UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 12, 2024

Inspirato Incorporated

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39791 |

|

85-2426959 |

(State or other jurisdiction

of incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

|

1544 Wazee Street

Denver, CO |

|

80202 |

| (Address of principal executive

offices) |

|

(Zip Code) |

(303) 839-5060

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A common stock, $0.0001 par value per share |

|

ISPO |

|

The Nasdaq Stock Market LLC |

| Warrants to purchase Class A common stock |

|

ISPOW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

On August 13, 2024, Inspirato Incorporated

(the “Company”) issued a press release, sent an email to its members, and sent two emails to its employees, in each

case announcing the execution on August 12, 2024 of an investment agreement (the “Investment Agreement”) with

One Planet Group LLC, a Delaware limited liability company (the “Purchaser”), relating to the issuance and sale to

the Purchaser of shares of Class A common stock of the Company, a warrant to purchase shares of Class A common stock, and an

option to acquire an additional number of shares of Class A common stock. Copies of the press release, the email to the Company’s

members, and the two emails to the Company’s employees are furnished as Exhibits 99.1, 99.2, 99.3 and 99.4, respectively, to

this Current Report on Form 8-K and are incorporated by reference herein.

The information in Item 7.01 of this Current

Report on Form 8-K, and Exhibits 99.1, 99.2, 99.3 and 99.4 attached hereto, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to

the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended

(the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a

filing. To the extent that information pertaining to the transactions contemplated by the Investment Agreement (collectively, the “Transactions”)

contained in Exhibits 99.1, 99.2, 99.3 and 99.4 constitutes soliciting material pursuant to Rule 14a-12 under the Exchange Act,

such information shall only be deemed filed pursuant to such rule.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities

Act and Section 21E of the Exchange Act. Forward-looking statements generally relate to future events or the Company’s future

financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “believe,”

“may,” “will,” “estimate,” “potential,” “continue,” “anticipate,”

“intend,” “expect,” “could,” “would,” “project,” “forecast,” “plan,”

“intend,” “target,” or the negative of these words or other similar expressions that concern the Company’s

expectations, strategy, priorities, plans, or intentions. Forward-looking statements in this Current Report on Form 8-K include,

but are not limited to, the Company’s ability to consummate the Transactions and satisfy applicable closing conditions, including

the receipt of its stockholders’ approval at a special meeting of stockholders (the “Special Meeting”) of a proposal

to authorize the issuance of certain shares of Class A common stock of the Company issuable pursuant to the Investment Agreement,

to the extent such approval is required under the rules of the Nasdaq Stock Market LLC (such proposal, the “Nasdaq Proposal”).

The Company’s expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject

to risks and uncertainties, including changes in the Company’s plans or assumptions, that could cause actual results to differ materially

from those projected. These risks include the risk of the Company’s stockholders not approving the Transactions, the occurrence

of any event, change or other circumstances that could result in the Investment Agreement being terminated or the Transactions not being

completed on the terms reflected in the Investment Agreement, or at all, and uncertainties as to the timing of the consummation of the

Transactions; the ability of each party to consummate the Transactions; and other risks detailed in the Company’s filings with the

Securities and Exchange Commission (the “SEC”), including the Company’s Annual Report on Form 10-K filed

with the SEC on March 12, 2024. All information provided in this Current Report on Form 8-K is as of the date hereof, and the

Company undertakes no duty to update this information unless required by law. These forward-looking statements should not be relied upon

as representing the Company’s assessment as of any date subsequent to the date of this Current Report on Form 8-K.

Additional Information and Where to Find It

The Company, its directors and certain executive

officers are participants in the solicitation of proxies from stockholders in connection with the Special Meeting to approve the Nasdaq

Proposal. The Company plans to file a proxy statement (the “Special Meeting Proxy Statement”) with the SEC in connection

with the solicitation of proxies for the Special Meeting. Additional information regarding such participants, including their direct or

indirect interests, by security holdings or otherwise, will be included in the Special Meeting Proxy Statement and other relevant documents

to be filed with the SEC in connection with the Special Meeting. Information relating to the foregoing can also be found in the Company’s

proxy statement for its 2024 annual meeting of stockholders (the “2024 Proxy Statement”). To the extent that such participants’

holdings of the Company’s securities have changed since the amounts printed in the 2024 Proxy Statement, such changes have been

or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC.

