0001558583

false

0001558583

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2023

ARCIMOTO, INC.

(Exact name of registrant as specified in its charter)

Oregon

(State or other jurisdiction of incorporation)

| 001-38213 |

|

26-1449404 |

| (Commission File Number) |

|

(IRS Employer |

| |

|

Identification No.) |

2034 West 2nd Avenue, Eugene, OR 97402

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code (541) 683-6293

(Former name or former address, if changed since

last report.)

Securities registered pursuant to Section 12(b)

of the Act:

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common stock, no par value |

|

FUV |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On August 8, 2023, Arcimoto,

Inc. (the “Company”) sold Gregory Castaldo and Joseph Reda (the “Investors”), each an unsecured original issue

discount promissory note in the principal amount of $330,000 (the “Promissory Notes”). The Company received net proceeds of

$600,000 in consideration of issuance of the Promissory Note.

The Promissory Notes

shall bear no interest until August 15, 2023 (the “Maturity Date”). The Company may prepay, in whole or in part, the principal

sum under the Promissory Notes.

The Promissory Notes provides

for standard and customary events of default (an “Event of Default”) such as the Company’s (i) default in the payment

of the principal of the Promissory Notes; (ii) breach of any term or provision of the Promissory Notes that is not remedied within 5 calendar

days after the date on which notice of such breach shall have been delivered; (iii) involvement in bankruptcy, insolvency, or other proceedings

under any reorganization, arrangement, adjustment of debt, relief of debtors, dissolution, insolvency or liquidation or similar law of

any jurisdiction whether now or hereafter in effect relating to the Company or any subsidiary; (iv) default in any of its respective obligations

under any other note or any mortgage, credit agreement or other facility, indenture agreement, factoring agreement or other instrument

under which there may be issued, or by which there may be secured or evidenced any indebtedness for borrowed money or money due under

any long term leasing or factoring arrangement of the Company or any subsidiary; (v) (a) involvement as a party to any Change of Control

Transaction (as defined in the Promissory Notes), (b) agreement to sell or dispose all or in excess of 33% of its assets in one or more

transactions (whether or not such sale would constitute a Change of Control Transaction), (c) redemption or repurchase of more than a

de minimis number of shares of Common Stock or other equity securities of the Company, or (d) make any distribution or declare or pay

any dividends (in cash or other property, other than common stock) to purchase, acquire, redeem, or retire any of Maker’s capital stock,

of any class, whether now or hereafter outstanding; or (vi) management shall cease to be a member of the Company’s senior management

or shall cease to perform any of the material functions and duties currently performed by such person.

If any Event of Default

occurs, the full principal amount of the Promissory Notes shall become, at the Investors’ election, immediately due and payable

in cash. Commencing 3 days after the occurrence of any Event of Default that results in the acceleration of the Promissory Notes, the

interest rate on the Promissory Notes shall accrue at the rate of 18% per annum, or such lower maximum amount of interest permitted to

be charged under applicable law.

The Investors shall have

the right, in their sole discretion, to convert the principal balance of their Promissory Note then outstanding, in whole or in part,

into securities of the Company (or its successor or parent) being issued in any private or public offering of equity securities of the

Company (or its successor or parent) consummated while the Promissory Notes are outstanding (“Subsequent Financing”), upon

the terms and conditions of such offering, at a rate equal to, for each $1 of principal amount of the Promissory Notes surrendered, $1

of new consideration offered (purchase price) for such securities.

The Company will use

the proceeds from the sale of the Promissory Notes for capital expenditures on equipment and working capital purposes and not for the

satisfaction of any portion of the Company’s or its subsidiaries’ debt (other than payment of trade payables in the ordinary

course of the Company’s business and prior practices), to redeem any of the Company’s equity or equity-equivalent securities

or to settle any outstanding litigation.

The Promissory Notes

were issued in a private placement in reliance upon an exemption from registration provided by Section 4(a)(2) of the Securities Act of

1933.

