false

0001145255

0001145255

2024-02-08

2024-02-08

0001145255

hnna:CommonStockNoParValueCustomMember

2024-02-08

2024-02-08

0001145255

hnna:NotesDue20264875CustomMember

2024-02-08

2024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2024

HENNESSY ADVISORS, INC.

(Exact name of registrant as specified in its charter)

|

California

|

001-36423

|

68-0176227

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

7250 Redwood Blvd., Suite 200

Novato, California

|

94945

|

|

(Address of principal executive offices)

|

(Zip code)

|

Registrant’s telephone number including area code: (415) 899-1555

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a‑12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol

|

Name of each exchange on which registered

|

|

Common stock, no par value

|

HNNA

|

The Nasdaq Stock Market LLC

|

|

4.875% Notes due 2026

|

HNNAZ

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition

|

On February 8, 2024, Hennessy Advisors, Inc. issued a press release announcing its financial results for the fiscal quarter ended December 31, 2023. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8‑K and is incorporated by reference herein.

|

Item 7.01.

|

Regulation FD Disclosure

|

On February 8, 2024, the Company issued a press release announcing that it had declared a cash dividend of $0.1375 per share on its common stock. The cash dividend is payable March 4, 2024, to shareholders of record at the close of business on February 20, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8‑K and is incorporated by reference herein.

|

Item 9.01.

|

Financial Statements and Exhibits

|

EXHIBIT INDEX

|

Exhibit

|

Description

|

| |

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HENNESSY ADVISORS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

February 8, 2024

|

By:

|

/s/ Teresa M. Nilsen

|

|

|

|

|

Teresa M. Nilsen

|

|

|

|

|

President

|

|

Exhibit 99.1

|

Media Contacts:

Teresa Nilsen

Hennessy Advisors, Inc.

Terry@hennessyadvisors.com; 800-966-4354

|

Hibre Teklemariam

SunStar Strategic

HTeklemariam@sunstarstrategic.com; 703-894-1057

|

FOR IMMEDIATE RELEASE

Hennessy Advisors, Inc. Reports 7% Increase in Quarterly

Earnings Per Share and Announces Quarterly Dividend

February 8, 2024, Novato, CA - Hennessy Advisors, Inc. (Nasdaq:HNNA) reported results for its first fiscal quarter of 2024, which ended December 31, 2023. The firm also announced a quarterly dividend of $0.1375 per share to be paid on March 4, 2024, to shareholders of record as of February 20, 2024, which represents an annualized dividend yield of 8.3%.*

“The markets and our economy were strong in 2023 as inflation fell slightly, employment data was positive, and interest rates flattened,” said Neil Hennessy, Chairman and CEO. “I strongly believe that corporate profits and cash flow remain healthy, and that the U.S. consumer is still participating in our economic growth in a meaningful way.”

“2023 market performance did not disappoint, with the S&P 500® Index returning 26.29% and the Dow Jones Industrial Average returning 16.18% for the year ended December 31, 2023. The backdrop of a strong market helped every one of our 17 Hennessy Funds produce positive returns for calendar year 2023. However, it is the longer-term performance of our products that makes me most proud. All 16 of our funds over ten years old had positive returns for both the five- and ten-year periods ended December 31, 2023,” said Neil Hennessy. “I’m also pleased to share the following three mentions of our Funds’ performances in industry journals from the first two weeks of January 2024.”

| |

•

|

On January 8, 2024, the Wall Street Journal announced its Category Kings in 18 Realms. The Hennessy Cornerstone Mid Cap 30 was ranked 5th in the Small-Cap Core category with 12-month performance through December 31, 2023, of 31.3%.

|

| |

•

|

Lawrence C. Strauss. (January 4, 2024). Japan is Hot. Here are the Best Funds to Play It. Barron’s. The Hennessy Japan Fund is ranked 9th in the article.

|

| |

•

|

Are these 3 Top-Ranked Mutual Funds in Your Retirement Portfolio? (January 1, 2024). Zacks Equity Research. The Hennessy Cornerstone Mid Cap 30 Fund is named in the article.

|

“Our investment products performed well during the quarter ended December 31, 2023, as evidenced by a 9% increase in total assets under management versus the prior comparable period,” said Teresa Nilsen, President, and COO. “We continue to increase our cash position net of debt, which is up over 15% in the last twelve months,” she added. “We remain focused on consistent distribution and marketing, and we are committed to our search for attractive acquisition opportunities as we head into calendar 2024 and beyond.”

