Enstar Group Limited (Nasdaq: ESGR) today announced financial

results for the second quarter 2024.

Merger and Financial Results Audio

Update:

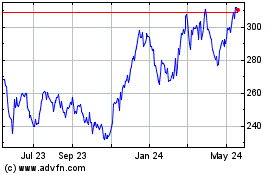

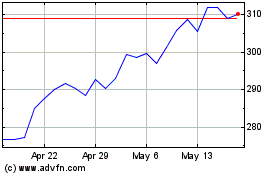

As previously announced, Enstar has entered into

a definitive merger agreement to be acquired by a consortium of

institutional investors led by Sixth Street for $5.1 billion or

$338 per ordinary share. A copy of the press release can be found

by visiting the Investor Relations section of the Enstar corporate

website at EnstarGroup.com. In light of the announced transaction,

Enstar will not be providing recorded commentary to accompany its

June 30, 2024 financial results.

President’s Departure:

Enstar also announced today that President, Orla

Gregory, will step down at the end of the year. Ms. Gregory has

been a pivotal leader at Enstar, contributing significantly to the

Company’s growth and success over her 21-year tenure, and serving

in senior executive leadership roles since 2015. She will focus on

leading the Company’s preparations for closing the merger and its

transition to a privately held business, as well as continuing to

serve as a director and executive leadership team member until

December 31, 2024.

Mr. Silvester said: “Orla has spent her career

in dedicated service to Enstar. She is a dynamic executive who has

contributed massively to the strong leadership, culture, and brand

built at Enstar. We are appreciative that she will be involved in

transitioning us into our next chapter. We will miss Orla

tremendously.”

Ms. Gregory said: “I am very proud of the

achievements by so many during my time at Enstar. With great

leadership in place, and significant opportunities in the legacy

space, I have no doubt that Enstar will continue to excel. Today’s

transaction is an exciting evolution, and I look forward to working

with the team in preparation for closing. I thank Dominic for the

great opportunities I’ve had and all of my colleagues for their

dedication and support.”

Transactions:

During the second quarter 2024, we:

-

Announced $400 million Loss Portfolio Transfer (“LPT”) agreement

with SiriusPoint to reinsure a portfolio of workers’ compensation

business covering underwriting years 2018 to 2023.

-

Signed an agreement to reinsure certain 2019 and 2020 business

written by a third-party capital platform for which Enstar will

receive a premium of $350m for the portfolio, which marks our first

ever deal in ILS and the first solution of its type in this market.

This deal closed on July 25, 2024.

-

Entered into an adverse development cover (“ADC”) agreement with

Insurance Australia Group, where Enstar will provide approximately

$430 million of excess cover over approximately $1.7 billion of

underlying reserves related to certain long-tail insurance

business, including product & public liability, compulsory

third-party motor, professional risks and workers’

compensation.

-

Completed a $297 million transaction to reinsure legacy business

with Accredited, in connection with Accredited’s acquisition by

Onex Partners.

Three Months Ended June 30, 2024

Highlights:

-

Net income attributable to Enstar ordinary shareholders of $126

million, or $8.49 per diluted ordinary share, compared to $21

million, or $1.34 per diluted ordinary share, for the three months

ended June 30, 2023.

-

Return on equity ("ROE") of 2.5% and Adjusted ROE* of 2.9% for the

quarter compared to ROE and Adjusted ROE* of 0.5% and 2.1%,

respectively, in the second quarter of 2023. Quarter-over-quarter

ROE performance was positively impacted by an increase in the gain

from fair value changes in trading securities, funds held and other

investments and favorable prior period loss development (“PPD”).

Second quarter 2024 Adjusted ROE* excludes $35 million of net

realized losses on our fixed maturities and fair value changes in

trading securities and funds held.

-

Run-off liability earnings ("RLE") of $62 million for the quarter

relative to the comparative quarter RLE of $10 million was driven

by favorable loss development on our construction defect line of

business after assuming active claims management, as well as our

professional indemnity/directors and officers line of

business.

- Annualized total investment return

(“TIR”) of 5.2% and Annualized Adjusted TIR* of 5.6% for the

quarter compared to Annualized TIR and Annualized Adjusted TIR* of

3.0% and 5.1%, respectively, for the three months ended June 30,

2023. TIR in the second quarter of 2024 benefited from the fact

that interest rates increased by less during the period relative to

the second quarter of 2023, resulting in reduced losses from fair

value changes in fixed income securities and funds held.

Quarter-over-quarter TIR performance was also positively impacted

by increased gains from fair value changes in other investments,

including equities, partially offset by a loss from equity method

investments.

* Non-GAAP measure; refer to "Non-GAAP Financial

Measures" further below for explanatory notes and a reconciliation

to the most directly comparable GAAP measure.

Six Months Ended June 30, 2024

Highlights:

-

Net income attributable to Enstar ordinary shareholders of $245

million, or $16.49 per diluted ordinary share. In comparison, net

income attributable to Enstar ordinary shareholders of $445

million, or $27.19 per diluted ordinary share, for the six months

ended June 30, 2023, which includes the one-time Enstar's share of

gain on novation of $194 million of our closed block reinsurance of

life annuity policies in Enhanzed Re.

-

ROE of 4.9% and Adjusted ROE* of 5.6%, compared to 10.0% and 8.6%,

respectively, for the six months ended June 30, 2023. The

prior-year period’s ROE and Adjusted ROE* included a $194 million

net gain recognized on the novation of Enhanzed Re reinsurance

closed block of life annuity policies. Period-over-period ROE

performance was also impacted by a decline in the gain from fair

value changes in trading securities, funds held and other

investments and losses from equity method investments. This is

partially offset by an increase in favorable prior period loss

development. Year-to-date second quarter 2024 Adjusted ROE* also

excludes $60 million of net realized losses on our fixed

maturities and fair value changes in trading securities and funds

held.

- RLE of $86 million was driven by

favorable loss development on our construction defect line of

business after assuming active claims management, as well as our

asbestos and professional indemnity/directors and officers lines of

business, partially offset by adverse loss development on our

environmental and general casualty lines of business. For the six

months ended June 30, 2023, RLE of $20 million was positively

impacted by favorable loss development in our workers’ compensation

and general casualty line of business. The favorable results in

2023 were partially offset by an increase in the fair value of

liabilities for which we have elected the fair value option and an

increase in the unallocated loss adjustment expenses (“ULAE”)

provision as a result of assuming active claims management

control.

-

Annualized TIR of 5.0% and Adjusted Annualized TIR* of 5.6%,

compared to 6.1% and 5.6%, respectively, for the six months ended

June 30, 2023. TIR was negatively impacted by increased losses from

fair value changes on trading securities and funds held as a result

of comparatively more significant increases in interest rates in

the U.S. in the first half of 2024 than in the prior period.

Period-over-period TIR was also impacted by losses from equity

method investments, partially offset by increases in the fair value

of other investments.

-

In March 2024, Enstar’s Bermuda-based wholly-owned subsidiary

Cavello Bay Reinsurance Limited was assigned an Insurer Financial

Strength Rating of ‘A’ with stable outlook by S&P Global

Ratings.

