As filed with the Securities and Exchange Commission on November 26, 2024

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_________________________

Grupo Financiero Galicia S.A.

(Exact name of registrant as specified in its charter)

Galicia Financial Group

(Translation of Registrant’s name into English)

__________________________

Argentina

(State or Other Jurisdiction of Incorporation or Organization)

Not Applicable

(I.R.S. Employer Identification Number)

Tte. Gral. Juan D. Perón 430, 25th floor

C1038 AAJ-Ciudad Autónoma de Buenos Aires, Argentina

Tel: +54 11-4343-7528

(Address and Telephone Number of Registrant’s Principal Executive Offices)

_________________________

CT Corporation System

28 Liberty Street

New York, New York 10005

+1-212-894-8940

(Name, Address, and Telephone Number of Agent for Service)

_________________________

Copies of communications, including communications sent to agent for service, should be sent to:

| | | | | |

Luciana Denegri

Estudio Beccar Varela

Tucumán 1, 3rd Floor

C1049AAA

Ciudad Autónoma de Buenos Aires, Argentina | Tomer Pinkusiewicz

Gibson, Dunn & Crutcher LLP

200 Park Avenue

New York, NY 10166

+1 (212) 351-4000 |

_________________________

Approximate date of commencement of proposed sale to the public: From time to time after the effectiveness of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 7(a)(2)(B) of the Securities Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Grupo Financiero Galicia S.A.

Class B Ordinary Shares, par value 1.00 peso per share,

including Class B Ordinary Shares Represented by American Depositary Shares

Rights to Purchase Class B Ordinary Shares

We may from time to time offer our Class B ordinary shares, which may be represented by American depositary shares, and rights to purchase Class B ordinary shares or Class B ordinary shares represented by American depositary shares, which we refer to collectively as the “securities.” This prospectus describes the general terms of these securities and the general manner in which we will offer these securities. We will provide the specific terms of the securities that may be offered, and the manner in which they are being offered, in one or more supplements to this prospectus. Any supplement may also add, update or change information contained in this prospectus. We will not use this prospectus to offer any securities unless it is attached to a prospectus supplement. You should read both this prospectus and any prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information,” before investing in the securities. The amount and price of the securities will be determined at the time of any offering thereof.

The American depositary shares (“ADSs”), each representing 10 of our Class B ordinary shares, are listed on the Nasdaq Capital Market under the symbol “GGAL.” Our Class B ordinary shares are listed on the Bolsas y Mercados Argentinos S.A., and on the Mercado Abierto Electrónico S.A. under the symbol “GGAL.”

Investing in the securities involves risks that are described in the “Risk Factors” section contained in our most recent annual report on Form 20-F filed with the U.S. Securities and Exchange Commission (the “SEC”) and in any applicable prospectus supplement and may be described in certain of the documents we incorporate by reference in this prospectus. See “Item 3.D. Risk Factors” beginning on page 6 of our Form 20-F, which is incorporated herein by reference.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 26, 2024.

TABLE OF CONTENTS

| | | | | |

| ABOUT THIS PROSPECTUS | |

| WHERE YOU CAN FIND MORE INFORMATION | |

| INCORPORATION OF CERTAIN INFORMATION BY REFERENCE | |

| FORWARD-LOOKING STATEMENTS | |

| ENFORCEABILITY OF CERTAIN CIVIL LIABILITIES | |

| SUMMARY | |

| REASONS FOR THE OFFERING AND USE OF PROCEEDS | |

| PROSPECTUS SUPPLEMENT | |

| DESCRIPTION OF SHARE CAPITAL | |

| DESCRIPTION OF AMERICAN DEPOSITARY SHARES | |

| DESCRIPTION OF RIGHTS TO PURCHASE CLASS B ORDINARY SHARES | |

| PLAN OF DISTRIBUTION | |

| LEGAL MATTERS | |

| EXPERTS | |

We are responsible for the information contained in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein. We have not authorized any person to give you any other information, and we take no responsibility for any other information that others may give you. This document may only be used where it is legal to sell the securities. You should not assume that the information contained in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates. We are not making an offer of the securities in any state where the offer is not permitted.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-3 that we filed with the SEC using a shelf registration process. Under this shelf registration process, we may offer and sell any combination of the securities described in this prospectus in one or more offerings. Each time we sell securities we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus.

Unless the context otherwise requires, in this prospectus the terms “we,” “us,” “our,” “Grupo Galicia” and “the registrant” refer to Grupo Financiero Galicia S.A. and its consolidated subsidiaries. In this prospectus, references to “pesos” and “Ps.” are to Argentine pesos, and references to “U.S. dollars” and “US$” are to United States dollars.

