UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-41110

GRAB HOLDINGS LIMITED

3 Media Close, #01-03/06

Singapore 138498

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐

Announcement of Fourth Quarter and Full Year 2023 Results, Share Repurchase Program, and Repayment of Term Loan B

On February 22, 2024, Grab Holdings Limited (“Grab”) announced its financial results for the fourth quarter and full year ended December 31, 2023. In addition, Grab announced that its board of directors has authorized a share repurchase program, under which Grab may repurchase up to $500 million worth of its outstanding Class A ordinary shares, and the full repayment of Grab’s outstanding Term Loan B. The announcement is furnished as Exhibit 99.1 to this Report on Form 6-K.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

GRAB HOLDINGS LIMITED |

|

|

By: |

/s/ Peter Oey____ |

Date: February 22, 2024 |

|

|

Name: Peter Oey |

|

|

|

|

Title: Chief Financial Officer |

|

Exhibit 99.1

Grab Reports Fourth Quarter and Full Year 2023 Results and

Announces Inaugural Share Repurchase Program of Up to $500 Million

●Q4 2023 Revenue grew 30% year-over-year to $653 million

●Q4 2023 Profit for the period was positive at $11 million

●Q4 2023 Adjusted EBITDA improved by $146 million year-over-year to $35 million

●Grab’s Board of Directors has authorized the repurchase of up to $500 million of the Company’s Class A ordinary shares

SINGAPORE, February 22, 2024 - Grab Holdings Limited (NASDAQ: GRAB) today announced unaudited financial results for the fourth quarter and full year ended December 31, 2023.

“2023 was a pivotal year for us. We generated over $11 billion of earnings1 for our partners, achieved strong top-line growth as we exited the year with Mobility GMV above pre-COVID levels and Deliveries GMV growth re-accelerating, while also reaching Adjusted EBITDA profitability in the year,” said Anthony Tan, Group Chief Executive Officer and Co-Founder of Grab. “We will continue to execute towards sustainable and profitable growth in 2024, as we deepen engagement with our users through affordable and high value offerings, grow our Financial Services business, while continuing to outserve our driver- and merchant-partners.”

“We reported a strong set of results in the fourth quarter, recording our eighth consecutive quarter of Adjusted EBITDA improvements,” said Peter Oey, Chief Financial Officer of Grab. “As we execute on our strategies in 2024, we expect to drive continued improvements in Adjusted EBITDA and Adjusted Free Cash Flow2. In the medium term, we see between 100 to 200 basis points of upside to our Segment Adjusted EBITDA margins for Deliveries, as we continue to drive growth in On-Demand GMV3 and accelerate year-over-year revenue growth rates beyond 2024. With our robust balance sheet position, we are pleased to announce that our Board of Directors has authorized our first share repurchase program of up to $500 million and the repayment of the outstanding balance of our Term Loan B.”

__________

1 Includes earnings by driver-partners and merchant-partners. ‘Driver-partner earnings’ is defined as the fare, bonuses, tips and fees, net of commission. ‘Merchant-partner earnings’ is defined as the total order bill, including taxes charged by the restaurant/merchant net of commission, advertising spend with Grab, and promotion costs.

2 Adjusted Free Cash Flow is a non-IFRS financial measure, defined as net cash flows from operating activities less capital expenditures, excluding changes in working capital related to loans and advances to customers, and deposits from the digital banking business. For a reconciliation to the most directly comparable IFRS measure, see the section titled "Non-IFRS Financial Measures.”

Group Fourth Quarter 2023 Key Operational and Financial Highlights

|

|

|

|

|

|

|

($ in millions, unless otherwise stated) |

Q4 2023 |

|

Q4 2022 |

|

YoY % Change |

YoY % Change (Constant Currency4) |

|

(unaudited) |

|

(unaudited) |

|

|

|

Operating metrics: |

|

|

|

|

|

|

GMV |

5,441 |

|

4,997 |

|

9% |

8% |

On-Demand GMV3 |

4,122 |

|

3,499 |

|

18% |

17% |

MTUs (millions of users) |

37.7 |

|

33.6 |

|

12% |

|

GMV per MTU ($) |

144 |

|

149 |

|

-3% |

-3% |

Partner incentives |

172 |

|

174 |

|

-1% |

|

Consumer incentives |

225 |

|

238 |

|

-5% |

|

|

|

|

|

|

|

|

Financial measures: |

|

|

|

|

|

|

Revenue |

653 |

|

502 |

|

30% |

30% |

Profit/(Loss) for the period |

11 |

|

(391) |

|

NM |

|

Total Segment Adjusted EBITDA |

228 |

|

112 |

|

104% |

|

Adjusted EBITDA |

35 |

|

(111) |

|

NM |

|

Net cash used in operating activities |

(26) |

|

(23) |

|

-9% |

|

Adjusted Free Cash Flow |

1 |

|

(32) |

|

NM |

|

●Revenue grew 30% year-over-year (“YoY”) to $653 million in the fourth quarter of 2023, attributable to revenue growth across all our segments and further reductions in incentives.

●Total GMV grew 9% YoY, and 8% YoY on a constant currency basis4, primarily attributed to growth in Mobility and Deliveries GMV, with Group MTUs growing 12% YoY. Notably, On-Demand GMV3 grew 18% YoY and 3% quarter-over-quarter (“QoQ”).

__________

3 On-Demand GMV is defined as the sum of Mobility and Deliveries GMV.

4 We calculate constant currency by translating our current period financial results using the corresponding prior period’s monthly exchange rates for our transacted currencies other than the U.S. dollar.