* Non-GAAP measure; refer to "Non-GAAP Financial

Measures" further below for explanatory notes and a reconciliation

to the most directly comparable GAAP measure.

Key Financial and Operating

Metrics

We use the following GAAP and Non-GAAP measures

to monitor the performance of and manage the company:

| |

Three Months Ended |

|

|

|

Six Months Ended |

|

|

| |

June 30, |

|

$ / pp / bp Change |

|

June 30, |

|

$ / pp / bpChange |

| |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

| |

(in millions of U.S. dollars, except per share

data) |

|

|

|

| |

|

|

Key Earnings Metrics |

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Enstar ordinary shareholders |

$ |

126 |

|

|

$ |

21 |

|

|

$ |

105 |

|

|

$ |

245 |

|

|

$ |

445 |

|

|

$ |

(200 |

) |

|

Adjusted operating income attributable to Enstar ordinary

shareholders* |

$ |

160 |

|

|

$ |

105 |

|

|

$ |

55 |

|

|

$ |

301 |

|

|

$ |

506 |

|

|

$ |

(205 |

) |

|

ROE |

|

2.5 |

% |

|

|

0.5 |

% |

|

2.0 pp |

|

|

4.9 |

% |

|

|

10.0 |

% |

|

|

(5.1 |

) pp |

|

Adjusted ROE* |

|

2.9 |

% |

|

|

2.1 |

% |

|

0.8 pp |

|

|

5.6 |

% |

|

|

8.6 |

% |

|

|

(3.0 |

) pp |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Key Run-off Metrics |

|

|

|

|

|

|

|

|

|

|

|

|

Prior period loss development |

$ |

62 |

|

|

$ |

10 |

|

|

$ |

52 |

|

|

$ |

86 |

|

|

$ |

20 |

|

|

$ |

66 |

|

|

Adjusted prior period loss development* |

$ |

65 |

|

|

$ |

8 |

|

|

$ |

57 |

|

|

$ |

89 |

|

|

$ |

44 |

|

|

$ |

45 |

|

|

RLE |

|

0.6 |

% |

|

|

0.1 |

% |

|

0.5 pp |

|

|

0.8 |

% |

|

|

0.2 |

% |

|

|

0.6 |

pp |

|

Adjusted RLE* |

|

0.6 |

% |

|

|

0.1 |

% |

|

0.5 pp |

|

|

0.7 |

% |

|

|

0.3 |

% |

|

|

0.4 |

pp |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Key Investment Return Metrics |

|

|

|

|

|

|

|

|

|

|

|

|

Total investable assets |

$ |

17,375 |

|

|

$ |

19,219 |

|

|

$ |

(1,844 |

) |

|

$ |

17,375 |

|

|

$ |

19,219 |

|

|

$ |

(1,844 |

) |

|

Adjusted total investable assets* |

$ |

18,178 |

|

|

$ |

20,272 |

|

|

$ |

(2,094 |

) |

|

$ |

18,178 |

|

|

$ |

20,272 |

|

|

$ |

(2,094 |

) |

|

Annualized investment book yield |

|

4.35 |

% |

|

|

4.47 |

% |

|

(12) bp |

|

|

4.35 |

% |

|

|

3.78 |

% |

|

|

57 |

bp |

|

Annualized TIR |

|

5.2 |

% |

|

|

3.0 |

% |

|

2.2 pp |

|

|

5.0 |

% |

|

|

6.1 |

% |

|

|

(1.1 |

) pp |

|

Adjusted Annualized TIR* |

|

5.6 |

% |

|

|

5.1 |

% |

|

0.5 pp |

|

|

5.6 |

% |

|

|

5.6 |

% |

|

|

— |

pp |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

As of |

|

|

|

Key Shareholder Metrics |

|

|

|

|

|

|

June 30, 2024 |

|

December 31, 2023 |

|

|

|

Book value per ordinary share |

|

|

|

|

|

|

$ |

358.74 |

|

|

$ |

343.45 |

|

|

$ |

15.29 |

|

|

Fully diluted book value per ordinary share* |

|

|

|

|

|

|

$ |

350.74 |

|

|

$ |

336.72 |

|

|

$ |

14.02 |

|

pp - Percentage point(s)

bp - Basis point(s)

*Non-GAAP measure; refer to "Non-GAAP Financial

Measures" further below for explanatory notes and a reconciliation

to the most directly comparable GAAP measure.

Results of Operations By Segment - For

the Three and Six Months Ended June 30, 2024 and 2023

Run-off Segment

The following is a discussion and analysis of

the results of operations for our Run-off segment.

| |

Three Months Ended |

|

|

|

Six Months Ended |

|

|

| |

June 30, |

|

$Change |

|

June 30, |

|

$Change |

| |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

| |

(in millions of U.S. dollars) |

|

|

|

|

|

|

|

REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

Net premiums earned |

$ |

5 |

|

|

$ |

7 |

|

|

$ |

(2 |

) |

|

$ |

16 |

|

|

$ |

15 |

|

|

$ |

1 |

|

|

Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

Reduction in estimates of net ultimate defendant A&E

liabilities - prior periods |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

(2 |

) |

|

Reduction in estimated future defendant A&E expenses |

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

|

2 |

|

|

|

1 |

|

|

|

1 |

|

|

All other income |

|

2 |

|

|

|

5 |

|

|

|

(3 |

) |

|

|

4 |

|

|

|

7 |

|

|

|

(3 |

) |

|

Total other income |

|

3 |

|

|

|

5 |

|

|

|

(2 |

) |

|

|

6 |

|

|

|

10 |

|

|

|

(4 |

) |

|

Total revenues |

|

8 |

|

|

|

12 |

|

|

|

(4 |

) |

|

|

22 |

|

|

|

25 |

|

|

|

(3 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

Net incurred losses and LAE: |

|

|

|

|

|

|

|

|

|

|

|

|

Current period |

|

4 |

|

|

|

3 |

|

|

|

1 |

|

|

|

9 |

|

|

|

13 |

|

|

|

(4 |

) |

|

Prior periods: |

|

|

|

|

|

|

|

|

|

|

|

|

Reduction in estimates of net ultimate losses |

|

(42 |

) |

|

|

(8 |

) |

|

|

(34 |

) |

|

|

(48 |

) |

|

|

(23 |

) |

|

|

(25 |

) |

|

Reduction in provisions for ULAE |

|

(22 |

) |

|

|

— |

|

|

|

(22 |

) |

|

|

(39 |

) |

|

|

(18 |

) |

|

|

(21 |

) |

|

Total prior periods |

|

(64 |

) |

|

|

(8 |

) |

|

|

(56 |

) |

|

|

(87 |

) |

|

|

(41 |

) |

|

|

(46 |

) |

|

Total net incurred losses and LAE |

|

(60 |

) |

|

|

(5 |

) |

|

|

(55 |

) |

|

|

(78 |

) |

|

|

(28 |

) |

|

|

(50 |

) |

|

Acquisition costs |

|

1 |

|

|

|

4 |

|

|

|

(3 |

) |

|

|

2 |

|

|

|

6 |

|

|

|

(4 |

) |

|

General and administrative expenses |

|

48 |

|

|

|

47 |

|

|

|

1 |

|

|

|

90 |

|

|

|

86 |

|

|

|

4 |

|

|

Total expenses |

|

(11 |

) |

|

|

46 |

|

|

|

(57 |

) |

|

|

14 |

|

|

|

64 |

|

|

|

(50 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

SEGMENT NET INCOME (LOSS) |

$ |

19 |

|

|

$ |

(34 |

) |

|

$ |

53 |

|

|

$ |

8 |

|

|

$ |

(39 |

) |

|

$ |

47 |

|

Overall Results

Three Months Ended June 30, 2024 versus

2023: Net income from our Run-off segment was $19 million

compared to net loss of $34 million in the comparative quarter,

primarily due to:

-

A $56 million increase in favorable PPD in the current quarter,

mainly driven by a $34 million increase in the reduction in

estimates of net ultimate losses and a $22 million release of ULAE

provisions.

-

During the second quarter of 2024, we recognized favorable loss

development on our construction defect and professional

indemnity/directors and officers lines of business of $24 million

and $12 million, respectively, driven by favorable claims

experience.

-

In comparison, during the second quarter of 2023 we recognized

favorable loss development of $9 million on our workers’

compensation line of business as a result of favorable claims

experience, most notably in the 2021 acquisition year. We also

increased our ULAE provision by $21 million as a result of assuming

active claims control on the 2022 LPT agreement with Argo, which

offset other ULAE reserve adjustments from our run-off

operations.

Six Months Ended June 30, 2024 versus

2023: Net income from our Run-off segment was $8 million

compared to net loss of $39 million in the comparative period,

primarily due to:

-

A $46 million increase in favorable PPD, mainly driven by a $25

million increase in the reduction in estimates of net ultimate

losses and a $21 million increase in the release of ULAE provisions

relative to the comparative period.

-

During the first half of 2024, PPD was driven by favorable loss

development across multiple lines of business. We recognized

$41 million and $22 million of favorable loss development

on our professional indemnity/directors and officers and

construction defect line of business, respectively, as a result of

favorable claims experience, as well as $25 million of

favorable loss development on our asbestos line of business

resulting from actuarial analysis. This was partially offset by

adverse loss development on our general casualty line of business

of $17 million, driven by adverse claims experience and adverse

loss development on our environmental line of business of $25

million due to results from actuarial reviews during the

period.

-

In comparison, in the first half of 2023, we recognized favorable

loss development of $20 million on our workers’ compensation line

of business as a result of continued favorable claims experience,

most notably in the 2021 acquisition year.

Investments Segment

The following is a discussion and analysis of

the results of operations for our Investments segment.

| |

Three Months Ended |

|

|

|

Six Months Ended |

|

|

| |

June 30, |

|

$Change |

|

June 30, |

|

$Change |

| |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

| |

(in millions of U.S. dollars) |

|

|

|

|

|

|

|

REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income: |

|

|

|

|

|

|

|

|

|

|

|

|

Fixed maturities |

$ |

137 |

|

|

$ |

145 |

|

|

$ |

(8 |

) |

|

$ |

279 |

|

|

$ |

276 |

|

|

$ |

3 |

|

|

Cash and restricted cash |

|

7 |

|

|

|

8 |

|

|

|

(1 |

) |

|

|

15 |

|

|

|

13 |

|

|

|

2 |

|

|

Other investments, including equities |

|

19 |

|

|

|

23 |

|

|

|

(4 |

) |

|

|

39 |

|

|

|

47 |

|

|

|

(8 |

) |

|

Less: Investment expenses |

|

(8 |

) |

|

|

(4 |

) |

|

|

(4 |

) |

|

|

(18 |

) |

|

|

(8 |

) |

|

|

(10 |

) |

|

Total net investment income |

|

155 |

|

|

|

172 |

|

|

|

(17 |

) |

|

|

315 |

|

|

|

328 |

|

|

|

(13 |

) |

|

Net realized losses: |

|

|

|

|

|

|

|

|

|

|

|

|

Fixed maturities |

|

(9 |

) |

|

|

(25 |

) |

|

|

16 |

|

|

|

(15 |

) |

|

|

(43 |

) |

|

|

28 |

|

|

Total net realized losses |

|

(9 |

) |

|

|

(25 |

) |

|

|

16 |

|

|

|

(15 |

) |

|

|

(43 |

) |

|

|

28 |

|

|

Fair value changes in: |

|

|

|

|

|

|

|

|

|

|

|

|

Fixed maturities, trading |

|

(26 |

) |

|

|

(64 |

) |

|

|

38 |

|

|

|

(45 |

) |

|

|

(5 |

) |

|

|

(40 |

) |

|

Other investments, including equities |

|

112 |

|

|

|

62 |

|

|

|

50 |

|

|

|

216 |

|

|

|

209 |

|

|

|

7 |

|

|

Total fair value changes in trading securities and other

investments |

|

86 |

|

|

|

(2 |

) |

|

|

88 |

|

|

|

171 |

|

|

|

204 |

|

|

|

(33 |

) |

|

Total revenues |

|

232 |

|

|

|

145 |

|

|

|

87 |

|

|

|

471 |

|

|

|

489 |

|

|

|

(18 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

10 |

|

|

|

10 |

|

|

|

— |

|

|

|

20 |

|

|

|

21 |

|

|

|

(1 |

) |

|

Total expenses |

|

10 |

|

|

|

10 |

|

|

|

— |

|

|

|

20 |

|

|

|

21 |

|

|

|

(1 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from equity method investments |

|

(8 |

) |

|

|

14 |

|

|

|

(22 |

) |

|

|

(13 |

) |

|

|

25 |

|

|

|

(38 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

SEGMENT NET INCOME |

$ |

214 |

|

|

$ |

149 |

|

|

$ |

65 |

|

|

$ |

438 |

|

|

$ |

493 |

|

|

$ |

(55 |

) |

Overall Results

Three Months Ended June 30, 2024 versus

2023: Net income from our Investments segment was

$214 million for the three months ended June 30, 2024 compared

to $149 million for the three months ended June 30, 2023. The

increase of $65 million was primarily due to:

-

an increase in the gain from fair value changes in other

investments, including equities of $50 million, primarily driven by

a favorable variance in relation to an embedded derivative related

to the assets supporting one of our LPTs and increases in the gains

for our CLO equities, hedge funds, private equity funds, privately

held equities and infrastructure. This is partially offset by

decreases in the gain from publicly traded equities, fixed income

funds, and real estate; and

-

a decrease in the aggregate of net realized losses and losses from

fair value changes in trading securities and funds held of $54

million, primarily as a result of moderating increases in interest

rates across U.S., U.K. and European markets in the current period,

relative to the comparative quarter. This is partially offset

by;

-

a decrease in our net investment income of $17 million due to an

overall reduction in investments and funds held assets as a result

of claims payments which outpaced new business relative to the

periods and an increase in investment expenses primarily due to

increased performance fees; and

-

a loss from equity method investments of $8 million for the current

quarter compared to $14 million income in the comparative quarter

as a result of increased losses on our investment in Monument

Re.

