0000882095false00008820952025-02-112025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): February 11, 2025

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 000-19731 | 94-3047598 |

| (State or Other Jurisdiction of Incorporation) | (Commission File No.) | (IRS Employer Identification No.) |

333 Lakeside Drive, Foster City, California

(Address of principal executive offices)

94404

(Zip Code)

650-574-3000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value, $0.001 per share | | GILD | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Section 2 - FINANCIAL INFORMATION

Item 2.02 Results of Operations and Financial Condition.

On February 11, 2025, Gilead Sciences, Inc., a Delaware corporation (“Gilead”), issued a press release announcing its financial results for the quarter and year ended December 31, 2024. A copy of the press release is filed as Exhibit 99.1 to this report.

Gilead has presented certain financial information in accordance with U.S. generally accepted accounting principles (“GAAP”) and also on a non-GAAP basis. Management believes this non-GAAP information is useful for investors, when considered in conjunction with Gilead’s GAAP financial statements, because management uses such information internally for its operating, budgeting and financial planning purposes. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of Gilead’s operating results as reported under GAAP. Non-GAAP measures may be defined and calculated differently by other companies in the same industry. A reconciliation between GAAP and non-GAAP financial information is provided in the tables on pages 11, 12 and 13 of the press release filed as Exhibit 99.1 to this report.

The information in Item 2.02 and Item 9.01 of this Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Section 9 - FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| GILEAD SCIENCES, INC. |

| (Registrant) |

| /s/ ANDREW D. DICKINSON |

Andrew D. Dickinson

Chief Financial Officer |

Date: February 11, 2025

Exhibit Index

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

GILEAD SCIENCES ANNOUNCES FOURTH QUARTER AND FULL YEAR 2024 FINANCIAL RESULTS

Product Sales Excluding Veklury Increased 8% Year-Over-Year to $26.8 billion for Full Year 2024

Biktarvy Sales Increased 13% Year-Over-Year to $13.4 billion for Full Year 2024

Oncology Sales Increased 12% Year-Over-Year to $3.3 billion for Full Year 2024

Foster City, CA, February 11, 2025 - Gilead Sciences, Inc. (Nasdaq: GILD) announced today its results of operations for the fourth quarter and full year 2024.

“Gilead delivered another exceptionally strong full year and fourth quarter, with growth in our base business product sales of 8% for 2024 and 13% year-over-year for the fourth quarter,” said Daniel O’Day, Gilead’s Chairman and Chief Executive Officer. “From this foundation of commercial strength, we are planning for the potential launch of lenacapavir for HIV PrEP in Summer 2025, with its unique opportunity to extend the reach of HIV prevention. This potential in HIV, along with our strong and diverse portfolio, and improved operational efficiencies, positions Gilead to deliver increasing patient impact and compelling shareholder returns in the years ahead.”

Fourth Quarter 2024 Financial Results

•Total fourth quarter 2024 revenue increased 6% to $7.6 billion compared to the same period in 2023, primarily due to higher sales in HIV, as well as in Oncology and Liver Disease, partially offset by lower sales of Veklury® (remdesivir).

•Diluted Earnings Per Share (“EPS”) increased to $1.42 in the fourth quarter 2024 compared to $1.14 in the same period in 2023, primarily driven by lower costs of goods sold, higher product sales and lower acquired in-process research and development ("IPR&D") expenses, partially offset by higher operating expenses as well as unrealized losses on equity investments in 2024 compared to gains in 2023.

•Non-GAAP diluted EPS increased to $1.90 in the fourth quarter 2024 compared to $1.72 in the same period in 2023. The increase was primarily driven by higher product sales and lower acquired IPR&D expenses, partially offset by higher operating expenses.

•As of December 31, 2024, Gilead had $10.0 billion of cash, cash equivalents and marketable debt securities compared to $8.4 billion as of December 31, 2023.

•During the fourth quarter 2024, Gilead generated $3.0 billion in operating cash flow.

•During the fourth quarter 2024, Gilead issued senior unsecured notes in an aggregate principal amount of $3.5 billion, paid cash dividends of $973 million and utilized $350 million to repurchase common stock.

Fourth Quarter 2024 Product Sales

Total fourth quarter 2024 product sales increased 7% to $7.5 billion compared to the same period in 2023. Total product sales excluding Veklury increased 13% to $7.2 billion compared to the same period in 2023, primarily due to higher sales in HIV, as well as in Oncology and Liver Disease.

HIV product sales increased 16% to $5.5 billion in the fourth quarter 2024 compared to the same period in 2023, primarily driven by higher demand, higher average realized price and favorable inventory dynamics.

•Biktarvy® (bictegravir 50mg/emtricitabine (“FTC”) 200mg/tenofovir alafenamide (“TAF”) 25mg) sales increased 21% to $3.8 billion in the fourth quarter 2024 compared to the same period in 2023, primarily driven by higher demand, favorable inventory dynamics and higher average realized price.

•Descovy® (FTC 200mg/TAF 25mg) sales increased 21% to $616 million in the fourth quarter 2024 compared to the same period in 2023, primarily driven by higher demand, higher average realized price and favorable inventory dynamics.

The Liver Disease portfolio sales increased 4% to $719 million in the fourth quarter 2024 compared to the same period in 2023. This was primarily driven by the launch of Livdelzi® (seladelpar) in primary biliary cholangitis (“PBC”), and increased demand in products for chronic hepatitis B virus (“HBV”) and chronic hepatitis delta virus (“HDV”), partially offset by lower demand and average realized price in products for chronic hepatitis C virus (“HCV”).

Veklury sales decreased 53% to $337 million in the fourth quarter 2024 compared to the same period in 2023, primarily driven by lower rates of COVID-19 related hospitalizations, particularly in the United States.

Cell Therapy product sales increased 5% to $488 million in the fourth quarter 2024 compared to the same period in 2023.

•Yescarta® (axicabtagene ciloleucel) sales increased 6% to $390 million in the fourth quarter 2024 compared to the same period in 2023, primarily driven by higher average realized price and increased demand outside of the United States, partially offset by lower demand in the United States.

•Tecartus® (brexucabtagene autoleucel) sales of $98 million in the fourth quarter 2024 were flat compared to the same period in 2023, reflecting increased demand outside of the United States, offset by lower demand in the United States.

Trodelvy® (sacituzumab govitecan-hziy) sales increased 19% to $355 million in the fourth quarter 2024 compared to the same period in 2023, primarily driven by increased demand in all regions, as well as higher average realized price.

Fourth Quarter 2024 Product Gross Margin, Operating Expenses and Tax

•Product gross margin was 79.0% in the fourth quarter 2024 compared to 70.4% in the same period in 2023, primarily driven by prior year restructuring expenses related to changes in our manufacturing strategy. Non-GAAP product gross margin was 86.7% in the fourth quarter 2024 compared to 86.1% in the same period in 2023.

•Research and development (“R&D”) expenses were $1.6 billion in the fourth quarter 2024 compared to $1.4 billion in the same period in 2023, primarily due to incremental investments and clinical activities across our portfolio and the impact of a prior year valuation adjustment to the MYR-related contingent consideration that did not repeat. Non-GAAP R&D expenses were $1.6 billion in the fourth quarter 2024 compared to $1.5 billion in the same period in 2023, primarily due to incremental investments and clinical activities across our portfolio.

