As filed with the Securities and Exchange

Commission on March 6, 2025

Registration No. 333-285389

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT NO. 1 TO

FORM

F-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

LYTUS

TECHNOLOGIES HOLDINGS PTV. LTD.

(Exact

name of registrant as specified in its charter)

| British Virgin Islands |

|

7841 |

|

Not applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification No.) |

LYTUS

TECHNOLOGIES HOLDINGS PTV. LTD.

Unit

1214, ONE BKC, G Block

Bandra

Kurla Complex

Bandra

East

Mumbai,

India 400 051

Tel:

+91-7777044778

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

CCS

Global Solutions, Inc.

530

Seventh Avenue, Suite 508

New

York, NY 10018

Tel:

+1-315-9304588

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Thomas

J. Poletti, Esq.

Veronica

Lah, Esq.

Manatt,

Phelps & Phillips LLP

695

Town Center Drive, 14th Floor

Costa

Mesa, CA 92626

(714)

371-2500

Approximate

date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Information

contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the

SEC. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective.

This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities

in any jurisdiction in which such offer, solicitation or sale would be unlawful.

SUBJECT

TO COMPLETION, DATED MARCH 6, 2025

PRELIMINARY

PROSPECTUS

LYTUS

TECHNOLOGIES HOLDINGS PTV. LTD.

49,962,532

Common Shares

This

prospectus relates to the resale, from time to time, of up to 49,962,532 shares of common shares, par value $0.01 per share (the

“Common Shares”), of Lytus Technologies Holdings PTV. Ltd., a company incorporated in the British Virgin Islands (the “Company,”

“we,” “us,” or “our”), by YA II PN, LTD, a Cayman Islands exempt limited company (the “Selling

Shareholder” or “Yorkville”). The Common Shares to which this prospectus relates have been or may be issued by us to

the Selling Shareholder pursuant to a standby equity purchase agreement, dated February 3, 2025 (the “Effective Date”),

by and between the Company and the Selling Shareholder (the “SEPA”), from time to time after the date of this prospectus,

upon the terms and subject to the conditions set forth in the SEPA.

Such Common Shares include

(i) up to 48,543,690 Common Shares that may be issued to the Selling Shareholder pursuant to the SEPA, either in our sole discretion

following an Advance Notice (as defined below) or pursuant to an Investor Notice (as defined below) and (ii) 1,418,842 Common Shares

(the “Commitment Shares”) consisting of (a) 567,537 Common Shares that have been issued to the Selling Shareholder on February

3, 2025, and (b) 851,305 Common Shares to be issued to the Selling Shareholder upon certain milestones, as consideration for its irrevocable

commitment to purchase Common Shares at the Company’s direction from time to time, upon the terms and subject to the conditions

set forth in the SEPA. We are not selling any securities under this prospectus and will not receive any of the proceeds from the

sale of our Common Shares by the Selling Shareholder hereby. However, we may receive up to $100,000,000 aggregate gross proceeds from

sales of Common Shares that we may elect to make to the Selling Shareholder pursuant to the SEPA after the date of this prospectus. See

“The Standby Equity Purchase Agreement” on page 6 of this prospectus for a description of the SEPA and “Selling Shareholder”

on page 9 of this prospectus for additional information regarding the Selling Shareholder. R. F. Lafferty & Co., Inc. and Revere

Securities LLC acted as finders (together, the “Finder”) in connection with the SEPA. The Finder will earn a cash fee of

8% of total proceeds raised through any Prepaid Advance. The Finder is also entitled to a cash fee of 4% of any subsequent drawdown on

the SEPA.

See

the section titled “Description of Standby Equity Purchase Agreement” for a description of the Purchase Agreement and the

section titled “Selling Shareholder” for additional information regarding Yorkville.

The Selling Shareholder may sell or otherwise dispose of the Common

Shares described in this prospectus in a number of different ways and at varying prices. The Selling Shareholder is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”),

only with respect to advances under the SEPA, and any profits on the sales of shares of our Common Shares by the Selling Shareholder and

any discounts, commissions, or concessions received by the Selling Shareholder are deemed to be underwriting discounts and commissions

under the Securities Act. If any underwriters, dealers, or agents are involved in the sale of any of the securities, their names and any

applicable purchase price, fee, commission, or discount arrangement between or among them will be set forth, or will be calculable from

the information set forth, in any applicable prospectus supplement. The Selling Shareholder is not an “underwriter” within

the meaning of Section 2(a)(11) of the Securities Act with respect to conversion of the Promissory Notes. We will pay the expenses incurred

in registering under the Securities Act the offer and sale of the shares of Common Shares to which this prospectus relates by the Selling

Shareholder, including our legal and accounting fees. See the sections “About this Prospectus” on page ii and “Plan

of Distribution” on page 10 of this prospectus for more information. No securities may be sold without delivery of this

prospectus and any applicable prospectus supplement describing the method and terms of the offering of such securities. You should carefully

read this prospectus and any applicable prospectus supplement before you invest in our securities.

On February 11, 2025,

we received a determination letter (the “Letter”) from the staff (the “Staff”) of The Nasdaq Stock Market LLC

(“Nasdaq”) notifying the Company that it was not in compliance with Nasdaq Listing Rule 5550(a)(2) which requires listed

companies to maintain a minimum bid price of $1.00 per share (the “Minimum Bid Price Requirement”). Normally, a company would

be afforded a 180-calendar day period to demonstrate compliance with the Minimum Bid Price Requirement. However, pursuant to Listing

Rule 5810(c)(3)(A)(iv) the Company is not eligible for any compliance period specified in Rule 5810(c)(3)(A) because the Company has

effected a reverse stock split over the prior one-year period or has effected one or more reverse stock splits over the prior two-year

period with a cumulative ratio of 250 shares or more to one. On February 23, 2024, the Company effected a 1 for 60 reverse stock split.

On February 12, 2025, the Company requested a hearing before the Nasdaq Hearings Panel (the “Panel”) to appeal the Letter

received on February 11, 2025. A hearing request will stay the suspension of trading of the Company’s common shares, and the Company’s

common shares will continue to trade on The Nasdaq Capital Market until the hearing process concludes and the Panel issues a written

decision. The hearing before the Panel is scheduled for March 18, 2025. If the Company is unable to meet the continued listing criteria

of Nasdaq and the common shares became delisted, trading of the common shares could thereafter be conducted in the over-the-counter markets

in the OTC Pink, also known as “pink sheets” or, if available, on another OTC trading platform. Any such delisting could

harm our ability to raise capital through alternative financing sources on terms acceptable to us, or at all, and may result in the loss

of confidence in our financial stability by suppliers, customers and employees. Investors would likely find it more difficult to dispose

of, or to obtain accurate market quotations for, the common shares, as the liquidity that Nasdaq provides would no longer be available

to investors. In addition, the failure of our common shares to continue to be listed on the Nasdaq could adversely impact the market

price for the common shares and our other securities, and we could face a lengthy process to re-list the common shares, if we are able

to re-list the common shares.

