0000355019

false

0000355019

2023-09-30

2023-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Act of 1934

Date

of Report (Date of earliest event reported): September

30, 2023

FONAR

CORPORATION

______________________________________________________

(Exact

name of registrant as specified in its charter)

| Delaware | |

0-10248 | |

11-2464137 |

| (State

or other jurisdiction of incorporation) | |

(Commission

File Number) | |

(I.R.S.

Employer Identification No.) |

| | |

| |

|

| | |

110

Marcus Drive,

Melville,

New

York 11747

(631)

694-2929 | |

|

| | |

(Address,

including zip code, and telephone number of registrant's principal executive office) | |

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

[

] Written

communications pursuant to Rule 425 under the Securities Act 17 CFR 230.425)

[

] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[

] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Securities

registered pursuant to Section 12(b) of the Act.

| Title

of each class | |

Trading

symbol(s) | |

Name

of each exchange on which registered |

| Common

Stock, $.0001 par value | |

FONR | |

Nasdaq

Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [

]

Item

2.02(a) Results of Operations and Financial Condition.

We

reported the results of operations and financial condition of the Company for the 1st Quarter of Fiscal 2024 which ended September

30, 2023 in a press release dated November 14, 2023.

Exhibits:

99.1 Press Release dated November 14, 2023.

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

FONAR

CORPORATION

(Registrant)

-------------------------------------------

By

/s/ Timothy R. Damadian

Timothy

R. Damadian

President

and CEO

Dated:

November 15, 2023

| NEWS |

|

Fonar

Corporation |

| For

Immediate Release |

|

The

Inventor of MR Scanning™ |

| Contact:

Daniel Culver |

|

An

ISO 9001 Company |

| Director

of Communications |

|

Melville,

New York 11747 |

| E-mail:

investor@fonar.com |

|

Phone:

(631) 694-2929 |

| www.fonar.com |

|

Fax:

(631) 390-1772 |

FONAR

ANNOUNCES FINANCIAL RESULTS FOR THE

1ST

QUARTER OF FISCAL 2024

| * | On

September 13, 2022, the Company adopted a stock repurchase plan of up to $9 million. At September

30, 2023, the Company has purchased 146,359

shares at a cost of $2,473,215. |

| * | Total

MRI scan volume at the HMCA-managed sites increased 14% to 50,744 scans for the quarter ending

September 30, 2023 versus the corresponding quarter one year earlier. |

| * | Cash

and cash equivalents increased 1% to $51.7 million at September 30, 2023 as compared to the

fiscal year-ended June 30, 2023. |

| * | Total

Revenues - Net increased by 11% to $25.8 million for the quarter ended September 30, 2023

versus the corresponding quarter one year earlier. |

| * | Income

from Operations increased 68% to $6.6 million for the quarter ended September 30, 2023 versus

the corresponding quarter one year earlier. |

| * | Net

Income approximately doubled to $5.4 million for the quarter ended September 30, 2023 versus

the corresponding quarter one year earlier. |

| * | Diluted

Net Income per Common Share approximately doubled to $0.59 for the quarter ended September

30, 2023 versus the corresponding quarter one year earlier. |

| * | Working

Capital increased by 4% to $114.9 million at September 30, 2023 as compared to the fiscal

year-ended June 30, 2023. |

| * | Book

Value Per Share increased by 7% to $23.88 per share versus the corresponding quarter one

year earlier. |

| * | One

HMCA-managed MRI scanner was added in the first quarter of fiscal 2024, bringing the total

number of managed scanners to 42. |

MELVILLE,

NEW YORK, November 14, 2023 - FONAR Corporation (NASDAQ-FONR), The Inventor of MR Scanning™,

reported today its financial results for the first quarter of fiscal 2024 which ended September 30, 2023. FONAR’s primary source

of income is attributable to its wholly-owned diagnostic imaging management subsidiary, Health Management Company of America (HMCA).

In 2009, HMCA managed 9 MRI scanners. Currently, HMCA manages 42 MRI scanners in New York and in Florida.

Financial

Results

Total

revenues - Net increased by 11% to $25.8 million for the 1st fiscal quarter ended September 30, 2023, as compared to $23.2 million for

the 1st fiscal quarter ended September 30, 2022.

