Kingsoft Cloud Holdings Limited (“Kingsoft Cloud” or the “Company”)

(NASDAQ: KC and HKEX: 3896), a leading cloud service provider in

China, today announced its unaudited financial results for the

third quarter ended September 30, 2024.

Financial Highlights

- Total Revenues reached RMB1,885.6 million

(US$268.71 million), increased by 16.0% year-over-year from

RMB1,625.2 million in the same quarter of 2023. The accelerated

growth of high-quality business, such as AI, has offset the decline

in the low-margin CDN business due to strategic proactive

adjustments.

- Gross profit was RMB303.4 million (US$43.2

million), representing a significant increase of 54.6% from

RMB196.2 million in the same quarter of 2023. Our profitability has

been fundamentally improved.

- Non-GAAP EBITDA2 was RMB185.4

million (US$26.4 million), compared with RMB-45.4 million in the

same quarter of 2023. Non-GAAP EBITDA margin was

9.8%, compared with -2.8% in the same quarter of 2023.

Mr. Tao Zou, Chief Executive Officer of Kingsoft Cloud,

commented, “This quarter, our steadfast belief in, and unwavering

execution of the ‘High-quality and Sustainable Development

Strategy’ continued to deliver strong results. We are excited to

announce further accelerated topline growth of 16%, with

fast-increasing Non-GAAP EBITDA margin reaching 9.8% in the third

quarter of 2024. In particular, AI business continued to expand to

RMB362 million, accounting for approximately 31% of public cloud

revenue. Meanwhile, as we wholeheartedly embrace the Xiaomi and

Kingsoft Ecosystem and tap into the vast tangible opportunities

from EV car, LLM to WPS AI, to name a few, we grew our revenues

from the Ecosystem by a significant year-over-year increase of 36%.

We are confident that we are on the right track and momentum to

building more success in the future.”

Mr. Henry He, Chief Financial Officer of Kingsoft Cloud,

added, “We recorded another strong quarter with growth in both

revenue and profits. The Company achieved a double-digit

year-on-year growth in total revenue, reaching RMB1,885.6 million,

restoring the high-speed growth of revenue. Meanwhile, the growth

rates of our gross profit and EBITDA profit far exceed the industry

average level. Compared with the adjusted gross profit margin of

3.6% in the second quarter of 2022, which was before the Company

carried out business structure adjustment and AI transformation, a

4.5-fold growth to 16.3% was achieved in this quarter; and the

adjusted EBITDA margin has been significantly improved from a loss

of 8.6% in the second quarter of 2022 to a profit of 9.8%, with an

increase of 18.4 percentage points. The Company’s revenue structure

adjustment and AI strategic transformation have achieved remarkable

results.”

______________________1 This announcement contains translations

of certain Renminbi (RMB) amounts into U.S. dollars (US$) at a

specified rate solely for the convenience of the reader. Unless

otherwise noted, the translation of RMB into US$ has been made at

RMB7.0176 to US$1.00, the noon buying rate in effect on September

30, 2024 as certified for customs purposes by the Federal Reserve

Bank of New York.

2 Non-GAAP EBITDA is defined as Non-GAAP net loss excluding

interest income, interest expense, income tax expense (benefit) and

depreciation and amortization, and we define Non-GAAP EBITDA margin

as Non-GAAP EBITDA as a percentage of revenues. See “Use of

Non-GAAP Financial Measures” set forth at the end of this press

release.

Third Quarter 2024 Financial Results

Total Revenues reached RMB1,885.6 million

(US$268.73 million), increased by 16.0% year-over-year from

RMB1,625.2 million in the same quarter of 2023 and remained flat

quarter-over-quarter from RMB1,891.8 million in the second quarter

of 2024. The year-over-year increase was mainly due to the expanded

revenue from Xiaomi and Kingsoft Ecosystem and AI related

customers, incremental demands from enterprise cloud and partially

offset by our proactive scale-down of low-margin content delivery

network (CDN) services.

Revenues from public cloud services

were RMB1,175.5 million (US$167.5 million), increased by 15.6% from

RMB1,016.6 million in the same quarter of 2023 and decreased by

4.8% from RMB1,234.5 million last quarter. The year-over-year

increase was mainly due to the growth of AI demands and partially

offset by the proactive scale-down of our CDN services.

Revenues from enterprise cloud

services were RMB710.0 million (US$101.2 million), representing an

increase of 16.7% from RMB608.5 million in the same quarter of 2023

and an increase of 8.0% from RMB657.2 million last quarter. We keep

focus on selected verticals such as public services cloud,

state-owned assets cloud, healthcare and financial services,

leverage Camelot’s capability to cater for the IT development,

enhance our solutions with AI capabilities and take profitability

and sustainability of the enterprise cloud projects as our

priorities.

Other revenues were nil this

quarter.