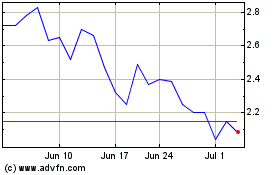

Our

common shares are listed for trading on the Nasdaq Capital Market (“Nasdaq”), under the symbol “LYT”. On February

24, 2025, the closing sale price of our common shares as reported by Nasdaq was $0.2422.

We

are an “emerging growth company” and a “foreign private issuer” under applicable Securities and Exchange Commission

rules, and will be subject to reduced public company reporting requirements for this prospectus and future filings. See “Prospectus

Summary - Implications of Being an Emerging Growth Company and a Foreign Private Issuer”.

You

should rely only on the information contained herein or incorporated by reference in this prospectus. Neither we nor any selling shareholder

have authorized any other person to provide you with different information.

The

Company is incorporated in the British Virgin Islands (“BVI”) and conducts a majority of its operations through its wholly-owned

subsidiary, Lytus Technologies Private Limited, outside the United States. The majority of the Company’s assets are located outside

the United States. A majority of the Company’s officers reside outside the United States and a substantial portion of the assets

of those persons are located outside of the United States. As a result, it could be difficult or impossible for you to bring an action

against the Company or against these individuals outside of the United States in the event that you believe that your rights have been

infringed under the applicable securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws

outside of the United States could render you unable to enforce a judgment against the Company’s assets or the assets of the Company’s

officers.

Our

business and an investment in our common shares involve significant risks. These risks are described under the section entitled “Risk

Factors” beginning on page 4 of this prospectus and in the documents incorporated by reference into this prospectus.

Neither

the SEC nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2025.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form F-3 that we filed with the Securities and Exchange Commission, or the SEC, using

a “shelf” registration process. Under this shelf registration process, the Selling Shareholder may, from time to time offer

and sell, up to an aggregate 49,962,532 of our Common Shares pursuant to the SEPA.

This

prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the offering

of the securities, you should refer to the registration statement, including its exhibits. This prospectus, together with the documents

incorporated by reference into this prospectus, includes all material information relating to the offering of securities under this prospectus.

Before purchasing our common shares, you should carefully read this prospectus, together with the additional information described under

the heading “Where You Can Find Additional Information” and “Information of Documents by Reference.”

We

and the Selling Shareholder have not authorized anyone to provide you with information different from that contained or incorporated

by reference in this prospectus. No dealer, salesperson or other person is authorized to give any information or to represent anything

not contained or incorporated by reference in this prospectus. We and the Selling Shareholder take no responsibility for, and can provide

no assurances as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the

securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the

information in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any

information incorporated herein by reference is accurate only as of the date of the document incorporated by reference, regardless of

the time of delivery of this prospectus or any sale of a security.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

References

in this prospectus to the terms “we,” “us,” “our,” “the Company,” or other similar terms

refer to Lytus Technologies Holdings PTV. Ltd., BVI company, together with its consolidated subsidiaries. “Lytus India” refers

to Lytus Technologies Private Limited, our wholly-owned subsidiary in India.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The

statements contained in this prospectus that are not purely historical are forward-looking statements. Our forward-looking statements

include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or

strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future

events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus may include, for example, statements

about:

| |

● |

the timing of the development

of future services; |

| |

|

|

| |

● |

projections of revenue,

earnings, capital structure and other financial items; |

| |

|

|

| |

● |

the development of

future company-owned call centers; |

| |

|

|

| |

● |

the capabilities of

our business operations; |

| |

|

|

| |

● |

our expected future

economic performance; |

| |

|

|

| |

● |

competition in our

market; |

| |

|

|

| |

● |

assumptions underlying

statements regarding us or our business; |

| |

|

|

| |

● |

our strategy

to finance our operations; |

| |

|

|

| |

● |

future marketing efforts,

advertising campaigns, and promotional efforts; |

| |

|

|

| |

● |

future growth and market

share projections, including projections regarding developments in technology and the effect of growth on our management and other

resources; |

| |

|

|

| |

● |

our future expansion

plans; |

| |

|

|

| |

● |

our future acquisition

strategy, including plans to acquire or make investments in complementary businesses, technologies, services or products, or enter

into strategic partnerships with parties who can provide access to those assets; |

| |

|

|

| |

● |

the future impact of

our acquisitions; |

| |

|

|

| |

● |

our strategy and intentions

regarding new product branding; |

| |

|

|

| |

● |

the future competitive

landscape and the effects of different pricing strategies; |

| |

|

|

| |

● |

the effect of future

tax laws on our business; |

| |

|

|

| |

● |

any legal proceeding,

hearing, or dispute; |

| |

|

|

| |

● |

market conditions and

global and economic factors beyond our control, including general economic conditions, unemployment and our liquidity, operations

and personnel; |

| |

|

|

| |

● |

volatility of our stock

price and potential share dilution; |

| |

|

|

| |

● |

future exchange and

interest rates; and |

| |

|

|

| |

● |

other factors contained

in, or incorporated into, this prospectus, including our Annual Report on Form 20-F for the year ended March 31, 2024, and any related

free writing prospectus, under the section entitled “Risk Factors.” |

These

forward-looking statements are based on information available as of the date of this prospectus, and current expectations, forecasts

and assumptions, and involve a number of judgments, risks and uncertainties. Important factors could cause actual results to differ materially

from those indicated or implied by forward-looking statements such as those contained in documents we have filed with the SEC. Accordingly,

forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any

obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result

of new information, future events or otherwise, except as may be required under applicable securities laws.

As

a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from

those expressed or implied by these forward-looking statements. For a discussion of the risks involved in our business and investing

in our common shares, see the section entitled “Risk Factors.”

Should

one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results

may vary in material respects from those expressed or implied by these forward-looking statements. You should not place undue reliance

on these forward-looking statements.

SUMMARY

OF THE PROSPECTUS

This

summary highlights selected information from this prospectus and does not contain all of the information that is important to you in

making an investment decision. This summary is qualified in its entirety by the more detailed information included in this prospectus.

Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, including the

information under “Risk Factors,” the risk factors set forth in our most recent annual filings with the SEC, as well as other

information in this prospectus and the documents incorporated by reference herein, before purchasing our securities.

The

Company

We

are a platform services company offering services primarily in India. Our business model consists primarily of (a) the current distribution

of linear content streaming/telecasting services and (b) the development of technology products, namely, telemedicine and fintech. The

Lytus platform provides our customers with a one-stop site with the access to all of the services provided by us.