Revenues

from the management of diagnostic imaging center segment, consisting of patient fee revenue, net of contractual allowances and discounts,

and management and other fees of related and non-related medical practices, increased by 12% to $23.8 million for the 1st fiscal quarter

ended September 30, 2023, as compared to $21.3 million for the fiscal quarter ended September 30, 2022.

Revenues

from product sales and upgrades and service and repair fees for related and non-related medical parties, for the quarter ended September

30, 2023 was $2.1 million, as compared to $1.9 million for the quarter ended September 30, 2022.

Selling,

general and administrative (S, G & A) expenses decreased 23% to $4.9 million in the first three months of fiscal 2024 from $6.3 million

in the first three months of fiscal 2023. This decrease in selling, general and administrative expenses was due mainly to less reserves

taken on management fees. Some of these reserves had been taken in the ordinary course of business and some in connection with the impact

of the COVID-19 virus.

Total

Costs and Expenses were approximately the same at $19.3 million for the 1st fiscal quarters ended September 30, 2023, and September 30,

2022. Decreases in S,G & A were offset by increases in costs in the management of diagnostic imaging center segment.

Income

from Operations increased 68% to $6.6 million for the quarter ended September 30, 2023, as compared to $3.9 million for the quarter ended

September 30, 2022.

Net

Income increased 102% to $5.4 million for the quarter ended September 30, 2023, as compared to $2.7 million for the quarter ended September

30, 2022.

Diluted

Net Income per Common Share available to common shareholders increased 103% to $0.59, for the quarter ended September 30, 2023, as compared

to $0.29 for the quarter ended September 30, 2022.

The

weighted average diluted shares outstanding attributable to common stockholders for the quarter ended September quarter ended September

and was 6.5 million versus 6.7 million for the quarter ended September, 2022.

Balance

Sheet Items

Total

Cash and Cash Equivalents and Short Term Investments at September 30, 2023 increased 1% to $51.7 million as compared to the $51.3 million

at June 30, 2023.

Total

Assets at September 30, 2023 were $201.6 million as compared to $200.6 million at June 30, 2023.

Total

Liabilities at September 30, 2023 were $47.5 million as compared to $49.8 million at June 30, 2023.

Total

Current Assets at September 30, 2023 were $129.1 million as compared to $125.7 million at June 30, 2023.

Total

Current Liabilities at September 30, 2023 were $14.2 million as compared to $15.6 million at June 30, 2023.

FONAR

Stockholders’ Equity was $161.3 million at September 30, 2023, as compared to $157.9 million at June 30, 2023.

The

Current Ratio was 9.1 at September 30, 2023.

Working

Capital increased 4% to $114.9 million at September 30, 2023, as compared to $110.0 million at June 30, 2023.

The

ratio of Total Assets/Total Liabilities increased 7% to 4.24 at September 30, 2023 as compared to 3.9 at September 30, 2022.

Net

Book Value per Common Share (Total Stockholder’s Equity divided by Common Shares Outstanding) increased 7% to $23.88 at September

30, 2023 as compared to $22.05 at September 30, 2022.

Cash

Flow Item

Net

Cash Flow provided by Operating activities decreased 3% to $2.6 million for the quarter ended September 30, 2023 as compared to $2.7

million at September 30, 2022.

Management

Discussion

Timothy

Damadian, president and CEO of FONAR, said, “I’m pleased to report that the total scan volume at HMCA-managed MRI sites in

the first quarter of Fiscal 2024 was a record 50,744, which was 14.1% higher than the scan volume in the corresponding quarter of Fiscal

2023 (44,471).”

“There

were two primary reasons for the increase. The first was the opening of a new HMCA-managed site in Casselberry, Florida last March. The

second was the full return to regular business hours at all HMCA-managed facilities, thanks to having successfully addressed the MRI

technologist staffing shortages caused by the COVID-19 pandemic.”

“I

am also pleased to announce that we now employ SwiftMR™, Artificial Intelligence (AI) software, at all HMCA-managed sites. SwiftMR™,

an FDA 510(k)-cleared software product of AIRS Medical, Inc., uses AI-powered denoising and sharpening to enhance the quality of MRI

images and enable the reduction of scan times by up to 50%. Although we’ve been using it for a relatively short period of time,

I can report that reading radiologists and referring physicians are very pleased with it; patients appreciate the shorter exam times;

and the HMCA facilities have been able to reduce backlogs and schedule more patients each day.”