•Acquired IPR&D expenses were $(11) million in the fourth quarter 2024, reflecting expenses related to the Terray Therapeutics, Inc. (“Terray”) and Tubulis GmbH (“Tubulis”) collaborations, offset by a favorable adjustment related to the CymaBay Therapeutics, Inc. (“CymaBay”) acquisition.

•Selling, general and administrative (“SG&A”) and non-GAAP SG&A expenses were $1.9 billion in the fourth quarter 2024 compared to $1.6 billion in the same period in 2023, primarily driven by a litigation accrual and higher sales and marketing spending, including launch preparation activities for lenacapavir for the investigational use of HIV pre-exposure prophylaxis (“PrEP”) as well as for Livdelzi.

•The effective tax rate (“ETR”) was 17.8% in the fourth quarter 2024 compared to 14.3% in the same period in 2023, primarily due to prior year settlements with tax authorities and non-taxable unrealized gains and losses on equity investments. Non-GAAP ETR was 19.2% in the fourth quarter 2024 compared to 17.1% in the same period in 2023, primarily due to prior year settlements with tax authorities.

Full Year 2024 Financial Results

•Total full year 2024 revenue increased 6% to $28.8 billion compared to 2023, primarily due to higher sales in HIV, Oncology and Liver Disease, partially offset by lower sales of Veklury.

•Diluted EPS decreased to $0.38 in the full year 2024 compared to $4.50 in 2023. The decrease was primarily driven by a pre-tax IPR&D impairment charge of $4.2 billion, or $2.49 per share net of tax impact, related to assets acquired by Gilead from Immunomedics, Inc. (“Immunomedics”) in 2020, and acquired IPR&D charges of $3.9 billion, or $3.14 per share, in the first quarter 2024 related to the acquisition of CymaBay, partially offset by higher product sales.

•Non-GAAP diluted EPS decreased to $4.62 in the full year 2024 compared to $6.72 in 2023. This was primarily driven by higher acquired IPR&D expenses related to the CymaBay acquisition and higher income tax expense, partially offset by higher product sales.

Full Year 2024 Product Sales

Total full year 2024 product sales increased 6% to $28.6 billion compared to 2023. Total product sales excluding Veklury increased 8% to $26.8 billion in the full year 2024 compared to 2023, primarily driven by higher sales in HIV, Oncology and Liver Disease.

HIV product sales increased 8% to $19.6 billion in the full year 2024 compared to 2023, primarily driven by higher demand, as well as the impact of higher average realized price.

•Biktarvy sales increased 13% to $13.4 billion in the full year 2024 compared to 2023, primarily driven by higher demand.

•Descovy sales increased 6% to $2.1 billion in the full year 2024 compared to 2023, primarily driven by higher demand, partially offset by lower average realized price.

The Liver Disease portfolio sales increased 9% to $3.0 billion in the full year 2024 compared to 2023. The increase was primarily due to higher demand across all liver diseases.

Veklury sales decreased 18% to $1.8 billion in the full year 2024 compared to 2023, primarily driven by lower rates of COVID-19 related hospitalizations.

Cell Therapy product sales increased 6% to $2.0 billion in the full year 2024 compared to 2023.

•Yescarta sales increased 5% to $1.6 billion in the full year 2024 compared to 2023, primarily driven by increased demand outside of the United States and higher average realized price, partially offset by lower demand in the United States.

•Tecartus sales increased 9% to $403 million in the full year 2024 compared to 2023, primarily driven by increased demand outside of the United States, partially offset by lower demand in the United States.

Trodelvy sales increased 24% to $1.3 billion in the full year 2024 compared to 2023, primarily driven by increased demand in all regions.

Full Year 2024 Product Gross Margin, Operating Expenses and Tax

•Product gross margin was 78.2% in the full year 2024 compared to 75.9% in 2023, primarily driven by prior year restructuring expenses related to changes in our manufacturing strategy. Non-GAAP product gross margin was 86.2% in the full year 2024 compared to 86.3% in 2023.

•R&D expenses were $5.9 billion in the full year 2024 compared to $5.7 billion in 2023, primarily driven by restructuring costs and integration expenses related to the CymaBay acquisition. Non-GAAP R&D expenses of $5.7 billion in the full year 2024 were flat compared to 2023.

•Acquired IPR&D expenses were $4.7 billion in the full year 2024 compared to $1.2 billion in 2023, primarily reflecting the acquisition of CymaBay.

•SG&A expenses of $6.1 billion in the full year 2024 were flat compared to 2023, reflecting higher sales and marketing spending, including launch preparation activities for lenacapavir for the investigational use of HIV PrEP as well as for Livdelzi, integration costs related to the acquisition of CymaBay, and restructuring expenses, offset by lower expenses related to legal matters. Non-GAAP SG&A expenses were $5.9 billion in the full year 2024 compared to $6.1 billion in 2023, primarily driven by lower expenses related to legal matters, partially offset by higher sales and marketing spending, including launch preparation activities for lenacapavir for the investigational use of HIV PrEP as well as for Livdelzi.

•The ETR was 30.5% in the full year 2024 compared to 18.2% in 2023, primarily driven by the non-deductible acquired IPR&D charge for CymaBay and prior year decrease in tax reserves that did not repeat, partially offset by the tax impact of a legal entity restructuring and Immunomedics IPR&D impairment expense, as well as current year settlements with tax authorities and remeasurement of certain deferred tax liabilities. Non-GAAP ETR was 25.9% in the full year 2024 compared to 15.2% in 2023, primarily due to the non-deductible acquired IPR&D charge for CymaBay and a prior year decrease in tax reserves that did not repeat, partially offset by current year settlements with tax authorities.

Guidance and Outlook

For the full-year 2025, Gilead expects:

| | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share amounts) | | February 11, 2025 Guidance | | | | |

| Low End | | High End | | | | | | |

| Product sales | | $ | 28,200 | | | $ | 28,600 | | | | | | | |

| Product sales excluding Veklury | | $ | 26,800 | | | $ | 27,200 | | | | | | | |

| Veklury | | $ | 1,400 | | | $ | 1,400 | | | | | | | |

| Diluted EPS | | $ | 5.95 | | | $ | 6.35 | | | | | | | |

| Non-GAAP diluted EPS | | $ | 7.70 | | | $ | 8.10 | | | | | | | |

Additional information and a reconciliation between GAAP and non-GAAP financial information for the 2025 guidance is provided in the accompanying tables. The financial guidance is subject to a number of risks and uncertainties. See the Forward-Looking Statements section below.

Key Updates Since Our Last Quarterly Release

Virology

•Presented new HIV data at the International Congress on Drug Therapy in HIV Infection (“HIV Glasgow 2024”). This included full results from the Phase 3 PURPOSE 2 trial evaluating investigational twice-yearly lenacapavir for HIV prevention among cisgender men and gender-diverse people, with data published in the New England Journal of Medicine.

•Additionally at HIV Glasgow 2024, presented new HIV treatment research data from Biktarvy, as well as for investigational regimens with once-daily, once-weekly and twice-yearly dosing frequencies.

