false

0001507605

0001507605

2024-11-12

2024-11-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 12, 2024

MARA

HOLDINGS, INC.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-36555 |

|

01-0949984 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

101

NE Third Avenue, Suite 1200

Fort

Lauderdale, FL 33301

(Address

of principal executive offices and zip code)

(800)

804-1690

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

MARA |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

November 12, 2024, MARA Holdings, Inc. issued a shareholder letter announcing its financial results for the fiscal quarter ended September

30, 2024. A copy of the shareholder letter is furnished hereto as Exhibit 99.1.

The

information contained in this Item 2.02, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference

in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference

in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MARA

HOLDINGS, INC. |

| |

|

|

| Date:

November 12, 2024 |

By: |

/s/

Zabi Nowaid |

| |

Name: |

Zabi

Nowaid |

| |

Title: |

General

Counsel and Corporate Secretary |

Exhibit

99.1

|

|

| |

IR.MARA.COM |

Q3

2024

Shareholder

Letter

| SHAREHOLDER LETTER Q3 2024 | 3 |

To

Our Shareholders

As

MARA Holdings, Inc. (“MARA” or the “Company”) continues to grow and evolve, we have chosen to move away from

issuing a standard quarterly earnings press release. We will now be issuing a shareholder letter as a better way to communicate our business

and strategy.

In

Q3 2024, we celebrated several key achievements towards establishing MARA as a leader in energy transformation. We leverage energy-efficient

high-performance compute to process Bitcoin network transactions, with the end goal of accumulating bitcoin.

Since

our Q2 2024 earnings report we:

| – | Added

372 megawatts (“MW”) of mining capacity in Ohio with an acquisition of a 222

MW site at $270,000 per MW, in addition to securing greenfield site development of 150 MW

(subsequent to quarter end). |

| – | Grew

our energized hash rate in October to 40.2 exahashes per second (“EH/s”), a 9%

increase over September. |

| – | At

quarter end, held 26,747 bitcoin (“BTC”) on our balance sheet. During the quarter,

we mined 2,070 BTC and purchased 6,210 BTC, of which 4,144 were acquired using proceeds from

a $300 million offering of convertible senior notes at an average price of $59,500 per BTC.

As of the end of Q3 2024, we had an improvement in BTC per share yield of 29%. We did not

sell any BTC. |

| – | At

quarter end, our holdings included 20,266 BTC mined at an average cost of $42,805 per BTC

and 6,481 BTC purchased at an average cost of $60,022 per BTC. |

| – | At

end of September, we increased our energized hash rate to an all-time high of 36.9 exahash,

deploying 18,000 new miners with an energy efficiency of 17 joules per terahash (“J/TH”). |

| – | Launched

a 25 MW micro data center operation across wellheads in Texas and North Dakota to transform

excess flared gas into electricity for use at co-located data centers, as part of our strategy

to own and operate near-zero-cost energy generation. |

| – | Secured

our first external orders for our two-phase immersion cooling (“2PIC”) tanks

and began deploying 2PIC in our own infrastructure. |

| – | Became

the first publicly traded digital asset mining company to submit a climate-related disclosure

report to the Climate Disclosure Project (CDP). |

| – | Welcomed

two new board members with deep expertise in artificial intelligence (“AI”),

data centers, and energy, and proven track records in driving innovation and growth across

complex industries. |

| – | Were

recognized by the World Energy Council as a finalist for Energy Technology of the Year, alongside

Aize and Chevron. |

| – | As

a co-founder of the Bitcoin Voter project, played a significant role in advocating for pro-crypto

candidates. Crypto PACs raised over $130 million into the election cycle and successfully

helped to elect 253 pro-crypto candidates to the House of Representatives and 16 to the Senate. |

| SHAREHOLDER LETTER Q3 2024 | 4 |

These

accomplishments demonstrate our dedication to innovation, sustainable growth and our long-term vision of transforming energy into value

using BTC mining and compute as ways to monetize underutilized energy. As an industry leader, MARA addresses the demands of high-performance

computing (“HPC”) and mining while actively contributing to a sustainable, energy-efficient future.

Our

team overcame the operational challenges faced earlier in the year, achieving significant progress this quarter with site upgrades and

renovations. This period was highlighted by infrastructure improvements, expanded hash rate capacity, and a focus on maximizing efficiency

across our portfolio of mining sites.

MARA’s

growing pipeline of over 2 gigawatts (“GW”) of domestic and international opportunities reinforces our ability to grow at

scale with a focus on near-zero-cost energy. We are focused on sourcing sustainable energy—such as solar, wind, and other renewables—with

the goal of ensuring our mining operations remain economically efficient and environmentally responsible. Through strategic partnerships

across the Middle East and Africa, we are actively exploring new sites to diversify geographically, maximize access to zero-cost energy,

and accelerate capacity expansion. By leveraging these opportunities, we believe we are poised to solidify our market leadership and

deliver sustained value to our stakeholders.

Why

the focus on zero-cost energy?

Throughout

this letter, we emphasize zero-cost energy—and for good reason. Energy costs are rising, with some competitors already facing rates

over $0.04 per kilowatt-hour and climbing. For MARA, achieving near-zero-cost energy is essential, as it would alleviate pressures from

the global hash rate, enabling us to extend equipment life well beyond industry standards while experiencing less share dilution and

yielding stronger returns. By converting flared gas into electricity, we generate all the energy we need at near-zero-cost and do not

need additional power.

| SHAREHOLDER LETTER Q3 2024 | 5 |

Utility-Scale

Mining

We

are focused on expanding our portfolio of owned and operated sites through a growing pipeline of near- and mid-term projects.

