false

0001476765

0001476765

2024-12-04

2024-12-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

December 4, 2024

GOLUB

CAPITAL BDC, INC.

(Exact name of Registrant as Specified in Its

Charter)

| Delaware |

|

814-00794 |

|

27-2326940 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

200

Park Avenue, 25th

Floor, New York,

NY 10166

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including

area code: (212) 750-6060

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which

registered |

| Common

Stock, par value $0.001 per share |

|

GBDC |

|

The

Nasdaq Global

Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b–2 of the Securities Exchange

Act of 1934.

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

Equity Distribution Agreement Amendment

On October 6, 2023, Golub Capital BDC, Inc.

(“GBDC”) established an “at-the-market” offering (the “ATM Program”) through which GBDC may sell,

from time to time through the Placement Agents (as defined below), shares of GBDC’s common stock, par value $0.001 per share (the

“Shares”), having an aggregate offering price of up to $250.0 million.

On December 4, 2024, GBDC entered into the

first amendment (the “First Amendment”) to the equity distribution agreement, dated as of October 6, 2023 (as amended,

the “Equity Distribution Agreement”), by and among GBDC, GC Advisors LLC, and Golub Capital LLC and Keefe, Bruyette &

Woods, Inc. and Regions Securities LLC (the “Placement Agents”), to modify certain settlement mechanics and to clarify

the periods during which GBDC can request the Placement Agents to sell Shares. The other material terms of the Equity Distribution Agreement

were unchanged.

The foregoing description is only a summary of

the material provisions of the First Amendment and is qualified in its entirety by reference to a copy of the First Amendment, which is

attached hereto as Exhibit 10.1 and is incorporated herein by reference.

This Current Report on Form 8-K shall not

constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of these securities in any

state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the

securities laws of any such state or other jurisdiction.

JPM Credit Facility Commitment Increase

On December 6, 2024, GBDC entered into an

agreement (the “Commitment Increase Agreement”), pursuant to which, through the accordion feature in the Senior Secured Revolving

Credit Facility, dated as of August 6, 2024, by and among GBDC, as borrower, JPMorgan Chase Bank, N.A., as administrative agent and

as collateral agent, and the lenders, syndication agents, joint bookrunners, and joint lead arrangers party thereto (as amended and supplemented,

the “JPM Credit Facility”), the aggregate commitments under the JPM Credit Facility increased from $1,897.5 million to $1,997.5

million. The accordion feature in the JPM Credit Facility allows GBDC, under certain circumstances, to increase the total size of the

facility to a maximum of $2.0 billion. The other material terms of the JPM Credit Facility remain unchanged.

The foregoing description is only a summary of

the material provisions of the Commitment Increase Agreement and is qualified in its entirety by reference to a copy of the Commitment

Increase Agreement, which is filed as Exhibit 10.2 to this Current Report on Form 8-K and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| 10.2 |

Commitment Increase Agreement, dated as of December

6, 2024, by Royal Bank of Canada, as an Assuming Lender, in favor of Golub Capital BDC, Inc., as borrower, and JPMorgan Chase Bank, N.A.,

as administrative agent under the Senior Secured Revolving Credit Facility, dated as of August 6, 2024, as amended, among Golub Capital

BDC, Inc., as borrower, JPMorgan Chase Bank, N.A., as administrative agent and as collateral agent, and the lenders, syndication agents,

joint bookrunners, and joint lead arrangers party thereto |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Golub Capital BDC, Inc. |

| |

|

|

| Date: December 6, 2024 |

By: |

/s/ Christopher C. Ericson |

| |

|

Name: |

Christopher C. Ericson |

| |

|

Title: |

Chief Financial Officer |

Exhibit 10.1

Execution Version

Golub

Capital BDC, Inc.

Shares of Common Stock, par value $0.001 per share

First

Amendment to the Equity Distribution Agreement

This First Amendment, dated December 4,

2024 (this “Amendment”), is to that certain Equity Distribution Agreement, dated October 6, 2023, by and among

Golub Capital BDC, Inc., a Delaware corporation (the “Company”), GC Advisors LLC, a Delaware limited liability

company (the “Adviser”), and Golub Capital LLC, a Delaware limited liability company (the “Administrator”),

on the one hand, and Keefe, Bruyette & Woods, Inc. and Regions Securities LLC (each, a “Placement Agent”

and collectively, the “Placement Agents”), on the other hand (the “Equity Distribution Agreement”).

WHEREAS,

the Company, the Adviser, the Administrator and the Placement Agents desire to amend certain provisions of the Equity Distribution Agreement

with effect on and after the date hereof.

