Investors Title Company (NASDAQ: ITIC) today announced record

revenues and net income for the fourth quarter ended December 31,

2005. The Company reported net income of $3,520,902, an increase of

30.9% compared with $2,689,303 for the fourth quarter of 2004.

Diluted earnings per share were $1.36 for the quarter ended

December 31, 2005 versus $1.03 for the prior year quarter. Net

premiums written increased 9.5% to $18,422,813 and total revenues

increased 12.5% to $21,646,914 compared with the fourth quarter of

2004. For the year ended December 31, 2005, the Company reported

record net income of $13,292,923, an increase of 24% compared with

2004. Diluted earnings per share were $5.10 versus $4.09 in the

prior year period. Net premiums written increased 6.5% to

$76,522,266 and total revenues increased 10% to $87,863,878

compared with 2004. "Net earnings for the period were the highest

for any fourth quarter," stated J. Allen Fine, Chairman of

Investors Title Company. "Operating results were driven by growth

in revenue and an increase in profit margin. Revenue in our title

insurance and 1031 exchange segments was favorably impacted by the

ongoing strength in real estate activity. Nationally, the pace of

existing home sales declined in the fourth quarter from earlier in

the year but remained above the prior year period. For 2005,

existing home sales hit a new record level for the fifth year in a

row." Investors Title Company is engaged through its subsidiaries

in the business of issuing and underwriting title insurance

policies. Title insurance is typically sold when real estate is

purchased and upon refinancing of loans secured by real estate.

Policies are issued through 29 branch offices and a network of

agents located across 23 states and the District of Columbia. The

Company also provides services in connection with tax-deferred

exchanges of like-kind property as well as investment management

services to individuals, trusts, foundations and businesses.

Certain statements contained herein may constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements include any predictions

regarding activity in the U.S. real estate market. These statements

involve a number of risks and uncertainties that could cause actual

results to differ materially from anticipated and historical

results. For more details on risk, uncertainties and other factors

that could affect expectations, refer to the Company's Annual

Report on Form 10-K for the year ended December 31, 2004, as filed

with the Securities and Exchange Commission. -0- *T Investors Title

Company and Subsidiaries Consolidated Statements of Income December

31, 2005 and 2004 (Unaudited) For The Three For The Twelve Months

Ended Months Ended December 31 December 31 2005 2004 2005 2004

----------- ----------- ----------- ----------- Revenues:

Underwriting income: Premiums written $18,504,712 $16,918,555

$76,838,399 $72,138,084 Less-premiums for reinsurance ceded 81,899

93,821 316,133 294,639 ----------- ----------- -----------

----------- Net premiums written 18,422,813 16,824,734 76,522,266

71,843,445 Investment income- interest and dividends 961,784

830,323 3,335,767 2,752,838 Net realized gain on sales of

investments 29,511 53,989 119,015 93,656 Exchange services revenue

1,271,065 848,244 4,543,099 2,801,888 Other 961,741 682,506

3,343,731 2,349,349 ----------- ----------- ----------- -----------

Total 21,646,914 19,239,796 87,863,878 79,841,176 -----------

----------- ----------- ----------- Operating Expenses: Commissions

to agents 7,259,076 6,868,738 30,309,405 29,152,645 Provision for

claims 1,810,298 1,844,784 8,164,783 7,984,339 Salaries, employee

benefits and payroll taxes 4,815,158 4,084,329 19,136,098

16,303,351 Office occupancy and operations 1,358,190 1,364,134

5,080,829 4,849,944 Business development 590,151 575,219 2,073,518

1,899,315 Taxes, other than payroll and income 136,246 111,477

523,464 453,354 Premium and retaliatory taxes 352,130 326,444

1,556,529 1,406,083 Professional fees 475,755 593,904 1,937,233

2,074,520 Other 201,008 76,464 499,096 215,459 -----------

----------- ----------- ----------- Total 16,998,012 15,845,493

69,280,955 64,339,010 ----------- ----------- -----------

----------- Income Before Income Taxes 4,648,902 3,394,303

18,582,923 15,502,166 ----------- ----------- -----------

----------- Provision For Income Taxes 1,128,000 705,000 5,290,000

4,783,000 ----------- ----------- ----------- ----------- Net

Income $ 3,520,902 $ 2,689,303 $13,292,923 $10,719,166 ===========

=========== =========== =========== Basic Earnings Per Common Share

$ 1.38 $ 1.08 $ 5.19 $ 4.29 =========== =========== ===========

=========== Weighted Average Shares Outstanding - Basic 2,554,935

2,484,883 2,560,418 2,496,711 =========== =========== ===========

=========== Diluted Earnings Per Common Share $ 1.36 $ 1.03 $ 5.10

$ 4.09 =========== =========== =========== =========== Weighted

Average Shares Outstanding - Diluted 2,596,541 2,617,022 2,607,633

2,620,916 =========== =========== =========== =========== Investors

Title Company and Subsidiaries Consolidated Balance Sheets As of

December 31, 2005 and 2004 (Unaudited) December 31, December 31,

2005 2004 -------------------------- Assets Cash and cash

equivalents $ 14,608,481 $ 4,726,443 Investments in securities:

Fixed maturities: Held-to-maturity, at amortized cost 1,648,708

2,202,635 Available-for-sale, at fair value 75,472,342 72,471,766

Equity securities, available-for-sale at fair value 9,437,678

7,240,306 Short term investments 7,257,734 10,134,321 Other

investments 1,336,111 1,211,517 ------------ ------------ Total

investments 95,152,573 93,260,545 Premiums receivable, net

7,818,558 6,679,994 Accrued interest and dividends 1,010,198

753,638 Prepaid expenses and other assets 1,592,326 1,410,584

Property acquired in settlement of claims 359,980 322,517 Property,

net 5,466,765 4,592,784 Deferred income taxes, net 2,462,647

1,440,247 ------------ ------------ Total Assets $128,471,528

$113,186,752 ============ ============ Liabilities and

Stockholders' Equity Liabilities: Reserves for claims $ 34,857,000

$ 31,842,000 Accounts payable and accrued liabilities 7,928,384

7,919,651 Commissions and reinsurance payables 442,098 551,662

Current income taxes payable 946,790 366,168 ------------

------------ Total liabilities 44,174,272 40,679,481 ------------

------------ Stockholders' Equity: Common stock - no par value

(shares authorized 10,000,000; 2,549,434 and 2,481,024 shares

issued and outstanding 2005 and 2004, respectively, excluding

297,783 and 374,720 shares 2005 and 2004, respectively, of common

stock held by the Company's subsidiary) 1 1 Retained earnings

81,477,022 69,272,092 Accumulated other comprehensive income (net

unrealized gain on investments) 2,820,233 3,235,178 ------------

------------ Total stockholders' equity 84,297,256 72,507,271

------------ ------------ Total Liabilities and Stockholders'

Equity $128,471,528 $113,186,752 ============ ============

Investors Title Company and Subsidiaries Net Premiums Written By

State December 31, 2005 and 2004 (Unaudited) For the Three Months

For the Twelve Months Ended Ended December 31 December 31

----------------------- ----------------------- State 2005 2004

2005 2004 ----------------------------------------------

----------------------- Alabama $ 270,588 $ 350,050 $ 1,304,820 $

1,361,437 Florida 370,267 291,783 1,552,282 1,190,399 Illinois

264,832 205,655 1,000,273 948,022 Kentucky 513,753 392,093

2,115,579 1,710,387 Maryland 422,875 343,137 1,754,867 1,494,686

Michigan 976,655 1,107,046 4,591,639 4,896,239 Minnesota 319,513

233,323 1,076,155 1,063,819 Mississippi 166,074 231,529 977,395

990,203 Nebraska 148,615 174,547 746,514 783,398 New York 889,671

794,212 3,248,635 3,495,587 North Carolina 8,792,267 7,474,235

36,269,649 32,515,123 Pennsylvania 399,762 559,103 1,687,410

2,634,407 South Carolina 1,874,160 1,593,239 7,011,099 6,464,495

Tennessee 701,180 620,602 2,767,576 2,954,957 Virginia 1,708,028

1,857,365 7,740,671 7,038,474 West Virginia 505,804 470,672

2,246,142 1,864,216 Other States 173,738 214,001 726,717 726,272

----------- ----------- ----------- ----------- Direct Premiums

18,497,782 16,912,592 76,817,423 72,132,121 Reinsurance Assumed

6,930 5,963 20,976 5,963 Reinsurance Ceded (81,899) (93,821)

(316,133) (294,639) ----------- ----------- ----------- -----------

Net Premiums Written $18,422,813 $16,824,734 $76,522,266

$71,843,445 =========== =========== =========== ===========

Investors Title Company and Subsidiaries Net Premiums Written By

Branch and Agency December 31, 2005 and 2004 (Unaudited) For The

Three Months Ended For The Twelve Months Ended December 31 December

31 ----------------------------------------------------------------

2005 % 2004 % 2005 % 2004 % --------------- ---------------

--------------- --------------- Branch $ 8,090,934 44 $ 7,122,836

42 $34,108,923 45 $31,606,909 44 Agency 10,331,879 56 9,701,898 58

42,413,343 55 40,236,536 56 --------------- ---------------

--------------- --------------- Total $18,422,813 100 $16,824,734

100 $76,522,266 100 $71,843,445 100 =============== ===============

=============== =============== *T

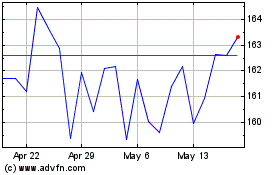

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jun 2024 to Jul 2024

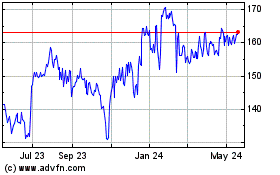

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jul 2023 to Jul 2024