WHERE YOU CAN FIND MORE INFORMATION

We file periodic reports and other information with the SEC. The SEC maintains a website on which our annual and other reports are made available. In addition, the securities may specify that certain documents are available for inspection at the office of the ADS depositary. We maintain a website at https://www.gfgsa.com. All Internet references in this prospectus are inactive textual references and we do not incorporate website contents into this prospectus.

Upon written or oral request, we will provide to any person, at no cost to such person, including any beneficial owner to whom a copy of this prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in this prospectus but not delivered with this prospectus. You may make such a request by writing or telephoning us at the following address or telephone number:

Grupo Financiero Galicia S.A.

Tte. Gral. Juan D. Perón 430, 25th floor

Ciudad Autónoma de Buenos Aires, Argentina

Tel: +54 11-4343-7528

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with the SEC, which means that we can disclose important information to you by referring you to those documents, which are considered part of this prospectus. Information that we file with the SEC in the future and incorporate by reference will automatically update and supersede the previously filed information. We incorporate by reference the documents listed below:

•our annual report on Form 20-F for the fiscal year ended December 31, 2023 filed with the SEC on April 26, 2024 (our “Form 20-F”), excluding the disclosure under Item 5 and Item 18 therein;

•our report on Form 6-K furnished to the SEC on June 28, 2024, August 22, 2024, August 23, 2024, August 27, 2024, September 12, 2024, October 4, 2024 and November 5, 2024 (containing discussion of our financial results for the quarter ended September 30, 2024, prepared in accordance with the accounting framework issued by the Argentine Central Bank); and

•our report on Form 6-K furnished to the SEC on November 26, 2024 containing our unaudited interim consolidated financial statements as of and for the three and nine months periods ended September 30, 2024 and 2023, and our report on Form 6-K furnished to the SEC on November 26, 2024 containing (i) our audited consolidated financial statements as of and for the years ended December 31, 2023 and 2022, which have been recast to present the audited consolidated financial statements in the measuring unit current at the end of the reporting period as of September 30, 2024 and (ii) our operating and financial review and prospects for the years ended December 31, 2023 and 2022.

We also incorporate by reference in this prospectus all subsequent annual reports filed with the SEC on Form 20-F under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and those of our reports on Form 6-K furnished to the SEC that we specifically identify as being incorporated by reference in this prospectus after the date hereof and prior to the completion of an offering of securities under this prospectus.

As you read the above documents, this prospectus and any prospectus supplement, you may find inconsistencies in information from one document to another. If you find inconsistencies you should rely on the statements made in the most recent document, including this prospectus and any prospectus supplement. All information appearing in this prospectus is qualified in its entirety by the information and financial statements, including the notes thereto, contained in the documents we have incorporated by reference.

When acquiring any securities discussed in this prospectus, you should rely only on the information contained or incorporated by reference in this prospectus, any prospectus supplement and any “free writing prospectus” that we authorize to be delivered to you. Neither we, nor any underwriters or agents, have authorized anyone to provide you with different information. We are not offering the securities in any jurisdiction in which an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

You should not assume that the information in this prospectus, any prospectus supplement or any document incorporated by reference is accurate or complete at any date other than the date mentioned on the cover page of those documents.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act, that involve substantial risks and uncertainties. All statements other than statements of historical facts contained or incorporated by reference in this prospectus (including statements regarding our future financial position, business strategy, budgets, projected costs and management’s plans and objectives for future operations) are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of such words as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue” or other similar terminology. Although we believe that the expectations reflected in these forward-looking statements are reasonable, no assurance can be provided with respect to these statements. Because these statements are subject to risks and uncertainties, actual results may differ materially and adversely from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially and adversely from those contemplated in such forward-looking statements include but are not limited to:

•changes in general political, legal, social or other conditions in Argentina, Latin America or other countries or regions;

•changes in the macroeconomic situation at the regional, national or international levels, and the influence of these changes on the microeconomic conditions of the financial markets in Argentina;

•changes in capital markets in general that may affect policies or attitudes toward lending to Argentina or Argentine companies, including expected or unexpected volatility in domestic or international financial markets;

•financial difficulties of the Argentine government (the “Government”) and its ability (or inability) to restructure or rollover its outstanding debt that is held by international credit entities;

•changes in the Government’s regulations applicable to financial institutions, including tax regulations and changes in, or failures to comply with, banking or other regulations;

•volatility of the Peso and the exchange rates between the Peso and foreign currencies;

•fluctuations in the Argentine rate of inflation, including hyperinflation;

•increased competition in the banking, financial services, credit card services, insurance, asset management, mutual funds and related industries;

•our subsidiaries’ inability to sustain or improve our performance;

•a loss of market share by any of our main businesses;

