03/11/20240001159167false00011591672024-03-112024-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 11, 2024

iROBOT CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | |

| (State or other jurisdiction of

incorporation or organization) | |

| 001-36414 | | 77-0259335 |

| (Commission File Number) | | (I.R.S. Employer

Identification No.) |

8 Crosby Drive

Bedford, MA 01730

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (781) 430-3000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | IRBT | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

Item 7.01 | Regulation FD Disclosure. |

On March 11, 2024, iRobot Corporation issued a press release regarding its financial expectations for the first fiscal quarter and reiterates its financial outlook for fiscal year 2024, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 7.01 and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | Press Release, dated March 11, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: March 11, 2024 | | iRobot Corporation |

| | |

| | |

| | /s/ Glen D. Weinstein |

| | Glen D. Weinstein |

| | Interim Chief Executive Officer |

| | |

EX-99.1

| | | | | | | | | | | | | | |

| Contacts: | | | | |

| Karian Wong | | | | Charlie Vaida |

| Investor Relations | | | | Media Relations |

| iRobot Corp. | | | | iRobot Corp. |

| (781) 430-3003 | | | | (781) 430-3182 |

| investorrelations@irobot.com | | | cvaida@irobot.com |

| | | | |

iRobot Provides First Quarter 2024 Financial Expectations and Reiterates

2024 Financial Outlook

BEDFORD, Mass., March 11, 2024 -- iRobot Corp. (NASDAQ: IRBT), a leader in consumer robots, today announced its GAAP and non-GAAP financial expectations for the first quarter ending March 30, 2024, and reiterated its previously announced financial outlook for the fiscal year ending December 28, 2024 ahead of meetings with institutional investors.

First Quarter 2024 Outlook

iRobot is providing GAAP and non-GAAP financial expectations for the first quarter ending March 30, 2024. A detailed reconciliation between the Company’s GAAP and non-GAAP expectations is included in the attached financial tables.

First Quarter 2024:

| | | | | | | | | | | | | | | | | |

Metric | GAAP | | Adjustments | | Non-GAAP |

Revenue | $137 - $142 million | | — | | $137 - $142 million |

Gross Margin | 22% to 23% | | ~1% | | 23% to 24% |

Operating Income (Loss) | $7 – $11 million | | ~($54) million | | ($47) – ($43) million |

Net Loss Per Share | ($0.22) – ($0.09) | | ~($1.91) | | ($2.13) – ($2.00) |

Reiterates 2024 Financial Outlook

iRobot is reiterating its GAAP and non-GAAP financial expectations for the fiscal year ending December 28, 2024 as well as first half and second half color, previously announced in its fourth-quarter and year-end 2023 news release on February 26, 2024. A detailed reconciliation between the Company’s GAAP and non-GAAP expectations is included in the attached financial tables.

Fiscal Year 2024:

| | | | | | | | | | | | | | | | | |

| Metric | GAAP | | Adjustments | | Non-GAAP |

| Revenue | $825 - $865 million | | — | | $825 - $865 million |

| Gross Margin | 31% to 33% | | ~1% | | 32% to 34% |

| Operating Loss | ($41) – ($29) million | | ~($17) million | | ($58) – ($46) million |

| Net Loss Per Share | ($3.13) – ($2.70) | | ~($0.60) | | ($3.73) – ($3.30) |

•For the first half of 2024, revenue is expected to decline in the high teens to low 20s percentage range compared to the first half of 2023, with Q2 expected to be the weaker quarter year-over-year as the Company expects a shifting of orders into Q3.

•For the second half of the year, the Company anticipates a mid-single-digit percentage improvement in revenue compared to the second half of 2023.

•iRobot anticipates that the majority of the gross margin improvement will occur in the second half of the year as the Company ramps its initiatives.

About iRobot Corp.