•Completed the New Drug Application submissions to U.S. Food and Drug Administration (“FDA”), as well as a marketing authorization application and an EU-Medicines for All application to the European Medicines Agency (“EMA”), for twice-yearly lenacapavir for HIV prevention.

•Lenacapavir named by Science Magazine as its 2024 “Breakthrough of the Year,” based in part on the PURPOSE 1 and PURPOSE 2 trial results.

Oncology

•Our partner, Arcellx, Inc. (“Arcellx”), presented new data evaluating investigational anitocabtagene autoleucel (“anito-cel”) in relapsed or refractory (“R/R”) multiple myeloma at the American Society of Hematology 2024 Annual Meeting (“ASH 2024”). This included preliminary data from the registrational Phase 2 iMMagine-1 trial, as well as updated Phase 1 data.

•Presented new data at ASH 2024 including long-term follow-up of Yescarta in R/R non-Hodgkin’s lymphoma and Tecartus in R/R mantle cell lymphoma, as well as real world data for Yescarta in R/R large B-cell lymphoma and Tecartus in B-cell precursor adult acute lymphoblastic leukemia.

•Granted Breakthrough Therapy Designation by FDA to Trodelvy for the treatment of adult patients with extensive-stage small cell lung cancer (“ES-SCLC”) whose disease has progressed on or after platinum-based chemotherapy. The use of Trodelvy in ES-SCLC is investigational.

•Entered into a single-asset focused collaboration, license, and option agreement with Tubulis to develop an antibody-drug conjugate candidate for a solid tumor target using Tubulis’ Tubutecan and Alco5 platforms.

Inflammation

•Received a positive opinion from the EMA’s Committee for Medicinal Products for Human Use recommending seladelpar for the treatment of PBC in combination with ursodeoxycholic acid (“UDCA”) in adults who have an inadequate response to UDCA alone, or as monotherapy in those unable to tolerate UDCA.

•Received marketing authorization from the Medicines and Healthcare products Regulatory Agency in the UK for seladelpar for treatment of PBC, including pruritus, in adults in combination with UDCA who have an inadequate response to UDCA alone, or as monotherapy in those unable to tolerate UDCA.

•Presented new data evaluating seladelpar in PBC at the American Association for the Study of Liver Diseases’ The Liver Meeting. This included longer-term follow-up data from the ASSURE trial, as well as additional analyses from the RESPONSE trial.

•Announced a strategic partnership to develop and commercialize the pre-clinical oral STAT6 program of LEO Pharma A/S (“LEO Pharma”) for the potential treatment of inflammatory diseases.

Corporate

•Appointed Dietmar Berger, MD, PhD, as Chief Medical Officer effective January 2025.

•Entered into a strategic research collaboration with Terray to discover and develop novel, small molecule therapies across multiple targets using Terray’s artificial intelligence tNOVA platform.

•Reached a final settlement agreement with the U.S. Department of Justice and the U.S. Department of Health and Human Services on patents that the government alleged covered Truvada® (FTC 200mg/tenofovir disoproxil fumarate (“TDF”) 300mg) and Descovy for HIV PrEP.

•Issued $3.5 billion aggregate principal amount of senior unsecured notes in a registered offering.

•The Board declared a quarterly dividend of $0.79 per share of common stock for the first quarter of 2025. The dividend is payable on March 28, 2025, to stockholders of record at the close of business on March 14, 2025. Future dividends will be subject to Board approval.

Certain amounts and percentages in this press release may not sum or recalculate due to rounding.

Conference Call

At 1:30 p.m. Pacific Time today, Gilead will host a conference call to discuss Gilead’s results. A live webcast will be available on http://investors.gilead.com and will be archived on www.gilead.com for one year.

Non-GAAP Financial Information

The information presented in this document has been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), unless otherwise noted as non-GAAP. Management believes non-GAAP information is useful for investors, when considered in conjunction with Gilead’s GAAP financial information, because management uses such information internally for its operating, budgeting and financial planning purposes. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of Gilead’s operating results as reported under GAAP. Non-GAAP financial information generally excludes acquisition-related expenses including amortization of acquired intangible assets and other items that are considered unusual or not representative of underlying trends of Gilead’s business, fair value adjustments of equity securities and discrete and related tax charges or benefits associated with such exclusions as well as changes in tax-related laws and guidelines, transfers of intangible assets between certain legal entities, and legal entity restructurings. Although Gilead consistently excludes the amortization of acquired intangible assets from the non-GAAP financial information, management believes that it is important for investors to understand that such intangible assets were recorded as part of acquisitions and contribute to ongoing revenue generation. Non-GAAP measures may be defined and calculated differently by other companies in the same industry. Reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures are provided in the accompanying tables.

About Gilead Sciences

Gilead Sciences, Inc. is a biopharmaceutical company that has pursued and achieved breakthroughs in medicine for more than three decades, with the goal of creating a healthier world for all people. The company is committed to advancing innovative medicines to prevent and treat life-threatening diseases, including HIV, viral hepatitis, COVID-19, cancer and inflammation. Gilead operates in more than 35 countries worldwide, with headquarters in Foster City, California.

Forward-Looking Statements

Statements included in this press release that are not historical in nature are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Gilead cautions readers that forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include those relating to: Gilead’s ability to achieve its full year 2025 financial guidance, including as a result of the uncertainty of the amount and timing of Veklury revenues; Gilead’s ability to make progress on any of its long-term ambitions or priorities laid out in its corporate strategy; Gilead’s ability to accelerate or sustain revenues for its virology, oncology and other programs; Gilead’s ability to realize the potential benefits of acquisitions, collaborations or licensing arrangements, including the arrangements with Arcellx, LEO Pharma, Terray and Tubulis; patent protection and estimated loss of exclusivity for our products and product candidates; Gilead’s ability to initiate, progress or complete clinical trials within currently anticipated timeframes or at all, the possibility of unfavorable results from ongoing and additional clinical trials, including those involving Biktarvy, Tecartus, Trodelvy, Yescarta, anito-cel, lenacapavir and seladelpar (such as the ASSURE, iMMagine-1, PURPOSE 1 and 2, and RESPONSE studies), and the risk that safety and efficacy data from clinical trials may not warrant further development of Gilead’s product candidates or the product candidates of Gilead’s strategic partners; Gilead’s ability to submit new

drug applications for new product candidates or expanded indications in the currently anticipated timelines, including for lenacapavir for HIV PrEP and seladelpar for PBC; Gilead’s ability to receive or maintain regulatory approvals in a timely manner or at all, and the risk that any such approvals, if granted, may be subject to significant limitations on use and may be subject to withdrawal or other adverse actions by the applicable regulatory authority; Gilead’s ability to successfully commercialize its products; the risk of potential disruptions to the manufacturing and supply chain of Gilead’s products; pricing and reimbursement pressures from government agencies and other third parties, including required rebates and other discounts; a larger than anticipated shift in payer mix to more highly discounted payer segments; market share and price erosion caused by the introduction of generic versions of Gilead products; the risk that physicians and patients may not see advantages of Gilead’s products over other therapies and may therefore be reluctant to prescribe the products, including Livdelzi; and other risks identified from time to time in Gilead’s reports filed with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. In addition, Gilead makes estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosures. Gilead bases its estimates on historical experience and on various other market specific and other relevant assumptions that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. There may be other factors of which Gilead is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ significantly from these estimates. Further, results for the quarter ended December 31, 2024 are not necessarily indicative of operating results for any future periods. Gilead directs readers to its press releases, annual reports on Form 10-K, quarterly reports on Form 10-Q and other subsequent disclosure documents filed with the SEC. Gilead claims the protection of the Safe Harbor contained in the Private Securities Litigation Reform Act of 1995 for forward-looking statements.