•a change in the credit cycle, increased borrower defaults and/or a decrease in the fees charged to clients;

•changes in the saving and consumption habits of its customers and other structural changes in the general demand for financial products, such as those offered by Banco Galicia;

•changes in interest rates which may, among other things, adversely affect margins;

•Banco Galicia’s inability to obtain additional debt or equity financing on attractive conditions or at all, which may limit its ability to fund existing operations and to finance new activities;

•technological changes and changes in Banco Galicia’s ability to implement new technologies;

•impact of epidemics or pandemics on the global, regional and national economy, financial activity, global trade -both in terms of volume and prices-, and on our ability to recover from the negative effects of the pandemic (or other future outbreak);

•other factors discussed under “Item 3.D. Risk Factors” in our most recent annual report on Form 20-F, which is incorporated herein by reference.

These statements include our current expectations and assumptions and are not a guarantee of future performance. You should not place undue reliance on forward-looking statements, which speak only as of the date that they were made. Moreover, you should consider these cautionary statements in connection with any written or oral forward-looking statements that we may issue in the future. We do not undertake any obligation to release publicly any revisions to forward-looking statements to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

Should one or more of these factors or situations materialize, or should the underlying assumptions prove to be incorrect, the actual results may differ considerably from those that are described as being foreseen, considered, estimated, expected, predicted or intended in this prospectus.

In light of the risks and uncertainties described above, the forward-looking events and circumstances discussed in this prospectus and the documents incorporated by reference herein might not occur and are not guarantees of future performance. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information or future events or developments. Additional factors affecting our business emerge from time to time and it is not possible for us to predict all of these factors, nor can we assess the impact of all such factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Although we believe that the plans, intentions and expectations reflected in or suggested by such forward-looking statement are reasonable, we cannot assure you that those plans, intentions or expectations will be achieved. In addition, you should not interpret statements regarding past trends or activities as assurances that those trends or activities will continue in the future.

ENFORCEABILITY OF CERTAIN CIVIL LIABILITIES

Grupo Financiero Galicia S.A. is a stock corporation (sociedad anónima) organized and incorporated under the laws of Argentina. Substantially all of our assets are located outside of the United States. The majority of our directors and officers and certain advisors named herein reside in Argentina or elsewhere outside the United States. As a result, it may not be possible for investors to effect service of process within the United States upon us or such persons or to enforce against us or them in United States courts judgments predicated upon the civil liability provisions of the federal securities laws of the United States.

Judgments of United States courts for civil liabilities based upon the federal securities laws of the United States may be enforced in Argentina, provided that the requirements of Article 517 of the Federal Civil and Commercial Procedure Code of Argentina (if enforcement is sought before federal courts) are met as follows: (i) the judgment, which must be final in the jurisdiction where rendered, was issued by a court competent in accordance with the Argentine principles regarding international jurisdiction and resulted from a personal action, or an in rem action with respect to personal property if such was transferred to Argentine territory during or after the prosecution of the foreign action, (ii) the defendant against whom enforcement of the judgment is sought was personally served with the summons and, in accordance with due process of law, was given an opportunity to defend against foreign action, (iii) the judgment is valid in the jurisdiction where rendered and meets authenticity requirements under Argentine law, (iv) the judgment does not violate the principles of public policy of Argentine law, and (v) the judgment is not contrary to a prior or simultaneous judgment of an Argentine court.

We have been advised by our Argentine counsel that:

•original actions based on the federal securities laws of the United States may be brought in Argentine courts and that, subject to applicable law, Argentine courts may enforce liabilities in such actions against us, our directors, our executive officers and the advisors named in this prospectus; and

•the ability of a judgment creditor to satisfy a judgment by attaching certain assets of ours is limited by provisions of Argentine law.

We have appointed CT Corporation System as agent in New York City to accept service of process.

SUMMARY

Overview

We are one of Argentina’s largest financial services groups with consolidated assets of Ps.22,975,397 million (US$23,664 million) as of September 30, 2024. As a holding company, we do not have operations of our own and conduct our business through our subsidiaries. Banco de Galicia y Buenos Aires S.A.U. (“Banco Galicia” or the “Bank”) is our main subsidiary and one of Argentina’s largest full-service banks.

Banco Galicia is a leading provider of financial services in Argentina. According to information published by the Argentine Central Bank, as of August 31, 2024, Banco Galicia ranked first in terms of assets and deposits and second in terms of loan portfolio among private-sector banks in Argentina. As of the same date, the Bank was also ranked first among private-sector domestic banks in terms of assets, loans and deposits. The Bank’s market share of private sector deposits and of loans to the private sector was 9.99% and 11.91%, respectively, as of September 30, 2024. The market share is calculated based on the Argentine Central Bank data as of September 30, 2024, for private-sector banks, including principal amounts only and excluding foreign residents, where applicable. As of September 30, 2024, Banco Galicia had total assets of AR$19,114,594 million (US$19,687 million), total loans and other financing of AR$6,198,773 million (US$6,384 million), total deposits of AR$13,193,044 million (US$13,588 million), and its shareholders’ equity amounted to AR$3,566,592 million (US$3,673 million).

