FTC Solar, Inc. (Nasdaq: FTCI), a leading provider of solar

tracker systems, today announced financial results for

the third quarter ending September 30, 2024, which were

in line with the company’s prior targets.

“I’m excited to have begun my tenure as CEO during the third

quarter,” said Yann Brandt, President and Chief Executive Officer

of FTC Solar. “As I take stock of our positioning at the 90-day

mark, I believe the company is in an enviable position in many

respects. This includes having a product portfolio that customers

love, a business they appreciate working with, and a cost structure

poised to enable strong margin growth and profitability. In

addition, the company now has a compelling and expanded 1P product

set that opens up the vast majority of the market that wasn’t

available to the company in the past. The company is in a strong

position as it relates to some of the most critical aspects of the

business, and I can’t wait to work alongside our team to scale our

market share.”

“With a solid underlying foundation, we have also been pleased

to announce some recent business wins, including a 500-megawatt,

scalable supply agreement with industry leader Strata Clean Energy,

a one-gigawatt plus agreement with new customer Dunlieh Energy,

additional project detail on one-gigawatt worth of projects with

Sandhills Energy, as well as new announcements today of a $15

million note placement and a $4.7 million earn out on a prior

investment, both of which add incremental strength to our balance

sheet.”

The company added $18 million in new purchase

orders since August 8, 2024. The contracted portion of the

company's backlog1 now stands at $513 million.

Summary Financial Performance: Q3 2024

compared to Q3 2023

|

|

|

U.S. GAAP |

|

|

Non-GAAP(b) |

|

|

|

|

Three months ended September 30, |

|

|

(in thousands, except per share data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

$ |

10,136 |

|

|

$ |

30,548 |

|

|

$ |

10,136 |

|

|

$ |

30,548 |

|

| Gross margin percentage |

|

|

(42.5 |

%) |

|

|

11.1 |

% |

|

|

(38.3 |

%) |

|

|

12.8 |

% |

| Total operating expenses |

|

$ |

10,670 |

|

|

$ |

19,656 |

|

|

$ |

8,131 |

|

|

$ |

13,222 |

|

| Loss from operations(a) |

|

$ |

(14,976 |

) |

|

$ |

(16,277 |

) |

|

$ |

(12,174 |

) |

|

$ |

(9,706 |

) |

| Net loss |

|

$ |

(15,359 |

) |

|

$ |

(16,937 |

) |

|

$ |

(12,678 |

) |

|

$ |

(10,008 |

) |

| Diluted loss per share |

|

$ |

(0.12 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.08 |

) |

(a) Adjusted EBITDA for

Non-GAAP(b) See below for reconciliation of

Non-GAAP financial measures to the nearest comparable GAAP

measures

Third Quarter ResultsTotal

third-quarter revenue was $10.1 million, within our target range.

This revenue level represents a decrease of 11.3% compared to the

prior quarter and a decrease of 66.8% compared to the year-earlier

quarter due to lower product volumes.

GAAP gross loss was $4.3 million, or 42.5% of

revenue, compared to gross loss of $2.3 million, or 20.5% of

revenue, in the prior quarter. Non-GAAP gross loss was $3.9 million

or 38.3% of revenue. The result for this quarter compares to

non-GAAP gross profit of $3.9 million in the prior-year period,

with the difference driven primarily by the impact of lower current

quarter revenues which were not sufficient to cover certain fixed

indirect costs.

GAAP operating expenses were $10.7 million. On a

non-GAAP basis, operating expenses were $8.1 million. This result

compares to non-GAAP operating expenses of $13.2 million in the

year-ago quarter.

GAAP net loss was $15.4 million or

$0.12 per diluted share, compared to a loss of $12.2 million or

$0.10 per diluted share in the prior quarter

and a net loss of $16.9 million or $0.14 per

diluted share in the year-ago quarter. Adjusted EBITDA loss,

which excludes an approximate $3.2 million net loss from

stock-based compensation expense and other non-cash items, was

$12.2 million, compared to losses of $10.5 million(2) in the prior

quarter and $9.7 million in the year-ago quarter.

Subsequent EventsSubsequent to

the end of the third quarter, the company received a $4.7 million

cash earn-out relating to the company’s prior investment in

Dimension Energy, a community solar developer in which the company

invested $4 million in 2018. FTC Solar sold its stake in 2021 for

$22 million and remained eligible to receive earn-out payments

based on Dimension achieving certain performance milestones.

