false

0001735948

A6

0001735948

2024-08-12

2024-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 12, 2024

GREENBROOK

TMS INC.

(Exact name of registrant as specified in its

charter)

| Ontario |

|

001-40199 |

|

98-1512724 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File No.) |

|

(IRS Employee

Identification No.) |

890

Yonge Street, 7th Floor

Toronto,

Ontario Canada

M4W

3P4

(Address of Principal Executive Offices)

(866)

928-6076

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of Each Exchange

on Which Registered |

| None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 7.01 | Regulation FD Disclosure. |

On August 12, 2024, Greenbrook TMS Inc. (the

“Company”) issued a press release announcing that they have entered into a definitive arrangement agreement in which Neuronetics,

Inc. (NASDAQ: STIM) will acquire all of the outstanding common shares of the Company in an all-stock transaction

The information contained

in this Current Report on Form 8-K under Item 7.01, including the attached Exhibit 99.1, is being furnished pursuant to Item 7.01 of

Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended,

or otherwise subject to the liabilities of that section. The information contained in this Current Report on Form 8-K under Item 7.01

shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or any filing under the Exchange

Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 12, 2024

| |

Greenbrook TMS Inc. |

| |

|

|

| |

By: |

/s/ Bill Leonard |

| |

Name: |

Bill Leonard |

| |

Title: |

President & Chief Executive Officer |

Exhibit 99.1

Neuronetics and Greenbrook TMS Announce Definitive Agreement to Merge

MALVERN, Pa. and TORONTO, On., August 12, 2024 (GLOBE

NEWSWIRE) -- Neuronetics, Inc. (NASDAQ: STIM) (“Neuronetics”) and Greenbrook TMS Inc. (OTCMKTS: GBNHF) (“Greenbrook”)

today announced that they have entered into a definitive arrangement agreement (the “Definitive Agreement”) in which Neuronetics

will acquire all of the outstanding common shares of Greenbrook in an all-stock transaction.

“This transaction brings together two of the

leaders in the mental health space in the U.S., which will allow us to provide access to innovative care to patients suffering from mental

health conditions. Leveraging the significant scale and capabilities of the two businesses, we can drive increased awareness of NeuroStar,

consistently deliver best practices, facilitate improved reimbursement on a regional and national level, and provide additional services

and training opportunities to all of our customers which can improve their business operations,” said Keith Sullivan, President

and Chief Executive Officer of Neuronetics. "Beyond the strategic benefits, we believe this acquisition will help create a more attractive

financial profile for the combined company, including the increased scale and growth trajectory of our top line, the ability to realize

material cost synergies, the acceleration of our path to profitability, and a bolstered balance sheet. In combination, we expect this

transaction will create significant long-term value for shareholders."

"This transaction combines two organizations who

share a common mission to better care for the growing number of patients who are suffering from mental health conditions, many of whom

are poorly served by medication alone,” said Bill Leonard, President and Chief Executive Officer of Greenbrook. "By combining

Neuronetics’ innovative NeuroStar platform as well as their education and training expertise, with Greenbrook’s well established

practice operations and support capabilities, we believe the combined company can improve care at Greenbrook’s existing sites and,

just as importantly, at any practice across the country that is looking to bring the benefits of NeuroStar to their patients."

Rationale for the Transaction

By creating a vertically-integrated organization capable of providing

access to TMS therapy with significant scale, the acquisition offers multiple strategic benefits for Neuronetics and its customers, including:

| · | Increased

Brand Awareness for NeuroStar TMS. Through marketing efforts under a single brand, Neuronetics

expects to be able to drive significant increases in awareness of NeuroStar amongst patients,

care givers, and providers. |

| · | More

Consistent Delivery of Best Practices. Under centralized management, Neuronetics believes

it can better operationalize NeuroStar TMS best practices across all Greenbrook sites nationwide. |

| · | Provides

a Variety of Positive Benefits for All NeuroStar Customers. The benefits include increased

brand recognition for NeuroStar, the expansion of training opportunities on how to successfully

incorporate med management and Spravato® treatment alongside NeuroStar, as well as access

to centralized services to improve their business operations, which includes the ability

