As

filed with the Securities and Exchange Commission on May 21, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

INVO

BIOSCIENCE, inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

20-4036208 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification No.) |

5582

Broadcast Court

Sarasota,

Florida 34240

(978)

878-9505

(Address,

including zip code, and telephone number,

including

area code of registrant’s principal executive offices)

Steven

Shum

INVO

Bioscience, Inc.

Chief

Executive Officer

5582

Broadcast Court

Sarasota,

Florida 34240

(978)

878-9505

(Name,

address, including zip code, and telephone number,

including

area code of agent for service)

With

a copy to:

Marc

A. Indeglia, Esq.

Glaser

Weil Fink Jordan Howard & Shapiro LLP

10250

Constellation Blvd, 19th Floor

Los

Angeles, California 90067

Telephone:

(310) 553-3000

Approximate

date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to

buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED MAY 21, 2024.

PROSPECTUS

INVO

BIOSCIENCE, INC.

Common

Stock

Preferred

Stock

Debt Securities

Warrants

Units

$100,000,000

We

may offer and sell up to $100,000,000 in the aggregate of the securities identified above from time to time in one or more offerings.

This prospectus provides you with a general description of the securities.

Each

time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering

and the amounts, prices and terms of the securities. The supplement may also add, update or change information contained in this prospectus

with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in

any of our securities.

We

may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters,

dealers, and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers, or agents are

involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission, or discount arrangement

between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information.

No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms

of the offering of such securities.

INVESTING

IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” SECTION ON PAGE 7 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED

IN THE APPLICABLE PROSPECTUS SUPPLEMENT AND THE OTHER DOCUMENTS THAT ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS CONCERNING FACTORS

YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

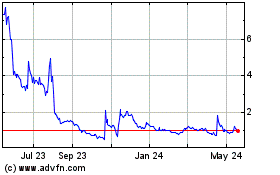

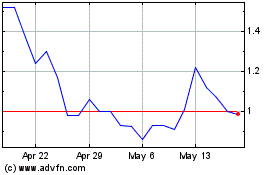

Our

common stock is listed on the Nasdaq Capital Market under the symbol “INVO.” On May 20, 2024 the last reported sale price

of our common stock on the Nasdaq Capital Market was $0.929 per share.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is ______________, 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”),

using a “shelf” registration process. By using a shelf registration statement, we may sell securities from time to time and

in one or more offerings up to a total dollar amount of $100,000,000 of securities as described in this prospectus. Each time that we

offer and sell securities, we will provide a prospectus supplement to this prospectus that contains specific information about the securities

being offered and sold and the specific terms of that offering. We may also authorize one or more free writing prospectuses to be provided

to you that may contain material information relating to these offerings. The prospectus supplement or free writing prospectus may also

add, update, or change information contained in this prospectus with respect to that offering. If there is any inconsistency between

the information in this prospectus and the applicable prospectus supplement or free writing prospectus, you should rely on the prospectus

supplement or free writing prospectus, as applicable. Before purchasing any securities, you should carefully read both this prospectus

and the applicable prospectus supplement (and any applicable free writing prospectuses), together with the additional information described

under the headings “Where You Can Find More Information” and “Incorporation by Reference.”

We

have not authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus,

any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you.

We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that

the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate only as of the date

on its respective cover, that the information appearing in any applicable free writing prospectuses is accurate only as of the date of

that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the document incorporated

by reference, unless we indicate otherwise. Our business, financial condition, results of operations, and prospects may have changed

since those dates. This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and

incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other

publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this

information and we have not independently verified this information. In addition, the market and industry data and forecasts that may

be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectuses may

involve estimates, assumptions, and other risks and uncertainties and are subject to change based on various factors, including those

discussed under the heading “Risk Factors” contained in this prospectus, the applicable prospectus supplement, and any applicable

free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly,

investors should not place undue reliance on this information.

When

we refer to “we,” “our,” “us,” and the “Company” in this prospectus, we mean INVO Bioscience,

Inc., unless otherwise specified. When we refer to “you,” we mean the potential holders of the applicable series of securities.

This

prospectus contains references to our trademarks and to trademarks belonging to other entities, which are protected under applicable

intellectual property laws. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork,

and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate that we

or their respective owners will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor

to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply

a relationship with, or endorsement or sponsorship of us by, any such companies.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and other reports, proxy statements, and other information with the SEC. The SEC maintains a website that contains

reports, proxy, and information statements and other information about issuers, such as us, who file electronically with the SEC. The

address of that website is http://www.sec.gov.

Our

website address is www.invobioscience.com. The information on our website, however, is not, and should not be deemed to be, a part of

this prospectus.

This

prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the

information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Forms

of the indenture and other documents establishing the terms of the offered securities are or may be filed as exhibits to the registration

statement or documents incorporated by reference in the registration statement. Statements in this prospectus or any prospectus supplement

about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers.

You should refer to the actual documents for a more complete description of the relevant matters. You may obtain a copy of the registration

statement through the SEC’s website, as provided above.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede

that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed

to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently

filed document incorporated by reference modifies or replaces that statement.

This

prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been

filed with the SEC (but excluding any information in such documents that has been furnished to, rather than filed with, the SEC):

| |

● |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the SEC on April

16, 2024, our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2023 filed with the SEC on April

17, 2024, and our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2023 filed with the SEC on April

29, 2024; |

| |

● |

our

Current Reports on Form 8-K filed with the SEC on January

3, 2024 (as amended on January

10, 2024), January

10, 2024, February

1, 2024, March

1, 2024, April

1, 2024 (as amended on April

2, 2024), April

11, 2024, April

16, 2024, April

17, 2024, April

19, 2024, and May

6, 2024; and |

| |

● |

the

description of our common stock contained in our registration statement on Form 8-A12B,

filed with the SEC on November 12, 2020 (File No. 001-39701), and all amendments or reports filed for the purpose of updating such

description. |

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), prior to the termination of this offering, including all such documents we may file with

the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding

any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed

to be part of this prospectus from the date of the filing of such reports and documents.

You

may request a free copy of any of the documents incorporated by reference in this prospectus by writing or telephoning us at the following

address:

INVO

Bioscience, Inc.

Attn:

CEO

5582

Broadcast Court

Sarasota,

Florida 34240

(978)

878-9505

Exhibits

to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or

any accompanying prospectus supplement.