This

approach includes targeted M&A as well as partnerships with leading data center developers. By prioritizing sites with access to

near-zero-cost energy, we aim to scale site development, optimize operational control, and increase capacity.

Domestic

Operations

At

our domestic operations, we made substantial progress in overcoming the infrastructure challenges we faced earlier this year, specifically

at our Ellendale, North Dakota site, and focused our efforts during the quarter on implementing significant upgrades, renovations and

expansion across our mining portfolio.

| Facility | |

Power Utilization | | |

Nameplate Capacity (MW) | | |

Efficiency (J/TH) | |

| King Mountain, TX | |

| 94 | % | |

| 200 | | |

| 27.5 | |

| Garden City, TX | |

| 94 | % | |

| 126 | | |

| 22.4 | |

| Kearney, NE | |

| 94 | % | |

| 92 | | |

| 16.4 | |

| Hopedale, OH | |

| 91 | % | |

| 22 | | |

| 28.6 | |

| Murray, KY | |

| 90 | % | |

| 12 | | |

| 18 | |

| Ellendale, ND | |

| 87 | % | |

| 180 | | |

| 19.7 | |

| Jamestown, ND | |

| 80 | % | |

| 70 | | |

| 25.8 | |

| Wolf Hollow, TX | |

| 53 | % | |

| 290 | | |

| 18.8 | |

During

the third quarter, our BTC production was impacted by increased global hash rate and resultant network difficulty. However, prior quarter

operational issues at third-party sites were fully remediated early in the third quarter. We grew our operational fleet by over 7% compared

to the second quarter to approximately 268,000 miners and reached an overall operational hash rate of 36.9 EH/s. Our current fleet efficiency

stands at 22.7 J/TH, and we expect this will improve through the fourth quarter and end the year at roughly 19.5 J/TH as we deploy additional

S21 Pros and immersion cooling.

At

our Garden City, Texas site, we steadily increased our hash rate, installed new miners, completed hardware repairs, and replaced power

distribution units. We started upgrading/replacing older S19 models with 27,000 S21 Pros, with the transition scheduled for completion

by mid-December. In Kearney, Nebraska, hash rate improved to over 5.0 exahash thanks to container upgrades and the installation of over

3,000 S21 Pro units. The site now operates exclusively with MARA miners with all deployment tasks completed by MARA’s skilled technicians.

In

Granbury, Texas, our team made significant progress upgrading the electrical infrastructure, and improving and extending the sound wall,

helping to maintain the reduced sound levels we achieved as we started energizing the immersion containers in Q3. We continue to upgrade

the site with the ongoing installation of single-phase immersion containers, which we expect will make up approximately 70% of the infrastructure

by year end, thereby improving our power utilization.

At

our third-party hosted sites, we are adding approximately 2.0 EH/s of hash rate in Ellendale as we replace 33,000 S19 XPs with S21 Pros.

We expect to complete the transition by the end of November.

MARA’s

Granbury, TX facility at Wolf Hollow Gas Plant: Powered by local generation, 50% of the site is expected to be converted to immersion

cooling by year end

MARA’s

Garden City, TX facility: 100 MW powered, 5.4 EH/s from 40,800 miners, adjacent to a wind farm, with potential to expand to 200 MW

| SHAREHOLDER LETTER Q3 2024 | 6 |

Adding

Capacity in Ohio

Yesterday,

we announced the acquisition of two operational data centers in Hannibal and Hopedale, Ohio, with 222 megawatts of interconnect-approved

capacity. These sites have 122 megawatts of capacity and interconnection approval to expand by another 100 megawatts. Simultaneously,

we have begun developing a 150-megawatt operation in Findlay, Ohio, which already has 30 megawatts of capacity. These three facilities

have a combined interconnect-approved capacity of 372 megawatts, which we intend to fully energize by the end of 2025. Compute for these

sites is purchased, secured, and ready for deployment, and we believe they will accelerate the achievement of our 2024 target of 50 EH/s.

These

data centers will increase our total owned and operated compute capacity by over 70 percent. Owning the sites will provide us with

greater operational control and could further reduce our operating costs at the Hopedale data center—previously hosted by the former

owner—by up to 50 percent. Much of the future capacity is alongside operating generation, providing opportunities for cost reduction,

power redundancy, and development optionality.

Our

goal is to convert the vast majority of our portfolio to owned and operated sites, resulting in significant cost savings as we transition

the remaining third-party hosted sites.

International

Operations

Finally,

we are proud to be one of the most globally diversified public miners in the industry with 15 data centers located on four continents.

Our international team is actively developing relationships with energy partners and sovereigns in the Middle East and Africa, and we

will update our progress as projects become concrete. As we have previously indicated, we aim to have 50% of our business come from outside

the United States by 2028. Our Abu Dhabi liquid immersion site already stands out as a crown jewel in our portfolio, operating at almost

100% uptime in the harsh desert and humid environment.

| SHAREHOLDER LETTER Q3 2024 | 7 |

Owned

and Operated Power Generation

Our

owned and operated power generation business, formerly known as energy harvesting, is focused on disintermediating pipelines and power

lines by bringing our operations directly to the energy source rather than the other way around. Over time, we expect this will provide

some of the lowest cost of production capacity to the MARA portfolio, helping to improve operating margins, lower our weighted average

cost of capital, and increase the average duration of our capacity. We believe this platform will provide MARA with a significant

competitive advantage as it gives us the ability to develop substantial off-grid capacity.

In

October, we announced a partnership with NGON, a privately held methane neutralization company, to launch a 25 MW micro data center operation

across wellheads in Texas and North Dakota. We will use excess natural gas from oilfield production to power data centers, transforming

what would otherwise be “waste” flared gas into valuable energy. This project aims not only to reduce methane emissions

significantly, achieving up to 99% mitigation efficiency, but also to help us achieve our strategic initiative to drive energy costs

to as close to zero as possible.