The reader is cautioned that forward-looking statements are not guarantees of future performance and is cautioned not to place undue reliance on these forward-looking statements. All forward-looking statements are based on information currently available to Gilead and Gilead assumes no obligation to update or supplement any such forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statements.

# # #

Gilead owns or has rights to various trademarks, copyrights and trade names used in its business, including the following: GILEAD®, GILEAD SCIENCES®, KITETM, AMBISOME®, ATRIPLA®, BIKTARVY®, CAYSTON®, COMPLERA®, DESCOVY®, DESCOVY FOR PREP®, EMTRIVA®, EPCLUSA®, EVIPLERA®, GENVOYA®, HARVONI®, HEPCLUDEX®, HEPSERA®, JYSELECA®, LIVDELZI®, LETAIRIS®, ODEFSEY®, SOVALDI®, STRIBILD®, SUNLENCA® , TECARTUS®, TRODELVY®, TRUVADA®, TRUVADA FOR PREP®, TYBOST®, VEKLURY®, VEMLIDY®, VIREAD®, VOSEVI®, YESCARTA® and ZYDELIG®.

For more information on Gilead Sciences, Inc., please visit www.gilead.com or call the Gilead Public Affairs Department at 1-800-GILEAD-5 (1-800-445-3235).

| | | | | | | | | | | | | | | | | |

| CONTACTS: | Investors: | Jacquie Ross, CFA | investor_relations@gilead.com | |

| | Media: | Ashleigh Koss | public_affairs@gilead.com | |

GILEAD SCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| (in millions, except per share amounts) | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | | |

| Product sales | | $ | 7,536 | | | $ | 7,070 | | | $ | 28,610 | | | $ | 26,934 | |

| Royalty, contract and other revenues | | 33 | | | 45 | | | 144 | | | 182 | |

| Total revenues | | 7,569 | | | 7,115 | | | 28,754 | | | 27,116 | |

| Costs and expenses: | | | | | | | | |

| Cost of goods sold | | 1,581 | | | 2,090 | | | 6,251 | | | 6,498 | |

| Research and development expenses | | 1,641 | | | 1,408 | | | 5,907 | | | 5,718 | |

| Acquired in-process research and development expenses | | (11) | | | 347 | | | 4,663 | | | 1,155 | |

| In-process research and development impairments | | — | | | 50 | | | 4,180 | | | 50 | |

| Selling, general and administrative expenses | | 1,906 | | | 1,608 | | | 6,091 | | | 6,090 | |

| Total costs and expenses | | 5,118 | | | 5,503 | | | 27,092 | | | 19,511 | |

| Operating income | | 2,451 | | | 1,612 | | | 1,662 | | | 7,605 | |

| Interest expense | | 248 | | | 252 | | | 977 | | | 944 | |

| Other (income) expense, net | | 35 | | | (293) | | | (6) | | | (198) | |

| Income before income taxes | | 2,168 | | | 1,653 | | | 690 | | | 6,859 | |

| Income tax expense | | 385 | | | 236 | | | 211 | | | 1,247 | |

| Net income | | 1,783 | | | 1,417 | | | 480 | | | 5,613 | |

| Net loss attributable to noncontrolling interest | | — | | | (12) | | | — | | | (52) | |

| Net income attributable to Gilead | | $ | 1,783 | | | $ | 1,429 | | | $ | 480 | | | $ | 5,665 | |

| Basic earnings per share attributable to Gilead | | $ | 1.43 | | | $ | 1.15 | | | $ | 0.38 | | | $ | 4.54 | |

| Shares used in basic earnings per share attributable to Gilead calculation | | 1,248 | | | 1,248 | | | 1,247 | | | 1,248 | |

| Diluted earnings per share attributable to Gilead | | $ | 1.42 | | | $ | 1.14 | | | $ | 0.38 | | | $ | 4.50 | |

| Shares used in diluted earnings per share attributable to Gilead calculation | | 1,259 | | | 1,256 | | | 1,255 | | | 1,258 | |

| | | | | | | | |

| Supplemental Information: | | | | | | | | |

| Cash dividends declared per share | | $ | 0.77 | | | $ | 0.75 | | | $ | 3.08 | | | $ | 3.00 | |

| Product gross margin | | 79.0 | % | | 70.4 | % | | 78.2 | % | | 75.9 | % |

| Research and development expenses as a % of revenues | | 21.7 | % | | 19.8 | % | | 20.5 | % | | 21.1 | % |

| Selling, general and administrative expenses as a % of revenues | | 25.2 | % | | 22.6 | % | | 21.2 | % | | 22.5 | % |

| Operating margin | | 32.4 | % | | 22.7 | % | | 5.8 | % | | 28.0 | % |

| Effective tax rate | | 17.8 | % | | 14.3 | % | | 30.5 | % | | 18.2 | % |

GILEAD SCIENCES, INC.

TOTAL REVENUE SUMMARY

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Twelve Months Ended | | |

| | December 31, | | | | December 31, | | |

| (in millions, except percentages) | | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| Product sales: | | | | | | | | | | | | |

| HIV | | $ | 5,452 | | | $ | 4,693 | | | 16% | | $ | 19,612 | | | $ | 18,175 | | | 8% |

Liver Disease | | 719 | | | 691 | | | 4% | | 3,021 | | | 2,784 | | | 9% |

| Oncology | | 843 | | | 765 | | | 10% | | 3,289 | | | 2,932 | | | 12% |

| Other | | 184 | | | 201 | | | (8)% | | 889 | | | 859 | | | 3% |

| Total product sales excluding Veklury | | 7,198 | | | 6,350 | | | 13% | | 26,811 | | | 24,750 | | | 8% |

| Veklury | | 337 | | | 720 | | | (53)% | | 1,799 | | | 2,184 | | | (18)% |

| Total product sales | | 7,536 | | | 7,070 | | | 7% | | 28,610 | | | 26,934 | | | 6% |

| Royalty, contract and other revenues | | 33 | | | 45 | | | (26)% | | 144 | | | 182 | | | (21)% |

| Total revenues | | $ | 7,569 | | | $ | 7,115 | | | 6% | | $ | 28,754 | | | $ | 27,116 | | | 6% |

GILEAD SCIENCES, INC.