Six Months Ended June 30, 2024 versus

2023: Net income from our Investments segment was $438

million for the six months ended June 30, 2024 compared to $493

million for the six months ended June 30, 2023. The decrease of $55

million was primarily due to:

-

an increase in the aggregate of net realized losses and losses from

fair value changes in trading securities and funds held of $12

million, primarily as a result of comparatively more significant

increase in interest rates in the U.S., as well as comparatively

less significant tightening credit spreads;

-

a loss from equity method investments of $13 million for the

current period compared to $25 million income in the comparative

period as a result of increased losses on our investment in

Monument Re, partially offset by an increase in income on our

investment in Core Specialty; and

- a decrease in our net investment

income of $13 million, which is primarily due reductions in our

investments and funds held assets as a result of claims payments

which outpaced new business, less dividend income earned on our

publicly traded equities and increased investment expenses

primarily due to increased performance fees; partially offset

by;

-

an increase in the gain on fair value changes from other

investments, including equities, of $7 million, primarily driven by

our privately held equities, CLO equities, hedge funds, and private

equity funds relative to the comparative period, partially offset

by decreased gains on publicly traded equities, private debt, and

real estate, and an unfavorable variance in relation to an embedded

derivative related to the assets supporting one of our LPTs.

Income and (Loss) by Segment - For the

Three and Six Months Ended June 30, 2024 and 2023

| |

Three Months Ended |

|

|

|

Six Months Ended |

|

|

| |

June 30, |

|

$Change |

|

June 30, |

|

$Change |

| |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

| |

(in millions of U.S. dollars) |

|

REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

Run-off |

$ |

8 |

|

|

$ |

12 |

|

|

$ |

(4 |

) |

|

$ |

22 |

|

|

$ |

25 |

|

|

$ |

(3 |

) |

|

Investments |

|

232 |

|

|

|

145 |

|

|

|

87 |

|

|

|

471 |

|

|

|

489 |

|

|

|

(18 |

) |

|

Assumed Life (1) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

275 |

|

|

|

(275 |

) |

|

Subtotal |

|

240 |

|

|

|

157 |

|

|

|

83 |

|

|

|

493 |

|

|

|

789 |

|

|

|

(296 |

) |

|

Corporate and other (1) |

|

(4 |

) |

|

|

(3 |

) |

|

|

(1 |

) |

|

|

(7 |

) |

|

|

(3 |

) |

|

|

(4 |

) |

|

Total revenues |

$ |

236 |

|

|

$ |

154 |

|

|

$ |

82 |

|

|

$ |

486 |

|

|

$ |

786 |

|

|

$ |

(300 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

SEGMENT NET INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

Run-off |

$ |

19 |

|

|

$ |

(34 |

) |

|

$ |

53 |

|

|

$ |

8 |

|

|

$ |

(39 |

) |

|

$ |

47 |

|

|

Investments |

|

214 |

|

|

|

149 |

|

|

|

65 |

|

|

|

438 |

|

|

|

493 |

|

|

|

(55 |

) |

|

Assumed Life (1) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

275 |

|

|

|

(275 |

) |

|

Total segment net income |

|

233 |

|

|

|

115 |

|

|

|

118 |

|

|

|

446 |

|

|

|

729 |

|

|

|

(283 |

) |

|

Corporate and other (1) |

|

(107 |

) |

|

|

(94 |

) |

|

|

(13 |

) |

|

|

(201 |

) |

|

|

(284 |

) |

|

|

83 |

|

|

NET INCOME ATTRIBUTABLE TO ENSTAR ORDINARY SHAREHOLDERS |

$ |

126 |

|

|

$ |

21 |

|

|

$ |

105 |

|

|

$ |

245 |

|

|

$ |

445 |

|

|

$ |

(200 |

) |

(1) Effective January 1, 2024, Assumed Life and

Legacy Underwriting were determined to no longer meet the

definition of reportable segments and their residual income and

loss activities were prospectively included in Corporate and other

activities. Activities prior to January 1, 2024 are recorded in

their respective segments. In addition, Legacy Underwriting had no

revenue or income activity for the three or six months ended June

30, 2024 and 2023 and therefore is excluded from the table

above.

Cautionary Statement

This press release contains certain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements include

statements regarding the intent, belief or current expectations of

Enstar and its management team. Investors can identify these

statements by the fact that they do not relate strictly to

historical or current facts. They use words such as ‘aim’,

‘anticipate’, ‘estimate’, ‘expect’, ‘intend’, ‘will’, ‘project’,

‘plan’, ‘believe’, ‘target’ and other words and terms of similar

meaning in connection with any discussion of future events or

performance. Investors are cautioned that any such forward-looking

statements speak only as of the date they are made, are not

guarantees of future performance and involve risks and

uncertainties, and that actual results may differ materially from

those projected in the forward-looking statements as a result of

various factors. Important risk factors regarding Enstar can be

found under the heading "Risk Factors" in our Form 10-K for the

year ended December 31, 2023 and are incorporated herein by

reference. Furthermore, Enstar undertakes no obligation to update

any written or oral forward-looking statements or publicly announce

any updates or revisions to any of the forward-looking statements

contained herein, to reflect any change in its expectations with

regard thereto or any change in events, conditions, circumstances

or assumptions underlying such statements, except as required by

law.

About Enstar

Enstar is a NASDAQ-listed leading global

(re)insurance group that offers capital release solutions through

its network of group companies in Bermuda, the United States, the

United Kingdom, Continental Europe and Australia. A market leader

in completing legacy acquisitions, Enstar has acquired over 115

companies and portfolios since its formation. For further

information about Enstar, see www.enstargroup.com.

Contacts

For Investors: Matthew Kirk

(investor.relations@enstargroup.com)

For Media: Jenna Kerr

(communications@enstargroup.com)

ENSTAR GROUP

LIMITEDCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONSFor the Three and Six Months Ended June

