Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

January 08 2025 - 4:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

MATTHEWS INTERNATIONAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

On January 8, 2025, Matthews International Corporation (the “Company”) issued the

following presentation in connection with the sale of its interests in SGK Brand Solutions, pursuant to the Contribution Agreement, dated January 7, 2025, by and among the Company, Logo Holdings II Corporation, a Delaware corporation

(“Logo”) and the indirect parent of Southern Graphics, Inc., and Peninsula Parent LLC, a Delaware limited liability company and a wholly-owned subsidiary of Logo.

Additional Information

In connection with the

Company’s 2025 Annual Meeting, the Company has filed with the U.S. Securities and Exchange Commission (“SEC”) and commenced mailing to the shareholders of record entitled to vote at the 2025 Annual Meeting a definitive proxy statement

and other documents, including a WHITE proxy card. SHAREHOLDERS ARE ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY THE COMPANY AND ALL OTHER RELEVANT DOCUMENTS WHEN FILED WITH THE SEC AND

WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Investors and other interested parties will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov, or from the Company at

its website: http://www.matw.com/investors/sec-filings. You may also obtain copies of the Company’s definitive proxy statement and other documents, free of charge, by contacting the Company’s

Investor Relations Department at Matthews International Corporation, Two NorthShore Center, Pittsburgh, Pennsylvania 15212-5851, Attention: Investor Relations, telephone (412) 442-8200.

Participants in the Solicitation

The participants in the

solicitation of proxies in connection with the 2025 Annual Meeting are the Company, Alvaro Garcia-Tunon, Gregory S. Babe, Joseph C. Bartolacci, Katherine E. Dietze, Terry L. Dunlap, Lillian D. Etzkorn, Morgan K. O’Brien, J. Michael Nauman,

Aleta W. Richards, David A. Schawk, Jerry R. Whitaker, Francis S. Wlodarczyk, Steven F. Nicola and Brian D. Walters.

Certain information about the

compensation of the Company’s named executive officers and non-employee directors and the participants’ holdings of the Company’s Common Stock is set forth in the sections entitled

“Compensation of Directors” (on page 36 and available here), “Stock Ownership of Certain Beneficial Owners and Management” (on page 64 and available here), “Executive Compensation and Retirement Benefits”

(on page 66 and available here), and “Appendix A” (on page A-1 and available here), respectively, in the Company’s definitive proxy statement, dated January 7, 2025, for its

2025 Annual Meeting as filed with the SEC on Schedule 14A, available here. Additional information regarding the interests of these participants in the solicitation of proxies in respect of the 2025 Annual Meeting and other relevant materials

will be filed with the SEC when they become available. These documents are or will be available free of charge at the SEC’s website at www.sec.gov.

Contacts

Matthews International Corporation

Steven F. Nicola

Chief Financial Officer and Secretary

(412) 442-8262

Dan

Moore / Scott Bisang / Clayton Erwin

MATW-CS@collectedstrategies.com

SGK Transaction Overview

Transaction overview TRANSACTION SUMMARY

Matthews to sell SGK Brand Solutions (“SGK”) to a newly formed entity created by affiliates of SGS & Co (“SGS”) Combination of SGS and SGK represents a world-class leader in brand experience and technology-enabled brand

solutions Combined enterprise value of approximately $900 million, representing an adjusted trailing-twelve-months EBITDA multiple of 9.0x Expected to achieve over $50 million in annual run-rate cost synergies Matthews to realize upfront

consideration of $350 million at closing while still benefiting from synergy-driven value creation Consideration includes $250 million cash at closing, $50 million of preferred equity in the new entity, and approximately $50 million in trade

receivables under the Matthews’ securitization program which Matthews will retain Matthews will also receive a 40% interest in the common equity of the new entity, creating opportunity for retained upside Matthews will also retain its German

roto-gravure packaging business and other related investments currently within the SGK Brand Solutions reporting segment Matthews to utilize cash proceeds predominantly for immediate debt repayment CLOSING CONDITIONS Transaction expected to close by

mid-2025 pending customary regulatory approvals

PROACTIVELY ADVANCING MATTHEWS’

STRATEGY ü ü ü ü ü Realizes significant value for the SGK Brand Solutions segment Simplifies Matthews’ corporate structure Allows for an immediate reduction in debt Retained upside in the new entity Potential for

additional shareholder value creation

transaction highlights Transaction values

the SGK business at 9.0x adjusted trailing-twelve-months EBITDA, a premium to its existing multiple The combination provides the opportunity to realize substantial run-rate cost synergies of over $50 million annually Given the potential to create

substantial value for shareholders through the realization of synergies, Matthews is retaining a 40% common equity stake in the new entity The transaction better positions the new entity to deliver the cutting-edge solutions that clients demand, and

to further penetrate the market for marketing execution services Provides a pathway for a full exit of the SGK business at an attractive valuation Net cash proceeds from the transaction will predominantly be used to delever, while other

consideration will be used to reduce debt as it is received Pro-forma for the transaction, Matthews’ LTM net leverage will be less than 3.0x Gary R. Kohl, current President of SGK, will lead the new entity as CEO, and Matthew T. Gresge, the

current CEO of SGS, will become Executive Chairman of the Board of the new company