●Foreign exchange currency fluctuations negatively impacted our results during the quarter. On a QoQ basis, Group revenue and GMV grew 6% and 2% respectively, and 9% and 4% on a constant currency basis, respectively.

●During the quarter, total incentives were further reduced to 7.3% of GMV, compared to 8.2% for the same period in 2022 as we continued to improve the health of our marketplace.

●Profit for the quarter was $11 million compared to a net loss of $391 million in the prior year period, primarily due to the improvement in Group Adjusted EBITDA, fair value changes in investments, and lowered share-based compensation expenses. The profit in the fourth quarter also benefited from the reversal of an accounting accrual no longer required.

●Group Adjusted EBITDA was $35 million for the quarter compared to negative $111 million for the same period in 2022 as we continued to grow GMV, while improving profitability on a Segment Adjusted EBITDA basis and lowering our regional corporate costs5.

●Group Adjusted EBITDA margin was 0.6% for the quarter, an improvement from (2.2)% in the fourth quarter of 2022 and from 0.5% in the third quarter of 2023.

●Regional corporate costs for the quarter were $193 million, improving from $223 million in the same period a year ago.

●Cash liquidity6 totaled $6.0 billion at the end of the fourth quarter, compared to $5.9 billion at the end of the prior quarter. Our net cash liquidity7 was $5.2 billion at the end of the fourth quarter, unchanged from $5.2 billion in the prior quarter.

●Net cash used in operating activities was $26 million in the fourth quarter of 2023 compared to $23 million in the same period in 2022, primarily driven by an increase in income taxes paid which was partially offset by an improvement in cash used in operations.

●Adjusted Free Cash Flow was $1 million in the fourth quarter of 2023, with improving Adjusted EBITDA offsetting working capital changes, capital expenditures and other operating cash expenses. Adjusted Free Cash Flow is defined as net cash flows from operating activities less capital expenditures, excluding changes in working capital related to loans and advances to customers, and deposits from the digital banking business.

__________

5 Regional corporate costs are costs that have not been attributed to any of the business segments, including certain costs of revenue, research and development expenses, general and administrative expenses and marketing expenses. These regional costs of revenue include cloud computing costs. These regional research and development expenses also include mapping and payment technologies and support and development of the internal technology infrastructure. These general and administrative expenses also include certain shared costs such as finance, accounting, tax, human resources, technology and legal costs. Regional corporate costs exclude share-based compensation expenses and capitalized software costs.

6 Cash liquidity includes cash on hand, time deposits, marketable securities and restricted cash.

7 Net cash liquidity includes cash liquidity less loans and borrowings.

Group Full Year 2023 Key Operational and Financial Highlights

|

|

|

|

|

|

|

($ in millions, unless otherwise stated) |

FY 2023 |

|

FY 2022 |

|

YoY % Change |

YoY % Change (Constant Currency) |

|

(unaudited) |

|

(unaudited) |

|

|

|

Operating metrics: |

|

|

|

|

|

|

GMV |

20,983 |

|

19,937 |

|

5% |

7% |

On-Demand GMV3 |

15,592 |

|

13,930 |

|

12% |

14% |

MTUs (millions of users) |

35.5 |

|

32.7 |

|

8% |

|

GMV per MTU ($) |

592 |

|

610 |

|

-3% |

-1% |

Partner incentives |

682 |

|

801 |

|

-15% |

|

Consumer incentives |

907 |

|

1,169 |

|

-22% |

|

|

|

|

|

|

|

|

Financial measures: |

|

|

|

|

|

|

Revenue8 |

2,359 |

|

1,433 |

|

65% |

67% |

Loss for the year |

(485) |

|

(1,740) |

|

72% |

|

Total Segment Adjusted EBITDA |

771 |

|

65 |

|

NM |

|

Adjusted EBITDA |

(22) |

|

(793) |

|

97% |

|

Net cash from/(used in) operating activities |

86 |

|

(798) |

|

NM |

|

Adjusted Free Cash Flow |

(234) |

|

(825) |

|

72% |

|

●Revenue for the full year grew 65% YoY, or 67% YoY on a constant currency basis, to $2,359 million, above our guidance of $2.31 billion to $2.33 billion. Growth was attributed to growth across all our segments, continued incentive optimization and a change in business model for certain delivery offerings in one of our markets8. Assuming the change in business model had occurred in 2022, full year 2023 Group revenue growth would have been 40% YoY and Deliveries revenue growth would have been 30% YoY.

__________

8 Deliveries revenue benefited due to a business model change implemented in Q4 2022 for certain delivery offerings in one of our markets from being an agent arranging for delivery services provided by our driver-partners to end-users, to being a principal whereby Grab is the delivery service provider contractually responsible for the delivery services provided to end-users. Assuming the change in business model had occurred in 2022, 2023 Group revenue growth would have been 40% YoY and Deliveries revenue growth would have been 30% YoY.

●Full year Group GMV grew 5% YoY, or 7% YoY on a constant currency basis to $20,983 million, driven by continued growth in Mobility and Deliveries. On-Demand GMV grew 12% YoY, or 14% YoY on a constant currency basis to $15,592 million.

●Loss for the year was $485 million, a 72% improvement YoY, primarily due to the improvements in Group Adjusted EBITDA, reduction in fair value losses on investments, and lower interest expenses and share-based compensation expenses. Non-cash expenses included $304 million in share-based compensation expenses, $145 million of depreciation and amortization and $38 million in fair value changes on investments.

●Full year Group Adjusted EBITDA was negative $22 million, an improvement of 97% compared to negative $793 million in 2022, and performed in line with our guidance of negative $25 million to negative $20 million.