The description of the

Promissory Notes are not complete and is qualified in its entirety by the full text of the Promissory Notes, filed herewith as Exhibits

10.1 and 10.2, which are incorporated by reference into this Item 1.01.

Item 2.03 Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided above in Item 1.01 herein

is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The information provided

above in Item 1.01 herein is incorporated by reference into this Item 3.02.

Item 9.01. Exhibits.

(d) Exhibits.

| + |

Pursuant to Item 601(a)(5) of Regulation S-K, schedules have been omitted and will be furnished on a supplemental basis to the SEC upon request. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

ARCIMOTO, INC. |

| |

|

|

| Date: August 14, 2023 |

By: |

/s/ Christopher W. Dawson |

| |

|

Christopher W. Dawson |

| |

|

Chief Executive Officer |

3

Exhibit 10.1

ORIGINAL ISSUE DISCOUNT PROMISSORY NOTE

FOR VALUE RECEIVED,

Arcimoto, Inc., an Oregon corporation (the “Maker” or “Company”), with its primary offices located

at 2034 West 2nd Avenue, Eugene, OR 97402, promises to pay to the order of GREGORY CASTALDO, or its registered assigns (the

“Payee”), upon the terms set forth below, the principal sum of THREE HUNDRED AND THIRTY THOUSAND DOLLARS ($330,000.00).

This promissory note (the “Note”) is being issued at an original issue discount purchase price of $300,000.

1. Payments.

(a) All

of the principal under this promissory note (the “Note”) shall be due on August 15, 2023 (the “Maturity Date”),

unless due earlier in accordance with the terms of this Note. Prior to the Maturity Date, this Note shall not bear interest.

(b) Maker

may prepay, in whole or in part, the principal sum under this Note.

2. Events of Default.

(a) “Event of Default”,

wherever used herein, means any one of the following events (whatever the reason and whether it shall be voluntary or involuntary or effected

by operation of law or pursuant to any judgment, decree or order of any court, or any order, rule or regulation of any administrative

or governmental body):

(i) any

default in the payment of the principal of this Note, as and when the same shall become due and payable;

(ii) Maker

shall fail to observe or perform any obligation or shall breach any term or provision of this Note and such failure or breach shall not

have been remedied within five calendar days after the date on which notice of such failure or breach shall have been delivered;

( ) Maker

or any of its subsidiaries shall commence, or there shall be commenced against Maker or any subsidiary a case under any applicable bankruptcy

or insolvency laws as now or hereafter in effect or any successor thereto, or Maker or any subsidiary commences any other proceeding

under any reorganization, arrangement, adjustment of debt, relief of debtors, dissolution, insolvency or liquidation or similar law of

any jurisdiction whether now or hereafter in effect relating to Maker or any subsidiary, or there is commenced against Maker or any subsidiary

any such bankruptcy, insolvency or other proceeding which remains undismissed for a period of 60 days; or Maker or any subsidiary is

adjudicated insolvent or bankrupt; or any order of relief or other order approving any such case or proceeding is entered; or Maker or

any subsidiary suffers any appointment of any custodian or the like for it or any substantial part of its property which continues undischarged

or unstayed for a period of 60 days; or Maker or any subsidiary makes a general assignment for the benefit of creditors; or Maker or

any subsidiary shall fail to pay, or shall state that it is unable to pay, or shall be unable to pay, its debts generally as they become

due; or Maker or any subsidiary shall call a meeting of its creditors with a view to arranging a composition, adjustment or restructuring

of its debts; or Maker or any subsidiary shall by any act or failure to act expressly indicate its consent to, approval of or acquiescence

in any of the foregoing; or any corporate or other action is taken by Maker or any subsidiary for the purpose of effecting any of the

foregoing;

(i) Maker

or any subsidiary shall default in any of its respective obligations under any other note or any mortgage, credit agreement or other

facility, indenture agreement, factoring agreement or other instrument under which there may be issued, or by which there may be

secured or evidenced any indebtedness for borrowed money or money due under any long term leasing or factoring arrangement of Maker

or any subsidiary, whether such indebtedness now exists or shall hereafter be created and such default shall result in such

indebtedness becoming or being declared due and payable prior to the date on which it would otherwise become due and payable;