THE

COMPANY

This

summary highlights selected information that is presented in greater detail elsewhere in this prospectus or incorporated by reference

in this prospectus. Because it is only a summary, it does not contain all of the information you should consider before investing in

our common stock, preferred stock, debt securities, warrants, or units, and it is qualified in its entirety by, and should be read in

conjunction with, the more detailed information included elsewhere in this prospectus. Before you decide whether to purchase shares of

our common stock or preferred stock, or our debt securities, warrants, or units, you should read this entire prospectus, the applicable

prospectus supplement and any related free writing prospectus carefully, including the risks of investing in our securities discussed

under the heading “Risk Factors” incorporated by reference into this prospectus or contained in the applicable prospectus

supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference

into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial

statements, and the exhibits to the registration statement of which this prospectus is a part. Unless the context otherwise requires,

the terms “INVO,” the “Company,” “we,” “us” and “our” in this prospectus

refer to INV Bioscience, Inc. and its wholly owned subsidiaries.

We

are a healthcare services fertility company dedicated to expanding access to fertility care around the world. Our commercial strategy

is primarily focused on operating fertility-focused clinics, which include the opening of “INVO Centers” dedicated primarily

to offering the intravaginal culture (“IVC”) procedure enabled by our INVOcell® medical device and the acquisition of

US-based, profitable in vitro fertilization (“IVF”) clinics. As of the date of this filing, we have two operational INVO

Centers in the United States and completed our first IVF clinic acquisition in August 2023. We also continue to engage in the sale and

distribution of our INVOcell technology solution into existing independently owned and operated fertility clinics. While the INVOcell

remains important to our efforts, our commercial and corporate development strategy has expanded to focus more broadly on providing assisted

reproductive technology (“ART”) services in general through our emphasis on clinic-based operations. We anticipate furthering

these activities with a focus on the acquisition of existing IVF clinics as well as on the opening of dedicated “INVO Centers”

offering the INVOcell and IVC procedure.

Our

proprietary technology, INVOcell®, is a revolutionary medical device that allows fertilization and early embryo development to take

place in vivo within the woman’s body. This treatment solution is the world’s first intravaginal culture technique for the

incubation of oocytes and sperm during fertilization and early embryo development. This technique, designated as “IVC”, provides

patients with a more natural, intimate, and more affordable experience in comparison to other ART treatments. We believe the IVC procedure

can deliver comparable results at a lower cost than traditional IVF and is a significantly more effective treatment than intrauterine

insemination (“IUI”).

Unlike

IVF where the oocytes and sperm develop into embryos in an expensive laboratory incubator, the INVOcell allows fertilization and early

embryo development to take place in the woman’s body. The IVC procedure can provide benefits, including the following:

| ● |

Reducing

expensive and time-consuming lab procedures, helping clinics and doctors to increase patient capacity and reduce costs; |

| ● |

Providing

a natural, stable incubation environment; |

| ● |

Offering

a more personal, intimate experience in creating a baby; and |

| ● |

Reducing

the risk of errors and wrong embryo transfers. |

In

both current utilization of the INVOcell, and in clinical studies, the IVC procedure has demonstrated equivalent pregnancy success and

live birth rates as IVF.

The

INVOcell Technology

The

INVOcell is the first in vivo Intravaginal Culture (IVC) system granted FDA clearance in the United States. We believe our novel

device and procedure provide a more natural, safe, effective and economical fertility treatment for patients. Unlike conventional infertility

treatments such as IVF where the eggs and sperm develop into embryos in a laboratory incubator, the INVOcell utilizes the women’s

vagina as an incubator to support a more natural fertilization and embryo development environment, and infertility treatment.

The

INVOcell system consists of the following components:

The

INVOcell Culture Device is used in preparing, holding, and transferring human gametes or embryos during In Vitro Fertilization/Intravaginal

Culture and Intra-cytoplasmic Sperm Injection Fertilization/Intravaginal Culture (ICSI/IVC) procedures. The INVOcell Culture Device is

positioned in the INVOcell Retention Device prior to placement in the patient’s vaginal cavity.

The

INVOcell Retention Device is used in conjunction with the INVOcell Culture Device to aid in retention of the INVOcell Device in

the vaginal cavity during the incubation period. The INVOcell Culture Device is positioned in the INVOcell Retention Device prior to

placement in the patient’s vaginal cavity.

During

an INVO Procedure, the patient undergoes an ovarian stimulation cycle. Once the eggs are retrieved and sperm is collected, they are placed

into the single use INVOcell Culture. Sperm collection and preparation generally occur before egg retrieval. Culture medium is placed

in the inner vessel of the INVOcell. Eggs and a low concentration of motile sperm are placed into the medium and the inner vessel is

closed and secured in the protective outer vessel. The INVOcell device is then immediately positioned in the upper vaginal cavity for

incubation, where natural fertilization and early development of the embryos take place for a period of three (3) to five (5) days. A

retention system can be used to maintain the INVOcell Culture Device in the vagina during the incubation period. The INVOcell Retention

Device consists of a diaphragm type device with holes in the membrane to allow natural elimination of vaginal secretions. The INVOcell

is designed so that no vaginal fluids penetrate the outer vessel thus ensuring that the inner vessel is not contaminated while allowing

the necessary CO2 for fertilization to pass through.

After

the three (3) to five (5) day incubation period, the patient returns to the physician’s office where the retention system and the

INVOcell are removed. The protective outer vessel is discarded and the contents of the inner vessel are placed into a petri plate for

an embryologist to evaluate the best embryos for transfer. The embryos to be transferred are aspirated into a standard transfer catheter

for transfer into the patient’s uterus. The INVO procedures can be performed in a physician’s office furnished with the necessary

equipment.

Corporate

History

We

were formed on January 5, 2007 under the laws of the Commonwealth of Massachusetts under the name Bio X Cell, Inc. to acquire the assets

of Medelle Corporation (“Medelle”). Dr. Claude Ranoux purchased all of the assets of Medelle, and then he contributed those

assets, including four patents relating to the INVOcell technology, to Bio X Cell, Inc. upon its formation in January 2007.

On

December 5, 2008, Bio X Cell, Inc., doing business as INVO Bioscience, and each of the shareholders of INVO Bioscience entered into a

share exchange agreement and consummated a share exchange with Emy’s Salsa AJI Distribution Company, Inc., a Nevada corporation

(“Emy’s”). Upon the closing of the share exchange on December 5, 2008, the INVO Bioscience shareholders transferred

all of their shares of common stock in INVO Bioscience to Emy’s. In connection with the share exchange, Emy’s changed its

name to INVO Bioscience, Inc. and Bio X Cell, Inc. became a wholly owned subsidiary of Emy’s (re-named INVO Bioscience, Inc.).

