false000132035000013203502024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 07, 2024 |

LENSAR, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39473 |

32-0125724 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2800 Discovery Drive |

|

Orlando, Florida |

|

32826 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 888 536-7271 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.01 per share |

|

LNSR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, LENSAR, Inc. (the “Company”) issued a press release announcing financial results for the fiscal quarter ended September 30, 2024. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The Company will host an earnings call on November 7, 2024, during which the Company will discuss its financial results for the fiscal quarter ended September 30, 2024 and provide a business update.

The information furnished in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

LENSAR, Inc. |

|

|

|

|

Date: |

November 7, 2024 |

By: |

/s/ Nicholas T. Curtis |

|

|

Name: Title: |

Nicholas T. Curtis

Chief Executive Officer |

Exhibit 99.1

LENSAR Reports Third Quarter 2024 Results and Provides Business Update

24 ALLY Robotic Laser Cataract Systems™ placed in 3Q 2024 including 11 sales in EU and Southeast Asia; Robust backlog with 24 systems pending installation as of September 30, 2024

38% Revenue growth over third quarter 2023 and 22% Recurring revenue growth in twelve-month trailing average

Worldwide procedure volumes increased 29% over third quarter of 2023

Installed system base grew 20% over third quarter of 2023

ORLANDO, Fla. (November 7, 2024) – LENSAR®, Inc. (Nasdaq: LNSR) (“LENSAR” or “the Company”), a global medical technology company focused on advanced robotic laser solutions for the treatment of cataracts, today announced financial results for the quarter ended September 30, 2024 and provided an update on key operational initiatives.

“Our third quarter results further show the continued momentum behind ALLY in each of our key metrics. We are reporting solid growth in system placements, system backlog and procedures purchased, in addition to robust demand following the pivotal, mid-quarter regulatory certification and clearance in the European Union and Taiwan. We sold 11 ALLY systems in the first two months of commercial availability outside the U.S., which contributed to robust total revenue growth of 38% over the third quarter of 2023. We believe LENSAR is positioned well for continued procedure and recurring revenue growth as we enter the fourth quarter, which is typically our strongest quarter of the year,” said Nick Curtis, President and CEO of LENSAR. “Our installed base has expanded to over 100 ALLYs worldwide as of quarter end, reflecting a 170% increase from the same period last year, and a total installed base of approximately 355 systems. Procedure volumes were up 29% over the third quarter of 2023 and translated to recurring revenue of $38 million on a trailing twelve-month basis, representing an increase of 22% over the comparable September 2023 twelve-month period. Market Scope estimates that LENSAR gained an additional 3.5% market share in the past year in the largest premium market, the U.S., and now has a total U.S. market share of 19.9% as of September 30, 2024.

Third Quarter 2024 Financial Results

Total revenue for the quarter ended September 30, 2024 was $13.5 million, an increase of $3.7 million, or 38%, compared to total revenue of $9.8 million for the quarter ended September 30, 2023. The increase in the third quarter of 2024 occurred in all revenue line items and was primarily due to the 11 systems sold outside the United States following regulatory certification and clearance in the European Union and Taiwan in August of 2024. Procedure volume in the United States increased approximately 22%, when comparing the third quarter of 2024 to 2023, with worldwide procedure volume increasing approximately 29% in the third quarter of 2024 as compared to 2023. During the three months ended September 30, 2024, the Company placed 24 ALLY Systems, increasing the installed base to over 100 ALLY Systems and the total installed base of LENSAR Laser Systems and ALLY Systems to approximately 355 at September 30, 2024, reflecting a 20% increase over the installed base of 295 systems at September 30, 2023.

The following table provides information about revenue and revenue attributable to recurring sources, which we consider to be all components of our revenue except for sales of our systems:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

(Dollars in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

System |

|

$ |

3,660 |

|

|

$ |

1,953 |

|

|

$ |

7,404 |

|

|

$ |

6,251 |

|

Recurring source revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Procedure |

|

|

6,918 |

|

|

|

5,203 |

|

|

|

20,141 |

|

|

|

15,940 |

|

Lease |

|

|

1,724 |

|

|

|

1,524 |

|

|

|

5,623 |

|

|

|

4,844 |

|

Service |

|

|

1,237 |

|

|

|

1,115 |

|

|

|

3,595 |

|

|

|

3,024 |

|

Total recurring source revenue |

|

|

9,879 |

|

|

|

7,842 |

|

|

|

29,359 |

|

|

|

23,808 |

|

Total revenue |

|

$ |

13,539 |

|

|

$ |

9,795 |

|

|

$ |

36,763 |

|

|

$ |

30,059 |

|

Recurring source revenue % |

|

|

73 |

% |

|

|

80 |

% |

|

|

80 |

% |

|

|

79 |

% |

As of September 30, 2024, the Company’s recurring revenue totaled $38 million, on a trailing twelve-month basis, representing an increase of 22% over the comparable twelve-month period in 2023.