●Net cash from operating activities was $86 million in 2023 as compared to net cash used in operating activities of $798 million in 2022, with the improvement driven by a decline in loss before income tax, as well as an increase in deposits from customers in the banking business.

●Adjusted Free Cash Flow2 was negative $234 million in 2023, compared to negative $825 million in 2022, mainly driven by improvements in net cash from operating activities.

Business Outlook

|

|

Financial Measure |

Guidance |

FY 2024 |

|

Revenue |

$2.70 billion - $2.75 billion 14% - 17% YoY |

Adjusted EBITDA |

$180 million - $200 million |

|

|

The guidance represents our expectations as of the date of this press release, and may be subject to change.

Segment Financial and Operational Highlights

Deliveries

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in millions, unless otherwise stated) |

Q4 2023 |

|

Q4 2022 |

|

YoY % Change |

YoY % Change |

FY 2023 |

|

FY 2022 |

|

YoY % Change |

YoY % Change |

|

(unaudited) |

|

(unaudited) |

|

|

(constant currency) |

(unaudited) |

|

(unaudited) |

|

|

(constant currency) |

Operating metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

GMV |

2,648 |

|

2,350 |

|

13% |

12% |

10,173 |

|

9,827 |

|

4% |

5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial measures: |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue8 |

321 |

|

268 |

|

20% |

21% |

1,194 |

|

663 |

|

80% |

85% |

Segment Adjusted EBITDA |

96 |

|

47 |

|

107% |

|

313 |

|

(35) |

|

NM |

|

●Deliveries revenue grew to $321 million in the fourth quarter 2023 from $268 million in the same period in 2022, and by 80% YoY for the full year 2023. The strong growth was primarily attributed to a reduction in incentives as a percentage of GMV, GMV growth, and a change in business model of certain Deliveries offerings in one of our markets. Assuming the change in business model had occurred in 2022, full year 2023 Deliveries revenue growth would have been 30% YoY.

●Deliveries GMV grew 13% YoY, or 12% YoY on a constant currency basis to $2,648 million in the fourth quarter of 2023, underpinned by an increase in spend per user, and growth in Deliveries MTUs which reached an all-time high during the quarter. On a full year basis, Deliveries GMV grew 4% YoY, and 5% YoY on a constant currency basis.

●In 2023, we continued to drive greater affordability of our services, and increased adoption rates of Saver deliveries, which offers users a lower delivery charge, in exchange for a longer delivery time, and improving batching rates. In the fourth quarter 2023, Saver deliveries now account for 23% of Deliveries transactions, and Saver users had average order frequencies in Food Deliveries that were 1.6x higher than users who have never used Saver.

●Deliveries segment adjusted EBITDA as a percentage of GMV expanded to 3.6% in the fourth quarter of 2023 from 2.0% in the same period in 2022. For the full year 2023, Deliveries segment adjusted EBITDA was $313 million, improving from negative $35 million in 2022, amid further optimization of incentives spend, improved operational efficiencies and GMV growth.

Mobility

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in millions, unless otherwise stated) |

Q4 2023 |

|

Q4 2022 |

|

YoY % Change |

YoY % Change |

FY 2023 |

|

FY 2022 |

|

YoY % Change |

YoY % Change |

|

(unaudited) |

|

(unaudited) |

|

|

(constant currency) |

(unaudited) |

|

(unaudited) |

|

|

(constant currency) |

Operating metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

GMV |

1,474 |

|

1,149 |

|

28% |

27% |

5,419 |

|

4,103 |

|

32% |

33% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial measures: |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

237 |

|

189 |

|

26% |

24% |

869 |

|

639 |

|

36% |

37% |

Segment Adjusted EBITDA |

182 |

|

152 |

|

20% |

|

676 |

|

494 |

|

37% |

|

●Mobility revenues grew strongly and rose 26% YoY, or 24% YoY on a constant currency basis, in the fourth quarter 2023, and grew by 36% YoY, or 37% YoY on a constant currency basis, for the full year 2023. The growth was mainly attributed to our efforts to improve supply across the region, which enabled us to capture the increase in tourism ride-hailing demand, and the growth in domestic demand.

●Mobility GMV rose 28% YoY, or 27% YoY on a constant currency basis, during the quarter and grew 32% YoY, or 33% YoY on a constant currency basis, on a full year basis. Growth during the quarter was mainly driven by an increase in Mobility MTUs and average order frequency.

●Mobility segment adjusted EBITDA as a percentage of GMV was 12.3% in the fourth quarter of 2023 and 12.5% for full year 2023.

●During the quarter, we continued to optimize our existing driver supply and enhance driver efficiency to meet the strong demand growth levels. In the fourth quarter of 2023, monthly active driver supply increased by 11% YoY, while earnings per transit hour9 of driver-partners on our platform increased 14% YoY. Our efforts to improve supply have resulted in surged Mobility rides10 as a proportion of total rides reducing by 6% YoY.

__________

9 Earnings per transit hour across both Mobility and Deliveries.

10 Surged Mobility rides are defined as completed rides where demand exceeds supply in a specified region and/or where pricing regulations adherence is required.