30, 2024 and 2023

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(expressed in millions of U.S. dollars, except share and

per share data) |

|

REVENUES |

|

|

|

|

|

|

|

|

Net premiums earned |

$ |

5 |

|

|

$ |

7 |

|

|

$ |

16 |

|

|

$ |

15 |

|

|

Net investment income |

|

155 |

|

|

|

172 |

|

|

|

315 |

|

|

|

328 |

|

|

Net realized losses |

|

(9 |

) |

|

|

(25 |

) |

|

|

(15 |

) |

|

|

(43 |

) |

|

Fair value changes in trading securities, funds held and other

investments |

|

86 |

|

|

|

(2 |

) |

|

|

171 |

|

|

|

204 |

|

|

Other (loss) income |

|

(1 |

) |

|

|

2 |

|

|

|

(1 |

) |

|

|

282 |

|

|

Total revenues |

|

236 |

|

|

|

154 |

|

|

|

486 |

|

|

|

786 |

|

| |

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

Net incurred losses and loss adjustment expenses |

|

|

|

|

|

|

|

|

Current period |

|

4 |

|

|

|

3 |

|

|

|

9 |

|

|

|

13 |

|

|

Prior periods |

|

(62 |

) |

|

|

(10 |

) |

|

|

(86 |

) |

|

|

(20 |

) |

|

Total net incurred losses and loss adjustment expenses |

|

(58 |

) |

|

|

(7 |

) |

|

|

(77 |

) |

|

|

(7 |

) |

|

Amortization of net deferred charge assets |

|

29 |

|

|

|

24 |

|

|

|

59 |

|

|

|

41 |

|

|

Acquisition costs |

|

1 |

|

|

|

4 |

|

|

|

2 |

|

|

|

6 |

|

|

General and administrative expenses |

|

98 |

|

|

|

85 |

|

|

|

185 |

|

|

|

174 |

|

|

Interest expense |

|

23 |

|

|

|

22 |

|

|

|

45 |

|

|

|

45 |

|

|

Net foreign exchange losses (gains) |

|

1 |

|

|

|

5 |

|

|

|

(8 |

) |

|

|

(1 |

) |

|

Total expenses |

|

94 |

|

|

|

133 |

|

|

|

206 |

|

|

|

258 |

|

| |

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAXES |

|

142 |

|

|

|

21 |

|

|

|

280 |

|

|

|

528 |

|

|

Income tax benefit (expense) |

|

2 |

|

|

|

4 |

|

|

|

(3 |

) |

|

|

5 |

|

|

(Loss) income from equity method investments |

|

(8 |

) |

|

|

14 |

|

|

|

(13 |

) |

|

|

25 |

|

|

NET INCOME |

|

136 |

|

|

|

39 |

|

|

|

264 |

|

|

|

558 |

|

|

Less: Net income attributable to noncontrolling interest |

|

(1 |

) |

|

|

(9 |

) |

|

|

(1 |

) |

|

|

(95 |

) |

|

NET INCOME ATTRIBUTABLE TO ENSTAR GROUP LIMITED |

|

135 |

|

|

|

30 |

|

|

|

263 |

|

|

|

463 |

|

|

Dividends on preferred shares |

|

(9 |

) |

|

|

(9 |

) |

|

|

(18 |

) |

|

|

(18 |

) |

|

NET INCOME ATTRIBUTABLE TO ENSTAR GROUP LIMITED ORDINARY

SHAREHOLDERS |

$ |

126 |

|

|

$ |

21 |

|

|

$ |

245 |

|

|

$ |

445 |

|

| |

|

|

|

|

|

|

|

|

Earnings per ordinary share attributable to Enstar: |

|

|

|

|

|

Basic |

$ |

8.59 |

|

|

$ |

1.36 |

|

|

$ |

16.72 |

|

|

$ |

27.44 |

|

|

Diluted |

$ |

8.49 |

|

|

$ |

1.34 |

|

|

$ |

16.49 |

|

|

$ |

27.19 |

|

|

Weighted average ordinary shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

14,664,767 |

|

|

|

15,460,318 |

|

|

|

14,652,962 |

|

|

|

16,216,080 |

|

|

Diluted |

|

14,846,505 |

|

|

|

15,660,981 |

|

|

|

14,854,673 |

|

|

|

16,366,517 |

|

ENSTAR GROUP

LIMITEDCONDENSED CONSOLIDATED BALANCE

SHEETSAs of June 30, 2024 and 2023

| |

June 30, 2024 |

|

December 31, 2023 |

| |

(in millions of U.S. dollars, except share

data) |

|

ASSETS |

|

|

|

|

Short-term investments, trading, at fair value |

$ |

9 |

|

|

$ |

2 |

|

|

Short-term investments, available-for-sale, at fair value

(amortized cost: 2024 — $45; 2023 — $62) |

|

45 |

|

|

|

62 |

|

|

Fixed maturities, trading, at fair value |

|

1,698 |

|

|

|

1,949 |

|

|

Fixed maturities, available-for-sale, at fair value (amortized

cost: 2024 — $5,381; 2023 — $5,642; net of allowance:

2024 — $14; 2023 — $16) |

|

4,971 |

|

|

|

5,261 |

|

|

Funds held |

|

4,730 |

|

|

|

5,251 |

|

|

Equities, at fair value (cost: 2024 — $602; 2023 — $615) |

|

761 |

|

|

|

701 |

|

|

Other investments, at fair value (includes consolidated variable

interest entity: 2024 - $101; 2023 - $59) |

|

4,091 |

|

|

|

3,853 |

|

|

Equity method investments |

|

318 |

|

|

|

334 |

|

|

Total investments |

|

16,623 |

|

|

|

17,413 |

|

|

Cash and cash equivalents (includes consolidated variable interest

entity: 2023 — $8) |

|

469 |

|

|

|

564 |

|

|

Restricted cash and cash equivalents |

|

283 |

|

|

|

266 |

|

|

Accrued interest receivable |

|

63 |

|

|

|

71 |

|

|

Reinsurance balances recoverable on paid and unpaid losses (net of

allowance: 2024 — $119; 2023 — $131) |

|

582 |

|

|

|

740 |

|

|

Reinsurance balances recoverable on paid and unpaid losses, at fair

value |

|

199 |

|

|

|

217 |

|

|

Insurance balances recoverable (net of allowance: 2024 — $4; 2023 —

$5 ) |

|

169 |

|

|

|

172 |

|

|

Net deferred charge assets |

|

687 |

|

|

|

731 |

|

|

Other assets |

|

821 |

|

|

|

739 |

|

|

TOTAL ASSETS |

$ |

19,896 |

|

|

$ |

20,913 |

|

|

LIABILITIES |

|

|

|

|

Losses and loss adjustment expenses |

$ |

10,148 |

|

|

$ |

11,196 |

|

|

Losses and loss adjustment expenses, at fair value |

|

1,056 |

|

|

|

1,163 |

|

|

Defendant asbestos and environmental liabilities |

|

540 |

|

|

|

567 |

|

|

Insurance and reinsurance balances payable |

|

32 |

|

|

|

43 |

|

|

Debt obligations |

|

1,832 |

|

|

|

1,831 |

|

|

Other liabilities (includes consolidated variable interest entity:

2024 and 2023 — $1) |

|

408 |

|

|

|

465 |

|

|

TOTAL LIABILITIES |

|

14,016 |

|

|

|

15,265 |

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

| |

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

Voting ordinary Shares (par value $1 each, issued and outstanding

2024: 15,230,911; 2023: 15,196,685) |

|

15 |

|

|

|

15 |

|

|

Preferred Shares: |

|

|

|

|

Series C Preferred Shares (issued and held in treasury 2024 and

2023: 388,571) |

|

— |

|

|

|

— |

|

|

Series D Preferred Shares (issued and outstanding 2024 and 2023:

16,000; liquidation preference $400) |

|

400 |

|

|

|

400 |

|

|

Series E Preferred Shares (issued and outstanding 2024 and 2023:

4,400; liquidation preference $110) |

|

110 |

|

|

|

110 |

|

|

Treasury Shares, at cost: |

|

|

|

|

Series C Preferred shares (2024 and 2023: 388,571) |

|

(422 |

) |

|

|

(422 |

) |

|

Joint Share Ownership Plan (voting ordinary shares, held in trust

2024 and 2023: 565,630) |

|

(1 |

) |

|

|

(1 |

) |

|

Additional paid-in capital |

|

591 |

|

|

|

579 |

|

|

Accumulated other comprehensive loss |

|

(357 |

) |

|

|

(336 |

) |

|

Retained earnings |

|

5,435 |

|

|

|

5,190 |

|

|

Total Enstar Shareholders’ Equity |

|

5,771 |

|

|

|

5,535 |

|

|

Noncontrolling interests |

|

109 |

|

|

|

113 |

|

|

TOTAL SHAREHOLDERS’ EQUITY |

|

5,880 |

|

|

|

5,648 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ |

19,896 |

|

|

$ |

20,913 |

|

Non-GAAP Financial Measures

In addition to our key financial measures

presented in accordance with GAAP, we present other non-GAAP

financial measures that we use to manage our business, compare our

performance against prior periods and against our peers, and as

performance measures in our incentive compensation program.

These non-GAAP financial measures provide an

additional view of our operational performance over the long-term

and provide the opportunity to analyze our results in a way that is

more aligned with the manner in which our management measures our

underlying performance.

The presentation of these non-GAAP financial

measures, which may be defined and calculated differently by other

companies, is used to enhance the understanding of certain aspects

of our financial performance. It is not meant to be considered in

isolation, superior to, or as a substitute for the directly

comparable financial measures prepared in accordance with GAAP.

Some of the adjustments reflected in our

non-GAAP measures are recurring items, such as the exclusion of

adjustments to net realized (gains)/losses and fair value changes

on fixed maturity investments recognized in our statements of

operations, the fair value of certain of our loss reserve

liabilities for which we have elected the fair value option, and

the amortization of fair value adjustments.

Management makes these adjustments in assessing

our performance so that the changes in fair value due to interest

rate movements, which are applied to some but not all of our assets

and liabilities as a result of preexisting accounting elections, do

not impair comparability across reporting periods.

It is important for the readers of our periodic

filings to understand that these items will recur from period to

period.

However, we exclude these items for the purpose

of presenting a comparable view across reporting periods of the

impact of our underlying claims management and investments without

the effect of interest rate fluctuations on assets that we

anticipate to hold to maturity and non-cash changes to the fair

value of our reserves.

Similarly, our non-GAAP measures reflect the

exclusion of certain items that we deem to be nonrecurring, unusual

or infrequent when the nature of the charge or gain is such that it

is not reasonably likely that such item may recur within two years,

nor was there a similar charge or gain in the preceding two years.

This includes adjustments related to bargain purchase gains on

acquisitions of businesses, net gains or losses on sales of

subsidiaries, net assets of held for sale or disposed subsidiaries

classified as discontinued operations and other items that we

separately disclose.

The following table presents more information on

each non-GAAP measure. The results and GAAP reconciliations for

these measures are set forth further below.

|

Non-GAAP Measure |

|

Definition |

|

Purpose of Non-GAAP Measure over GAAP Measure |

|

Fully diluted book value per ordinary share |

|

Total Enstar ordinary shareholders' equityDivided byNumber of

ordinary shares outstanding, adjusted for:-the ultimate effect of

any dilutive securities (which include restricted shares,

restricted share units, directors’ restricted share units and

performance share units) on the number of ordinary shares

outstanding |

|

Increases the number of ordinary shares to reflect the exercise of

equity awards granted but not yet vested as, over the long term,

this presents both management and investors with a more

economically accurate measure of the realizable value of

shareholder returns by factoring in the impact of share dilution.We

use this non-GAAP measure in our incentive compensation

program. |

|

Adjusted return on equity (%)Adjusted

operating income (loss) attributable to Enstar ordinary

shareholders(numerator) |

|

Adjusted operating income (loss) attributable to Enstar ordinary

shareholders divided by adjusted opening Enstar ordinary

shareholder's equityNet income (loss) attributable to Enstar

ordinary shareholders, adjusted for:-fair value changes and net

realized (gains) losses on fixed maturities and funds held-directly

managed,-change in fair value of insurance contracts for which we

have elected the fair value option (1),-amortization of fair value

adjustments,-net gain/loss on purchase and sales of subsidiaries

(if any),-net income from discontinued operations (if any),-tax

effects of adjustments, and-adjustments attributable to

noncontrolling interests |

|

Calculating the operating income (loss) as a percentage of our

adjusted opening Enstar ordinary shareholders' equity provides a

more consistent measure of the performance of our business by

enabling comparison between the financial periods presented.We

eliminate the impact of fair value changes and net realized (gains)

losses on fixed maturities and funds-held directly managed and the

change in fair value of insurance contracts for which we have

elected the fair value option, as:

- we typically hold most of our fixed

maturities until the earlier of maturity or the time that they are

used to fund any settlement of related liabilities which are

generally recorded at cost; and

- removing the fair value option

improves comparability since there are limited acquisition years

for which we elected the fair value option.

Therefore, we believe that excluding their impact on our earnings

improves comparability of our core operational performance across

periods. |

|

Adjusted opening Enstar ordinary shareholders' equity

(denominator) |

|

Opening Enstar ordinary shareholders' equity, less:-fair value

changes on fixed maturities and funds held-directly managed,-fair

value of insurance contracts for which we have elected the fair

value option (1),-fair value adjustments, and-net assets of held

for sale or disposed subsidiaries classified as discontinued

operations (if any) |

|

We include fair value adjustments as non-GAAP adjustments to the

adjusted operating income (loss) attributable to Enstar ordinary

shareholders as they are non-cash charges that are not reflective

of the impact of our claims management strategies on our loss

portfolios.We eliminate the net gain (loss) on the purchase and

sales of subsidiaries and net income from discontinued operations,

as these items are not indicative of our ongoing operations.We use

this non-GAAP measure in our incentive compensation program. |

|

Adjusted run-off liability earnings (%) |

|

Adjusted PPD divided by average adjusted net loss reserves. |

|

Calculating the RLE as a percentage of our adjusted average net

loss reserves provides a more meaningful and comparable measurement

of the impact of our claims management strategies on our loss

portfolios across acquisition years and also to our overall

financial periods. We use this measure to evaluate the impact

of our claims management strategies because it provides visibility

into our ability to settle our claims obligations for amounts less

than our initial estimate at the point of acquiring the

obligations.The following components of periodic recurring net

incurred losses and LAE and net loss reserves are not considered

key components of our claims management performance for the

following reasons:

- Prior to the settlement of the

contractual arrangements, the results of our Legacy Underwriting

segment were economically transferred to a third party primarily

through use of reinsurance and a Capacity Lease Agreement(3); as

such, the results were not a relevant contribution to Adjusted RLE,

which is designed to analyze the impact of our claims management

strategies(2);

- The change in fair value of insurance

contracts for which we have elected the fair value option(1) has

been removed to support comparability between the two acquisition

years for which we elected the fair value option in reserves

assumed and the acquisition years for which we did not make this

election (specifically, this election was only made in the 2017 and

2018 acquisition years and the election of such option is

irrevocable); and

- The amortization of fair value

adjustments are non-cash charges that obscure our trends on a

consistent basis.