Cost of revenues was RMB1,582.2 million

(US$225.5 million), representing an increase of 10.7% from

RMB1,429.0 million in the same quarter of 2023. IDC costs decreased

significantly by 8.7% year-over-year from RMB737.7 million to

RMB673.8 million (US$96.0 million) this quarter. The decrease was

in line with the scale-down of our CDN services and our strict

control over procurement costs. Depreciation and amortization costs

increased by 48.5% from RMB200.4 million in the same quarter of

2023 to RMB297.5 million (US$42.4 million) this quarter. The

increase was mainly due to the depreciation of newly acquired

electronic equipments which were related to AI business. Solution

development and services costs increased by 17.3% year-over-year

from RMB425.3 million in the same quarter of 2023 to RMB499.0

million (US$71.1 million) this quarter. The increase was mainly due

to the solution personnel expansion of Camelot. Fulfillment costs

and other costs were RMB59.5 million (US$8.5 million) and RMB52.3

million (US$7.5 million) this quarter.

Gross profit was RMB303.4 million (US$43.2

million), representing a significant increase of 54.6% from

RMB196.2 million in the same quarter of 2023, demonstrating our

improvements in revenue quality and structure. Gross

margin was 16.1%, compared with 12.1% in the same period

in 2023. Non-GAAP gross profit4 was RMB307.6

million (US$43.8 million), compared with RMB196.3 million in the

same period in 2023. Non-GAAP gross

margin4 was 16.3%, compared with 12.1% in

the same period in 2023. The significant improvements of our gross

profit and margin were mainly due to our strategic adjustment of

revenue mix, expansion of AI revenues, optimized enterprise cloud

project selection and efficient cost control measures, while

partially offset under pressure of bandwidth costs increase and

price fluctuation of certain customer.

______________________3 This announcement contains translations

of certain Renminbi (RMB) amounts into U.S. dollars (US$) at a

specified rate solely for the convenience of the reader. Unless

otherwise noted, the translation of RMB into US$ has been made at

RMB7.0176 to US$1.00, the noon buying rate in effect on September

30, 2024 as certified for customs purposes by the Federal Reserve

Bank of New York.

4 Non-GAAP gross profit is defined as gross profit excluding

share-based compensation allocated in the cost of revenues and we

define Non-GAAP gross margin as Non-GAAP gross profit as a

percentage of revenues. See “Use of Non-GAAP Financial Measures”

set forth at the end of this press release.

Total operating expenses were RMB1,447.1

million (US$206.2 million), including impairment of long-lived

assets of RMB919.7 million (US$131.1 million), increased by 44.6%

from RMB1,001.1 million in the same period in 2023. Excluding

impairment of long-lived assets, operating expenses were RMB527.4

million (US$75.2million), decreased by 1.0% from RMB532.5 million

in the same quarter last year. Among which:

Selling and marketing expenses were RMB121.1

million (US$17.3 million), increased by 4.0% from RMB116.4 million

in the same period in 2023 and decreased by 3.7% from RMB125.7

million last quarter, the slightly sequential decrease was due to

the decrease of marketing campaigns.

General and administrative expenses were

RMB170.4 million (US$24.3 million), decreased by 21.0% from

RMB215.7 million in the same period in 2023 and decreased by 36.0%

from RMB266.2 million last quarter. The decrease was mainly due to

the decrease of credit loss expense.

Research and development expenses were RMB235.9

million (US$33.6 million), increased by 17.7% from RMB200.4 million

in the same period in 2023 and 15.7% from RMB204.0 million last

quarter. The increase was mainly due to the increase in personnel

costs.

Impairment of long-lived assets was RMB919.7

million (US$131.1 million), compared with RMB468.5 million in the

same quarter last year. The impairment of long-lived assets was

dedicated to assets of low-margin services.

Operating loss was RMB1,143.8 million (US$163.0

million), compared with operating loss of RMB804.8 million in the

same quarter of 2023 and RMB277.6 million last quarter. The

increase was mainly due to impairment of long-lived assets.

Non-GAAP operating loss5 was RMB140.2 million

(US$20.0 million), decreased by 46.7% from RMB262.9 million in the

same quarter last year and 25.6% from RMB188.5 million last

quarter. The decrease was mainly due to the gross profit increase

and the expenses decrease explained above.

Net loss was RMB1,061.1 million (US$151.2

million), compared with net loss of RMB789.7 million in the same

quarter of 2023 and RMB353.7 million last quarter. The increase was

mainly due to the impairment of long-lived assets of RMB919.7

million (US$131.1 million).

Non-GAAP net loss6 was

RMB236.7 million (US$33.7 million), narrowed down compared with

RMB313.3 million in the same quarter of 2023 and RMB301.1 million

last quarter. The improvement was mainly due to the revenue quality

increase, revenue mix adjustment, strict costs control and expenses

control.