We

are focused on consolidating our subscriber base for future technology services, such as telemedicine and healthcare services, while

continuing to develop our technology platform for a better service experience. Presently, we provide streaming and internet services

through our platform. We are simultaneously working to strengthen its platform services, including advancing its platform with the state-of-art

technology.

Streaming

and Telecast

Lytus

India provides technology enabled customer services, which includes streaming and content services. The present software is being further

upgraded to support the unified and integrated platform through which it shall provide multi-dimensional services such as MedTech IOT

(IOT refers to the Internet of Things).

In

India the regulation does not differentiate between telecasting and streaming as long as the streaming is done in IPTV format. Lytus

plans to offer additional value added services such as MedTech IOT, by upgrading the existing cable networks for Sri Sai Cable Network.

The upgrade primarily consists of deploying Fiber to the Home (“FTTH”), Gigabit Passive Optical Networks (“GPON”)

and changing the existing STB/CPE. On July 24, 2023, the Company announced its commencement of IPTV and broadband business and Fintech

business.

Remote

Healthcare

In

India, Lytus’ telemedicine business, through Lytus India, has commenced repurposing its existing local cable operator network infrastructure

to set up local health centers and diagnostic centers (“LHCs”). We expect that typical services provided at LHCs will include

ECGs, blood and urine testing.

With

respect to remote healthcare, our initial plan is to focus on the sale and distribution of remote patient monitoring devices pre-installed

with proprietary monitoring and reporting software developed by our Lytus Health division. We expect that these devices, sourced from

various HIPAA and FDA compliant vendors, would be installed at the homes of the patients of participating physicians practices. Lytus

Health currently has not developed any proprietary software that is deployed with patients in the United States.

We

also expect Lytus Health’s business to focus on artificial intelligence, machine learning, and other capabilities that we believe

are required to efficiently run a telemedicine business.

Implications

of Being an Emerging Growth Company and a Foreign Private Issuer

Emerging

Growth Company Status

As

a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company”

as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012, and may take advantage of reduced reporting

requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| |

● |

being permitted to present

only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial

Condition and Results of Operations in our SEC filings, |

| |

● | not

being required to comply with the auditor attestation requirements of Section 404 of the

Sarbanes-Oxley Act, |

| |

● |

reduced disclosure obligations

regarding executive compensation in periodic reports, proxy statements and registration statements, and |

| |

● |

exemptions from the requirements

of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously

approved. |

We

may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first

sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended (the

“Securities Act”). However, if certain events occur before the end of such five-year period, including if we become a “large

accelerated filer,” our annual gross revenues exceed $1.235 billion or we issue more than $1.00 billion of non-convertible debt

in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

In

addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition

period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. We have elected to

take advantage of the extended transition period for complying with new or revised accounting standards and acknowledge such election

is irrevocable pursuant to Section 107 of the JOBS Act.

Foreign

Private Issuer Status

We

are a “foreign private issuer,” as defined in Rule 405 under the Securities Act and Rule 3b-4I under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). As a result, we are not subject to the same requirements as U.S. domestic issuers.

Under the Exchange Act, we will be subject to reporting obligations that, to some extent, are more lenient and less frequent than those

of U.S. domestic reporting companies. For example, we will not be required to issue quarterly reports or proxy statements. We will not

be required to disclose detailed individual executive compensation information. Furthermore, our directors and executive officers will

not be required to report equity holdings under Section 16 of the Exchange Act and will not be subject to the insider short-swing profit

disclosure and recovery regime.

As

an exempted British Virgin Islands company to be listed on the NASDAQ Capital Market, we are subject to the NASDAQ Stock Market corporate

governance listing standards. However, the NASDAQ Stock Market rules permit a foreign private issuer like us to follow the corporate

governance practices of its home country. Certain corporate governance practices in the British Virgin Islands, which is our home country,

may differ significantly from the NASDAQ Stock Market corporate governance listing standards. For instance, we are not required to:

| |

● |

have

a majority of the board to be independent (although all of the members of the audit committee must be independent under the U.S.

Securities Exchange Act of 1934, as amended, or the Exchange Act); |

| |

● |

have

a compensation committee or a nominating or corporate governance committee consisting entirely of independent directors; |

| |

● |

have

regularly scheduled executive sessions for non-management directors; |

| |

● |

obtain

shareholder approval prior to the issuance of 20% or more of our common shares as a price that is less than the Minimum Price (as

defined in Nasdaq Listing Rule 5635(d)); and |

| |

● |

have

annual meetings and director elections. |

Currently, we

do rely on home country practice with respect to our corporate governance.

Corporate

Information

Our

principal executive offices are located at Unit 1214, ONE BKC, G Block, Bandra Kurla Complex, Bandra East Mumbai, India 400 051, and

our telephone number is +91-7777044778, where we conduct investment relations and to where we are shifting our headquarters and treasury

operations. Our website address is www.lytuscorp.com. The information on or accessed through our website is not incorporated in this

prospectus. The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information

regarding issuers that file electronically with the SEC, including Lytus Technologies Holdings PTV. Ltd.

We

have modified our earlier arrangement and have reorganized the business by only acquiring the Sri Sai business, whereas our initial arrangement

was to acquire the 1.8 million subscriber base of Reachnet Cable Service Pvt. Ltd. and its revenue generating contracts. Under the modified

arrangement, we own a controlling stake in Sri Sai’s business, and control the infrastructure hub that supports services. A more

detailed discussion can be found in our financial statements included in our most recent Annual Report on Form 20-F filed with the SEC

on August 15, 2024.

THE

OFFERING

| Securities offered by the selling

shareholder |

|

Up to 49,962,532 common

shares. |

| |

|

|

| Common Shares outstanding prior to this offering |

|

31,111,032 common shares

(including 567,537 Common Shares that have been issued to the Selling Shareholder on February 3, 2025). |

| |

|

|

| Common Shares outstanding after this offering |

|

80,506,027 common shares

(assuming the sale of the maximum number of common shares by the Selling Shareholder).(1) |

| |

|

|

| Use

of proceeds |

|

We will not receive any

of the proceeds from the sale by the Selling Shareholder of the Common Shares. We will bear all fees and expenses incident to our

obligation to register the common shares. See section titled “Use of Proceeds” for more information. |

| |

|

|

| Risk

Factors |

|

Investing in our common

shares involves a high degree of risk. See “Risk Factors” beginning on page 4 of this prospectus and in the documents

incorporated by reference into this prospectus for a discussion of certain factors to consider carefully before deciding to purchase

any of our common shares. |

| |

|

|

| Ticker

symbols |

|

Our common shares are listed

on the NASDAQ Capital Market under the symbol “LYT”. |

| (1) | The

number of shares of Common Stock to be outstanding immediately before this offering, as shown

above, is as of February 19, 2025. The number of shares of Common Stock to be outstanding

immediately after this offering, as shown above, is based on 31,111,032 shares of Common