Financial Services

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in millions, unless otherwise stated) |

Q4 2023 |

|

Q4 2022 |

|

YoY % Change |

YoY % Change |

FY 2023 |

|

FY 2022 |

|

YoY % Change |

YoY % Change |

|

(unaudited) |

|

(unaudited) |

|

|

(constant currency) |

(unaudited) |

|

(unaudited) |

|

|

(constant currency) |

Operating metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

Pre-Interco Total Payment Volume (TPV) |

3,957 |

|

3,744 |

|

6% |

5% |

15,342 |

|

14,954 |

|

3% |

4% |

GMV |

1,255 |

|

1,452 |

|

-14% |

-13% |

5,185 |

|

5,809 |

|

-11% |

-9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial measures: |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

56 |

|

28 |

|

102% |

100% |

184 |

|

71 |

|

159% |

162% |

Segment Adjusted EBITDA |

(81) |

|

(93) |

|

13% |

|

(294) |

|

(415) |

|

29% |

|

●Revenue for Financial Services doubled to $56 million in the fourth quarter 2023, from $28 million in the same period in 2022, and grew by 159% YoY or 162% YoY on a constant currency basis for the full year 2023. The strong YoY growth was primarily attributed to improved monetization of our payments business, higher contributions from our lending business, and lowered incentive spend.

●Financial Services GMV declined 14% YoY during the quarter, or 13% YoY on a constant currency basis, and by 11% YoY or 9% YoY on a constant currency basis for the full year, consistent with our focus on driving ecosystem transactions.

●Segment adjusted EBITDA for the quarter improved 13% YoY, and 29% YoY for the full year, as we further streamlined overhead expenses in our GrabFin cost base to achieve operational efficiencies. Cost of Funds, a variable cost that supports the payment platform, was higher YoY due to increased transaction volumes. Cost of Funds represented 26% and 29% of our Financial Services segment cost structure in the fourth quarter and full year 2023, respectively. Segment adjusted EBITDA declined QoQ to negative $81 million, mainly attributed to the launch of our digibank in Malaysia, GX Bank Berhad (GXBank), while costs in GrabFin remained stable despite the increased Cost of Funds expenses associated with the growth in On-Demand transactions.

●Loans disbursed to our ecosystem partners continued to grow. For the full year 2023, total loan disbursements grew 57% YoY to reach $1.5 billion, while total loans outstanding11 amounted to $326 million as of December 31, 2023. Customer deposits in GXS Bank and GXBank, our digital banks in Singapore and Malaysia respectively, stood at $374 million as of December 31, 2023.

●In November 2023, GXBank was the first Digibank to launch in Malaysia. In the span of two weeks following the launch, over 100,000 depositors opened an account with GXBank, with 79% of GXBank depositors being existing Grab users.

__________

11 Total loans outstanding include current and non-current loan receivables held by Grab and GXS Singapore.

Enterprise and New Initiatives

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in millions, unless otherwise stated) |

Q4 2023 |

|

Q4 2022 |

|

YoY % Change |

YoY % Change |

FY 2023 |

|

FY 2022 |

|

YoY % Change |

YoY % Change |

|

(unaudited) |

|

(unaudited) |

|

|

(constant currency) |

(unaudited) |

|

(unaudited) |

|

|

(constant currency) |

Operating metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

GMV |

64 |

|

46 |

|

40% |

40% |

206 |

|

198 |

|

4% |

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial measures: |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

39 |

|

17 |

|

124% |

122% |

112 |

|

60 |

|

86% |

87% |

Segment Adjusted EBITDA |

31 |

|

6 |

|

378% |

|

76 |

|

21 |

|

267% |

|

●Revenue from Enterprise and New Initiatives grew 124% YoY, or 122% YoY on a constant currency basis for the fourth quarter 2023, and by 86% YoY, or 87% YoY on a constant currency basis for the full year 2023, mainly driven by growing contributions from Advertising. During the fourth quarter, the total number of monthly active advertisers who joined our self-serve platform increased 54% YoY while average spend by monthly active advertisers on our platform increased 129% YoY, as we continued to deepen Advertising penetration among our merchant-partners.

●Segment adjusted EBITDA grew by 378% YoY in the fourth quarter 2023, and by 267% YoY for the full year, primarily attributed to the increase in revenue.

Other Events

●Grab’s Board of Directors has authorized a share repurchase program, under which Grab may repurchase up to $500 million worth of its outstanding Class A ordinary shares. The proposed repurchases may be made from time to time through open market transactions at prevailing market prices, privately negotiated transactions, block trades and/or through other legally permissible means, or any combination thereof, depending on market conditions and the trading price of the Company’s Class A ordinary shares, among other factors, and in accordance with applicable rules and regulations. The Company's Board of Directors will review the share repurchase program periodically, and may amend the terms and size of the program. The Company intends to fund the repurchases with excess cash after allocating and potentially allocating for investments to drive growth. The share repurchase program does not obligate the Company to acquire any particular amount of Class A ordinary shares.

●Grab’s Board of Directors has also approved the full repayment of our outstanding Term Loan B. This loan facility was issued in January 2021, with a five-year tenor and a principal amount of $2 billion. As of December 31, 2023, $497 million in principal amount and accrued interest was outstanding under our Term Loan B. The repayment is expected to create significant interest expense savings.

A Note on our Financial Reporting going forward

●Beginning with our First Quarter 2024 earnings release, we will discontinue the reporting of GMV for our Financial Services segment, consistent with our strategic focus on ecosystem transactions and lending for GrabFin and our digital banks, and we will limit our GMV reporting to our On-Demand businesses. We also intend to report results under four segments of Mobility, Deliveries, Financial Services and Others. These reporting changes reflect a change in how we plan to evaluate the performance of our businesses, and to enhance comparability to the reporting of our peers. As part of that initiative, we will attribute a portion of the cost of funds in our Financial Services segment to the Mobility and Deliveries segments where such cost of funds is attributable to a Mobility and Deliveries transaction, allocate a portion of the regional corporate costs to the segments where such costs can be directly attributed to supporting those segments, while allocating Advertising contributions to the Mobility, Deliveries, and Financial Services segments where such contributions can be attributed to the respective segments. We will share additional details about these changes during our First Quarter 2024 earnings call.