Banco Galicia provides a full range of financial services through one of the most extensive and diversified distribution platforms among private-sector financial institutions in Argentina. This distribution platform, as of September 30, 2024, was comprised of 297 full-service banking branches, located throughout the country, 739 ATMs and 1,211 self-service terminals, phone banking and e-banking facilities. Banco Galicia’s customer base, as of September 30, 2024, comprised approximately 4 million customers, who consisted mostly of individuals but who also included more than 29,000 companies. Banco Galicia’s primary clients are classified into four categories or segments (i) retail, (ii) business and small and medium-sized companies (or SMEs), (iii) wholesale, and (iv) financing.

Our goal is to consolidate our position as one of Argentina’s leading comprehensive financial services providers while continuing to strengthen Banco Galicia’s position as one of Argentina’s leading banks. We seek to broaden and complement the operations and businesses of Banco Galicia, through holdings in companies and undertakings whose objectives are related to and/or can produce synergies with financial activities. Our non-banking subsidiaries operate in financial and related activities in which Banco Galicia either cannot participate or in which it can participate only on a limited basis due to restrictive banking regulations.

REASONS FOR THE OFFERING AND USE OF PROCEEDS

Except as may be described otherwise in a prospectus supplement, we will use the net proceeds from our sale of the securities under this prospectus for general corporate purposes. We may designate a specific allocation of the net proceeds of an offering of securities by us to a specific purpose, if any, at the time of the offering and will describe any allocation in the related prospectus supplement.

PROSPECTUS SUPPLEMENT

This prospectus provides you with a general description of the securities that may be offered. With respect to a particular offering of the securities registered hereby, to the extent required, an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement of which this prospectus is a part will be prepared. You should read both this prospectus and any prospectus supplement and the documents incorporated by reference in this prospectus and any prospectus supplement, together with additional information described under the heading “Where You Can Find More Information” carefully before investing in the securities. The prospectus supplement to be attached to the front of this prospectus will describe the terms of the offering, including the amount and more detailed items of the securities, the initial public offering price, the price paid for the securities, net proceeds, the expenses of the offering, the terms of offers and sales outside of the United States, if any, our capitalization, the nature of the plan of distribution, the terms of any rights offering, including the subscription price for ordinary shares, record date, ex-rights date and exercise period, the other specific terms related to the offering, and any U.S. federal income tax considerations and Argentine tax considerations applicable to the securities. Any information in a prospectus supplement, if any, or information incorporated by reference after the date of this prospectus is considered part of this prospectus and may add, update or change information contained in this prospectus. Any information in such subsequent filings that is inconsistent with this prospectus will supersede the information in this prospectus.

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We have not authorized any other person to provide you with different information. We are not making an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Grupo Financiero Galicia S.A. is a stock corporation organized under the laws of the Republic of Argentina. We maintain our financial books and records and publish our financial statements in pesos.

DESCRIPTION OF SHARE CAPITAL

For a description of our share capital, including the rights and obligations attached thereto, please refer to “Item 10. Additional Information—Memorandum and Articles of Association—Description of Our Bylaws” in our Form 20-F, which is incorporated by reference herein.

DESCRIPTION OF AMERICAN DEPOSITARY SHARES

For a description of the ADSs, including the rights and obligations attached thereto, please refer to “Item 12-D. American Depositary Shares” in our Form 20-F, which is incorporated by reference herein, as well as to the registration statement on Form F-6 (Registration No. 333-175170) including the Deposit Agreement pursuant to which the ADSs will be issued, which is filed as an exhibit thereto.

DESCRIPTION OF RIGHTS TO PURCHASE CLASS B ORDINARY SHARES

We may issue subscription rights to purchase our Class B ordinary shares, including Class B ordinary shares represented by ADSs. We may issue these rights independently or together with any other offered security. The rights may or may not be transferable in the hands of their holders.

The applicable prospectus supplement will describe the specific terms of any subscription rights offering, including:

•the title of the subscription rights;

•the securities for which the subscription rights are exercisable;

•the number of subscription rights issued;

•the extent to which the subscription rights are transferable;

•if applicable, a discussion of the material U.S. federal or other income tax considerations applicable to the issuance or exercise of the subscription rights;

•any other terms of the subscription rights, including terms, procedures and limitations relating to the exchange and exercise of the subscription rights;

•if applicable, the record date to determine who is entitled to the subscription rights and the ex-rights date;

•the date on which the rights to exercise the subscription rights will commence, and the date on which the rights will expire;

•the extent to which the offering includes an over-subscription privilege with respect to unsubscribed securities; and

•if applicable, the material terms of any standby underwriting arrangement we enter into in connection with the offering.