We include our performance in managing claims and estimated future

expenses on our defendant A&E liabilities because such

performance is relevant to assessing our claims management

strategies even though such liabilities are not included within the

loss reserves.We use this measure to assess the performance of our

claim strategies and part of the performance assessment of our past

acquisitions. |

|

Adjusted prior period

development(numerator) |

|

Prior period net incurred losses and LAE, adjusted to: Remove:

-Legacy Underwriting(2) operations-amortization of fair value

adjustments, -change in fair value of insurance contracts for which

we have elected the fair value option (1), and Add:-the

reduction/(increase) in estimates of net ultimate liabilities and

reduction in estimated future expenses of our defendant A&E

liabilities. |

|

|

Adjusted net loss reserves

(denominator) |

|

Net losses and LAE, adjusted to:Remove:-Legacy Underwriting(2) net

loss reserves-current period net loss reserves-net fair value

adjustments associated with the acquisition of companies,-the fair

value adjustments for contracts for which we have elected the fair

value option (1) andAdd:-net nominal defendant A&E liability

exposures and estimated future expenses. |

|

|

Adjusted total investment return (%) |

|

Adjusted total investment return (dollars) recognized in earnings

for the applicable period divided by period average adjusted total

investable assets. |

|

Provides a key measure of the return generated on the capital held

in the business and is reflective of our investment

strategy.Provides a consistent measure of investment returns as a

percentage of all assets generating investment returns.We adjust

our investment returns to eliminate the impact of the change in

fair value of fixed maturities (both credit spreads and interest

rates), as we typically hold most of these investments until the

earlier of maturity or used to fund any settlement of related

liabilities which are generally recorded at cost. |

|

Adjusted total investment return ($)

(numerator) |

|

Total investment return (dollars), adjusted for:-fair value changes

in fixed maturities, trading and funds held-directly managed;

and-unrealized (gains) losses on fixed maturities, AFS included

within OCI, net of reclassification adjustments and excluding

foreign exchange. |

|

|

Adjusted average aggregate total investable assets

(denominator) |

|

Total average investable assets, adjusted for: -net unrealized

(gains) losses on fixed maturities, AFS included within AOCI-fair

value changes in fixed maturities, trading and funds held-directly

managed |

|

(1) Comprises the discount rate and risk margin

components.

(2) As of January 1, 2024, Legacy Underwriting is

no longer a reportable segment as it no longer engages in any

active business.

(3) The reinsurance contractual arrangements

(including the Capacity Lease Agreement) were settled during the

second quarter of 2023. Other than the settlement of these

arrangements, we did not record any other transactions in the

Legacy Underwriting segment in 2023.

Reconciliation of GAAP to Non-GAAP

Measures

The table below presents a reconciliation of

BVPS to Fully Diluted BVPS*:

| |

|

June 30, 2024 |

|

December 31, 2023 |

| |

|

Equity (1) |

|

OrdinaryShares |

|

Per ShareAmount |

|

Equity (1) |

|

OrdinaryShares |

|

Per ShareAmount |

| |

|

(in millions of U.S. dollars, except share and per share

data) |

|

Book value per ordinary share |

|

$ |

5,261 |

|

14,665,281 |

|

$ |

358.74 |

|

$ |

5,025 |

|

14,631,055 |

|

$ |

343.45 |

|

Non-GAAP adjustment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation plans |

|

|

|

334,625 |

|

|

|

|

|

292,190 |

|

|

|

Fully diluted book value per ordinary share* |

|

$ |

5,261 |

|

14,999,906 |

|

$ |

350.74 |

|

$ |

5,025 |

|

14,923,245 |

|

$ |

336.72 |

(1) Equity comprises Enstar ordinary

shareholders' equity, which is calculated as Enstar shareholders'

equity less preferred shares ($510 million) prior to any non-GAAP

adjustments.

The table below presents a reconciliation of ROE

to Adjusted ROE* and Annualized ROE to Annualized Adjusted

ROE*:

| |

Three Months Ended |

| |

June 30, 2024 |

|

June 30, 2023 |

| |

Netincome(loss)(1) |

|

Opening equity(1) |

|

ROE |

|

AnnualizedROE |

|

Netincome(loss)(1) |

|

Opening equity(1) |

|

ROE |

|

AnnualizedROE |

| |

(in millions of U.S. dollars) |

|

Net income (loss)/Opening equity/ROE/Annualized

ROE (1) |

$ |

126 |

|

|

$ |

5,122 |

|

|

2.5 |

% |

|

9.8 |

% |

|

$ |

21 |

|

|

$ |

4,367 |

|

|

0.5 |

% |

|

1.9 |

% |

|

Non-GAAP adjustments for loss (gains): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net realized losses on fixed maturities, AFS (2) / Cumulative fair

value changes to fixed maturities, AFS (3) |

|

9 |

|

|

|

416 |

|

|

|

|

|

|

|

25 |

|

|

|

531 |

|

|

|

|

|

|

Fair value changes on fixed maturities, trading (2) / Fair value

changes on fixed maturities, trading (3) |

|

16 |

|

|

|

251 |

|

|

|

|

|

|

|

42 |

|

|

|

316 |

|

|

|

|

|

|

Fair value changes in funds held - directly managed (2) / Fair

values changes on funds held - directly managed (3) |

|

10 |

|

|

|

122 |

|

|

|

|

|

|

|

22 |

|

|

|

147 |

|

|

|

|

|

|

Change in fair value of insurance contracts for which we have

elected the fair value option / Fair value of insurance contracts

for which we have elected the fair value option (4) |

|

(4 |

) |

|

|

(249 |

) |

|

|

|

|

|

|

(8 |

) |

|

|

(278 |

) |

|

|

|

|

|

Amortization of fair value adjustments / Fair value

adjustments |

|

6 |

|

|

|

(103 |

) |

|

|

|

|

|

|

6 |

|

|

|

(121 |

) |

|

|

|

|

|

Tax effects of adjustments (5) |

|

(3 |

) |

|

|

— |

|

|

|

|

|

|

|

(3 |

) |

|

|

— |

|

|

|

|

|

|

Adjusted net income (loss)/Adjusted opening equity/Adjusted

ROE/Annualized adjusted ROE* |

$ |

160 |

|

|

$ |

5,559 |

|

|

2.9 |

% |

|

11.5 |

% |

|

$ |

105 |

|

|

$ |

4,962 |

|

|

2.1 |

% |

|

8.5 |

% |

(1) Net income (loss) comprises net income

(loss) attributable to Enstar ordinary shareholders, prior to any

non-GAAP adjustments. Opening equity comprises Enstar ordinary

shareholders' equity, which is calculated as opening Enstar

shareholders' equity less preferred shares ($510 million), prior to

any non-GAAP adjustments.