Our

team has identified a substantial number of sites with strong potential for developing onsite power generation, which would enable us

to expand our sustainable energy initiatives and enhance operational efficiency. These sites are strategically located to capitalize

on untapped resources, which can be converted into a reliable power source for data center operations. By developing these locations,

we will not only diversify our energy sources but also take significant steps toward energy independence, lower operational costs, and

increasing the useful life of our miners.

MARA’s

and NGON’s operations in Hearne, Texas

The

Onsite Power vertical intends to add substantial capacity over the next few years as the Company grows into the next BTC halving. We

believe MARA’s ability to pair onsite demand to onsite power (fueled by low-cost natural gas) will unlock hundreds of MW—if

not more than a GW—of low-cost and long-duration gas-to-power opportunities.

| SHAREHOLDER LETTER Q3 2024 | 8 |

Technology

The

MARA Tech team is busy and growing.

With

a legacy of successful utility-scale mining, we are leveraging our expertise in compute optimization and densification to innovate

at the forefront of cooling technology. Operating at approximately 1.1 GW of mining capacity—of which 25% is single-phase

liquid immersion cooling—MARA applies its large-scale insights to continuously refine and advance cooling solutions. Our work

in immersion cooling has led us to develop 2PIC technology, optimized for density, cooling efficiency, and heat capture and reuse.

This will be the flagship of a growing portfolio of liquid cooling solutions that reflects our commitment to energy-efficient

technology.

Our

cooling systems not only drive industry-leading power use efficiency, but also support heat reuse applications and feature no water usage,

advancing MARA’s commitment to reducing waste and promoting sustainability across mining and compute environments.

2PIC

MARA

has begun deploying 2PIC technology, with 40 tanks scheduled for Q4 delivery to enhance the density and efficiency of our own mining

operations, as well as those of our go-to-market partners and customers. Key locations for these deployments include our new Ohio

sites and the MARA Dallas Customer Experience Center, which will showcase our capabilities for potential clients. We also have secured

our first commercial orders, which marks a major milestone for MARA Tech.

This

rollout not only demonstrates our dedication to compute densification as we transition our 1.1 GW mining estate to advanced cooling solutions,

but also underscores our distinctive approach to technology development. Our innovation cycle is grounded in practical experience, enabling

us to build, test, and learn from our own solutions—a cycle that continuously drives new advancements. The 2PIC tanks are the first

product of this iterative process, setting the stage for future minimal waste focused cooling solutions developed and built by MARA.

As

market demand grows for sustainable, high-performance technologies across mining and compute, we believe MARA’s distinctive approach

to development positions us as an industry leader in the evolution of cooling solutions.

MARA

2PIC (two-phase immersion cooling) technology: Superior cooling, built for demanding conditions, with significant space and cost savings

for data center operators

MARA

Pool

Owning

our own mining pool has a number of inherent benefits, including greater control over our mining operations, better operational efficiency,

higher rewards and no fees. It also allows us to continually adjust the pool’s policies and technical settings in order to maximize

profitability and streamline mining processes.

However,

there still remains an inherent “luck” factor in mining, which refers to the difference between expected and actual blocks

won. In our view, luck is noise and noticed by investors more when it is bad. While we had some stretches of bad luck over the past quarter,

when analyzed over a longer period of time, the MARA Pool luck factor has been more than 10% over the mean.

We

evaluate owning our own mining pool from a longer-term perspective rather than focusing on the day-to-day volatility. The alternative

is to transition to an FPPS pool, which has no luck factor but nets less because of fees.

| SHAREHOLDER LETTER Q3 2024 | 9 |

Additional

Updates

New

Board Members

As

we continue to evolve as a leading technology-enabled BTC miner on a global scale, and advance our AI and hyperscaler strategy, we recognized

the importance of adding further expertise to our Board of Directors.

We

were excited to welcome Janet George and Barbara Humpton to the MARA Board of Directors in September. Janet brings with her a

wealth of experience in data center operations and AI, offering unparalleled insights into technology’s role in shaping the future

of our industry. Her innovative mindset and expertise will undoubtedly drive MARA’s growth initiatives. Barbara’s extensive

background in finance and operations adds a strategic depth to our leadership, enhancing MARA’s commitment to sustainable growth

and operational excellence. Together, their unique perspectives and expertise will play a pivotal role in MARA’s continued success.

We

would also like to extend our gratitude to Kevin DeNuccio and Said Ouissal, who stepped down from the Board of Directors. Their invaluable

contributions have been instrumental in shaping MARA’s growth and success, and we look forward to building upon the strong foundation

they helped create.

Political

Activity

Our

team was very active this election season. As a co-founder of the Bitcoin Voter project, we played a significant role in advocating for

pro-crypto candidates. In fact, every candidate that the Bitcoin Voter PAC supported won. In total, crypto PACs raised over $130 million

into the election cycle and successfully helped to elect 253 pro-crypto candidates to the House of Representatives and 16 to the Senate

We

look forward to working with the new Trump administration and educating on the benefits and strategic importance of blockchain technology

and the ownership of block space. We have been actively involved in political and regulatory discussions at both national and international

levels to advocate for the role of BTC mining in economic growth, energy stability, and sustainability, which we believe is an important

priority.

During

NYC Climate Week in September, we led a roundtable with New York Assembly members on sustainable energy investments, and at the UN General

Assembly, we engaged with officials from Egypt, the UAE, and Saudi Arabia on BTC mining’s contributions to economic diversification

and sustainable energy.

Finally,

we remain highly engaged with the communities where we operate with an increased focus on social responsibility.

