Diamondback Energy, Inc. (NASDAQ: FANG) (“Diamondback” or the

“Company”) and Endeavor Energy Resources, L.P. (“Endeavor”), today

announced that they have entered into a definitive merger agreement

under which Diamondback and Endeavor will merge in a transaction

valued at approximately $26 billion, inclusive of Endeavor’s net

debt. The combination will create a premier Permian independent

operator.

The transaction consideration will consist of

approximately 117.3 million shares of Diamondback common stock and

$8 billion of cash, subject to customary adjustments. The cash

portion of the consideration is expected to be funded through a

combination of cash on hand, borrowings under the Company’s credit

facility and/or proceeds from term loans and senior notes

offerings. As result of the transaction, the Company’s existing

stockholders are expected to own approximately 60.5% of the

combined company and Endeavor’s equity holders are expected to own

approximately 39.5% of the combined company.

The transaction was unanimously approved by the

Board of Directors of the Company and has all necessary Endeavor

approvals.

“This is a combination of two strong,

established companies merging to create a ‘must own’ North American

independent oil company. The combined company’s inventory will have

industry-leading depth and quality that will be converted into cash

flow with the industry’s lowest cost structure, creating a

differentiated value proposition for our stockholders,” stated

Travis Stice, Chairman and Chief Executive Officer of Diamondback.

“This combination meets all the required criteria for a successful

combination: sound industrial logic with tangible synergies,

improved combined capital allocation and significant near and

long-term financial accretion. With this combination, Diamondback

not only gets bigger, it gets better.”

Mr. Stice continued, “Over the past forty-five

years, Mr. Stephens and his team at Endeavor have built the highest

quality private oil company in the United States. Our companies

share a similar culture and operating philosophy and are

headquartered across the street from one another, which should

allow for a seamless integration of our two teams. As a result, we

look forward to continuing to deliver best-in-class results with a

combined employee base headquartered in Midland, assuring Midland’s

relevance in the global oil market for the next generation.”

“I am grateful to the Endeavor team and proud of

what we have built since 1979,” said Autry C. Stephens,Founder and

Chairman of the Board of Endeavor. “We believe Diamondback is the

right partner for Endeavor, our employees, families and

communities. Together we will create value for shareholders and our

other stakeholders.”

“As we look toward the future, we are confident

joining with Diamondback is a transformational opportunity for us,”

said Lance Robertson, President and Chief Executive Officer of

Endeavor. “Our success up to this point is attributable to the

dedication and hard work of Endeavor employees, and today’s

announcement is recognition by Diamondback of the significant

efforts from our team over the past seven years, driving production

growth, improving safety performance and building a more

sustainable company. We look forward to working together to scale

our combined business, unlock value for all of our stakeholders and

ensure our new company is positioned for long-term success as we

build the premier Permian-focused company in Midland.”

Strategic and Financial

Benefits

- Combined pro forma scale of approximately 838,000 net acres and

816 MBOE/d of net production

- Best in-class inventory depth and quality with approximately

6,100 pro forma locations with break evens at <$40 WTI

- Annual synergies of $550 million representing over $3.0 billion

in NPV10 over the next decade

- Capital and operating cost synergies: approximately $325

million

- Capital allocation and land synergies: approximately $150

million

- Financial and corporate cost synergies: approximately $75

million

- Substantial near and long-term financial accretion with ~10%

free cash flow per share accretion expected in 2025

- Stock-weighted transaction solidifies investment grade balance

sheet

- Advances leading ESG profile

“This combination offers significant, tangible

synergies that will accrue to the pro forma stockholder base,”

stated Travis Stice. “Diamondback has proven itself to be a premier

low-cost operator in the Permian Basin over the last twelve years,

and this combination allows us to bring this cost structure to a

larger asset and allocate capital to a stronger pro forma inventory

position. We expect both teams will learn from each other and

implement best practices to improve combined capital efficiency for

years to come.”

2024 Diamondback Stand-alone Guidance

and Base Dividend Increase

In conjunction with this announcement,

Diamondback is releasing selected operating information for the

fourth quarter of 2023 and providing initial production and capital

guidance for 2024. Diamondback today also announced that the

Company's Board of Directors will approve a 7% increase to its base

dividend to $3.60 per share annually ($0.90 per share quarterly),

effective for the fourth quarter of 2023.