Disclaimer Additional Information

In connection with the Company’s 2025 Annual Meeting, the Company has filed with the U.S. Securities and Exchange Commission (“SEC”) and commenced mailing to the shareholders of record entitled to vote at the 2025 Annual Meeting a

definitive proxy statement and other documents, including a WHITE proxy card. SHAREHOLDERS ARE ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY THE COMPANY AND ALL OTHER RELEVANT DOCUMENTS

WHEN FILED WITH THE SEC AND WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Investors and other interested parties will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov, or

from the Company at its website: http://www.matw.com/investors/sec-filings. You may also obtain copies of the Company’s definitive proxy statement and other documents, free of charge, by contacting the Company’s Investor Relations

Department at Matthews International Corporation, Two NorthShore Center, Pittsburgh, Pennsylvania 15212-5851, Attention: Investor Relations, telephone (412) 442-8200. Participants in the Solicitation The participants in the

solicitation of proxies in connection with the 2025 Annual Meeting are the Company, Alvaro Garcia-Tunon, Gregory S. Babe, Joseph C. Bartolacci, Katherine E. Dietze, Terry L. Dunlap, Lillian D. Etzkorn, Morgan K. O’Brien, J. Michael Nauman,

Aleta W. Richards, David A. Schawk, Jerry R. Whitaker, Francis S. Wlodarczyk, Steven F. Nicola and Brian D. Walters. Certain information about the compensation of the Company’s named executive officers and non-employee directors and the

participants’ holdings of the Company’s Common Stock is set forth in the sections entitled “Compensation of Directors” (on page 36 and available here), “Stock Ownership of Certain Beneficial Owners and Management”

(on page 64 and available here), “Executive Compensation and Retirement Benefits” (on page 66 and available here), and “Appendix A” (on page A-1 and available here), respectively, in the Company’s definitive proxy

statement, dated January 7, 2025, for its 2025 Annual Meeting as filed with the SEC on Schedule 14A, available here. Additional information regarding the interests of these participants in the solicitation of proxies in respect of the 2025 Annual

Meeting and other relevant materials will be filed with the SEC when they become available. These documents are or will be available free of charge at the SEC’s website at www.sec.gov. Forward-looking Information Any

forward-looking statements contained in this release are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to,

statements regarding the expectations, hopes, beliefs, intentions or strategies of the Company regarding the future, including statements regarding the anticipated timing and benefits of the proposed joint venture transaction, and may be identified

by the use of words such as “expects,” “believes,” “intends,” “projects,” “anticipates,” “estimates,” “plans,” “seeks,” “forecasts,”

“predicts,” “objective,” “targets,” “potential,” “outlook,” “may,” “will,” “could” or the negative of these terms, other comparable terminology and

variations thereof. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations, and no

assurance can be given that such expectations will prove correct. Factors that could cause the Company’s results to differ materially from the results discussed in such forward-looking statements principally include our ability to satisfy the

conditions precedent to the consummation of the proposed joint venture transaction on the expected timeline or at all, our ability achieve the anticipated benefits of the proposed joint venture transaction, uncertainties regarding future actions

that may be taken by Barington in furtherance of its intention to nominate director candidates for election at the Company’s 2025 Annual Meeting, potential operational disruption caused by Barington’s actions that may make it more

difficult to maintain relationships with customers, employees or partners, changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in interest rates, changes in the cost of materials used in the

manufacture of the Company’s products, any impairment of goodwill or intangible assets, environmental liability and limitations on the Company’s operations due to environmental laws and regulations, disruptions to certain services, such

as telecommunications, network server maintenance, cloud computing or transaction processing services, provided to the Company by third-parties, changes in mortality and cremation rates, changes in product demand or pricing as a result of

consolidation in the industries in which the Company operates, or other factors such as supply chain disruptions, labor shortages or labor cost increases, changes in product demand or pricing as a result of domestic or international competitive

pressures, ability to achieve cost-reduction objectives, unknown risks in connection with the Company’s acquisitions and divestitures, cybersecurity concerns and costs arising with management of cybersecurity threats, effectiveness of the

Company’s internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond the Company’s control, impact of pandemics or similar outbreaks, or other disruptions to our industries, customers, or

supply chains, the impact of global conflicts, such as the current war between Russia and Ukraine, the outcome of the Company’s dispute with Tesla, Inc. (“Tesla”), the Company’s plans and expectations with respect to its

exploration, and contemplated execution, of various strategies with respect to its portfolio of businesses, the Company’s plans and expectations with respect to its Board, and other factors described in the Company’s Annual Report on

Form 10-K and other periodic filings with the U.S. Securities and Exchange Commission.

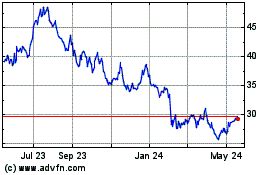

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Dec 2024 to Jan 2025

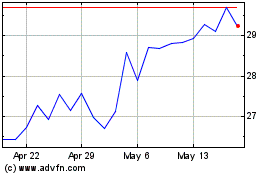

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Jan 2024 to Jan 2025