to benefit from regional and national payor contracts, the outsourcing of reimbursement billing

and processing, better revenue cycle management, and a national call center. |

Beyond the strategic benefits, the transaction is expected to create

compelling financial benefits, which include:

| · | Increased

Revenue Scale and Strong Growth Trajectory. In fiscal year 2023, the pro forma revenue

of the combined company would have been approximately $145 million, effectively doubling

the scale of the stand-alone businesses. Additionally, the combined company expects mid-teens

year over year revenue growth in fiscal years 2025 and 2026. |

| · | Material

Cost Synergies. Through the optimization of marketing spend as well as back office functions,

the combined company expects to be able to realize at least $15 million of annualized cost

savings, the majority of which will be realized in fiscal year 2025. |

| · | Accelerated

Path to Profitability. Coming as a result of strong expected revenue growth and the realization

of cost synergies, the combined company anticipates to be Adjusted EBITDA positive and also

cash flow positive for the full fiscal year 2025, excluding one-time costs related to the

transaction. |

| · | Bolstered

Balance Sheet. As a result of the pre-transaction conversion of Greenbrook’s debt

into common shares, in combination with the scale of the business post-acquisition, the consolidated

company will be able to leverage an improved balance sheet to execute on its long-term growth

strategy. |

Leadership Structure

Neuronetics’ executive management team will

continue with the combined company, and the executive leadership team will be bolstered by key Greenbrook leadership team members, including

Bill Leonard, Greenbrook’s current President and Chief Executive Officer, Peter Willett, Greenbrook’s current Chief Financial

Officer, and Dr. Geoffrey Grammer, Greenbrook’s current Chief Medical Officer.

Terms of the Acquisition

Under the terms of the Definitive Agreement:

| · | Prior to the completion of the transaction, all of Greenbrook’s existing

credit facility and subordinated convertible debt will be converted into Greenbrook common shares. |

| · | Greenbrook shareholders will receive a fraction of shares of Neuronetics

common stock for each Greenbrook common share owned at the exchange ratio described below such that immediately following the closing

of the transaction, Neuronetics shareholders will own approximately 57% of the combined company, and Greenbrook shareholders will own

approximately 43% of the combined company, respectively, on a fully diluted basis. As of the date of the Definitive Agreement, each Greenbrook

share is expected to be exchanged for 0.01149 shares of Neuronetics common stock at the closing of the transaction, subject to adjustment

for any interim period funding by Madryn and other customary adjustments prior to the closing based on the terms of the Definitive Agreement.

An aggregate of 25,304,971 Neuronetics shares will be issued to Greenbrook shareholders in connection with the transaction. |

| · | The

transaction will be implemented by way of a court-approved plan of arrangement under the

Business Corporations Act (Ontario). The transaction must be approved by the Superior

Court of Ontario (Commercial List), which will consider the fairness and reasonableness of

the transaction to all Greenbrook shareholders. |

| · | As

part of the transaction, Madryn Asset Management LP and its affiliates (“Madryn”)

has agreed to convert all of the amount outstanding under its credit facility with Greenbrook

and all of the subordinated convertible notes of Greenbrook (including notes held by Madryn

and other third-parties, which are forced to convert as a result of Madryn’s election)

into common shares of Greenbrook prior to the effective date of the transaction. As a result,

subject to adjustment for any interim period funding by Madryn and other customary adjustments,

Madryn will own 95.3% of the Greenbrook common shares immediately prior to closing and will

receive 95.3% of the Neuronetics common stock being issued to Greenbrook shareholders. |

| · | The

transaction requires approval by (i) at least 66 2/3% of the votes cast by the holders

of Greenbrook shares present in person or represented by proxy at a special meeting of the

holders of the Greenbrook shares to be called to consider the transaction; and (ii) a

simple majority of the votes cast by the holders of Greenbrook shares present in person or

represented by proxy, excluding Greenbrook shares that are required to be excluded under

Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special

Transactions (including shares held by Madryn). |

| · | The

issuance of the Neuronetics shares pursuant to the transaction requires approval by holders

of a majority of shares of Neuronetics common stock who, being present or voting by proxy

and entitled to vote at the Neuronetics stockholder meeting, cast votes affirmatively or

negatively on the Neuronetics share issuance resolution. Among other things, Neuronetics

will also propose to amend its certificate of incorporation to increase the size of authorized

share capital in order to issue the Neuronetics shares. Approval of this proposed amendment

will be required by the holders of a majority of the outstanding shares of Neuronetics common

stock entitled to vote at the Neuronetics stockholder meeting. |

| · | The

Definitive Agreement provides for customary deal protection provisions, including reciprocal

non-solicitation covenants and rights to match superior proposals. |

| · | The

Definitive Agreement provides for mutual termination fees of $1,900,000 in the event the

transaction is terminated by either party in certain circumstances, including to enter into

a superior proposal. |

| · | The

combined company will continue to operate as Neuronetics, Inc., and trade under the

ticker STIM on the NASDAQ stock exchange. Following closing of the transaction, Neuronetics

intends to cause the common shares of Greenbrook to be delisted from the OTCQB and to cause

Greenbrook to submit an application to cease to be a reporting issuer under applicable Canadian

securities laws. |

Each

of Neuronetics’ directors and certain members of the executive leadership team, as of the date hereof, who hold in the aggregate

1,680,718 Neuronetics shares (representing approximately 5.55% of

issued and outstanding Neuronetics shares (on a fully-diluted basis)) have entered into voting support agreements agreeing to vote their

stock in favor of the transaction.

Key shareholders of Greenbrook, including Madryn and

certain subordinated convertible noteholders, and directors and certain members of the executive leadership team, as of the date hereof,

who hold in the aggregate 16,536,208 Greenbrook common shares (representing approximately 48.7% of issued and outstanding Greenbrook shares

(on a non-diluted basis and assuming the cancellation of 11,634,660 outstanding Greenbrook shares on or about August 15, 2024, as previously

disclosed by Greenbrook) have entered into voting support agreements agreeing to vote their Greenbrook shares in favor of the transaction.

The Madryn voting agreement is terminable under certain

specified circumstances including in the event of receipt of a superior proposal that satisfies a hurdle that represents a 20% premium

to the value of the consideration payable under this transaction and, concurrently therewith, the Definitive Agreement is terminated

for a superior proposal upon payment of a termination fee. The voting agreement entered into with other key shareholders of Greenbrook

are terminable under certain specified circumstances including upon the termination of the Madryn voting agreement.

Greenbrook Strategic Review Process

The transaction is the culmination of a strategic

review process undertaken by Greenbrook. The process and negotiation of the transaction was supervised by a committee of independent

directors (the “Greenbrook Special Committee”). Both the Greenbrook board and Greenbrook Special Committee determined, after

receiving financial and legal advice, that the transaction is in the best interest of Greenbrook and is fair, from a financial point

of view, to Greenbrook shareholders (other than Madryn).

Alliance Global Partners has provided an opinion to

the Greenbrook board and the Greenbrook Special Committee that, as at the date of its opinion and based upon and subject to the assumptions,

limitations and qualifications set out therein, the consideration to be received by the shareholders of Greenbrook pursuant to the transaction

is fair, from a financial point of view, to such shareholders.

The terms of the Definitive Agreement were negotiated

with oversight and participation of the Greenbrook Special Committee and the assistance of Greenbrook’s external financial and

legal advisors. Such terms are reasonable in the judgment of the Greenbrook Special Committee and the Greenbrook board.

Timing and Approvals

The Board of Directors of both companies have unanimously

approved the transaction.

The transaction is expected to close during the fourth

quarter of 2024, subject to approval by both companies’ shareholders, court approval in respect of the plan of arrangement as well

as other customary closing conditions.

Further information regarding the transaction will be contained in

a joint proxy statement that Neuronetics and Greenbrook will prepare, file and make available to their respective stockholders and shareholders

in advance of the Neuronetics stockholder meeting and the Greenbrook shareholder meeting, respectively. Copies of the Definitive Agreement

and joint proxy statement will be available on Greenbrook’s profile at the SEC’s website at www.sec.gov and on SEDAR+ (www.sedarplus.ca)

and the Definitive Agreement and joint proxy statement will be available at the SEC’s website at www.sec.gov. See “Important

Information and Where to Find It” below.