Stock outstanding as of February 19, 2025. |

RISK

FACTORS

Investing in our securities involves a high

degree of risk. Before making a decision to invest in our common shares, you should carefully consider the following risks, as well as

the risks and other information contained in our Annual Report on Form 20-F, including our historical financial statements and related

notes included elsewhere in our Annual Report, and in our interim financial statements for the period ended September 30, 2023 contained

in our Report on Form 6-K filed on February 28, 2025, before you decide to purchase our securities. Any one of these risks and uncertainties

has the potential to cause material adverse effects on our business, prospects, financial condition and operating results which could

cause actual results to differ materially from any forward-looking statements expressed by us and a significant decrease in the value

of our securities. Refer to “Cautionary Note Regarding Forward-Looking Statements.” Also see sections of this prospectus entitled

“Where You Can Find More Information” and “Incorporation of Documents by Reference” for more information.

We

may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause. These potential

risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties

that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse

effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Risks

Related to this Offering

It

is not possible to predict the actual number of shares we will sell under the SEPA to the Selling Shareholder, or the actual gross proceeds

resulting from those sales.

On

February 3, 2025, we entered into the SEPA with the Selling Shareholder, pursuant to which the Selling Shareholder has committed

to purchase up to $100 million of shares of Common Shares, subject to certain limitations and conditions set forth in the SEPA. The

shares of Common Shares that may be issued under the SEPA may be sold by us to the Selling Shareholder at our discretion from time to

time for a period of up to 36 months following the execution of the SEPA, unless the SEPA is earlier terminated.

We

generally have the right to control the timing and amount of any sales of our Common Shares to the Selling Shareholder under the SEPA. Generally,

sales of our Common Shares, if any, to the Selling Shareholder under the SEPA will depend upon market conditions and other factors to

be determined by us. We may ultimately decide to sell to the Selling Shareholder all, some, or none of the shares of our Common Shares

that may be available for us to sell to the Selling Shareholder pursuant to the SEPA.

Because

the purchase price per share to be paid by the Selling Shareholder for the Common Shares that we may elect to sell to the Selling Shareholder

under the SEPA, if any, will fluctuate based on the market prices of our Common Shares prior to each advance made pursuant to the SEPA,

if any, it is not possible for us to predict, as of the date of this prospectus and prior to any such sales, the number of Common Shares

that we will sell to the Selling Shareholder under the SEPA, the purchase price per share that the Selling Shareholder will pay for shares

purchased from us under the SEPA, or the aggregate gross proceeds that we will receive from those purchases by the Selling Shareholder

under the SEPA, if any.

Investors

who buy shares at different times will likely pay different prices.

Pursuant

to the SEPA, we will generally have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold to the

Selling Shareholder. If and when we do elect to sell Common Shares to the Selling Shareholder pursuant to the SEPA, after the Selling

Shareholder has acquired such shares, the Selling Shareholder may resell all, some, or none of such shares at any time or from time to

time in its discretion and at different prices. As a result, investors who purchase shares from the Selling Shareholder in this offering

at different times will likely pay different prices for those shares, and so may experience different levels of dilution, and in some

cases substantial dilution, and different outcomes in their investment results. Investors may experience a decline in the value of the

shares they purchase from the Selling Shareholder in this offering as a result of future sales made by us to the Selling Shareholder

at prices lower than the prices such investors paid for their shares in this offering. In addition, if we sell a substantial number of

shares to the Selling Shareholder under the SEPA, or if investors expect that we will do so, the actual sales of shares or the mere existence

of our arrangement with the Selling Shareholder may make it more difficult for us to sell equity or equity-related securities in the

future at a time and at a price that we might otherwise wish to effect such sales.

Sales

of a substantial number of our securities in the public market by our existing shareholders could cause the price of our Common Shares

to fall.

The

Selling Shareholder can resell, under this prospectus, up to 49,962,532 Common Shares, consisting of (i) up to 48,543,690 shares

of Common Shares that we may elect to sell to the Selling Shareholder, from time to time from and after the Effective Date pursuant to

the SEPA, and (ii) 1,418,842 Common Shares (the “Commitment Shares”) consisting of (a) 567,537 Common Shares that have

been issued to the Selling Shareholder on February 3, 2025, and (b) 851,305 Common Shares to be issued to the Selling Shareholder upon

certain milestones, as consideration for its irrevocable commitment to purchase Common Shares at the Company’s direction from time

to time, upon the terms and subject to the conditions set forth in the SEPA. If all of the 49,962,532 shares offered for resale

by the Selling Shareholder under this prospectus were issued and outstanding as of February 19, 2025, such shares would represent

approximately 62.06% of the total number of Common Shares outstanding and approximately 76.06% of the total number of outstanding Common

Shares held by non-affiliates of our Company, in each case as of February 19, 2025.

Sales

of a substantial number of our Common Shares in the public market by the Selling Shareholder and/or by our other existing shareholders,

or the perception that those sales might occur, could depress the market price of our shares of Common Shares and could impair our ability

to raise capital through the sale of additional equity securities.

Our

management team will have broad discretion over the use of the net proceeds from our sale of Common Shares to the Selling Shareholder,

if any, and you may not agree with how we use the proceeds and the proceeds may not be invested successfully.

Our

management team will have broad discretion as to the use of the net proceeds from our sale of Common Shares to the Selling Shareholder,

if any, and we could use such proceeds for purposes other than those contemplated at the time of commencement of this offering. Accordingly,

you will be relying on the judgment of our management team with regard to the use of those net proceeds, and you will not have the opportunity,

as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that, pending their

use, we may invest those net proceeds in a way that does not yield a favorable, or any, return for us. The failure of our management

team to use such funds effectively could have a material adverse effect on our business, financial condition, operating results, and

cash flows.

It is not possible to predict the actual

number of Common Shares, if any, we will issue upon conversion of the Promissory Notes to the Selling Shareholder.

We do not have the right to control the timing

and amount of any conversions of principal under the Promissory Notes by the Selling Shareholder. The number of shares that we issue to

the Selling Shareholder pursuant to the Promissory Notes, if any, will depend upon market conditions and other factors to be determined

by the Selling Shareholder. The Selling Shareholder may ultimately decide to convert none or a portion of the principal amount of the

Promissory Notes.