AI/HPC

We

are in active discussions with data center developers to create a symbiotic relationship between AI and BTC mining, where each enhances

the other’s efficiency and sustainability. BTC mining can play a valuable role in load balancing for inference AI by providing

flexible, demand-responsive energy usage that can adapt to fluctuating loads.

MARA’s

strategy includes not only expanding our mining operations but also providing robust infrastructure tailored for AI and HPC workloads.

By building and operating specialized data centers, we aim to support these demanding applications and position MARA as a key player

in both BTC mining and the growing AI/HPC market.

While

we are not going to be running AI sites, our focus is to become a core provider of infrastructure and infrastructure management technologies,

allowing us to use BTC mining as a vehicle to support AI.

| SHAREHOLDER LETTER Q3 2024 | 10 |

Mercury

test tank for AI/HPC Servers

What’s

Next?

Our

50 exahash goal for this year is firmly in sight and we expect to get there by mid- to late December. Now, the question becomes,

where do we go from here?

We

believe we are on a strong growth trajectory, with no plans to slow down. We anticipate continued expansion across U.S. and international

markets and have set ambitious goals to expand our portfolio of owned and operated sites. Alongside this, we are selectively pursuing

M&A opportunities to further enhance our capacity. Finally, we believe our strategy to utilize zero-cost energy will reduce dependency

on hash cost and price volatility, enabling scalable and sustainable growth.

We

hope you found this letter to be informative and look forward to any feedback. We want to thank our employees, partners, communities,

and shareholders for their continued support.

______________________

MARA

Chairman & CEO

| SHAREHOLDER LETTER Q3 2024 | 11 |

Third

Quarter 2024 Financial and Operational Discussion

Highlights

| – | Revenues

increased 35% to $131.6 million in Q3 2024 from $97.8 million in Q3 2023. |

| – | Energized

hash rate increased 93% to 36.9 EH/s in Q3 2024 from 19.1 EH/s in Q3 2023. |

| – | At

quarter end, we held 26,747 BTC on our balance sheet. During the quarter, we mined 2,070

BTC and purchased 6,210 BTC, of which 4,144 were acquired using proceeds from a $300.0 million

offering of convertible senior notes at an average price of $59,500 per BTC. As of the end

of Q3 2024, we had a BTC per share yield improvement of 29%. We did not sell any BTC. |

| – | Totaled

604 block wins during Q3 2024, a 32% increase over from Q2 2024. |

| – | Net

loss increased to $124.8 million, or $0.42 loss per diluted share, in Q3 2024 from a net

loss of $0.4 million, or $0.34 loss per diluted share, in Q3 2023. Net loss includes $30.1

million income on fair value of digital assets. |

| – | Cost

of revenue per petahash per day (excluding depreciation) continued to improve by 10% this

quarter and 18% YTD. |

| – | Adjusted

EBITDA increased to $21.8 million in Q3 2024 from a loss of $21.3 million in Q3 2023. |

| – | Combined

unrestricted cash and cash equivalents and BTC increased to $1.9 billion as of September

30, 2024. |

| – | As

of November 11, 2024, our HODL is approaching $2.5 billion. |

Third

Quarter 2024 Production Highlights

| | |

Prior Quarter Comparison | |

| Metric | |

Q3 2024 | | |

Q2 2024 | | |

% Δ | |

| Number of Blocks Won | |

| 604 | | |

| 457 | | |

| 32 | % |

| BTC Produced | |

| 2,070 | | |

| 2,058 | | |

| 1 | % |

| Average BTC Produced per Day | |

| 22.5 | | |

| 22.9 | | |

| (2 | )% |

| Share of Available Miners Rewards (1) | |

| 4.8 | % | |

| 3.7 | % | |

| N/A | |

| Energized Hash Rate (EH/s) (2) | |

| 36.9 | | |

| 31.5 | | |

| 17 | % |

| 1. | Defined

as the total amount of block rewards including transaction fees that MARA earned during the

period divided by the total amount of block rewards and transaction fees awarded by the Bitcoin

network during the period. |

| | |

| 2. | Defined

as the amount of hash rate that could theoretically be generated if all miners that have

been energized are currently in operation including miners that may be temporarily offline.

Hash rates are estimates based on the manufacturers’ specifications. All figures are

rounded. |

| SHAREHOLDER LETTER Q3 2024 | 12 |

Data

Center Acquisitions and Integrations

With

the Ohio announcement yesterday, our total nameplate capacity has increased to just under 1.5 GW, with approximately 65% of this capacity

proudly owned and operated by MARA. During the year, we have secured 962 MW with over 800 MW through acquisitions. Although we are the

largest digital asset compute company globally, we believe we are the only large-scale public miner that has the opportunity to further

reduce operating costs in the future.

For

the nine months ended September 30, 2024, we successfully reduced our cost of revenue (excluding depreciation) per petahash per day by

17% compared to the same period last year. Notably, we achieved this while paying significantly less to acquire sites than our competitors.

For example, we paid on average approximately 400 thousand per megawatt for data center infrastructure acquisitions, which was 28% cheaper

than the average of our nearest three competitors in 2024 (based on publicly available information). This not only minimizes our cash

for acquisitions but also reduces shareholder dilution compared to other miners.

NET

LOSS AND EARNINGS

We

reported a net loss of $125 million, or $0.42 loss per diluted share, in the quarter compared to a net loss of $390 thousand, or $0.34

loss per diluted share, in the third quarter of last year. This was primarily driven by a $92 million increase in operating loss, the

absence of an $83 million net gain from the extinguishment of debt, offset by a $49 million income tax benefit in the current period

compared to the prior year period.

