false

--12-31

0001798270

0001798270

2024-07-05

2024-07-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (date of

earliest event reported): July 5, 2024

Assure Holdings Corp.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40785 |

|

82-2726719 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

7887 East Belleview Avenue, Suite 240

Denver, Colorado |

|

80111 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 720-287-3093

_____________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act: None

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.03 Material

Modification to Rights of Security Holders.

Reverse Stock Split

The Board of Directors

of Assure Holdings Corp. (the “Company”) approved the consolidation of the Company’s authorized and issued and

outstanding common stock, par $0.001, on an eighteen (18) (old) for one (1) (new) share basis (the “Reverse Split”),

pursuant to Nevada Revised Statute (“NRS”) Section 78.207. On July 5, 2024, the Company filed a Certificate of Change

(“Certificate of Change”) with the Nevada Secretary of State pursuant to NRS 78.209, to effect the Reverse Split, effective

at 12:01 a.m. (Pacific Standard Time) on July 9, 2024 (the “Effective Time”), subject to the right of termination by

the Board of Directors prior to the Effective Time.

The Board of Directors

approved the Reverse Split to meet the share bid price requirements of the NASDAQ Capital Market.

Effect

of Reverse Split

At the Effective Time,

the total number of shares of common stock (“Common Stock”) authorized by the Corporation will be reduced from 250,000,000

shares of Common Stock, par $0.001, to 13,888,888 shares of Common Stock, par $0.001, and the number of shares of Common Stock held by

each stockholder of the Company will be consolidated automatically into the number of shares of Common Stock equal to the number of issued

and outstanding shares of Common Stock held by each such stockholder immediately prior to the Reverse Split divided by eighteen (18):

effecting an eighteen (18) pre-split shares for one (1) post-split share reverse stock split.

No fractional shares

will be issued in connection with the Reverse Split and all fractional shares will be rounded up to the next whole share, pursuant to

NRS 78.205(2)(b).

As of July 8, 2023, the

Company had 10,602,306 shares of Common Stock issued and outstanding, and after the Reverse Split, the Company will have approximately

589,017 shares of Common Stock issued and outstanding.

Also on the Effective

Date, all options, warrants and other convertible securities of the Company outstanding immediately prior to the Reverse Split will be

adjusted by dividing the number of shares of Common Stock into which the options, warrants and other convertible securities are exercisable

or convertible by eighteen (18) and multiplying the exercise or conversion price thereof by eighteen (18), all in accordance with the

terms of the plans, agreements or arrangements governing such options, warrants and other convertible securities and subject to rounding

to the nearest whole share.

Immediately after the

Reverse Split, each stockholder’s percentage ownership interest in the Company and proportional voting power will remain virtually

unchanged, except for minor changes and adjustments that will result from rounding fractional shares into whole shares. The rights and

privileges of the holders of shares of Common Stock will be substantially unaffected by the Reverse Split.

No

Shareholder Approval Required.

Pursuant

to NRS 78.207, no consent or approval of the stockholders is required for the Reverse Split.

Symbol;

CUSIP

The Common Stock is expected

to begin trading on the NASDAQ Capital Market on a split-adjusted basis when the market opens on July 9, 2024, meaning that each eighteen

(18) pre-split shares will represent one (1) post-split share, and the share price is expected to increase mechanically in proportion

to the 18:1 ratio. The Common Stock will continue to trade under its existing symbol “IONM”. The new CUSIP number for the

Common Stock following the Reverse Split will be 04625J402.

Certificated

and Non-Certificated Shares.

The Company intends to treat stockholders holding

shares of Common Stock in “street name” (that is, held through a bank, broker or other nominee) in the same manner as stockholders

of record whose shares of Common Stock are registered in their names. Banks, brokers or other nominees will be instructed to effect the

Reverse Split for their beneficial holders holding shares of our Common Stock in “street name;” however, these banks, brokers

or other nominees may apply their own specific procedures for processing the Reverse Split. Stockholders who are holding their shares

of Common Stock in electronic form at brokerage firms do not need to take any action, as the effect of the Reverse Split will automatically

be reflected in their brokerage accounts.

Stockholders who are holding their shares of Common

Stock electronically in direct registered book-entry form (“DRS”) with Computershare Trust Company, N.A., the Company’s

transfer agent (the “Transfer Agent”), will not need to take action. The Reverse Split will automatically be reflected

in the Transfer Agent’s records and on such stockholders’ next account statement.