The number of Common Shares ultimately offered for sale by the Selling

Shareholder is dependent upon the number of shares, if any, we ultimately issue upon conversion of the Promissory Notes. However, even

if the Selling Shareholder elects to convert the entire principal amount of the Promissory Notes, the Selling Shareholder may resell all,

some or none of such shares at any time or from time to time in its sole discretion and at different prices.

Risks

Related to Ownership of our Common Shares

We

may not be able to maintain the listing of our Common Shares on Nasdaq, which may adversely affect the ability of purchasers of Common

Shares in this offering to resell their securities in the secondary market.

On

February 11, 2025, we received a determination letter (the “Letter”) from the staff (the “Staff”) of The Nasdaq

Stock Market LLC (“Nasdaq”) notifying the Company that it was not in compliance with Nasdaq Listing Rule 5550(a)(2) which

requires listed companies to maintain a minimum bid price of $1.00 per share (the “Minimum Bid Price Requirement”). Normally,

a company would be afforded a 180-calendar day period to demonstrate compliance with the Minimum Bid Price Requirement. However, pursuant

to Listing Rule 5810(c)(3)(A)(iv) the Company is not eligible for any compliance period specified in Rule 5810(c)(3)(A) because the Company

has effected a reverse stock split over the prior one-year period or has effected one or more reverse stock splits over the prior two-year

period with a cumulative ratio of 250 shares or more to one. On February 23, 2024, the Company effected a 1 for 60 reverse stock split.

On February 12, 2025, the Company requested a hearing before the Nasdaq Hearings Panel (the “Panel”) to appeal the Letter

received on February 11, 2025. A hearing request will stay the suspension of trading of the Company’s common shares, and the Company’s

common shares will continue to trade on The Nasdaq Capital Market until the hearing process concludes and the Panel issues a written

decision. If the Company is unable to meet the continued listing criteria of Nasdaq and the common shares became delisted, trading of

the common shares could thereafter be conducted in the over-the-counter markets in the OTC Pink, also known as “pink sheets”

or, if available, on another OTC trading platform. Any such delisting could harm our ability to raise capital through alternative financing

sources on terms acceptable to us, or at all, and may result in the loss of confidence in our financial stability by suppliers, customers

and employees. Investors would likely find it more difficult to dispose of, or to obtain accurate market quotations for, the common shares,

as the liquidity that Nasdaq provides would no longer be available to investors. In addition, the failure of our common shares to continue

to be listed on the Nasdaq could adversely impact the market price for the common shares and our other securities, and we could face

a lengthy process to re-list the common shares, if we are able to re-list the common shares.

As a company incorporated in the British

Virgin Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly

from the NASDAQ Stock Market corporate governance listing standards; these practices may afford less protection to shareholders than they

would enjoy if we complied fully with the NASDAQ Stock Market corporate governance listing standards.

As an exempted British Virgin Islands company

to be listed on the NASDAQ Capital Market, we are subject to the NASDAQ Stock Market corporate governance listing standards. However,

the NASDAQ Stock Market rules permit a foreign private issuer like us to follow the corporate governance practices of its home country.

Certain corporate governance practices in the British Virgin Islands, which is our home country, may differ significantly from the NASDAQ

Stock Market corporate governance listing standards. For instance, we are not required to:

| ● | have a majority of independent directors on our board of

directors (although all of the members of the audit committee must be independent under the U.S. Securities Exchange Act of 1934, as

amended, or the Exchange Act); |

| ● | have a compensation committee or a nominating or corporate

governance committee consisting entirely of independent directors; |

| ● | have regularly scheduled executive sessions for non-management

directors; and |

| ● | have annual meetings and director elections. |

Currently, we do rely on home country practice

with respect to our corporate governance.

DESCRIPTION

OF THE STANDBY EQUITY PURCHASE AGREEMENT

On

February 3, 2025, we entered into the SEPA with the Selling Shareholder. Pursuant to the SEPA, the Selling Shareholder will advance to

the Company, subject to the satisfaction of certain conditions as set forth therein, the principal amount of $6 million, which will

be evidenced by Promissory Notes in two tranches. The Promissory Notes will accrue interest on the outstanding principal balance at an

annual rate equal to 0%, which shall increase to an annual rate of 18% upon the occurrence of an Event of Default (as defined in the

Promissory Notes) for so long as such event remains uncured. The Promissory Notes will mature on March 1, 2026, which may be extended

at the option of the Selling Shareholder. The Promissory Notes are convertible at a conversion price equal to the lower of (i) $0.7048

per share or (ii) 93% of the lowest daily VWAP (as defined below) during the five consecutive trading days immediately preceding

the date of conversion (the “Conversion Price”), which price shall not be lower than the floor price of $0.1236 (the “Floor

Price”).

The

first tranche of the Pre-Paid Advance was disbursed on February 3, 2025, in the principal amount of $5 million. The second tranche

of the Pre-Paid Advance will be in the principal amount of $1 million and advanced on the second trading day after the registration

statement of which this prospectus forms a part becomes effective. At each Pre-Advance Closing, the Selling Shareholder advanced, and

is expected to advance, to the Company the principal amount of the applicable tranche of the Pre-Paid Advance, less a discount in the

amount equal to 5% of the principal amount of such tranche of the Pre-Paid Advance netted from the purchase price due and structured

as an original issue discount.

Pursuant

to the SEPA, and upon the satisfaction of the conditions to the Selling Shareholder’s purchase obligation set forth in the SEPA,

including the registration of shares of Common Shares issuable pursuant to the SEPA for resale, we will have the right, from time to

time, until March 1, 2028, to require the Selling Shareholder to purchase up to $100 million of shares of our Common Shares,

subject to certain limitations and conditions set forth in the SEPA, by delivering Advance Notices to the Selling Shareholder.

If

there is no balance outstanding under a Promissory Note, we may, in our sole discretion, select the amount of the advance that we desire

to issue and sell to the Selling Shareholder in each Advance Notice, subject to a maximum limit equal to 100% of the average of the daily

volume traded of the Company’s Common Shares on Nasdaq during the five consecutive trading days immediately preceding an Advance

Notice (“Maximum Advance Amount”). If there is a balance outstanding under a Promissory Note, we may only submit an Advance

Notice (i) if an Amortization Event (as defined below) has occurred and our obligation to make prepayments under the Promissory

Notes has not ceased, and (ii) the aggregate purchase price owed to us from such Advances (“Advance Proceeds”) will

be paid by the Selling Shareholder by offsetting the amount of the Advance Proceeds against an equal amount outstanding under the Promissory

Notes.

Pursuant

to an Advance Notice, the shares will be issued and sold to the Selling Shareholder at a per share price equal to, at the election of

the Company as specified in the relevant Advance Notice: (i) 94.0% of the VWAP of the common shares during the applicable trading

day on which the Advance Notice is delivered, or (ii) 97.0% of the lowest daily VWAP of the common shares during the three consecutive

trading days commencing on the date the Advance Notice is delivered.