The

price of BTC improved on September 30, 2024 versus June 30, 2024, resulting in income on digital assets of $30 million during the third

quarter of 2024. As we continue to hold a larger number of BTC on our balance sheet, we expect the volatility in BTC price to impact

our earnings to a larger extent. For example, a $10,000 change in BTC price will result in over a $200 million impact in our earnings

purely due to our large HODL position.

| SHAREHOLDER LETTER Q3 2024 | 13 |

REVENUE

Revenues

increased 35% to $132 million from $98 million in the third quarter of 2023. With the average price of BTC mined 116% higher this quarter

than the prior year period, the increase in revenue was primarily driven by a $74 million increase in the average price of BTC, partially

offset by a $41 million decrease in BTC production due to the April 2024 halving event.

We

produced an average of 22.5 BTC each day during the quarter compared to 37.9 BTC each day in the prior year period and 1,420 less BTC

in the third quarter of 2024 as compared to the prior year period, primarily due to the halving and increased global hashrate, partially

offset by an increase in the our share of the network hashrate, which resulted in a 14% increase in number of blocks won. During the

three months ended September 30, 2024, the third-party site equipment failure and transmission line maintenance were completely resolved.

As

we mentioned last quarter, the Company will not be taking new hosting services customers at our existing sites in order to focus on our

owned and operated mining business.

| SHAREHOLDER LETTER Q3 2024 | 14 |

COST

OF REVENUE

Our

hosting and energy costs in the quarter were $97 million compared to $60 million in the prior year period. The $38 million or approximately

63% increase was primarily driven by the growth in the Company’s hash rate from the deployment and energization of mining rigs

in existing and new facilities, which increased hosting and energy costs compared to the prior year period.

Our

cost of revenue per petahash per day improved 18% from $45.2 in the third quarter of 2023 to $37.1 dollar per petahash per day in the

third quarter of 2024. Sequentially, we improved this cost from $41.0 in Q2 of 2024, reflecting a 10% improvement despite a higher difficulty

level to mine due to a higher global hash rate. Due to our shift from an asset-light to asset-heavy strategy, we believe we are well-positioned

to reduce our operating costs over time as we further expand our owned and operated initiatives.

Depreciation

and amortization in the third quarter was $101 million, a $48 million increase from the same quarter in the prior year. The change was

predominantly the result of deploying additional mining rigs since last year. Our energized hash rate grew from 19.1 exahash to 36.9

exahash from the same period last year.

Our

non-GAAP total margin, excluding depreciation and amortization was $34 million this quarter, compared to $38 million in the same quarter

last year. The change was predominantly related to higher average BTC prices and increased operational efficiency.

G&A

AND ADJUSTED EBITDA

General

and administrative expenses, excluding stock-based compensation, was $40 million compared with $14 million in the prior year period.

This increase in expenses was primarily due to the increasing scale of the business and acquisitions, including payroll and benefits,

professional fees, facility and equipment repair and maintenance expenses, and other third-party costs. Our headcount grew from 48 employees

at the end of Q3 last year to approximately 130 employees at the end of Q3 this year. We expect to continue funding diversified growth

initiatives as we scale.

Primarily

due to an increase in net loss, adjusted for an increase in stock compensation expense, the change in fair value of derivative instrument,

and the absence of net gain from the extinguishment of debt from the prior year period, we reported an adjusted EBITDA of $22 million

compared to a loss of $21 million in the prior year period. As a reminder, these numbers include the fair market value gain on digital

assets of $30 million and a loss of $45 million, respectively.

| SHAREHOLDER LETTER Q3 2024 | 15 |

BALANCE

SHEET AND TREASURY MANAGEMENT

Last

quarter, we announced a significant shift in our treasury policy and adopted a full HODL approach to retain all BTC going forward. The

adoption of this strategy reflects our confidence in the long-term value of BTC and our belief that it is the world’s best treasury

reserve asset.

In

Q3 of this year, we purchased $100 million of BTC using cash on hand and used the net proceeds of the issuance of $300 million of 2.125%

convertible senior notes due 2031 to purchase an additional 4,144 BTC, or approximately $249 million. These two transactions, at an average

price of approximately $60,000, helped to increase our BTC holdings by 45% from 18,488 at the end of Q2 2024 to 26,747 BTC at the end

of of Q3 2024.

Digging

more into our BTC holdings and cash position, unrestricted cash and cash equivalents totaled $164 million, up from $101 million in the

prior year period. Combined, our balance of cash and BTC was approximately $1.9 billion as of September 30, 2024.

Our

decision to purchase BTC involves carefully evaluating BTC’s price relative to mining costs. Outside the context of an acquisition,

investing in mining infrastructure typically has a 12- to 18-month timeline to generate revenue. However, while we continue to invest

in our mining operations and grow our business, we will also capitalize on opportunities as they arise to purchase BTC, particularly

during market downturns. Our strategy is to strike a balance between mining BTC and buying BTC, factoring in market conditions.

Our

HODL strategy and the opportunistic BTC purchases that we made during the quarter have benefited our shareholders as they continue to

see sustained yield when it comes to our BTC holdings from a per share perspective. A shareholder holding $1,000 of MARA stock hypothetically

holds approximately 0.08 BTC as of the end of Q3 2024. Our shareholders have experienced a

29% and a 31% increase in BTC per share yield (a key performance indicator that represents the ratio between the Company’s BTC holdings and fully diluted shares outstanding) in Q3 2024 and on a quarter-to-date

and year-to-date basis, respectively. Finally, it’s important to note that our HODL per share is three times more than our closest

competition.

Year-to-date,

our strategy to HODL BTC through mining and open market purchases has started to create significant value. During the nine months ended

September 30, 2024, we bought over 6,400 BTC at approximately $60,000 per BTC. Given BTC’s price increase post quarter-end, of

these purchases in 2024 appreciated by almost 50%.

