UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Amendment No. 7)

Tender Offer Statement Under Section 13(e)(1)

of the Securities Exchange Act of 1934

ASSURE HOLDINGS CORP.

(Name of Subject Company (Issuer) and Filing

Person (Offeror))

9% CONVERTIBLE DEBENTURES DUE 2023 AND 2024

(Title of Class of Securities)

|

04625J303

(CUSIP Number of Common Stock Underlying Debentures) |

| |

|

John Farlinger

Executive Chairman and Chief Executive Officer

7887 East Belleview Avenue, Suite 240

Denver, Colorado 80111

Telephone: 720-287-3093 |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Person) |

| |

| |

| Copies to: |

| |

|

Jason K Brenkert, Esq.

Dorsey & Whitney LLP

1400 Wewatta Street, Suite 400

Denver, Colorado 80202

Telephone: (303) 352-1133

Fax Number: (303) 629-3450 |

| |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate

any transactions to which the statement relates:

| ¨ |

third party tender offer subject to Rule 14d-1. |

| x |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final

amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below

to designate the appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

INTRODUCTORY STATEMENT

This Amendment No. 7 (“Amendment No.

7”) amends the Tender Offer Statement on Schedule TO originally filed by Assure Holdings Corp., a Nevada corporation (the “Company”,

“we”, “us” or “our”), on June 21, 2024, as amended on July 3, July 9, July 12,

July 22, July 30 and August 7, 2024 (as amended through August 7, 2024 the “Sixth Amended Schedule TO”), in connection

with an offer (the “Convertible Note Exchange Offer”) by Assure to exchange, for each $1,000 claim, consisting of principal

amount, and accrued and unpaid interest through, and including, July 19, 2024, of the Company’s 9% Convertible Debentures due 2023

and 2024 (the “Assure Convertible Debentures”), 238.44 shares of the Company’s common stock (the “Common

Stock”) equal to the quotient of $1,000 divided by a per share price of $4.194. Assure is seeking to exchange any and

all outstanding Assure Convertible Debentures in the Convertible Note Exchange Offer for the offered shares of Common Stock.

The Convertible Note Exchange Offer commenced

on June 21, 2024 and will expire at 11:59 p.m. (Denver time) on August 23, 2024, unless extended by the Company.

This Amendment No. 7 is being filed solely to

provide as an exhibit the press release, dated August 19, 2024, announcing the extension of the Convertible Note Exchange Offer from 11:59

p.m. (Denver Time) on August 16, 2024 to 11:59 p.m. (Denver Time) on August 23, 2024.

This Amendment No. 7 amends and supplements only

Items 11 and 12. Except to the extent specifically provided herein, as amended hereby, the information contained in the Sixth Amended

Schedule TO and the exhibits to the Sixth Amended Schedule TO remain unchanged and are hereby expressly incorporated into this Amendment

No. 7 by reference in response to Items 1 through 13. This Amendment No. 7 should be read with the Fourth Amended Schedule TO and the

exhibits thereto.

Item 11. Additional Information

Item 11 of the Sixth Amended Schedule TO is hereby amended and supplemented

by adding the following:

On August 20, 2024, the Company issued a press

release extending the expiration date of the Convertible Note Exchange Offer from 11:59 p.m. (Denver Time) on August 16, 2024 to 11:59

p.m. (Denver Time) on August 23, 2024.

Item 12. Exhibits.

| |

(a) |

(1) |

(i)* |

Offer Letter dated June 21, 2024 |

| |

|

|

(ii)* |

Amendment No. 1 to Offer Letter dated July 3, 2024 |

| |

|

|

(iii)* |

Amendment No. 2 to Offer Letter dated July 12, 2024 |

| |

|

|

(iv)* |

Amendment No. 3 to Offer Letter dated August 5, 2024 |

| |

|

|

(v)* |

Amended Letter of Transmittal dated July 3, 2024 |

| |

|

|

(vi)* |

Withdrawal Form |

| |

|

|

(vii)* |

Form of Confirmation email/letter to Holders who Elect to Participate in the Offer |