“Market

Price” is defined as Option 1 Market Price or Option 2 Market Price, as applicable. Option 1 Market Price means, the daily

volume weighted average price of the Common Shares on Nasdaq as reported by Bloomberg L.P. (“VWAP”) during the Option 1

Pricing Period. The Option 1 Pricing Period means the period on the date the Advance Notice is delivered (“Advance Notice

Date”) with respect to an Advance Notice selecting an Option 1 Pricing Period commencing (i) if submitted to Yorkville prior

to 9:00 a.m. Eastern Time on a trading day, the open of trading on such day or (ii) if submitted to Yorkville after 9:00 a.m.

Eastern Time on a trading day, upon receipt by the Company of written confirmation of acceptance of such Advance Notice by the

Yorkville (or the open of regular trading hours, if later), and which confirmation shall specify such commencement time, and, in

either case, ending on 4:00 p.m. New York City time on the applicable Advance Notice Date, or such other time as may be agreed by

the Company and Yorkville. Option 2 Market Price means the lowest daily VWAP of the Common Shares during the three consecutive

trading days commencing on the Advance Notice Date (“Option 2 Pricing Period”). If, with respect to an Option 1 Pricing

Period, the total number of Common Shares traded on Nasdaq during the applicable Pricing Period is less than the Volume Threshold

(as defined below), then the number of Common Shares issued and sold pursuant to such Advance Notice will be reduced to the greater

of (a) 30% of the trading volume of the Common Shares on Nasdaq during the relevant Pricing Period as reported by Bloomberg

L.P. or (b) the number of Common Shares sold by the Selling Shareholder during such Pricing Period, but in each case not to

exceed the amount requested in the Advance Notice. “Volume Threshold” is defined as a number of Common Shares equal to

the quotient of (a) the number of Advance Shares requested by the Company in an Advance Notice divided by (b) 0.30.

“Amortization Event” means (i) the daily VWAP is less than the Floor Price then in effect for five Trading Days during a

period of seven consecutive Trading Days (a “Floor Price Event”), or (ii) the Company is in material breach of the

Registration Rights Agreement, and such breach remains uncured for a period of 10 consecutive Trading Days, or the occurrence of an

Event as defined in the Registration Rights Agreement.

For

so long as there is a balance outstanding under a Promissory Note, the Selling Shareholder, at its sole discretion, may deliver to us

a notice (“Investor Notice”), to cause an Advance Notice to be deemed delivered to the Selling Shareholder and the issuance

of our Common Shares to the Selling Shareholder pursuant to an Advance. The Selling Shareholder may select the amount of the Advance

pursuant to an Investor Notice which shall not exceed the limitations set forth in the SEPA, provided that the amount of the Advance

selected shall not exceed the balance owed under all Promissory Notes outstanding on the date of delivery of the Investor Notice. The

shares will be issued and sold to the Selling Shareholder pursuant to an Investor Notice at a per share price equal to the Conversion

Price that would be applicable to the amount of the Advance selected by the Selling Shareholder if such amount were to be converted as

of the date of delivery of the Investor Notice. The Selling Shareholder will pay the purchase price for such shares to be issued pursuant

to the Investor Notice by offsetting the amount of the purchase price to be paid by the Selling Shareholder against an amount outstanding

under the Promissory Notes.

We

paid the Selling Shareholder a structuring fee of $25,000 and agreed to pay the Selling Shareholder a commitment fee in an amount equal

to 1.00% of the Commitment Amount (the “Commitment Fee”) of which by the issuance to the Selling Shareholder of such number

of common shares that is equal to the Commitment Fee divided by the Fixed Price (the “Commitment Shares”). The Commitment

Shares are due as follows: (i) 40% was due on the Effective Date, (ii) 30% shall be due on the date that is 90 days following the Effective

Date and (iii) 30% shall be due on the date this is 180 days following the Effective Date.

Actual

sales of Common Shares to the Selling Shareholder under the SEPA will depend on a variety of factors, which may include, among other

things, market conditions, the trading price of our Common Shares and determinations by us as to the appropriate sources of funding for

our business and operations.

In

addition, we may not issue or sell any shares of Common Shares to the Selling Shareholder under the SEPA or under the Promissory Notes,

which, when aggregated with all other shares of Common Shares then beneficially owned by the Selling Shareholder and its affiliates (as

calculated pursuant to Section 13(d) of the Exchange Act of 1934, as amended (the “Exchange Act”)

and Rule 13d-3 promulgated thereunder), would result in the Selling Shareholder and its affiliates beneficially owning more than

4.99% of the then-outstanding shares of Common Shares (the “Beneficial Ownership Limitation”). However, the Beneficial Ownership

Limitation does not prevent the Selling Shareholder from selling some or all of the shares of Common Shares it acquires and then acquiring

additional shares, consequently resulting in the Selling Shareholder being able to sell in excess of the 4.99% Beneficial Ownership Limitation

despite not holding more than 4.99% of our outstanding shares of Common Shares at any given time.

The

net proceeds to us under the SEPA (other than the two tranches of the $6 million Pre-Paid Advance) will depend on the frequency

and prices at which we sell shares of Common Shares to the Selling Shareholder. We expect that any proceeds received by us from such

sales to the Selling Shareholder will be used for working capital.

The

Selling Shareholder has agreed that, except as otherwise expressly provided in the SEPA, it and its affiliates will not engage in any

short sales of the Common Shares during the term of the SEPA.

The

SEPA will automatically terminate on the earliest to occur of (i) the 36-month anniversary

of the date of the SEPA or (ii) the date on which the Selling Shareholder shall have made payment of Advances pursuant to the SEPA for

common shares equal to the Commitment Amount. We have the right to terminate the SEPA upon five trading days’ prior written

notice to the Selling Shareholder, provided that there are no outstanding Advance Notices under which we are yet to issue shares of Common

Shares and provided that we have paid all amounts owed to the Selling Shareholder pursuant to the SEPA and the Promissory Notes. We and

the Selling Shareholder may also agree to terminate the SEPA by mutual written consent.

Neither

the Company nor the Selling Shareholder may assign or transfer their respective rights and obligations under the SEPA without the prior

written consent of the other party. No provision of the SEPA may be modified or waived other than by an instrument in writing signed

by both parties.

The

SEPA contains customary representations, warranties, conditions, and indemnification obligations of the parties. The representations,

warranties, and covenants contained in the SEPA were made only for purposes of such agreement and as of specific dates, were solely for

the benefit of the parties to such agreement and may be subject to limitations agreed upon by the contracting parties.