Subsequent

to quarter end, we secured a $200 million line of credit, collateralized by a portion of our BTC holdings. This facility allows us to

access alternative forms of growth capital outside of issuing equity. As of October 17, 2024, the facility was fully utilized. We are

encouraged by the additional sources of capital available to MARA due to the size of our HODL. As this market matures further, we expect

additional sources of capital to help reduce our reliance entirely on ATMs.

| SHAREHOLDER LETTER Q3 2024 | 16 |

During

the nine months ended September 30, 2024, we raised $666 million from at-the-market (“ATM”) equity sales which we primarily

intend to use for BTC purchases, miners, operating costs, acquisition of infrastructure and for other general corporate purposes.

MARA’s

return on capital employed on the last 12-month basis remains top tier amongst our competitors. This is a testament of MARA systematically

investing in its mining and data center operations carefully and creating top tier value for our stockholders from a capital efficiency

standpoint in this capital intensive industry. While ATMs have been the primary source of capital in this sector, as the industry evolves,

we expect additional sources of capital and project finance availability.

Finally,

as we spoke about last quarter, we recently introduced Kaspa to our digital asset compute portfolio. As of September 30, 2024, we held

approximately 108 million Kaspa coins on our balance sheet. We intend to add to our Kaspa holdings primarily through production activities.

As of now, we incur significantly less cost to produce Kaspa in U.S. dollar terms, which helps pay for our expenses and allows us to

hold a larger amount of BTC on our balance sheet.

________________________

MARA

Chief Financial Officer

| SHAREHOLDER LETTER Q3 2024 | 17 |

Earnings

Webcast and Conference Call

MARA

will hold a webcast and conference call today, November 12, 2024, at 5:00 p.m. Eastern time to discuss its financial results for the

quarter ended September 30, 2024.

To

register to participate in the conference call or to listen to the live audio webcast, please use this link. The webcast will

also be broadcast live and available for replay via the investor relations section of our website.

Earnings

Webcast and Conference Call Details

Date:

Tuesday, November 12, 2024

Time:

5:00 p.m. Eastern time (2:00 p.m. Pacific time)

Registration

link: LINK

If

you have any difficulty connecting with the conference call, please contact MARA’s investor relations team at ir@mara.com

About

MARA

MARA

(NASDAQ: MARA) is a global leader in digital asset compute that develops and deploys innovative technologies to build a more sustainable

and inclusive future. MARA secures the world’s preeminent blockchain ledger and supports the energy transformation by converting

clean, stranded, or otherwise underutilized energy into economic value.

For

more information, visit www.mara.com, or follow us on:

| Twitter |

@MARAHoldings |

| Linkedin |

Marathon-digital-holdings |

| Facebook |

MarathonDigitalHoldings |

| Instagram |

@MARAHoldingsinc |

MARA

Company Contacts:

Telephone:

1.800.804.1690

Email:

ir@mara.com

MARA

Media Contact:

Email:

mara@wachsman.com

| SHAREHOLDER LETTER Q3 2024 | 18 |

MARA

Holdings, Inc.

and

Subsidiaries Condensed Consolidated

Statements

of Operations

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| (in thousands, except share and per share data) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Total revenues | |