(ii) Maker

shall (a) be a party to any Change of Control Transaction (as defined below), (b) agree to sell or dispose all or in excess of 33%

of its assets in one or more transactions (whether or not such sale would constitute a Change of Control Transaction), (c) redeem or

repurchase more than a de minimis number of shares of Common Stock or other equity securities of Maker, or (d) make any distribution

or declare or pay any dividends (in cash or other property, other than common stock) to purchase, acquire, redeem, or retire any of

Maker’s capital stock, of any class, whether now or hereafter outstanding. “Change of Control Transaction” means

the occurrence of any of: (i) an acquisition after the date hereof by an individual or legal entity or “group” (as

described in Rule 13d-5(b)(1) promulgated under the Securities Exchange Act of 1934, as amended) of effective control (whether

through legal or beneficial ownership of capital stock of Maker, by contract or otherwise) of in excess of 33% of the voting

securities of Maker, (ii) a replacement at one time or over time of more than one-half of the members of Maker’s board of directors

which is not approved by a majority of those individuals who are members of the board of directors on the date hereof (or by those

individuals who are serving as members of the board of directors on any date whose nomination to the board of directors was approved

by a majority of the members of the board of directors who are members on the date hereof), (iii) the merger of Maker with or into

another entity that is not wholly-owned by Maker, consolidation or sale of 33%% or more of the assets of Maker in one or a series of

related transactions, or (iv) the execution by Maker of an agreement to which Maker is a party or by which it is bound, providing

for any of the events set forth above in (i), (ii) or (iii); or

(vi) any member of Maker’s management

shall cease to be a member of Maker’s senior management or shall cease to perform any of the material functions and duties currently performed

by such person. For purposes hereof, “senior management” refers to the President, the Chief Executive Officer, the Chief Financial

Officer, the Chief Operations Officer and any officer performing the customary function of such officers; or

(b) If any Event of Default occurs,

the full principal amount of this Note shall become, at the Payee’s election, immediately due and payable in cash. Commencing 3 days after

the occurrence of any Event of Default that results in the acceleration of this Note, the interest rate on this Note shall accrue at the

rate of 18% per annum, or such lower maximum amount of interest permitted to be charged under applicable law. The Payee need not provide

and Maker hereby waives any presentment, demand, protest or other notice of any kind, and the Payee may immediately and without expiration

of any grace period enforce any and all of his rights and remedies hereunder and all other remedies available to it under applicable law.

Such declaration may be rescinded and annulled by Payee at any time prior to payment hereunder. No such rescission or annulment shall

affect any subsequent Event of Default or impair any right consequent thereon.

3. Most Favored Nations; Right of Participation;

Automatic Conversion.

| a. | MFN. The Payee shall have the right, in his sole discretion,

to convert the principal balance of this Note then outstanding, in whole or in part, into securities of the Maker (or its successor or

parent) being issued in any private or public offering of equity securities of the Maker (or its successor or parent) consummated while

this Note is outstanding (“Subsequent Financing”), upon the terms and conditions of such offering, at a rate equal

to, for each $1 of principal amount of this Note surrendered, $1 of new consideration offered (purchase price) for such securities. |

| a. | By way of example, if the Payee wishes to purchase $100,000

of this Note, the Note would have a principal amount of $110,000. If the Payee wishes to surrender $110,000 principal amount of this

Note to the Maker as consideration for the purchase of new securities in the contemplated convertible preferred offering, the Payee would

receive, and the Maker would issue, $137,500 of new securities to the Payee otherwise on the same terms and conditions as the other participants. |

4. No Waiver of Payee’s

Rights. All payments of principal and interest shall be made without setoff, deduction or counterclaim. No delay or failure on the

part of the Payee in exercising any of his options, powers or rights, nor any partial or single exercise of his options, powers or rights

shall constitute a waiver thereof or of any other option, power or right, and no waiver on the part of the Payee of any of his options,

powers or rights shall constitute a waiver of any other option, power or right. Maker hereby waives presentment of payment, protest,

and all notices or demands in connection with the delivery, acceptance, performance, default or endorsement of this Note. Acceptance

by the Payee of less than the full amount due and payable hereunder shall in no way limit the right of the Payee to require full payment

of all sums due and payable hereunder in accordance with the terms hereof.