On

November 2, 2015, we were notified by the United States Food & Drug Administration (“FDA”) that the INVOcell and INVO

Procedure were granted clearance via the de novo classification (as a Class II device) allowing us to market the INVOcell in the United

States. Following this approval, we began marketing and selling INVOcell in many locations across the U.S. We currently have approximately

140 trained clinics or satellite facilities in the U.S. where patients can receive guidance and treatment for the INVO Procedure. In

June 2023, we received FDA 510(k) clearance to expand the labeling on the INVOcell device and its indication for use to provide for a

5-day incubation period. The data supporting the expanded 5-day incubation clearance demonstrated improved patient outcomes.

In

August of 2021, we opened our first two INVO Centers as part of our strategy to move the company beyond just a device company and transition

more toward healthcare services within the fertility marketplace. These initial INVO Centers are fertility clinics focused on offering

INVO Cell and the IVC procedure to patients.

On

August 10, 2023, we completed our first acquisition of an established IVF clinic, as part of our more recent acquisition strategy designed

to further accelerate our expansion into healthcare services.

Our

principal executive offices are located at 5582 Broadcast Court Sarasota, Florida 34240.and our telephone number is (978) 878-9505. The

address of our website is www.INVOBioscience.com. The information provided on our website is not part of this prospectus and you should

not consider the contents of our website in making an investment decision regarding out stock.

Recent

Developments

NAYA

Biosciences Merger Agreement

On

October 22, 2023, we entered into an Agreement and Plan of Merger, as amended effective October 25, 2023, December 27, 2023, and May

1, 2024 (collectively, the “Merger Agreement”) with INVO Merger Sub Inc., our wholly owned subsidiary and a Delaware corporation

(“Merger Sub”), and NAYA Biosciences, Inc., a Delaware corporation (“NAYA”). Upon the terms and subject to the

conditions set forth in the Merger Agreement, Merger Sub will merge (the “Merger”) with and into NAYA, with NAYA continuing

as the surviving corporation and our wholly owned subsidiary. At the effective time and as a result of the Merger, each share of Class

A common stock, par value $0.000001 per share, of NAYA (the “NAYA common stock”) outstanding immediately prior to the effective

time of the Merger, other than certain excluded shares held by NAYA as treasury stock or owned by the Company or Merger Sub, will be

converted into the right to receive 7.33333 (subject to adjustment as set forth in the Merger Agreement) shares of a newly designated

series of our common stock, par value $0.0001 per share, which shall be entitled to ten (10) votes per each share (“Company Class

B common stock”) for a total of approximately 18,150,000 of our shares (together with cash proceeds from the sale of fractional

shares, the “Merger Consideration”).

Immediately

following the effective time of the Merger, Dr. Daniel Teper, NAYA’s current chairman and chief executive officer, will be named

our chairman and chief executive officer, and the board of directors will be comprised of at least nine (9) directors, of which (i) one

shall be Steven Shum, our current chief executive officer, and (ii) eight shall be identified by NAYA, of which seven (7) shall be independent

directors.

The

completion of the Merger is conditioned upon the sale of 5,000,000 shares of our Series A Preferred

Stock plus the sale of shares of our preferred stock at a price per share of $5.00 per share in a private offering, to be consummated

prior to the closing of the Merger, resulting in an amount as may be required, to be determined in good faith by the parties to the Merger

Agreement, to adequately support our fertility business activities per an agreed forecast for us as well as for a period of twelve (12)

months following the closing, including a catch-up on our past due accrued payables still outstanding. We remain free to secure any amount

of funding from third parties on any terms we deem reasonably acceptable under SEC and Nasdaq regulations without the prior written consent

of NAYA.

In

addition, the completion of the Merger is subject to satisfaction or waiver of certain customary mutual closing conditions, including

(1) the adoption of the Merger Agreement by our stockholders and NAYA’s stockholders, (2) the absence of any injunction or other

order issued by a court of competent jurisdiction or applicable law or legal prohibition prohibiting or making illegal the consummation

of the Merger, (3) the completion of due diligence, (4) the aggregate of our liabilities, excluding certain specified liabilities, shall

not exceed $5,000,000, (5) the receipt of waivers from any and all holders of warrants (and any other similar instruments) to our securities,

with respect to any fundamental transaction rights such warrant holders may have under any such warrants, (7) the continued listing of

our common stock on NASDAQ through the effective time of the Merger and the approval for listing on NASDAQ of the shares of our common

stock to be issued in connection with the Merger, the interim private offering, and a private offering of shares of our common stock

at a target price of $5.00 per share (subject to appropriate adjustment in the event of any stock dividend, stock split, combination

or other similar recapitalization with respect to our common stock) resulting in sufficient cash available for us for one year of operations,

as estimated by NAYA, (8) the effectiveness of a registration statement on Form S-4 to be filed by us pursuant to which the shares of

our common stock to be issued in connection with the Merger will be registered with the SEC, and the absence of any stop order suspending

such effectiveness or proceeding for the purpose of suspending such effectiveness being pending before or threatened by the SEC, and

(9) we shall have received customary lock-up Agreement from certain of our stockholders. The obligation of each party to consummate the

Merger is also conditioned upon (1) the other party having performed in all material respects its obligations under the Merger Agreement

and (2) the other party’s representations and warranties in the Merger Agreement being true and correct (subject to certain materiality

qualifiers); provided, however, that these conditions, other than with respects to certain representations and warranties, will be deemed

waived by us upon the closing of the interim private offering.