- Average fourth quarter 2023 production of 273.1 MBO/d (462.6

MBOE/d)

- Fourth quarter 2023 cash capital expenditures of $649

million

- On a stand-alone basis in 2024 Diamondback expects to generate

oil production of 270 – 275 MBO/d (458 – 466 MBOE/d) with a total

capital budget of approximately $2.3 - $2.55 billion

- Beginning in the first quarter of 2024, Diamondback will reduce

its return of capital commitment to at least 50% of free cash flow

to stockholders from at least 75% of free cash flow previously

“Diamondback today released fourth quarter

production that exceeded expectations and announced a 2024 capital

and operating plan that prioritizes capital efficiency and free

cash flow generation over growth,” stated Travis Stice. “The

decision to reduce our return of capital to stockholders reflects

our Board’s desire to increase financial flexibility and pay down

debt added through this combination. Our near-term objective is to

reduce pro forma net debt below $10 billion very quickly, ensuring

balance sheet strength and best-in-class credit quality. Return of

capital to stockholders will always remain a core tenet of our

value proposition and capital allocation philosophy at

Diamondback.”

2024 Endeavor Stand-alone

Guidance

Endeavor is providing stand-alone 2024 capital

and operating guidance while the two companies work to close the

merger.

- Expected 2024 oil production of 190 – 200 MBO/d (350 – 365

MBOE/d)

- Total 2024 capital budget of approximately $2.5 - $2.6

billion

Full pro forma guidance will be released by

Diamondback after closing of the transaction.

2025 Pro Forma Outlook

Diamondback expects operational synergies to be

realized in 2025 by the combined company. Therefore, the Company is

providing a preliminary look at its pro forma 2025 combined company

capital and operating plan assuming Diamondback’s cost structure

and current estimated well costs. The 2025 plan is preliminary and

subject to changes, including as result of changes in oil and gas

prices, the macro environment and well costs.

- On a pro forma basis in 2025, Diamondback expects to generate

oil production of 470 – 480 MBO/d (800 – 825 MBOE/d) with a capital

budget of approximately $4.1 - $4.4 billion

- This operating plan implies significant pro forma cash flow and

free cash flow per share accretion

Pro Forma Governance

Highlights

The combined company will continue to be

headquartered in Midland, Texas.

Upon closing, Diamondback’s Board of Directors

will expand to 13 members and Charles Meloy and Lance Robertson,

together with two other individuals mutually agreed upon by

Diamondback and Endeavor, will be added to the Board of

Directors.

At closing, Diamondback will enter into a

stockholders agreement with the former equity holders of Endeavor.

Under that agreement the former Endeavor equity holders will be

subject to certain standstill, voting and transfer restrictions and

will be provided with certain director nominations rights and

customary registration rights with respect to the shares of

Diamondback common stock issued to them as transaction

consideration.

Additional details regarding the stockholders

agreement will be provided in Diamondback’s filings with the

Securities and Exchange Commission.

Timing and Approvals

Diamondback expects the merger to close in the

fourth quarter of 2024, subject to the satisfaction of customary

closing conditions, including termination or expiration of the

waiting period under the Hart-Scott-Rodino Antitrust Improvements

Act of 1976, and approval of the transaction by the Company’s

stockholders. The transaction is not subject to a financing

contingency.

Advisors

Jefferies LLC is serving as lead financial

advisor to Diamondback and Citi is serving as M&A and Capital

Markets advisor to Diamondback. Citi is the sole provider of

committed bridge financing, as well as leading the term loan

issuances and senior notes offerings. Wachtell, Lipton, Rosen &

Katz is acting as legal advisor to Diamondback.

J.P. Morgan Securities LLC is acting as

exclusive financial advisor to Endeavor, Goldman Sachs & Co.

LLC provided corporate advisory services and Paul, Weiss,

Rifkind, Wharton & Garrison LLP and Vinson & Elkins LLP are

acting as legal advisors to Endeavor.

Conference Call

Diamondback will host a conference call and

webcast for investors and analysts to discuss this transaction on

Monday, February 12, 2024 at 7:30 a.m. CT. Access to the webcast,

and replay which will be available following the call, may be found

here. The live webcast of the conference call will also be

available via Diamondback’s website at www.diamondbackenergy.com

under the “Investor Relations” section of the site.

About Diamondback

Diamondback is an independent oil and natural

gas company headquartered in Midland, Texas focused on the

acquisition, development, exploration and exploitation of

unconventional, onshore oil and natural gas reserves in the Permian

Basin in West Texas. For more information, please visit

www.diamondbackenergy.com.

About Endeavor

Endeavor is a privately-held exploration and

production company. Headquartered near operational activity in

Midland, Texas, Endeavor has more than 1,200 valued employees and

is one of the largest private operators in the United States.

With more than 45 years of experience acquiring

assets, the company is uniquely situated holding nearly 344,000 net

acres in the Core 6 Midland Basin counties. For more information,

please visit www.endeavorenergylp.com.