Promptly after filing the definitive Special Meeting

Proxy Statement with the SEC, the Company will mail the definitive Special Meeting Proxy Statement and related proxy card to each stockholder

entitled to vote at the Special Meeting. STOCKHOLDERS ARE URGED TO READ THE SPECIAL MEETING PROXY STATEMENT (INCLUDING ANY AMENDMENTS

OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the preliminary and definitive versions of the Special Meeting

Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by the Company with the SEC in connection

with the Special Meeting at the SEC’s website (http://www.sec.gov). Copies of the Company’s definitive Special Meeting Proxy

Statement, any amendments or supplements thereto, and any other relevant documents filed by the Company with the SEC in connection with

the Special Meeting will also be available, free of charge, at the Company’s investor relations website (https://investor.inspirato.com/)

or by writing to the Company at Inspirato Incorporated, 1544 Wazee Street, Denver, Colorado 80202, Attention: Investor Relations.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 13, 2024

| |

INSPIRATO INCORPORATED |

| |

|

| |

|

| |

By: |

/s/ Robert Kaiden |

| |

|

Name: |

Robert Kaiden |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

Inspirato Announces

$10 Million Capital Infusion by One Planet Group, Appoints Payam Zamani as CEO and Chairman

New CEO Focused on Profitable Growth, Remains

Committed to Delivering Exceptional Service and World Class Experiences for its Members

Implementing Immediate Efficiencies to Reduce

Annualized Costs by Approximately $25 Million

DENVER, August 12, 2024 (GLOBE NEWSWIRE) – Inspirato

Incorporated (“Inspirato” or the “Company”) (NASDAQ: ISPO), the innovative luxury travel club, today announced

it has entered into a definitive investment agreement with One Planet Group LLC (“One Planet Group”) on a comprehensive transaction

(“the Transaction”) that includes $10 million of equity financing in exchange for approximately 2.9 million new shares of

Inspirato Class A Common Stock and an equivalent number of warrants.

“I’m incredibly excited for what this transaction does

for the future of Inspirato and our members,” said President, David Kallery. “Over the last several quarters, we’ve

worked tirelessly with our members top of mind to improve our product offerings and optimize our portfolio. While the decision to reduce

our workforce was not easy, I’m grateful for the hard work and dedication of the entire team and am confident that under Payam

Zamani’s leadership, Inspirato will continue to provide a world-class travel experience to its members for years to come.”

Upon closing, One Planet Group will name three new Directors to the

Inspirato Board of Directors, including Mr. Zamani as Chairman. The size of the Company’s Board is expected to remain at seven

Directors. The Company also plans to implement initiatives expected to reduce costs by approximately $25 million on an annualized basis.

This includes a reduction in workforce of 15% and the termination of previously impaired, poorly performing leases.

CEO and Chairman, Payam Zamani, commented, “This transaction,

not only strengthens Inspirato’s liquidity and improves the Company’s capital structure with a large, supportive shareholder,

but it injects our boardroom with a fresh perspective. I look forward to working with the team, meeting our members and taking Inspirato

to new heights in a more sustainable and profitable manner.”

The purchase price for each share and warrant in the transaction is

$3.43. The first tranche of the transaction will close August 13, 2024 for consideration of approximately $4.6 million; the second

tranche is expected to close in September 2024, subject to shareholder approval, for consideration of approximately $5.4 million.

Following the second closing, One Planet Group will have an option to invest an additional $2.5 million on the same terms.