The

description of the SEPA does not purport to be complete and is qualified in its entirety by reference to the full text of the SEPA, a

copy of which is filed as an exhibit to the registration statement of which this prospectus forms a part and is incorporated herein by

reference.

Because

the purchase price per share to be paid by the Selling Shareholder for the shares of Common Shares that we may elect to sell to the Selling

Shareholder under the SEPA, if any, will fluctuate based on the market prices of our Common Shares during the applicable Pricing Period,

as of the date of this prospectus we cannot reliably predict the number of shares of Common Shares that we will sell to the Selling Shareholder

under the SEPA, the actual purchase price per share to be paid by the Selling Shareholder for those shares, or the actual gross proceeds

to be raised by us from those sales, if any. As of February 19, 2025, there were 31,111,032 shares of Common Shares outstanding,

of which 15,728,121 shares were held by non-affiliates. If all of the 49,962,532 shares offered for resale by the Selling Shareholder

under the registration statement of which this prospectus forms a part were issued and outstanding as of February 19, 2025, such shares

would represent approximately 62.06% of the total number of shares of our Common Shares outstanding and approximately 76.06% of the total

number of outstanding shares of Common Shares held by non-affiliates.

Although

the SEPA provides that we may, in our discretion, from time to time after the date of this prospectus and during the term of the SEPA,

direct the Selling Shareholder to purchase shares of our Common Shares from us in one or more advances under the SEPA, for a maximum

aggregate purchase price of up to $100 million, only 49,962,532 shares of Common Shares are being registered for resale under

the registration statement of which this prospectus forms a part. While the market price of our Common Shares may fluctuate from time

to time after the date of this prospectus and, as a result, the actual purchase price to be paid by the Selling Shareholder under the

SEPA for shares of our Common Shares, if any, may also fluctuate, in order for us to receive the full amount of the Selling Shareholder’s

commitment under the SEPA, it is possible that we may need to issue and sell more than the number of shares being registered for resale

under the registration statement of which this prospectus forms a part.

If

it becomes necessary for us to issue and sell to the Selling Shareholder more shares than are being registered for resale under this

prospectus in order to receive aggregate gross proceeds equal to $100 million under the SEPA, we must file with the SEC one or more

additional registration statements to register under the Securities Act the resale by the Selling Shareholder of any such additional

shares of Common Shares, which the SEC must declare effective, in each case, before we may elect to sell any additional shares of our

Common Shares to the Selling Shareholder under the SEPA. The number of shares of our Common Shares ultimately offered for resale

by the Selling Shareholder depends upon the number of shares of Common Shares, if any, we ultimately sell to the Selling Shareholder

under the SEPA.

USE

OF PROCEEDS

All

of the shares of our Common Shares offered by the Selling Shareholder pursuant to this prospectus will be sold by the Selling Shareholder

for its own respective account. We will not receive any of the direct proceeds from these sales. However, we expect to receive proceeds

under the SEPA from sales of Common Shares that we may elect to make to the Selling Shareholder pursuant to the SEPA, if any, from time

to time in our discretion. See the section of this prospectus titled “Plan of Distribution” elsewhere in this prospectus

for more information.

We

currently expect to use any net proceeds we receive under the SEPA primarily for working capital. As of the date of this prospectus,

we cannot specify with certainty all of the particular uses, and the respective amounts we may allocate to those uses, for any net proceeds

we receive. Accordingly, we will retain broad discretion over the use of these proceeds and could utilize the proceeds in ways that do

not necessarily improve our results of operations or enhance the value of our securities.

SELLING

SHAREHOLDER

This

prospectus relates to the possible resale from time to time by the Selling Shareholder of up to 49,962,532 Common Shares that have

been and may be issued by us to the Selling Shareholder under the SEPA. For additional information regarding the shares of Common

Shares included in this prospectus, see the section titled “The Standby Equity Purchase Agreement” above. We are registering

the shares of Common Shares included in this prospectus pursuant to the provisions of the SEPA we entered into with the Selling Shareholder,

in order to permit the Selling Shareholder to offer the shares included in this prospectus for resale from time to time. Except for the

transactions contemplated by the SEPA, and as set forth in the section titled “Plan of Distribution” in this prospectus,

the Selling Shareholder has not had any material relationship with us within the past three years.

The

table below presents information regarding the Selling Shareholder and the shares of Common Shares that may be resold by the Selling

Shareholder from time to time under this prospectus. This table is prepared based on information supplied to us by the Selling Shareholder

and reflects holdings as of February 19, 2025. The number of shares in the column “Maximum Number of Shares of Common Shares

to be Offered” represents all of the Common Shares being offered for resale by the Selling Shareholder under this prospectus. The

Selling Shareholder may sell some, all, or none of the shares being offered for resale in this offering. We do not know how long the

Selling Shareholder will hold the shares before selling them, and we are not aware of any existing arrangements between the Selling Shareholder

and any other stockholder, broker, dealer, underwriter, or agent relating to the sale or distribution of the shares of our Common Shares

being offered for resale by this prospectus.

The

table below lists the Selling Shareholder and other information regarding the beneficial ownership (as determined under Section 13(d)

of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder) of the common shares held by the Selling

Shareholder. The second column lists the number of Common Shares beneficially owned by the Selling Shareholder, based on the Selling

Shareholder’s ownership of Common Shares and Notes as of February 19, 2025, assuming conversion of the Notes held by such

Selling Shareholder on that date but taking account of any limitations on conversion and exercise set forth therein. Because the purchase

price to be paid by the Selling Shareholder for Common Shares, if any, that we may elect to sell to the Selling Shareholder in one or

more advances from time to time under the SEPA will fluctuate based on the market prices of our Common Shares during the applicable Pricing

Period, the actual number of shares of Common Shares that we may sell to the Selling Shareholder under the SEPA may be fewer than the

number of shares being offered for resale under this prospectus. The fourth column assumes the resale by the Selling Shareholder of all

of the Common Shares being offered for resale pursuant to this prospectus.