The

Merger Agreement contains termination rights for each of us and NAYA, including, among others: (1) if the consummation of the Merger

does not occur on or before December 31, 2023 (the “End Date”) (which has since been extended to June 30, 2024), except that

any party whose material breach of the Merger Agreement caused or was the primary contributing factor that resulted in the failure of

the Merger to be consummated on or before the End Date, (2) if any governmental authority has enacted any law or order making illegal,

permanently enjoining, or otherwise permanently prohibiting the consummation of the Merger, and (3) if the required vote of the stockholders

of either us or NAYA has not been obtained. The Merger Agreement contains additional termination rights for NAYA, including, among others:

(1) if we materially breach our non-solicitation obligations or fail to take all action necessary to hold a stockholder meeting to approve

the transactions contemplated by the Merger Agreement, (2) if the aggregate of our liabilities, excluding certain specified liabilities,

exceed $5,000,000, (3) if NAYA determines that the due diligence contingency will not be satisfied by October 26, 2023, (4) if NAYA determines

that we have experienced a material adverse effect, or (5) we materially breach any representation, warranty, covenant, or agreement

such that the conditions to closing would not be satisfied and such breach is incapable of being cured, unless such breach is caused

by NAYA’s failure to perform or comply with any of the covenants, agreements, or conditions hereof to be performed or complied

with by it prior to the closing. The Merger Agreement also contains an additional termination right for us if NAYA breaches any of its

covenants and agreements set forth in that certain Securities Purchase Agreement dated as of December 29, 2023, as amended pursuant to

an Amendment to Securities Purchase Agreement dated as of April 30, 2024 (as amended, the “Securities Purchase Agreement”)

in any respect.

If

all of NAYA’s conditions to closing are satisfied or waived and NAYA fails to consummate the Merger, NAYA would be required to

pay us a termination fee of $1,000,000. If all of our conditions to closing conditions are satisfied or waived and we fail to consummate

the Merger, we would be required to pay NAYA a termination fee of $1,000,000.

Wisconsin

Fertility Institute Acquisition

On

August 10, 2023, we consummated the first acquisition of an existing IVF clinic, the Wisconsin Fertility Institute (“WFI”).

As an established and profitable clinic, the closing of the WFI acquisition more than tripled our current annual revenues and became

a major part of our clinic-based operations. The acquisition is accelerating the transformation of INVO to a healthcare services company

and immediately added scale and positive cash flow to the operations. It also complements our existing new-build INVO Center efforts.

Through

Wood Violet Fertility LLC, our indirect, wholly owned subsidiary, we consummated its acquisition of WFI for a combined purchase price

of $10 million, of which $2.5 million was paid on the closing date (net cash paid was $2,150,000 after a $350,000 holdback) plus assumption

of the inter-company loan owed by WFRSA (as defined below) in the amount of $528,756. The remaining three installments of $2.5 million

each will be paid on the subsequent three anniversaries of closing. The sellers have the option to take all or a portion of the final

three installments in shares of INVO common stock at a per share value of $125.00, $181.80, and $285.80, for the second, third, and final

installments, respectively.

WFI

is comprised of (a) a medical practice, Wisconsin Fertility and Reproductive Surgery Associates, S.C., a Wisconsin professional service

corporation d/b/a Wisconsin Fertility Institute (“WFRSA”), and (b) a laboratory services company, Fertility Labs of Wisconsin,

LLC, a Wisconsin limited liability company (“FLOW”). WFRSA owns, operates, and manages WFI’s fertility practice that

provides direct treatment to patients focused on fertility, gynecology, and obstetrics care and surgical procedures, and employs physicians

and other healthcare providers to deliver such services and procedures. FLOW provides WFRSA with related laboratory services.

We

purchased the non-medical assets of WFRSA and one hundred percent of FLOW’s membership interests. WVF and WFRSA entered into a

management services agreement pursuant to which WFRSA outsourced all its non-medical activities to WVF.

We

expect to continue to pursue additional acquisitions of established and profitable existing fertility clinics as part of its ongoing

strategy to accelerate overall growth.

RISK

FACTORS

Investment

in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. You should carefully consider

the risk factors incorporated by reference to our most recent Annual Report on Form 10-K, as amended, our Quarterly Reports on Form 10-Q,

and any subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, or Current Reports on Form 8-K we file after the date

of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent

filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement and any

applicable free writing prospectuses before acquiring any of such securities. The occurrence of any of these risks might cause you to

lose all or part of your investment in the offered securities.

USE

OF PROCEEDS

We

intend to use the net proceeds from the sale of the securities as set forth in the applicable prospectus supplement.

DESCRIPTION

OF CAPITAL STOCK WE MAY OFFER

General

Our

authorized capital stock consists of 50,000,000 shares of common stock, par value $0.0001 per share, and 100,000,000 shares of preferred

stock, par value $0.0001 per share.

The

following description of our common stock and preferred stock, together with the additional information included in any applicable prospectus

supplements or related free writing prospectuses, summarizes the material terms and provisions of these types of securities, but it is

not complete. For the complete terms of our common stock and preferred stock, please refer to our articles of incorporation and our bylaws

that are incorporated by reference into the registration statement which includes this prospectus and, with respect to preferred stock,

any certificate of designation that we may file with the SEC for a series of preferred stock we may designate, if any.

We

will describe, in a prospectus supplement or related free writing prospectuses, the specific terms of any common stock or preferred stock

we may offer pursuant to this prospectus. If indicated in a prospectus supplement, the terms of such common stock or preferred stock

may differ from the terms described below.

Common

Stock

As

of May 20, 2024, there were 3,808,752 shares of common stock outstanding. The holders of our common stock are entitled to one vote for

each share held of record on all matters submitted to a vote of the stockholders. The holders of common stock are not entitled to cumulative

voting rights with respect to the election of directors, and as a consequence, minority stockholders will not be able to elect directors

on the basis of their votes alone.

Subject

to preferences that may be applicable to any then outstanding shares of preferred stock, holders of common stock are entitled to receive

ratably such dividends as may be declared by the board of directors out of funds legally available therefor. In the event of a liquidation,

dissolution, or winding up of us, holders of the common stock are entitled to share ratably in all assets remaining after payment of

liabilities and the liquidation preferences of any then outstanding shares of preferred stock. Holders of common stock have no preemptive

rights and no right to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable

to our common stock. All outstanding shares of common stock are, and all shares of common stock to be issued under this prospectus will

be, fully paid and non-assessable. The rights, preferences, and privileges of holders of our common stock are subject to, and may be

adversely affected by, the rights of the holders of shares of any of our outstanding preferred stock.

Listing

Our

common stock is listed on the Nasdaq Capital Market under the symbol “INVO.”

Transfer

Agent and Registrar

We

have engaged the services of Transfer Online, Inc. as our transfer agent and registrar.

Dividends

We

have not declared any cash dividends on our common stock since inception and we do not anticipate paying any cash dividends on our common

stock in the foreseeable future.