“Also,

FONAR is now the exclusive distributor of SwiftMR™ to FONAR customers for use on their FONAR MRIs and any other MRI scanners they

may own. We are proud to be working with AIRS Medical and look forward to long and mutually beneficial relationship.”

“I

would also like to report that pursuant to our September 13, 2022 announcement of a FONAR stock repurchase plan of up to $9 million,

the Company has, as of September 30, 2023, repurchased 146,359 shares at a cost of $2,473,215. FONAR is limited by the manner, timing,

price, and volume restrictions of its share repurchases as prescribed in the safe harbor provisions of Rule 10b-18.”

Mr.

Damadian concluded, “HMCA is now managing 42 MRI scanners, 25 in New York and 17 in Florida, and we’re off to a good start

for Fiscal 2024. The damage wreaked by COVID-19, including the severe and long-lasting labor shortages it caused, is finally behind us.

Yet through it all, we have maintained positive trends in both revenue and profit. I proudly credit our management team and all our employees.

Together we look forward to a very successful Fiscal 2024.”

Significant

Events

On

September 13, 2022, the Company adopted a common stock repurchase plan. The plan has no expiration date and cannot determine the number

of shares which will be repurchased. On September 26, 2022, the Board of Directors approved up to $9 million to be repurchased under

the plan. The stock will be purchased on the publicly traded open market at prevailing prices.

For

the quarter ended September 30, 2023, the Company purchased 43,211 shares at a cost of $713,758. At September 30, 2023, the Company had

purchased 146,359 shares at a cost of $2,473,215. Those shares were returned to the corporate treasury. (See note 10 of the 10-Q for

details.)

Company

Legacy

FONAR’s

history is that of being the first Company in the MRI industry and that its founder, Raymond V. Damadian, M.D., is the inventor of the

MRI. To accurately preserve these truths, occasionally various achievements of FONAR and Dr. Damadian will be selected and presented.

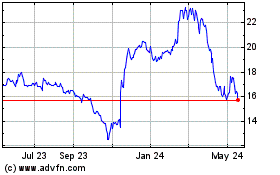

On

July 15, 1988, the National Medal of Technology was presented by President Ronald Reagan, to Raymond V. Damadian, M.D., which he shared

jointly with Dr. Paul Lauterbur, for "their independent contributions in conceiving and developing the application of magnetic resonance

technology to medical uses, including whole-body scanning and diagnostic imaging."

The

National Medal of Technology and Innovation (NMTI) is the nation’s highest honor for technological achievement, bestowed by the

president of the United States on America's leading innovators.