Each subscription right will entitle its holder to purchase for cash a number of our Class B ordinary shares, ADSs or any combination thereof at an exercise price described in the applicable prospectus supplement. Subscription rights may be exercised at any time up to the close of business on the expiration date set forth in the prospectus supplement. After the close of business on the expiration date, all unexercised subscription rights will become void.

Upon receipt of payment and the subscription form properly completed and executed at the subscription rights agent’s office or another office indicated in the applicable prospectus supplement, we will, as soon as practicable, forward our Class B ordinary shares or the ADSs purchasable with this exercise. Rights to purchase our Class B ordinary shares represented by ADSs will be evidenced by certificates issued upon receipt by the ADS depositary of the rights to purchase Class B ordinary shares registered hereby. The applicable prospectus supplement may offer more details on how to exercise the subscription rights.

We may determine to offer subscription rights to our shareholders only or additionally to persons other than shareholders as described in the applicable prospectus supplement. In the event subscription rights are offered to our shareholders only and their rights remain unexercised, we may determine to offer the unsubscribed securities to persons other than shareholders. In addition, we may enter into a standby underwriting arrangement with one or more underwriters under which the underwriter(s) will purchase any securities remaining unsubscribed for after the offering, as described in the applicable prospectus supplement.

PLAN OF DISTRIBUTION

The securities may be sold, and the underwriters may resell the securities, directly or through agents in one or more transactions, including negotiated transactions, at a fixed public offering price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. The securities may be sold in portions outside the United States at an offering price and on terms specified in the applicable prospectus supplement relating to a particular issue of the securities. Without limiting the generality of the foregoing, any one or more of the following methods may be used when selling the securities:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•settlement of short sales entered into after the date of this prospectus;

•sales in which broker-dealers agree with us or a selling securityholder to sell a specified number of securities at a stipulated price per security;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•by pledge to secure debts or other obligations;

•by an underwritten public offering;

•in a combination of any of the above; or

•any other method permitted pursuant to applicable law.

In addition, the securities may be sold by way of exercise of rights granted pro rata to our existing shareholders.

The securities may also be sold short, and securities covered by this prospectus may be delivered to close out such short positions, or the securities may be loaned or pledged to broker-dealers that in turn may sell them. Options, swaps, derivatives or other transactions may be entered into with broker-dealers or other financial institutions which require the delivery to such broker-dealer or other financial institution of the securities and Class B ordinary shares, respectively, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

Any underwriters or agents will be identified, and their compensation described in the applicable prospectus supplement.

In connection with the sale of securities, the underwriters or agents may receive compensation from us, a selling securityholder or from purchasers of the securities for whom they may act as agents. The underwriters may sell securities to or through dealers, who may also receive compensation from the underwriters or from purchasers of the securities for whom they may act as agents. Compensation may be in the form of discounts, concessions or commissions. Underwriters, dealers and agents that participate in the distribution of the securities may be deemed to be underwriters as defined in the Securities Act, and any discounts or commissions received by them from us or a

selling securityholder and any profit on the resale of the securities by them may be treated as underwriting discounts and commissions under the Securities Act.

We or a selling securityholder may enter into agreements that will entitle the underwriters, dealers and agents to indemnification by us or a selling securityholder against and contribution toward certain liabilities, including liabilities under the Securities Act.

Certain underwriters, dealers and agents and their associates may be customers of, engage in transactions with or perform commercial banking, investment banking, advisory or other services for a selling securityholder or us, including our subsidiaries, in the ordinary course of their business.

If so indicated in the applicable prospectus supplement relating to a particular issue of securities, the underwriters, dealers or agents will be authorized to solicit offers by certain institutions to purchase the securities under delayed delivery contracts providing for payment and delivery at a future date. These contracts will be subject only to those conditions set forth in the applicable prospectus supplement, and the prospectus supplement will set forth the commission payable for solicitation of these contracts.

We will advise any selling securityholder that while it is engaged in a distribution of the securities, it is required to comply with Regulation M promulgated under the Exchange Act (“Regulation M”). With limited exceptions, Regulation M precludes a selling securityholder, any affiliated purchasers and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security which is the subject of the distribution until the entire distribution is complete. All of the foregoing might affect the marketability of the securities.

LEGAL MATTERS

Certain legal matters with respect to Argentine law will be passed upon for us by our Argentine counsel, Estudio Beccar Varela.