5. Modifications. No term

or provision contained herein may be modified, amended or waived except by written agreement or consent signed by the party to be bound

thereby.

6. Cumulative Rights and Remedies;

Usury. The rights and remedies of Payee expressed herein are cumulative and not exclusive of any rights and remedies otherwise available

under this Note, the Security Agreements, or applicable law (including at equity). The election of Payee to avail himself of any one

or more remedies shall not be a bar to any other available remedies, which Maker agrees Payee may take from time to time. If it shall

be found that any interest due hereunder shall violate applicable laws governing usury, the applicable rate of interest due hereunder

shall be reduced to the maximum permitted rate of interest under such law.

7. Use of Proceeds. Maker

shall use the proceeds from this Note hereunder for capital expenditures on equipment and working capital purposes and not for the satisfaction

of any portion of Maker’s or Subsidiary’s debt (other than payment of trade payables in the ordinary course of Maker’s

business and prior practices), to redeem any of Maker’s equity or equity-equivalent securities or to settle any outstanding litigation.

8. Collection Expenses.

If Payee shall commence an action or proceeding to enforce this Promissory Note, then Maker shall reimburse Payee for his costs of collection

and reasonable attorneys’ fees incurred with the investigation, preparation and prosecution of such action or proceeding.

9. Severability. If any

provision of this Note is declared by a court of competent jurisdiction to be in any way invalid, illegal or unenforceable, the balance

of this Note shall remain in effect, and if any provision is inapplicable to any person or circumstance, it shall nevertheless remain

applicable to all other persons and circumstances. If it shall be found that any interest or other amount deemed interest due hereunder

shall violate applicable laws governing usury, the applicable rate of interest due hereunder shall automatically be lowered to equal

the maximum permitted rate of interest.

10. Successors and Assigns.

This Note shall be binding upon Maker and its successors and shall inure to the benefit of the Payee and his successors and assigns.

The term “Payee” as used herein, shall also include any endorsee, assignee or other holder of this Note.

11. Lost or Stolen

Promissory Note. If this Note is lost, stolen, mutilated or otherwise destroyed, Maker shall execute and deliver to the Payee a new

promissory note containing the same terms, and in the same form, as this Note. In such event, Maker may require the Payee to deliver

to Maker an affidavit of lost instrument and customary indemnity in respect thereof as a condition to the delivery of any such new promissory

note.

12. Due Authorization.

This Note has been duly authorized, executed and delivered by Maker and is the legal obligation of Maker, enforceable against Maker in

accordance with its terms. No consent of any other party and no consent, license, approval or authorization of, or registration or declaration

with, any governmental authority, bureau or agency is required in connection with the execution, delivery or performance by the Maker,

or the validity or enforceability of this Note other than such as have been met or obtained. The execution, delivery and performance

of this Note and all other agreements and instruments executed and delivered or to be executed and delivered pursuant hereto or thereto

or the securities issuable upon conversion of this will not violate any provision of any existing law or regulation or any order or decree

of any court, regulatory body or administrative agency or the certificate of incorporation or by-laws of the Maker or any mortgage, indenture,

contract or other agreement to which the Maker is a party or by which the Maker or any property or assets of the Maker may be bound.

13. Construction. The

parties agree that each of them and/or their respective counsel has reviewed and had an opportunity to revise this Note and, therefore,

the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not be employed

in the interpretation of the terms hereof or any amendments hereto.

14. Governing Law. All

questions concerning the construction, validity, enforcement and interpretation of this Note shall be governed by and construed and enforced

in accordance with the internal laws of the State of New York, without regard to the principles of conflicts of law thereof. Each of

Maker and Payee agree that all legal proceedings concerning the interpretations, enforcement and defense of this Note shall be commenced

in the state and federal courts sitting in New York, New York (the “New York Courts”). Each of Maker and Payee hereby

irrevocably submit to the exclusive jurisdiction of the New York Courts for the adjudication of any dispute hereunder (including with

respect to the enforcement of this Note), and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding,

any claim that it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding is improper.