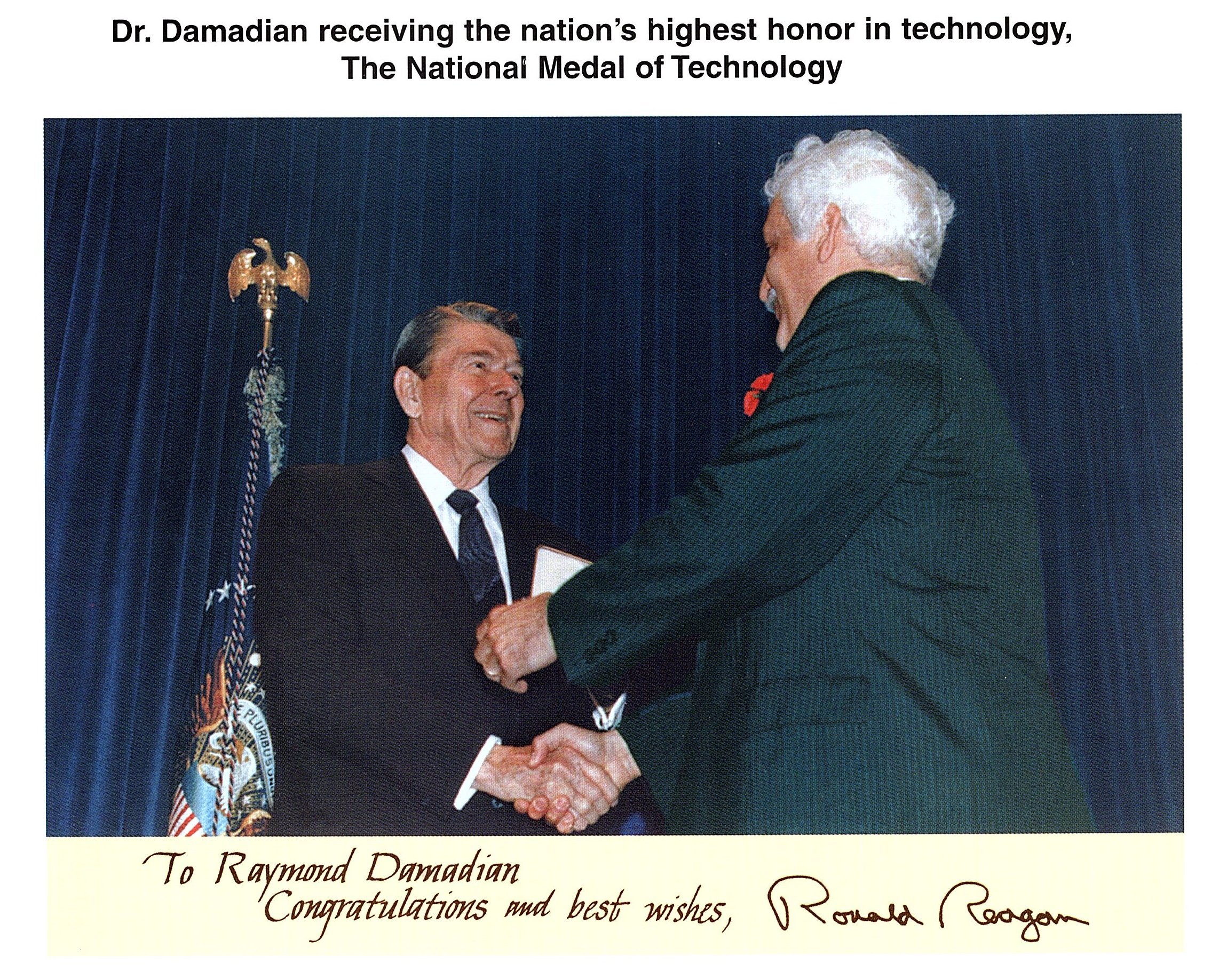

Picture:

Courtesy of Fonar Corporation

Among

Dr. Damadian’s independent contributions in conceiving and developing the application of magnetic resonance technology to medical

uses, including whole-body scanning and diagnostic imaging was building the world’s first MRI scanner and performing the world’s

first MRI scan. The attached photo shows Dr. Damadian with the world’s 1st MRI scanner that

he and his graduate assistants built. Inside the scanner is his graduate student, Lawrence Minkoff, Ph.D., who on July 3, 1977, was the

first person scanned by an NMR (MRI) machine.

About

FONAR

FONAR,

The Inventor of MR Scanning™, located in Melville, NY, was incorporated in 1978, and is the first, oldest and most experienced

MRI Company in the industry. FONAR went public in 1981 (Nasdaq:FONR). FONAR sold the world’s first commercial MRI to Ronald J Ross,

MD, Cleveland, Ohio. It was installed in 1980. Dr. Ross and his team began the world’s first clinical MRI trials in January 1981.

The results were reported in the June 1981 edition of Radiology/Nuclear Medicine Magazine. The technique used for obtaining T1 and T2

values was the FONAR technique (Field fOcusing Nuclear mAgnetic Resonance), not the back projection technique. www.fonar.com/innovations-timeline.html.

FONAR’s

signature product is the FONAR UPRIGHT® Multi-Position™ MRI (also known as the STAND-UP® MRI), the only whole-body MRI

that performs Position™ Imaging (pMRI™) and scans patients in numerous weight-bearing positions, i.e. standing, sitting,

in flexion and extension, as well as the conventional lie-down position. The FONAR UPRIGHT® MRI often detects patient problems that

other MRI scanners cannot because they are lie-down, “weightless-only” scanners. The patient-friendly UPRIGHT® MRI has

a near-zero patient claustrophobic rejection rate. As a FONAR customer states, “If the patient is claustrophobic in this scanner,

they’ll be claustrophobic in my parking lot.” Approximately 85% of patients are scanned sitting while watching TV.