NOW

THEREFORE, in consideration of the mutual promises contained in this Amendment and other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the parties to this Amendment, intending to be legally bound, hereby amend

the Equity Distribution Agreement and agree as follows:

1. Amendments to Section 6(b). Section 6(b) of

the Equity Distribution Agreement is amended and restated as follows:

Settlement

of Placement Securities. Unless otherwise specified in the applicable Placement Notice (as amended by the corresponding Acceptance,

if applicable), settlement for sales of Placement Securities will occur on the first (1st) Trading Day following the date on which such

sales are made or such other date as may be mutually agreed by the Company and the Designated Agent (each, a “Settlement Date”).

The amount of proceeds to be delivered to the Company on a Settlement Date against receipt of the Placement Securities sold (the “Net

Proceeds”) will be equal to the aggregate sales price received by Designated Agent at which such Placement Securities were

sold, after deduction for (i) Designated Agent’s commission, discount or other compensation for such sales payable by the

Company pursuant to Section 2 hereof and (ii) any transaction fees imposed by any governmental or self-regulatory organization

in respect of such sales.

2. Amendments to Section 6(g). Section 6(g) of

the Equity Distribution Agreement is amended and restated as follows:

Restrictions

on Sales. Notwithstanding any other provision of this Agreement, no sales of Securities shall take place, and the Company

shall not request the sale of any Securities, and the Placement Agents shall not be obligated to sell any Securities, during any period

in which the Company is in possession of material non-public information.

3. Consent to Amendment. Each of the Company,

the Adviser, and the Administrator and the Placement Agents by the execution of this Amendment hereby consents to the amendments, modifications

and supplements to the Equity Distribution Agreement contemplated herein.

4. No Other Amendments. No other amendments

to the Equity Distribution Agreement are intended by the parties hereto, are made, or shall be deemed to be made, pursuant to this Amendment,

and all provisions of the Equity Distribution Agreement, including all annexes and exhibits thereto, unaffected by this Amendment shall

remain in full force and effect.

5. Governing Law and Time. THIS AMENDMENT

SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK. The Company, the Adviser and the Administrator

hereby submit to the non-exclusive jurisdiction of the federal and state courts in the Borough of Manhattan in The City of New York in

any suit or proceeding arising out of or relating to this Agreement or the transactions contemplated hereby. The Company, the Adviser

and the Administrator irrevocably and unconditionally waive any objection to the laying of venue of any suit or proceeding arising out

of or relating to this Agreement or the transactions contemplated hereby in federal and state courts in the Borough of Manhattan in The

City of New York and irrevocably and unconditionally waive and agree not to plead or claim in any such court that any such suit or proceeding

in any such court has been brought in an inconvenient forum.

6. Capitalized Terms. Capitalized terms

used but not defined herein shall have the meanings assigned to such terms in the Equity Distribution Agreement.

7. Counterparts. This Amendment may be

executed in any number of counterparts, each of which shall be deemed to be an original, but all such counterparts shall together constitute

one and the same Agreement. Counterparts may be delivered via facsimile, electronic mail (including any electronic signature covered

by the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable

law, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly

delivered and be valid and effective for all purposes.

If the foregoing is in accordance with your understanding,

please sign and return to us a counterpart hereof, and upon the acceptance hereof by each of you, this Agreement and such acceptance

hereof shall constitute a binding agreement among each of you, the Company, the Adviser and the Administrator.

[Signature pages to follow]

| |

Very truly yours, |

| |

|

| |

GOLUB CAPITAL

BDC, INC. |

| |

|

|

| |

By: |

/s/ David B. Golub |

| |

|

Name: |

David

B. Golub |

| |

|

Title: |

Chief

Executive Officer |

| |

|

| |

GC ADVISORS

LLC |

| |

|

|

| |

By: |

/s/ David B. Golub |

| |

|

Name: |

David

B. Golub |

| |

|

Title: |

President

|

| |

|

|

| |

GOLUB CAPITAL

LLC |

| |

|

|

| |

By: |

/s/ David B. Golub |

| |

|

Name: |

David

B. Golub |

| |

|

Title: |

President

|

[Signature Page to

First Amendment to Equity Distribution Agreement]

| |

|

Accepted

as of the date hereof: |

| |

|

|

| |

|

|

| |

|

KEEFE,

BRUYETTE & WOODS, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/

Al Laufenberg

|

| |

|

Name: |

Al

Laufenberg |

| |

|

Title:

|

Managing Director

|

| |

|

|

|

| |

|

|

|

| |

|

REGIONS SECURITIES

LLC

|

| |

|

|

| |

By: |

/s/

Edward L. Armstrong

|

| |

|

Name: |

Edward

L. Armstrong |

| |

|

Title:

|

Managing

Director – ECM |

[Signature Page to First Amendment to

Equity Distribution Agreement]

Exhibit 10.2

Execution Version

COMMITMENT INCREASE AGREEMENT

December 6, 2024

JPMorgan Chase Bank, N.A.,

as Administrative Agent

500 Stanton Christiana Road

NCC 5, Floor 1

Newark, DE 19713-2107

Attention: Loan & Agency Services Group

Ladies and Gentlemen:

We refer to the Second Amended

and Restated Senior Secured Revolving Credit Agreement dated as of August 6, 2024 (as amended, modified or supplemented from time

to time, the “Credit Agreement”; the terms defined therein being used herein as therein defined) among Golub Capital

BDC, Inc. (the “Borrower”), the Lenders party thereto and JPMorgan Chase Bank, N.A., as Administrative Agent

for said Lenders. You have advised us that the Borrower has requested in a letter dated December 6, 2024 (the “Increase

Request”) from the Borrower to the Administrative Agent that the aggregate amount of the Commitments be increased on the terms

and subject to the conditions set forth herein.