Preferred

Stock

We

are authorized to issue a total of 100,000,000 shares of preferred stock. As of May 20, 2024, there were 1,381,200 shares of preferred

stock issued and outstanding, which are convertible into 276,240 shares of common stock.

Preferred

stock may be issued from time to time, in one or more series, as authorized by the board of directors, without stockholder approval.

The prospectus supplement relating to the preferred shares offered thereby will include specific terms of any preferred shares offered,

including, if applicable:

| |

● |

the

title of the shares of preferred stock; |

| |

● |

the

number of shares of preferred stock offered, the liquidation preference per share and the offering price of the shares of preferred

stock; |

| |

● |

the

dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation thereof applicable to the shares of preferred stock; |

| |

● |

whether

the dividends on shares of preferred stock are cumulative or not and, if cumulative, the date from which dividends on the shares

of preferred stock shall accumulate; |

| |

● |

the

procedures for any auction and remarketing, if any, for the shares of preferred stock; |

| |

● |

the

provision for a sinking fund, if any, for the shares of preferred stock; |

| |

● |

the

provision for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase

rights of the shares of preferred stock; |

| |

● |

any

listing of the shares of preferred stock on any securities exchange; |

| |

● |

the

terms and conditions, if applicable, upon which the shares of preferred stock will be convertible into common shares, including the

conversion price (or manner of calculation thereof); |

| |

● |

discussion

of federal income tax considerations applicable to the shares of preferred stock; |

| |

● |

the

relative ranking and preferences of the shares of preferred stock as to dividend rights and rights upon liquidation, dissolution

or winding up of our affairs; |

| |

● |

any

limitations on issuance of any series or class of shares of preferred stock ranking senior to or on a parity with such series or

class of shares of preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of our affairs; |

| |

● |

any

other specific terms, preferences, rights, limitations or restrictions of the shares of preferred stock; and |

| |

● |

any

voting rights of such preferred stock. |

The

transfer agent and registrar for any series or class of preferred stock will be set forth in the applicable prospectus supplement.

Series

A Preferred Stock

On

November 20, 2023, the Company filed with the Nevada Secretary of State a Certificate of Designation of Series A Convertible Preferred

Stock (the “Series A Certificate of Designation”) which sets forth the rights, preferences, and privileges of the Series

A Preferred Stock (the “Series A Preferred”). One million (1,000,000) shares of Series A Preferred with a stated value of

$5.00 per share were authorized under the Series A Certificate of Designation.

Each

share of Series A Preferred has a stated value of $5.00, which is convertible into shares of the Company’s common stock (the “Common

Stock”) at a fixed conversion price equal to $2.20 per share, subject to adjustment. The Company may not effect the conversion

of any shares of Series A Preferred if, after giving effect to the conversion or issuance, the holder, together with its affiliates,

would beneficially own more than 9.99% of the Company’s outstanding Common Stock. Moreover, the Company may not effect the conversion

of any shares of Series A Preferred if, after giving effect to the conversion or issuance, the holder, together with its affiliates,

would beneficially own more than 19.99% of the Company’s outstanding Common Stock unless and until the Company receives the approval

required by the applicable rules and regulations of The Nasdaq Stock Market LLC (or any subsequent trading market).

Each

share of Series A Preferred stock shall automatically convert into Common Stock upon the closing of the previously announced merger with

NAYA.

The

holders of Series A Preferred shall be entitled to receive a pro-rata portion, on an as-if converted basis, of any dividends payable

on Common Stock.

In

the event of any voluntary or involuntary liquidation, dissolution, or winding up, or sale of the Company (other than the previously

announced merger with NAYA Biosciences, Inc.), each holder of Series A Preferred shall be entitled to receive its pro rata portion of

an aggregate payment equal to (i) $5.00, multiplied by (ii) the total number of shares of Series A Preferred Stock issued under the Series

A Certificate of Designation.

Other

than those rights provided by law, the holders of Series A Preferred shall not have any voting rights.

Series

B Preferred Stock

On

November 20, 2023, the Company filed with the Nevada Secretary of State a Certificate of Designation of Series B Convertible Preferred

Stock (the “Series B Certificate of Designation”) which sets forth the rights, preferences, and privileges of the Series

B Preferred Stock (the “Series B Preferred”). One million two hundred (1,200,000) shares of Series B Preferred with a stated

value of $5.00 per share were authorized under the Series B Certificate of Designation.

Each

share of Series B Preferred has a stated value of $5.00, which is convertible into shares of the Company’s common stock (the “Common

Stock”) at a fixed conversion price equal to $5.00 per share, subject to adjustment. The Company may not effect the conversion

of any shares of Series B Preferred if, after giving effect to the conversion or issuance, the holder, together with its affiliates,

would beneficially own more than 19.99% of the Company’s outstanding Common Stock unless and until the Company receives the approval

required by the applicable rules and regulations of Nasdaq (or any subsequent trading market).

Each

share of Series B Preferred stock shall automatically convert into Common Stock upon the closing of the previously announced merger with

NAYA.

The

holders of Series B Preferred shall be entitled to receive a pro-rata portion, on an as-if converted basis, of any dividends payable

on Common Stock.

In

the event of any voluntary or involuntary liquidation, dissolution, or winding up, or sale of the Company (other than the previously

announced merger with NAYA), each holder of Series B Preferred shall be entitled to receive its pro rata portion of an aggregate payment

equal to (i) $5.00, multiplied by (ii) the total number of shares of Series B Preferred Stock issued under the Series B Certificate of

Designation.

Other

than those rights provided by law, the holders of Series B Preferred shall not have any voting rights.

Effect

of Certain Provisions of our Amended and Restated Articles of Incorporation and Bylaws and the Nevada Anti-Takeover Provisions

Some

provisions of Nevada law and our amended and restated articles of incorporation and bylaws contain provisions that could make our acquisition

by means of a tender offer, a proxy contest or otherwise, and the removal of incumbent officers and directors more difficult. These provisions,

summarized below, are expected to discourage coercive takeover practices and inadequate takeover bids and to promote stability in our

management. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our board

of directors.