The following table provides information about procedure volume:

|

|

|

|

|

Procedure Volume

|

|

2024 |

|

2023 |

Q1 |

39,486 |

|

31,600 |

Q2 |

42,203 |

|

35,349 |

Q3 |

42,231 |

|

32,649 |

Total |

123,920 |

|

99,598 |

Selling, general and administrative expenses were $6.1 million and $5.1 million for the quarters ended September 30, 2024 and 2023, respectively, an increase of $1.0 million or 19%. General and administrative expenses increased in the quarter due to recording an Employee Retention Credit (“ERC”) of $1.4 million in the three months ended September 30, 2023, which significantly reduced expenses in the third quarter of 2023. Excluding the $1.4 million attributable to the ERC, selling, general and administrative expenses decreased $0.4 million due to lower stock-based compensation expense and lower cash-based general and administrative expenses, partially offset by a 16% increase in selling and marketing expenses in the third quarter of 2024 supporting the continued ALLY growth in placements and procedures.

Research and development expenses were $1.2 million and $1.5 million for the quarters ended September 30, 2024 and 2023, respectively, a decrease of $0.3 million or 21%.

Total operating expenses for the quarter September 30, 2024 were $7.5 million as compared to $6.9 million in the third quarter of 2023, which included a reduction for the ERC of $1.4 million. Operating loss for the third quarter of 2024 was $1.3 million and improved $0.8 million, or 39%, from the $2.0 million in the third quarter of 2023.

Net loss for the quarter ended September 30, 2024 was $1.5 million, or ($0.13) per common share, compared to net income of $2.6 million, or $0.13 per common share, for the quarter ended September 30, 2023. The most significant change in results between the third quarter comparison relates to a $4.3 million decrease in warrant liability, which occurred in the third quarter of 2023, and generated net income from an operating loss in that quarter. Included within operating expenses are stock-based compensation expenses recorded for the quarters ended September 30, 2024 and 2023 of $0.7 million and $1.2 million, respectively, and change in fair value of warrant liabilities of $0.4 million and ($4.3) million, respectively.

Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) for the quarter ended September 30, 2024 was ($0.6) million, compared with $3.2 million for the quarter ended September 30, 2023. Adjusted EBITDA, which we calculate by adding back stock-based

compensation expense, (income)/expense related to the change in the fair value of warrant liabilities, impairment of intangible assets and the ERC to EBITDA, was $0.4 million for the quarter ended September 30, 2024 and ($1.4) million for the quarter ended September 30, 2023. EBITDA and Adjusted EBITDA are non-GAAP financial measures, and a reconciliation of these measures to net loss is set forth below in this press release.

As of September 30, 2024, the Company had cash, cash equivalents, and investments of $18.6 million, as compared to $24.6 million at December 31, 2023, and $15.4 million at June 30, 2024. The Company’s cash balance increased approximately $3.1 million in the quarter ended September 30, 2024, which was primarily related to the 11 ALLY systems sold outside the U.S. in the third quarter of 2024 as well as periodic changes in working capital balances. The Company achieved break-even for the quarter on an Adjusted EBITDA basis.

Conference Call:

LENSAR management will host a conference call and live webcast to discuss the third quarter results and provide a business update today, November 7, 2024, at 8:30 a.m. ET.

To participate by telephone, please dial (800) 715-9871 (Domestic) or (646) 307 1963 (International). The conference ID is 8444582. The live webcast can be accessed under “Events & Presentations” in the Investor Relations section of the company’s website at https://ir.lensar.com. Please log in approximately 5 to 10 minutes prior to the call to register and to download and install any necessary software. The call and webcast replay will be available until November 21, 2024.

About LENSAR

LENSAR is a commercial-stage medical device company focused on designing, developing, and marketing advanced systems for the treatment of cataracts and the management of astigmatism as an integral aspect of the procedure. LENSAR has developed its ALLY Robotic Cataract Laser System™ as a compact, highly ergonomic system utilizing an extremely fast dual-modality laser and integrating AI into proprietary imaging and software. ALLY is designed to transform premium cataract surgery by utilizing LENSAR’s advanced robotic technologies with the ability to perform the entire procedure in a sterile operating room or in-office surgical suite, delivering operational efficiencies and reducing overhead. ALLY includes LENSAR’s proprietary Streamline ® software technology, which is designed to guide surgeons to achieve better outcomes.