Each of Maker and Payee hereby irrevocably waive personal service of process and consents to process being served in any such suit, action

or proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to the other

at the address in effect for notices to it under this Note and agrees that such service shall constitute good and sufficient service

of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner

permitted by law. Each of Maker and Payee hereby irrevocably waive, to the fullest extent permitted by applicable law, any and all right

to trial by jury in any legal proceeding arising out of or relating to this Note or the transactions contemplated hereby.

15. Notice. Any

and all notices or other communications or deliveries to be provided by the Payee hereunder, including, without limitation, any conversion

notice, shall be in writing and delivered personally, by facsimile, sent by a nationally recognized overnight courier service or sent

by certified or registered mail, postage prepaid, addressed to the Maker, at its address above, or such other address or facsimile number

as the Maker may specify for such purposes by notice to the Payee delivered in accordance with this paragraph. Any and all notices or

other communications or deliveries to be provided by the Maker hereunder shall be in writing and delivered personally, by facsimile,

sent by a nationally recognized overnight courier service or sent by certified or registered mail, postage prepaid, addressed to each

Payee at the address of such Payee appearing on the books of the Maker, or if no such address appears, at the principal place of business

of the Payee. Any notice or other communication or deliveries hereunder shall be deemed given and effective on the earliest of (i) the

date of transmission if delivered by hand or by telecopy that has been confirmed as received by 5:00 P.M. on a business day, (ii) one

business day after being sent by nationally recognized overnight courier or received by telecopy after 5:00 P.M. on any day, or (iii)

five business days after being sent by certified or registered mail, postage and charges prepaid, return receipt requested.

| |

ARCIMOTO, INC. |

| |

|

| |

By: |

/s/ Christopher Dawson |

| |

Name: |

Christopher Dawson |

| |

Title: |

Chief Executive Officer |

5

Exhibit 10.2

ORIGINAL ISSUE DISCOUNT PROMISSORY NOTE

FOR VALUE RECEIVED,

Arcimoto, Inc., an Oregon corporation (the “Maker” or “Company”), with its primary offices located

at 2034 West 2nd Avenue, Eugene, OR 97402, promises to pay to the order of JOSEPH REDA, or its registered assigns (the “Payee”),

upon the terms set forth below, the principal sum of THREE HUNDRED AND THIRTY THOUSAND DOLLARS ($330,000.00). This promissory note (the

“Note”) is being issued at an original issue discount purchase price of $300,000.

1. Payments.

(a) All of the principal under this promissory note (the “Note”) shall be due on August 15, 2023 (the “Maturity Date”), unless due earlier in accordance with the terms of this Note. Prior to the Maturity Date, this Note shall not bear interest.

(b) Maker may prepay, in whole or in part, the principal sum under this Note.

2. Events of Default.

(a) “Event of Default”, wherever used herein, means any one of the following events (whatever the reason and whether it shall be voluntary or involuntary or effected by operation of law or pursuant to any judgment, decree or order of any court, or any order, rule or regulation of any administrative or governmental body):

(i) any default in the payment of the principal of this Note, as and when the same shall become due and payable;

(ii) Maker shall fail to observe or perform any obligation or shall breach any term or provision of this Note and such failure or breach shall not have been remedied within five calendar days after the date on which notice of such failure or breach shall have been delivered;