Non-GAAP

EBITDA7 was RMB185.4 million (US$26.4

million), compared with RMB-45.4 million in the same quarter of

2023 and RMB60.6 million last quarter. Non-GAAP EBITDA

margin was 9.8%, compared with -2.8% in the same quarter

of 2023 and 3.2% last quarter. The increase was mainly due to the

expansion in gross profit and our strict control over costs and

expenses.

______________________5 Non-GAAP operating loss

is defined as operating loss excluding share-based compensation,

impairment of long-lived assets and amortization of intangible

assets and we define Non-GAAP operating loss as Non-GAAP operating

loss margin as a percentage of revenues. See “Use of Non-GAAP

Financial Measures” set forth at the end of this press release.

6 Non-GAAP net loss is defined as net loss

excluding share-based compensation, impairment of long-lived assets

and foreign exchange (gain) loss, and we define Non-GAAP net loss

margin as adjusted net loss as a percentage of revenues. See “Use

of Non-GAAP Financial Measures” set forth at the end of this press

release.

7 Non-GAAP EBITDA is defined as Non-GAAP net

loss excluding interest income, interest expense, income tax

expense (benefit) and depreciation and amortization, and we define

Non-GAAP EBITDA margin as Non-GAAP EBITDA as a percentage of

revenues. See “Use of Non-GAAP Financial Measures” set forth at the

end of this press release.

Basic and diluted net loss per

share was RMB0.29 (US$0.04), compared with RMB0.22 in the

same quarter of 2023 and RMB0.10 last quarter.

Cash and cash equivalents were RMB1,617.9

million (US$230.6 million) as of September 30, 2024, compared

with RMB1,837.8 million as of June 30, 2024. The decrease was

mainly due to the investment into the procurement of high

performance electronic equipments, the payment to daily operation

and the repayment of borrowings.

Outstanding ordinary shares

were 3,621,895,582 as of September 30, 2024, equivalent to

about 241,459,705 ADSs.

Business Outlook

For the fourth quarter of 2024, thanks to the parallel two

drivers of both public cloud and enterprise cloud, we will continue

to deliver healthy growth during such quarter. We expect to achieve

accelerated growth rate for the total revenues in the fourth

quarter of 2024. We expect our profitability will continue to

improve. For the operating profit and adjusted operating profit, we

expect to deliver accelerated improvement in the fourth quarter.

This forecast reflects the Company’s current and preliminary views

on the market and operational conditions, which are subject to

change.

Conference Call Information

Kingsoft Cloud’s management will host an earnings conference

call on Tuesday, November 19, 2024 at 7:15 A.M., U.S. Eastern

Time (8:15 P.M., Beijing/Hong Kong Time on the same day).

Participants can register for the conference call by navigating

to

https://register.vevent.com/register/BI9c3a629d6e164637ab8af374255609ee.

Once preregistration has been completed, participants will receive

dial-in numbers, direct event passcode, and a unique access

PIN.

To join the conference, simply dial the number in the calendar

invite you receive after preregistering, enter the passcode

followed by your PIN, and you will join the conference

instantly.

Additionally, a live and archived webcast of the conference call

will also be available on the Company’s investor relations website

at http://ir.ksyun.com.

Use of Non-GAAP Financial Measures

The unaudited condensed consolidated financial information is

prepared in conformity with accounting principles generally

accepted in the United States of America (“U.S. GAAP”). In

evaluating our business, we consider and use certain non-GAAP

measures, Non-GAAP gross profit, Non-GAAP gross margin, Non-GAAP

operating loss, Non-GAAP operating loss margin, Non-GAAP EBITDA,

Non-GAAP EBITDA margin, Non-GAAP net loss and Non-GAAP net loss

margin, as supplemental measures to review and assess our operating

performance. The presentation of these non-GAAP financial measures

is not intended to be considered in isolation or as a substitute

for the financial information prepared and presented in accordance

with U.S. GAAP. We define Non-GAAP gross profit as gross profit

excluding share-based compensation allocated in the cost of

revenues, and we define Non-GAAP gross margin as Non-GAAP gross

profit as a percentage of revenues. We define Non-GAAP operating

loss as operating loss excluding share-based compensation,

impairment of long-lived assets and amortization of intangible

assets and we define Non-GAAP operating loss margin as Non-GAAP

operating loss as a percentage of revenues. We define Non-GAAP net

loss as net loss excluding share-based compensation, foreign

exchange (gain) loss and impairment of long-lived assets, and we

define Non-GAAP net loss margin as Non-GAAP net loss as a

percentage of revenues. We define Non-GAAP EBITDA as Non-GAAP net

loss excluding interest income, interest expense, income tax

expense (benefit) and depreciation and amortization, and we define

Non-GAAP EBITDA margin as Non-GAAP EBITDA as a percentage of

revenues. We present these non-GAAP financial measures because they

are used by our management to evaluate our operating performance

and formulate business plans. We also believe that the use of these

non-GAAP measures facilitates investors’ assessment of our

operating performance.