Forward-looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s business strategies, expected growth, expected product advancement, the ALLY System’s performance, market adoption and usage, including in non-U.S. jurisdictions, and seasonality trends. In some cases, you can identify forward-looking statements by terms such as “aim,” “anticipate,” “approach,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “goal,” “intend,” “look,” “may,” “mission,” “plan,” “possible,” “potential,” “predict,” “project,” “pursue,” “should,” “target,” “will,” “would,” or the negative thereof and similar words and expressions.

Forward-looking statements are based on management’s current expectations, beliefs and assumptions and on information currently available to us. Such statements are subject to a number of known and unknown risks, uncertainties and assumptions, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various important factors, including, but not limited to: our history of operating losses and ability to achieve or sustain profitability; our ability to develop, receive and maintain regulatory clearance or certification of and successfully commercialize the ALLY System and to maintain our LENSAR

Laser System; the impact to our business, financial condition, results of operations and our suppliers and distributors as a result of global macroeconomic conditions; the willingness of patients to pay the price difference for our products compared to a standard cataract procedure covered by Medicare or other insurance; our ability to grow our U.S. sales and marketing organization or maintain or grow an effective network of international distributors; our future capital needs and our ability to raise additional funds on acceptable terms, or at all; the impact to our business, financial condition and results of operations as a result of a material disruption to the supply or manufacture of our systems or necessary component parts for such system or material inflationary pressures affecting pricing of component parts; our ability to compete against competitors that have longer operating histories, more established products and greater resources than we do; our ability to address the numerous risks associated with marketing, selling and leasing our products in markets outside the United States; the impact to our business, financial condition and results of operations as a result of exposure to the credit risk of our customers; our ability to accurately forecast customer demand and our inventory levels; the impact to our business, financial condition and results of operations if we are unable to secure adequate coverage or reimbursement by government or other third-party payors for procedures using our ALLY System or our other products, or changes in such coverage or reimbursement; the impact to our business, financial condition and results of operations of product liability suits brought against us; risks related to government regulation applicable to our products and operations; risks related to our intellectual property and other intellectual property matters; and the other important factors that are disclosed under the heading “Risk Factors” contained in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, filed with the Securities and Exchange Commission (“SEC”), as such factors may be updated from time to time in the Company’s other filings with the SEC, including the Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2024, to be filed with the SEC, each accessible on the SEC’s website at www.sec.gov and the Investor Relations section of the Company’s website at https://ir.lensar.com. All forward-looking statements are expressly qualified in their entirety by such factors. Except as required by law, the Company undertakes no obligation to publicly update or review any forward-looking statement, whether because of new information, future developments or otherwise. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this press release.

|

|

|

Contacts: |

|

Lee Roth / Cameron Radinovic |

Thomas R. Staab, II, CFO |

|

Burns McClellan for LENSAR |

ir.contact@lensar.com |

|

lroth@burnsmc.com / cradinovic@burnsmc.com |

Non-GAAP Financial Measures

The Company prepares and analyzes operating and financial data and non-GAAP measures to assess the performance of its business, make strategic and offering decisions and build its financial projections. The key non-GAAP measures it uses are EBITDA and Adjusted EBITDA. EBITDA is defined as net loss before interest expense, interest income, income tax expense, depreciation and amortization expenses. EBITDA is a non-GAAP financial measure. EBITDA is included in this filing because we believe that EBITDA provides meaningful supplemental information for investors regarding the performance of our business and facilitates a meaningful evaluation of actual results on a comparable basis with historical results. Adjusted EBITDA is also a non-GAAP financial measure. We believe Adjusted EBITDA, which is defined as EBITDA and further excluding stock-based compensation expense, change in fair value of warrant liabilities, impairment of intangible assets and the Employee Retention Credit provides meaningful supplemental information for investors when evaluating our results and comparing us to peer companies as stock-based compensation expense and change in fair value of warrant liabilities are significant non-cash charges and impairment of intangible assets is a non-cash charge that is not indicative of our core operating results and the Employee Retention Credit is not recurring. We use these non-GAAP financial measures in order to have comparable financial results to analyze changes in our underlying business from quarter to quarter. However, there are a number of limitations related to the use of non-GAAP measures and their nearest GAAP equivalents. For example, other companies may calculate non-GAAP measures differently, or may use other measures to

calculate their financial performance and, therefore, any non-GAAP measures we use may not be directly comparable to similarly titled measures of other companies. Investors should not consider our non-GAAP financial measures in isolation or as a substitute for an analysis of our results as reported under GAAP.