(2) Net realized gains (losses) on fixed

maturities, AFS are included in net realized gains (losses) in our

unaudited condensed consolidated statements of operations. Fair

value changes in our fixed maturities, trading and funds held -

directly managed are included in fair value changes in trading

securities, funds held and other investments in our unaudited

condensed consolidated statements of operations

(3) Our fixed maturities are held directly on

our balance sheet and also within the "Funds held" balance.

(4) Comprises the discount rate and risk margin

components.

(5) Represents an aggregation of the tax expense

or benefit associated with the specific country to which the

pre-tax adjustment relates, calculated at the applicable

jurisdictional tax rate.

*Non-GAAP measure.

| |

Six Months Ended |

| |

June 30, 2024 |

|

June 30, 2023 |

| |

Netincome (loss) (1) |

|

Opening equity (1) |

|

ROE |

|

AnnualizedROE |

|

Netincome (loss) (1) |

|

Openingequity (1)(2) |

|

ROE |

|

AnnualizedROE |

| |

(in millions of U.S. dollars) |

|

Net income/Opening equity/ROE

(1) |

$ |

245 |

|

|

$ |

5,025 |

|

|

4.9 |

% |

|

9.8 |

% |

|

$ |

445 |

|

|

$ |

4,464 |

|

|

10.0 |

% |

|

19.9 |

% |

|

Non-GAAP adjustments for loss (gains): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net realized losses on fixed maturities, AFS (2) / Cumulative fair

value changes to fixed maturities, AFS (3) |

|

15 |

|

|

|

380 |

|

|

|

|

|

|

|

43 |

|

|

|

647 |

|

|

|

|

|

|

Fair value changes on fixed maturities, trading (3) / Fair value

changes on fixed maturities, trading (4) |

|

30 |

|

|

|

234 |

|

|

|

|

|

|

|

2 |

|

|

|

400 |

|

|

|

|

|

|

Fair value changes on funds held - directly managed (3) / Fair

value changes on funds held - directly managed (4) |

|

15 |

|

|

|

111 |

|

|

|

|

|

|

|

3 |

|

|

|

780 |

|

|

|

|

|

|

Change in fair value of insurance contracts for which we have

elected the fair value option / Fair value of insurance contracts

for which we have elected the fair value option (5) |

|

(8 |

) |

|

|

(246 |

) |

|

|

|

|

|

|

12 |

|

|

|

(294 |

) |

|

|

|

|

|

Amortization of fair value adjustments / Fair value

adjustments |

|

9 |

|

|

|

(107 |

) |

|

|

|

|

|

|

9 |

|

|

|

(124 |

) |

|

|

|

|

|

Tax effects of adjustments (6) |

|

(5 |

) |

|

|

— |

|

|

|

|

|

|

|

(6 |

) |

|

|

— |

|

|

|

|

|

|

Adjustments attributable to noncontrolling interests (7) |

|

— |

|

|

|

— |

|

|

|

|

|

|

|

(2 |

) |

|

|

— |

|

|

|

|

|

|

Adjusted net income /Adjusted opening equity/Adjusted

ROE* |

$ |

301 |

|

|

$ |

5,397 |

|

|

5.6 |

% |

|

11.2 |

% |

|

$ |

506 |

|

|

$ |

5,873 |

|

|

8.6 |

% |

|

17.2 |

% |

(1) Net income (loss) comprises net income

(loss) attributable to Enstar ordinary shareholders, prior to any

non-GAAP adjustments. Opening equity comprises Enstar ordinary

shareholders' equity, which is calculated as opening Enstar

shareholders' equity less preferred shares ($510 million), prior to

any non-GAAP adjustments.

(2) Enstar ordinary shareholders’ equity as of

December 31, 2022 has been retrospectively adjusted for the impact

of adopting ASU 2018-12. Refer to Note 12 of our condensed

consolidated financial statements in our Annual Report on Form 10-K

for the year ended December 31, 2023 for further information.

(3) Net realized gains (losses) on fixed

maturities, AFS are included in net realized gains (losses) in our

unaudited condensed consolidated statements of operations. Fair

value changes in our fixed maturities, trading and funds held -

directly managed are included in fair value changes in trading

securities, funds held and other investments in our unaudited

condensed consolidated statements of operations

(4) Our fixed maturities are held directly on

our balance sheet and also within the "Funds held" balance.

(5) Comprises the discount rate and risk margin

components.

(6) Represents an aggregation of the tax expense

or benefit associated with the specific country to which the

pre-tax adjustment relates, calculated at the applicable

jurisdictional tax rate.

(7) Represents the impact of the adjustments on

the net income (loss) attributable to noncontrolling interests

associated with the specific subsidiaries to which the adjustments

relate.

*Non-GAAP measure.

The tables below present a reconciliation of RLE

to Adjusted RLE*:

| |

|

ThreeMonthsEnded |

|

As of |

|

ThreeMonthsEnded |

| |

|

June 30,2024 |

|

June 30,2024 |

|

March 31,2024 |

|

June 30,2024 |

|

June 30,2024 |

| |

|

RLE / PPD |

|

Net lossreserves |

|

Net loss reserves |

|

Averagenet loss reserves |

|

RLE % |

| |

|

(in millions of U.S. dollars) |

|

PPD/net loss reserves/RLE % |

|

$ |

62 |

|

|

$ |

10,518 |

|

|

$ |

10,827 |

|

|

$ |

10,673 |

|

|

0.6 |

% |

|

Non-GAAP adjustments for expenses (income): |

|

|

|

|

|

|

|

|

|

|

|

Net loss reserves - current period |

|

|

— |

|

|

|

(9 |

) |

|

|

(5 |

) |

|

|

(7 |

) |

|

|

|

Amortization of fair value adjustments / Net fair value adjustments

associated with the acquisition of companies |

|

|

6 |

|

|

|

98 |

|

|

|

103 |

|

|

|

101 |

|

|

|

|

Changes in fair value - fair value option / Net fair value

adjustments for contracts for which we have elected the fair value

option (1) |

|

|

(4 |

) |

|

|

253 |

|

|

|

249 |

|

|

|

251 |

|

|

|

|

Change in estimate of net ultimate liabilities - defendant A&E

/ Net nominal defendant A&E liabilities |

|

|

— |

|

|

|

497 |

|

|

|

516 |

|

|

|

506 |

|

|

|

|

Reduction in estimated future expenses - defendant A&E /

Estimated future expenses - defendant A&E |

|

|

1 |

|

|

|

31 |

|

|

|

32 |

|

|

|

31 |

|

|

|

|

Adjusted PPD/Adjusted net loss reserves/Adjusted RLE

%* |

|

$ |

65 |

|

|

$ |

11,388 |

|

|

$ |

11,722 |

|

|

$ |

11,555 |

|

|

0.6 |

% |

| |

|

ThreeMonthsEnded |

|

As of |

|

ThreeMonthsEnded |

| |

|

June 30,2023 |

|

June 30,2023 |

|

March 31,2023 |

|