These non-GAAP financial measures are not defined under U.S.

GAAP and are not presented in accordance with U.S. GAAP. These

non-GAAP financial measures have limitations as analytical tools.

One of the key limitations of using these non-GAAP financial

measures is that they do not reflect all items of income and

expense that affect our operations. Further, these non-GAAP

measures may differ from the non-GAAP information used by other

companies, including peer companies, and therefore their

comparability may be limited.

We compensate for these limitations by reconciling these

non-GAAP financial measures to the nearest U.S. GAAP performance

measure, all of which should be considered when evaluating our

performance. We encourage you to review our financial information

in its entirety and not rely on a single financial measure.

Exchange Rate

Information

This press release contains translations of certain RMB amounts

into U.S. dollars at specified rates solely for the convenience of

readers. Unless otherwise noted, all translations from RMB to U.S.

dollars, in this press release, were made at a rate of RMB7.0176 to

US$1.00, the noon buying rate in effect on September 30, 2024

as certified for customs purposes by the Federal Reserve Bank of

New York.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” and similar statements. Among other things,

the Business Outlook, and quotations from management in this

announcement, as well as Kingsoft Cloud’s strategic and operational

plans, contain forward-looking statements. Kingsoft Cloud may also

make written or oral forward-looking statements in its periodic

reports to the U.S. Securities and Exchange Commission (“SEC”), in

its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. Statements that are not

historical facts, including but not limited to statements about

Kingsoft Cloud’s beliefs and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: Kingsoft

Cloud’s goals and strategies; Kingsoft Cloud’s future business

development, results of operations and financial condition;

relevant government policies and regulations relating to Kingsoft

Cloud’s business and industry; the expected growth of the cloud

service market in China; the expectation regarding the rate at

which to gain customers, especially Premium Customers; Kingsoft

Cloud’s ability to monetize the customer base; fluctuations in

general economic and business conditions in China; and the economy

in China and elsewhere generally; China’s political or social

conditions and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks is

included in Kingsoft Cloud’s filings with the SEC. All information

provided in this press release and in the attachments is as of the

date of this press release, and Kingsoft Cloud does not undertake

any obligation to update any forward-looking statement, except as

required under applicable law.

About Kingsoft Cloud Holdings Limited

Kingsoft Cloud Holdings Limited (NASDAQ: KC and HKEX:3896) is a

leading cloud service provider in China. With extensive cloud

infrastructure, cutting-edge cloud-native products based on

vigorous cloud technology research and development capabilities,

well-architected industry-specific solutions and end-to-end

fulfillment and deployment, Kingsoft Cloud offers comprehensive,

reliable and trusted cloud service to customers in strategically

selected verticals.

For more information, please visit: http://ir.ksyun.com.

For investor and media inquiries, please

contact:

Kingsoft Cloud Holdings LimitedNicole ShanTel: +86

(10) 6292-7777 Ext. 6300Email: ksc-ir@kingsoft.com

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(All amounts in thousands) |

|

|

Dec 31,2023 |

Sep 30,2024 |

Sep 30,2024 |

|

|

RMB |

RMB |

US$ |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

2,255,287 |

|

1,617,935 |

|

230,554 |

|

|

Restricted cash |

234,194 |

|

92,454 |

|

13,175 |

|

|

Accounts receivable, net |

1,529,915 |

|

1,731,863 |

|

246,789 |

|

|

Prepayments and other assets |

1,812,692 |

|

2,314,827 |

|

329,860 |

|

|

Amounts due from related parties |

266,036 |

|

291,385 |

|

41,522 |

|

|

Total current assets |

6,098,124 |

|

6,048,464 |

|

861,900 |

|

|

Non-current assets: |

|

|

|

|

Property and equipment, net |

2,186,145 |

|

4,496,438 |

|

640,737 |

|

|

Intangible assets, net |

834,478 |

|

706,344 |

|

100,653 |

|

|

Goodwill |

4,605,724 |

|

4,605,724 |

|

656,310 |

|

|

Prepayments and other assets |

870,781 |

|

437,664 |

|

62,367 |

|

|

Equity investments |

259,930 |

|

252,583 |

|

35,993 |

|

|

Amounts due from related parties |

56,264 |

|

4,486 |

|

639 |

|

|

Operating lease right-of-use assets |

158,832 |

|

144,881 |

|

20,645 |

|

|

Total non-current assets |

8,972,154 |

|

10,648,120 |

|

1,517,344 |

|

|

Total assets |

15,070,278 |

|

16,696,584 |

|

2,379,244 |

|

|

|

|

|

|

|

LIABILITIES, NON-CONTROLLING INTERESTS AND SHAREHOLDERS'

EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

1,805,083 |

|

2,121,379 |

|

302,294 |

|

|

Accrued expenses and other current liabilities |

2,838,085 |

|

3,861,720 |

|

550,291 |

|

|

Short-term borrowings |

1,110,896 |

|

1,808,146 |

|

257,659 |

|

|

Income tax payable |

63,961 |

|

67,111 |

|

9,563 |

|

|

Amounts due to related parties |

931,906 |

|

1,163,600 |

|

165,812 |

|

|

Current operating lease liabilities |

78,659 |

|

51,338 |

|

7,316 |

|

|

Total current liabilities |

6,828,590 |

|

9,073,294 |

|

1,292,935 |

|

|

Non-current liabilities: |

|

|

|

|

Long-term borrowings |

100,000 |

|

541,347 |

|

77,141 |

|

|

Amounts due to related parties |

40,069 |

|

300,000 |

|

42,750 |

|

|

Deferred tax liabilities |

142,565 |

|

105,912 |

|

15,092 |

|

|

Other liabilities |

634,803 |

|

1,029,195 |

|

146,659 |

|

|

Non-current operating lease liabilities |

78,347 |

|

75,688 |

|

10,785 |

|

|

Total non-current liabilities |

995,784 |

|

2,052,142 |

|

292,427 |

|

|

Total liabilities |

7,824,374 |

|

11,125,436 |

|

1,585,362 |

|

|

Shareholders’ equity: |

|

|

|

|

Ordinary shares |

25,443 |

|

25,864 |

|

3,686 |

|

|

Treasury stock |

(208,385 |

) |

(208,385 |

) |

(29,695 |

) |

|

Additional paid-in capital |

18,811,028 |

|

19,012,461 |

|

2,709,254 |

|

|

Statutory reserves funds |

21,765 |

|

21,765 |

|

3,101 |

|

|

Accumulated deficit |

(12,315,041 |

) |

(14,084,762 |

) |

(2,007,063 |

) |

|

Accumulated other comprehensive income |

555,342 |

|

463,258 |

|

66,014 |

|

|

Total Kingsoft Cloud Holdings Limited shareholders’

equity |

6,890,152 |

|

5,230,201 |

|

745,297 |

|

|

Non-controlling interests |

355,752 |

|

340,947 |

|

48,585 |

|

|

Total equity |

7,245,904 |

|

5,571,148 |

|

793,882 |

|

|

Total liabilities, non-controlling interests and

shareholders’ equity |

15,070,278 |

|

16,696,584 |

|

2,379,244 |

|

| |

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE LOSS |

|

(All amounts in thousands, except for share and per share

data) |

|

|

Three Months Ended |

Nine Months Ended |

|

|

Sep 30,2023 |

Mar 31,2024 |

Jun 30,2024 |

Sep 30,2024 |

Sep 30,2024 |

Sep 30,2023 |

Sep 30,2024 |

Sep 30,2024 |

|

|

RMB |

RMB |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|

Revenues: |

|

|

|

|

|

|

|

|

|

Public cloud services |

1,016,592 |

|

1,187,370 |

|

1,234,542 |

|

1,175,535 |

|

167,512 |

|

3,329,775 |

|

3,597,447 |

|

512,632 |

|

|

Enterprise cloud services |

608,510 |

|

588,162 |

|

657,238 |

|

710,039 |

|

101,180 |

|

1,993,662 |

|

1,955,439 |

|

278,648 |

|

|

Others |

106 |

|

152 |

|

- |

|

- |

|

- |

|

1,574 |

|

152 |

|

22 |

|

|

Total revenues |

1,625,208 |

|

1,775,684 |

|

1,891,780 |

|

1,885,574 |

|

268,692 |

|

5,325,011 |

|

5,553,038 |

|

791,302 |

|

|

Cost of revenues |

(1,428,968 |

) |

(1,482,431 |

) |

(1,573,433 |

) |

(1,582,220 |

) |

(225,465 |

) |

(4,727,980 |

) |

(4,638,084 |

) |

(660,922 |

) |

|

Gross profit |

196,240 |

|

293,253 |

|

318,347 |

|

303,354 |

|

43,227 |

|

597,031 |

|

914,954 |

|

130,380 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Selling and marketing expenses |