Diamondback Investor

Contact:

Adam Lawlis+1

432.221.7467alawlis@diamondbackenergy.com

Endeavor Media Contact:

Aaron Palash / Andrew Siegel / Lyle WestonJoele

Frank, Wilkinson Brimmer Katcher+1 212.355.4449

Forward-Looking Statements:

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Exchange Act of 1934,

as amended, which involve risks, uncertainties, and assumptions.

All statements, other than statements of historical fact, including

statements regarding the proposed business combination transaction

between Diamondback and Endeavor; future performance; business

strategy; future operations (including drilling plans and capital

plans); estimates and projections of revenues, losses, costs,

expenses, returns, cash flow, and financial position; reserve

estimates and its ability to replace or increase reserves;

anticipated benefits of strategic transactions (including

acquisitions and divestitures), including the proposed transaction;

the expected amount and timing of synergies from the proposed

transaction; the anticipated timing of the proposed transaction;

and plans and objectives of management (including plans for future

cash flow from operations and for executing environmental

strategies) are forward-looking statements. When used in this press

release, the words “aim,” “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “future,” “guidance,”

“intend,” “may,” “model,” “outlook,” “plan,” “positioned,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” and similar expressions (including the negative of

such terms) are intended to identify forward-looking statements,

although not all forward-looking statements contain such

identifying words. Although Diamondback believes that the

expectations and assumptions reflected in its forward-looking

statements are reasonable as and when made, they involve risks and

uncertainties that are difficult to predict and, in many cases,

beyond Diamondback’s control. Accordingly, forward-looking

statements are not guarantees of future performance and actual

outcomes could differ materially from what Diamondback has

expressed in its forward-looking statements.

Factors that could cause the outcomes to differ

materially include (but are not limited to) the following: the

completion of the proposed transaction on anticipated terms and

timing or at all, including obtaining Diamondback stockholder

approval, regulatory approval and satisfying other conditions to

the completion of the transaction; uncertainties as to whether the

proposed transaction, if consummated, will achieve its anticipated

benefits and projected synergies within the expected time period or

at all; Diamondback’s ability to integrate Endeavor’s operations in

a successful manner and in the expected time period; the occurrence

of any event, change, or other circumstance that could give rise to

the termination of the proposed transaction; risks that the

anticipated tax treatment of the proposed transaction is not

obtained; unforeseen or unknown liabilities; unexpected future

capital expenditures; potential litigation relating to the proposed

transaction; the possibility that the proposed transaction may be

more expensive to complete than anticipated, including as a result

of unexpected factors or events; the effect of the announcement,

pendency, or completion of the proposed transaction on the parties’

business relationships and business generally; risks that the

proposed transaction disrupts current plans and operations of

Diamondback or Endeavor and their respective management teams and

potential difficulties in retaining employees as a result of the

proposed transaction; the risks related to Diamondback’s financing

of the proposed transaction; potential negative effects of this

announcement and the pendency or completion of the proposed

transaction on the market price of Diamondback’s common stock

and/or operating results; rating agency actions and Diamondback’s

ability to access short- and long-term debt markets on a timely and

affordable basis; changes in supply and demand levels for oil,

natural gas, and natural gas liquids, and the resulting impact on

the price for those commodities; the impact of public health

crises, including epidemic or pandemic diseases and any related

company or government policies or actions; actions taken by the

members of OPEC and Russia affecting the production and pricing of

oil, as well as other domestic and global political, economic, or

diplomatic developments, including any impact of the ongoing war in

Ukraine and the Israel-Hamas war on the global energy markets and

geopolitical stability; instability in the financial markets;

concerns over a potential economic slowdown or recession;

inflationary pressures; rising interest rates and their impact on

the cost of capital; regional supply and demand factors, including

delays, curtailment delays or interruptions of production, or

governmental orders, rules or regulations that impose production

limits; federal and state legislative and regulatory initiatives

relating to hydraulic fracturing, including the effect of existing

and future laws and governmental regulations; physical and

transition risks relating to climate change; those risks described

in Item 1A of Diamondback’s Annual Report on Form 10-K, filed with

the SEC on February 23, 2023, and those risks disclosed in its

subsequent filings on Forms 10-Q and 8-K, which can be obtained

free of charge on the SEC’s website at http://www.sec.gov and

Diamondback’s website at www.diamondbackenergy.com/investors/; and

those risks that will be more fully described in the definitive

proxy statement on Schedule 14A that is intended to be filed with

the SEC in connection with the proposed transaction.

