FinWise Bancorp Announces Strategic Lending Program with Plannery to Provide Debt Consolidation Loans to Healthcare Professionals

May 16 2024 - 3:15PM

FinWise Bancorp (NASDAQ: FINW) (“FinWise” or the “Company”), parent

company of FinWise Bank (the “Bank”), today announced the launch of

a new strategic lending program with Plannery, Inc. (“Plannery”).

Plannery, based in San Mateo, CA and New York, NY, is a

cutting-edge financial wellness platform that hospital systems can

offer their employees to become and stay debt free.

The FinWise loan product, in partnership with

Plannery, allows hospital systems to offer their employees a simple

solution to consolidate and reduce interest rates on credit card

and personal loans. The product’s unique payroll-linked payment

structure helps reduce missed payments and late fees and

accelerates employees’ path to financial stability by providing

access to financial services these healthcare professionals may not

otherwise qualify for. Plannery helps combat financial stress, a

leading cause of clinical burnout, and supports employee

recruitment and retention.

Plannery and FinWise will offer this innovative

product through business sponsorships such as hospitals and

strategic partners. The product will be an unsecured, fixed rate

loan available nationwide.

Kent Landvatter, CEO of FinWise commented, "We

are thrilled to partner with Plannery on this innovative debt

consolidation loan product that offers our country’s valued

healthcare employees a sound path to lowering their debt burden. We

are also confident that FinWise’s comprehensive solutions will

provide meaningful benefits to Plannery’s long-term efforts to

consolidate various financial services with one bank. Finally, this

strategic loan program is in-line with our commitment to diversify

the balance sheet.”

"We are excited to enter into this partnership

with an innovative and compliance-first fintech banking solutions

provider like FinWise," said Krishnan Gopalakrishnan, CEO of

Plannery. “FinWise will support Plannery by originating debt

consolidation loans designed exclusively for healthcare

professionals. This solution will increase access to transparent

and affordable financing, allowing Plannery to reach additional

healthcare plans and workers nationwide, thereby accelerating our

growth plans.”

About FinWise Bancorp

FinWise provides comprehensive Banking and

Payments solutions to fintech brands. 2024 is a key expansion year

for the Company, as it diversifies its business model by launching

and incorporating Payments Hub and BIN Sponsorship offerings into

its current platforms.

Its existing Strategic Program Lending business,

done through scalable API-driven infrastructure, powers deposit,

lending and payments programs for leading fintech brands. In

addition, FinWise manages other Lending programs such as SBA 7(a),

Real Estate, and Leasing, which provide optionality for disciplined

balance sheet growth.

Through its compliance oversight and risk

management-first culture, the Company is also well positioned to

guide fintechs through a rigorous process to ensure regulatory

compliance.

About Plannery

Plannery is a financial wellness platform built

exclusively for healthcare professionals to support their financial

journey from eliminating debt to building wealth. Our vision is a

world where no healthcare professional has to worry about finances

and can instead focus on taking care of patients. Plannery partners

with healthcare organizations to offer their products as an

employee benefit to help with recruitment and retention, and to

build a strong, loyal and productive workforce.

Contacts

investors@finwisebank.commedia@finwisebank.com

hello@planneryapp.com

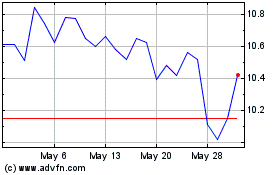

FinWise Bancorp (NASDAQ:FINW)

Historical Stock Chart

From Jan 2025 to Feb 2025

FinWise Bancorp (NASDAQ:FINW)

Historical Stock Chart

From Feb 2024 to Feb 2025