(116,438 |

) |

(116,752 |

) |

(125,708 |

) |

(121,117 |

) |

(17,259 |

) |

(333,744 |

) |

(363,577 |

) |

(51,809 |

) |

|

General and administrative expenses |

(215,740 |

) |

(218,695 |

) |

(266,249 |

) |

(170,374 |

) |

(24,278 |

) |

(765,782 |

) |

(655,318 |

) |

(93,382 |

) |

|

Research and development expenses |

(200,362 |

) |

(231,963 |

) |

(203,959 |

) |

(235,912 |

) |

(33,617 |

) |

(609,652 |

) |

(671,834 |

) |

(95,736 |

) |

|

Impairment of long-lived assets |

(468,535 |

) |

- |

|

- |

|

(919,724 |

) |

(131,060 |

) |

(653,670 |

) |

(919,724 |

) |

(131,060 |

) |

|

Total operating expenses |

(1,001,075 |

) |

(567,410 |

) |

(595,916 |

) |

(1,447,127 |

) |

(206,214 |

) |

(2,362,848 |

) |

(2,610,453 |

) |

(371,987 |

) |

|

Operating loss |

(804,835 |

) |

(274,157 |

) |

(277,569 |

) |

(1,143,773 |

) |

(162,987 |

) |

(1,765,817 |

) |

(1,695,499 |

) |

(241,607 |

) |

|

Interest income |

26,332 |

|

8,370 |

|

9,945 |

|

4,517 |

|

644 |

|

65,968 |

|

22,832 |

|

3,254 |

|

|

Interest expense |

(40,800 |

) |

(51,066 |

) |

(59,414 |

) |

(57,404 |

) |

(8,180 |

) |

(99,034 |

) |

(167,884 |

) |

(23,923 |

) |

|

Foreign exchange gain (loss) |

20,200 |

|

(42,737 |

) |

(6,999 |

) |

135,777 |

|

19,348 |

|

(131,222 |

) |

86,041 |

|

12,261 |

|

|

Other gain (loss), net |

3,855 |

|

(8,207 |

) |

(7,829 |

) |

6,046 |

|

862 |

|

(15,932 |

) |

(9,990 |

) |

(1,424 |

) |

|

Other income (expense), net |

16,520 |

|

(11,190 |

) |

(4,961 |

) |

4,433 |

|

632 |

|

66,587 |

|

(11,718 |

) |

(1,670 |

) |

|

Loss before income taxes |

(778,728 |

) |

(378,987 |

) |

(346,827 |

) |

(1,050,404 |

) |

(149,681 |

) |

(1,879,450 |

) |

(1,776,218 |

) |

(253,109 |

) |

|

Income tax (expense) benefit |

(10,990 |

) |

15,371 |

|

(6,891 |

) |

(10,662 |

) |

(1,519 |

) |

(17,361 |

) |

(2,182 |

) |

(311 |

) |

|

Net loss |

(789,718 |

) |

(363,616 |

) |

(353,718 |

) |

(1,061,066 |

) |

(151,200 |

) |

(1,896,811 |

) |

(1,778,400 |

) |

(253,420 |

) |

|

Less: net loss attributable to non-controlling interests |

(3,859 |

) |

(4,206 |

) |

(542 |

) |

(3,931 |

) |

(560 |

) |

(4,619 |

) |

(8,679 |

) |

(1,237 |

) |

|

Net loss attributable to Kingsoft Cloud Holdings

Limited |

(785,859 |

) |

(359,410 |

) |

(353,176 |

) |

(1,057,135 |

) |

(150,640 |

) |

(1,892,192 |

) |

(1,769,721 |

) |

(252,183 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

(0.22 |

) |

(0.10 |

) |

(0.10 |

) |

(0.29 |

) |

(0.04 |

) |

(0.53 |

) |

(0.49 |

) |

(0.07 |

) |

|

Shares used in the net loss per share

computation: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

3,564,635,578 |

|

3,614,662,846 |

|

3,649,307,331 |

|

3,655,882,906 |

|

3,655,882,906 |

|

3,551,616,821 |

|

3,640,406,551 |

|

3,640,406,551 |

|

|

Other comprehensive (loss) income, net of tax of

nil: |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

(38,904 |

) |

20,704 |

|

(530 |

) |

(112,296 |

) |

(16,002 |

) |

169,877 |

|

(92,122 |

) |

(13,127 |

) |

|

Comprehensive loss |

(828,622 |

) |

(342,912 |

) |

(354,248 |

) |

(1,173,362 |

) |

(167,202 |

) |

(1,726,934 |

) |

(1,870,522 |

) |

(266,547 |

) |

|

Less: Comprehensive loss attributable to non-controlling

interests |

(3,897 |

) |

(4,247 |

) |

(570 |

) |

(3,900 |

) |

(556 |

) |

(4,672 |

) |

(8,717 |

) |

(1,242 |

) |

|

Comprehensive loss attributable to Kingsoft Cloud Holdings

Limited shareholders |

(824,725 |

) |

(338,665 |

) |

(353,678 |

) |

(1,169,462 |

) |

(166,646 |

) |

(1,722,262 |

) |

(1,861,805 |

) |

(265,305 |

) |

| |