NON-GAAP FINANCIAL INFORMATION(1)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Twelve Months Ended | | |

| | December 31, | | | | December 31, | | |

| (in millions, except percentages) | | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| Non-GAAP: | | | | | | | | | | | | |

| Cost of goods sold | | $ | 1,002 | | | $ | 980 | | | 2% | | $ | 3,936 | | | $ | 3,697 | | | 6% |

| Research and development expenses | | $ | 1,612 | | | $ | 1,452 | | | 11% | | $ | 5,732 | | | $ | 5,720 | | | —% |

Acquired IPR&D expenses(2) | | $ | (11) | | | $ | 347 | | | NM | | $ | 4,663 | | | $ | 1,155 | | | NM |

| Selling, general and administrative expenses | | $ | 1,852 | | | $ | 1,597 | | | 16% | | $ | 5,903 | | | $ | 6,060 | | | (3)% |

| Other (income) expense, net | | $ | (91) | | | $ | (104) | | | (13)% | | $ | (279) | | | $ | (365) | | | (24)% |

| Diluted EPS | | $ | 1.90 | | | $ | 1.72 | | | 10% | | $ | 4.62 | | | $ | 6.72 | | | (31)% |

| Shares used in non-GAAP diluted earnings per share attributable to Gilead calculation | | 1,259 | | 1,256 | | —% | | 1,255 | | 1,258 | | —% |

| | | | | | | | | | | | |

| Product gross margin | | 86.7 | % | | 86.1 | % | | 56 bps | | 86.2 | % | | 86.3 | % | | -3 bps |

| Research and development expenses as a % of revenues | | 21.3 | % | | 20.4 | % | | 89 bps | | 19.9 | % | | 21.1 | % | | -116 bps |

| Selling, general and administrative expenses as a % of revenues | | 24.5 | % | | 22.4 | % | | 203 bps | | 20.5 | % | | 22.3 | % | | -182 bps |

| Operating margin | | 41.1 | % | | 38.5 | % | | 265 bps | | 29.6 | % | | 38.7 | % | | -903 bps |

| Effective tax rate | | 19.2 | % | | 17.1 | % | | 210 bps | | 25.9 | % | | 15.2 | % | | 1075 bps |

________________________________

NM - Not Meaningful

(1) Refer to Non-GAAP Financial Information section above for further disclosures on non-GAAP financial measures. A reconciliation between GAAP and non-GAAP financial information is provided in the tables below.

(2) Equal to GAAP financial information.

GILEAD SCIENCES, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| (in millions, except percentages and per share amounts) | | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of goods sold reconciliation: | | | | | | | | |

| GAAP cost of goods sold | | $ | 1,581 | | | $ | 2,090 | | | $ | 6,251 | | | $ | 6,498 | |

Acquisition-related – amortization(1) | | (579) | | | (580) | | | (2,316) | | | (2,271) | |

| Restructuring | | — | | | (479) | | | — | | | (479) | |

Other(2) | | — | | | (51) | | | — | | | (51) | |

| Non-GAAP cost of goods sold | | $ | 1,002 | | | $ | 980 | | | $ | 3,936 | | | $ | 3,697 | |

| | | | | | | | |

| Product gross margin reconciliation: | | | | | | | | |

| GAAP product gross margin | | 79.0 | % | | 70.4 | % | | 78.2 | % | | 75.9 | % |

Acquisition-related – amortization(1) | | 7.7 | % | | 8.2 | % | | 8.1 | % | | 8.4 | % |

| Restructuring | | — | % | | 6.8 | % | | (—) | % | | 1.8 | % |

Other(2) | | — | % | | 0.7 | % | | — | % | | 0.2 | % |

| Non-GAAP product gross margin | | 86.7 | % | | 86.1 | % | | 86.2 | % | | 86.3 | % |

| | | | | | | | |

| Research and development expenses reconciliation: | | | | | | | | |

| GAAP research and development expenses | | $ | 1,641 | | | $ | 1,408 | | | $ | 5,907 | | | $ | 5,718 | |

Acquisition-related – other costs(3) | | — | | | 59 | | | (78) | | | 22 | |

| Restructuring | | (30) | | | (15) | | | (98) | | | (20) | |

| Non-GAAP research and development expenses | | $ | 1,612 | | | $ | 1,452 | | | $ | 5,732 | | | $ | 5,720 | |

| | | | | | | | |

| IPR&D impairment reconciliation: | | | | | | | | |

| GAAP IPR&D impairment | | $ | — | | | $ | 50 | | | $ | 4,180 | | | $ | 50 | |

| IPR&D impairment | | — | | | (50) | | | (4,180) | | | (50) | |

| Non-GAAP IPR&D impairment | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | |

| Selling, general and administrative expenses reconciliation: | | | | | | | | |

| GAAP selling, general and administrative expenses | | $ | 1,906 | | | $ | 1,608 | | | $ | 6,091 | | | $ | 6,090 | |

Acquisition-related – other costs(3) | | (8) | | | — | | | (97) | | | (2) | |

| Restructuring | | (46) | | | (11) | | | (91) | | | (28) | |

| Non-GAAP selling, general and administrative expenses | | $ | 1,852 | | | $ | 1,597 | | | $ | 5,903 | | | $ | 6,060 | |

| | | | | | | | |

| Operating income reconciliation: | | | | | | | | |

| GAAP operating income | | $ | 2,451 | | | $ | 1,612 | | | $ | 1,662 | | | $ | 7,605 | |

Acquisition-related – amortization(1) | | 579 | | | 580 | | | 2,316 | | | 2,271 | |

Acquisition-related – other costs(3) | | 8 | | | (59) | | | 174 | | | (20) | |

| Restructuring | | 76 | | | 505 | | | 188 | | | 527 | |

| IPR&D impairment | | — | | | 50 | | | 4,180 | | | 50 | |

Other(2) | | — | | | 51 | | | — | | | 51 | |

| Non-GAAP operating income | | $ | 3,114 | | | $ | 2,739 | | | $ | 8,520 | | | $ | 10,484 | |

| | | | | | | | |

| Operating margin reconciliation: | | | | | | | | |

| GAAP operating margin | | 32.4 | % | | 22.7 | % | | 5.8 | % | | 28.0 | % |

Acquisition-related – amortization(1) | | 7.6 | % | | 8.1 | % | | 8.1 | % | | 8.4 | % |

Acquisition-related – other costs(3) | | 0.1 | % | | (0.8) | % | | 0.6 | % | | (0.1) | % |

| Restructuring | | 1.0 | % | | 7.1 | % | | 0.7 | % | | 1.9 | % |

| IPR&D impairment | | — | % | | 0.7 | % | | 14.5 | % | | 0.2 | % |

Other(2) | | — | % | | 0.7 | % | | — | % | | 0.2 | % |

| Non-GAAP operating margin | | 41.1 | % | | 38.5 | % | | 29.6 | % | | 38.7 | % |

| | | | | | | | |

| Other (income) expense, net reconciliation: | | | | | | | | |

| GAAP other (income) expense, net | | $ | 35 | | | $ | (293) | | | $ | (6) | | | $ | (198) | |

| (Loss) gain from equity securities, net | | (126) | | | 189 | | | (274) | | | (167) | |

| Non-GAAP other (income) expense, net | | $ | (91) | | | $ | (104) | | | $ | (279) | | | $ | (365) | |

GILEAD SCIENCES, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION - (Continued)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| (in millions, except percentages and per share amounts) | | 2024 | | 2023 | | 2024 | | 2023 |

| Income before income taxes reconciliation: | | | | | | | | |

| GAAP income before income taxes | | $ | 2,168 | | | $ | 1,653 | | | $ | 690 | | | $ | 6,859 | |