Summary Highlights (compared to the prior comparable quarter ended December 31, 2022):

| |

●

|

Total revenue of $6.1 million.

|

| |

●

|

Net income of $1.2 million, an increase of 7%.

|

| |

●

|

Fully diluted earnings per share of $0.16, an increase of 7%.

|

| |

●

|

Average assets under management, upon which revenue is earned, of $3.0 billion.

|

| |

●

|

Total assets under management of $3.3 billion, an increase of 9%.

|

| |

●

|

Cash and cash equivalents, net of gross debt, of $19.4 million, an increase of 15%.

|

| |

|

Three Months Ended December 31,

|

|

|

Change

|

|

| |

|

2023

|

|

|

2022

|

|

|

Dollar

|

|

|

Percent

|

|

|

Total Revenue

|

|

$ |

6,143,843 |

|

|

$ |

6,144,863 |

|

|

$ |

(1,020 |

) |

|

|

0.0 |

% |

|

Net Income

|

|

|

1,200,095 |

|

|

|

1,119,100 |

|

|

|

80,995 |

|

|

|

7.2 |

% |

|

Earnings Per Share (Diluted)

|

|

|

0.16 |

|

|

|

0.15 |

|

|

|

0.01 |

|

|

|

6.7 |

% |

|

Weighted Average Number of Shares Outstanding (Diluted)

|

|

|

7,673,688 |

|

|

|

7,581,157 |

|

|

|

92,531 |

|

|

|

1.2 |

% |

|

Average Fund Assets Under Management

|

|

|

3,038,241,860 |

|

|

|

3,044,246,652 |

|

|

|

(6,004,792 |

) |

|

|

-0.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31,

|

|

|

|

|

|

|

|

|

|

| |

|

2023

|

|

|

2022

|

|

|

|

|

|

|

|

|

|

|

Total Fund Assets Under Management

|

|

$ |

3,280,372,061 |

|

|

$ |

3,009,457,663 |

|

|

$ |

270,914,398 |

|

|

|

9.0 |

% |

|

Cash and Cash Equivalents, Net of Gross Debt Balance

|

|

|

19,355,225 |

|

|

|

16,800,396 |

|

|

|

2,554,829 |

|

|

|

15.2 |

% |

* Based on the closing stock price of $6.60 on February 7, 2024, and an annualized dividend of $0.55 per share.

About Hennessy Advisors, Inc.

Hennessy Advisors, Inc. is a publicly traded investment manager offering a broad range of domestic equity, multi-asset, and sector and specialty funds. Hennessy Advisors, Inc. is committed to providing superior service to shareholders and employing a consistent and disciplined approach to investing based on a buy‑and‑hold philosophy that rejects the idea of market timing.

Supplemental Information

Nothing in this press release shall be considered a solicitation to buy or an offer to sell a security to any person in any jurisdiction where such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction.

Forward-Looking Statements

This press release contains “forward-looking statements” for which Hennessy Advisors, Inc. claims the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. Forward‑looking statements relate to expectations and projections about future events based on currently available information. Forward‑looking statements are not a guarantee of future performance or results and are not necessarily accurate indications of the times at which, or means by which, such performance or results may be achieved. Forward‑looking statements are subject to risks, uncertainties, and assumptions, including those described in the sections entitled “Risk Factors” and elsewhere in the reports that Hennessy Advisors, Inc. files with the Securities and Exchange Commission. Unforeseen developments could cause actual performance or results to differ substantially from those expressed in, or suggested by, the forward‑looking statements. Hennessy Advisors, Inc. management does not assume responsibility for the accuracy or completeness of the forward-looking statements and undertakes no responsibility to update any such statement after the date of this press release to conform to actual results or to changes in expectations.

v3.24.0.1

Document And Entity Information

|

Feb. 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

HENNESSY ADVISORS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 08, 2024

|

| Entity, Incorporation, State or Country Code |

CA

|

| Entity, File Number |

001-36423

|

| Entity, Tax Identification Number |

68-0176227

|

| Entity, Address, Address Line One |

7250 Redwood Blvd., Suite 200

|

| Entity, Address, City or Town |

Novato

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94945

|

| City Area Code |

415

|

| Local Phone Number |

899-1555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001145255

|

| CommonStockNoParValue Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, no par value

|

| Trading Symbol |

HNNA

|

| Security Exchange Name |

NASDAQ

|

| NotesDue20264875 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.875% Notes due 2026

|

| Trading Symbol |

HNNAZ

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hnna_CommonStockNoParValueCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hnna_NotesDue20264875CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

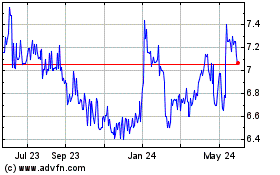

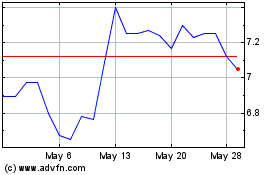

Hennessy Advisors (NASDAQ:HNNA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hennessy Advisors (NASDAQ:HNNA)

Historical Stock Chart

From Nov 2023 to Nov 2024