LifeWallet Acquires Assignment of Additional MSP Claims with an Overall Paid Amount Exceeding $10.6 billion Comprised of Over 450,000 Medicare Members and Announces it Secured a Waiver of Acceleration on a Second Loan Agreement in the Event of a Negative G

October 02 2024 - 8:22AM

MSP Recovery, Inc. d/b/a LifeWallet (NASDAQ: LIFW)

(“LifeWallet” or “the Company”), as previously announced

on August 2, 2024, today LifeWallet entered into a definitive

agreement with Hazel Partners Holdings LLC consistent with the

letter agreement.1 LifeWallet acquired the recovery rights to

claims as per its assignment of additional Medicare Secondary Payer

claims consisting of more than 450,000 Medicare members, as

documented by health insurance plans, with an estimated total

claims paid amount exceeding $10.6 billion.2

This latest assignment of Medicare Secondary Payer claims

exemplifies LifeWallet’s continued progress in acquiring additional

healthcare claims, paving the way for the discovery and potential

recovery of improperly paid claims on the part of Medicare Payers.

Because of LifeWallet’s existing settlements with insurance

companies, any claims pertaining to insurance companies that have

already been settled, would be processed under the terms of the

settlement without having to resort to costly and time-consuming

litigation.

In addition to providing historic claims payment reconciliation,

these claims will be onboarded onto the LifeWallet Palantir

clearinghouse system, a sophisticated data analytics system created

through an exclusive healthcare partnership with Palantir

Technologies (NYSE: PLTR). This system utilizes the Palantir

Foundry platform through the development of new technological tools

and machine learning. It captures and manages healthcare data

effectively, enhancing the identification of improper payments.

This further enhances LifeWallet’s Chase to Pay model, utilizing

its extensive legal infrastructure to enforce Primary Payer

obligations through years of federal and state litigation to the

extent the health insurance plans are signed. The Company continues

to create reimbursement recovery solutions for health insurance

plans and healthcare providers, discovering Medicare liens owed to

them, capturing instances where another payer should be paying for

medical bills, saving the health insurance plans money by not

having to pay claims they are not responsible for, and recovering

conditional payments from responsible primary payers, such as

property and casualty insurers.

LifeWallet’s CIO, Christopher Miranda, said of today’s

announcement, “This builds upon the Company’s more than ten-year

commitment to revolutionize the fragmented healthcare reimbursement

system with data-driven solutions, resulting in improved outcomes

for healthcare payers, providers, leading to improved patient

care.”

Waiver from Hazel Partners Holdings, LLC and Virage

Capital Partners

LifeWallet also announces the waiver of a payment acceleration

clause pursuant to a material credit agreement. Hazel Partners

Holdings, LLC (“Hazel”) agreed to waive a provision of the Second

Amended and Restated Credit Agreement, as amended, that otherwise

would have accelerated the payment of amounts due in the event that

the Company receives a negative going concern opinion from its

auditors. This waiver only applies in the event that the Company

receives a negative going concern opinion for the fiscal year

ending December 31, 2024. This is in addition to a previous waiver

of acceleration also granted by its largest creditor, Virage

Capital Partners (“Virage”). On September 6, 2024, Virage agreed to

waive a provision of the Company’s Master Transaction Agreement

that would accelerate the payment of amounts due to Virage in the

event the Company receives a negative going concern opinion from

its auditors for the year ending December 31, 2024. The company

continues to work on expense reductions and efforts to restructure

existing debt while monitoring its deployment of cash and

increasing its liquidity inflows.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements may generally be identified by the use of words such as

“anticipate,” “believe,” “expect,” “intend,” “plan" and “will” or,

in each case, their negative, or other variations or comparable

terminology. These forward-looking statements include all matters

that are not historical facts, including for example statements

regarding potential future settlements. By their nature,

forward-looking statements involve risks and uncertainties because

they relate to events and depend on circumstances that may or may

not occur in the future. As a result, these statements are not

guarantees of future performance or results and actual events may

differ materially from those expressed in or suggested by the

forward-looking statements. Any forward-looking statement made by

the Company herein speaks only as of the date made. New risks and

uncertainties come up from time to time, and it is impossible for

the Company to predict or identify all such events or how they may

affect it. the Company has no obligation, and does not intend, to

update any forward-looking statements after the date hereof, except

as required by federal securities laws. Factors that could cause

these differences include, but are not limited to, the Company’s

ability to capitalize on its assignment agreements and recover

monies that were paid by the assignors; the inherent uncertainty

surrounding settlement negotiations and/or litigation, including

with respect to both the amount and timing of any such results; the

success of the Company's scheduled settlement mediations; the

validity of the assignments of claims to the Company; negative

publicity concerning healthcare data analytics and payment

accuracy; and those other factors included in the Company’s Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and other