Acquisition-related – amortization(1) | | 579 | | | 580 | | | 2,316 | | | 2,271 | |

Acquisition-related – other costs(3) | | 8 | | | (59) | | | 174 | | | (20) | |

| Restructuring | | 76 | | | 505 | | | 188 | | | 527 | |

| IPR&D impairment | | — | | | 50 | | | 4,180 | | | 50 | |

| Loss (gain) from equity securities, net | | 126 | | | (189) | | | 274 | | | 167 | |

Other(2) | | — | | | 51 | | | — | | | 51 | |

| Non-GAAP income before income taxes | | $ | 2,956 | | | $ | 2,591 | | | $ | 7,822 | | | $ | 9,905 | |

| | | | | | | | |

| Income tax expense reconciliation: | | | | | | | | |

| GAAP income tax (benefit) expense | | $ | 385 | | | $ | 236 | | | $ | 211 | | | $ | 1,247 | |

| Income tax effect of non-GAAP adjustments: | | | | | | | | |

Acquisition-related – amortization(1) | | 121 | | | 119 | | | 484 | | | 466 | |

Acquisition-related – other costs(3) | | 2 | | | 1 | | | 41 | | | 9 | |

| Restructuring | | 16 | | | 90 | | | 37 | | | 95 | |

| IPR&D impairment | | — | | | 15 | | | 1,051 | | | 15 | |

| Loss (gain) from equity securities, net | | 13 | | | (18) | | | (39) | | | (14) | |

Discrete and related tax charges(4) | | 29 | | | (12) | | | 243 | | | (326) | |

Other(2) | | — | | | 11 | | | — | | | 11 | |

| Non-GAAP income tax expense | | $ | 566 | | | $ | 442 | | | $ | 2,028 | | | $ | 1,503 | |

| | | | | | | | |

| Effective tax rate reconciliation: | | | | | | | | |

| GAAP effective tax rate | | 17.8 | % | | 14.3 | % | | 30.5 | % | | 18.2 | % |

Income tax effect of above non-GAAP adjustments and discrete and related tax adjustments(4) | | 1.4 | % | | 2.8 | % | | (4.6) | % | | (3.0) | % |

| Non-GAAP effective tax rate | | 19.2 | % | | 17.1 | % | | 25.9 | % | | 15.2 | % |

| | | | | | | | |

| Net income attributable to Gilead reconciliation: | | | | | | | | |

| GAAP net income attributable to Gilead | | $ | 1,783 | | | $ | 1,429 | | | $ | 480 | | | $ | 5,665 | |

Acquisition-related – amortization(1) | | 458 | | | 460 | | | 1,832 | | | 1,805 | |

Acquisition-related – other costs(3) | | 6 | | | (59) | | | 134 | | | (29) | |

| Restructuring | | 59 | | | 414 | | | 151 | | | 431 | |

| IPR&D impairment | | — | | | 35 | | | 3,129 | | | 35 | |

| Loss (gain) from equity securities, net | | 113 | | | (171) | | | 313 | | | 180 | |

Discrete and related tax charges(4) | | (29) | | | 12 | | | (243) | | | 326 | |

Other(2) | | — | | | 40 | | | — | | | 40 | |

| Non-GAAP net income attributable to Gilead | | $ | 2,390 | | | $ | 2,161 | | | $ | 5,795 | | | $ | 8,454 | |

| | | | | | | | |

| Diluted earnings per share reconciliation: | | | | | | | | |

| GAAP diluted earnings per share | | $ | 1.42 | | | $ | 1.14 | | | $ | 0.38 | | | $ | 4.50 | |

Acquisition-related – amortization(1) | | 0.36 | | | 0.37 | | | 1.46 | | | 1.43 | |

Acquisition-related – other costs(3) | | — | | | (0.05) | | | 0.11 | | | (0.02) | |

| Restructuring | | 0.05 | | | 0.33 | | | 0.12 | | | 0.34 | |

| IPR&D impairment | | — | | | 0.03 | | | 2.49 | | | 0.03 | |

| Loss (gain) from equity securities, net | | 0.09 | | | (0.14) | | | 0.25 | | | 0.14 | |

Discrete and related tax charges(4) | | (0.02) | | | 0.01 | | | (0.19) | | | 0.26 | |

Other(2) | | — | | | 0.03 | | | — | | | 0.03 | |

| Non-GAAP diluted earnings per share | | $ | 1.90 | | | $ | 1.72 | | | $ | 4.62 | | | $ | 6.72 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| (in millions, except percentages and per share amounts) | | 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP adjustment summary: | | | | | | | | |

| Cost of goods sold adjustments | | $ | 579 | | | $ | 1,110 | | | $ | 2,315 | | | $ | 2,801 | |

| Research and development expenses adjustments | | 29 | | | (44) | | | 176 | | | (2) | |

| IPR&D impairment adjustments | | — | | | 50 | | | 4,180 | | | 50 | |

| Selling, general and administrative expenses adjustments | | 54 | | | 11 | | | 188 | | | 30 | |

Total non-GAAP adjustments to costs and expenses | | 663 | | | 1,127 | | | 6,858 | | | 2,879 | |

| Other (income) expense, net, adjustments | | 126 | | | (189) | | | 274 | | | 167 | |

| Total non-GAAP adjustments before income taxes | | 789 | | | 938 | | | 7,132 | | | 3,046 | |

| Income tax effect of non-GAAP adjustments above | | (152) | | | (218) | | | (1,574) | | | (583) | |

Discrete and related tax charges(4) | | (29) | | | 12 | | | (243) | | | 326 | |

| Total non-GAAP adjustments to net income attributable to Gilead | | $ | 607 | | | $ | 732 | | | $ | 5,315 | | | $ | 2,789 | |

______________________________(1) Relates to amortization of acquired intangibles.

(2) Relates to a write-off of an intangible asset related to the restructuring of our collaboration with Galapagos NV during the fourth quarter of 2023.

(3) Adjustments include integration expenses, contingent consideration fair value adjustments and other expenses associated with Gilead’s recent acquisitions.

(4) Represents discrete and related deferred tax charges or benefits primarily associated with acquired intangible assets and in-process research and development, transfers of intangible assets from a foreign subsidiary to Ireland and the United States, and legal entity restructurings.

GILEAD SCIENCES, INC.