iRobot is a global consumer robot company that designs and builds thoughtful robots and intelligent home innovations that make life better. iRobot introduced the first Roomba robot vacuum in 2002. Today, iRobot is a global enterprise that has sold more than 50 million robots worldwide. iRobot's product portfolio features technologies and advanced concepts in cleaning, mapping and navigation. Working from this portfolio, iRobot engineers are building robots and smart home devices to help consumers make their homes easier to maintain and healthier places to live. For more information about iRobot, please visit www.irobot.com.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains "forward-looking statements" within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which relate to, among other things: the Company's expectations regarding future financial performance, including with respect to first quarter and fiscal year 2024 revenue, gross margin, operating loss and loss per share; and the Company's implementation of its operational restructuring plan, the expected business and financial impacts thereof, and related restructuring charges. These forward-looking statements are based on the Company's current expectations, estimates and projections about its business and industry, all of which are subject to change. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as "expect," "anticipate," "intend," "plan," "believe," "could," "seek," "see," "will," "may," "would," "might," "potentially," "estimate," "continue," "expect," "target," similar expressions or the negatives of these words or other comparable terminology that convey uncertainty of future events or outcomes. All forward-looking statements by their nature address matters that involve risks and uncertainties, many of which are beyond our control, and are not guarantees of future results, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: (i) the Company's ability to obtain capital when desired on favorable terms, if at all; (ii) our restructuring efforts may not be successful; (iii) the impact of the COVID-19 pandemic and various global conflicts on the Company's business and general economic conditions; (iv) the Company's ability to implement its business strategy; (v) the risk that disruptions from the proposed restructuring will harm the Company's business, including current plans and operations; (vi) the ability of the Company to retain and hire key personnel, including successfully navigating its leadership transition; (vii) legislative, regulatory and economic developments affecting the Company's business; (viii)

general economic and market developments and conditions; (ix) the evolving legal, regulatory and tax regimes under which the Company operates; (x) potential business uncertainty, including changes to existing business relationships that could affect the Company's financial performance; (xi) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, (xii) current supply chain challenges including current constraints in the availability of certain semiconductor components used in the Company's products; (xiii) the financial strength of the Company's customers and retailers; (xiv) the impact of tariffs on goods imported into the United States; and (xv) competition, as well as the Company's response to any of the aforementioned factors. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the caption "Risk Factors" in the Company's most recent annual and quarterly reports filed with the SEC and any subsequent reports on Form 10-K, Form 10-Q or Form 8-K filed from time to time and available at www.sec.gov. While the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability and similar risks, any of which could have a material adverse effect on the Company's financial condition, results of operations, or liquidity. The forward-looking statements included herein are made only as of the date hereof. The Company does not assume any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

iRobot Corporation

Explanation of Non-GAAP Measures

This press release contains references to the non-GAAP financial measures described below. We use non-GAAP measures to internally evaluate and analyze financial results. We believe these non-GAAP financial measures provide investors with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and enable comparison of our financial results with other public companies, many of which present similar non-GAAP financial measures.

Our non-GAAP financial measures reflect adjustments based on the following items. These non-GAAP financial measures should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations from these results should be carefully evaluated.

Amortization of acquired intangible assets: Amortization of acquired intangible assets consists of amortization of intangible assets including completed technology, customer relationships, and reacquired distribution rights acquired in connection with business combinations as well as any non-cash impairment charges associated with intangible assets in connection with our past acquisitions. Amortization charges for our acquisition-related intangible assets are inconsistent in size and are significantly impacted by the timing and valuation of our acquisitions. We exclude these charges from our non-GAAP measures to facilitate an evaluation of our current operating performance and comparisons to our past operating performance.

Net Merger, Acquisition and Divestiture (Income) Expense: Net merger, acquisition and divestiture (income) expense primarily consists of transaction fees, professional fees, and transition and integration costs directly associated with mergers, acquisitions and divestitures, including with respect to the iRobot-Amazon Merger which was terminated on January 28, 2024. It also includes business combination adjustments including adjustments after the measurement period has ended. The occurrence and amount of these costs will vary depending on the timing and size of these transactions. We exclude these charges from our non-GAAP measures to facilitate an evaluation of our current operating performance and comparisons to our past operating performance.

Stock-Based Compensation: Stock-based compensation is a non-cash charge relating to stock-based awards. We exclude this expense as it is a non-cash expense, and we assess our internal operations excluding this expense and believe it facilitates comparisons to the performance of other companies.

Restructuring and Other: Restructuring charges are related to one-time actions associated with realigning resources, enhancing operational productivity and efficiency, or improving our cost structure in support of our strategy. Such actions are not reflective of ongoing operations and include costs primarily associated with severance costs, certain professional fees, costs associated with consolidation of facilities, warehouses and any other leased properties, and other non-recurring costs directly associated with resource realignments tied to strategic initiatives or changes in business conditions. We exclude this item from our non-GAAP measures when evaluating our recent and prospective business performance as such items vary significantly based on the magnitude of the action and do not reflect anticipated future operating costs. In addition, these charges do not necessarily provide meaningful insight into the fundamentals of current or past operations of our business.

