false

0000714395

0000714395

2025-02-01

2025-02-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 1, 2025

GERMAN AMERICAN BANCORP, INC.

(Exact name of registrant as specified in its charter)

Indiana

(State or other jurisdiction of incorporation)

| 001-15877 |

|

35-1547518 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| 711 Main Street |

|

|

| Jasper, Indiana |

|

47546 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (812) 482-1314

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange

Act (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, no par value |

|

GABC |

|

Nasdaq Global Select Market |

Explanatory Note

This Amendment

No. 1 on Form 8-K/A (this “Form 8-K/A) is an amendment to the Current Report on Form 8-K of German

American Bancorp, Inc. dated February 3, 2025 (the “Original Report”). This Form 8-K/A is being filed to

correct an error in the reporting of the cash payment amount paid to option holders in the second sentence of the second paragraph

of Item 2.01 of the Original Report. The cash payment amount paid to option holders was similarly reported incorrectly in the

press release attached as Exhibit 99.1 to the Original Report. This Form 8-K/A amends and restates in its entirety the

second sentence of the second paragraph of Item 2.01 of the Original Report. In addition, a copy of the corrected press release

is furnished herewith as Exhibit 99.1 to this Form 8-K/A. Other than as set forth in this Form 8-K/A, the remainder of the

Original Report remains unchanged. Capitalized terms used but not defined herein shall have the meanings assigned to them in the

Original Report.

Item 2.01. Completion of Acquisition or Disposition

of Assets.

Each option to acquire a share

of Heartland common stock outstanding at the closing of the Merger has been cancelled in exchange for the right to receive a cash payment

equal to (i) $154.60 per share, which is equal to the Exchange Ratio multiplied by the volume-weighted average price of the Company’s

common shares over the ten (10) consecutive trading days ending on January 28, 2025, less (ii) the option exercise price

per share, and less (iii) any applicable withholding taxes.

Item

9.01. Financial Statements and Exhibits.

* * * * * *

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

GERMAN AMERICAN BANCORP, INC. |

| |

|

|

| Date: February 4, 2025 |

By: |

/s/

D. Neil Dauby |

| |

|

D. Neil Dauby, Chairman and Chief Executive Officer |

Exhibit 99.1

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman

and Chief Executive Officer

Bradley M. Rust, President and

Chief Financial Officer

(812) 482-1314

1 of 3

GERMAN AMERICAN ANNOUNCES COMPLETION OF MERGER

WITH HEARTLAND BANCCORP AND HEARTLAND BANK

JASPER, Ind., February 3, 2025 –

German American Bancorp, Inc. (Nasdaq: GABC) announced today that it has completed its merger with Heartland BancCorp, the parent

company of Heartland Bank, effective at 12:01 a.m. (Eastern time) on February 1, 2025. Immediately following completion of

the holding company transaction, Heartland Bank merged with and into German American’s banking subsidiary, German American Bank.

Each Heartland shareholder of record at closing

(other than the Heartland 401(k) Plan) is entitled to receive 3.90 shares of German American common stock (the “Exchange Ratio”)

for each of their shares of Heartland common stock, subject to their surrender of the old Heartland shares to the exchange agent designated

by German American. Instructions and forms to accomplish that surrender and exchange process are being mailed by the exchange agent to

each of Heartland’s shareholders of record as of closing.

The beneficial owners of Heartland shares held

in the Heartland 401(k) Plan are entitled to receive a cash payment equal to $161.19 per share, which is equal to the Exchange Ratio

multiplied by the closing trading price of German American’s common shares on January 31, 2025.

Each option to acquire a share of Heartland common

stock outstanding at the closing of the merger has been cancelled in exchange for the right to receive a cash payment equal to (i) $154.60

per share, which is equal to the Exchange Ratio multiplied by the volume-weighted average price of German American’s common shares

over the ten (10) consecutive trading days ending on January 28, 2025, less (ii) the option exercise price per share,

and less (iii) any applicable withholding taxes.

Giving effect to the merger, the combined organization

will have a community branch network of 94 locations across Indiana, Kentucky and Ohio and would have had approximately $8.3 billion

in total assets as of December 31, 2024.

“We expect this strategic transaction will

be accretive to German American’s earnings per share during the twelve months following completion of the transaction with a relatively

quick tangible book value earn back period,” stated D. Neil Dauby, Chairman and CEO of German American. “We also expect our

pro forma capital ratios will continue to exceed regulatory well-capitalized levels providing ongoing financial strength and future growth

opportunities.”

Dauby continued, “This strategic partnership

will bring together two high-performing, community-oriented organizations and expand German American’s footprint into Columbus

and Cincinnati, Ohio, two of the most vibrant and fastest-growing markets in the Midwest. We share the same culture and commitment to

serving our customers and our communities with a relationship-based approach. We are excited to welcome the Heartland customers, employees,

communities and shareholders to the German American family.