About Grab

Grab is a leading superapp in Southeast Asia, operating across the deliveries, mobility and digital financial services sectors. Serving over 500 cities in eight Southeast Asian countries – Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam – Grab enables millions of people everyday to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending and insurance, all through a single app. Grab was founded in 2012 with the mission to drive Southeast Asia forward by creating economic empowerment for everyone, and strives to serve a triple bottom line: to simultaneously deliver financial performance for its shareholders and have a positive social and environmental impact in Southeast Asia.

Forward-Looking Statements

This document and the announced investor webcast contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this document and the webcast, including but not limited to, statements about Grab’s goals, targets, projections, outlooks, beliefs, expectations, strategy, plans, objectives of management for future operations of Grab, and growth opportunities, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “could,” “would,” “may,” “will,” “forecast” or other similar expressions. Forward-looking statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Grab, which involve inherent risks and uncertainties, and therefore should not be relied upon as being necessarily indicative of future results. A number of factors, including macro-economic, industry, business, regulatory and other risks, could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to: Grab’s ability to grow at the desired rate or scale and its ability to manage its growth; its ability to further develop its business, including new products and services; its ability to attract and retain partners and consumers; its ability to compete effectively in the intensely competitive and constantly changing market; its ability to continue to raise sufficient capital; its ability to reduce net losses and the use of partner and consumer incentives, and to achieve profitability; potential impact of the complex legal and regulatory environment on its business; its ability to protect and maintain its brand and reputation; general economic conditions, in particular as a result of COVID-19, currency exchange fluctuations and inflation; expected growth of markets in which Grab operates or may operate; and its ability to defend any legal or governmental proceedings instituted against it. In addition to the foregoing factors, you should also carefully consider the other risks and uncertainties described under “Item 3. Key Information – D. Risk Factors” and in other sections of Grab’s annual report on Form 20-F for the year ended December 31, 2022, as well as in other documents filed by Grab from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

Forward-looking statements speak only as of the date they are made. Grab does not undertake any obligation to update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required under applicable law.

Unaudited Financial Information

Grab’s unaudited selected financial data for the three months and twelve months ended December 31, 2023 and 2022 included in this document and the investor webcast is based on financial data derived from the Grab’s management accounts that have not been reviewed or audited.

Non-IFRS Financial Measures

This document and the investor webcast include references to non-IFRS financial measures, which include: Adjusted EBITDA, Segment Adjusted EBITDA, Total Segment Adjusted EBITDA, Adjusted EBITDA margin and Adjusted Free Cash Flow. Grab uses Adjusted EBITDA, Segment Adjusted EBITDA, Total Segment Adjusted EBITDA and Adjusted EBITDA margin for financial and operational decision-making and as a means to evaluate period-to-period comparisons, and Grab’s management believes that these non-IFRS financial measures provide meaningful supplemental information regarding its performance by excluding certain items that may not be indicative of its recurring core business operating results. For example, Grab’s management uses Total Segment Adjusted EBITDA as a useful indicator of the economics of Grab’s business segments, as it does not include regional corporate costs. Adjusted Free Cash Flow excludes the effects of the movement in working capital for our lending and digital banking deposit activities. Grab has recently begun using Adjusted Free Cash Flow to monitor business performance and assess its cash flow activity other than its lending and digital banking deposit activities, and Grab’s management believes that the additional disclosure serves as a useful indicator for comparison with the cash flow reporting of certain of its peers. However, there are a number of limitations related to the use of non-IFRS financial measures, and as such, the presentation of these non-IFRS financial measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS. In addition, these non-IFRS financial measures may differ from non-IFRS financial measures with comparable names used by other companies. See below for additional explanations about the non-IFRS financial measures, including their definitions and a reconciliation of these measures to the most directly comparable IFRS financial measures. With regard to forward-looking non-IFRS guidance and targets provided in this document and the investor webcast, Grab is unable to provide a reconciliation of these forward-looking non-IFRS measures to the most directly comparable IFRS measures without unreasonable efforts because the information needed to reconcile these measures is dependent on future events, many of which Grab is unable to control or predict.

Explanation of non-IFRS financial measures:

●Adjusted EBITDA is a non-IFRS financial measure calculated as profit (loss) for the period adjusted to exclude: (i) net interest income (expenses), (ii) net other income (expenses), (iii) income tax expenses (credit), (iv) depreciation and amortization, (v) share-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses.

●Segment Adjusted EBITDA is a non-IFRS financial measure, representing the Adjusted EBITDA of each of our four business segments, excluding, in each case, regional corporate costs.

●Total Segment Adjusted EBITDA is a non-IFRS financial measure, representing the sum of Adjusted EBITDA of our four business segments.

●Adjusted EBITDA margin is a non-IFRS financial measure calculated as Adjusted EBITDA divided by Gross Merchandise Value.