|

|

|

|

|

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|

(All amounts in thousands, except for

percentage) |

|

|

Three Months Ended |

Nine Months Ended |

|

|

Sep 30,2023 |

Mar 31,2024 |

Jun 30,2024 |

Sep 30,2024 |

Sep 30,2024 |

Sep 30,2023 |

Sep 30,2024 |

Sep 30,2024 |

|

|

RMB |

RMB |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|

Gross profit |

196,240 |

293,253 |

318,347 |

303,354 |

43,227 |

597,031 |

914,954 |

130,380 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

– Share-based compensation expenses (allocated in cost of

revenues) |

34 |

5,814 |

5,076 |

4,252 |

606 |

427 |

15,142 |

2,158 |

|

Adjusted gross profit (Non-GAAP Financial Measure) |

196,274 |

299,067 |

323,423 |

307,606 |

43,833 |

597,458 |

930,096 |

132,538 |

| |

|

|

|

|

|

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|

(All amounts in thousands, except for

percentage) |

| |

Three Months Ended |

Nine Months Ended |

| |

Sep 30,2023 |

Mar 31,2024 |

Jun 30,2024 |

Sep 30,2024 |

Sep 30,2023 |

Sep 30,2024 |

|

Gross margin |

12.1 |

% |

16.5 |

% |

16.8 |

% |

16.1 |

% |

11.2 |

% |

16.5 |

% |

|

Adjusted gross margin (Non-GAAP Financial

Measure) |

12.1 |

% |

16.8 |

% |

17.1 |

% |

16.3 |

% |

11.2 |

% |

16.7 |

% |

| |

|

|

|

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|

(All amounts in thousands, except for

percentage) |

|

|

Three Months Ended |

Nine Months Ended |

|

|

Sep 30,2023 |

Mar 31,2024 |

Jun 30,2024 |

Sep 30,2024 |

Sep 30,2024 |

Sep 30,2023 |

Sep 30,2024 |

Sep 30,2024 |

|

|

RMB |

RMB |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|

Net Loss |

(789,718 |

) |

(363,616 |

) |

(353,718 |

) |

(1,061,066 |

) |

(151,200 |

) |

(1,896,811 |

) |

(1,778,400 |

) |

(253,420 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

– Share-based compensation expenses |

28,102 |

|

103,595 |

|

45,649 |

|

40,423 |

|

5,760 |

|

71,208 |

|

189,667 |

|

27,027 |

|

|

– Foreign exchange (gain) loss |

(20,200 |

) |

42,737 |

|

6,999 |

|

(135,777 |

) |

(19,348 |

) |

131,222 |

|

(86,041 |

) |

(12,261 |

) |

|

– Impairment of long-lived assets |

468,535 |

|

- |

|

- |

|

919,724 |

|

131,060 |

|

653,670 |

|

919,724 |

|

131,060 |

|

|

Adjusted net loss (Non-GAAP Financial Measure) |

(313,281 |

) |

(217,284 |

) |

(301,070 |

) |

(236,696 |

) |

(33,728 |

) |

(1,040,711 |

) |

(755,050 |

) |

(107,594 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

– Interest income |

(26,332 |

) |

(8,370 |

) |

(9,945 |

) |

(4,517 |

) |

(644 |

) |

(65,968 |

) |

(22,832 |

) |

(3,254 |

) |

|

– Interest expense |

40,800 |

|

51,066 |

|

59,414 |

|

57,404 |

|

8,180 |

|

99,034 |

|

167,884 |

|

23,923 |

|

|

– Income tax expense (benefit) |

10,990 |

|

(15,371 |

) |

6,891 |

|

10,662 |

|

1,519 |

|

17,361 |

|

2,182 |

|

311 |

|

|

– Depreciation and amortization |

242,421 |

|

223,146 |

|

305,304 |

|

358,540 |

|

51,092 |

|

752,940 |

|

886,990 |

|

126,395 |

|

|

Adjusted EBITDA (Non-GAAP Financial Measure) |

(45,402 |

) |

33,187 |

|

60,594 |

|

185,393 |

|

26,419 |

|

(237,344 |

) |

279,174 |

|

39,781 |

|

|

– Loss (gain) on disposal of property and equipment |

1,324 |

|

(23,821 |

) |

- |

|

(10,667 |

) |

(1,520 |

) |

22,996 |

|

(34,488 |

) |

(4,915 |

) |

|

Excluding loss or gain on disposal of property and equipment,

normalized Adjusted EBITDA |

(44,078 |

) |

9,366 |

|

60,594 |

|

174,726 |

|

24,899 |

|

(214,348 |

) |

244,686 |

|

34,866 |

|

| |

|

|

|

|

|

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|

(All amounts in thousands, except for

percentage) |