FONAR

has new works-in-progress technology for visualizing and quantifying the cerebral hydraulics of the central nervous system, the flow

of cerebrospinal fluid (CSF), which circulates throughout the brain and vertebral column at the rate of 32 quarts per day. This imaging

and quantifying of the dynamics of this vital life-sustaining physiology of the body’s neurologic system has been made possible

first by FONAR’s introduction of the MRI and now by this latest works-in-progress method for quantifying CSF in all the normal

positions of the body, particularly in its upright flow against gravity. Patients with whiplash or other neck injuries are among those

who will benefit from this new understanding.

FONAR’s

primary source of income and growth is attributable to its wholly-owned diagnostic imaging management subsidiary, Health Management Company

of America (HMCA) www.hmca.com.

FONAR’s

substantial list of patents includes recent patents for its technology enabling full weight-bearing MRI imaging of all the gravity sensitive

regions of the human anatomy, especially the brain, extremities and spine. It includes its newest technology for measuring the Upright

cerebral hydraulics of the cerebrospinal fluid (CSF) of the central nervous system. FONAR’s UPRIGHT® Multi-Position™

MRI is the only scanner licensed under these patents.

UPRIGHT®

and STAND-UP® are registered trademarks. The Inventor of MR Scanning™, CSP™, Multi-Position™, UPRIGHT RADIOLOGY™,

The Proof is in the Picture™, pMRI™, CSF Videography™, and Dynamic™ are trademarks of FONAR Corporation.

This

release may include forward-looking statements from the company that may or may not materialize. Additional information on factors that

could potentially affect the company's financial results may be found in the company's filings with the Securities and Exchange Commission.

FONAR

CORPORATION AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(Amounts

and shares in thousands, except per share amounts)

(UNAUDITED)

ASSETS

| | |

September

30, | |

June

30, |

| | |

2023 | |

2023 |

| Current

Assets: | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 51,693 | | |

$ | 51,280 | |

| Short-term

investments | |

| 33 | | |

| 33 | |

| Accounts

receivable - net | |

| 4,092 | | |

| 3,861 | |

| Accounts

receivable - related party | |

| 90 | | |

| — | |

| Medical

receivable - net | |

| 21,924 | | |

| 21,259 | |

| Management

and other fees receivable - net | |

| 38,118 | | |

| 35,888 | |

| Management

and other fees receivable - related medical practices - net | |

| 9,063 | | |

| 9,162 | |

| Inventories | |

| 2,824 | | |

| 2,570 | |

| Prepaid

expenses and other current assets | |

| 1,310 | | |

| 1,608 | |

| | |

| | | |

| | |

| Total

Current Assets | |

| 129,147 | | |

| 125,661 | |

| | |

| | | |

| | |

| Accounts

receivable - long term | |

| 500 | | |

| 710 | |

| Deferred

income tax asset | |

| 8,800 | | |

| 10,042 | |

| Property

and equipment - net | |

| 21,107 | | |

| 22,146 | |

| Right-of-use

Asset - operating lease | |

| 33,203 | | |

| 33,069 | |

| Right-of-use

Asset - financing lease | |

| 680 | | |

| 729 | |

| Goodwill | |

| 4,269 | | |

| 4,269 | |

| Other

intangible assets - net | |

| 3,355 | | |

| 3,432 | |

| Other

assets | |

| 495 | | |

| 524 | |

| | |

| | | |

| | |

| Total

Assets | |

$ | 201,556 | | |

$ | 200,582 | |

FONAR

CORPORATION AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(Amounts

and shares in thousands, except per share amounts)

(UNAUDITED)