To-date, FTC has received more than $9 million in earn-out payments

and is eligible to receive up to an additional $5 million based on

performance through the end of 2024.

The company also announced today that on

November 8, 2024, the company entered into a binding term sheet

with an institutional investor (the “Investor”) to issue to the

Investor, in a private placement, senior secured promissory notes

(the “Notes”) in an aggregate principal amount of fifteen million

dollars ($15,000,000) and common stock purchase warrants (the

“Warrants”) to purchase 17,500,000 shares of our common stock.

The Notes will bear interest at a rate of 11%

per annum if payable in cash or, at our option, 13% per annum if

paid-in-kind and will mature five (5) years from the date of

issuance. The Warrants are immediately exercisable at an exercise

price of $0.01 per share, subject to certain customary adjustments

to be set forth in the definitive documentation, and will expire

ten (10) years from the date of issuance. We have also agreed that

the Investor shall be entitled to nominate one (1) person for

election to our board of directors at our annual stockholder

meeting. The issuance of the Notes and Warrants will be subject to

customary closing conditions and the preparation and negotiation of

definitive documents. We currently expect that the issuance of the

Notes and Warrants will occur on or prior to November 30, 2024.

OutlookFor the fourth quarter,

we expect revenue to be approximately flat to up 39% relative to

the third quarter.

|

(in millions) |

|

3Q'24Guidance |

|

3Q'24Actual |

|

4Q'24Guidance(3) |

|

Revenue |

|

$9.0 – $11.0 |

|

$10.1 |

|

$10.0 – $14.0 |

| Non-GAAP Gross Profit

(Loss) |

|

$(4.3) – $(1.5) |

|

$(3.9) |

|

$(4.2) – $(1.5) |

| Non-GAAP Gross Margin |

|

(47.8%) – (13.5%) |

|

(38.3%) |

|

(42.2%) – (10.7%) |

| Non-GAAP operating

expenses |

|

$9.3 – $10.0 |

|

$8.1 |

|

$8.2 – $9.0 |

| Non-GAAP adjusted EBITDA |

|

$(14.7) – $(11.0) |

|

$(12.2) |

|

$(13.7) – $(9.9) |

| |

|

|

|

|

|

|

Looking ahead to 2025, for the first quarter we expect continued

improvement in revenue, margin and adjusted EBITDA. We remain

confident we will achieve adjusted EBITDA breakeven on a quarterly

basis in 2025.

Third Quarter 2024 Earnings Conference

CallFTC Solar’s senior management will host a conference

call for members of the investment community at 8:30 a.m. E.T.

today, during which the company will discuss its third quarter

results, its outlook and other business items. This call will be

webcast and can be accessed within the Investor Relations section

of FTC Solar's website at https://investor.ftcsolar.com. A replay

of the conference call will also be available on the website for 30

days following the webcast.

About FTC Solar Inc. Founded in

2017 by a group of renewable energy industry veterans, FTC Solar is

a global provider of solar tracker systems, technology, software,

and engineering services. Solar trackers significantly increase

energy production at solar power installations by dynamically

optimizing solar panel orientation to the sun. FTC Solar’s

innovative tracker designs provide compelling performance and

reliability, with an industry-leading installation cost-per-watt

advantage.

Footnotes1. The term ‘backlog’

or ‘contracted and awarded’ refers to the combination of our

executed contracts (contracted) and awarded orders (awarded), which

are orders that have been documented and signed through a contract,

where we are in the process of documenting a contract but for which

a contract has not yet been signed, or that have been awarded in

writing or verbally with a mutual understanding that the order will

be contracted in the future. In the case of certain projects,

including those that are scheduled for delivery on later dates, we

have not locked in binding pricing with customers, and we instead

use estimated average selling price to calculate the revenue

included in our contracted and awarded orders for such projects.