●Adjusted Free Cash Flow is a non-IFRS financial measure, defined as net cash flows from operating activities less capital expenditures, excluding changes in working capital related to loans and advances to customers, and deposits from the digital banking business.

|

|

|

|

|

|

Three months ended December 31, |

For the year ended December 31, |

|

2023 |

2022 |

2023 |

2022 |

($ in millions, unless otherwise stated) |

$ |

$ |

$ |

$ |

Profit/(Loss) for the period |

11 |

(391) |

(485) |

(1,740) |

|

|

|

|

|

Net interest (income)/expenses |

(35) |

5 |

(98) |

57 |

Net other income |

(25) |

(6) |

(8) |

(7) |

Income tax (credit)/expenses |

(4) |

* |

19 |

6 |

Depreciation and amortization |

37 |

40 |

145 |

150 |

Share-based compensation expenses |

66 |

90 |

304 |

412 |

Unrealized foreign exchange loss/(gain) |

11 |

12 |

(2) |

2 |

Impairment losses on goodwill and non-financial assets |

* |

3 |

* |

5 |

Fair value changes on investments |

(30) |

119 |

38 |

294 |

Restructuring costs |

3 |

4 |

56 |

8 |

Legal, tax and regulatory settlement provisions |

1 |

13 |

9 |

20 |

Adjusted EBITDA |

35 |

(111) |

(22) |

(793) |

Regional corporate costs |

193 |

223 |

793 |

858 |

Total Segment Adjusted EBITDA |

228 |

112 |

771 |

65 |

|

|

|

|

|

Segment Adjusted EBITDA |

|

|

|

|

Deliveries |

96 |

47 |

313 |

(35) |

Mobility |

182 |

152 |

676 |

494 |

Financial services |

(81) |

(93) |

(294) |

(415) |

Enterprise and new initiatives |

31 |

6 |

76 |

21 |

Total Segment Adjusted EBITDA |

228 |

112 |

771 |

65 |

* Amount less than $1 million

|

|

|

|

|

|

Three months ended December 31, |

For the year ended December 31, |

|

2023 |

2022 |

2023 |

2022 |

($ in millions, unless otherwise stated) |

$ |

$ |

$ |

$ |

Net cash (used in)/from operating activities |

(26) |

(23) |

86 |

(798) |

Less: Capital expenditures |

(38) |

(47) |

(140) |

(134) |

Free Cash Flow |

(64) |

(70) |

(54) |

(932) |

|

|

|

|

|

Changes in: |

|

|

|

|

- Loan receivables in the financial services segment |

65 |

41 |

184 |

110 |

- Deposits from customers in the banking business |

* |

(3) |

(364) |

(3) |

|

|

|

|

|

Adjusted Free Cash Flow |

1 |

(32) |

(234) |

(825) |

This document and the investor webcast also includes “Pre-InterCo” data that does not reflect elimination of intragroup transactions, which means such data includes earnings and other amounts from transactions between entities within the Grab group that are eliminated upon consolidation. Such data differs materially from the corresponding figures post-elimination of intra-group transactions.

We compare the percent change in our current period results from the corresponding prior period using constant currency. We present constant currency growth rate information to provide a framework for assessing how our underlying GMV and revenue performed excluding the effect of foreign currency rate fluctuations. We calculate constant currency by translating our current period financial results using the corresponding prior period’s monthly exchange rates for our transacted currencies other than the U.S. dollar.

Operating Metrics

Gross Merchandise Value (GMV) is an operating metric representing the sum of the total dollar value of transactions from Grab’s products and services, including any applicable taxes, tips, tolls, surcharges and fees, over the period of measurement. GMV includes sales made through offline stores. GMV is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business. GMV provides useful information to investors as it represents the amount of customer spend that is being directed through Grab’s platform. This metric enables Grab and investors to understand, evaluate and compare the total amount of customer spending that is being directed through its platform over a period of time. Grab presents GMV as a metric to understand and compare, and to enable investors to understand and compare, Grab’s aggregate operating results, which captures significant trends in its business over time.

Total Payments Volume (TPV) means total payments volume received from consumers, which is an operating metric defined as the value of payments, net of payment reversals, successfully completed through our platform.

Monthly Transacting User (MTUs) is defined as the monthly number of unique users who transact via Grab’s apps (including OVO), where transact means to have successfully paid for or utilized any of Grab’s products or services. MTUs over a quarterly or annual period are calculated based on the average of the MTUs for each month in the relevant period. Starting from 2023, MTUs additionally include the monthly number of unique users who transact with Grab offline while recording their Jaya Grocer loyalty points on Grab's apps. Starting from the fourth quarter of 2023, MTUs additionally include the monthly number of unique users who transact via Grab’s apps (including OVO) through group orders. MTUs is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business.

Partner incentives is an operating metric representing the dollar value of incentives granted to driver- and merchant-partners, the effect of which is to reduce revenue. The incentives granted to driver- and merchant-partners include base incentives and excess incentives, with base incentives being the amount of incentives paid to driver- and merchant-partners up to the amount of commissions and fees earned by us from those driver- and merchant-partners, and excess incentives being the amount of payments made to driver- and merchant-partners that exceed the amount of commissions and fees earned by us from those driver- and merchant-partners. For certain delivery offerings where Grab is contractually responsible for delivery services provided to end-users, incentives granted to driver-partners are recognized in cost of revenue.

Consumer incentives is an operating metric representing the dollar value of discounts and promotions offered to consumers, the effect of which is to reduce revenue. Partner incentives and consumer incentives are metrics by which we understand, evaluate and manage our business, and we believe are necessary for investors to understand and evaluate our business. We believe these metrics capture significant trends in our business over time.

Industry and Market Data

This document also contains information, estimates and other statistical data derived from third party sources, including research, surveys or studies, some of which are preliminary drafts, conducted by third parties, information provided by customers and/or industry or general publications. Such information involves a number of assumptions and limitations and due to the nature of the techniques and methodologies used in market research, and as such neither Grab nor the third-party sources (including Euromonitor) can guarantee the accuracy of such information. You are cautioned not to give undue weight on such estimates. Grab has not independently verified such third-party information, and makes no representation as to the accuracy of such third-party information.