About Inspirato

Inspirato (NASDAQ: ISPO) is a luxury travel company that provides exclusive

access to a managed and controlled portfolio of curated vacation options, delivered through an innovative model designed to ensure the

service, certainty, and value that discerning customers demand. The Inspirato portfolio includes branded luxury vacation homes, accommodations

at five-star hotel and resort partners, and custom travel experiences. For more information, visit www.inspirato.com and follow @inspirato

on Instagram, Facebook, X, and LinkedIn.

About One Planet Group LLC

One Planet Group is a closely held private equity firm that owns

a suite of technology and media businesses while also investing in early-stage companies. Owned and operated businesses span a variety

of industries including ad tech, publishing, and media. One Planet Group’s mission is to support strong business ideas while building

an ethos that helps improve society and give back to communities. The company’s investment portfolio includes a diverse group

of innovative tech-enabled products and solutions. Investing primarily in high-growth early-stage entities, emphasizing companies that

aspire to ‘Innovation + Intention.’ One Planet Group was founded by tech entrepreneur Payam Zamani in 2015. With offices

and employees in over ten countries, its global headquarters is in Walnut Creek, California. For more information, visit www.oneplanetgroup.com.

Forward-Looking Statements

This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E

of the Exchange Act. Forward-looking statements generally relate to future events or the Company’s future financial or operating

performance. In some cases, you can identify forward-looking statements because they contain words such as “believe,” “may,”

“will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,”

“expect,” “could,” “would,” “project,” “forecast,” “plan,” “intend,”

“target,” or the negative of these words or other similar expressions that concern the Company’s expectations, strategy,

priorities, plans, or intentions. Forward-looking statements in this release include, but are not limited to, the Company’s ability

to consummate the Transaction and satisfy applicable closing conditions, including stockholder approval, where applicable. The Company’s

expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties,

including changes in the Company’s plans or assumptions, that could cause actual results to differ materially from those projected.

These risks include the risk of the Company’s stockholders not approving the Transaction, the occurrence of any event, change or

other circumstances that could result in the investment agreement being terminated or the transactions not being completed on the terms

reflected in the investment agreement, or at all, and uncertainties as to the timing of the consummation of the transactions; the ability

of each party to consummate the transactions; and other risks detailed in the Company’s filings with the Securities and Exchange

Commission (“SEC”), including the Company’s Annual Report on Form 10-K filed with the SEC on March 12, 2024.

All information provided in this press release is as of the date hereof, and the Company undertakes no duty to update this information

unless required by law. These forward-looking statements should not be relied upon as representing the Company’s assessment as of

any date subsequent to the date of this press release.

Additional Information and Where to Find It

The Company, its directors and certain executive

officers are participants in the solicitation of proxies from stockholders in connection with a special meeting (the “Special Meeting”)

to approve a proposal to issue a portion of the securities contemplated by the transactions described herein. The Company plans to file

a proxy statement (the “Special Meeting Proxy Statement”) with the SEC in connection with the solicitation of proxies for

the Special Meeting. Additional information regarding such participants, including their direct or indirect interests, by security holdings

or otherwise, will be included in the Special Meeting Proxy Statement and other relevant documents to be filed with the SEC in connection

with the Special Meeting. Information relating to the foregoing can also be found in the Company’s proxy statement for the 2024

annual meeting of stockholders as filed with the SEC (the “2024 Proxy Statement”). To the extent that such participants’

holdings of the Company’s securities have changed since the amounts set forth in the 2024 Proxy Statement, such changes have been

or will be reflected on Statements of Change in Ownership on Form 4s filed with the SEC.

Promptly after filing the definitive Special Meeting

Proxy Statement with the SEC, the Company will mail the definitive Special Meeting Proxy Statement and related proxy card to each stockholder

entitled to vote at the Special Meeting. STOCKHOLDERS ARE URGED TO READ THE SPECIAL MEETING PROXY STATEMENT (INCLUDING ANY AMENDMENTS

OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the preliminary and definitive versions of the Special Meeting

Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by the Company with the SEC in connection

with the Special Meeting at the SEC’s website (http://www.sec.gov). Copies of the Company’s definitive Special Meeting Proxy

Statement, any amendments or supplements thereto, and any other relevant documents filed by the Company with the SEC in connection with

the Special Meeting will also be available, free of charge, at the Company’s investor relations website (https://investor.inspirato.com/)

or by writing to the Company at Inspirato Incorporated, 1544 Wazee Street, Denver, Colorado 80202, Attention: Investor Relations.