A reconciliation of EBITDA and Adjusted EBITDA to their most comparable GAAP financial measure is set forth below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

(Dollars in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net (loss) income |

|

$ |

(1,502 |

) |

|

$ |

2,568 |

|

|

$ |

(12,702 |

) |

|

$ |

(10,457 |

) |

Less: Interest income |

|

|

(153 |

) |

|

|

(265 |

) |

|

|

(511 |

) |

|

|

(465 |

) |

Add: Depreciation expense |

|

|

774 |

|

|

|

609 |

|

|

|

2,087 |

|

|

|

1,767 |

|

Add: Amortization expense |

|

|

232 |

|

|

|

273 |

|

|

|

738 |

|

|

|

824 |

|

EBITDA |

|

|

(649 |

) |

|

|

3,185 |

|

|

|

(10,388 |

) |

|

|

(8,331 |

) |

Add: Stock-based compensation expense |

|

|

668 |

|

|

|

1,173 |

|

|

|

2,003 |

|

|

|

4,723 |

|

Add: Change in fair value of warrant liabilities |

|

|

410 |

|

|

|

(4,343 |

) |

|

|

3,838 |

|

|

|

1,654 |

|

Add: Impairment of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

3,729 |

|

|

|

— |

|

Less: Employee retention credit |

|

|

— |

|

|

|

(1,368 |

) |

|

|

— |

|

|

|

(1,368 |

) |

Adjusted EBITDA |

|

$ |

429 |

|

|

$ |

(1,353 |

) |

|

$ |

(818 |

) |

|

$ |

(3,322 |

) |

LENSAR, Inc.

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Product |

|

$ |

10,578 |

|

|

$ |

7,156 |

|

|

$ |

27,545 |

|

|

$ |

22,191 |

|

Lease |

|

|

1,724 |

|

|

|

1,524 |

|

|

|

5,623 |

|

|

|

4,844 |

|

Service |

|

|

1,237 |

|

|

|

1,115 |

|

|

|

3,595 |

|

|

|

3,024 |

|

Total revenue |

|

|

13,539 |

|

|

|

9,795 |

|

|

|

36,763 |

|

|

|

30,059 |

|

Cost of revenue (exclusive of amortization) |

|

|

|

|

|

|

|

|

|

|

|

|

Product |

|

|

4,473 |

|

|

|

2,933 |

|

|

|

10,914 |

|

|

|

8,897 |

|

Lease |

|

|

790 |

|

|

|

524 |

|

|

|

2,056 |

|

|

|

1,514 |

|

Service |

|

|

2,010 |

|

|

|

1,461 |

|

|

|

5,050 |

|

|

|

3,690 |

|

Total cost of revenue |

|

|

7,273 |

|

|

|

4,918 |

|

|

|

18,020 |

|

|

|

14,101 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

6,077 |

|

|

|

5,117 |

|

|

|

19,657 |

|

|

|

19,726 |

|

Research and development expenses |

|

|

1,202 |

|

|

|

1,527 |

|

|

|

3,994 |

|

|

|

4,676 |

|

Amortization of intangible assets |

|

|

232 |

|

|

|

273 |

|

|

|

738 |

|

|

|

824 |

|

Impairment of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

3,729 |

|

|

|

— |

|

Operating loss |

|

|

(1,245 |

) |

|

|

(2,040 |

) |

|

|

(9,375 |

) |

|

|

(9,268 |

) |

Other (expense) income |

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of warrant liabilities |

|

|

(410 |

) |

|

|

4,343 |

|

|

|

(3,838 |

) |

|

|

(1,654 |

) |

Other income, net |

|

|

153 |

|

|

|

265 |

|

|

|

511 |

|

|

|

465 |

|

Net (loss) income |

|

|

(1,502 |

) |

|

|

2,568 |

|

|

|

(12,702 |

) |

|

|

(10,457 |

) |

Other comprehensive (loss) income |

|

|

|

|

|

|

|

|

|

|

|

|

Change in unrealized loss on investments |

|

|

21 |

|

|

|

— |

|

|

|

11 |

|

|

|

— |

|

Net (loss) income and comprehensive (loss) income |

|

$ |

(1,481 |

) |

|

$ |

2,568 |

|

|

$ |

(12,691 |

) |

|

$ |

(10,457 |

) |

Net (loss) earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.13 |

) |

|

$ |

0.13 |

|

|

$ |

(1.11 |

) |

|

$ |

(0.96 |

) |

Diluted |

|

$ |

(0.13 |

) |

|

$ |

(0.23 |

) |

|

$ |

(1.11 |

) |

|

$ |

(0.96 |

) |

Weighted-average number of common shares used in calculation of net (loss) earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

11,604 |

|

|

|

11,102 |

|

|

|

11,481 |

|

|

|

10,881 |

|

Diluted |

|

|

11,604 |

|

|

|

11,956 |

|

|

|

11,481 |

|

|

|

10,881 |

|

LENSAR, Inc.