LIABILITIES

AND STOCKHOLDERS’ EQUITY

| | |

September

30, | |

June

30, |

| | |

2023 | |

2023 |

| Current

Liabilities: | |

| | | |

| | |

| Current

portion of long-term debt | |

$ | 45 | | |

$ | 44 | |

| Accounts

payable | |

| 1,040 | | |

| 1,579 | |

| Other

current liabilities | |

| 3,984 | | |

| 5,444 | |

| Unearned

revenue on service contracts | |

| 3,944 | | |

| 3,832 | |

| Unearned

revenue on service contracts – related party | |

| 82 | | |

| — | |

| Operating

lease liability - current portion | |

| 4,295 | | |

| 3,905 | |

| Financing

lease liability - current portion | |

| 219 | | |

| 218 | |

| Customer

deposits | |

| 623 | | |

| 602 | |

| Total

Current Liabilities | |

| 14,232 | | |

| 15,624 | |

| | |

| | | |

| | |

| Long-Term

Liabilities: | |

| | | |

| | |

| Unearned

revenue on service contracts | |

| 562 | | |

| 760 | |

| Deferred

income tax liability | |

| 395 | | |

| 395 | |

| Due

to related medical practices | |

| 93 | | |

| 93 | |

| Operating

lease liability – net of current portion | |

| 31,503 | | |

| 32,105 | |

| Financing

lease liability – net of current portion | |

| 565 | | |

| 620 | |

| Long-term

debt, less current portion | |

| 104 | | |

| 115 | |

| Other

liabilities | |

| 29 | | |

| 42 | |

| | |

| | | |

| | |

| Total

Long-Term Liabilities | |

| 33,251 | | |

| 34,130 | |

| | |

| | | |

| | |

| Total

Liabilities | |

| 47,483 | | |

| 49,754 | |

FONAR

CORPORATION AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(Amounts

and shares in thousands, except per share amounts)

(UNAUDITED)

LIABILITIES

AND STOCKHOLDERS’ EQUITY (Continued)

| STOCKHOLDERS'

EQUITY: | |

September

30, 2023 | |

June

30,

2023 |

| Class

A non-voting preferred stock $.0001 par value; 453 shares authorized at September 30, 2023 and June 30, 2023, 313 issued and outstanding

at September 30, 2023 and June 30, 2023 | |

$ | — | | |

$ | — | |

| Preferred

stock $.001 par value; 567 shares authorized at September 30, 2023 and June 30, 2023, issued and outstanding – none | |

| — | | |

| — | |

| Common

Stock $.0001 par value; 8,500 shares authorized at September 30, 2023 and June 30, 2023, 6,506 and 6,462 issued at September 30,

2023 and June 30, 2023, respectively 6,451 and 6,451 outstanding at September 30, 2023 and June 30, 2023 respectively | |

| 1 | | |

| 1 | |

| Class

B Common Stock (10 votes per share) $.0001 par value; 227 shares authorized at September 30, 2023 and June 30, 2023; .146 issued

and outstanding at September 30, 2023 and June 30, 2023 | |

| — | | |

| — | |

| Class

C Common Stock (25 votes per share) $.0001 par value; 567 shares authorized at September 30, 2023 and June 30, 2023, 383 issued and

outstanding at September 30, 2023 and June 30, 2023 | |

| — | | |

| — | |

| Paid-in

capital in excess of par value | |

| 182,613 | | |

| 182,613 | |

| Accumulated

deficit | |

| (20,085 | ) | |

| (24,191 | ) |

| Treasury

stock, at cost – 55 shares of common stock at September 30, 2023 and 11 shares of common stock at June 30, 2023 | |

| (1,230 | ) | |

| (516 | ) |

| Total

Fonar Corporation’s Stockholders’ Equity | |

| 161,299 | | |

| 157,907 | |

| Noncontrolling

interests | |

| (7,226 | ) | |

| (7,079 | ) |

| Total

Stockholders' Equity | |

| 154,073 | | |

| 150,828 | |

| Total

Liabilities and Stockholders' Equity | |

$ | 201,556 | | |

$ | 200,582 | |

FONAR

CORPORATION AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF INCOME

(Amounts

and shares in thousands, except per share amounts)