Amended

and Restated Articles of Incorporation and Bylaws

Our

amended and restated articles of incorporation and bylaws provide for the following:

| |

● |

Preferred

Stock. The ability to authorize preferred stock makes it possible for our board of directors to issue one or more series of preferred

stock with voting or other rights or preferences that could impede the success of any attempt to change control of the Company. These

and other provisions may have the effect of deferring hostile takeovers or delaying changes in control or management of us. |

| |

● |

Requirements

for Advance Notification of Stockholder Nominations. Our bylaws establish advance notice procedures with respect to stockholder

proposals and the nomination of candidates for election as directors, other than nominations made by or at the direction of the board

of directors. |

| |

● |

Stockholder

Meetings. Our charter documents provide that a special meeting of stockholders may be called only by resolution adopted by the

majority board of directors, the chairman of the board of directors or the chief executive officer. |

| |

● |

Amendment

of Bylaws. Our board of directors have the sole power to amend the bylaws. |

Nevada

Anti-Takeover Provision

Section

78.438 of the Nevada Revised Statutes (“NRS”) prohibits a publicly held Nevada corporation from engaging in a business combination

with an interested stockholder, generally a person that together with its affiliates owns or within the last two years has owned 10%

of the outstanding voting stock, for a period of two years after the date of the transaction in which the person became an interested

stockholder, unless the business combination is approved in a prescribed manner, or falls within certain exemptions under the NRS. As

a result of these provisions in our charter documents under Nevada law, the price investors may be willing to pay in the future for shares

of our common stock may be limited.

DESCRIPTION

OF DEBT SECURITIES WE MAY OFFER

The

following description, together with the additional information we include in any applicable prospectus supplements or free writing prospectuses,

summarizes the material terms and provisions of the debt securities that we may offer under this prospectus. We may issue debt securities,

in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. While the terms we have summarized

below will apply generally to any future debt securities we may offer under this prospectus, we will describe the particular terms of

any debt securities that we may offer in more detail in the applicable prospectus supplement or free writing prospectus. The terms of

any debt securities we offer under a prospectus supplement may differ from the terms we describe below. Unless the context requires otherwise,

whenever we refer to the “indentures,” we also are referring to any supplemental indentures that specify the terms of a particular

series of debt securities.

We

will issue any senior debt securities under the senior indenture that we will enter into with the trustee named in the senior indenture.

We will issue any subordinated debt securities under the subordinated indenture and any supplemental indentures that we will enter into

with the trustee named in the subordinated indenture. We have filed forms of these documents as exhibits to the registration statement,

of which this prospectus is a part, and supplemental indentures and forms of debt securities containing the terms of the debt securities

being offered will be filed as exhibits to the registration statement of which this prospectus is a part or will be incorporated by reference

to reports that we file with the SEC.

The

indentures will be qualified under the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”). We use the term

“trustee” to refer to either the trustee under the senior indenture or the trustee under the subordinated indenture, as applicable.

The

following summaries of material provisions of the senior debt securities, the subordinated debt securities and the indentures are subject

to, and qualified in their entirety by reference to, all of the provisions of the indenture and any supplemental indentures applicable

to a particular series of debt securities. We urge you to read the applicable prospectus supplements and any related free writing prospectuses

related to the debt securities that we may offer under this prospectus, as well as the complete indenture that contains the terms of

the debt securities. Except as we may otherwise indicate, the terms of the senior indenture and the subordinated indenture are identical.

General

The

terms of each series of debt securities will be established by or pursuant to a resolution of our board of directors and set forth or

determined in the manner provided in an officers’ certificate or by a supplemental indenture. Debt securities may be issued in

separate series without limitation as to aggregate principal amount. We may specify a maximum aggregate principal amount for the debt

securities of any series. We will describe in the applicable prospectus supplement the terms of the series of debt securities being offered,

including the following:

| |

● |

the

principal amount being offered, and if a series, the total amount authorized and the total amount outstanding; |

| |

● |

any

limit on the amount that may be issued; |

| |

● |

whether

or not we will issue the series of debt securities in global form, and, if so, the terms and who the depositary will be; |

| |

● |

whether

and under what circumstances, if any, we will pay additional amounts on any debt securities held by a person who is not a U.S. person

for tax purposes, and whether we can redeem the debt securities if we have to pay such additional amounts; |

| |

● |

the

annual interest rate, which may be fixed or variable, or the method for determining the rate and the date interest will begin to

accrue, the dates interest will be payable and the regular record dates for interest payment dates or the method for determining

such dates; |

| |

● |

whether

or not the debt securities will be secured or unsecured, and the terms of any secured debt; |

| |

● |

the

terms of the subordination of any series of subordinated debt; |

| |

● |

the

place where payments will be payable; |

| |

● |

restrictions

on transfer, sale or other assignment, if any; |

| |

● |

our

right, if any, to defer payment of interest and the maximum length of any such deferral period; |

| |

● |

the

date, if any, after which, and the price at which, we may, at our option, redeem the series of debt securities pursuant to any optional

or provisional redemption provisions and the terms of those redemption provisions; |

| |

● |

provisions

for a sinking fund purchase or other analogous fund, if any, including the date, if any, on which, and the price at which we are

obligated, pursuant thereto or otherwise, to redeem, or at the holder’s option, to purchase, the series of debt securities

and the currency or currency unit in which the debt securities are payable; |

| |

● |

provisions

relating to modification of the terms of the security or the rights of the security holder; |

| |

● |

whether

the indenture will restrict our ability or the ability of our subsidiaries to do any of the following: |

| |

● |

incur

additional indebtedness; |

| |

● |

issue

additional securities; |

| |

● |

pay

dividends or make distributions in respect of our capital stock or the capital stock of our subsidiaries; |

| |

● |

place

restrictions on our subsidiaries’ ability to pay dividends, make distributions or transfer assets; |

| |

● |

make

investments or other restricted payments; |

| |

● |

sell,

transfer or otherwise dispose of assets; |

| |

● |

enter

into sale-leaseback transactions; |

| |

● |

engage

in transactions with stockholders or affiliates; |

| |

● |

issue

or sell stock of our subsidiaries; or |

| |

● |

effect

a consolidation or merger; |

| |

● |

whether

the indenture will require us to maintain any interest coverage, fixed charge, cash flow-based, asset-based or other financial ratios; |

| |

● |

information

describing any book-entry features; |

| |

● |

the

applicability of the provisions in the indenture on discharge; |

| |

● |

whether

the debt securities are to be offered at a price such that they will be deemed to be offered at an “original issue discount”

as defined in paragraph (a) of Section 1273 of the Internal Revenue Code of 1986, as amended; |

| |

● |

the

denominations in which we will issue the series of debt securities, if other than denominations of $1,000 and any integral multiple

thereof; |

| |

● |

the

currency of payment of debt securities if other than U.S. dollars and the manner of determining the equivalent amount in U.S. dollars;

and |

| |

● |

any

other specific terms, preferences, rights, or limitations of, or restrictions on, the debt securities, including any additional events

of default or covenants provided with respect to the debt securities, and any terms that may be required by us or advisable under

applicable laws or regulations. |

U.S.

federal income tax consequences applicable to debt securities sold at an original issue discount will be described in the applicable

prospectus supplement. In addition, U.S. federal income tax or other consequences applicable to any debt securities which are denominated

in a currency or currency unit other than U.S. dollars may be described in the applicable prospectus supplement.