Contacts:

Investor Relations:

ir@inspirato.com

| Media Relations: |

|

| Inspirato |

communications@inspirato.com |

| |

|

| One Planet Group |

pr@oneplanetgroup.com |

Exhibit 99.2

I am thrilled to introduce

myself as the incoming CEO & Chairman of the Board at Inspirato.

Read the full update | View online

Dear Inspirato Members,

Following the press

release issued earlier today, I am thrilled

to introduce myself as the incoming CEO & Chairman of the Board at Inspirato. The investment from One Planet Group marks a significant

milestone that not only strengthens our financial base but also boosts our ability to provide you with unparalleled experiences, ensuring

that your time with loved ones continues to be memorable and deeply fulfilling.

Exhibit 99.3

Dear Inspirato Team,

I am writing to let you know that we just issued a press release announcing

two major developments at Inspirato:

| · | A $10 million investment in the company. |

| · | The appointment of a new CEO and Chairman of the Board. |

Read the press release here. [link to unique URL with the release]

We usually aim to give you advance notice of announcements like these.

However, due to a combination of timing factors, we had to issue the press release first this time. I want to make sure you're fully informed

and offer some context.

$10 Million Investment in Inspirato

As many of you know, we have been working to strengthen Inspirato’s

liquidity and improve our capital structure. I am pleased to share that One Planet Group LLC has entered into an agreement to invest $10

million into the company, which will make it our largest shareholder. For those of you not familiar with One Planet Group, it is a closely

held private equity firm with a mission to support strong business ideas while building an ethos that helps improve society and give back

to communities.

Read more about One Planet Group here.

New CEO and Chairman of the Board

With this investment, the founder of One Planet Group, Payam Zamani,

will join Inspirato as our new CEO and Chairman of the Board. Payam is an extraordinary leader and visionary with a remarkable business

track record and inspiring personal story. I had the privilege of working with him earlier in my career, where I saw firsthand the exceptional

energy and, he brings to any organization. Importantly, Payam shares our member-centric approach and is ideally suited to take Inspirato

and everything we stand for to new heights. To introduce himself and share some initial thoughts, Payam will be sending emails to all

employees and our members today.

Read more about Payam here.

All-Employee Town Hall Meetings

I recognize that between yesterday’s employee reduction in force

and today’s announcements - this is a lot to digest. Payam, Robert and I will be hosting an Empoyee Town Hall Meeting on Wednesday

at 10:30am MT to provide more information and answer questions. If you are in Denver, please join us in the office on Wednesday to meet

Payam.

Thank You

This is undoubtedly a challenging time, full of mixed emotions. We

are saying goodbye to valued colleagues and at the same time, we are starting a new chapter at Inspirato. We will all need to process

this juxtaposition in our own way. For my part, let me just say – I am enormously grateful to you all. And I remain committed to

working with you to make Inspirato the very best it can be.

Thank you for all you do.

David

David S. Kallery

President

o: 720.370.2515

m: 415.577.1889

e: dk@inspirato.com

www.inspirato.com

The way you travel sets you apart. Our Club

brings you together. Learn more about Inspirato Club membership.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or the future financial or operating

performance of Inspirato (the “Company”). In some cases, you can identify forward-looking statements because they contain

words such as “believe,” “may,” “will,” “estimate,” “potential,” “continue,”

“anticipate,” “intend,” “expect,” “could,” “would,” “project,”