RECONCILIATION OF GAAP TO NON-GAAP 2025 FULL YEAR GUIDANCE(1)

(unaudited)

| | | | | | | | |

| | |

| (in millions, except percentages and per share amounts) | | Provided February 11, 2025 |

| Projected product gross margin GAAP to non-GAAP reconciliation: | | |

| GAAP projected product gross margin | | 77.0% - 78.0% |

| Acquisition-related expenses | | ~ 8.0% |

| Non-GAAP projected product gross margin | | 85.0% - 86.0% |

| | |

| Projected operating income GAAP to non-GAAP reconciliation: | | |

| GAAP projected operating income | | $10,200 - $10,700 |

| Acquisition-related and restructuring expenses | | ~ 2,500 |

| Non-GAAP projected operating income | | $12,700 - $13,200 |

| | |

| Projected effective tax rate GAAP to non-GAAP reconciliation: | | |

| GAAP projected effective tax rate | | ~ 20% |

| Income tax effect of above non-GAAP adjustments, and discrete and related tax adjustments | | (~ 1%) |

| Non-GAAP projected effective tax rate | | ~ 19% |

| | |

| Projected diluted EPS GAAP to non-GAAP reconciliation: | | |

| GAAP projected diluted EPS | | $5.95 - $6.35 |

| Acquisition-related and restructuring expenses, and discrete and related tax adjustments | | ~ 1.75 |

| Non-GAAP projected diluted EPS | | $7.70 - $8.10 |

________________________________(1) Our full-year guidance excludes the potential impact of any (i) acquisitions or business development transactions that have not been executed, (ii) future fair value adjustments of equity securities and (iii) discrete tax charges or benefits associated with changes in tax related laws and guidelines that have not been enacted, as Gilead is unable to project such amounts. The non-GAAP full-year guidance includes non-GAAP adjustments to actual current period results as well as adjustments for the known future impact associated with events that have already occurred, such as future amortization of our intangible assets and the future impact of discrete and related deferred tax charges or benefits primarily associated with acquired intangible assets and in-process research and development, transfers of intangible assets from a foreign subsidiary to Ireland and the United States, and legal entity restructurings.

GILEAD SCIENCES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

| | | | | | | | | | | | | | |

| | December 31, |

| (in millions) | | 2024 | | 2023 |

| Assets | | | | |

| Cash, cash equivalents and marketable debt securities | | $ | 9,991 | | | $ | 8,428 | |

| Accounts receivable, net | | 4,420 | | | 4,660 | |

| Inventories | | 3,589 | | | 3,366 | |

| Property, plant and equipment, net | | 5,414 | | | 5,317 | |

| Intangible assets, net | | 19,948 | | | 26,454 | |

| Goodwill | | 8,314 | | | 8,314 | |

| Other assets | | 7,319 | | | 5,586 | |

| Total assets | | $ | 58,995 | | | $ | 62,125 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities | | $ | 12,004 | | | $ | 11,280 | |

| Long-term liabilities | | 27,744 | | | 28,096 | |

Stockholders’ equity(1) | | 19,246 | | | 22,749 | |

| Total liabilities and stockholders’ equity | | $ | 58,995 | | | $ | 62,125 | |

________________________________

(1) As of December 31, 2024 and 2023, there were 1,246 shares of common stock issued and outstanding.

GILEAD SCIENCES, INC.

SELECTED CASH FLOW INFORMATION

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | | $ | 2,975 | | | $ | 2,168 | | | $ | 10,828 | | | $ | 8,006 | |

| Net cash used in investing activities | | (225) | | | (726) | | | (3,449) | | | (2,265) | |

| Net cash used in financing activities | | 2,260 | | | (1,100) | | | (3,433) | | | (5,125) | |

| Effect of exchange rate changes on cash and cash equivalents | | (55) | | | 37 | | | (40) | | | 57 | |

| Net change in cash and cash equivalents | | 4,954 | | | 380 | | | 3,906 | | | 673 | |

| Cash and cash equivalents at beginning of period | | 5,037 | | | 5,705 | | | 6,085 | | | 5,412 | |

| Cash and cash equivalents at end of period | | $ | 9,991 | | | $ | 6,085 | | | $ | 9,991 | | | $ | 6,085 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | | $ | 2,975 | | | $ | 2,168 | | | $ | 10,828 | | | $ | 8,006 | |

| Capital expenditures | | (147) | | | (214) | | | (523) | | | (585) | |

Free cash flow(1) | | $ | 2,828 | | | $ | 1,954 | | | $ | 10,305 | | | $ | 7,421 | |

________________________________

(1) Free cash flow is a non-GAAP liquidity measure. Please refer to our disclosures in the Non-GAAP Financial Information section above.

GILEAD SCIENCES, INC.

PRODUCT SALES SUMMARY

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| HIV | | | | | | | | |

| Biktarvy – U.S. | | $ | 3,129 | | | $ | 2,588 | | | $ | 10,855 | | | $ | 9,692 | |

| Biktarvy – Europe | | 400 | | | 333 | | | 1,509 | | | 1,253 | |

| Biktarvy – Rest of World | | 246 | | | 188 | | | 1,060 | | | 905 | |

| | 3,774 | | | 3,109 | | | 13,423 | | | 11,850 | |

| | | | | | | | |

| Descovy – U.S. | | 563 | | | 457 | | | 1,902 | | | 1,771 | |

| Descovy – Europe | | 25 | | | 25 | | | 100 | | | 100 | |

| Descovy – Rest of World | | 28 | | | 28 | | | 110 | | | 114 | |

| | 616 | | | 509 | | | 2,113 | | | 1,985 | |

| | | | | | | | |

| Genvoya – U.S. | | 410 | | | 447 | | | 1,498 | | | 1,752 | |

| Genvoya – Europe | | 42 | | | 48 | | | 180 | | | 205 | |

| Genvoya – Rest of World | | 18 | | | 22 | | | 84 | | | 103 | |

| | 470 | | | 517 | | | 1,762 | | | 2,060 | |

| | | | | | | | |

| Odefsey – U.S. | | 252 | | | 258 | | | 957 | | | 1,012 | |

| Odefsey – Europe | | 74 | | | 71 | | | 290 | | | 294 | |

| Odefsey – Rest of World | | 11 | | | 11 | | | 41 | | | 44 | |

| | 336 | | | 340 | | | 1,288 | | | 1,350 | |

| | | | | | | | |

Symtuza - Revenue share(1) – U.S. | | 112 | | | 104 | | | 450 | | | 382 | |

Symtuza - Revenue share(1) – Europe | | 30 | | | 32 | | | 130 | | | 133 | |

Symtuza - Revenue share(1) – Rest of World | | 3 | | | 3 | | | 12 | | | 13 | |

| | 144 | | | 139 | | | 592 | | | 529 | |

| | | | | | | | |

Other HIV(2) – U.S. | | 67 | | | 46 | | | 257 | | | 238 | |

Other HIV(2) – Europe | | 33 | | | 25 | | | 129 | | | 116 | |

Other HIV(2) – Rest of World | | 11 | | | 9 | | | 48 | | | 47 | |

| | 111 | | | 79 | | | 434 | | | 401 | |

| | | | | | | | |

| Total HIV – U.S. | | 4,532 | | | 3,899 | | | 15,918 | | | 14,848 | |

| Total HIV – Europe | | 603 | | | 533 | | | 2,339 | | | 2,102 | |

| Total HIV – Rest of World | | 317 | | | 261 | | | 1,355 | | | 1,226 | |

| | 5,452 | | | 4,693 | | | 19,612 | | | 18,175 | |

| Liver Disease | | | | | | | | |

Sofosbuvir / Velpatasvir(3) – U.S. | | 185 | | | 216 | | | 922 | | | 859 | |

Sofosbuvir / Velpatasvir(3) – Europe | | 69 | | | 74 | | | 299 | | | 323 | |

Sofosbuvir / Velpatasvir(3) – Rest of World | | 75 | | | 89 | | | 374 | | | 355 | |