EXPERTS

The consolidated financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this prospectus by reference to the annual report on Form 20-F for the year ended December 31, 2023 have been so incorporated in reliance on the report of Price Waterhouse & Co. S.R.L., an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 8. Indemnification of Directors and Officers

Grupo Financiero Galicia S.A. ’s bylaws do not provide indemnity to the members of its board of directors, past or present, and under Argentine law they remain liable to Grupo Financiero Galicia S.A., its shareholders and creditors, for any damage they cause through acts contrary to the law or the bylaws, as well as for acts executed in breach of the duties inherent to the discharge of their office.

Grupo Financiero Galicia S.A. maintains an insurance policy that protects its directors, officers and syndics (members of the supervisory committee), for liabilities incurred as a result of actions taken by them in their official capacity, associated with any civil, criminal or administrative process.

Item 9. Exhibits

| | | | | | | | |

| Exhibit No. | Name of Document | Method of Filing |

| 1.1 | Form of underwriting agreement for equity securities of the Registrant | To be filed by amendment or incorporated by reference to a subsequently furnished Report on Form 6-K |

| 3.1 | Restated By-laws of the Registrant | |

| 4.1 | Amended and Restated Deposit Agreement, dated as of July 12, 2011, among the Registrant, The Bank of New York Mellon, as depositary, and the holders from time to time of American Depositary Shares issued thereunder | |

| 4.2 | Form of subscription agreement to exercise rights to purchase Class B ordinary shares | To be filed by amendment or incorporated by reference to a subsequently furnished Report on Form 6-K. |

| 4.3 | Form of rights certificate to purchase Class B ordinary shares | To be filed by amendment or incorporated by reference to a subsequently furnished Report on Form 6-K. |

| 5.1 | Opinion of Estudio Beccar Varela, Argentine counsel | |

| 23.1 | Consent of Price Waterhouse & Co. S.R.L., independent registered public accounting firm | |

| 23.2 | Consent of Estudio Beccar Varela | Included as part of Exhibit 5.1. |

| 24.1 | Powers of Attorney of the Registrant | Included on the signature pages. |

| 107 | Filing Fee Table | |

Item 10. Undertakings

a.The undersigned registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

A.To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

B.To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total U.S. dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

C.To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(A), (a)(1)(B) and (a)(1)(C) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by such registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)To file a post-effective amendment to the registration statement to include any financial statements required by Item 8.A. of Form 20-F at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of the Securities Act need not be furnished, provided, that the registrant includes in the prospectus, by means of a post-effective amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information in the prospectus is at least as current as the date of those financial statements. Notwithstanding the foregoing, with respect to registration statements on Form F-3, a post-effective amendment need not be filed to include financial statements and information required by Section 10(a)(3) of the Securities Act or Item 8.A of Form 20-F if such financial statements and information are contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Form F-3.

(5)That, for the purpose of determining liability under the Securities Act to any purchaser:

A.Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

B.Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is

part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(6)That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

A.Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

B.Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

C.The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

D.Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

b.The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual reports pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

c.The undersigned registrant hereby undertakes to supplement the prospectus, after the expiration of the subscription period, to set forth the results of the subscription offer, the transactions by the underwriters during the subscription period, the amount of unsubscribed securities to be purchased by the underwriters, and the terms of any subsequent reoffering thereof. If any public offering by the underwriters is to be made on terms differing from those set forth on the cover page of the prospectus, a post-effective amendment will be filed to set forth the terms of such offering.

d.Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

e.The undersigned registrant hereby undertakes that:

(1)For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

(2)For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant to the requirements of the U.S. Securities Act of 1933, as amended, the registrant, Grupo Financiero Galicia S.A., a corporation incorporated and existing under the laws of Argentina, certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form F-3 and has duly caused this Form F-3 registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Ciudad Autónoma de Buenos Aires, Argentina on November 26, 2024.

GRUPO FINANCIERO GALICIA S.A.

By: /s/ Fabián E. Kon

Name: Fabián E. Kon

Title: Chief Executive Officer

POWER OF ATTORNEY

Each of the undersigned do hereby constitute and appoint Fabián E. Kon and Diego Rivas and each of them, individually, his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, in his or her name, place and stead, in any and all capacities (including his capacity as a director and/or officer of the registrant), to sign any and all amendments and post-effective amendments and supplements to this registration statement, and including any registration statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the U.S. Securities Act of 1933, as amended, and to file the same, with all exhibits thereto and other documents in connection therewith, with the SEC, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or his substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the U.S. Securities Act of 1933, as amended, this Form F-3 registration statement has been signed by the following persons in the capacities and on the dates indicated.