“forecast,” “plan,” “intend,” “target,” or the negative of these words or other similar

expressions that concern the Company’s expectations, strategy, priorities, plans, or intentions. Forward-looking statements in this

release include, but are not limited to, the Company’s ability to consummate the transactions described herein and satisfy applicable

closing conditions, including stockholder approval, where applicable. The Company’s expectations and beliefs regarding these matters

may not materialize, and actual results in future periods are subject to risks and uncertainties, including changes in the Company’s

plans or assumptions, that could cause actual results to differ materially from those projected. These risks include the risk of the Company’s

stockholders not approving the transactions, the occurrence of any event, change or other circumstances that could result in the definitive

investment agreement being terminated or the transactions not being completed on the terms reflected in the investment agreement, or at

all, and uncertainties as to the timing of the consummation of the transactions; the ability of each party to consummate the transactions;

and other risks detailed in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including

the Company’s Annual Report on Form 10-K filed with the SEC on March 12, 2024. All information provided in this communication

is as of the date hereof, and the Company undertakes no duty to update this information unless required by law. These forward-looking

statements should not be relied upon as representing the Company’s assessment as of any date subsequent to the date of this communication.

Additional Information and Where to Find It

The Company, its directors and certain executive officers are participants

in the solicitation of proxies from stockholders in connection with a special meeting (the “Special Meeting”) to approve a

proposal to issue a portion of the securities contemplated by the transactions described herein. The Company plans to file a proxy statement

(the “Special Meeting Proxy Statement”) with the SEC in connection with the solicitation of proxies for the Special Meeting.

Additional information regarding such participants, including their direct or indirect interests, by security holdings or otherwise, will

be included in the Special Meeting Proxy Statement and other relevant documents to be filed with the SEC in connection with the Special

Meeting. Information relating to the foregoing can also be found in the Company’s proxy statement for the 2024 annual meeting of

stockholders as filed with the SEC (the “2024 Proxy Statement”). To the extent that such participants’ holdings of the

Company’s securities have changed since the amounts set forth in the 2024 Proxy Statement, such changes have been or will be reflected

on Statements of Change in Ownership on Form 4s filed with the SEC.

Promptly after filing the definitive Special Meeting Proxy Statement

with the SEC, the Company will mail the definitive Special Meeting Proxy Statement and related proxy card to each stockholder entitled

to vote at the Special Meeting. STOCKHOLDERS ARE URGED TO READ THE SPECIAL MEETING PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the preliminary and definitive versions of the Special Meeting Proxy

Statement, any amendments or supplements thereto, and any other relevant documents filed by the Company with the SEC in connection with

the Special Meeting at the SEC’s website (http://www.sec.gov). Copies of the Company’s definitive Special Meeting

Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by the Company with the SEC in connection

with the Special Meeting will also be available, free of charge, at the Company’s investor relations website (https://investor.inspirato.com/)

or by writing to the Company at Inspirato Incorporated, 1544 Wazee Street, Denver, Colorado 80202, Attention: Investor Relations.

Exhibit 99.4

Dear Inspirato Team,

Following our recent public announcements, I am excited

and deeply honored to introduce myself as your new CEO & Chairman of the Board at Inspirato. We are entering a transformative

period filled with both significant changes and promising opportunities.

The investment from One Planet Group is a testament to the faith in

our potential and provides a strong foundation for sustainable growth and innovation. As we navigate these changes, including the difficult

decision to reduce our workforce, I am deeply committed to supporting everyone affected. My approach to leadership, deeply rooted

in the principles of spiritual capitalism as detailed in my memoir, Crossing the Desert, is profoundly influenced by timeless

spiritual values. These values of leading with love, innovation with intention, and work offered in the spirit of service to our fellow

humans align closely with the ethos of Inspirato!

I understand the challenges that accompany change, and I am here to

support each of you as we navigate this transition together. As we move forward, it’s vital to remain focused on our commitment

to serving our members effectively, ensuring their satisfaction and continuing to drive revenue retention. We will strive to maintain

a workplace that values collaboration and respect, where every voice is heard, and every contribution is crucial to our collective success

and the outstanding service we provide to our customers.

I look forward to connecting with you during the upcoming Town Hall,

learning from you, and achieving our shared goals. Together, we will chart a course towards a thriving and prosperous future for all members

of the Inspirato family.