| | 330 | | | 378 | | | 1,596 | | | 1,537 | |

| | | | | | | | |

| Vemlidy – U.S. | | 148 | | | 115 | | | 486 | | | 410 | |

| Vemlidy – Europe | | 11 | | | 10 | | | 44 | | | 38 | |

| Vemlidy – Rest of World | | 100 | | | 92 | | | 428 | | | 414 | |

| | 260 | | | 217 | | | 959 | | | 862 | |

| | | | | | | | |

Other Liver Disease(4) – U.S. | | 58 | | | 39 | | | 192 | | | 152 | |

Other Liver Disease(4) – Europe | | 54 | | | 38 | | | 202 | | | 150 | |

Other Liver Disease(4) – Rest of World | | 18 | | | 19 | | | 73 | | | 83 | |

| | 130 | | | 96 | | | 467 | | | 385 | |

| | | | | | | | |

| Total Liver Disease – U.S. | | 391 | | | 370 | | | 1,601 | | | 1,421 | |

| Total Liver Disease – Europe | | 134 | | | 121 | | | 545 | | | 511 | |

| Total Liver Disease – Rest of World | | 194 | | | 200 | | | 876 | | | 852 | |

| | 719 | | | 691 | | | 3,021 | | | 2,784 | |

| | | | | | | | |

| Veklury | | | | | | | | |

| Veklury – U.S. | | 108 | | | 364 | | | 892 | | | 972 | |

| Veklury – Europe | | 80 | | | 181 | | | 284 | | | 408 | |

| Veklury – Rest of World | | 150 | | | 175 | | | 623 | | | 805 | |

| | 337 | | | 720 | | | 1,799 | | | 2,184 | |

GILEAD SCIENCES, INC.

PRODUCT SALES SUMMARY - (Continued)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Oncology | | | | | | | | |

| Cell Therapy | | | | | | | | |

| Tecartus – U.S. | | 53 | | | 66 | | | 234 | | | 245 | |

| Tecartus – Europe | | 36 | | | 27 | | | 138 | | | 110 | |

| Tecartus – Rest of World | | 10 | | | 5 | | | 31 | | | 15 | |

| | 98 | | | 98 | | | 403 | | | 370 | |

| | | | | | | | |

| Yescarta – U.S. | | 161 | | | 187 | | | 662 | | | 811 | |

| Yescarta – Europe | | 156 | | | 140 | | | 666 | | | 547 | |

| Yescarta – Rest of World | | 72 | | | 42 | | | 242 | | | 140 | |

| | 390 | | | 368 | | | 1,570 | | | 1,498 | |

| | | | | | | | |

| Total Cell Therapy – U.S. | | 213 | | | 253 | | | 896 | | | 1,055 | |

| Total Cell Therapy – Europe | | 193 | | | 167 | | | 804 | | | 658 | |

| Total Cell Therapy – Rest of World | | 82 | | | 46 | | | 274 | | | 156 | |

| | 488 | | | 466 | | | 1,973 | | | 1,869 | |

| | | | | | | | |

| Trodelvy | | | | | | | | |

| Trodelvy – U.S. | | 247 | | | 226 | | | 902 | | | 777 | |

| Trodelvy – Europe | | 77 | | | 48 | | | 294 | | | 217 | |

| Trodelvy – Rest of World | | 31 | | | 24 | | | 119 | | | 68 | |

| | 355 | | | 299 | | | 1,315 | | | 1,063 | |

| | | | | | | | |

| Total Oncology – U.S. | | 461 | | | 479 | | | 1,798 | | | 1,833 | |

| Total Oncology – Europe | | 269 | | | 216 | | | 1,098 | | | 875 | |

| Total Oncology – Rest of World | | 113 | | | 70 | | | 393 | | | 224 | |

| | 843 | | | 765 | | | 3,289 | | | 2,932 | |

| Other | | | | | | | | |

| AmBisome – U.S. | | 7 | | | 4 | | | 44 | | | 43 | |

| AmBisome – Europe | | 66 | | | 68 | | | 276 | | | 260 | |

| AmBisome – Rest of World | | 36 | | | 39 | | | 212 | | | 189 | |

| | 109 | | | 111 | | | 533 | | | 492 | |

| | | | | | | | |

Other(5) – U.S. | | 51 | | | 64 | | | 255 | | | 261 | |

Other(5) – Europe | | 8 | | | 9 | | | 34 | | | 40 | |

Other(5) – Rest of World | | 16 | | | 17 | | | 68 | | | 66 | |

| | 76 | | | 90 | | | 356 | | | 367 | |

| | | | | | | | |

| Total Other – U.S. | | 59 | | | 68 | | | 299 | | | 304 | |

| Total Other – Europe | | 74 | | | 77 | | | 310 | | | 301 | |

| Total Other – Rest of World | | 52 | | | 56 | | | 280 | | | 255 | |

| | 184 | | | 201 | | | 889 | | | 859 | |

| | | | | | | | |

| Total product sales – U.S. | | 5,550 | | | 5,180 | | | 20,508 | | | 19,377 | |

| Total product sales – Europe | | 1,160 | | | 1,128 | | | 4,576 | | | 4,197 | |

| Total product sales – Rest of World | | 826 | | | 762 | | | 3,526 | | | 3,361 | |

| | $ | 7,536 | | | $ | 7,070 | | | $ | 28,610 | | | $ | 26,934 | |

_______________________________(1) Represents Gilead’s revenue from cobicistat (“C”), FTC and TAF in Symtuza (darunavir/C/FTC/TAF), a fixed dose combination product commercialized by Janssen Sciences Ireland Unlimited Company.

(2) Includes Atripla, Complera/Eviplera, Emtriva, Stribild, Sunlenca, Truvada and Tybost.

(3) Includes Epclusa and the authorized generic version of Epclusa sold by Gilead’s separate subsidiary, Asegua Therapeutics LLC (“Asegua”).

(4) Includes ledipasvir/sofosbuvir (Harvoni and the authorized generic version of Harvoni sold by Asegua), Hepcludex, Hepsera, Livdelzi, Sovaldi, Viread and Vosevi.

(5) Includes Cayston, Jyseleca, Letairis, Ranexa and Zydelig.

v3.25.0.1

Cover Cover

|

Feb. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity Registrant Name |

GILEAD SCIENCES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-19731

|

| Entity Tax Identification Number |

94-3047598

|

| Entity Address, Address Line One |

333 Lakeside Drive

|

| Entity Address, City or Town |

Foster City

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94404

|

| City Area Code |

650

|

| Local Phone Number |

574-3000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value, $0.001 per share

|

| Trading Symbol |

GILD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000882095

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

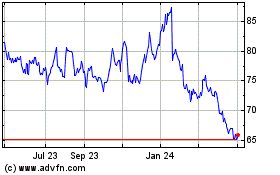

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Jan 2025 to Feb 2025

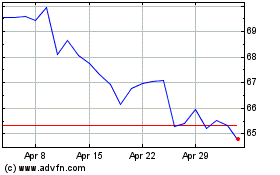

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Feb 2024 to Feb 2025