LifeWallet Announces Reverse Stock Split to Regain Compliance with Nasdaq’s Minimum Bid Price Requirement

November 12 2024 - 11:00AM

MSP Recovery, Inc. d/b/a LifeWallet (NASDAQ: LIFW) (“LifeWallet,”

or the “Company”), a Medicare, Medicaid, commercial, and secondary

payer reimbursement recovery and technology leader, today announced

that it will affect a reverse stock split of its Class A common

stock at a reverse stock split ratio of 1-for-25, effective at

11:59 P.M. on November 15, 2024, in order to regain compliance with

the minimum $1.00 bid price per share requirement of Nasdaq’s

Marketplace Rule 5450(a)(1).

LifeWallet’s Common Stock will continue to trade on the Nasdaq

Global Market (“Nasdaq”) under the symbol “LIFW” and will begin

trading on a split-adjusted basis when the Nasdaq opens on November

18, 2024 (“Effective Time”). The new CUSIP number for the Class A

common stock following the reverse split will be: 553745-30-8.

The Company’s stockholders previously approved the reverse stock

split and granted the Company’s board of directors the authority to

determine the final reverse stock split ratio and when to proceed

with the reverse stock split. The Company has filed an amendment to

its Second Amended and Restated Certificate of Incorporation to

affect the reverse stock split at the ratio of 1-for-25 as of the

Effective Time.

As a result of the reverse split, every 25 shares of the

Company’s issued and outstanding Common Stock will automatically be

converted into one share of issued and outstanding Common Stock.

The Company’s shares will begin trading on a split-adjusted basis

on the Nasdaq Capital Market commencing upon market open on

November 18, 2024. Immediately after the reverse split becomes

effective, there will be approximately 1.6 million shares of Class

A common stock issued and outstanding.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements contained in this press release may be identified by the

use of words such as “anticipate,” “believe,” “contemplate,”

“could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,”

“plan,” “potential,” “predict,” “project,” “target,” “aim,”

“should,” “will,” “would,” or the negative of these words or other

similar expressions, although not all forward-looking statements

contain these words. Forward-looking statements are based on the

Company’s current expectations and are subject to inherent

uncertainties, risks and assumptions that are difficult to predict.

Further, certain forward-looking statements are based on

assumptions as to future events that may not prove to be accurate.

These and other risks and uncertainties are described more fully in

the section titled “Risk Factors” included in the Company’s Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and other

reports filed by it with the SEC. These statements constitute the

Company’s cautionary statements under the Private Securities

Litigation Reform Act of 1995.

About LifeWallet

Founded in 2014 as MSP Recovery, LifeWallet has become a

Medicare, Medicaid, commercial, and secondary payer reimbursement

recovery leader, disrupting the antiquated healthcare reimbursement

system with data-driven solutions to secure recoveries from

responsible parties. LifeWallet provides comprehensive solutions

for multiple industries including healthcare, legal, and sports

NIL. For more information, visit: LIFEWALLET.COM.

Contacts

MediaMedia@LifeWallet.com

InvestorsInvestors@LifeWallet.com

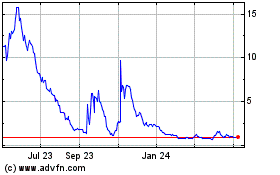

MSP Recovery (NASDAQ:LIFW)

Historical Stock Chart

From Feb 2025 to Mar 2025

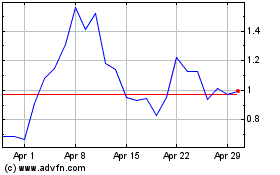

MSP Recovery (NASDAQ:LIFW)

Historical Stock Chart

From Mar 2024 to Mar 2025