NEWS RELEASE

2 of 3

As contemplated by the terms of the merger agreement,

G. Scott McComb, Heartland’s Chairman, President and CEO, and Ronnie R. Stokes, another Heartland board member, have been appointed

to the German American Bancorp and German American Bank boards of directors, effective February 1, 2025.

Many members of the Heartland Executive and senior

teams will continue to serve the combined organization as regional management to provide local leadership and decision making while the

customer/client focused Heartland banking and wealth management teams will continue to serve the financial and investment needs of individuals

and businesses throughout the Greater Columbus and Cincinnati communities.

Commenting on the merger, Mr. McComb stated,

“This strategic partnership with a like-minded, larger community bank will enable us to continue our strong brand and growth trajectory

within the markets we serve. It will also allow us to deepen and broaden our current and prospective customer relationships with enhanced

financial service offerings. Strategically and culturally, Heartland and German American are exceptionally well aligned with a strong

commitment to the community banking business model. That model, centered on delivering an exceptional customer experience and a willingness

to invest in local communities, which Ohio has come to know and love from Heartland, will continue to propel the combined organization’s

success.”

Keefe, Bruyette & Woods, Inc.,

A Stifel Company served as financial advisor on the transaction to German American and Dentons Bingham Greenebaum LLP served as

legal counsel.

Raymond James & Associates, Inc.

served as the financial advisor on the transaction to Heartland and Hunton Andrews Kurth LLP served as legal counsel.

Forward-Looking Statements

This press release contains forward-looking statements

made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements

can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”,

“estimate”, “project”, “intend”, “anticipate”, “expect” and similar expressions

or future or conditional verbs such as “will”, would”, “should”, “could”, “might”,

“can”, “may”, or similar expressions. These forward-looking statements include, but are not limited to, statements

relating to the expected benefits of the merger (the “Merger”) between German American Bancorp, Inc. (“German

American”) and Heartland BancCorp (“Heartland”), including future financial and operating results, cost savings, enhanced

revenues, and accretion/dilution to reported earnings that may be realized from the Merger, as well as other statements of expectations

regarding the Merger, and other statements of German American’s goals, intentions and expectations; statements regarding German

American’s business plan and growth strategies; statements regarding the asset quality of German American’s loan and investment

portfolios; and estimates of German American’s risks and future costs and benefits, whether with respect to the Merger or otherwise.

NEWS RELEASE

3 of 3

These forward-looking statements are subject

to significant risks, assumptions and uncertainties that may cause results to differ materially from those set forth in forward-looking

statements, including, among other things: the risk that the businesses of German American and Heartland will not be integrated successfully

or such integration may be more difficult, time-consuming, or costly than expected; expected revenue synergies and cost savings from

the Merger may not be fully realized or realized within the expected time frame; revenues following the Merger may be lower than expected;

customer and employee relationships and business operations may be disrupted by the Merger; the ability of German American to complete

integration and attract new customers; possible changes in economic and business conditions; the impacts of epidemics, pandemics or other

infectious disease outbreaks; the existence or exacerbation of general geopolitical instability and uncertainty; possible changes in

monetary and fiscal policies, and laws and regulations; possible changes in the creditworthiness of customers and the possible impairment

of collectability of loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking

legislation or regulatory requirements of federal and state agencies applicable to bank holding companies and banks like German American’s

affiliate bank; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends;

changes in market, economic, operational, liquidity, credit, and interest rate risks associated with German American’s business;

and other risks and factors identified in German American’s cautionary language included under the headings “Forward-Looking

Statements and Associated Risk” and “Risk Factors” in German American’s Annual Report on Form 10-K for the

year ended December 31, 2023, and other documents subsequently filed by German American with the SEC. German American does not undertake

any obligation to update any forward-looking statement, whether written or oral, relating to the matters discussed in this press release.

In addition, German American’s past results of operations do not necessarily indicate its anticipated future results.

About German American

German

American Bancorp, Inc. (Nasdaq: GABC) is a financial holding company based in Jasper, Indiana. German American, through its

banking subsidiary German American Bank, operates 94 banking offices located throughout Indiana (central/southern), Kentucky (northern/central/western),

and Ohio (central/ southwest). In Columbus, Ohio and Greater Cincinnati, the Company does business as Heartland Bank, a Division of German

American Bank. The Company also owns an investment brokerage subsidiary, German American Investment Services, Inc.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

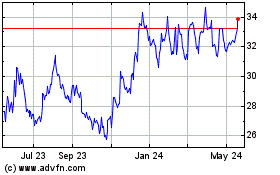

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Jan 2025 to Feb 2025

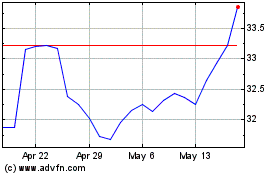

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Feb 2024 to Feb 2025