By: /s/ Fabián E. Kon

Name: Fabián E. Kon

Title: Chief Executive Officer (Principal Executive Officer)

Date: November 26, 2024

By: /s/ Diego Rivas

Name: Diego Rivas

Title: Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer)

Date: November 26, 2024

By: /s/ Eduardo J. Escasany

Name: Eduardo J. Escasany

Title: Chairman

Date: November 26, 2024

By: /s/ Pablo Gutierrez

Name: Pablo Gutierrez

Title: Vice Chairman

Date: November 26, 2024

By: Federico Braun

Name: Federico Braun

Title: Director

Date: November 26, 2024

By: /s/ Silvestre Vila Moret

Name: Silvestre Vila Moret

Title: Director

Date: November 26, 2024

By: /s/ Sebastián Gutierrez

Name: Sebastián Gutierrez

Title: Director

Date: November 26, 2024

By: /s/ Tomás Braun

Name: Tomás Braun

Title: Director

Date: November 26, 2024

By: /s/ Alejandro Asrin

Name: Alejandro Asrin

Title: Director

Date: November 26, 2024

By: /s/ Claudia Raquel Estecho

Name: Claudia Raquel Estecho

Title: Director

Date: November 26, 2024

By: /s/ Miguel C. Maxwell

Name: Miguel C. Maxwell

Title: Director

Date: November 26, 2024

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements of the U.S. Securities Act of 1933, as amended, the undersigned, a duly authorized representative of Grupo Financiero Galicia S.A. in the United States, has signed this registration statement on November 26, 2024.

By: /s/ Gloria E. Palomino Moreno

Name: Gloria E. Palomino Moreno

Title: Authorized Representative in the United States

Calculation of Filing Fee Tables

Form S-3

(Form Type)

GRUPO FINANCIERO GALICIA S.A.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation or Carry Forward Rule | Amount Registered | Proposed Maximum Offering Price Per Unit | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee | Carry Forward Form

Type | Carry Forward

File

Number | Carry Forward Initial effective

date | Filing Fee Previously

Paid In Connection with Unsold

Securities

to be

Carried

Forward |

Newly Registered Securities |

Fees to Be Paid | Equity | Class B ordinary shares (including Class B ordinary shares represented by American Depositary Shares), Ps.1.00 Argentine peso, par value (1)(2) | Rule 456(b) and

Rule 457(r) (3) | (4) | (4) | (4) | (3) | (3) |

|

|

|

|

Fees to Be Paid | Other | Rights to Purchase Class B ordinary shares (including Class B ordinary shares represented by American Depositary Shares) (1)(2) | Rule 456(b) and

Rule 457(r) (3) | (4) | (4) | (4) | (3) | (3) |

|

|

|

|

Fees Previously Paid | N/A | N/A | N/A | N/A | N/A | N/A | | N/A |

|

|

|

|

Carry Forward Securities |

Carry

Forward Securities | N/A | N/A | N/A | N/A | N/A | N/A | | N/A | N/A | N/A | N/A | N/A |

| Total Offering Amounts | | N/A | | (3) |

|

|

|

|

| Total Fees Previously Paid | | | | N/A |

|

|

|

|

| Total Fee Offsets | | | | N/A |

|

|

|

|

(1)A portion of the Class B ordinary shares, par value 1.00 peso per share, may be represented by American Depositary Shares (“ADSs”).

(2)ADSs issuable on deposit of the Class B ordinary shares, each ADS representing the right to receive 10 Class B ordinary shares, have been registered pursuant to a separate Registration Statement on Form F-6 (File No. 333-175170).

(3)In accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended, the registrant is deferring payment of all of the registration fee. In connection with the securities offered hereby, the registrant will pay “pay-as-you-go registration fees” in accordance with Rule 456(b). The registrant will calculate the registration fee applicable to an offer of securities pursuant to this registration statement based on the fee payment rate in effect on the date of such fee payment.

(4)An indeterminate aggregate offering price or number of securities is being registered as may be offered or sold hereunder from time to time at indeterminate prices.

Ladies and Gentlemen:

We have acted as special Argentine counsel to Grupo Financiero Galicia S.A. (the “Company”), in connection with the preparation and filing by the Company with the Securities and Exchange Commission (the “SEC”), under the U.S. Securities Act of 1933, as amended, of a Registration Statement on Form F-3 of the Company (the “Registration Statement”), relating to the offering from time to time of Class "B" ordinary shares of the Company, par value 1.00 Argentine Peso and one vote per share (the “Class B Ordinary Shares”), in the form of American Depositary Shares (“ADSs”). Each ADS represents 10 Class B Ordinary Shares.

In our capacity as special Argentine counsel to the Company, we have examined the Registration Statement and the by-laws of the Company, as amended. In addition, we have reviewed the originals or copies, certified or otherwise, of such other documents and corporate records of the Company and such other instruments and other certificates of officers and representatives of the Company and such other persons, and have made investigations of laws, as we deemed appropriate as a basis for the opinions expressed below.