| |

Three Months Ended |

Nine Months Ended |

| |

Sep 30,2023 |

Mar 31,2024 |

Jun 30,2024 |

Sep 30,2024 |

Sep 30,2024 |

Sep 30,2023 |

Sep 30,2024 |

Sep 30,2024 |

| |

RMB |

RMB |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|

Operating loss |

(804,835 |

) |

(274,157 |

) |

(277,569 |

) |

(1,143,773 |

) |

(162,987 |

) |

(1,765,817 |

) |

(1,695,499 |

) |

(241,607 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

– Share-based compensation expenses |

28,102 |

|

103,595 |

|

45,649 |

|

40,423 |

|

5,760 |

|

71,208 |

|

189,667 |

|

27,027 |

|

|

– Impairment of long-lived assets |

468,535 |

|

- |

|

- |

|

919,724 |

|

131,060 |

|

653,670 |

|

919,724 |

|

131,060 |

|

|

– Amortization of intangible assets |

45,326 |

|

43,517 |

|

43,415 |

|

43,460 |

|

6,193 |

|

135,803 |

|

130,392 |

|

18,581 |

|

|

Adjusted operating loss (Non-GAAP Financial Measure) |

(262,872 |

) |

(127,045 |

) |

(188,505 |

) |

(140,166 |

) |

(19,974 |

) |

(905,136 |

) |

(455,716 |

) |

(64,939 |

) |

|

– Loss (gain) on disposal of property and equipment |

1,324 |

|

(23,821 |

) |

- |

|

(10,667 |

) |

(1,520 |

) |

22,996 |

|

(34,488 |

) |

(4,915 |

) |

|

Excluding loss or gain on disposal of property and equipment,

normalized Adjusted operating loss |

(261,548 |

) |

(150,866 |

) |

(188,505 |

) |

(150,833 |

) |

(21,494 |

) |

(882,140 |

) |

(490,204 |

) |

(69,854 |

) |

| |

|

|

|

|

|

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|

(All amounts in thousands, except for

percentage) |

| |

Three Months Ended |

Nine Months Ended |

| |

Sep 30,2023 |

Mar 31,2024 |

Jun 30,2024 |

Sep 30,2024 |

Sep 30,2023 |

Sep 30,2024 |

|

Net loss margin |

-48.6 |

% |

-20.5 |

% |

-18.7 |

% |

-56.3 |

% |

-35.6 |

% |

-32.0 |

% |

|

Adjusted net loss margin (Non-GAAP Financial

Measure) |

-19.3 |

% |

-12.2 |

% |

-15.9 |

% |

-12.6 |

% |

-19.5 |

% |

-13.6 |

% |

|

Adjusted EBITDA margin (Non-GAAP Financial

Measure) |

-2.8 |

% |

1.9 |

% |

3.2 |

% |

9.8 |

% |

-4.5 |

% |

5.0 |

% |

|

Normalized Adjusted EBITDA margin |

-2.7 |

% |

0.5 |

% |

3.2 |

% |

9.3 |

% |

-4.0 |

% |

4.4 |

% |

|

Adjusted operating loss margin (Non-GAAP Financial

Measure) |

-16.2 |

% |

-7.2 |

% |

-10.0 |

% |

-7.4 |

% |

-17.0 |

% |

-8.2 |

% |

|

Normalized Adjusted operating loss margin |

-16.1 |

% |

-8.5 |

% |

-10.0 |

% |

-8.0 |

% |

-16.6 |

% |

-8.8 |

% |

| |

|

|

|

|

|

|

|

KINGSOFT CLOUD HOLDINGS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS |

|

(All amounts in thousands) |

|

|

Three Months Ended |

|

|

Sep 30,2023 |

Sep 30,2024 |

Sep 30,2024 |

|

|

RMB |

RMB |

US$ |

|

Net cash generated from operating activities |

20,372 |

|

228,364 |

|

32,542 |

|

|

Net cash generated from (used in) investing

activities |

165,089 |

|

(458,621 |

) |

(65,353 |

) |

|

Net cash used in financing activities |

(1,263,894 |

) |

(183,390 |

) |

(26,133 |

) |

|

Effect of exchange rate changes on cash, cash equivalents and

restricted cash |

(13,026 |

) |

27,632 |

|

3,938 |

|

|

Net decrease in cash, cash equivalents and restricted cash |

(1,091,459 |

) |

(386,015 |

) |

(55,006 |

) |

|

Cash, cash equivalents and restricted cash at beginning of

period |

3,823,087 |

|

2,096,404 |

|

298,735 |

|

|

Cash, cash equivalents and restricted cash at end of

period |

2,731,628 |

|

1,710,389 |

|

243,729 |

|

| |

|

|

|

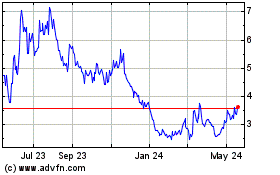

Kingsoft Cloud (NASDAQ:KC)

Historical Stock Chart

From Dec 2024 to Jan 2025

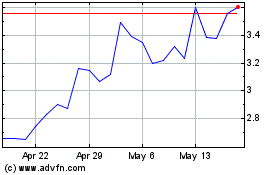

Kingsoft Cloud (NASDAQ:KC)

Historical Stock Chart

From Jan 2024 to Jan 2025