| |

|

|

(viii)* |

Form of Cover Letter to Holders |

| |

|

|

(ix)* |

Letter to Holders dated July 9, 2024 |

| |

|

|

(x)* |

Press Release dated July 22, 2024 |

| |

|

|

(xi)* |

Press Release dated July 29, 2024 |

| |

|

|

(xii)* |

Press Release dated August 5, 2024 |

| |

|

|

(xiii) |

Press Release dated August 19, 2024 |

| |

(b) |

Not applicable |

| |

(d) |

(1) |

(i) Form of Convertible Debenture (incorporated by reference to Exhibit 4.2 to the Company’s Registration Statement on Form S-1 as filed on December 30, 2020) |

| |

(g) |

Not applicable |

| |

(h) |

Not applicable |

| |

107 |

Filing Fees* |

| |

|

|

* - Previously filed

SIGNATURES

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

ASSURE HOLDINGS CORP. |

|

| |

|

|

| By: |

/s/ John Farlinger |

|

| |

John Farlinger |

|

| |

Chief Executive Officer |

|

Dated: August 20, 2024

INDEX TO EXHIBITS

| |

(a) |

(1) |

(i)* |

Offer Letter dated June 21, 2024 |

| |

|

|

(ii)* |

Amendment No. 1 to Offer Letter dated July 3, 2024 |

| |

|

|

(iii)* |

Amendment No. 2 to Offer Letter dated July 12, 2024 |

| |

|

|

(iv)* |

Amendment No. 3 to Offer Letter dated August 5, 2024 |

| |

|

|

(v)* |

Amended Letter of Transmittal dated July 3, 2024 |

| |

|

|

(vi)* |

Withdrawal Form |

| |

|

|

(vii)* |

Form of Confirmation email/letter to Holders who Elect to Participate in the Offer |

| |

|

|

(viii)* |

Form of Cover Letter to Holders |

| |

|

|

(ix)* |

Letter to Holders dated July 9, 2024 |

| |

|

|

(x)* |

Press Release dated July 22, 2024 |

| |

|

|

(xi)* |

Press Release dated July 29, 2024 |

| |

|

|

(xii)* |

Press Release dated August 5, 2024 |

| |

|

|

(xiii) |

Press Release dated August 19, 2024 |

| |

(b) |

Not applicable |

| |

(d) |

(1) |

(i) Form of Convertible Debenture (incorporated by reference to Exhibit 4.2 to the Company’s Registration Statement on Form S-1 as filed on December 30, 2020) |

| |

(g) |

Not applicable |

| |

(h) |

Not applicable |

| |

107 |

Filing Fees* |

| |

|

|

* - Previously filed

Exhibit (a)(1)(xiii)

Assure Announces Extension of Exchange

Offer Relating to its Convertible Notes

Denver, August 19,

2024 – Assure Holdings Corp. (“Assure” or the “Company”) (NASDAQ: IONM), today announced

that it has extended the expiration date of its exchange offer (the “Offer”) relating to the Company’s 9% Convertible

Debentures due 2023 and 2024 (the “Assure Convertible Debentures”). As a result of the extension, the Exchange Offer is now

scheduled to expire at 11:59 p.m. (Denver Time), on August 23, 2024 (the “Expiration Date”) unless further

extended.

The Offer was originally

scheduled to expire at 11:59 p.m. (Denver Time) on July 19, 2024, and has been extended several times to now expire at 11:59 p.m. (Denver

Time), on August 23, 2024. Except for the extension of the Expiration Date, all of the other terms of the Offer remain as set forth in

the Offer Letter dated June 21, 2024, as amended (the “Offer Letter”), and a Schedule TO related thereto, as filed with the

U.S. Securities and Exchange Commission (“SEC”) on June 21, 2024, as amended (the “Schedule TO”).

As of 11:59 p.m. (Denver

Time) on August 16, 2024, $2.0 million in principal face amount of Assure Convertible Debentures have been tendered into the Offer..

Important Information Has Been Filed with

the SEC

Copies of the Offer Letter

(and all amendments thereto) and the Schedule TO (and all amendments thereto) are available free of charge at the website of the SEC at

www.sec.gov. Requests for documents may also be directed to Assure Holdings Corp., 7887 E. Belleview Ave., Suite 240,

Denver, Colorado, USA 80111 or email to ir@assureiom.com.