In giving this opinion, we have made the following assumptions:

(a) the authenticity of all documents submitted to us as originals and certified copies;

(b) the conformity to original documents of all documents submitted to us as copies;

(c) the authenticity of the originals of such copies;

(d) that signatures, stamps and seals on all documents examined by us (whether original documents or copies of such documents) are genuine;

(e) that all documents relevant for the purpose of giving the opinions set forth herein have been validly authorized, executed, and delivered by all parties thereto (other than the Company);

(f) that no amendment have been or will be made to the documents examined by us and that such documents remain true, complete, accurate and in full force and effect;

(g) that all consents, licenses, approvals, authorizations, notices, waivers, filings and registrations that are necessary under any applicable law or regulation (other than the laws and regulations of Argentina) in order to permit the performance of the actions to be carried out under the Registration Statement have been or will be duly made or obtained and are, or will be, in full force and effect;

(h) the truth and accuracy of the representations and all matters of fact set forth in all relevant documents furnished to us by the Company, its subsidiaries and their officers and directors (but not any legal conclusion to the extent we express an opinion with respect thereto);

(i) that there are no facts or circumstances or matters or documents which may be material to the opinion set out herein which, notwithstanding our reasonable inquiry, have not been disclosed to us; and

(j) that no petition has been presented to, or order made by, a court or other governmental authority for the winding-up, composition proceedings, liquidation, dissolution, or bankruptcy of the Company or any of its subsidiaries.

We express no opinion as to any laws other than the laws of Argentina as in effect at the date of this opinion and we have assumed that there is nothing in any other law that affects our opinion. In particular, we have made no independent investigation of the laws of the State of New York

or of any other jurisdiction, as a basis for the opinions stated herein and do not express or imply any opinion on such laws.

Based upon and subject to the above, we are of the opinion that:

| | | | | |

(i) | the Company is a corporation (sociedad anónima) duly organized and validly existing as a corporation in good standing under the laws of Argentina and has all corporate power and authority necessary to conduct its business as currently conducted; |

| | | | | |

(ii) | all the outstanding shares of capital stock of the Company have been duly authorized, validly issued, and subscribed, and are fully paid and non-assessable under the laws of Argentina; and |

| | | | | |

(iii) | when the Class B Ordinary Shares underlying the ADSs have been issued in accordance with the terms as set out in the Registration Statement and any related prospectus supplement relating to the issuance, offer and sale of such Class B Ordinary Shares, and such Class B Ordinary Shares are sold and delivered to, and fully paid for by, the purchasers at a price specified in any such related prospectus supplement, such Class B Ordinary Shares will be duly authorized, validly and legally issued, fully paid, and non-assessable under the laws of Argentina. |

This opinion is limited to the matters expressly stated herein and does not extend to and is not to be read as extended by implication to, any other matter.

We hereby consent to the filing of this opinion with the SEC as Exhibit 5.1 to the Registration Statement and to the reference to us under the captions “Legal Matters” and “Enforceability of Certain Civil Liabilities” in the prospectus constituting a part of the Registration Statement, as counsel to the Company who has passed on the validity of the Class B Ordinary Shares being registered by the Registration Statement. In giving such consent we do not admit that we come within the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended.

| | |

|

Sincerely yours, |

|

/s/ Beccar Varela |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form F-3 of Grupo Financiero Galicia S.A. of our report dated April 26, 2024, except for the effects of the recast of the financial statements to measure them in equivalent purchasing power units as of September 30, 2024, as described in Note 1.1.(a) to the consolidated financial statements, as to which the date is November 26, 2024, relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in Grupo Financiero Galicia S.A.'s Current Report on Form 6-K dated November 26, 2024. We also consent to the reference to us under the heading “Experts” in such Registration Statement.

/s/ PRICE WATERHOUSE & CO. S.R.L.

____________________________

/s/ María Mercedes Baño

Buenos Aires, Argentina

November 26, 2024

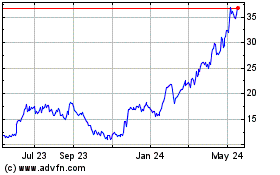

Grupo Financiero Galicia (NASDAQ:GGAL)

Historical Stock Chart

From Nov 2024 to Dec 2024

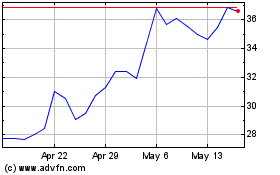

Grupo Financiero Galicia (NASDAQ:GGAL)

Historical Stock Chart

From Dec 2023 to Dec 2024