Stockholders holding paper certificates may (but

are not required to) exchange their stock certificates for post-split shares of Common Stock held electronically in DRS book-entry form,

which means they will not receive physical stock certificates and will receive a statement of account and instructions from the Transfer

Agent regarding the transition to book-entry share registration. To obtain a Letter of Transmittal or for instructions on how a stockholder

should surrender his, her or its certificates representing pre-split shares of Common Stock to the Transfer Agent in exchange for post-split

shares in DRS book-entry form, please contact the Transfer Agent toll free at 1 (800) 546-5141.

Nevada Filing - Certificate

of Change

On July 5, 2024, the

Company filed the Certificate of Change with the Nevada Secretary of State pursuant to NRS 78.209, which amends the Company’s Articles

of Incorporation to effect the Reverse Split, effective at the Effective Time. Pursuant to 78.209, the Board of Directors may terminate

the Reverse Split at any time prior to the Effective Time by resolution and filing of a certificate of termination.

The description contained

herein of the Reverse Split and proportional decrease of the Company’s authorized shares of Common Stock is qualified in its entirety

by reference to the Certificate of Change, a copy of which is attached to this report as Exhibit 3.1 hereto and incorporated herein by

reference.

Item 5.03 Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Certificate of Change

The information set forth

in Item 3.03 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 5.03.

Item 8.01 Other Events

The information set forth

in Item 3.03 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 8.01.

The Company has a registration

statement on Form S-8 (File No. 333-262092) on file with the United States Securities and Exchange Commission (the “Commission”).

Commission regulations permit the Company to incorporate by reference future filings made with the Commission pursuant to Sections 13(a),

13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, prior to the termination of the offerings covered by registration

statements filed on Form S-8. The information incorporated by reference is considered to be part of the prospectus included within each

of those registration statements. Information in this Item 8.01 of this Current Report on Form 8-K is therefore intended to be automatically

incorporated by reference into each of the active registration statements listed above, thereby amending them. Pursuant to Rule 416(b)

under the Securities Act, the amount of undistributed shares of Common Stock deemed to be covered by the effective registration statements

of the Company described above are proportionately reduced as of the Effective Time to give effect to the Reverse Split.

Item 9.01 Exhibits

| Exhibit No. | |

Name |

| 3.1 | |

Certificate of Change |

| 104 | |

Cover Page Interactive Data File (formatted in Inline XBRL and included as Exhibit 101). |

SIGNATURE

Pursuant to the requirement of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

ASSURE HOLDINGS CORP. |

| |

|

|

| Date: July 9, 2024 |

By: |

/s/ John Farlinger |

| |

Name: |

John Farlinger |

| |

Title: |

Chief Executive Officer |

Exhibit

3.1

| Certified Copy

7/5/2024 12:52:40 PM

Work Order Number: W2024070500713

Reference Number: 20244168171

Through Date: 7/5/2024 12:52:40 PM

Corporate Name: ASSURE HOLDINGS CORP

The undersigned filing officer hereby certifies that the attached copies are true and exact

copies of all requested statements and related subsequent documentation filed with the

Secretary of State’s Office, Commercial Recordings Division listed on the attached report.

Document Number Description Number of Pages

20244168165 Certificate Pursuant to NRS 78.209 1

Certified By: Ashley Popham

Certificate Number: B202407054782909

You may verify this certificate

online at https://www.nvsilverflume.gov/home

Respectfully,

FRANCISCO V. AGUILAR

Nevada Secretary of State

FRANCISCO V. AGUILAR

Secretary of State

DEPUTY BAKKEDAHL

Deputy Secretary for

Commercial Recordings

STATE OF NEVADA

OFFICE OF THE

SECRETARY OF STATE

Commercial Recordings Division

401 N. Carson Street

Carson City, NV 89701

Telephone (775) 684-5708

Fax (775) 684-7138

North Las Vegas City Hall

2250 Las Vegas Blvd North, Suite 400

North Las Vegas, NV 89030

Telephone (702) 486-2880

Fax (702) 486-2888

|

| Filed in the Office of

Secretary of State

State Of Nevada

Business Number

E0232292017-6

Filing Number

20244168165

Filed On

7/5/2024 12:04:00 PM

Number of Pages

1 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

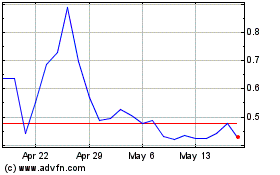

Assure (NASDAQ:IONM)

Historical Stock Chart

From Jan 2025 to Feb 2025

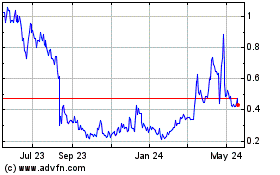

Assure (NASDAQ:IONM)

Historical Stock Chart

From Feb 2024 to Feb 2025