Discrete Manufacturing Operations,

Semi-Automation Production, and State-of-the-Art Manufacturing. To achieve this, the Company is jointly working with customers to understand

delivery timelines based on customer site readiness while producing at volumes that optimize its cost-out roadmap. As previously

communicated, the Company expects to implement various cost-reduction initiatives throughout 2024 with the first benefits being realized

in late Q1 2024 and the majority of the expected cost-reduction benefits being realized in the fourth quarter. The Company believes this

prudent approach ensures that critical deliveries and customer relationships are prioritized while optimizing capital.

Expected Q4 and Full

Year 2023 Revenue

Eos will provide further commentary on its fourth

quarter performance in connection with the release of its full year and fourth quarter 2023 financial results in March with conference

call timing and details to follow.

About Eos

Eos Energy Enterprises, Inc. is accelerating the shift to clean energy

with positively ingenious solutions that transform how the world stores power. Our breakthrough Znyth™ aqueous zinc battery was

designed to overcome the limitations of conventional lithium-ion technology. Safe, scalable, efficient, sustainable—and manufactured

in the U.S—it's the core of our innovative systems that today provide utility, industrial, and commercial customers with a proven,

reliable energy storage alternative for 3- to 12-hour applications. Eos was founded in 2008 and is headquartered in Edison, New Jersey.

For more information about Eos (NASDAQ: EOSE), visit eose.com.

Contacts

Investors: ir@eose.com

Media: media@eose.com

Forward-Looking Statements / Disclaimer

This press release includes

certain statements that may constitute "forward-looking statements" within the meaning of the "safe harbor" provisions

of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements that refer

to our expected revenue for the fourth quarter and full year 2023, expected margins for full year 2023, and cash balance and orders backlog

as of December 31, 2023. The words "anticipate," "believe," "continue," "could," "estimate,"

"expect," "intends," "may," "might," "plan," "possible," "potential,"

"predict," "project," "should," "would" and similar expressions may identify forward-looking statements,

but the absence of these words does not mean that a statement is not forward-looking. Factors which may cause actual results to differ

materially from current

expectations include,

but are not limited to: the preliminary financial information remains subject to changes and finalization based upon management’s

ongoing review of results for the fourth quarter and full year 2023 and the completion of all quarter closing procedures; changes adversely

affecting the business in which we are engaged; our ability to forecast trends accurately; our ability to secure final approval of a loan

from the Department of Energy or the final amount of any loan; our ability to generate cash, service indebtedness and incur additional

indebtedness; our ability to secure financing to continue expansion; our customer’s ability to secure project financing; our ability

to develop efficient manufacturing processes to scale and to forecast related costs and efficiencies accurately, and to secure labor;

fluctuations in our revenue and operating results; competition from existing or new competitors; the failure to convert firm order backlog

and pipeline to revenue; the failure to sufficiently reduce manufacturing costs, potential delays in the launch of our Eos Z3 battery;

inefficient implementation of the Inflation Reduction Act of 2022; the amount of final tax credits available to our customers or to Eos

pursuant to the Inflation Reduction Act; risks associated with security breaches in our information technology systems; risks related

to legal proceedings or claims; risks associated with evolving energy policies in the United States and other countries and the potential

costs of regulatory compliance; risks associated with changes in federal, state, or local laws; risks associated with potential costs

of regulatory compliance; risks associated with changes to U.S. trade policies; risks resulting from the impact of global pandemics, including

the novel coronavirus, Covid-19; our ability to maintain the listing of our shares of common stock on NASDAQ; our ability to grow our

business and manage growth profitably, maintain relationships with customers and suppliers and retain our management and key employees;

risks related to the adverse changes in general economic conditions, including inflationary pressures and increased interest rates; risk

from supply chain disruptions and other impacts of geopolitical conflict; changes in applicable laws or regulation; the possibility that

Eos may be adversely affected by other economic, business, and/or competitive factors; other factors beyond our control; and other risks

and uncertainties. The forward-looking statements contained in this press release are also subject to additional risks, uncertainties,

and factors, including those more fully described in Eos’s most recent filings with the Securities and Exchange Commission, including

Eos’s most recent Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Further information on potential risks

that could affect actual results will be included in the subsequent periodic and current reports and other filings that Eos makes with

the Securities and Exchange Commission from time to time. Moreover, Eos operates in a very competitive and rapidly changing environment,

and new risks and uncertainties may emerge that could have an impact on the forward-looking statements contained in this press release.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and, except as required by law, Eos assumes no obligation and does not intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or otherwise.

v3.24.0.1

Cover

|

Feb. 13, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 13, 2024

|

| Entity File Number |

001-39291

|

| Entity Registrant Name |

EOS ENERGY ENTERPRISES,

INC.

|

| Entity Central Index Key |

0001805077

|

| Entity Tax Identification Number |

84-4290188

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3920 Park Avenue

|

| Entity Address, City or Town |

Edison

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08820

|

| City Area Code |

732

|

| Local Phone Number |

225-8400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

EOSE

|

| Security Exchange Name |

NASDAQ

|

| Warrant [Member] |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of common stock

|

| Trading Symbol |

EOSEW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

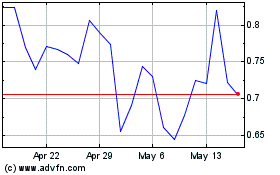

Eos Energy Enterprises (NASDAQ:EOSE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Eos Energy Enterprises (NASDAQ:EOSE)

Historical Stock Chart

From Mar 2024 to Mar 2025