(UNAUDITED)

| | |

FOR

THE THREE MONTHS

ENDED SEPTEMBER 30, |

| REVENUES | |

2023 | |

2022 |

| Patient

fee revenue – net of contractual allowances and discounts | |

$ | 8,676 | | |

$ | 6,076 | |

| Product

sales – net | |

| 164 | | |

| 30 | |

| Service

and repair fees – net | |

| 1,864 | | |

| 1,820 | |

| Service

and repair fees - related parties – net | |

| 28 | | |

| 28 | |

| Management

and other fees – net | |

| 12,119 | | |

| 12,250 | |

| Management

and other fees - related medical practices – net | |

| 2,987 | | |

| 2,987 | |

| Total

Revenues – Net | |

| 25,838 | | |

| 23,191 | |

| COSTS

AND EXPENSES | |

| | | |

| | |

| Costs

related to patient fee revenue | |

| 4,427 | | |

| 3,800 | |

| Costs

related to product sales | |

| 103 | | |

| 169 | |

| Costs

related to service and repair fees | |

| 848 | | |

| 718 | |

| Costs

related to service and repair fees - related parties | |

| 13 | | |

| 11 | |

| Costs

related to management and other fees | |

| 7,024 | | |

| 6,501 | |

| Costs

related to management and other fees – related medical practices | |

| 1,519 | | |

| 1,398 | |

| Research

and development | |

| 467 | | |

| 349 | |

| Selling,

general and administrative | |

| 4,866 | | |

| 6,334 | |

| Total

Costs and Expenses | |

| 19,267 | | |

| 19,280 | |

| Income

From Operations | |

| 6,571 | | |

| 3,911 | |

| Other

Income | |

| — | | |

| 11 | |

| Interest

Expense | |

| (48 | ) | |

| (14 | ) |

| Investment

Income | |

| 507 | | |

| 151 | |

| Income

Before Provision for Income Taxes and Noncontrolling Interests | |

| 7,030 | | |

| 4,059 | |

| Provision

for Income Taxes | |

| (1,670 | ) | |

| (1,409 | ) |

| Net

Income | |

| 5,360 | | |

| 2,650 | |

| Net

Income - Noncontrolling Interests | |

| (1,254 | ) | |

| (603 | ) |

| Net

Income – Attributable to FONAR | |

$ | 4,106 | | |

$ | 2,047 | |

| Net

Income Available to Common Stockholders | |

$ | 3,855 | | |

$ | 1,923 | |

| Net

Income Available to Class A Non-Voting Preferred Stockholders | |

$ | 187 | | |

$ | 92 | |

| Net

Income Available to Class C Common Stockholders | |

$ | 64 | | |

$ | 32 | |

| Basic

Net Income Per Common Share Available to Common Stockholders | |

$ | 0.60 | | |

$ | 0.29 | |

| Diluted

Net Income Per Common Share Available to Common Stockholders | |

$ | 0.59 | | |

$ | 0.29 | |

| Basic

and Diluted Income Per Share – Class C Common | |

$ | 0.17 | | |

$ | 0.08 | |

| Weighted

Average Basic Shares Outstanding – Common Stockholders | |

| 6,408 | | |

| 6,545 | |

| Weighted

Average Diluted Shares Outstanding - Common Stockholders | |

| 6,536 | | |

| 6,673 | |

| Weighted

Average Basic and Diluted Shares Outstanding – Class C Common | |

| 383 | | |

| 383 | |

FONAR

CORPORATION AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts

and shares in thousands, except per share amounts)

(UNAUDITED)

| | |

FOR

THE THREE MONTHS

ENDED SEPTEMBER 30, |

| | |

2023 | |

2022 |

| Cash

Flows from Operating Activities: | |

| | | |

| | |

| Net

income | |

$ | 5,360 | | |

$ | 2,650 | |

| Adjustments

to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation

and amortization | |

| 1,195 | | |

| 1,118 | |

| Amortization

of right-of-use assets | |

| 1,024 | | |

| 1,061 | |

| (Recovery)

