false

0001417926

0001417926

2024-09-12

2024-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 12, 2024

INVO

BIOSCIENCE, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39701 |

|

20-4036208 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5582

Broadcast Court

Sarasota,

Florida 34240

(Address

of principal executive offices)

(Zip

Code)

Registrant’s

telephone number, including area code: (978) 878-9505

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Common

Stock, $0.0001 par value |

|

INVO |

|

The

Nasdaq Stock Market LLC |

| (Title

of Each Class) |

|

(Trading

Symbol) |

|

(Name

of Each Exchange on Which Registered) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (CFR §240.12b-2 of this chapter). Emerging growth company

☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

Fourth

Amendment to Agreement and Plan of Merger

Effective

as of September 12, 2024, INVO Bioscience, Inc.,

a Nevada corporation (the “Company”) entered into a fourth amendment (“Fourth Amendment”) to the

previously announced agreement and plan of merger (the “Merger Agreement”) by and among the Company, INVO Merger Sub,

Inc. (“Merger Sub”), and NAYA Biosciences, Inc., a Delaware corporation (“NAYA”).

Pursuant

to the Fourth Amendment, the parties agreed to extend the end date (the date by which either the Company or NAYA may terminate the Merger

Agreement, subject to certain exceptions) of the merger contemplated by the Merger Agreement (the “Merger”) to October

14, 2024. The parties further agreed that NAYA would purchase 27,500 shares of the Company’s Series A Preferred Stock for $137,500

pursuant to that certain Securities Purchase Agreement dated as of December 29, 2023, as amended pursuant to an Amendment to Securities

Purchase Agreement dated as of May 1, 2024 (as amended, the “Securities Purchase Agreement”) and could purchase up

to an additional 72,500 shares of Series A Preferred Stock for an aggregate of $362,500 pursuant to the Securities Purchase Agreement

prior to or concurrently with the closing of the Merger. Each party waived prior breaches of the Merger Agreement.

Each

party also agreed to use its best efforts to consummate the transactions contemplated by the Fourth Amendment, including to negotiate

in good faith to amend and restate the Merger Agreement (the “A&R Merger Agreement”) to, among other things, (1)

provide that the closing of the Merger shall occur simultaneously or shortly after the execution and delivery of the A&R Merger Agreement,

and that the parties shall commit to use its respective best efforts to cause the closing to occur on or about October 1, 2024, but,

in any case, no later than October 14, 2024, (2) ensure that the revised structure of the Merger shall be in compliance in all material

respects with the applicable current listing and governance rules and regulations of the Nasdaq Stock Market, (3) provide that the aggregate

merger consideration to be paid by the Company for all of the outstanding shares of NAYA’s capital stock shall consist of (a) such

number of shares of the Company’s common stock as shall represent a number of shares equal to no more than 19.9% of the outstanding

shares of the Company’s common stock as of immediately before the effective time of the Merger (the “Common Stock Payment

Shares”) and (b) shares of a newly designated Series C Convertible Preferred Stock of the Company (the “Parent Preferred

Stock Payment Shares”), (4) include an acknowledgment by the parties that NAYA shall transfer 85% of the Common Stock Payment

Shares to Five Narrow Lane LP (“FNL”), as a secured lender of NAYA, (5) provide that the Company shall take all action

necessary under applicable law to (i) call, give notice of, and hold a meeting of its stockholders as soon as possible after the closing

of the Merger, but in any case, no later than 120 days thereafter (the “Stockholder Meeting Deadline”; provided, that,

the Company acknowledges that, if the Parent receives comments from the Securities and Exchange Commission (“SEC”)

on the proxy statement filed in connection with such stockholder meeting and the Parent uses its best efforts to revise and refile the

proxy statement to address such comments, the date of such stockholder meeting may be after the Stockholder Meeting Deadline), for the

purpose of, among other things, seeking stockholder approval (the “Stockholder Approval”) of the issuance of all shares

of the Company’s common stock issuable upon conversion (the “Series C Conversion Shares”) of the Preferred Stock

Payment Shares in accordance with the terms of the Certificate of Designations of Series C Convertible Preferred Stock (the “Series

C Certificate of Designations”), and (ii) to file with the SEC a proxy statement for the purpose of obtaining the Stockholder

Approval, no later than 35 days after the closing of the Merger, (6) provide that, upon receipt of the Stockholder Approval, the Preferred

Stock Payment Shares shall be automatically converted into the Series C Conversion Shares at the conversion price in effect as set forth

in the Series C Certificate of Designations; provided that, following such conversion, the Series C Conversion Shares shall represent

approximately 60.1% of the outstanding shares of the Company’s common stock; and (7) provide that, as soon as possible after the

closing of the Merger, the Company shall file a resale registration statement with the SEC to register the Common Stock Payment Shares

and the Series C Conversion Shares in accordance with the terms of a registration rights agreement to be entered into between the parties.

The

foregoing description of the Fourth Amendment does not purport to be complete and is qualified in its entirety by reference to the Fourth

Amendment, which is attached hereto as Exhibit 2.1 and is incorporated herein by reference.