reports filed by it with the SEC. These statements constitute the

Company’s cautionary statements under the Private Securities

Litigation Reform Act of 1995.

About LifeWallet

Founded in 2014 as MSP Recovery, LifeWallet has become a

Medicare, Medicaid, commercial, and secondary payer reimbursement

recovery leader, disrupting the antiquated healthcare reimbursement

system with data-driven solutions to secure recoveries from

responsible parties. LifeWallet provides comprehensive solutions

for multiple industries including healthcare, legal, and sports

NIL. For more information, visit: LIFEWALLET.COM.

CONTACTS

MediaICR,

Inc.MSP@icrinc.com

InvestorsInvestors@LifeWallet.com

______________________________

1 On August 2, 2024, Subrogation Holdings, LLC, a wholly owned

subsidiary of MSP Recovery, Inc. d/b/a LifeWallet (the “Company”)

entered into a letter agreement (the “HPH Letter Agreement”)

whereby the parties have set out the terms to amend the Second

Amended and Restated Credit Agreement with Hazel Partners Holdings

LLC (the “Credit Agreement”), to: (i) extend the period for the

Company to draw up to $14 million for working capital, accessible

in eight tranches of $1.75 million, that can be drawn at least one

month apart, until September 2025; and (ii) provide for a $2.0

million loan to be funded by August 31, 2024 for the purpose of

acquiring additional Claims (the “New Claims”) that will further

collateralize the Working Capital Credit Facility (collectively,

(i) and (ii) the “Operational Collection Floor”). The parties have

agreed that such amendment to the Credit Agreement shall be agreed

and entered into at a later date.

2 “Paid Amount” (a/k/a Medicare Paid Rate or wholesale price)

means the amount paid to the provider from the health plan or

insurer. This amount varies based on the party making payment. For

example, Medicare typically pays a lower fee for service rate than

commercial insurers. The Paid Amount is derived from the Claims

data we receive from our Assignors. In the limited instances where

the data received lacks a paid value, our team calculates the Paid

Amount with a formula. The formula used provides rates for

outpatient services and is derived from the customary rate at the

95th percentile as it appears from standard industry commercial

rates or, where that data is unavailable, the Billed Amount if

present in the data. These amounts are then adjusted to account for

the customary Medicare adjustment to arrive at the calculated Paid

Amount. Management believes that this formula provides a

conservative estimate for the Medicare paid amount rate, based on

industry studies which show the range of differences between

private insurers and Medicare rates for outpatient services. We

periodically update this formula to enhance the calculated paid

amount where that information is not provided in the data received

from our Assignors. Management believes this measure provides a

useful baseline for potential recoveries, but it is not a measure

of the total amount that may be recovered in respect of potentially

recoverable Claims, which in turn may be influenced by any

applicable potential statutory recoveries such as double damages or

fines. Where we have to extrapolate a Paid Amount to establish

damages, the calculated amount may be contested by opposing

parties. The figures pertaining to Medicare Member Lives as well as

the paid amount were tabulated based on the data provided by health

care plans; these figures may be subject to adjustment upon further

investigation of the paid amounts reflected by the health

plans.

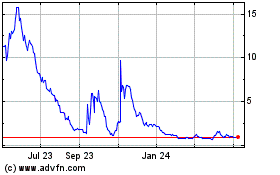

MSP Recovery (NASDAQ:LIFW)

Historical Stock Chart

From Nov 2024 to Dec 2024

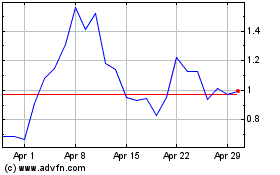

MSP Recovery (NASDAQ:LIFW)

Historical Stock Chart

From Dec 2023 to Dec 2024