$ | 131,647 | | |

$ | 97,849 | | |

$ | 441,984 | | |

$ | 230,740 | |

| | |

| | | |

| | | |

| | | |

| | |

| Costs and expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| | | |

| | | |

| | | |

| | |

| Mining and hosting services | |

| (97,527 | ) | |

| (59,628 | ) | |

| (281,625 | ) | |

| (148,227 | ) |

| Depreciation and amortization | |

| (101,136 | ) | |

| (53,548 | ) | |

| (266,939 | ) | |

| (108,556 | ) |

| Total cost of revenues | |

| (198,663 | ) | |

| (113,176 | ) | |

| (548,564 | ) | |

| (256,783 | ) |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses | |

| (63,725 | ) | |

| (19,428 | ) | |

| (194,154 | ) | |

| (54,404 | ) |

| Change in fair value of digital assets | |

| 30,088 | | |

| (44,692 | ) | |

| 370,896 | | |

| 117,868 | |

| Change in fair value of derivative instrument | |

| (58,234 | ) | |

| — | | |

| (35,235 | ) | |

| — | |

| Research and development | |

| (2,813 | ) | |

| (713 | ) | |

| (9,124 | ) | |

| (1,573 | ) |

| Early termination expenses | |

| (10,304 | ) | |

| — | | |

| (38,061 | ) | |

| — | |

| Amortization of intangible assets | |

| (219 | ) | |

| — | | |

| (22,658 | ) | |

| — | |

| Total operating expenses | |

| (105,207 | ) | |

| (64,833 | ) | |

| 71,664 | | |

| 61,891 | |

| Operating income (loss) | |

| (172,223 | ) | |

| (80,160 | ) | |

| (34,916 | ) | |

| 35,848 | |

| Gain (loss) on investments | |

| (1,000 | ) | |

| — | | |

| 4,236 | | |

| — | |

| Loss on hedge instruments | |

| — | | |

| — | | |

| (2,292 | ) | |

| — | |

| Equity in net earnings of unconsolidated affiliate | |

| (2,133 | ) | |

| (647 | ) | |

| (825 | ) | |

| (647 | ) |

| Net gain from extinguishment of debt | |

| — | | |

| 82,600 | | |

| — | | |

| 82,267 | |

| Interest income | |

| 3,894 | | |

| 426 | | |

| 8,655 | | |

| 1,366 | |

| Interest expense | |

| (2,342 | ) | |

| (2,536 | ) | |

| (4,967 | ) | |

| (9,136 | ) |

| Other non-operating income (loss) | |

| (146 | ) | |

| — | | |

| 67 | | |

| — | |

| Income (loss) before income taxes | |

| (173,950 | ) | |

| (317 | ) | |

| (30,042 | ) | |

| 109,698 | |

| Income tax benefit (expense) | |

| 49,161 | | |

| (73 | ) | |

| 42,767 | | |

| (351 | ) |

| Net income (loss) | |

$ | (124,789 | ) | |

$ | (390 | ) | |

$ | 12,725 | | |

$ | 109,347 | |

| Series A preferred stock accretion to redemption value | |

| — | | |

| — | | |

| — | | |

| (2,121 | ) |

| Net income (loss) attributable to common stockholders | |

$ | (124,789 | ) | |

$ | (390 | ) | |

$ | 12,725 | | |

$ | 107,226 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) per share of common stock - basic | |

$ | (0.42 | ) | |

$ | — | | |

$ | 0.05 | | |

$ | 0.63 | |

| Weighted average shares of common stock - basic | |

| 294,942,685 | | |

| 179,602,722 | | |

| 277,643,666 | | |

| 169,162,821 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) per share of common stock - diluted | |

$ | (0.42 | ) | |

$ | (0.34 | ) | |

$ | 0.05 | | |

$ | 0.27 | |

| Weighted average shares of common stock - diluted | |

| 294,942,685 | | |

| 183,736,770 | | |

| 282,651,034 | | |

| 174,393,108 | |

| | |

| | | |

| | | |

| | | |

| | |

| Supplemental information: | |

| | | |

| | | |

| | | |

| | |

| BTC production during the period, in whole BTC | |

| 2,070 | | |

| 3,490 | | |

| 6,938 | | |

| 8,610 | |

| Average BTC per day, in whole BTC | |

| 22.5 | | |

| 37.9 | | |

| 25.3 | | |

| 31.5 | |

| Total margin (total revenues less total cost of revenues) | |

$ | (67,016 | ) | |

$ | (15,327 | ) | |

$ | (106,580 | ) | |

$ | (26,043 | ) |

| Cost of revenues - depreciation and amortization | |

$ | (101,136 | ) | |

$ | (53,548 | ) | |

$ | (266,939 | ) | |

$ | (108,556 | ) |

| Total margin excluding the impact of depreciation and amortization (1): | |

| | | |

| | | |

| | | |

| | |

| Mining | |

$ | 34,157 | | |

$ | 38,221 | | |

$ | 157,980 | | |

$ | 82,513 | |

| Hosting services | |

$ | (37 | ) | |

$ | — | | |

$ | 2,379 | | |

$ | — | |

| General and administrative expenses excluding stock-based compensation | |

$ | (40,385 | ) | |

$ | (13,917 | ) | |

$ | (90,569 | ) | |

$ | (40,497 | ) |

| Installed Hash Rate (Exahashes per second) - at end of period (2) | |

| 36.9 | | |

| 23.1 | | |

| 36.9 | | |

| 23.1 | |

| Energized Hash Rate (Exahashes per second) - at end of period (2) | |

| 36.9 | | |

| 19.1 | | |

| 36.9 | | |

| 19.1 | |

| Average Operational Hash Rate (Exahashes per second) (2) | |

| 28.8 | | |

| 14.5 | | |

| 23.6 | | |

| 11.1 | |

| Cost per Petahash per day (2) | |

$ | 37.1 | | |

$ | 45.2 | | |

$ | 40.7 | | |

$ | 48.9 | |

| Share of available miner rewards | |

| 4.8 | % | |

| 4.0 | % | |

| 3.6 | % | |

| 3.3 | % |

| Number of blocks won | |

| 604 | | |

| 528 | | |

| 1,429 | | |

| 1,163 | |

| Transaction fees as a percentage of total | |

| 2.4 | % | |

| 2.5 | % | |

| 6.8 | % | |

| 4.6 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation to Adjusted EBITDA: | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | (124,789 | ) | |

$ | (390 | ) | |

$ | 12,725 | | |

$ | 109,347 | |

| Interest income | |

| (3,894 | ) | |

| (426 | ) | |

| (8,655 | ) | |

| (1,366 | ) |

| Interest expense | |

| 2,342 | | |

| 2,536 | | |

| 4,967 | | |

| 9,136 | |

| Income tax expense (benefit) | |

| (49,161 | ) | |

| 73 | | |

| (42,767 | ) | |

| 351 | |

| Depreciation and amortization | |

| 104,463 | | |

| 54,032 | | |

| 298,826 | | |

| 109,040 | |

| EBITDA | |

| (71,039 | ) | |

| 55,825 | | |

| 265,096 | | |

| 226,508 | |

| Stock compensation expense | |

| 23,340 | | |

| 5,511 | | |

| 103,585 | | |

| 13,907 | |

| Change in fair value of derivative instrument | |

| 58,234 | | |

| — | | |

| 35,235 | | |

| — | |

| Early termination expenses and other | |

| 11,304 | | |

| — | | |

| 33,825 | | |

| — | |

| Net gain from extinguishment of debt | |

| — | | |

| (82,600 | ) | |

| — | | |

| (82,267 | ) |

| Adjusted EBITDA (1) | |

$ | 21,839 | | |

$ | (21,264 | ) | |

$ | 437,741 | | |

$ | 158,148 | |

| SHAREHOLDER LETTER Q3 2024 | 19 |

(1)

Non-GAAP Financial Measures. In order to provide a more comprehensive understanding of the information used by our management team

in financial and operational decision-making, we supplement our Condensed Consolidated Financial Statements that have been prepared in

accordance with generally accepted accounting principles in the United States (“GAAP”) with the non-GAAP financial measures

of adjusted EBITDA and total margin excluding depreciation and amortization.