In light of these factors, the events

anticipated by Diamondback’s forward-looking statements may not

occur at the time anticipated or at all. Moreover, Diamondback

operates in a very competitive and rapidly changing environment and

new risks emerge from time to time. Diamondback cannot predict all

risks, nor can it assess the impact of all factors on its business

or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those anticipated by

any forward-looking statements it may make. Accordingly, you should

not place undue reliance on any forward-looking statements. All

forward-looking statements speak only as of the date of this press

release or, if earlier, as of the date they were made. Diamondback

does not intend to, and disclaims any obligation to, update or

revise any forward-looking statements unless required by applicable

law.

Non-GAAP Financial Measures

This press release includes financial

information not prepared in conformity with generally accepted

accounting principles (GAAP), including free cash flow and NPV10.

The non-GAAP information should be considered by the reader in

addition to, but not instead of, financial information prepared in

accordance with GAAP. A reconciliation of the differences between

these non-GAAP financial measures and the most directly comparable

GAAP financial measures can be found in Diamondback's quarterly

results posted on Diamondback's website at

www.diamondbackenergy.com/investors/. Furthermore, this press

release includes or references certain forward-looking, non-GAAP

financial measures. Because Diamondback provides these measures on

a forward-looking basis, it cannot reliably or reasonably predict

certain of the necessary components of the most directly comparable

forward-looking GAAP financial measures, such as future impairments

and future changes in working capital. Accordingly, Diamondback is

unable to present a quantitative reconciliation of such

forward-looking, non-GAAP financial measures to the respective most

directly comparable forward-looking GAAP financial measures.

Diamondback believes that these forward-looking, non-GAAP measures

may be a useful tool for the investment community in comparing

Diamondback's forecasted financial performance to the forecasted

financial performance of other companies in the industry.

Additional Information about the Merger

and Where to Find It

In connection with the potential transaction

between Diamondback and Endeavor, Diamondback expects to file

relevant materials with the SEC including a proxy statement on

Schedule 14A. Promptly after filing its definitive proxy statement

with the SEC, Diamondback will mail the definitive proxy statement

to each stockholder entitled to vote at the meeting relating to the

proposed transaction. This press release is not a substitute for

the proxy statement or for any other document that Diamondback may

file with the SEC and send to its stockholders in connection with

the proposed transaction. INVESTORS AND STOCKHOLDERS ARE URGED TO

CAREFULLY READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE

THEREIN) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE

TRANSACTION THAT DIAMONDBACK WILL FILE WITH THE SEC WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The

definitive proxy statement, the preliminary proxy statement, and

other relevant materials in connection with the transaction (when

they become available) and any other documents filed by Diamondback

with the SEC, may be obtained free of charge at the SEC’s website

www.sec.gov. Copies of the documents filed with the SEC by

Diamondback will be available free of charge on Diamondback ’s

website at www.diamondbackenergy.com/investors.

Participants in the

Solicitation

Diamondback and its directors and executive

officers may be deemed, under SEC rules, to be participants in the

solicitation of proxies from Diamondback’s stockholders in

connection with the transaction. Information about the directors

and executive officers of Diamondback is set forth in (i) in

Diamondback ’s proxy statement for its 2023 annual meeting,

including under the headings “Proposal 1—Election of Directors”,

“Executive Officers”, “Compensation Discussion and Analysis”,

“Compensation Tables”, “Stock Ownership” and “Certain Relationships

and Related Transactions”, which was filed with the SEC on April

27, 2023 and is available at

https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1539838/000130817923000793/fang-20221231.htm,

(ii) Diamondback ’s Annual Report on Form 10-K for the year ended

December 31, 2022, including under the headings “Item 10.

Directors, Executive Officers and Corporate Governance”, “Item 11.

Executive Compensation”, “Item 12. Security Ownership of Certain

Beneficial Owners and Management and Related Stockholder Matters”

and “Item 13. Certain Relationships and Related Transactions, and

Director Independence”, which was filed with the SEC on February

23, 2023 and is available at

https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1539838/000153983823000022/fang-20221231.htm

and (iii) subsequent statements of changes in beneficial ownership

on file with the SEC. Additional information regarding the

participants in the proxy solicitation and a description of their

direct or indirect interests, by security holdings or otherwise,

will be contained in the proxy statement and other relevant

materials filed with the SEC when they become available. These

documents may be obtained free of charge from the SEC’s website at

www.sec.gov and Diamondback’s website at

www.diamondbackenergy.com/investors.

No Offer or Solicitation

This press release does not constitute an offer

to sell or the solicitation of an offer to buy any securities, or a

solicitation of any vote or approval, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction.

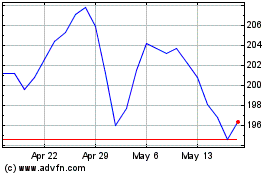

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Feb 2024 to Feb 2025