Conversion

or Exchange Rights

We

will set forth in the applicable prospectus supplement the terms under which a series of debt securities may be convertible into or exchangeable

for our common stock, our preferred stock, or other securities (including securities of a third party). We will include provisions as

to whether conversion or exchange is mandatory, at the option of the holder or at our option. We may include provisions pursuant to which

the number of shares of our common stock, our preferred stock, or other securities (including securities of a third party) that the holders

of the series of debt securities receive would be subject to adjustment.

Consolidation,

Merger, or Sale

Unless

we provide otherwise in the prospectus supplement applicable to a particular series of debt securities, the indentures will not contain

any covenant that restricts our ability to merge or consolidate, or sell, convey, transfer, or otherwise dispose of all or substantially

all of our assets. However, any successor to or acquirer of such assets must assume all of our obligations under the indentures or the

debt securities, as appropriate. If the debt securities are convertible into or exchangeable for our other securities or securities of

other entities, the person with whom we consolidate or merge or to whom we sell all of our assets must make provisions for the conversion

of the debt securities into securities that the holders of the debt securities would have received if they had converted the debt securities

before the consolidation, merger, or sale.

Events

of Default under the Indenture

Unless

we provide otherwise in the prospectus supplement applicable to a particular series of debt securities, the following are events of default

under the indentures with respect to any series of debt securities that we may issue:

| |

● |

if

we fail to pay interest when due and payable and our failure continues for 90 days and the time for payment has not been extended; |

| |

● |

if

we fail to pay the principal, premium, or sinking fund payment, if any, when due and payable and the time for payment has not been

extended; |

| |

● |

if

we fail to observe or perform any other covenant contained in the debt securities or the indentures, other than a covenant specifically

relating to another series of debt securities, and our failure continues for 90 days after we receive notice from the trustee or

we and the trustee receive notice from the holders of at least 25% in aggregate principal amount of the outstanding debt securities

of the applicable series; and |

| |

● |

if

specified events of bankruptcy, insolvency or reorganization occur. |

We

will describe in each applicable prospectus supplement any additional events of default relating to the relevant series of debt securities.

If an event of default with respect to debt securities of any series occurs and is continuing, other than an event of default specified

in the last bullet point above, the trustee or the holders of at least 25% in aggregate principal amount of the outstanding debt securities

of that series, by notice to us in writing, and to the trustee if notice is given by such holders, may declare the unpaid principal,

premium, if any, and accrued interest, if any, due and payable immediately. If an event of default arises due to the occurrence of certain

specified bankruptcy, insolvency, or reorganization events, the unpaid principal, premium, if any, and accrued interest, if any, of each

issue of debt securities then outstanding shall be due and payable without any notice or other action on the part of the trustee or any

holder.

The

holders of a majority in principal amount of the outstanding debt securities of an affected series may waive any default or event of

default with respect to the series and its consequences, except defaults or events of default regarding payment of principal, premium,

if any, or interest, unless we have cured the default or event of default in accordance with the indenture. Any such waiver shall cure

the default or event of default.

Subject

to the terms of the applicable indenture, if an event of default under an indenture shall occur and be continuing, the trustee will be

under no obligation to exercise any of its rights or powers under such indenture at the request or direction of any of the holders of

the applicable series of debt securities, unless such holders have offered the trustee reasonable indemnity or security satisfactory

to it against any loss, liability, or expense. The holders of a majority in principal amount of the outstanding debt securities of any

series will have the right to direct the time, method and place of conducting any proceeding for any remedy available to the trustee,

or exercising any trust or power conferred on the trustee, with respect to the debt securities of that series, provided that:

| |

● |

the

direction so given by the holders is not in conflict with any law or the applicable indenture; and |

| |

● |

subject

to its duties under the Trust Indenture Act, the trustee need not take any action that might subject it to personal liability or

might be unduly prejudicial to the holders not involved in the proceeding. |

The

indentures provide that if an event of default has occurred and is continuing, the trustee will be required in the exercise of its powers

to use the degree of care that a prudent person would use in the conduct of its own affairs. The trustee, however, may refuse to follow

any direction that conflicts with law or the indenture, or that the trustee determines is unduly prejudicial to the rights of any other

holder of the relevant series of debt securities, or that would subject the trustee to personal liability. Prior to taking any action

under the indentures, the trustee will be entitled to indemnification against all costs, expenses, and liabilities that would be incurred

by taking or not taking such action.

A

holder of the debt securities of any series will have the right to institute a proceeding under the indentures or to appoint a receiver

or trustee, or to seek other remedies only if the following occur:

| |

● |

the

holder has given written notice to the trustee of a continuing event of default with respect to that series; |

| |

● |

the

holders of at least 25% in aggregate principal amount of the outstanding debt securities of that series have made a written request

and such holders have offered reasonable indemnity to the trustee or security satisfactory to it against any loss, liability or expense

to be incurred in compliance with instituting the proceeding as trustee; and |

| |

● |

the

trustee does not institute the proceeding, and does not receive from the holders of a majority in aggregate principal amount of the

outstanding debt securities of that series other conflicting directions within 60 days after the notice, request and offer. |

These

limitations do not apply to a proceeding instituted by a holder of debt securities if we default in the payment of the principal, premium,

if any, or interest on, the debt securities.

We

will periodically file statements with the trustee regarding our compliance with specified covenants in the indentures.

The

indentures provide that if a default occurs and is continuing and is actually known to a responsible officer of the trustee, the trustee

must mail to each holder notice of the default within 45 days after it occurs, unless such default has been cured. Except in the case

of a default in the payment of principal or premium of, or interest on, any debt security or certain other defaults specified in an indenture,

the trustee shall be protected in withholding such notice if and so long as the board of directors, the executive committee or a trust

committee of directors, or responsible officers of the trustee, in good faith determine that withholding notice is in the best interests

of holders of the relevant series of debt securities.