The

Company defines adjusted EBITDA as (a) GAAP net income (loss) plus (b) adjustments to add back the impacts of (1) interest income, (2)

interest expense, (3) income tax expense (benefit), (4) depreciation and amortization, and (5) adjustments for non-cash and/or non-recurring

items with currently include (i) stock compensation expense, (ii) change in fair value of derivative instrument, (iii) early termination

expenses and other and (iv) net gain from extinguishment of debt. The Company defines total margin excluding depreciation and amortization

as (a) GAAP total margin less (b) depreciation and amortization.

Management

uses adjusted EBITDA and total margin excluding depreciation and amortization, along with the supplemental information provided herein,

as a means of understanding, managing, and evaluating business performance and to help inform operating decision-making. The Company

relies primarily on its Condensed Consolidated Financial Statements to understand, manage, and evaluate its financial performance and

uses non-GAAP financial measures only supplementally.

We

believe that adjusted EBITDA and total margin excluding depreciation and amortization are useful measures to us and to our investors

because they exclude certain financial, capital structure, and non-cash items that we do not believe directly reflect our core operations

and may not be indicative of our recurring operations, in part because they may vary widely across time and within our industry independent

of the performance of our core operations. We believe that excluding these items enables us to more effectively evaluate our performance

period-over-period and relative to our competitors. Adjusted EBITDA and total margin excluding depreciation and amortization may not

be comparable to similarly titled measures provided by other companies due to potential differences in methods of calculations.

The

Company acquired a commodity swap agreement, which meets the definition of a derivative, in conjunction with its acquisition of GC Data

Center Equity Holdings, LLC on January 12, 2024. The change in fair value of this derivative instrument fluctuated significantly since

we acquired this contract, and we believe these fluctuations do not reflect the performance of our core operations. In addition, we believe

excluding the change in fair value of derivative instruments enables us to more effectively evaluate our performance period-over-period

and relative to our competitors who make similar adjustments to adjusted EBITDA. As such, beginning with the period ended September 30,

2024, the Company has updated its calculation of adjusted EBITDA to exclude the change in fair value of derivative instrument. Accordingly,

certain prior period information has been reclassified to conform to the current period presentation.

(2)

Mining and hosting services margin excluding the impact of depreciation and amortization is calculated using revenues less cost of revenues,

excluding depreciation and amortization, for mining and hosting services, respectively. The Company defines Energized Hash Rate as the

total hash rate that could theoretically be generated if all mining rigs that have been operational are currently in operation and running

at 100% of the manufacturers’ specifications (includes mining servers that are offline for maintenance or similar reasons). The

Company uses this metric as an indicator of progress in bringing rigs online. The Company defines Average Operational Hash Rate as the

average hash rate that was actually generated during the period from all operational miners. The Company uses this metric as an indicator

of its operational progress. The Company defines Installed Hash Rate as the sum of Energized Hash Rate and hash rate that has been installed

but is not yet operational (e.g., mining rigs that have been installed, but are not yet energized and in operation). The Company uses

this metric as an indicator of progress in deploying mining rigs at its production sites. Cost per Petahash per day is calculated using

mining cost of revenues, excluding depreciation and amortization, divided by the Average Operational Hash Rate, excluding the Company’s

share of the hash rate for the equity method investee. Hash rates are estimates based on the manufacturers’ specifications. All

figures are estimates and rounded.

The

Company believes that these metrics are useful as an indicator of potential BTC production. However, these metrics cannot be tied directly

to any production level expected to be actually achieved as (a) there may be delays in the energization of Installed Hash Rate (b) the

Company cannot predict when installed and energized rigs may be offline for any reason.

| SHAREHOLDER LETTER Q3 2024 | 20 |

Investor

Notice

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties

and forward-looking statements described under the heading “Risk Factors” in our most recent annual report on Form 10-K and

any other periodic reports that we may file with the U.S. Securities and Exchange Commission (the “SEC”). If any of these

risks were to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our

securities could decline, and you could lose part or all of your investment. The risks and uncertainties we describe are not the only

ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations.

In addition, our past financial performance may not be a reliable indicator of future performance, and historical trends should not be

used to anticipate results in the future. See “Forward-Looking Statements” below.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the federal securities laws. All statements, other than statements

of historical fact, included in this press release are forward-looking statements. The words “may,” “will,” “could,”

“anticipate,” “expect,” “intend,” “believe,” “continue,” “target”

and similar expressions or variations or negatives of these words are intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Such forward-looking statements include, among other things, statements related

to our strategy, future operations, growth targets, developing technologies and BTC treasury policy. Such forward-looking statements

are based on management’s current expectations about future events as of the date hereof and involve many risks and uncertainties

that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Subsequent

events and developments, including actual results or changes in our assumptions, may cause our views to change. We do not undertake to

update our forward-looking statements except to the extent required by applicable law. Readers are cautioned not to place undue reliance

on such forward-looking statements. All forward-looking statements included herein are expressly qualified in their entirety by these

cautionary statements. Our actual results and outcomes could differ materially from those included in these forward-looking statements

as a result of various factors, including, but not limited to, the factors set forth under the heading “Risk Factors” in

our most recent annual report on Form 10-K and any other periodic reports that we may file with the SEC.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

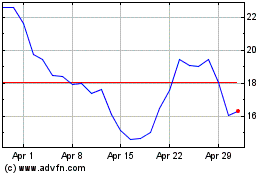

MARA (NASDAQ:MARA)

Historical Stock Chart

From Oct 2024 to Nov 2024

MARA (NASDAQ:MARA)

Historical Stock Chart

From Nov 2023 to Nov 2024