Advisors

Canaccord Genuity is serving as financial advisor

to Neuronetics, and Ballard Spahr LLP as well as Stikeman Elliott LLP are serving as its legal counsel. A.G.P./Alliance Global Partners

is serving as financial advisor to Greenbrook, and Torys LLP is serving as its legal counsel.

Conference Call and Webcast

Neuronetics’ management team will host a conference

call to discuss the transaction, in conjunction with the announcement of their second quarter earnings call today, August 12, 2024,

beginning at 8:30 a.m. Eastern Time.

The conference call will be broadcast live in listen-only mode via

webcast HERE.

To listen to the conference call on your telephone, you may register

for the call HERE.

While it is not required, it is recommended you join

10 minutes prior to the event start.

About Neuronetics

Neuronetics, Inc. believes that mental health is as important

as physical health. As a global leader in neuroscience, Neuronetics is redefining patient and physician expectations with its NeuroStar

Advanced Therapy for Mental Health. NeuroStar is a non-drug, noninvasive treatment that can improve the quality of life for people suffering

from neurohealth conditions when traditional medication hasn’t helped. NeuroStar is indicated for the treatment of depressive episodes

and for decreasing anxiety symptoms for those who may exhibit comorbid anxiety symptoms in adult patients suffering from MDD and who

failed to achieve satisfactory improvement from previous antidepressant medication treatment in the current episode. It is also FDA-cleared

as an adjunct for adults with obsessive-compulsive disorder and for adolescent patients aged 15-21 with MDD. NeuroStar Advanced Therapy

is the leading TMS treatment for MDD in adults with over 6.4 million treatments delivered. Neuronetics is committed to transforming lives

by offering an exceptional treatment that produces extraordinary results. For safety and prescribing information, NeuroStar.com.

About Greenbrook TMS

Operating through 130 company-operated

treatment centers (118 treatment centers following completion of the previously-disclosed settlement transaction), Greenbrook is a leading

provider of Transcranial Magnetic Stimulation (“TMS”) and Spravato® (esketamine nasal spray), FDA-cleared, non-invasive

therapies for the treatment of Major Depressive Disorder (“MDD”) and other mental health disorders, in the United States.

TMS therapy provides local electromagnetic stimulation to specific brain regions known to be directly associated with mood regulation.

Spravato® is offered to treat adults with treatment-resistant depression and depressive symptoms in adults with MDD with suicidal

thoughts or actions. Greenbrook has provided more than one million treatments to over 30,000 patients struggling with depression.

Neuronetics Contact:

Investors: Mike Vallie or Mark Klausner

ICR Westwicke

443-213-0499

ir@neuronetics.com

Media:

EvolveMKD

646-517-4220

NeuroStar@evolvemkd.com

“Safe harbor” statement under the Private

Securities Litigation Reform Act of 1995:

This document includes “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities

Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created by those laws and other applicable laws

and “forward-looking information” within the meaning of applicable Canadian securities laws. Statements in the press release

that are not historical facts constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements may be identified by terms such as “outlook,” “potential,”

“believe,” “expect,” “plan,” “anticipate,” “predict,” “may,” “will,”

“could,” “would” and “should” as well as the negative of these terms and similar expressions. These

statements include those relating to the proposed combination of Greenbrook and Neuronetics, potential benefits of the transaction and

the timing thereof. These statements are subject to significant risks and uncertainties and actual results could differ materially from

those projected. Investors are cautioned not to place undue reliance on the forward-looking statements contained in this release. These

risks and uncertainties include, without limitation, risks and uncertainties related to: (i) the parties’ ability to meet expectations

regarding the timing and completion of the transaction; (ii) the occurrence of any event, change or other circumstance that would give

rise to the termination of the Definitive Agreement; (iii) the fact that Greenbrook’s and Neuronetics’ respective stockholders

may not approve the transaction; (iv) the fact that certain terminations of the Definitive Agreement require Greenbrook or Neuronetics

to pay a termination fee; (v) the failure to satisfy each of the conditions to the consummation of the transaction; (vi) the disruption

of management’s attention from ongoing business operations due to the transaction; (vii) the effect of the announcement of the transaction

on Greenbrook’s and Neuronetics’ relationships with their respective customers, as well as their respective operating results

and business generally; (viii) the outcome of any legal proceedings related to the transaction; (ix) retention of employees of Greenbrook

following the announcement of the transaction; (x) the fact that Greenbrook’s and Neuronetics’ stock price may decline significantly

if the transaction is not completed; and other factors described under the heading “Risk Factors” in Neuronetics’ Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 and its Quarterly Report on Form 10-Q for the quarter ended March 31,