Income tax adjustments: Income tax adjustments include the tax effect of the non-GAAP adjustments, calculated using the appropriate statutory tax rate for each adjustment. We regularly assess the need to record valuation allowances based on non-GAAP profitability and other factors. We also exclude certain tax items, including the impact from stock-based compensation windfalls/shortfalls, that are not reflective of income tax expense incurred as a result of current period earnings. We believe disclosure of the income tax provision

before the effect of such tax items is important to permit investors’ consistent earnings comparison between periods.

| | | | | |

| iRobot Corporation |

| Supplemental Reconciliation of First Quarter Fiscal Year 2024 GAAP to Non-GAAP Guidance |

| (unaudited) |

| |

| |

| Q1-24 |

| GAAP Gross Profit | $30 - $32 million |

| Stock-based compensation | ~$1 million |

| Restructuring and other | ~$1 million |

| Total adjustments | ~$2 million |

| Non-GAAP Gross Profit | $32 - $34 million |

| |

| Q1-24 |

| GAAP Gross Margin | 22% - 23% |

| Stock-based compensation | ~1% |

| Restructuring and other | ~1% |

| Total adjustments | ~1% |

| Non-GAAP Gross Margin | 23% - 24% |

| |

| Q1-24 |

| GAAP Operating Income | $7 - $11 million |

| Amortization of acquired intangible assets | ~$0 million |

| Stock-based compensation | ~$9 million |

| Net merger, acquisition and divestiture expense (income) | ~($74) million |

| Restructuring and other | ~$11 million |

| Total adjustments | ~($54) million |

| Non-GAAP Operating Loss | ($47) - ($43) million |

| |

| Q1-24 |

| GAAP Net Loss Per Diluted Share | ($0.22) - ($0.09) |

| Amortization of acquired intangible assets | ~$0.01 |

| Stock-based compensation | ~$0.33 |

| Net merger, acquisition and divestiture expense (income) | ~($2.64) |

| Restructuring and other | ~$0.39 |

| Income tax effect | ~$0 |

| Total adjustments | ~($1.91) |

| Non-GAAP Net Loss Per Diluted Share | ($2.13) - ($2.00) |

| |

| Number of shares used in diluted per share calculations* | ~28.0 million |

| |

| * Number of shares does not include impact from the at-the-market offering program announced on February 27, 2024 |

| Certain numbers may not total due to rounding | |

| | | | | |

| iRobot Corporation |

| Supplemental Reconciliation of Fiscal Year 2024 GAAP to Non-GAAP Guidance |

| (unaudited) |

| |

| |

| FY-24 |

| GAAP Gross Profit | $258 - $288 million |

| Stock-based compensation | ~$4 million |

| Restructuring and other | ~$2 million |

| Total adjustments | ~$6 million |

| Non-GAAP Gross Profit | $264 - $294 million |

| |

| FY-24 |

| GAAP Gross Margin | 31% - 33% |

| Stock-based compensation | ~1% |

| Restructuring and other | ~0% |

| Total adjustments | ~1% |

| Non-GAAP Gross Margin | 32% - 34% |

| |

| FY-24 |

| GAAP Operating Loss | ($41) - ($29) million |

| Amortization of acquired intangible assets | ~$1 million |

| Stock-based compensation | ~$41 million |

| Net merger, acquisition and divestiture expense (income) | ~($74) million |

| Restructuring and other | ~$15 million |

| Total adjustments | ~($17) million |

| Non-GAAP Operating Loss | ($58) - ($46) million |

| |

| FY-24 |

| GAAP Net Loss Per Diluted Share | ($3.13) - ($2.70) |

| Amortization of acquired intangible assets | ~$0.03 |

| Stock-based compensation | ~$1.45 |

| Net merger, acquisition and divestiture expense (income) | ~($2.61) |

| Restructuring and other | ~$0.53 |

| |

| Income tax effect | ~$0 |

| Total adjustments | ~($0.60) |

| Non-GAAP Net Loss Per Diluted Share | ($3.73) - ($3.30) |

| |

| Number of shares used in diluted per share calculations | ~28.3 million |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

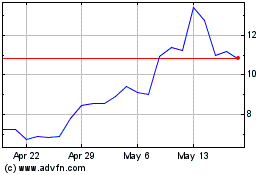

iRobot (NASDAQ:IRBT)

Historical Stock Chart

From Sep 2024 to Oct 2024

iRobot (NASDAQ:IRBT)

Historical Stock Chart

From Oct 2023 to Oct 2024