Item

3.02 Unregistered Sale of Equity Securities.

The

information set forth in Item 1.01 is incorporated herein by reference. On September 16, 2024, the Company issued 27,500 shares of the

Company’s Series A Preferred Stock for $137,500 pursuant to the Securities Purchase Agreement. The Company offered the Series A

Preferred Stock pursuant to an exemption from registration under Section 4(a)(2) of the Securities

Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

September 18, 2024

| |

INVO

BIOSCIENCE, INC. |

| |

|

|

| |

By: |

/s/

Steven Shum |

| |

|

Steven

Shum |

| |

|

Chief

Executive Officer |

Exhibit

2.1

FOURTH

AMENDMENT TO AGREEMENT AND PLAN OF MERGER

This

Fourth Amendment (the “Amendment”), dated as of September 12, 2024, to the Agreement and Plan of Merger, originally

entered into as of October 22, 2023 (as amended by the First Amendment to Agreement and Plan of Merger, dated as of October 25, 2023,

the Second Amendment to Agreement and Plan of Merger, dated as of December 27, 2023, the Third Amendment to Agreement and Plan of Merger,

dated as of May 1, 2024, and as further amended from time to time, the “Merger Agreement”), by and among NAYA Biosciences,

Inc., a Delaware corporation (the “Company”), INVO Bioscience, Inc., a Nevada corporation (the “Parent”),

and INVO Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of the Parent (the “Merger Sub”). Capitalized

terms used (including in the immediately preceding sentence) and not otherwise defined herein shall have the meanings set forth in the

Merger Agreement.

WHEREAS,

Section 8.6 of the Merger Agreement provides that the Merger Agreement may be amended or supplemented by written agreement signed by

each of the parties thereto;

WHEREAS,

each of the Company, the Parent, and the Merger Sub desire to amend and restate the Merger Agreement (the “A&R Merger Agreement”),

to, among other things, do the following:

| |

(1) |

provide

that the Closing shall occur simultaneously or shortly after the execution and delivery of the A&R Merger Agreement, and that

the parties shall commit to use its respective best efforts to cause the Closing Date to occur on or about October 1, 2024, but,

in any case, no later than October 14, 2024; |

| |

|

|

| |

(2) |

ensure

that the revised structure of the Merger shall be in compliance in all material respects with the applicable current listing and

governance rules and regulations of the Nasdaq Stock Market; |

| |

|

|

| |

(3) |

provide

that the aggregate merger consideration to be paid by the Parent for all of the outstanding shares of the Company’s capital

stock at the Closing shall consist of (a) such number of shares of common stock of the Parent (the “Parent Common Stock”)

as shall represent a number of shares equal to no more than 19.9% of the outstanding shares of Parent Common Stock as of immediately

before the effective time of the Merger (the “Parent Common Stock Consideration Cap”; and such shares, the “Parent

Common Stock Payment Shares”) and (b) shares of a newly designated Series C Convertible Preferred Stock of the Parent (“Parent

Preferred Stock Payment Shares”); |

| |

|

|

| |

(4) |

include

an acknowledgment by the Company and the Parent that the Company shall transfer 85% of the Parent Common Stock Payment Shares to

Five Narrow Lane LP, as a secured lender of the Company (“FNL”); |

| |

|

|

| |

(5) |

provide

that, the Parent shall take all action necessary under applicable law to call, give notice of and hold a meeting of the stockholders

of the Parent as soon as possible after the Closing Date, but in any case, no later than 120 days after the Closing Date (the “Stockholder

Meeting Deadline”; provided, that, the Company acknowledges that, if the Parent receives comments from the Securities and

Exchange Commission on the proxy statement filed in connection with such stockholder meeting and the Parent uses its best efforts

to revise and refile the proxy statement to address such comments, the date of such stockholder meeting may be after the Stockholder

Meeting Deadline), for the purpose of, among other things, seeking stockholder approval (the “Stockholder Approval”)

of the issuance of all shares of Parent Common Stock issuable upon conversion (the “Series C Conversion Shares”)

of the Parent Preferred Stock Payment Shares in accordance with the terms of the Certificate of Designations of Series C Convertible

Preferred Stock (the “Series C Certificate of Designations”); |

| |

|

|

| |

(6) |

provide

that, upon receipt of the Stockholder Approval, the Parent Preferred Stock Payment Shares shall be automatically converted into the

Series C Conversion Shares at the conversion price in effect as set forth in the Series C Certificate of Designations; provided that,

following such conversion, the Series C Conversion Shares shall represent approximately 60.1% of the outstanding shares of Parent

Common Stock; and |

| |

(7) |

provide

that, as soon as possible after the Closing Date, the Parent shall file a resale registration statement with the Securities and Exchange

Commission to register the Parent Common Stock Payment Shares and the Parent Common Stock issuable upon conversion of the Parent

Preferred Stock Payment Shares, in accordance with the terms of a registration rights agreement to be entered into between the parties

(each of (1) through (7), the “Proposed Amendments”). |

WHEREAS,

the parties are negotiating in good faith to amend and restate the Merger Agreement to reflect, among other modified terms, the Proposed

Amendments and, accordingly, desire to enter into this Amendment to extend the End Date to October 14, 2024;

NOW,

THEREFORE, in consideration of the foregoing and of the representations, warranties, covenants, and agreements contained in this Amendment,

the parties, intending to be legally bound, agree as follows:

1.