( ) Maker or any of its subsidiaries shall commence, or there shall be commenced against Maker or any subsidiary a case under any applicable bankruptcy or insolvency laws as now or hereafter in effect or any successor thereto, or Maker or any subsidiary commences any other proceeding under any reorganization, arrangement, adjustment of debt, relief of debtors, dissolution, insolvency or liquidation or similar law of any jurisdiction whether now or hereafter in effect relating to Maker or any subsidiary, or there is commenced against Maker or any subsidiary any such bankruptcy, insolvency or other proceeding which remains undismissed for a period of 60 days; or Maker or any subsidiary is adjudicated insolvent or bankrupt; or any order of relief or other order approving any such case or proceeding is entered; or Maker or any subsidiary suffers any appointment of any custodian or the like for it or any substantial part of its property which continues undischarged or unstayed for a period of 60 days; or Maker or any subsidiary makes a general assignment for the benefit of creditors; or Maker or any subsidiary shall fail to pay, or shall state that it is unable to pay, or shall be unable to pay, its debts generally as they become due; or Maker or any subsidiary shall call a meeting of its creditors with a view to arranging a composition, adjustment or restructuring of its debts; or Maker or any subsidiary shall by any act or failure to act expressly indicate its consent to, approval of or acquiescence in any of the foregoing; or any corporate or other action is taken by Maker or any subsidiary for the purpose of effecting any of the foregoing;

(i) Maker or any subsidiary shall default in any of its respective obligations under any other note or any mortgage, credit agreement or other facility, indenture agreement, factoring agreement or other instrument under which there may be issued, or by which there may be secured or evidenced any indebtedness for borrowed money or money due under any long term leasing or factoring arrangement of Maker or any subsidiary, whether such indebtedness now exists or shall hereafter be created and such default shall result in such indebtedness becoming or being declared due and payable prior to the date on which it would otherwise become due and payable;

(ii) Maker shall (a) be a party to any Change of Control Transaction (as defined below), (b) agree to sell or dispose all or in excess of 33% of its assets in one or more transactions (whether or not such sale would constitute a Change of Control Transaction), (c) redeem or repurchase more than a de minimis number of shares of Common Stock or other equity securities of Maker, or (d) make any distribution or declare or pay any dividends (in cash or other property, other than common stock) to purchase, acquire, redeem, or retire any of Maker’s capital stock, of any class, whether now or hereafter outstanding. “Change of Control Transaction” means the occurrence of any of: (i) an acquisition after the date hereof by an individual or legal entity or “group” (as described in Rule 13d-5(b)(1) promulgated under the Securities Exchange Act of 1934, as amended) of effective control (whether through legal or beneficial ownership of capital stock of Maker, by contract or otherwise) of in excess of 33% of the voting securities of Maker, (ii) a replacement at one time or over time of more than one-half of the members of Maker’s board of directors which is not approved by a majority of those individuals who are members of the board of directors on the date hereof (or by those individuals who are serving as members of the board of directors on any date whose nomination to the board of directors was approved by a majority of the members of the board of directors who are members on the date hereof), (iii) the merger of Maker with or into another entity that is not wholly-owned by Maker, consolidation or sale of 33%% or more of the assets of Maker in one or a series of related transactions, or (iv) the execution by Maker of an agreement to which Maker is a party or by which it is bound, providing for any of the events set forth above in (i), (ii) or (iii); or

(vi) any member of Maker’s management shall cease to be a member of Maker’s senior management or shall cease to perform any of the material functions and duties currently performed by such person. For purposes hereof, “senior management” refers to the President, the Chief Executive Officer, the Chief Financial Officer, the Chief Operations Officer and any officer performing the customary function of such officers; or

(b) If any Event of Default occurs, the full principal amount of this Note shall become, at the Payee’s election, immediately due and payable in cash. Commencing 3 days after the occurrence of any Event of Default that results in the acceleration of this Note, the interest rate on this Note shall accrue at the rate of 18% per annum, or such lower maximum amount of interest permitted to be charged under applicable law. The Payee need not provide and Maker hereby waives any presentment, demand, protest or other notice of any kind, and the Payee may immediately and without expiration of any grace period enforce any and all of his rights and remedies hereunder and all other remedies available to it under applicable law. Such declaration may be rescinded and annulled by Payee at any time prior to payment hereunder. No such rescission or annulment shall affect any subsequent Event of Default or impair any right consequent thereon.