BALANCE SHEETS

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

10,442 |

|

|

$ |

20,621 |

|

Short-term investments |

|

|

7,638 |

|

|

|

3,443 |

|

Accounts receivable, net of allowance of $39 and $62, respectively |

|

|

4,373 |

|

|

|

4,001 |

|

Notes receivable, net of allowance of $7 and $7, respectively |

|

|

352 |

|

|

|

323 |

|

Inventories |

|

|

14,892 |

|

|

|

15,689 |

|

Prepaid and other current assets |

|

|

1,705 |

|

|

|

2,367 |

|

Total current assets |

|

|

39,402 |

|

|

|

46,444 |

|

Property and equipment, net |

|

|

677 |

|

|

|

679 |

|

Equipment under lease, net |

|

|

12,303 |

|

|

|

7,459 |

|

Long-term investments |

|

|

494 |

|

|

|

492 |

|

Notes and other receivables, long-term, net of allowance of $20 and $26, respectively |

|

|

952 |

|

|

|

1,279 |

|

Intangible assets, net |

|

|

6,344 |

|

|

|

11,025 |

|

Other assets |

|

|

1,847 |

|

|

|

2,207 |

|

Total assets |

|

$ |

62,019 |

|

|

$ |

69,585 |

|

Liabilities, redeemable convertible preferred stock, and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

3,867 |

|

|

$ |

4,007 |

|

Accrued liabilities |

|

|

5,800 |

|

|

|

5,717 |

|

Deferred revenue |

|

|

1,437 |

|

|

|

1,349 |

|

Operating lease liabilities |

|

|

574 |

|

|

|

559 |

|

Total current liabilities |

|

|

11,678 |

|

|

|

11,632 |

|

Long-term operating lease liabilities |

|

|

1,319 |

|

|

|

1,750 |

|

Warrant liabilities |

|

|

12,295 |

|

|

|

8,457 |

|

Other long-term liabilities |

|

|

205 |

|

|

|

570 |

|

Total liabilities |

|

|

25,497 |

|

|

|

22,409 |

|

Series A Redeemable Convertible Preferred Stock, par value $0.01 per share, 20 shares authorized at September 30, 2024 and December 31, 2023; 20 shares issued and outstanding at September 30, 2024 and December 31, 2023; aggregate liquidation preference of $20,000 at September 30, 2024 and December 31, 2023 |

|

|

13,784 |

|

|

|

13,747 |

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, par value $0.01 per share, 9,980 shares authorized at September 30, 2024 and December 31, 2023; no shares issued and outstanding at September 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

Common stock, par value $0.01 per share, 150,000 shares authorized at September 30, 2024 and December 31, 2023; 11,612 and 11,327 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively |

|

|

116 |

|

|

|

113 |

|

Additional paid-in capital |

|

|

147,200 |

|

|

|

145,203 |

|

Accumulated other comprehensive income |

|

|

15 |

|

|

|

4 |

|

Accumulated deficit |

|

|

(124,593 |

) |

|

|

(111,891 |

) |

Total stockholders’ equity |

|

|

22,738 |

|

|

|

33,429 |

|

Total liabilities, redeemable convertible preferred stock, and stockholders’ equity |

|

$ |

62,019 |

|

|

$ |

69,585 |

|

v3.24.3

Document And Entity Information

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity Registrant Name |

LENSAR, INC.

|

| Entity Central Index Key |

0001320350

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-39473

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

32-0125724

|

| Entity Address, Address Line One |

2800 Discovery Drive

|

| Entity Address, City or Town |

Orlando

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32826

|

| City Area Code |

888

|

| Local Phone Number |

536-7271

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

LNSR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

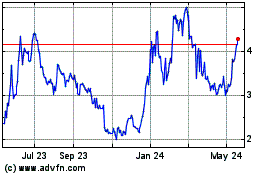

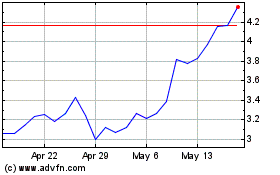

LENSAR (NASDAQ:LNSR)

Historical Stock Chart

From Nov 2024 to Dec 2024

LENSAR (NASDAQ:LNSR)

Historical Stock Chart

From Dec 2023 to Dec 2024