Modification

of Indenture; Waiver

Subject

to the terms of the indenture for any series of debt securities that we may issue, we and the trustee may change an indenture without

the consent of any holders with respect to the following specific matters:

| |

● |

to

fix any ambiguity, defect, or inconsistency in the indenture; |

| |

● |

to

comply with the provisions described above under “-Consolidation, Merger, or Sale”; |

| |

● |

to

comply with any requirements of the SEC in connection with the qualification of any indenture under the Trust Indenture Act; |

| |

● |

to

add to, delete from, or revise the conditions, limitations, and restrictions on the authorized amount, terms or purposes of issue,

authentication and delivery of debt securities, as set forth in such indenture; |

| |

● |

to

provide for the issuance of, and establish the form and terms and conditions of, the debt securities of any series as provided above

under “-General,” to establish the form of any certifications required to be furnished pursuant to the terms of the indenture

or any series of debt securities, or to add to the rights of the holders of any series of debt securities; |

| |

● |

to

evidence and provide for the acceptance of appointment hereunder by a successor trustee; |

| |

● |

to

provide for uncertificated debt securities in addition to or in place of certificated debt securities and to make all appropriate

changes for such purpose; |

| |

● |

to

add such new covenants, restrictions, conditions, or provisions for the protection of the holders, and to make the occurrence, or

the occurrence and the continuance, of a default in any such additional covenants, restrictions, conditions or provisions an event

of default or to surrender any right or power conferred to us in the indenture; or |

| |

● |

to

change anything that does not materially adversely affect the interests of any holder of debt securities of any series in any material

respect; provided that any amendment made solely to conform the provisions of the indenture to the corresponding description of the

debt securities contained in the applicable prospectus or prospectus supplement shall be deemed not to adversely affect the interests

of the holders of such debt securities; and provided further, that in connection with any such amendment we will provide the trustee

with an officers’ certificate certifying that such amendment will not adversely affect the rights or interests of the holders

of such debt securities. |

In

addition, under the indentures, the rights of holders of a series of debt securities may be changed by us and the trustee with the written

consent of the holders of at least a majority in aggregate principal amount of the outstanding debt securities of each series that is

affected. However, unless we provide otherwise in the prospectus supplement applicable to a particular series of debt securities, we

and the trustee may only make the following changes with the consent of each holder of any outstanding debt securities affected:

| |

● |

extending

the fixed maturity of the series of debt securities; |

| |

● |

reducing

the principal amount, reducing the rate of or extending the time of payment of interest, or reducing any premium payable upon the

redemption of any debt securities; |

| |

● |

reducing

the percentage of debt securities, the holders of which are required to consent to any amendment, supplement, modification, or waiver; |

| |

● |

changing

any of our obligations to pay additional amounts; |

| |

● |

reducing

the amount of principal of an original issue discount security or any other note payable upon acceleration of the maturity thereof; |

| |

● |

changing

the currency in which any note or any premium or interest is payable; |

| |

● |

impairing

the right to enforce any payment on or with respect to any note; |

| |

● |

adversely

changing the right to convert or exchange, including decreasing the conversion rate or increasing the conversion price of, such note,

if applicable; |

| |

● |

in

the case of the subordinated indenture, modifying the subordination provisions in a manner adverse to the holders of the subordinated

debt securities; |

| |

● |

if

the debt securities are secured, changing the terms and conditions pursuant to which the debt securities are secured in a manner

adverse to the holders of the secured debt securities; |

| |

● |

reducing

the requirements contained in the applicable indenture for quorum or voting; |

| |

● |

changing

any of our obligations to maintain an office or agency in the places and for the purposes required by the indentures; or |

| |

● |

modifying

any of the above provisions set forth in this paragraph. |

Discharge

Each

indenture provides that, subject to the terms of the indenture and any limitation otherwise provided in the prospectus supplement applicable

to a particular series of debt securities, we may elect to be discharged from our obligations with respect to one or more series of debt

securities, except for specified obligations, including obligations to do the following:

| |

● |

register

the transfer or exchange of debt securities of the series; |

| |

● |

replace

stolen, lost, or mutilated debt securities of the series; |

| |

● |

maintain

paying agencies; |

| |

● |

hold

monies for payment in trust; |

| |

● |

recover

excess money held by the trustee; |

| |

● |

compensate

and indemnify the trustee; and |

| |

● |

appoint

any successor trustee. |

In

order to exercise our rights to be discharged, we must deposit with the trustee money or government obligations sufficient to pay all

the principal of, and any premium and interest on, the debt securities of the series on the dates payments are due.

Form,

Exchange, and Transfer

We

will issue the debt securities of each series only in fully registered form without coupons and, unless we otherwise specify in the applicable

prospectus supplement, in denominations of $1,000 and any integral multiple thereof. The indentures provide that we may issue debt securities

of a series in temporary or permanent global form and as book-entry securities that will be deposited with, or on behalf of, The Depository

Trust Company or another depositary named by us and identified in a prospectus supplement with respect to that series.

At

the option of the holder, subject to the terms of the indentures and the limitations applicable to global securities described in the

applicable prospectus supplement, the holder of the debt securities of any series can exchange the debt securities for other debt securities

of the same series, in any authorized denomination and of like tenor and aggregate principal amount.

Subject

to the terms of the indentures and the limitations applicable to global securities set forth in the applicable prospectus supplement,

holders of the debt securities may present the debt securities for exchange or for registration of transfer, duly endorsed or with the

form of transfer endorsed thereon duly executed if so required by us or the security registrar, at the office of the security registrar

or at the office of any transfer agent designated by us for this purpose. Unless otherwise provided in the debt securities that the holder

presents for transfer or exchange, we will impose no service charge for any registration of transfer or exchange, but we may require

payment of any taxes or other governmental charges.

We

will name in the applicable prospectus supplement the security registrar, and any transfer agent in addition to the security registrar,

that we initially designate for any debt securities. We may at any time designate additional transfer agents or rescind the designation

of any transfer agent or approve a change in the office through which any transfer agent acts, except that we will be required to maintain

a transfer agent in each place of payment for the debt securities of each series.

If

we elect to redeem the debt securities of any series, we will not be required to any of the following:

| |

● |

issue,

register the transfer of, or exchange any debt securities of that series during a period beginning at the opening of business 15

days before the day of mailing of a notice of redemption of any debt securities that may be selected for redemption and ending at