3. Most Favored

Nations; Right of Participation; Automatic Conversion

| a. | MFN. The Payee shall have the right, in his sole discretion,

to convert the principal balance of this Note then outstanding,

in whole or in part, into securities of the Maker (or its successor or parent) being issued in any private or public offering of equity

securities of the Maker (or its successor or parent) consummated while this Note is outstanding (“Subsequent Financing”),

upon the terms and conditions of such offering, at a rate equal to, for each $1 of principal amount of this Note surrendered, $1 of new

consideration offered (purchase price) for such securities. |

| a. | By way of example, if the Payee wishes to purchase $100,000

of this Note, the Note would have a principal amount

of $110,000. If the Payee wishes to surrender $110,000 principal amount of this Note to the Maker as consideration for the purchase of

new securities in the contemplated convertible preferred offering, the Payee would receive, and the Maker would issue, $137,500 of new

securities to the Payee otherwise on the same terms and conditions as the other participants. |

4. No Waiver

of Payee’s Rights. All payments of principal and interest shall be made without setoff, deduction or counterclaim. No delay

or failure on the part of the Payee in exercising any of his options, powers or rights, nor any partial or single exercise of his options,

powers or rights shall constitute a waiver thereof or of any other option, power or right, and no waiver on the part of the Payee of

any of his options, powers or rights shall constitute a waiver of any other option, power or right. Maker hereby waives presentment of

payment, protest, and all notices or demands in connection with the delivery, acceptance, performance, default or endorsement of this

Note. Acceptance by the Payee of less than the full amount due and payable hereunder shall in no way limit the right of the Payee to

require full payment of all sums due and payable hereunder in accordance with the terms hereof.

5. Modifications.

No term or provision contained herein may be modified, amended or waived except by written agreement or consent signed by the party to

be bound thereby.

6. Cumulative

Rights and Remedies; Usury. The rights and remedies of Payee expressed herein are cumulative and not exclusive of any rights and

remedies otherwise available under this Note, the Security Agreements, or applicable law (including at equity). The election of Payee

to avail himself of any one or more remedies shall not be a bar to any other available remedies, which Maker agrees Payee may take from

time to time. If it shall be found that any interest due hereunder shall violate applicable laws governing usury, the applicable rate

of interest due hereunder shall be reduced to the maximum permitted rate of interest under such law.

7. Use of Proceeds.

Maker shall use the proceeds from this Note hereunder for capital expenditures on equipment and working capital purposes and not for

the satisfaction of any portion of Maker’s or Subsidiary’s debt (other than payment of trade payables in the ordinary course

of Maker’s business and prior practices), to redeem any of Maker’s equity or equity-equivalent securities or to settle any

outstanding litigation.

8. Collection

Expenses. If Payee shall commence an action or proceeding to enforce this Promissory Note, then Maker shall reimburse Payee for his

costs of collection and reasonable attorneys’ fees incurred with the investigation, preparation and prosecution of such action

or proceeding.

9. Severability.

If any provision of this Note is declared by a court of competent jurisdiction to be in any way invalid, illegal or unenforceable, the

balance of this Note shall remain in effect, and if any provision is inapplicable to any person or circumstance, it shall nevertheless

remain applicable to all other persons and circumstances. If it shall be found that any interest or other amount deemed interest due

hereunder shall violate applicable laws governing usury, the applicable rate of interest due hereunder shall automatically be lowered

to equal the maximum permitted rate of interest.

10. Successors

and Assigns. This Note shall be binding upon Maker and its successors and shall inure to the benefit of the Payee and his successors

and assigns. The term “Payee” as used herein, shall also include any endorsee, assignee or other holder of this Note.

11. Lost or Stolen

Promissory Note. If this Note is lost, stolen, mutilated or otherwise destroyed, Maker shall execute and deliver to the Payee a new

promissory note containing the same terms, and in the same form, as this Note. In such event, Maker may require the Payee to deliver

to Maker an affidavit of lost instrument and customary indemnity in respect thereof as a condition to the delivery of any such new promissory

note.