Actual revenue for these projects could differ once contracts with

binding pricing are executed, and there is also a risk that a

contract may never be executed for an awarded but uncontracted

project, or that a contract may be executed for an awarded but

uncontracted project at a date that is later than anticipated, or

that a contract once executed may be subsequently amended,

supplemented, rescinded, cancelled or breached, including in a

manner that impacts the timing and amounts of payments due

thereunder, thus reducing anticipated revenues. Please refer to our

SEC filings, including our Form 10-K, for more information on our

contracted and awarded orders, including risk factors.2. A

reconciliation of prior quarter Non-GAAP financial measures to the

nearest comparable GAAP measures may be found in Exhibit 99.1 of

our Form 8-K filed on August 8, 2024.3. We do not provide a

quantitative reconciliation of our forward-looking non-GAAP

guidance measures to the most directly comparable GAAP financial

measures because certain information needed to reconcile those

measures is not available without unreasonable efforts due to the

inherent difficulty in forecasting and quantifying these measures

as a result of changes in project schedules by our customers that

may occur, which are outside of our control, and the impact, if

any, of credit loss provisions, asset impairment charges,

restructuring or changes in the timing and level of indirect or

overhead spending, as well as other matters, that could occur which

could significantly impact the related GAAP financial measures.

Forward-Looking StatementsThis

press release contains forward looking statements. These statements

are not historical facts but rather are based on our current

expectations and projections regarding our business, operations and

other factors relating thereto. Words such as “may,” “will,”

“could,” “would,” “should,” “anticipate,” “predict,” “potential,”

“continue,” “expects,” “intends,” “plans,” “projects,” “believes,”

“estimates” and similar expressions are used to identify these

forward-looking statements. These statements are only predictions

and as such are not guarantees of future performance and involve

risks, uncertainties and assumptions that are difficult to predict.

You should not rely on our forward-looking statements as

predictions of future events, as actual results may differ

materially from those in the forward-looking statements because of

several factors, including those described in more detail above and

in our filings with the U.S. Securities and Exchange Commission,

including the section entitled “Risk Factors” contained therein.

FTC Solar undertakes no duty or obligation to update any

forward-looking statements contained in this release as a result of

new information, future events or changes in its expectations,

except as required by law.

FTC Solar Investor Contact:Bill Michalek Vice

President, Investor Relations FTC SolarT: (737) 241-8618 E:

IR@FTCSolar.com

|

|

|

|

FTC Solar, Inc.Condensed Consolidated

Statements of Comprehensive

Loss(unaudited) |

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

(in thousands, except shares and per share

data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product |

|

$ |

7,411 |

|

|

$ |

27,274 |

|

|

$ |

27,092 |

|

|

$ |

80,927 |

|

|

Service |

|

|

2,725 |

|

|

|

3,274 |

|

|

|

7,061 |

|

|

|

22,874 |

|

|

Total revenue |

|

|

10,136 |

|

|

|

30,548 |

|

|

|

34,153 |

|

|

|

103,801 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product |

|

|

11,798 |

|

|

|

22,775 |

|

|

|

34,632 |

|

|

|

73,694 |

|

|

Service |

|

|

2,644 |

|

|

|

4,394 |

|

|

|

8,278 |

|

|

|

22,492 |

|

|

Total cost of revenue |

|

|

14,442 |

|

|

|

27,169 |

|

|

|

42,910 |

|

|

|

96,186 |

|

|

Gross profit (loss) |

|

|

(4,306 |

) |

|

|

3,379 |

|

|

|

(8,757 |

) |

|

|

7,615 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

1,467 |

|

|

|

1,921 |

|

|

|

4,441 |

|

|

|

5,716 |

|

|

Selling and marketing |

|

|

2,406 |

|

|

|

6,324 |

|

|

|

6,830 |

|

|

|

9,887 |

|

|

General and administrative |

|

|

6,797 |

|

|

|

11,411 |

|

|

|

19,374 |

|

|

|

31,053 |

|

|

Total operating expenses |

|

|

10,670 |

|

|

|

19,656 |

|

|

|

30,645 |

|

|

|

46,656 |

|

|

Loss from operations |

|

|

(14,976 |

) |

|

|

(16,277 |

) |

|

|

(39,402 |

) |

|

|

(39,041 |

) |

| Interest income (expense),

net |

|

|

24 |

|

|

|

(108 |

) |

|

|

(111 |

) |

|

|

(194 |

) |

| Gain from disposal of

investment in unconsolidated subsidiary |

|

|

— |

|

|

|

— |

|

|

|

4,085 |

|

|

|

898 |

|

| Other income (expense),

net |

|

|

93 |

|

|

|

(50 |

) |

|

|

122 |

|

|

|

(265 |

) |

| Loss from unconsolidated

subsidiary |

|

|

(256 |

) |

|

|

(336 |

) |

|

|

(767 |

) |

|

|

(336 |

) |

|

Loss before income taxes |

|

|

(15,115 |

) |

|

|

(16,771 |

) |

|

|

(36,073 |

) |

|

|

(38,938 |

) |

| Provision for income

taxes |

|

|

(244 |

) |

|

|

(166 |

) |

|

|

(298 |

) |

|

|

(175 |

) |

|

Net loss |

|

|

(15,359 |

) |

|

|

(16,937 |

) |

|

|

(36,371 |

) |

|

|

(39,113 |

) |

| Other comprehensive

income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustments |

|

|

207 |

|

|

|

(38 |

) |

|

|

62 |

|

|

|

(451 |

) |

|

Comprehensive loss |

|

$ |

(15,152 |

) |

|

$ |

(16,975 |

) |

|

$ |

(36,309 |

) |

|

$ |

(39,564 |

) |

| Net loss per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.12 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.35 |