(payam’s signature image)

Forward-Looking Statements

This communication contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or the future

financial or operating performance of Inspirato (the “Company”). In some cases, you can identify forward-looking statements

because they contain words such as “believe,” “may,” “will,” “estimate,” “potential,”

“continue,” “anticipate,” “intend,” “expect,” “could,” “would,”

“project,” “forecast,” “plan,” “intend,” “target,” or the negative of these

words or other similar expressions that concern the Company’s expectations, strategy, priorities, plans, or intentions. Forward-looking

statements in this release include, but are not limited to, the Company’s ability to consummate the transactions described herein

and satisfy applicable closing conditions, including stockholder approval, where applicable. The Company’s expectations and beliefs

regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties, including changes

in the Company’s plans or assumptions, that could cause actual results to differ materially from those projected. These risks include

the risk of the Company’s stockholders not approving the transactions, the occurrence of any event, change or other circumstances

that could result in the definitive investment agreement being terminated or the transactions not being completed on the terms reflected

in the investment agreement, or at all, and uncertainties as to the timing of the consummation of the transactions; the ability of each

party to consummate the transactions; and other risks detailed in the Company’s filings with the Securities and Exchange Commission

(the “SEC”), including the Company’s Annual Report on Form 10-K filed with the SEC on March 12, 2024. All

information provided in this communication is as of the date hereof, and the Company undertakes no duty to update this information unless

required by law. These forward-looking statements should not be relied upon as representing the Company’s assessment as of any date

subsequent to the date of this communication.

Additional Information and Where to Find It

The Company, its directors and certain executive officers

are participants in the solicitation of proxies from stockholders in connection with a special meeting (the “Special Meeting”)

to approve a proposal to issue a portion of the securities contemplated by the transactions described herein. The Company plans to file

a proxy statement (the “Special Meeting Proxy Statement”) with the SEC in connection with the solicitation of proxies for

the Special Meeting. Additional information regarding such participants, including their direct or indirect interests, by security holdings

or otherwise, will be included in the Special Meeting Proxy Statement and other relevant documents to be filed with the SEC in connection

with the Special Meeting. Information relating to the foregoing can also be found in the Company’s proxy statement for the 2024

annual meeting of stockholders as filed with the SEC (the “2024 Proxy Statement”). To the extent that such participants’

holdings of the Company’s securities have changed since the amounts set forth in the 2024 Proxy Statement, such changes have been

or will be reflected on Statements of Change in Ownership on Form 4s filed with the SEC.

Promptly after filing the definitive

Special Meeting Proxy Statement with the SEC, the Company will mail the definitive Special Meeting Proxy Statement and related proxy

card to each stockholder entitled to vote at the Special Meeting. STOCKHOLDERS ARE URGED TO READ THE SPECIAL MEETING PROXY STATEMENT

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the preliminary and definitive

versions of the Special Meeting Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by the

Company with the SEC in connection with the Special Meeting at the SEC’s website (http://www.sec.gov).

Copies of the Company’s definitive Special Meeting Proxy Statement, any amendments or supplements thereto, and any other relevant

documents filed by the Company with the SEC in connection with the Special Meeting will also be available, free of charge, at the Company’s

investor relations website (https://investor.inspirato.com/) or by writing to the Company

at Inspirato Incorporated, 1544 Wazee Street, Denver, Colorado 80202, Attention: Investor Relations.

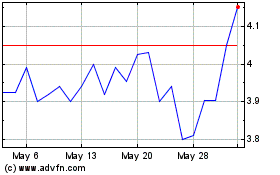

Inspirato (NASDAQ:ISPO)

Historical Stock Chart

From Jul 2024 to Aug 2024

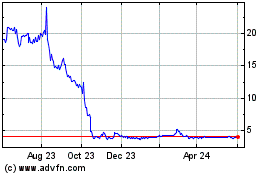

Inspirato (NASDAQ:ISPO)

Historical Stock Chart

From Aug 2023 to Aug 2024