12. Due Authorization.

This Note has been duly authorized, executed and delivered by Maker and is the legal obligation of Maker, enforceable against Maker in

accordance with its terms. No consent of any other party and no consent, license, approval or authorization of, or registration or declaration

with, any governmental authority, bureau or agency is required in connection with the execution, delivery or performance by the Maker,

or the validity or enforceability of this Note other than such as have been met or obtained. The execution, delivery and performance

of this Note and all other agreements and instruments executed and delivered or to be executed and delivered pursuant hereto or thereto

or the securities issuable upon conversion of this will not violate any provision of any existing law or regulation or any order or decree

of any court, regulatory body or administrative agency or the certificate of incorporation or by-laws of the Maker or any mortgage, indenture,

contract or other agreement to which the Maker is a party or by which the Maker or any property or assets of the Maker may be bound.

13. Construction.

The parties agree that each of them and/or their respective counsel has reviewed and had an opportunity to revise this Note and, therefore,

the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not be employed

in the interpretation of the terms hereof or any amendments hereto.

14. Governing

Law. All questions concerning the construction, validity, enforcement and interpretation of this Note shall be governed by and construed

and enforced in accordance with the internal laws of the State of New York, without regard to the principles of conflicts of law thereof.

Each of Maker and Payee agree that all legal proceedings concerning the interpretations, enforcement and defense of this Note shall be

commenced in the state and federal courts sitting in New York, New York (the “New York Courts”). Each of Maker and

Payee hereby irrevocably submit to the exclusive jurisdiction of the New York Courts for the adjudication of any dispute hereunder (including

with respect to the enforcement of this Note), and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding,

any claim that it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding is improper.

Each of Maker and Payee hereby irrevocably waive personal service of process and consents to process being served in any such suit, action

or proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to the other

at the address in effect for notices to it under this Note and agrees that such service shall constitute good and sufficient service

of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner

permitted by law. Each of Maker and Payee hereby irrevocably waive, to the fullest extent permitted by applicable law, any and all right

to trial by jury in any legal proceeding arising out of or relating to this Note or the transactions contemplated hereby.

15. Notice.

Any and all notices or other communications or deliveries to be provided by the Payee hereunder, including, without limitation, any conversion

notice, shall be in writing and delivered personally, by facsimile, sent by a nationally recognized overnight courier service or sent

by certified or registered mail, postage prepaid, addressed to the Maker, at its address above, or such other address or facsimile number

as the Maker may specify for such purposes by notice to the Payee delivered in accordance with this paragraph. Any and all notices or

other communications or deliveries to be provided by the Maker hereunder shall be in writing and delivered personally, by facsimile,

sent by a nationally recognized overnight courier service or sent by certified or registered mail, postage prepaid, addressed to each

Payee at the address of such Payee appearing on the books of the Maker, or if no such address appears, at the principal place of business

of the Payee. Any notice or other communication or deliveries hereunder shall be deemed given and effective on the earliest of (i) the

date of transmission if delivered by hand or by telecopy that has been confirmed as received by 5:00 P.M. on a business day, (ii) one

business day after being sent by nationally recognized overnight courier or received by telecopy after 5:00 P.M. on any day, or (iii)

five business days after being sent by certified or registered mail, postage and charges prepaid, return receipt requested.

| |

ARCIMOTO, INC. |

| |

|

| |

By: |

/s/ Christopher Dawson |

| |

Name: |

Christopher Dawson |

| |

Title: |

Chief Executive Officer |

5

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

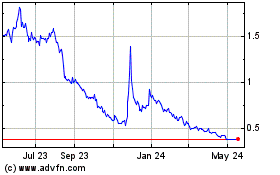

Arcimoto (NASDAQ:FUV)

Historical Stock Chart

From Oct 2024 to Nov 2024

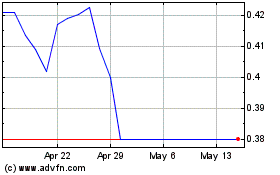

Arcimoto (NASDAQ:FUV)

Historical Stock Chart

From Nov 2023 to Nov 2024