) |

| Weighted-average

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

127,380,292 |

|

|

|

119,793,821 |

|

|

|

126,234,997 |

|

|

|

112,794,562 |

|

| |

|

FTC Solar, Inc.Condensed Consolidated

Balance Sheets(unaudited) |

| |

|

(in thousands, except shares and per share

data) |

|

September 30,2024 |

|

|

December 31,2023 |

|

|

ASSETS |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

8,255 |

|

|

$ |

25,235 |

|

|

Accounts receivable, net |

|

|

37,345 |

|

|

|

65,279 |

|

|

Inventories |

|

|

15,124 |

|

|

|

3,905 |

|

|

Prepaid and other current assets |

|

|

15,502 |

|

|

|

14,089 |

|

|

Total current assets |

|

|

76,226 |

|

|

|

108,508 |

|

| Operating lease right-of-use

assets |

|

|

1,720 |

|

|

|

1,819 |

|

| Property and equipment,

net |

|

|

2,409 |

|

|

|

1,823 |

|

| Intangible assets, net |

|

|

137 |

|

|

|

542 |

|

| Goodwill |

|

|

7,421 |

|

|

|

7,353 |

|

| Equity method investment |

|

|

1,273 |

|

|

|

240 |

|

| Other assets |

|

|

2,507 |

|

|

|

2,785 |

|

|

Total assets |

|

$ |

91,693 |

|

|

$ |

123,070 |

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

18,742 |

|

|

$ |

7,979 |

|

|

Accrued expenses |

|

|

23,965 |

|

|

|

34,848 |

|

|

Income taxes payable |

|

|

333 |

|

|

|

88 |

|

|

Deferred revenue |

|

|

4,444 |

|

|

|

3,612 |

|

|

Other current liabilities |

|

|

9,862 |

|

|

|

8,138 |

|

|

Total current liabilities |

|

|

57,346 |

|

|

|

54,665 |

|

| Operating lease liability, net

of current portion |

|

|

883 |

|

|

|

1,124 |

|

| Other non-current

liabilities |

|

|

3,056 |

|

|

|

4,810 |

|

|

Total liabilities |

|

|

61,285 |

|

|

|

60,599 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

Preferred stock par value of $0.0001 per share, 10,000,000 shares

authorized; none issued as of September 30, 2024 and

December 31, 2023 |

|

|

— |

|

|

|

— |

|

|

Common stock par value of $0.0001 per share, 850,000,000 shares

authorized; 127,723,582 and 125,445,325 shares issued and

outstanding as of September 30, 2024 and December 31,

2023 |

|

|

13 |

|

|

|

13 |

|

|

Treasury stock, at cost; 10,762,566 shares as of September 30,

2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

366,132 |

|

|

|

361,886 |

|

|

Accumulated other comprehensive loss |

|

|

(231 |

) |

|

|

(293 |

) |

|

Accumulated deficit |

|

|

(335,506 |

) |

|

|

(299,135 |

) |

|

Total stockholders’ equity |

|

|

30,408 |

|

|

|

62,471 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

91,693 |

|

|

$ |

123,070 |

|

|

|

|

FTC Solar, Inc.Condensed Consolidated

Statements of Cash Flows(unaudited) |

|

|

|

|

|

Nine months ended September 30, |

|

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

Net loss |

|

$ |

(36,371 |

) |

|

$ |

(39,113 |

) |

| Adjustments to reconcile net

loss to cash used in operating activities: |

|

|

|

|

|

|

|

Stock-based compensation |

|

|

4,243 |

|

|

|

9,044 |

|

|

Depreciation and amortization |

|

|

1,229 |

|

|

|

1,004 |

|

|

(Gain) loss from sale of property and equipment |

|

|

— |

|

|

|

(2 |

) |

|

Amortization of debt issue costs |

|

|

236 |

|

|

|

532 |

|

|

Provision for obsolete and slow-moving inventory |

|

|

177 |

|

|

|

1,261 |

|

|

Loss from unconsolidated subsidiary |

|

|

767 |

|

|

|

336 |

|

|

Gain from disposal of investment in unconsolidated subsidiary |

|

|

(4,085 |

) |

|

|

(898 |

) |

|

Warranty and remediation provisions |

|

|

4,735 |

|

|

|

3,938 |

|

|

Warranty recoverable from manufacturer |

|

|

388 |

|

|

|

45 |

|

|

Credit loss provisions |

|

|

1,330 |

|

|

|

4,302 |

|

|

Deferred income taxes |

|

|

220 |

|

|

|

221 |

|

|

Lease expense and other |

|

|

861 |

|

|

|

748 |

|

| Impact on cash from changes in

operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

26,604 |

|

|

|

(26,625 |

) |

|

Inventories |

|

|

(11,396 |

) |

|

|

9,033 |

|

|

Prepaid and other current assets |

|

|

(1,403 |

) |

|

|

(3,122 |

) |

|

Other assets |

|

|

(514 |

) |

|

|

67 |

|

|

Accounts payable |

|

|

10,622 |

|

|

|

(6,160 |

) |

|

Accruals and other current liabilities |

|

|

(13,502 |

) |

|

|

5,491 |

|

|

Deferred revenue |

|

|

832 |

|

|

|

(138 |

) |

|

Other non-current liabilities |

|

|

(2,013 |

) |

|

|

(5,740 |

) |

|

Lease payments and other, net |

|

|

(968 |

) |

|

|

(607 |

) |

|

Net cash used in operations |

|

|

(18,008 |

) |

|

|

(46,383 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(1,355 |

) |

|

|

(460 |

) |

|

Equity method investment in Alpha Steel |

|

|

(1,800 |

) |

|

|

(900 |

) |

|

Proceeds from disposal of investment in unconsolidated

subsidiary |

|

|

4,085 |

|

|

|

898 |

|

|

Net cash provided by (used in) investing activities |

|

|

930 |

|

|

|

(462 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

Sale of common stock |

|

|

— |

|

|

|

34,007 |

|

|

Stock offering costs paid |

|

|

— |

|

|

|

(95 |

) |

|

Proceeds from stock option exercises |

|

|

3 |

|

|

|

221 |

|

|

Net cash provided by financing activities |

|

|

3 |

|

|

|

34,133 |

|

| Effect of exchange rate

changes on cash and cash equivalents |

|

|

95 |

|

|

|

(153 |

) |

| Decrease in cash and cash

equivalents |

|

|

(16,980 |

) |

|

|

(12,865 |

) |

| Cash and cash equivalents at

beginning of period |

|

|

25,235 |

|

|

|

44,385 |

|

| Cash and cash equivalents at

end of period |

|

$ |

8,255 |

|

|

$ |

31,520 |

|

Notes to Reconciliations of Non-GAAP

Financial Measures to Nearest Comparable GAAP MeasuresWe

present Non-GAAP gross profit (loss), Non-GAAP operating expense,

Adjusted EBITDA, Adjusted Net Loss and Adjusted EPS as supplemental

measures of our performance. We define Adjusted EBITDA as net loss

plus (i) provision for (benefit from) income taxes, (ii) interest

(income) expense, net (iii) depreciation expense, (iv) amortization

of intangibles, (v) stock-based compensation, and (vi) CEO

transition costs, non-routine legal fees, severance and certain

other costs (credits). We also deduct the contingent gains arising

from earnout payments and project escrow releases relating to the

disposal of our investment in an unconsolidated subsidiary from net

loss in arriving at Adjusted EBITDA. We define Adjusted Net Loss as

net loss plus (i) amortization of debt issue costs and intangibles,

(ii) stock-based compensation, (iii) CEO transition costs,

non-routine legal fees, severance and certain other costs

(credits), and (iv) the income tax expense (benefit) of those

adjustments, if any. We also deduct the contingent gains arising

from earnout payments and project escrow releases relating to the

disposal of our investment in an unconsolidated subsidiary from net

loss in arriving at Adjusted Net Loss. Adjusted EPS is defined as

Adjusted Net Loss on a per share basis using our weighted average

diluted shares outstanding.