A. Commitment

Increase. Pursuant to Section 2.07(e) of the Credit Agreement, Royal Bank of Canada (the “Assuming Lender”),

hereby agrees to make Commitments in the amount set forth opposite the name of the Assuming Lender, as listed in Schedule I hereto pursuant

to the instruction of the Administrative Agent, such Commitments to be effective as of the Increase Date (as defined in the Increase

Request); provided that the Administrative Agent shall have received a duly executed officer’s certificate from the Borrower, dated

the Increase Date, in substantially the form of Exhibit I hereto. Pursuant to Section 2.07(e)(i)(C) of the Credit Agreement,

the Administrative Agent and the Issuing Bank hereby consent to the Assuming Lender making the Commitments in the amount specified in

the Increase Request and in Schedule I hereto.

B. Confirmation

of Assuming Lender. The Assuming Lender (i) confirms that it has received a copy of the Credit Agreement and the other Loan

Documents, together with copies of the financial statements referred to therein and such other documents and information as it has deemed

appropriate to make its own credit analysis and decision to enter into this Commitment Increase Agreement; (ii) agrees that it will,

independently and without reliance upon the Administrative Agent or any other Lender or Agent and based on such documents and information

as it shall deem appropriate at the time, continue to make its own credit decisions in taking or not taking action under the Credit Agreement;

and (iii) acknowledges and agrees that, from and after the Increase Date, the Commitments set forth opposite the name of the Assuming

Lender listed in Schedule I hereto shall be included in its Commitments and be governed for all purposes by the Credit Agreement and

the other Loan Documents.

C. Counterparts.

This Commitment Increase Agreement may be executed in counterparts (and by different parties hereto on different counterparts), each

of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed

counterpart of a signature page to this Commitment Increase Agreement by telecopy or other electronic transmission shall be effective

as delivery of a manually executed counterpart of this Commitment Increase Agreement.

D. Governing

Law. This Commitment Increase Agreement shall be construed in accordance with and governed by the law of the State of New York. Section 9.09(b) (Submission

to Jurisdiction), Section 9.09(c) (Waiver of Venue) and Section 9.09(d) (Service of Process) of the Credit Agreement

are hereby incorporated mutatis mutandis and shall apply hereto.

EACH

PARTY HERETO HEREBY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL

PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS Commitment Increase AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY

(WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). EACH PARTY HERETO (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY

OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO

ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HERETO HAVE BEEN INDUCED TO ENTER INTO THIS Commitment

Increase Agreement BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS paragraph.

| | Very truly yours, |

| | |

| | ASSUMING LENDER |

| | |

| | Royal Bank of Canada |

| | |

| | By: |

/s/ Alex Figueroa |

| | |

Name: |

Alex Figueroa |

| | |

Title: |

Authorized Signatory |

Commitment Increase Agreement

| Accepted and Agreed: | |

| | |

| GOLUB CAPITAL BDC, INC. | |

| | |

| By: |

/s/ Christopher Ericson | |

| |

Name: |

Christopher Ericson | |

| |

Title: |

Chief Financial Officer | |

| | |

| Acknowledged By: | |

| | |

| JPRMORGAN CHASE BANK, N.A., | |

| as Administrative Agent and Issuing Bank | |

| | |

| By: |

/s/ Tom Gillespie | |

| |

Name: |

Tom Gillespie | |

| |

Title: |

Executive Director | |

Commitment Increase Agreement

v3.24.3

Cover

|

Dec. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 04, 2024

|

| Entity File Number |

814-00794

|

| Entity Registrant Name |

GOLUB

CAPITAL BDC, INC.

|

| Entity Central Index Key |

0001476765

|

| Entity Tax Identification Number |

27-2326940

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

200

Park Avenue

|

| Entity Address, Address Line Two |

25th

Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10166

|

| City Area Code |

212

|

| Local Phone Number |

750-6060

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

GBDC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

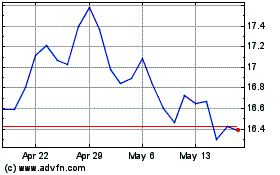

Golub Capital BDC (NASDAQ:GBDC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Golub Capital BDC (NASDAQ:GBDC)

Historical Stock Chart

From Feb 2024 to Feb 2025