Provision for bad debts | |

| (68 | ) | |

| 1,398 | |

| Deferred

income tax – net | |

| 1,242 | | |

| 1,146 | |

| (Increase)

decrease in operating assets, net: | |

| | | |

| | |

| Accounts,

medical and management fee receivable(s) | |

| (2,837 | ) | |

| (1,407 | ) |

| Notes

receivable | |

| 5 | | |

| 11 | |

| Inventories | |

| (255 | ) | |

| (98 | ) |

| Prepaid

expenses and other current assets | |

| 293 | | |

| (14 | ) |

| Other

assets | |

| 29 | | |

| — | |

| Increase

(decrease) in operating liabilities, net: | |

| | | |

| | |

| Accounts

payable | |

| (539 | ) | |

| (779 | ) |

| Other

current liabilities | |

| (1,463 | ) | |

| (1,580 | ) |

| Operating

lease liabilities | |

| (1,322 | ) | |

| (912 | ) |

| Financing

lease liabilities | |

| (54 | ) | |

| (52 | ) |

| Customer

deposits | |

| 20 | | |

| 171 | |

| Other

liabilities | |

| (12 | ) | |

| (16 | ) |

| Net

cash provided by operating activities | |

| 2,618 | | |

| 2,697 | |

| Cash

Flows from Investing Activities: | |

| | | |

| | |

| Purchases

of property and equipment | |

| (63 | ) | |

| (939 | ) |

| Cost

of patents | |

| (16 | ) | |

| (24 | ) |

| Net

cash used in investing activities | |

| (79 | ) | |

| (963 | ) |

| Cash

Flows from Financing Activities: | |

| | | |

| | |

| Repayment

of borrowings and capital lease obligations | |

| (11 | ) | |

| (5 | ) |

| Purchase

of treasury stock | |

| (714 | ) | |

| (122 | ) |

| Distributions

to noncontrolling interests | |

| (1,401 | ) | |

| (1,634 | ) |

| Net

cash used in financing activities | |

| (2,126 | ) | |

| (1,761 | ) |

| Net

Increase (Decrease) in Cash and Cash Equivalents | |

| 413 | | |

| (27 | ) |

| Cash

and Cash Equivalents - Beginning of Period | |

| 51,280 | | |

| 48,723 | |

| Cash

and Cash Equivalents - End of Period | |

$ | 51,693 | | |

$ | 48,696 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

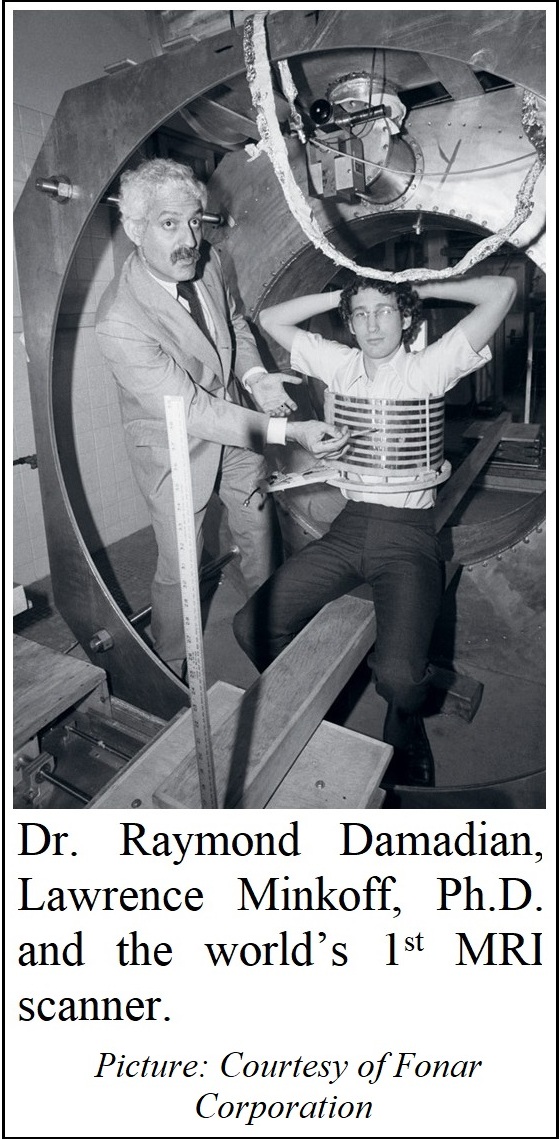

Fonar (NASDAQ:FONR)

Historical Stock Chart

From Oct 2024 to Nov 2024

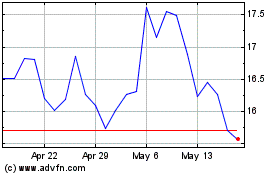

Fonar (NASDAQ:FONR)

Historical Stock Chart

From Nov 2023 to Nov 2024