2024, and Greenbrook’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and its Quarterly Report on Form 10-Q

for the quarter ended March 31, 2024, as each may be updated or supplemented by subsequent reports that Neuronetics has filed or files

with the SEC and Greenbrook files with the SEC and on SEDAR+. These forward-looking statements are based on expectations and assumptions

as of the date of this press release. Except as required by law, Neuronetics and Greenbrook undertake no duty or obligation to update

any forward-looking statements contained in this press release as a result of new information, future events, or changes in the their

expectations.

Important Additional Information and Where to Find

It

In connection with the transaction, Neuronetics and Greenbrook will

be filing preliminary and definitive joint proxy statements and other relevant documents relating to the proposed transaction with the

Securities and Exchange Commission (the “SEC”) and on SEDAR+, as applicable. This communication is not a substitute for the

joint proxy statement or any other document that Neuronetics or Greenbrook may file with the SEC or on SEDAR+ or send to their stockholders

in connection with the transaction. The description of the Definitive Agreement and voting agreements above do not purport to be complete

and are qualified in its entirety by reference to such agreement as filed pursuant to the joint proxy statement and/or any other filing

with the SEC and on SEDAR+. Before making any voting decision, Neuronetics’ and Greenbrook’s stockholders are urged to read

all relevant documents filed with the SEC and on SEDAR+, including the joint proxy statement, when they become available because they

will contain important information about the transaction. Investors and security holders will be able to obtain the joint proxy statement

and other documents filed by Neuronetics or Greenbrook with the SEC (when available) free of charge at the SEC’s website, www.sec.gov

or on SEDAR+, at www.sedarplus.ca, as applicable, or from Neuronetics or Greenbrook at the investor relations page of their respective

websites, https://ir.neuronetics.com/ and greenbrooktms.com/investor-relations. These documents are not currently available.

No Offer or Solicitation

This communication is for information purposes only

and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to

purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval

in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities

in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

Neuronetics, Greenbrook and their respective directors

and executive officers may be deemed participants in the solicitation of proxies from Neuronetics’ stockholders in connection with

the transaction. Neuronetics’ stockholders and other interested persons may obtain, without charge, more detailed information (i) regarding

the directors and officers of Neuronetics in Neuronetics’ Annual Report on Form 10-K filed with the SEC on March 7, 2024,

its proxy statement relating to its 2024 Annual Meeting of Stockholders filed with the SEC on April 11, 2024 and other relevant

materials filed with the SEC when they become available; and (ii) regarding Greenbrook’s directors and officers in Greenbrook’s

Annual Report on Form 10-K filed with the SEC and on SEDAR+ on April 25, 2024 and other relevant materials filed with the SEC

and on SEDAR+, as applicable, when they become available. Information regarding the persons who may, under SEC rules, be deemed participants

in the solicitation of proxies to Neuronetics’ stockholders in connection with the transaction will be set forth in the joint proxy

statement for the transaction when available. Additional information regarding the interests of participants in the solicitation of proxies

in connection with the transaction will be included in the joint proxy statement that Neuronetics and Greenbrook intend to file with

the SEC and on SEDAR+, as applicable.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

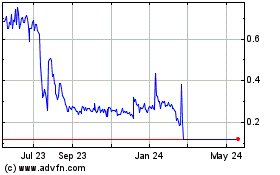

Greenbrook TMS (NASDAQ:GBNH)

Historical Stock Chart

From Feb 2025 to Mar 2025

Greenbrook TMS (NASDAQ:GBNH)

Historical Stock Chart

From Mar 2024 to Mar 2025