Non-GAAP gross profit (loss), Non-GAAP operating

expense, Adjusted EBITDA, Adjusted Net Loss and Adjusted EPS are

intended as supplemental measures of performance that are neither

required by, nor presented in accordance with, U.S. generally

accepted accounting principles (“GAAP”). We present these non-GAAP

measures, many of which are commonly used by investors and

analysts, because we believe they assist those investors and

analysts in comparing our performance across reporting periods on

an ongoing basis by excluding items that we do not believe are

indicative of our core operating performance. In addition, we use

Adjusted EBITDA, Adjusted Net Loss and Adjusted EPS to evaluate the

effectiveness of our business strategies.

Non-GAAP gross profit (loss), Non-GAAP operating

expense, Adjusted EBITDA, Adjusted Net Loss and Adjusted EPS should

not be considered in isolation or as substitutes for performance

measures calculated in accordance with GAAP, and you should not

rely on any single financial measure to evaluate our business.

These Non-GAAP financial measures, when presented, are reconciled

to the most closely applicable GAAP measure as disclosed below.

The following table reconciles Non-GAAP gross

profit (loss) to the most closely related GAAP measure for the

three and nine months ended September 30, 2024 and 2023,

respectively:

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

(in thousands, except percentages) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

U.S. GAAP revenue |

|

$ |

10,136 |

|

|

$ |

30,548 |

|

|

$ |

34,153 |

|

|

$ |

103,801 |

|

| U.S. GAAP gross profit

(loss) |

|

$ |

(4,306 |

) |

|

$ |

3,379 |

|

|

$ |

(8,757 |

) |

|

$ |

7,615 |

|

|

Depreciation expense |

|

|

183 |

|

|

|

90 |

|

|

|

534 |

|

|

|

339 |

|

|

Stock-based compensation |

|

|

243 |

|

|

|

181 |

|

|

|

699 |

|

|

|

1,313 |

|

|

Severance costs |

|

|

— |

|

|

|

252 |

|

|

|

— |

|

|

|

252 |

|

| Non-GAAP gross profit

(loss) |

|

$ |

(3,880 |

) |

|

$ |

3,902 |

|

|

$ |

(7,524 |

) |

|

$ |

9,519 |

|

| Non-GAAP gross margin

percentage |

|

|

(38.3 |

%) |

|

|

12.8 |

% |

|

|

(22.0 |

%) |

|

|

9.2 |

% |

The following table reconciles Non-GAAP

operating expenses to the most closely related GAAP measure for the

three and nine months ended September 30, 2024 and 2023,

respectively:

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

U.S. GAAP operating expenses |

|

$ |

10,670 |

|

|

$ |

19,656 |

|

|

$ |

30,645 |

|

|

$ |

46,656 |

|

|

Depreciation expense |

|

|

(101 |

) |

|

|

(115 |

) |

|

|

(294 |

) |

|

|

(256 |

) |

|

Amortization expense |

|

|

(133 |

) |

|

|

(133 |

) |

|

|

(401 |

) |

|

|

(409 |

) |

|

Stock-based compensation |

|

|

(1,076 |

) |

|

|

(1,011 |

) |

|

|

(3,544 |

) |

|

|

(7,731 |

) |

|

CEO transition |

|

|

(1,229 |

) |

|

|

— |

|

|

|

(1,229 |

) |

|

|

— |

|

|

Non-routine legal fees |

|

|

— |

|

|

|

(98 |

) |

|

|

(66 |

) |

|

|

(181 |

) |

|

Severance costs |

|

|

— |

|

|

|

(1,836 |

) |

|

|

— |

|

|

|

(1,823 |

) |

|

Other (costs) credits |

|

|

— |

|

|

|

(3,241 |

) |

|

|

— |

|

|

|

(3,241 |

) |

| Non-GAAP operating

expenses |

|

$ |

8,131 |

|

|

$ |

13,222 |

|

|

$ |

25,111 |

|

|

$ |

33,015 |

|

The following table reconciles Non-GAAP Adjusted

EBITDA to the related GAAP measure of loss from operations for the

three and nine months ended September 30, 2024 and 2023,

respectively:

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

U.S. GAAP loss from operations |

|

$ |

(14,976 |

) |

|

$ |

(16,277 |

) |

|

$ |

(39,402 |

) |

|

$ |

(39,041 |

) |

|

Depreciation expense |

|

|

284 |

|

|

|

205 |

|

|

|

828 |

|

|

|

595 |

|

|

Amortization expense |

|

|

133 |

|

|

|

133 |

|

|

|

401 |

|

|

|

409 |

|

|

Stock-based compensation |

|

|

1,319 |

|

|

|

1,192 |

|

|

|

4,243 |

|

|

|

9,044 |

|

|

CEO transition |

|

|

1,229 |

|

|

|

— |

|

|

|

1,229 |

|

|

|

— |

|

|

Non-routine legal fees |

|

|

— |

|

|

|

98 |

|

|

|

66 |

|

|

|

181 |

|

|

Severance costs |

|

|

— |

|

|

|

2,088 |

|

|

|

— |

|

|

|

2,075 |

|

|

Other costs |

|

|

— |

|

|

|

3,241 |

|

|

|

— |

|

|

|

3,241 |

|

|

Other income (expense), net |

|

|

93 |

|

|

|

(50 |

) |

|

|

122 |

|

|

|

(265 |

) |

|

Loss from unconsolidated subsidiary |

|

|

(256 |

) |

|

|

(336 |

) |

|

|

(767 |

) |

|

|

(336 |

) |

| Adjusted

EBITDA |

|

$ |

(12,174 |

) |

|

$ |

(9,706 |

) |

|

$ |

(33,280 |

) |

|

$ |

(24,097 |

) |

The following table reconciles Non-GAAP Adjusted

EBITDA and Adjusted Net Loss to the related GAAP measure of net

loss for the three months ended September 30, 2024 and 2023,

respectively:

|

|

|

Three months ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

(in thousands, except shares and per share

data) |

|

Adjusted EBITDA |

|

|

Adjusted Net Loss |

|

|

Adjusted EBITDA |

|

|

Adjusted Net Loss |

|

|

Net loss per U.S. GAAP |

|

$ |

(15,359 |

) |

|

$ |

(15,359 |

) |

|

$ |

(16,937 |

) |

|

$ |

(16,937 |

) |

| Reconciling items - |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for (benefit from) income taxes |

|

|

244 |

|

|

|

— |

|

|

|

166 |

|

|

|

— |

|

|

Interest (income) expense, net |

|

|

(24 |

) |

|

|

— |

|

|

|

108 |

|

|

|

— |

|

|

Amortization of debt issue costs in interest expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

177 |

|

|

Depreciation expense |

|

|

284 |

|

|

|

— |

|

|

|

205 |

|

|

|

— |

|

|

Amortization of intangibles |

|

|

133 |

|

|

|

133 |

|

|

|

133 |

|

|

|

133 |

|

|

Stock-based compensation |

|

|

1,319 |

|

|

|

1,319 |

|

|

|

1,192 |

|

|

|

1,192 |

|

|

CEO transition(a) |

|

|

1,229 |

|

|

|

1,229 |

|

|

|

— |

|

|

|

— |

|

|

Non-routine legal fees(b) |

|

|

— |

|

|

|

— |

|

|

|

98 |

|

|

|

98 |

|

|

Severance costs(c) |

|

|

— |

|

|

|

— |

|

|

|

2,088 |

|

|

|

2,088 |

|

|

Other costs(d) |

|

|

— |

|

|

|

— |

|

|

|

3,241 |

|

|

|

3,241 |

|

| Adjusted Non-GAAP

amounts |

|

$ |

(12,174 |

) |

|

$ |

(12,678 |

) |

|

$ |

(9,706 |

) |

|

$ |

(10,008 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Non-GAAP net

loss per share (Adjusted EPS): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

N/A |

|

|

$ |

(0.10 |

) |

|

N/A |

|

|

$ |

(0.08 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

N/A |

|

|

|

127,380,292 |

|

|

N/A |

|

|

|

119,793,821 |

|

|

(a) |

We incurred one-time incremental recruitment fees in connection

with hiring a new CEO in August 2024. In addition, we agreed to

upfront and incremental sign-on bonuses (collectively, the "sign-on

bonuses"), a portion of which will be paid to our CEO in 2024, with

clawback provisions over the next two years, and a portion of which

will be paid annually over the next two years, all contingent upon

continued employment. These sign-on bonuses will be expensed over

the next two years, ending on October 1, 2026, to reflect the

required service periods. We do not view these sign-on bonuses as

being part of the normal on-going compensation arrangements for our

CEO. |

|

(b) |

Non-routine legal fees represent legal fees and other costs

incurred for specific matters that were not ordinary or routine to

the operations of the business. |

|

(c) |

Severance costs in 2023 were due to restructuring changes. |

|

(d) |

Other costs in 2023 included the write-down of remaining prepaid

costs resulting from the termination of our consulting agreement

with a related party. |

The following table reconciles Non-GAAP Adjusted

EBITDA and Adjusted Net Loss to the related GAAP measure of net

loss for the nine months ended September 30, 2024 and 2023,

respectively:

|

|

|

Nine months ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

(in thousands, except shares and per share

data) |

|

Adjusted EBITDA |

|

|

Adjusted Net Loss |

|

|

Adjusted EBITDA |

|

|

Adjusted Net Loss |

|

|

Net loss per U.S. GAAP |

|

$ |

(36,371 |

) |

|

$ |

(36,371 |

) |

|

$ |

(39,113 |

) |

|

$ |

(39,113 |

) |

| Reconciling items - |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for (benefit from) income taxes |

|

|

298 |

|

|

|

— |

|

|

|

175 |

|

|

|

— |

|

|

Interest expense, net |

|

|

111 |

|

|

|

— |

|

|

|

194 |

|

|

|

— |

|

|

Amortization of debt issue costs in interest expense |

|

|

— |

|

|

|

236 |

|

|

|

— |

|

|

|

532 |

|

|

Depreciation expense |

|

|

828 |

|

|

|

— |

|

|

|

595 |

|

|

|

— |

|

|

Amortization of intangibles |

|

|

401 |

|

|

|

401 |

|

|

|

409 |

|

|

|

409 |

|

|

Stock-based compensation |

|

|

4,243 |

|

|

|

4,243 |

|

|

|

9,044 |

|

|

|

9,044 |

|

|

Gain from disposal of investment in unconsolidated

subsidiary(a) |

|

|

(4,085 |

) |

|

|

(4,085 |

) |

|

|

(898 |

) |

|

|

(898 |

) |

|

CEO transition(b) |

|

|

1,229 |

|

|

|

1,229 |

|

|

|

— |

|

|

|

— |

|

|

Non-routine legal fees(c) |

|

|

66 |

|

|

|

66 |

|

|

|

181 |

|

|

|

181 |

|

|

Severance costs(d) |

|

|

— |

|

|

|

— |

|

|

|

2,075 |

|

|

|

2,075 |

|

|

Other costs(e) |

|

|

— |

|

|

|

— |

|

|

|

3,241 |

|

|

|

3,241 |

|

|

Adjusted Non-GAAP amounts |

|

$ |

(33,280 |

) |

|

$ |

(34,281 |

) |

|

$ |

(24,097 |

) |

|

$ |

(24,529 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Non-GAAP net

loss per share (Adjusted EPS): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

N/A |

|

|

$ |

(0.27 |

) |

|

N/A |

|

|

$ |

(0.22 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

N/A |

|

|

|

126,234,997 |

|

|

N/A |

|

|

|

112,794,562 |

|

|

(a) |

We exclude the gain from collection of contingent contractual

amounts arising from the sale in 2021 of our investment in an

unconsolidated subsidiary as these amounts are not considered part

of our normal ongoing operations. |

|

(b) |

We incurred one-time incremental recruitment fees in connection

with hiring a new CEO in August 2024. In addition, we agreed to

upfront and incremental sign-on bonuses (collectively, the "sign-on

bonuses"), a portion of which will be paid to our CEO in 2024, with

clawback provisions over the next two years, and a portion of which

will be paid annually over the next two years, all contingent upon

continued employment. These sign-on bonuses will be expensed over

the next two years, ending on October 1, 2026, to reflect the

required service periods. We do not view these sign-on bonuses as

being part of the normal on-going compensation arrangements for our

CEO. |

|

(c) |

Non-routine legal fees represent legal fees and other costs

incurred for specific matters that were not ordinary or routine to

the operations of the business. |

|

(d) |

Severance costs in 2023 were due to restructuring changes. |

|

(e) |

Other costs in 2023 included the write-off of remaining prepaid

costs resulting from the termination of our consulting agreement

with a related party. |

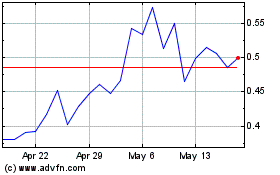

FTC Solar (NASDAQ:FTCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

FTC Solar (NASDAQ:FTCI)

Historical Stock Chart

From Feb 2024 to Feb 2025