Unaudited Summary of Financial Results

Condensed consolidated statement of profit or loss and other comprehensive income

|

|

|

|

|

|

Three months ended December 31, |

For the year ended December 31, |

|

2023 |

2022 |

2023 |

2022 |

($ in millions, except for share amounts which are reflected in thousands and per share data) |

$ |

$ |

$ |

$ |

Revenue |

653 |

502 |

2,359 |

1,433 |

Cost of revenue |

(377) |

(388) |

(1,499) |

(1,356) |

Other income |

5 |

9 |

17 |

17 |

Sales and marketing expenses |

(84) |

(70) |

(293) |

(278) |

General and administrative expenses |

(136) |

(166) |

(550) |

(646) |

Research and development expenses |

(103) |

(110) |

(421) |

(465) |

Restructuring costs |

(3) |

(4) |

(56) |

(8) |

Net impairment losses on financial assets |

(21) |

(19) |

(72) |

(58) |

Other income/(expenses) |

20 |

(9) |

(4) |

(12) |

Operating loss |

(46) |

(255) |

(519) |

(1,373) |

Finance income |

42 |

38 |

198 |

107 |

Finance costs |

(17) |

(54) |

(99) |

(166) |

Net change in fair value of financial assets and liabilities |

29 |

(119) |

(39) |

(294) |

Net finance income/(costs) |

54 |

(135) |

60 |

(353) |

Share of loss of equity-accounted investees (net of tax) |

(1) |

(1) |

(7) |

(8) |

Profit/(Loss) before income tax |

7 |

(391) |

(466) |

(1,734) |

Income tax credit/(expense) |

4 |

* |

(19) |

(6) |

Profit/(Loss) for the period |

11 |

(391) |

(485) |

(1,740) |

|

|

|

|

|

Items that will not be reclassified to profit or loss: |

|

|

|

|

Defined benefit plan remeasurements |

1 |

2 |

2 |

2 |

Investments and put liabilities at FVOCI – net change in fair value |

(9) |

(2) |

(24) |

(3) |

Items that are or may be reclassified subsequently to profit or loss: |

|

|

|

|

Foreign currency translation differences – foreign operations |

60 |

64 |

7 |

(42) |

Other comprehensive income/(loss) for the period, net of tax |

52 |

64 |

(15) |

(43) |

|

|

|

|

|

Total comprehensive income/(loss) for the period |

63 |

(327) |

(500) |

(1,783) |

|

|

|

|

|

|

|

|

|

|

Profit/(Loss) attributable to: |

|

|

|

|

Owners of the Company |

35 |

(386) |

(434) |

(1,683) |

Non-controlling interests |

(24) |

(5) |

(51) |

(57) |

Profit/(Loss) for the period |

11 |

(391) |

(485) |

(1,740) |

|

|

|

|

|

Total comprehensive income/(loss) attributable to: |

|

|

|

|

Owners of the Company |

77 |

(327) |

(448) |

(1,729) |

Non-controlling interests |

(14) |

* |

(52) |

(54) |

Total comprehensive income/(loss) for the period |

63 |

(327) |

(500) |

(1,783) |

|

|

|

|

|

Earnings/(Loss) per share: |

|

|

|

|

Basic |

$ 0.01 |

$ (0.10) |

$ (0.11) |

$ (0.44) |

Diluted |

$ 0.01 |

$ (0.10) |

$ (0.11) |

$ (0.44) |

|

|

|

|

|

Weighted-average ordinary shares outstanding: |

|

|

|

|

Basic |

3,916,321 |

3,837,981 |

3,894,724 |

3,814,492 |

Diluted |

3,916,321 |

3,837,981 |

3,894,724 |

3,814,492 |

* Amount less than $1 million

As we incurred net losses for the years ended December 31, 2023 and 2022, basic loss per share was the same as diluted loss per share.

The number of outstanding Class A and Class B ordinary shares was 3,813 million and 110 million, respectively, for the year ended December 31, 2023, and 3,736 million and 104 million, respectively, for the year ended December 31, 2022. 343 million and 359 million potentially dilutive outstanding securities were excluded from the computation of diluted loss per ordinary share because their effects would have been antidilutive for the years ended December 31, 2023 and 2022, respectively, or issuance of such shares is contingent upon the satisfaction of certain conditions which were not satisfied by the end of the period.