Amendment of Section 1.53 of the Merger Agreement. The parties hereby agree that, at the Effective Time, Section 1.53 of the Merger

Agreement shall be amended and restated in its entirety to read as follows:

“End

Date” shall mean October 14, 2024.

2.

Stock Purchase. Promptly following the execution of this Amendment, and in no event later than September 13, 2024, the Company

shall purchase 27,500 shares of the Parent’s Series A Convertible Preferred Stock for $137,500, pursuant to that certain Securities

Purchase Agreement, dated as of December 29, 2023, as amended pursuant to an Amendment to Securities Purchase Agreement dated as of May

1, 2024 (the “Securities Purchase Agreement”; and the time of the consummation of such purchase, the “Effective

Time”).

3.

Waiver. Effective upon the Effective Time, each party hereby waives any prior breaches of the Merger Agreement. The waiver herein

is a limited waiver and shall not be deemed to constitute a waiver with respect to any future breaches of the Merger Agreement, and shall

not be deemed to prejudice any right or rights which either party may now have or may have in the future under or in connection with

the Merger Agreement. The foregoing waiver set forth herein shall also not be deemed to operate as, or obligate any party to grant any

future consent to or modification or waiver of any other term, condition, breach of, or default under the Merger Agreement.

4.

Further Assurances. Each of the parties shall use its best efforts, on and after the Effective Time, to take, or cause to be taken,

all actions, and to do, or cause to be done, all things, reasonably necessary, proper or advisable under applicable laws, regulations

and agreements to consummate and make effective the transactions contemplated by this Amendment, including but not limited to promptly

negotiate in good faith the A&R Merger Agreement and to fulfill such party’s respective conditions precedents and obligations

to ensure a timely Closing.

5.

Additional SPA Closings. The Company may purchase, and the Parent may sell, in one or more tranches, up to an additional 72,500

shares of the Parent’s Series A Preferred Stock for an aggregate of $362,500 pursuant to the Securities Purchase Agreement prior

to or concurrently with the Closing.

6.

FNL Pledge. The Company hereby agrees and that Parent acknowledges that any shares of the Parent’s Series A Preferred Stock

purchased by the Company pursuant to the Securities Purchase Agreement, in accordance with Sections 2 and 5 above, will be pledged by

the Company to FNL, as a secured party under that certain Security Agreement, dated as of January 3, 2024, between the Company, the other

debtors party thereto from time to time and FNL.

7.

Amendment. This Amendment shall be deemed an amendment of the Merger Agreement in accordance with Section 8.6 of the Merger Agreement.

Except as specifically modified hereby, the Merger Agreement shall be deemed controlling and effective, and the parties hereby agree

to be bound by each of its terms and conditions.

8.

Counterparts; Effectiveness. This Amendment may be executed in any number of counterparts, all of which will be one and the same

agreement. This Amendment will become effective when each party to this Amendment will have received counterparts signed by all of the

other parties. A signed copy of this Amendment delivered by email or other means of electronic transmission shall be deemed to have the

same legal effect as delivery of an original signed copy of this Amendment. This Amendment shall be considered signed when the signature

of a party is delivered by .PDF, DocuSign or other generally accepted electronic signature. Such .PDF, DocuSign, or other generally accepted

electronic signature shall be treated in all respects as having the same effect as an original signature.

9.

Governing Law. The terms of Section 9.2 (Governing Law) of the Merger Agreement are hereby incorporated by reference mutatis

mutandis.

[signature

pages follow]

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed as of the date first written above by their respective

officers thereunto duly authorized.

| COMPANY: |

|

| |

|

|

| NAYA

BIOSCIENCES, INC. |

|

| |

|

|

| By: |

/s/

Daniel Teper |

|

| Name: |

Daniel

Teper |

|

| Title: |

CEO |

|

| |

|

|

| PARENT: |

|

| |

|

|

| INVO

BIOSCIENCE, INC. |

|

| |

|

|

| By: |

/s/

Steven Shum |

|

| Name: |

Steven

Shum |

|

| Title: |

CEO |

|

| |

|

|

| MERGER

SUB: |

|

| |

|

|

| INVO

MERGER SUB INC. |

|

| |

|

|

| By: |

/s/

Steven Shum |

|

| Name: |

Steven

Shum |

|

| Title: |

CEO |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

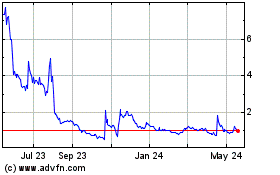

INVO BioScience (NASDAQ:INVO)

Historical Stock Chart

From Feb 2025 to Mar 2025

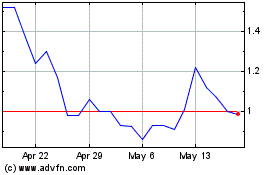

INVO BioScience (NASDAQ:INVO)

Historical Stock Chart

From Mar 2024 to Mar 2025