This announcement is

for informational purposes only and shall not constitute an offer to purchase or a solicitation of an offer to sell the Assure Convertible

Notes or an offer to sell or a solicitation of an offer to buy any shares of Assure’s common stock. The Offer is being made only

through the Schedule TO and Offer Letter, and the complete terms and conditions of the Offer are set forth in the Schedule TO and Offer

Letter. Holders of the Assure Convertible Debentures are urged to read the Schedule TO and Offer Letter carefully before making any decision

with respect to the Offer because they contain important information, including the various terms of, and conditions to, the Offer. None

of Assure, or any of its management or its board of directors makes any recommendation as to whether or not holders of Assure Convertible

Debentures should tender such Assure Convertible Debentures for exchange in the Offer.

About Assure Holdings

Assure Holdings Corp.

is a provider of outsourced intraoperative neuromonitoring and remote neurology services. The Company delivers a turnkey suite of clinical

and operational services to support surgeons and medical facilities during invasive procedures that place the nervous system at risk including

neurosurgery, spine, cardiovascular, orthopedic and ear, nose and throat surgeries. Assure employs highly trained technologists that provide

a direct point of contact in the operating room. Physicians employed through Assure subsidiaries simultaneously monitor the functional

integrity of patients’ neural structures throughout the procedure communicating in real-time with the surgeon and technologist.

Accredited by The Joint Commission, Assure’s mission is to provide exceptional surgical care and a positive patient experience.

For more information, visit the Company’s website at www.assureneuromonitoring.com.

Forward-Looking Statements

This news release may

contain “forward-looking statements” within the meaning of applicable securities laws. Forward-looking statements may generally

be identified by the use of the words “anticipates,” “expects,” “intends,” “plans,” “should,”

“could,” “would,” “may,” “will,” “believes,” “estimates," “potential,”

“target,” or “continue” and variations or similar expressions. Forward-looking statements include, but are not

limited to, the future expiration date of the Offer, and other similar statements. These statements are based upon the current expectations

and beliefs of management and are subject to certain risks and uncertainties that could cause actual results to differ materially from

those described in the forward-looking statements. These risks include risks regarding our patient volume or cases not growing as expected,

or decreasing, which could impact revenue and profitability; unfavorable economic conditions could have an adverse effect on our business;

risks related to increased leverage resulting from incurring additional debt; the policies of health insurance carriers may affect the

amount of revenue we receive; our ability to successfully market and sell our products and services; we may be subject to competition

and technological risk which may impact the price and amount of services we can sell and the nature of services we can provide; regulatory

changes that are unfavorable in the states where our operations are conducted or concentrated; our ability to comply and the cost of compliance

with extensive existing regulation and any changes or amendments thereto; changes within the medical industry and third-party reimbursement

policies and our estimates of associated timing and costs with the same; our ability to adequately forecast expansion and the Company’s

management of anticipated growth; and risks and uncertainties discussed in our most recent annual and quarterly reports filed with the

United States Securities and Exchange Commission, including our annual report on Form 10-K filed on April 26, 2024, and with the Canadian

securities regulators and available on the Company’s profiles on EDGAR at www.sec.gov and SEDAR at www.sedar.com, which risks and

uncertainties are incorporated herein by reference. Readers are cautioned not to place undue reliance on forward-looking statements. Except

as required by law, Assure does not intend, and undertakes no obligation, to update any forward-looking statements to reflect, in particular,

new information or future events.

Investor Contact

Brett Maas, Managing Principal, Hayden IR

ionm@haydenir.com

(646) 536-7331

Source:

Assure Holdings Corp.

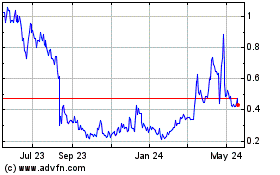

Assure (NASDAQ:IONM)

Historical Stock Chart

From Jan 2025 to Feb 2025

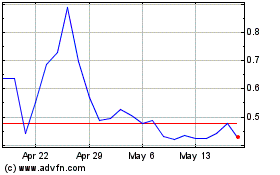

Assure (NASDAQ:IONM)

Historical Stock Chart

From Feb 2024 to Feb 2025