Condensed consolidated statement of financial position

|

|

|

|

December 31, 2023 |

December 31, 2022 |

($ in millions, unless otherwise stated) |

$ |

$ |

Non-current assets |

|

|

Property, plant, and equipment |

512 |

492 |

Intangible assets and goodwill |

916 |

904 |

Associates and joint venture |

102 |

107 |

Deferred tax assets |

56 |

20 |

Other investments |

1,188 |

1,742 |

Loan receivables in the Financial Services segment |

54 |

- |

Prepayments and other assets |

196 |

217 |

|

3,024 |

3,482 |

Current assets |

|

|

Inventories |

49 |

48 |

Trade and other receivables |

196 |

187 |

Loan receivables in the financial services segment |

272 |

185 |

Prepayments and other assets |

208 |

182 |

Other investments |

1,905 |

3,134 |

Cash and cash equivalents |

3,138 |

1,952 |

|

5,768 |

5,688 |

Total assets |

8,792 |

9,170 |

Equity |

|

|

Share capital and share premium |

22,669 |

22,278 |

Reserves |

544 |

602 |

Accumulated losses |

(16,764) |

(16,277) |

Equity attributable to owners of the Company |

6,449 |

6,603 |

Non-controlling interests |

19 |

54 |

Total equity |

6,468 |

6,657 |

|

|

|

Non-current liabilities |

|

|

Loans and borrowings |

668 |

1,248 |

Provisions |

18 |

18 |

Other liabilities |

140 |

132 |

Deferred tax liabilities |

20 |

18 |

|

|

|

|

846 |

1,416 |

Current liabilities |

|

|

Loans and borrowings |

125 |

117 |

Provisions |

39 |

38 |

Trade and other payables |

925 |

930 |

Deposits from customers in the banking business |

374 |

3 |

Current tax liabilities |

15 |

9 |

|

1,478 |

1,097 |

Total liabilities |

2,324 |

2,513 |

Total equity and liabilities |

8,792 |

9,170 |

Condensed consolidated statement of cash flow

|

|

|

|

|

|

Three months ended December 31, |

For the year ended December 31, |

|

2023 |

2022 |

2023 |

2022 |

($ in millions, unless otherwise stated) |

$ |

$ |

$ |

$ |

Cash flows from operating activities |

|

|

|

|

Profit/(Loss) before income tax |

7 |

(391) |

(466) |

(1,734) |

Adjustments for: |

|

|

|

|

Amortization of intangible assets |

4 |

6 |

17 |

21 |

Depreciation of property, plant and equipment |

33 |

33 |

128 |

129 |

Impairment of intangible assets and goodwill |

- |

3 |

- |

3 |

Impairment of property, plant and equipment |

* |

* |

* |

3 |

Equity-settled share-based payments |

66 |

90 |

304 |

412 |

Finance costs |

17 |

54 |

99 |

166 |

Net change in fair value of financial assets and liabilities |

(29) |

119 |

39 |

294 |

Net impairment loss on financial assets |

21 |

19 |

71 |

58 |

Finance income |

(42) |

(37) |

(198) |

(107) |

Gain on disposal of property, plant and equipment |

(2) |

(3) |

(11) |

(3) |

Gain on disposal of subsidiary |

- |

(2) |

- |

(2) |

Share of loss of equity-accounted investees (net of tax) |

1 |

1 |

7 |

8 |

Change in provisions |

* |

3 |

1 |

3 |

|

76 |

(105) |

(9) |

(749) |

Changes in: |

|

|

|

|

- Inventories |

(3) |

(6) |

(1) |

6 |

- Deposits pledged |

(6) |

(3) |

(22) |

* |

- Trade and other receivables |

(33) |

(3) |

(10) |

(51) |

- Loan receivables in the financial services segment |

(65) |

(41) |

(184) |

(110) |

- Trade and other payables |

29 |

138 |

(7) |

129 |

- Deposits from customers in the banking business |

* |

3 |

364 |

3 |

Cash (used in)/from operations |

(2) |

(17) |

131 |

(772) |

Income tax paid |

(24) |

(6) |

(45) |

(26) |

Net cash (used in)/from operating activities |

(26) |

(23) |

86 |

(798) |

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

Acquisition of property, plant and equipment |

(28) |

(24) |

(71) |

(58) |

|

|

|

|

|

Purchase of intangible assets |

- |

(8) |

(21) |

(16) |

Proceeds from disposal of property, plant and equipment |

2 |

5 |

28 |

12 |

Acquisition of additional interests in associate |

- |

- |

- |

(109) |

Proceeds from disposal of associate |

- |

3 |

- |

3 |

Acquisition of subsidiaries with non-controlling interests, net of cash acquired, and loan receivables |

- |

(98) |

- |

(266) |

Net proceeds from/(acquisition of) other investments |

119 |

438 |

1,752 |

(683) |

Interest received |

52 |

23 |

183 |

55 |

Net cash from/(used in) investing activities |

145 |

339 |

1,871 |

(1,062) |

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

Proceeds from share-based payment arrangements |

1 |

8 |

16 |

8 |

Payment of listing expenses |

- |

- |

- |

(39) |

Proceeds from bank loans |

28 |

21 |

116 |

109 |

Repayment of bank loans |

(46) |

(813) |

(765) |

(1,019) |

Payment of lease liabilities |

(9) |

(12) |

(39) |

(35) |

Acquisition of non-controlling interests without change in control |

- |

(15) |

(27) |

(15) |

Proceeds from subscription of shares in subsidiaries by non-controlling interests without change in control |

- |

3 |

10 |

32 |

Deposits pledged |

(4) |

* |

(1) |

(3) |

Interest paid |

(16) |

(40) |

(80) |

(160) |

Net cash used in financing activities |

(46) |

(848) |

(770) |

(1,122) |

|

|

|

|

|

Net increase/(decrease) in cash and cash equivalents |

73 |

(532) |

1,187 |

(2,982) |

Cash and cash equivalents at beginning of the period |

3,018 |

2,447 |

1,952 |

4,991 |

Effect of exchange rate fluctuations on cash held |

47 |

37 |

(1) |

(57) |

Cash and cash equivalents at end of the period |

3,138 |

1,952 |

3,138 |

1,952 |

* Amount less than $1 million

For inquiries regarding Grab, please contact:

Media

Grab: press@grab.com

Investors

Grab: investor.relations@grab.com

Source: Grab Holdings Limited

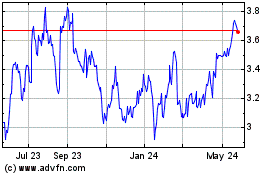

Grab (NASDAQ:GRAB)

Historical Stock Chart

From Oct 2024 to Nov 2024

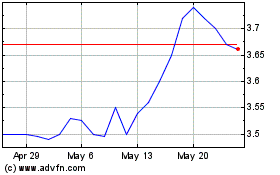

Grab (NASDAQ:GRAB)

Historical Stock Chart

From Nov 2023 to Nov 2024