Under

the terms of the Promissory Notes, the Selling Shareholder may not convert the Promissory Notes to the extent (but only to the extent)

such Selling Shareholder or any of its affiliates would beneficially own a number of our Common Shares which would exceed 4.99% of our

outstanding shares (the “Maximum Percentage”). The number of shares in the second column reflects these limitations. The

Selling Shareholder may sell all, some or none of its shares in this offering. See “Plan of Distribution.”

| | |

Number

of Common

Shares Owned Prior to

Offering(3) |

| |

Maximum

Number

of Common Shares

to be Sold Pursuant | | |

Number

of Common

Shares of Owned

After Offering(5) | |

| Name

of Selling Shareholder | |

Number | |

Percent |

| |

to

this Prospectus(4) | | |

Number | | |

Percent | |

| YA II PN, LTD.(1) | |

1,552,441 | (2) |

| 4.99 |

% | |

| 49,962,532 | | |

| 0 | | |

| 0 | % |

| (1) | Investment

decisions for the Selling Shareholder are made by Mr. Mark Angelo. The business address

of the Selling Shareholder is 1012 Springfield Avenue, Mountainside, NJ 07092. |

| (2) | Represents

the 567,537 shares of Common Shares we issued to the Selling Shareholder on February 3,

2025, as Commitment Shares in partial consideration for entering into the SEPA with us and

984,904 shares of our Common Stock issuable upon conversion of the first Promissory Note

issued to the Selling Securityholder as of February 3, 2025. Shares reported herein do not

include 39,468,170 shares of common stock issuable upon the conversion of the Promissory

Notes because the Selling Securityholder is prohibited from acquiring shares of our Common

Stock pursuant to the SEPA or upon conversion of the Promissory Notes to the extent such

shares, when aggregated with all other shares of our Common Stock then beneficially owned

by the Selling Securityholder, would cause the Selling Securityholder’s beneficial

ownership of our Common Stock to exceed the 4.99% of our outstanding shares. |

| (3) | Applicable

percentage ownership is based on 31,111,032 shares of our common shares outstanding as of

February 19, 2025. |

| (4) | Assumes

the sale of all shares being offered pursuant to this prospectus. |

| (5) | Represents

the amount of shares that will be held by the selling shareholder after completion of this

offering based on the assumptions that (a) all Commitment Shares and common shares underlying

Note registered for sale by the registration statement of which this prospectus is part of

will be sold, and (b) no other common shares are acquired or sold by the selling shareholder

prior to completion of this offering. However, the selling shareholder is not obligated to

sell all or any portion of the shares of our common shares offered pursuant to this prospectus.

Applicable percentage ownership is based on 80,506,027 shares of our common shares outstanding

after this offering. |

PLAN

OF DISTRIBUTION

The

Common Shares offered by this prospectus are being offered by the Selling Shareholder. The Selling Shareholder may sell all or a portion

of the common shares held by it and offered hereby from time to time directly or through one or more underwriters, broker-dealers or

agents. If the common shares are sold through underwriters or broker-dealers, the Selling Shareholder will be responsible for underwriting

discounts or commissions or agent’s commissions. The common shares may be sold in one or more transactions at fixed prices, at

prevailing market prices at the time of the sale, at varying prices determined at the time of sale or at negotiated prices. These sales

may be effected in transactions, which may involve crosses or block transactions, pursuant to one or more of the following methods:

| ● | on

any national securities exchange or quotation service on which the securities may be listed

or quoted at the time of sale; |

| | | |

| ● | in

the over-the-counter market; |

| | | |

| ● | in

transactions otherwise than on these exchanges or systems or in the over-the-counter market; |

| | | |

| ● | through

the writing or settlement of options, whether such options are listed on an options exchange

or otherwise; |

| | | |

| ● | ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| | | |

| ● | block

trades in which the broker-dealer will attempt to sell the shares as agent but may position

and resell a portion of the block as principal to facilitate the transaction; |

| | | |

| ● | purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| | | |

| ● | an

exchange distribution in accordance with the rules of the applicable exchange; |

| | | |

| ● | privately

negotiated transactions; |

| | | |

| ● | short

sales made after the date the Registration Statement is declared effective by the SEC; |

| | | |

| ● | broker-dealers

may agree with a selling security holder to sell a specified number of such shares at a stipulated

price per share; |

| | | |

| ● | a

combination of any such methods of sale; and |

| | | |

| ● | any

other method permitted pursuant to applicable law. |

The

Selling Shareholder may also sell common shares under Rule 144 promulgated under the Securities Act of 1933, as amended, if available,

rather than under this prospectus. In addition, the Selling Shareholder may transfer the common shares by other means not described in

this prospectus. If the Selling Shareholder effect such transactions by selling common shares to or through underwriters, broker-dealers

or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from

the selling shareholder or commissions from purchasers of the common shares for whom they may act as agent or to whom they may sell as

principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those

customary in the types of transactions involved). In connection with sales of the common shares or otherwise, the Selling Shareholder

may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the common shares in the course of

hedging in positions they assume. The Selling Shareholder may also sell common shares short and deliver common shares covered by this

prospectus to close out short positions and to return borrowed shares in connection with such short sales. The Selling Shareholder may

also loan or pledge common shares to broker-dealers that in turn may sell such shares.

The

Selling Shareholder may pledge or grant a security interest in some or all of the Notes, Warrants or common shares owned by them and,

if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the common shares

from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision

of the Securities Act amending, if necessary, the list of selling shareholder to include the pledgee, transferee or other successors

in interest as selling shareholder under this prospectus. The Selling Shareholder also may transfer and donate the common shares in other

circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for

purposes of this prospectus.

To

the extent required by the Securities Act and the rules and regulations thereunder, the Selling Shareholder and any broker-dealer participating

in the distribution of the common shares may be deemed to be “underwriters” within the meaning of the Securities Act, and

any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions

or discounts under the Securities Act. At the time a particular offering of the common shares is made, a prospectus supplement, if required,

will be distributed, which will set forth the aggregate amount of common shares being offered and the terms of the offering, including

the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the Selling

Shareholder and any discounts, commissions or concessions allowed or re-allowed or paid to broker-dealers.

Under

the securities laws of some states, the common shares may be sold in such states only through registered or licensed brokers or dealers.

In addition, in some states the common shares may not be sold unless such shares have been registered or qualified for sale in such state

or an exemption from registration or qualification is available and is complied with.

If

the Selling Shareholder utilizes a broker-dealer in the sale of the shares of Common Shares being offered by this prospectus, such broker-dealer

may receive commissions in the form of discounts, concessions or commissions from the Selling Shareholder, or commissions from purchasers

of the shares of Common Shares for whom they may act as agent or to whom they may sell as principal.

There

can be no assurance that any selling shareholder will sell any or all of the common shares registered pursuant to the registration statement,

of which this prospectus forms a part.

In

relation to Advance Notice under the SEPA, the Selling Shareholder is an underwriter within the meaning of the Securities Act of

1933, as amended (“Securities Act”) and any broker-dealers or agents that are involved in selling the shares may be

deemed to be “underwriters” within the meaning of the Securities Act of 1933 in connection with such sales. Any

commissions received by such broker-dealers or agents, and any profit on the resale of the shares purchased by them, may be deemed

to be underwriting commissions or discounts under the Securities Act of 1933. The Selling Shareholder has informed us that it does

not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute our common shares.